Publications Taxation Of Cross-Border Mergers And Acquisitions: Brazil 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Brazil 2014

- Christopher Kummer

SHARE:

Introduction

Despite internal economic challenges and slower global economic growth than forecast, Brazil remains attractive for foreign investors due to a variety of economic factors, including its relative economic and political stability, control over inflation and large and growing consumer market. Like other Latin American countries, Brazil has made significant strides in amending its tax legislation to attract direct foreign investments.

The Brazilian mergers and acquisitions (M&A) environment is dynamic, in the sense that tax laws are subject to frequent changes, creating not only pitfalls that can frustrate M&A tax advisors but also tax planning opportunities. Further, although Brazilian tax law often seems inflexible, it offers significant flexibility for Brazilian tax planning.

Good acquisition due diligence is important everywhere, but particularly in Brazil. the complexity of the tax system, the high amount of tax litigation necessary to resolve tax issues and protective labor regulations, among other issues, can complicate the evaluation of Brazilian targets and negotiations significantly.

A number of potentially significant tax issues are not yet identified or assessed by the tax authorities or tested in the courts, including:

- informal practices, such as income not recorded and false invoices in the accounts

- outsourced or unregistered employees

- doubtful or aggressive tax planning

- low quality of financial information and controls

- inclusion of private/shareholders’ interests with the company’s interests

- frequent tax law changes and increases in the tax burden

- high number of tax lawsuits

- succession risk.

Overall, there is a relatively high tax burden in Brazil, with complex and inter-related tax provisions. Good tax planning is essential for the parties involved in any M&A project in Brazil.

New accounting rules

With the introduction of Law 11,638/07 in 2008, Brazil took its first steps toward the adoption of international accounting standards. this has created a complex situation because of the differences between existing and forthcoming rules based on these international standards and the old Brazilian Generally Accepted Accounting Principles (GAAP). to mitigate the effects of this gap and provide taxpayers with general guidelines, the Brazilian government issued a special regulation at the end of 2008.

The main object of this regulation (Law 11,941/09) was to provide a temporary tax neutrality for the new accounting rules (i.e. changes in accounting rules should not affect corporate tax calculations). The provision caused a number of uncertainties for taxpayers as certain aspects of the legislation were not clear (i.e. whether goodwill deduction should take into consideration the purchase price allocation or calculated under the old accounting rules).

Recently, a new tax Law (Provisory Measure 627/13) clarified certain aspects of the accounting and tax divergences, giving taxpayers a clearer picture of what can or cannot be done and where risks and opportunities lie in terms of tax procedures. The Provisional Measure still needs to be approved by the Brazilian Congress.

In relation to cross-border transactions, especially those directly or indirectly connected to M&A processes, the new legislation considerably affects the rules for recording and deducting the goodwill generated in the acquisition of investments, payment of dividends and payment of interest on net equity.

Recent developments

A number of changes in the Brazilian tax legislation were put in place as of 2013, directly or indirectly affecting both M&A and cross-border transactions. The main changes that occurred in this period are discussed below.

Goodwill amortization

Historically, corporate tax law defines goodwill as the positive difference between the acquisition price and the net equity of the acquired company.

Tax treatment of the goodwill after pushdown depends on the goodwill characterization as related to:

- fair value of assets (potential tax-deductible step-up)

- future profitability (tax amortization over a minimum five-year period)

- other economic reasons (non-deductible for tax purposes).

Almost all M&A deals in Brazil involve a share deal with goodwill attributed to future profitability of the target. Aggressive tax planning and its impact on tax collections created significant pressure from the tax authorities to revoke the tax goodwill benefit, especially with respect to intragroup acquisitions. although not revoked, tax authorities increased rigor in tax audits in order to limit the utilization of goodwill on non-straightforward operations.

As of 2008, International Financial Reporting Standards (IFRS) introduced to Brazil’s accounting system a new method to compute and register goodwill on the books (purchase price allocation approach – PPA). No direct tax rules were established to clarify whether this affects the tax impact of the goodwill. Tax practitioners understood that two different interpretations were possible:

- The transitory tax regime provided tax neutrality to any IFRS-related impact, so the recording of goodwill and amortization would remain the same for tax purposes.

- The taxpayer must have a consistent approach to computing and allocating goodwill (for accounting and tax purposes), so PPA potentially would reduce the goodwill to be allocated to future profits.

Provisional Measure 627/13 determines that the goodwill allocation must follow IFRS: goodwill must be allocated first to the fair value of assets/liabilities and intangibles and the remaining portion is allocated as goodwill (based on future profitability). Tax amortization was preserved, complying with the maximum limit of 1/60 per month. The PPA must be prepared by an independent expert and must be filed with the Brazilian Federal Revenue or the Register of Deeds and Documents within 13 months (as a condition for the tax deduction of the goodwill).

Goodwill generated as a result of transactions with related parties and involving an exchange of shares is no longer allowed.

The effectiveness of this measure’s new regulations is optional for fiscal year 2014 and mandatory for 2015 and later fiscal years (tax-neutrality remains applicable for taxpayers that decide not to adopt the new regulation in 2014).

Payment of dividends and interest on net equity

In Brazil, dividend distributions are tax-exempt for the shareholders. No withholding tax (WHT) and taxation for corporate tax purposes applies.

Since 2008, distributable profits from a corporate law perspective are those computed in the accounting books (IFRS). In 2013, the tax authorities published an interpretation saying that, since 2008, the tax exemption only applied to Brazilian GAAP-based profits. This position surprised the tax community and sparked a debate about its legality.

Interest on net equity (INE) paid is tax-deductible for the Brazilian payer and taxable for the recipient. WHT applies at 15 percent. Since INE is calculated based on the value of the net equity, there is uncertainty, similar to that regarding dividends, about whether the value of the net equity should be utilized under IFRS or under Brazilian GAAP.

Provisional Measure 627/2013 also clarified the rules applicable to the payment of dividends and their exemption and to tax-deductibility of INE.

The measure states that, as of 2015, IFRS dividends are tax-exempt. All Brazilian companies that paid 2008 to 2013 dividends before 12 November 2013 are grandfathered by the new regulation. All companies that have yet to receive 2008 to 2013 dividends may be taxed on any profits exceeding old-GAAP profits. The same applies to 2014 dividends. Taxpayers paying IFRS-based dividends in the period from 2008 through 2014 may also be tax-exempt if they elect to adopt the measure in 2014. Similar provisions are established for the payments of INE.

The election is valid from 1 January 2014, but there is not yet guidance on how to formalize the election and the implications that would arise if Provisional Measure 627 is not converted into law.

New transfer pricing regulations

In late 2012, Brazil’s federal tax authority issued guidance (Normative Instruction 1,312/12) to implement changes in the transfer pricing legislation, as enacted pursuant to Law 12.715/12. also, Law 12,766/12 introduced new rules for testing the interest on related-party loans.

The provisions are effective as of 1 January 2013, or the taxpayer may elect to have them apply retroactively from 1 January 2012, provided that the changes are fully adopted by the taxpayer.

Methods for testing commodity transactions

Inbound and outbound commodity transactions must be tested using only the following methods:

- The quotation price on imports (PCI) method applies for inbound transactions and is based on the average daily price of goods or rights as recognized on an international futures and commodities exchange, adjusted by the average premium.

- The quotation price on exports (PCEX) method applies for outbound transactions and is based on the average daily price of goods or rights as recognized on an international futures and commodity exchange, adjusted by average premium.

When the commodity is not recognized on an international futures and commodities exchange, the following sources can be used:

- independent data provided by an internationally recognized industrial research institute (as defined by Brazilian federal tax authority)

- prices published in the official daily gazette by agencies or regulatory bodies for export transactions comparisons.

Normative Instruction 1,312/12 lists the products that must be considered to be a commodity for transfer pricing purposes. It also lists the international futures and commodities exchanges, research institutes and publications that are acceptable sources of market price.

Differential factor margin

The general rule allows a differential factor of 5 percent between the actual price and the comparable price. For commodities transactions, the permitted difference between the actual price and the quotation sourced by international futures and commodities exchanges, research institutes and publications is 3 percent.

Safe harbor

The safe harbor rules for export transactions have been significantly revised. to be eligible for the safe harbor, the net pre-tax profits on exports to a related party must be 10 percent (the prior rule required a 5 percent net profit). However, the safe harbor relief is only available when the export net revenue with related parties does not exceed 20 percent of the total export net revenue during the period.

Interest on related-party loans

Law 12,766/12 introduced new rules for testing the deductibility of interest on related-party loans. These new rules apply to loan agreements as of 1 January 2013, and to the renewal or re-negotiation of existing loan agreements.

The rules on interest and minimal revenue arising from related-party loans include the following:

- For loans denominated in US dollars (USD) at fixed rate, the parameter rate (i.e. the maximum or minimum rate depending on whether the transaction is inbound or outbound) is the market rate of the sovereign bonds issued by the Brazilian government on the external market, indexed in USD.

- For loans in Brazilian real (BRL) at fixed rate, the parameter rate is the market rate of the sovereign bonds issued by the Brazilian government on the external market, indexed in BRL. For loans denominated in BRL at a floating rate, the Ministry of Finance regulates the parameter rate price.

- For all other loans, the parameter rate is the six-month London Interbank Offered Rate (LIBOR). The spread rate may be determined by Brazil’s Ministry of Finance based on market conditions.

In August 2013, the Ministry of Finance fixed the spread margin to be added to the interest rates as follows:

For the purpose of recognition of minimum income:

- 0 percent, applicable from 1 January 2013 to 2 August 2013

- 2.5 percent, applicable as of 2 August 2013.

Back-to-back transactions

’Back-to-back transactions‘ involve the acquisition of goods abroad by a Brazilian company without the goods effectively entering Brazil or being subject to Brazilian customs clearance, followed by resale of the goods to an entity located in a third country. The goods are then shipped directly from the foreign seller to the buyer in the third country, with the transaction being regulated by the Brazilian Central Bank (BACEN).

Previously, it was uncertain whether such back-to-back transactions were subject to Brazil’s transfer pricing rules when conducted between related parties, given that there was effectively no entry or exit of the goods into or from Brazil.

Normative Instruction 1,312/12 provides that import and export back-to-back transactions, when performed with related parties and/or with companies located in a ’low-tax jurisdiction‘ or in a country having a ’privileged tax regime‘, should be tested separately by applying the import and export methods.

Resale minus (PRL) method

Import tax, customs duties, freight and insurance paid on inbound transactions are not included in the import cost when testing the transaction, provided the payment is made to an unrelated party or to a company or individual not domiciled in a listed low-tax jurisdiction or in a country having a privileged tax regime.

However, when calculating the PRL price, import tax or customs duties, freight and insurance should be proportionally deducted from the net revenue to apply the mark-up established by the law.

Comparable uncontrolled price (PIC) method

Where a Brazilian entity uses its independent transactions as comparables (i.e. a purchase of the same or similar product in the domestic or local market), the third-party comparables must represent at least 5 percent of the amount of import transactions.

Where the minimum sample of independent transactions during the period is not achieved, transactions from the preceding year can be used, provided the foreign exchange effects are appropriately adjusted.

State value added tax (ICMS) – Changes for interstate transactions involving imported goods

According to Resolution 12/2012 issued by the Brazilian Federal Senate, as of January 2013, the applicable ICMS rate for interstate transactions involving imported goods and products is 4 percent. Previous legislation established that transactions of this nature involving imported goods and products would be subject to an ICMS rate that varied from 7 percent to 12 percent, depending on the states of origin and destination.

The new regulation applies to interstate transactions involving imported goods and products that are not subject to any industrial process or, when submitted to an industrial process, result in a good or product in which the percentage of utilization of imported inputs is higher than 40 percent of its total cost.

The new interstate rate for imported products does not apply in certain cases and to certain products, such as imported goods and products without equivalent in the Brazilian market, operations of imported natural gas and products subject to certain specific tax incentives.

Tax on financial operations on foreign loans

According to federal Decree 7,853, issued on 5 December 2012, a 0 percent tax on financial operations (IOF) rate applies to foreign loans with weighted average maturity (duration) longer than 360 days (one year). A 6 percent IOF rate remains applicable where maturity is shorter than a 360-day period.

Although this significantly reduces the cost of the loan in case of debt-funded transactions, as the Brazilian government frequently increases and reduces IOF rates on foreign loans, current applicable IOF rates should be confirmed before implementing an agreement.

Asset purchase or share purchase

Purchase of assets

Brazil’s successor liability rules are broad and also apply to asset deals. Brazilian legislation stipulates that private corporations that acquire goodwill or commercial, industrial or professional establishments from an unrelated entity and continue to operate the target business are liable for historical taxes related to the intangibles or establishments acquired. However, where a seller ceases to operate its business, the acquirer becomes liable for all the business’s historical tax liabilities.

The seller of assets is subject to income tax and social contribution tax (totaling approximately 34 percent) on any increase in value of the assets. For Brazilian tax purposes, no preferential rates apply to capital gains; both operational and non-operational gains are taxed at the same rate, although there is a difference in the tax treatment of capital and ordinary losses.

Purchase price

For tax purposes, it is necessary to apportion the total consideration among the assets acquired. It is generally advisable for the purchase agreement to specify the allocation, which is normally acceptable for tax purposes provided it is commercially justifiable.

Goodwill

Goodwill is recorded as a permanent asset and cannot be amortized for tax purposes, even though it may be amortized for accounting purposes.

Depreciation

the acquisition cost of fixed assets is subject to future depreciation as a deductible expense according to their economic useful life.

Tax attributes

Value added tax (VAT) credits may be transferred where an establishment is acquired as a going concern. Tax losses and other tax attributes remain with the seller.

Value added tax

Programa de Integração Social (PIS) and Contribuição para Financiamento da Seguridade Social (COFINS) may apply, depending on the type of asset sold. these taxes apply on the sale of most assets other than property, plant, and equipment (such as fixed assets).

Imposto sobre Circulação de Mercadorias e Prestação de Serviços de Transporte Interestadual e Intermunicipal e de Comunicação (ICMS) applies to the transfer of inventory. The tax paid may become a credit to the purchaser insofar as these same products are later sold or used as raw materials in the manufacture of products sold by the purchaser. The ICMS credits generated on the purchase of the assets generally can be used to offset the ICMS debts arising from later taxable transactions, such as sales. There are restrictions on a taxpayer’s ability to use credits on the purchase of fixed assets. Generally, the sale of fixed assets is not subject to ICMS, but ICMS credits generated on the purchase of fixed assets may have to be written off.

Excise tax

Imposto sobre Produtos Industrializados (IPI) also applies to the transfer of the inventory, where the inventory was directly imported or manufactured by the seller. IPI tax paid may also be creditable by the purchaser where the product is to be used in the manufacture of other products. IPI may also apply on the sale of fixed assets, where the asset was directly imported or manufactured by the seller and the subsequent sale occurred within 5 years of the date the asset was recorded as a permanent asset by the seller.

Transfer taxes

Municipal real estate transfer tax (ITBI) may apply to the transfer of real estate.

Stamp duties do not apply.

Tax on financial operations

Loans granted to the Brazilian company are also subject to IOF. The rate may vary from 0.38 percent to. 6 percent depending on the characteristics of the debt (mainly related to the maturity date).

Purchase of shares

The sale or purchase of shares in a Brazilian entity is more common than an asset deal because of lower documentation requirements and indirect taxation.

The taxation of a share sale depends, to some extent, on the residence of the seller and purchaser.

A Brazilian corporate seller (pessoa jurídica) is subject to income tax and social contribution tax on the net gain from the sale of shares. In most cases, where a seller owns a significant interest (usually more than 10 percent), the gain is calculated as the difference between the gross proceeds and the proportional book value of the target entity’s equity.

Whether the seller is a Brazilian individual or a non-resident, the gain is subject to a final 15 percent WHT, but the amount of the gain is calculated differently.

For a Brazilian individual, the gain is calculated based on the difference between the gross proceeds and the capital contributed or paid in a previous acquisition.

For a non-resident, because of the lack of clarity of the relevant tax provisions, there is some debate about how the capital gain is determined. A possible interpretation is that the gain is normally calculated as the difference between the amount of foreign capital registered with the Brazilian Central Bank and the gross sales proceeds in the foreign currency. Another possible interpretation is that the gain should be calculated as the difference in Brazilian currency between the sales proceeds and the capital invested, thereby including exchange fluctuations in the tax base. The different positions arise because of differences between the wording of the law and the regulations. It is important to state in the sales contract whether the sale price is gross or net of WHT.

If both the buyer and the seller are non-residents, it is likely that the tax authorities will tax an eventual capital gain. Previously, the common view among Brazilian tax practitioners was that no Brazilian taxation applied on the sale of shares or quotas in Brazilian entities where the transaction was performed between two non-residents (in principle, Brazilian tax law would require a Brazilian source of payment). As of 2004, Law 10.833/03 introduced a change to the Brazilian tax law that is interpreted as introducing the taxation of non-residents’ capital gains with respect to the assets located in Brazil even when neither party to the agreement is a Brazilian resident. Capital gains on the sale of publicly traded shares are subject to tax at a rate of 20 percent for resident individuals and are exempt for non-residents, provided certain formalities are met and the seller is not a resident of a tax haven.

According to the Brazilian legislation, equity investment funds (FIPs) are not legal entities but condominia with shares held by their investors. Generally, FIPs are exempt from corporate taxes (income and social contribution taxes on profits) and gross revenue taxes (PIS, COFINS), since some requirements are met. Non-resident investors are not subject to Brazilian taxation on the redemption of FIPs’ quotas, even where the redemption follows liquidation. The exemption only applies where certain requirements are met. Among other things, the non-resident must:

- hold less than 40 percent of the FIP’s quotas

- not be entitled to more than 40 percent of the income paid by the FIP

- not be resident in low-tax jurisdiction

- not hold the investment in the FIP through an account incorporated in accordance with Brazilian Central Bank rules.

One significant advantage of a share sale over an asset sale is that, where a share sale is structured properly, the amount paid in excess of the net equity of the target may generate an amortizable premium or a step-up in the tax bases of otherwise depreciable or amortizable assets. This opportunity is not available where shares in a Brazilian company are purchased directly by a non-resident and is not available to the same extent where assets are purchased.

To take advantage of this opportunity, the acquisition of shares needs to be made through a Brazilian acquisition vehicle.

The liquidation or merger of the acquisition vehicle and the target allows the premium paid on the shares to become recoverable in certain situations. To the extent that the premium relates to the value of recoverable fixed assets or the value associated with the future profitability of the company, the premium could be amortized or otherwise recovered through depreciation.

As mentioned earlier in the chapter, Provisional Measure 627/13 determines that the goodwill allocation must follow IFRS: it must be allocated first to fair value of assets/liabilities and intangibles and the remaining portion is allocated as goodwill (based on future profitability). Tax amortization is preserved, complying with the maximum limit of 1/60 per month. The PPA prepared by an independent expert must be filed with the Brazilian Federal Revenue or the Register of Deeds and Documents within 13 months in order to deduct the goodwill for tax purposes.

Tax indemnities and warranties

Generally, tax legislation and prevailing jurisprudence stress that corporate entities resulting from transformations, upstream or downstream mergers and spin-offs are liable for taxes payable by the original corporate entity up to the date of the transaction. This liability is also applicable on the wind-up of companies whose business continues to be exploited by any remaining partner, under the same or another corporate name, or a proprietorship.

Successor liability depends on one of two factors:

- the acquisition of the business (also referred to in the case law as the acquisition of goodwill, meaning business intangibles)

- the acquisition of the commercial, industrial or professional establishment (i.e. elements that are inherent in and essential for the business).

This rule treats an acquisition of assets, which constitutes a business unit, similarly to the acquisition of shares of a company where the seller goes out of business. If the seller stays in business with another activity, then the buyer’s responsibility is secondary, meaning that the tax authorities must first target the existing seller’s assets to satisfy the existing tax contingency.

Therefore, regardless of whether the transaction is structured as an asset or share acquisition, due diligence is extremely important in Brazil. Proper indemnities and warranties should be sought by the buyer.

Tax losses

In general, tax losses are kept by the acquired company, but the income tax code provides for some exceptions, including the following:

- On a merger (incorporação), the tax losses of the absorbed company cannot be used by the surviving entity and thus are essentially lost. In a spin-off (cisão), the tax losses of the target entity are lost in proportion to the net equity transferred.

- Between the tax period in which the losses are generated and the tax period in which they are used, there is a change of ownership and a change in the company’s main activity. In this case, the carried forward tax losses are forfeited.

Income tax regulations provide that tax losses generated in one year can be carried forward indefinitely. However, the use of tax loss carry forwards is limited to 30 percent of taxable income generated in a carry forward year.

Further, capital loss carry forwards may only be used against capital gains. The 30 percent limitation applies here as well.

A gain or loss from the sale of inventory generally is treated as ordinary or operational loss, while a gain or loss from the sale of the machinery and equipment, buildings, land and general intangibles is treated as a non-operational (capital) gain or loss.

Pre-sale dividend

In certain circumstances, the seller may prefer to realize part of the value of their investment as income by means of a pre-sale dividend. The rationale here is that the dividend is currently exempt from taxes in Brazil but reduces the proceeds of sale and thus the gain on sale, which may be subject to tax. However, each case must be examined on its merits.

Tax clearances

In Brazil, the concept of tax clearance does not exist. Consequently, tax and labor liabilities are only extinguished on expiration of the statute of limitations. Generally, the statute of limitations period is 5 years, beginning with the first day of the period following the taxable event (normally, a tax period comprises a month or a year).

Choice of acquisition vehicle

Several potential acquisition vehicles are available to a foreign purchaser, and tax factors often influence the choice.

Local holding company

A Brazilian holding company is typically used where the purchaser wishes to ensure the tax-deductibility of the goodwill paid or where tax relief for interest is available to offset the target’s taxable profits.

Foreign parent company

The foreign purchaser may choose to make the acquisition itself. This does not necessarily cause any tax problems in Brazil, as dividends are currently exempt from WHT. However, Brazil does charge WHT on interest.

Non-resident intermediate holding company

As mentioned earlier, a direct sale of a Brazilian company’s shares by a non-resident is subject to WHT in Brazil where a capital gain is recorded. An intermediate holding company resident abroad could be used to defer this tax, but both buyer and purchaser should be aware that the Brazilian tax authorities may try to establish whether this intermediate company has a real economic purpose and substance in order to look through the intermediate company and charge the appropriate tax.

Local branch

A Brazilian branch of a multinational company is treated as a regular legal entity in Brazil for tax purposes. A branch is also subject to Brazilian law and courts with regard to business and transactions it carries out in Brazil.

Generally, a business unit (branch) of a foreign company located in Brazil requires prior approval from the federal government by presidential decree, which is a lengthy process. The federal government also must authorize any amendments to the branch’s articles of incorporation. The power to grant the authorizations may be delegated. Currently, the authorizations must be issued by the Ministry of Development, Industry and Commerce.

Joint venture

Joint ventures are corporate companies (with the joint venture partners holding shares in a Brazilian company). There are no special rules for the taxation of such entities.

Choice of acquisition funding

From a Brazilian tax perspective, the capitalization of an entity with debt or equity is influenced by the expected profitability of the company. At least for a non-resident shareholder, financing through debt is generally more tax advantageous as interest paid on the debt is fully deductible for Brazilian corporate tax purposes. The potential benefits of an interest deduction may outweigh the WHT burden associated with the interest paid.

Foreign capital must be registered with the Brazilian Central Bank (Law 4131/62). Obtaining the foreign capital registration is of paramount importance because this is the foundation for paying dividends and repatriating capital in foreign currency, and, in some cases, it is required to record a tax base in a target company’s shares or assets.

Deductibility of interest

Changes to Brazilian legislation were published on 16 December 2009. Among them, KPMG in Brazil highlights the first legal provision in Brazil on thin capitalization. The legislation establishes new requirements for the deductibility of interest expenses arising from debt operations. Generally, for tax purposes, the debt cannot be higher than:

- two times the amount of the participation of the lender located anywhere outside Brazil (except for lenders located on low-tax jurisdictions or under a privileged tax regime) in the net equity of the borrower

- 30 percent of the net equity of the borrower where the lender is located in a low-tax jurisdiction or under a privileged tax regime (whether a related party or not).

This rule also applies for any kind of debt operation where a foreign related party acts as guarantor, cosigner or intervening party of the debt contract.

This new legislation also defines specific requirements that taxpayers must meet to deduct payments to beneficiaries located in a low-tax jurisdiction or under a privileged tax regime. These requirements include identifying the beneficiary owner and determining the operational capability of the foreign party to carry out the operation agreed with the Brazilian party.

Withholding tax on debt and methods to reduce or eliminate it there is a WHT burden of 15 percent associated with the interest paid (25 percent if paid to a tax haven resident).

Equity

Unlike interest, dividends are not subject to WHT when paid to a non-resident.

Additionally, Brazilian tax law (Law 9.249/95) allows a company to elect to pay interest to shareholders as return on equity capital at the official long-term interest rate. Interest on equity paid or accrued to resident or non-resident shareholders is generally deductible for income tax and social contribution tax. The payment is subject to WHT of 15 percent. However, opinions are divided on whether an increased rate should apply where the recipient is a tax haven resident. Brazilian tax authorities believe that a WHT of 25 percent should apply in such cases.

INE is calculated by applying the daily pro rata variation of the long-term interest rate (TJLP) to the value of the company’s net equity accounts at the beginning of the year. Increases and decreases in the equity accounts must also be considered in the computation, and the deduction is subject to limitations.

Because of its unique nature, interest on equity payments may be considered as dividend payments in several recipients’ home countries, carrying underlying foreign tax credits or being exempt, while being deductible for Brazilian income tax and social contribution tax purposes.

As previously mentioned, under MP 627/2013, 2015, IFRS-based dividends will be tax-exempt starting in 2015. All Brazilian companies that paid 2008 to 2013 dividends before 12 november 2013 are grandfathered by the new regulation. All companies that have yet to receive 2008 to 2013 dividends may be taxed on any profits exceeding old GAAP profits. The same applies to 2014 dividends. Taxpayers paying IFRS-based dividends in the period from 2008 to 2014 may also be tax-exempt if the taxpayer elects to adopt MP 627 in 2014. Similar provisions are established for payments of INE.

Corporate reorganization

Generally, corporate reorganizations (e.g. incorporações, fusões and cisões as described earlier in the chapter), liquidations and capital contributions – including capital contributions of shares – can be accomplished tax-free in Brazil, as long as assets are transferred at tax book value and other formalities are met.

However, there may be reasons to structure a reorganization as a taxable transaction (e.g. transfer of assets at fair market value). For example, transferring assets as part of a reorganization may allow:

- use of current-year losses that would otherwise become subject to loss limitations

- international tax planning

- a step-up in the tax bases of assets.

Hybrid instruments (i.e. instruments that may have either debt and equity characteristics or that may be treated differently in different jurisdictions) are relatively new to Brazil. They are being used with limited success. Brazil has very flexible tax rules with respect to debt, which makes the creation of hybrid financing instruments possible, but strict exchange control regulations generally limit the taxpayer’s options.

Other considerations

Company law and accounting

Brazilian GAAP is mainly governed by Corporate Law (Law 6.404/76) and the basic conceptual framework is provided by the Conselho Federal de Contabilidade (CFC – Accounting Federal Council).

On 28 December 2007, Law 6.404/76 was amended and modified in certain aspects by Law 11.638/07, which is effective from 1 January 2008. One of the main objectives of Law 11.638/07 is to align Brazilian GAAP with IFRS.

The rules and regulations issued by Brazil’s federal securities regulator (CVM) are consistent with international accounting standards adopted in the major financial and capital markets. The implication is that a systematization of new financial reporting standards, applicable to the preparation of financial statements and financial reports in general, gradually will converge to full adoption of IFRS. This convergence is already occurring, and it is being coordinated by the Accounting Standards Committee (CPC).

Generally, Brazilian GAAP is based on the accrual method of accounting, unless specific legislation or a rule states otherwise. Inflationary adjustments are not required in financial statements.

Group relief/consolidation

Brazil does not have group relief or tax consolidation rules.

Transfer pricing

In structuring acquisitions and reorganizations, it is important to keep in mind the potential application of Brazil’s tax rules related to transfer pricing and disguised distributions of profits. Generally, these provisions require that Brazilian-resident companies that buy or sell assets, including shares, from or to a related party do so at market value determined according to specific rules. Variations from market value may increase tax or reduce the tax base.

Foreign investments of a local target company

Brazilian controlled foreign company rules (CFC) subject any profits recorded by foreign subsidiaries to tax in Brazil at the end of the year. A foreign tax credit is granted up to the amount of Brazilian tax due on the same profits. Losses generated by the foreign subsidiary can offset against future profits generated abroad but not against Brazilian profits.

As previously mentioned, MP 627/2013 basically determines that tax standards should follow IFRS regulations implemented in Brazil. Such determination is optional for 2014 and mandatory as of 2015.

Comparison of asset and share purchases

Advantages of asset purchases

- Buyer usually obtains a step-up in the bases of the assets.

- Where the assets acquired constitute a going concern (acervo de negócios), the buyer may obtain benefits of tax credits and certain other tax attributes, especially those associated with indirect taxes, such as IPI and ICMS.

- Often helps minimize the inheritance of tax, legal and labor liabilities.

- May take less time to implement.

Disadvantages of asset purchases

- Tends to result in a more tax burdensome transaction when compared to a share deal (especially for IPI, ICMS, PIS, COFINS and ITBI purposes).

- May prevent the buyer from acquiring the target’s tax losses and other tax attributes.

- From a seller’s perspective, an asset sale may provide much more limited opportunities than a share sale for tax planning to minimize gains on the assets sold.

- Where the assets transferred constitute a going concern (acervo de negócios), some inheritance of liabilities cannot be avoided. The buyer of a going concern generally remains with either joint, several, or secondary liability for pre-acquisition tax liabilities related to the business acquired, depending on whether the seller continues to operate in the same line of business.

- Depending on the assets or business acquired, acquiring assets may require new registrations for tax, labor and other regulatory purposes, termination costs and re-hiring costs for employees and other administrative burdens. Brazilian labor and tax laws provide for significant termination costs for employers. In an asset sale, employment technically must be terminated, triggering certain severance costs that can be significant.

- The post-acquisition administrative burden associated with the transfer of the assets or a going concern can be much more significant in an asset sale.

Advantages of share purchases

- Minimization of tax impacts, especially for IPI, ICMS, PIS, COFINS and ITBI purposes.

- Where the transaction is structured properly, the buyer may be able to obtain a better tax result by structuring the acquisition as an acquisition of shares rather than acquiring the assets directly. The benefit is that acquiring shares allows for the recovery of the purchase premium (sales proceeds exceeding book value of the target company) through amortization. The nature of the premium is significant for Brazilian tax purposes, but in most cases, a premium can be recovered over a five-year period – significantly faster than the recovery period for most fixed assets, which are generally depreciable over 10 years.

- Tax losses and other tax attributes of the target company may be carried over (see discussions on loss limitations earlier in the chapter).

- Where employees are to be transferred with the target business, it may be possible to transfer them with the acquired business without terminating their employment.

Disadvantages of share purchases

- Pre-acquisition tax liabilities of the target remain with the purchased legal entity.

- Where the buyer wants to purchase only part of the target’s business, pre-acquisition structuring steps may take some time to implement.

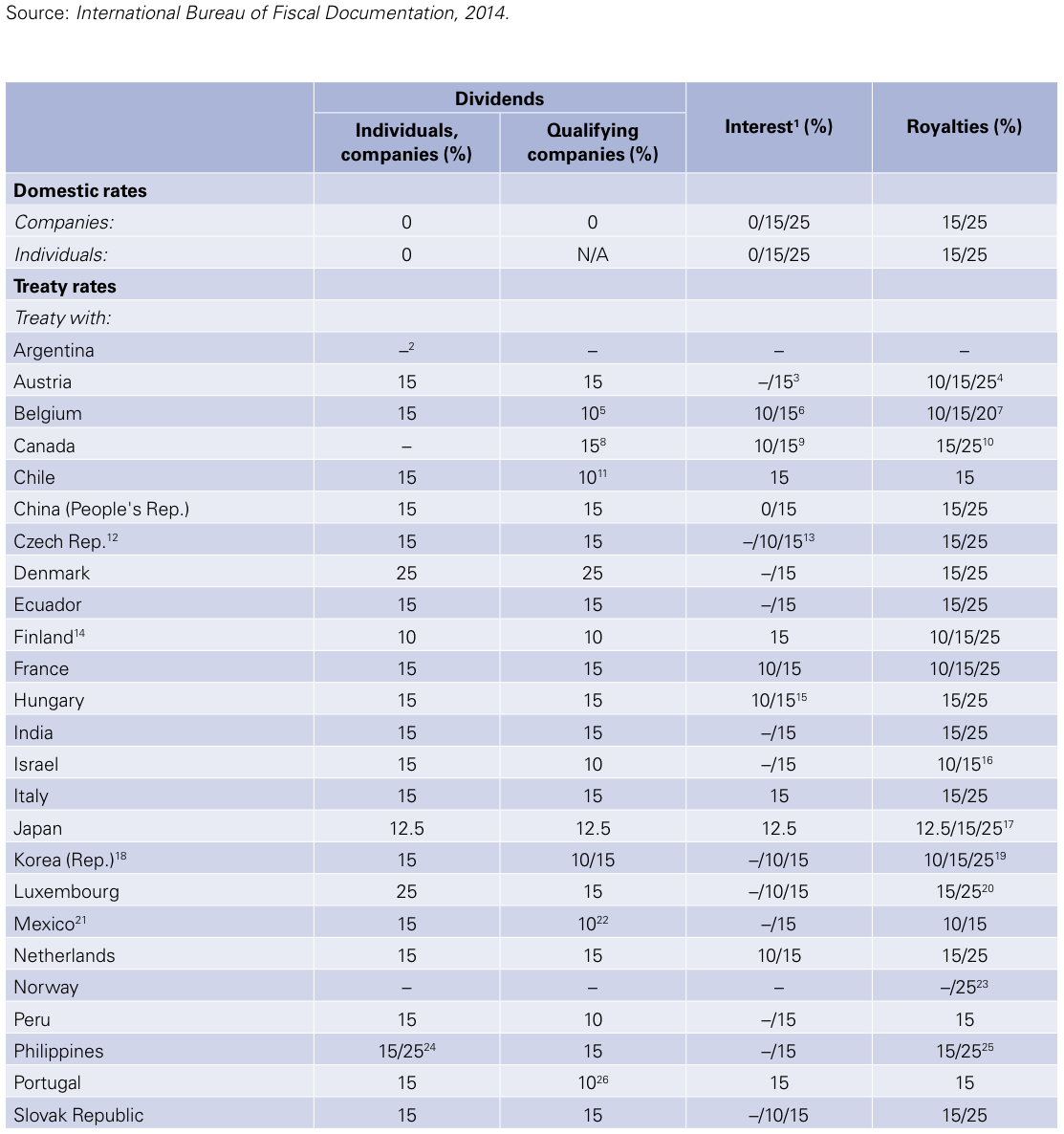

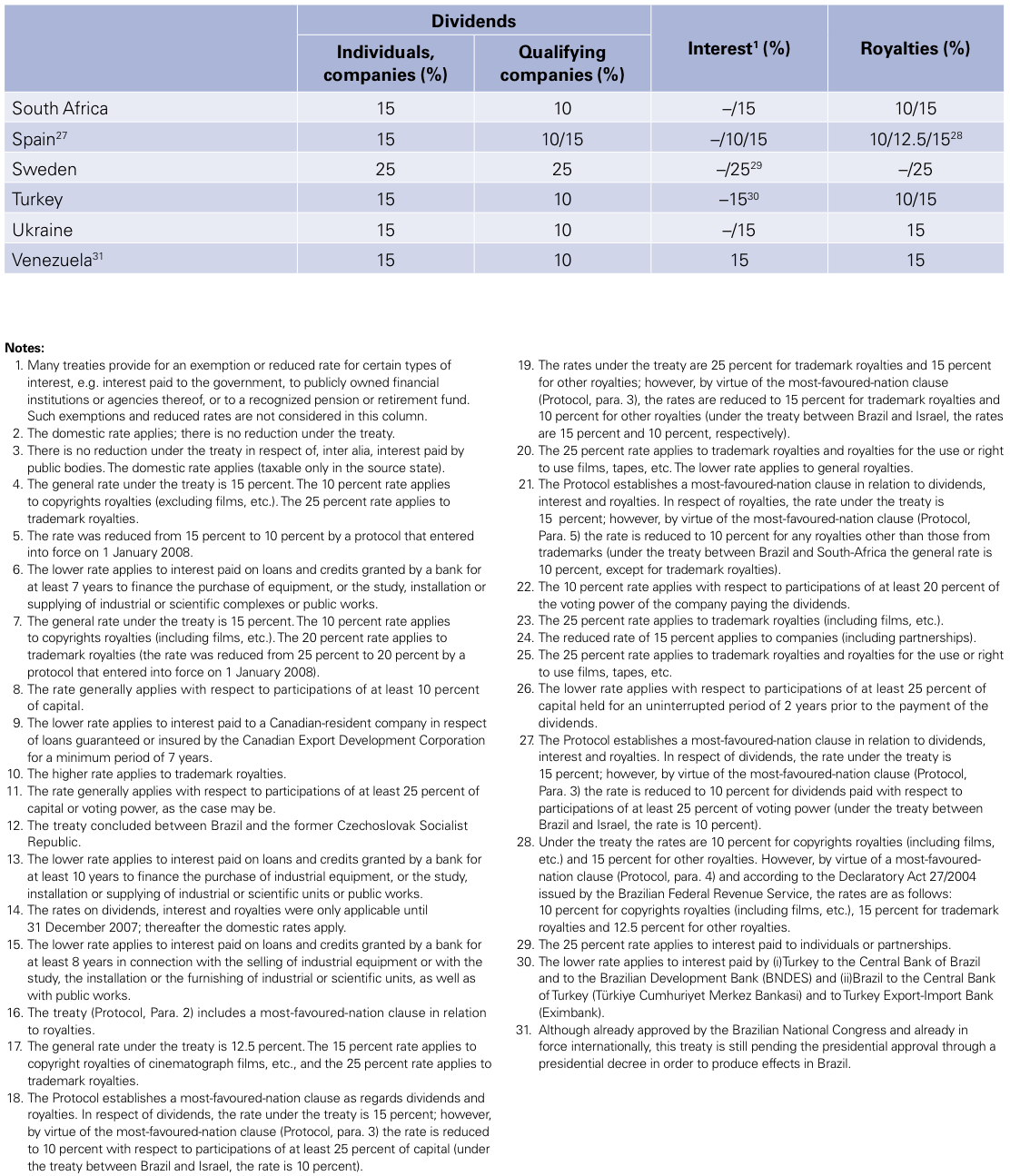

Brazil – Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Brazil’s tax treaties. This table is based on information up to 1 January 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter