Publications Learning to let go: Making better exit decisions

- Publications

Learning to let go: Making better exit decisions

- Bea

SHARE:

By John T. Horn, Dan P. Lovallo, and S. Patrick Viguerie – McKinsey & Company

Psychological biases can make it difficult to get out of an ailing business.

When General Motors launched Saturn, in 1985, the small-car division was GM’s response to surging demand for Japanese brands. At first, consumers were very receptive to what was billed as “a new kind of car company,” but sales peaked in 1994 and then drifted steadily downward. GM reorganized the division, taking away some of its autonomy in order to leverage the parent company’s economies of scale, and in 2004 GM agreed to invest a further $3 billion to rejuvenate the brand. But 21 years and billions of dollars after its founding, it has yet to earn a profit. Similarly, Polaroid, the pioneer of instant photography and the employer of more than 10,000 people in the 1980s, failed to find a niche in the digital market. A series of layoffs and restructurings culminated in bankruptcy, in October 2001.

Research bears out the tendency of companies to linger. One study showed that as a business ages, the average total return to shareholders tends to decline. For most of the divestitures in the sample, the seller would have received a higher price had it sold earlier. According to our analysis of a broad cross-section of US companies from 1993 to 2004, the probability that a failing business will grow appreciably or become profitable within three years was less than 35 percent. Finally, researchers who studied the entry and exit patterns of businesses across industries found that companies are more likely to exit at the troughs of business cycles—usually the worst time to sell.

Why is it so difficult to divest a business at the right time or to exit a failing project and redirect corporate resources? Many factors play a role, from the fact that managers who shepherd an exit often must eliminate their own jobs to the costs that companies incur for layoffs, worker buyouts, and accelerated depreciation. Yet a primary reason is the psychological biases that affect human decision making and lead executives astray when they confront an unsuccessful enterprise or initiative. Such biases routinely cause companies to ignore danger signs, to refrain from adjusting goals in the face of new information, and to throw good money after bad.

In contrast to other important corporate decisions, such as whether to make acquisitions or enter new markets, bad timing in exit decisions tends to go in one direction, since companies rarely exit or divest too early. An awareness of this fact should make it easier to avoid errors—and does, if companies identify the biases at play, determine where in the decision-making process they crop up, and then adopt mechanisms to minimize their impact. Techniques such as contingent road maps and tools borrowed from private equity firms can help companies to decide objectively whether they should halt a failing project or business and to navigate the complexities of the exit.

The psychological biases at play

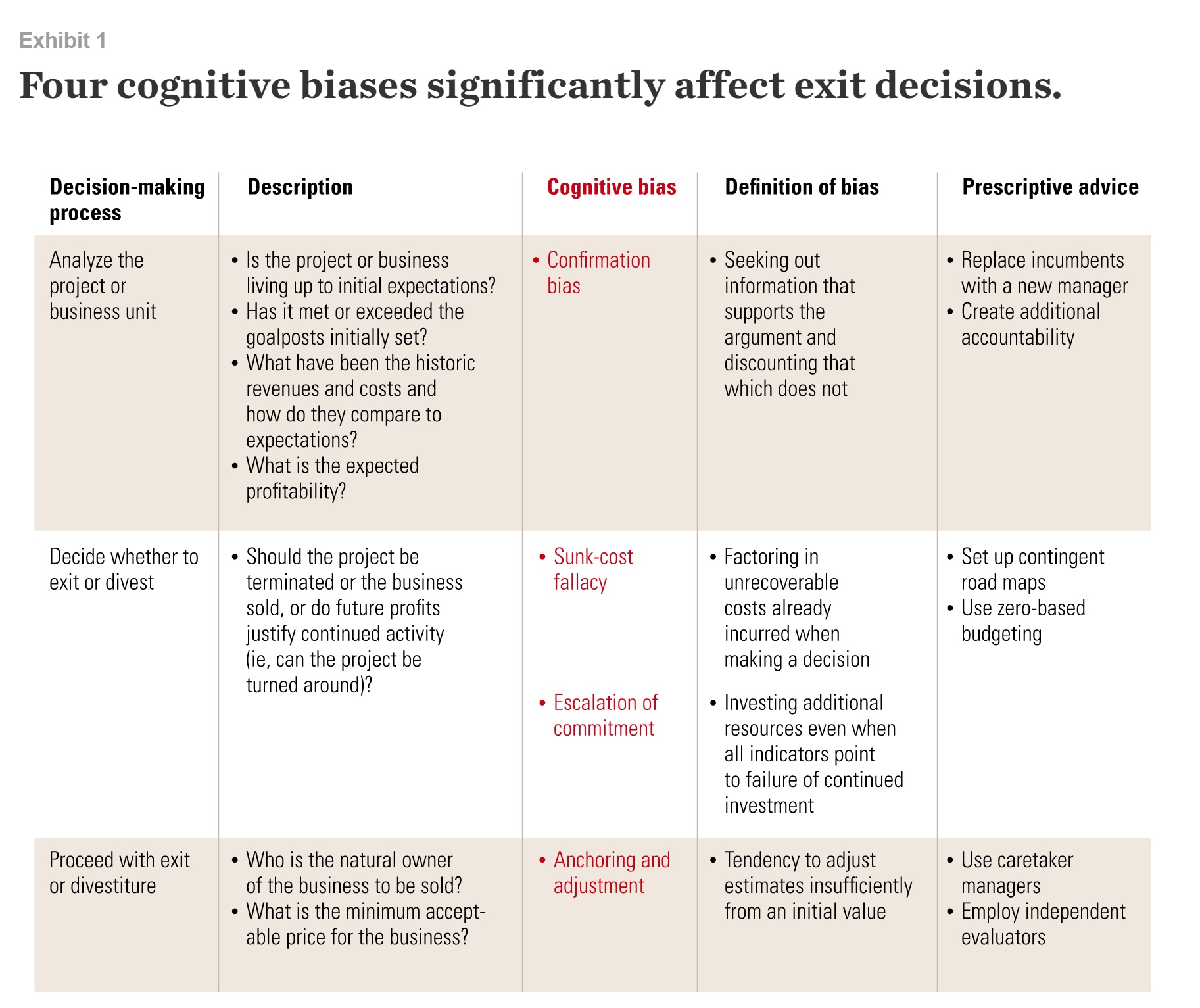

The decision-making process for exiting a project, business, or industry has three steps. First, a well-run company routinely assesses whether its products, internal projects, and business units are meeting expectations. If they aren’t, the second step is the difficult decision about whether to shut them down or divest if they can’t be improved. Finally, executives tackle the nitty-gritty details of exiting.

Each step of this process is vulnerable to cognitive biases that can undermine objective decision making. Four biases have significant impact: the confirmation bias, the sunk-cost fallacy, escalation of commitment, and anchoring and adjustment. We explore the psychology behind each one, as well as its influence on decisions (Exhibit 1).

Analyzing the project

Let’s start with a brief test of a person’s ability to analyze hypotheses. Imagine that someone deals four cards from a deck, each with a number printed on one side and a letter on the other. Which pair would you choose given an opportunity to flip over just two cards to test the assertion, “If a card has a vowel on one side, then there must be an odd number on the other side”?

Most people correctly choose the U but then incorrectly select 7. This pattern illustrates the confirmation bias: people tend to seek information that supports their point of view and to discount information that doesn’t. An odd number opposite U confirms the statement, while an even number refutes it. But the 7 doesn’t provide any new information—a vowel on the other side confirms the assertion, but a consonant doesn’t reveal anything, since consonants can have even or odd numbers on their flip sides. The correct choice is the 8 because it could reveal something: if there is a vowel on the other side, the statement is false.

Now imagine a group of executives evaluating a project to see if it meets performance hurdles and if its revenues and costs match the initial estimates. Just as most people choose cards that support a statement rather than those that could contradict it, business evaluators rarely seek data to disprove the contention that a troubled project or business will eventually come around. Instead, they seek market research trumpeting a successful launch, quality control estimates predicting that a product will be reliable, or forecasts of production costs and start-up times that would confirm the success of the turnaround effort. Indeed, reports of weak demand, tepid customer satisfaction, or cost overruns often give rise to additional reports that contradict the negative ones.

Consider the fate of a US beer maker, Joseph Schlitz Brewing. In the early 1970s, executives at the company decided to use a cheaper brewing process, citing market research suggesting that consumers couldn’t tell beers apart. Although they received constant evidence, in the form of lower sales, that customers found the taste of the beer brewed with the new process noticeably worse, the executives stuck with their low-cost strategy too long. Schlitz, once the third-largest brewer in the United States, went into decline and was acquired by rival Stroh in 1982. Like-wise, when Unilever launched a new Persil laundry detergent in the United Kingdom, in 1994, the company tested the formula on new clothes successfully but didn’t seek disconfirming evidence, such as whether it would damage older clothing or react negatively to common clothing dyes. Consumers discovered that it did, and Unilever eventually had to return to the old formula.

Deciding which projects to exit

At this stage, the sunk-cost fallacy is the key bias affecting the decision-making process. In deciding whether to exit, executives often focus on the unrecoverable money already spent or on the project-specific know-how and capabilities already developed. A related bias is the escalation of commitment: yet more resources are invested, even when all indicators point to failure. This misstep, typical of failing endeavors, often goes hand in hand with the sunk-cost fallacy, since large investments can induce the people who make them to spend more in an effort to justify the original costs, no matter how bleak the outlook. When anyone in a meeting justifies future costs by pointing to past ones, red flags should go up; what’s required instead is a levelheaded assessment of the future prospects of a project or business.

The Vancouver Expo 86 is a classic example. The initial budget, CAN $78 million in 1978, ballooned to CAN $1.5 billion by 1985, with a deficit of more than CAN $300 million. During those seven years, the expo received several cash infusions because of the provincial government’s commitment to the project. Outrageous attendance estimates were used to justify the added expense (the confirmation bias at play). Predictions of 12.5 million visitors, which would have stressed Vancouver’s infrastructure, grew at one point to 28 million—roughly Canada’s population at the time. Moreover, Canadians had seen budget deficits for big events before: the 1967 Montreal Exposition lost CAN $285 million—six times early estimates—and the 1976 Montreal Olympics lost more than CAN $1 billion, though no deficit had been expected.

Contrast that with the story of the Cincinnati subway. Construction began in 1920. When the $6 million budget ran out, in 1927, the leaders of the city decided that it no longer needed the subway, a point suggested by studies from independent experts. Further construction was stopped, though crews had finished building the tunnels. The idea for the subway had been conceived in 1884, and the project was supported by Republicans and Democrats alike, so this decision was not a whim; World War I and shifting demographic needs had altered the equation. Fortunately for Cincinnatians, during the past 80 years, referendums to raise funds for completion have all failed.

Proceeding with the cancellation

The final bias is anchoring and adjustment: decision makers don’t sufficiently adjust future estimates away from an initial value. Early estimates can influence decisions in many business situations, and this bias is particularly relevant in divestment decisions. There are three possible anchors. One is tied to the sunk cost, which the owner may hope to recover. Another is a previous valuation, perhaps made in better times. The third—the price paid previously for other businesses in the same industry—often comes up during merger waves, as it did recently in the consolidation of dot-com companies. If the first company sold for, say, $1 billion, other owners may think that their companies are worth that much too, even though buyers often target the best, most valuable company first.

The sale of PointCast, which in the 1990s was one of the earliest providers of personalized news and information over the Internet, shows this bias at work. The company had 1.5 million users and $5 million in annual advertising revenue when Rupert Murdoch’s News Corporation (NewsCorp) offered $450 million to acquire it. The deal was never finalized, however, and shortly thereafter problems arose. Customers complained of slow service and began defecting to Yahoo! and other rivals. In the next two years, a number of companies considered buying PointCast, but the offer prices kept dropping. In the end, it was sold to Infogate for $7 million. PointCast’s executives may well have anchored their expectations on the first figure, making them reluctant to accept subsequent lower offers.

Axing a project that flops is relatively straight-forward, but exiting a business or an industry is more complex: companies can more easily reallocate resources—especially human resources—from terminated projects than from failed businesses. Higher investments, which loom larger in decision making, are typically tied up in an ongoing business rather than in an internal project. The anguish executives often feel when they must fire colleagues also partially explains why many closures don’t occur until after a change in the executive suite. Divestiture, however, is easier because of the possibility of selling the business to another owner. Selling a project to another company is much more difficult, if it is possible at all.

When a company decides to exit an entire business, the characteristics of the company and the industry can influence the decision-making process. If a flagging division is the only problematic unit in an otherwise healthy company, for instance, all else being equal, managers can sell or close it more easily than they could if it were the core business, where exit would likely mean the company’s death. (Managers might still sell in this case, but we recognize that it will be hard to do so.) It sometimes (though rarely) does make sense to hang on in a declining industry—for instance, if rivals are likely to exit soon, leaving the remaining company with a monopoly.

Becoming unbiased

Several techniques can mitigate the effects of the human biases that confound exit decision making. One way of overcoming the confirmation bias, for instance, is to assign someone new from the management team to assess a project. At a multinational energy and raw-materials company, a manager who was not part of an initial proposal must sign off on the project. If the R&D department claims that a prototype production process can ramp up to full speed in three months, for example, the production manager has to approve it. If the target isn’t met, the production manager too is held accountable. Making executives responsible for the estimates of other people is a powerful check: managers are unlikely to agree to a target they cannot reach or to overestimate the chances that a project will be profitable. The likely result is more honest opinions.

Well-run private equity firms adopt these practices too. One leading US firm assigns independent partners to conduct periodic reviews of businesses in its portfolio. If Mr. Jones buys and initially oversees a company, for example, Ms. Smith is later charged with the task of reviewing the purchase and its ensuing performance. She takes her role seriously because she is also accountable for the unit’s final performance. Although the process can’t eliminate the possibility that the partners’ collective judgment will be biased, the reviews not only make biases less likely but also make it more likely that underperforming companies will be sold before they drain the firm’s equity.

Another tool that can help executives overcome biases and make more objective decisions is a contingent road map that lays out signposts to guide decision makers through their options at predetermined checkpoints over the life of a project or business. Signposts mark the points when key uncertainties must be resolved, as well as the ensuing decisions and possible outcomes. For a contingent road map to be effective, specific choices must be assigned to each signpost before the project begins (or at least well before the project approaches the signpost). This system in effect supplies a precommitment that helps mitigate biases when the time to make the decision arrives.

One petrochemical company, for instance, created a road map for an unprofitable business unit that proposed a new catalyst technology in an attempt to turn itself around (Exhibit 2). The road map established specific targets—a tight range of outcomes—that the new technology had to achieve at a series of checkpoints over several years. It also set up exit rules if the business missed these targets.

Road maps can also help to isolate the specific biases that may affect the corporate decision-making process. If a signpost suggests, for example, that a project or business should be shut down but executives decide that the company has invested too much time and money to stop, the sunk-cost fallacy and escalation-of-commitment bias are quite likely at work. Of course, the initial road map might have to be adjusted as new information arrives, but the changes, if any, should always be made solely to future signposts, not to the current one.

Contingent road maps prevent executives from changing the decision criteria in midstream unless there is a valid, objective reason. They help decision makers to focus on future expectations (rather than past performance) and to recognize uncertainty in an explicit way through the use of multiple potential paths. They limit the impact of the emotional sunk costs of executives in projects and businesses. And they help decision makers by removing the blame for unfavorable outcomes that have been specified in advance: the explicit recognition of problems gives an organization a chance to adapt, while a failure to recognize problems beforehand requires a change in strategy that is often psychologically and politically difficult to justify. Before the invasion of Iraq in 2003, for example, it was uncertain how US troops would be received there. If the Bush administration had publicly announced a contingency plan providing for the possibility of increased troop levels should an insurgency erupt, the president would most likely have had the political cover to adopt that strategy.

When companies are finally ready to sell a business, the decision makers can overcome any lingering anchoring and adjustment biases by using independent evaluators who have never seen the initial projections of its value. Uninfluenced by these earlier estimates, the reviews of such people will take into account nothing but the project’s actual experience, such as the evolution of market share, competition, and costs. One leading private equity firm overcomes anchoring and other biases in decision making by routinely hiring independent evaluators, who bring a new set of eyes to older businesses in its portfolio.

There are ways to ease the emotional pain of shutting down or selling projects or businesses. If a company has several flagging ones, for example, they can be bundled together and exited all at once or at least in quick succession—the business equivalent of ripping a bandage off quickly. Such moves ensure that the psychological sense of failure that often accompanies an exit isn’t revisited several times. A onetime disappointment is also easier to sell to stakeholders and capital markets, especially for a new CEO with a restructuring agenda.

In addition, companies can focus on exiting businesses with products and capabilities that are far from their core activities, as P&G did in 2002, when it divested and spun off certain products in order to focus on others with stronger growth prospects and a more central position in its corporate portfolio.

Although canceling a project or exiting a business may often be regarded as a sign of failure, such moves are really a perfectly normal part of the creative-destruction process. Companies need to realize that in this way they can free up their resources and improve their ability to embrace new market opportunities.

By neutralizing the cognitive biases that make it harder for executives to evaluate struggling ventures objectively, companies have a considerably better shot at making investments in ventures with strong growth prospects. The unacceptable alternative is to gamble away the company’s resources on endeavors that are likely to fail in the long run no matter how much is invested in them.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter