Publications Deal Capsule: Transactions In Chemicals & Pharmaceuticals April 2016

- Publications

Deal Capsule: Transactions In Chemicals & Pharmaceuticals April 2016

- Christopher Kummer

SHARE:

Contributor: Andy Qiu

HIGHLIGHTS

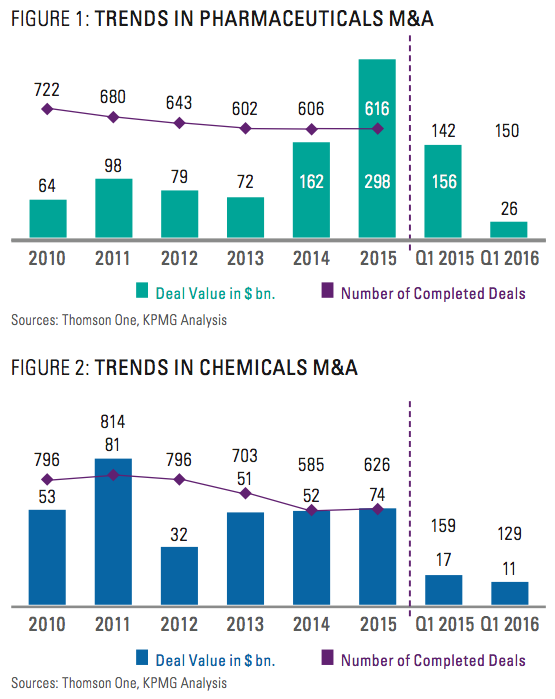

— While the number of completed pharma deals were slightly higher in Q1 2016 versus Q1 2015, deal value was far lower in the absence of any >$10 billion completions. Only one deal exceeded $5 billion in Q1 2016 (versus 8 in Q1 2015).

— Specialization continues to be a driving force in Q1 2016, especially in sectors such as OTC, rare diseases and oncology.

— Declines in transaction values were also witnessed in chemicals. Downstream specialty chemicals was the leading focus area, notably in applications, resins and agrochemicals.

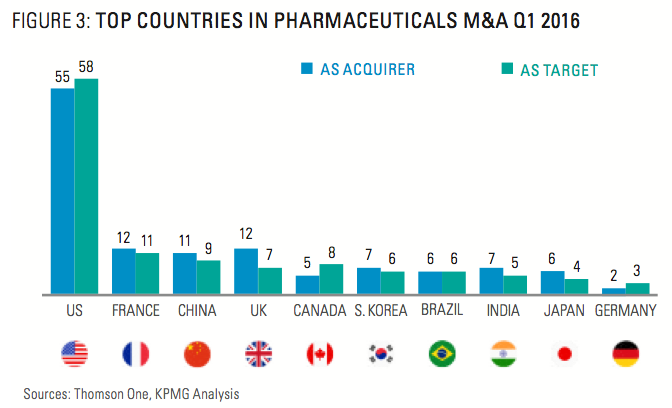

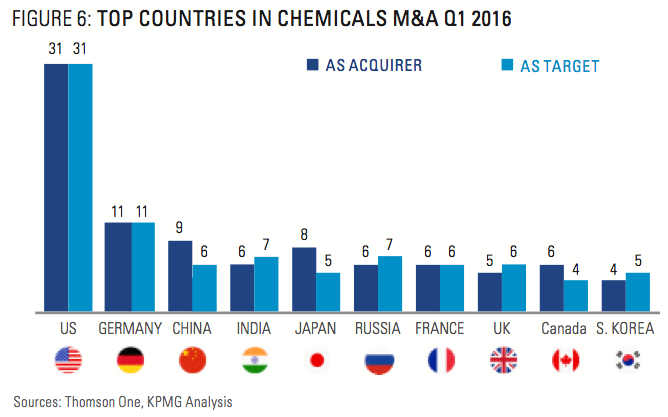

— US continues to be the most active country followed by Europe (France for pharma, Germany for chemicals), moving China into third place.

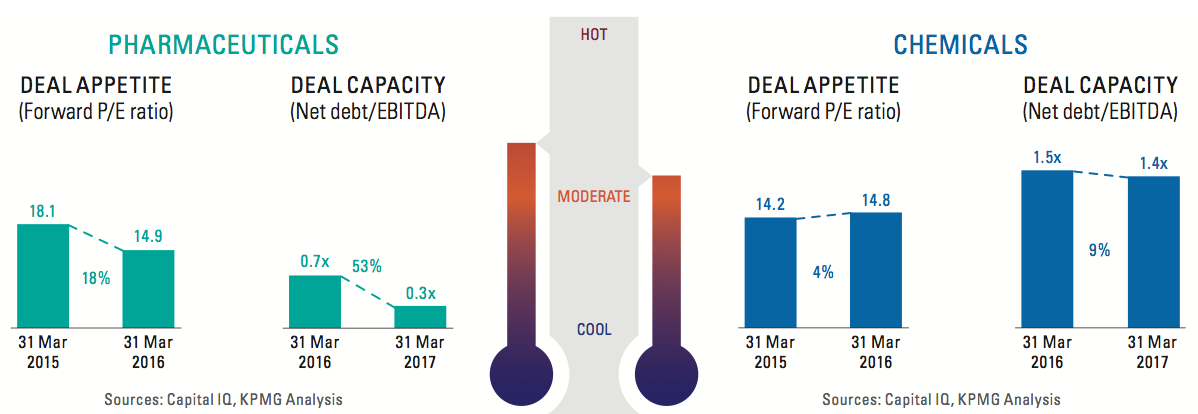

— KPMG’s Deal Thermometer indicates that the environment for M&A activity will remain moderately strong in both pharmaceuticals and chemicals.

“Big Pharma’s strong balance sheets are expected to drive further deal-making, despite a Q1 correction in market valuations.” – Vir Lakshman, Head Of Chemicals & Pharmaceuticals, KPMG In Germany

DEAL THERMOMETER Q1 2016

KPMG’s Deal Thermometer signals the environment for M&A deals in chemicals and pharmaceuticals. It combines the appetite for deals (changes in forward P/E ratios) with the capacity to fund deals (changes in Net Debt/ EBITDA multiples). ‘Hot’ signifies an environment conducive to deal-making.

Pharmaceuticals

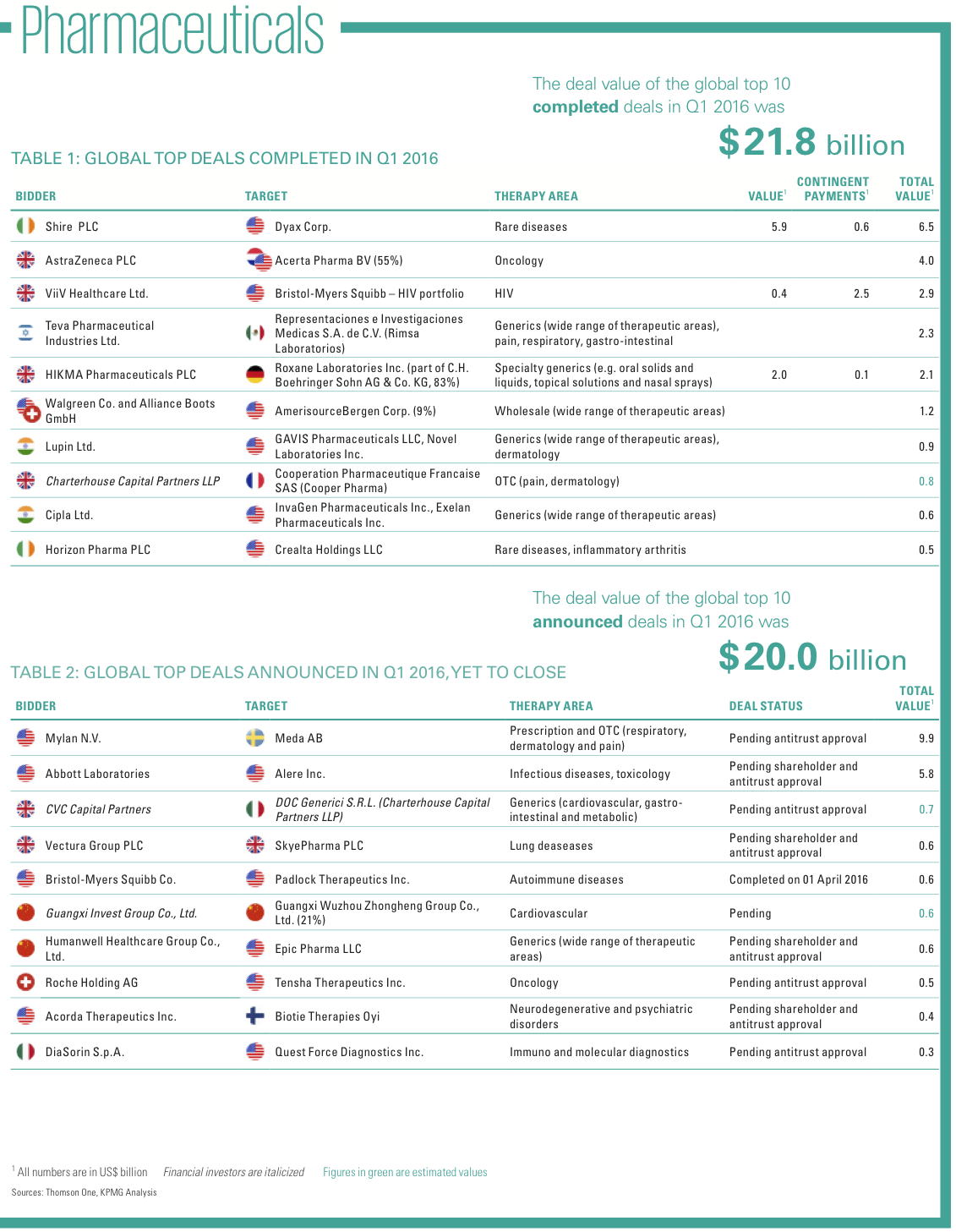

Pharmaceutical deal values have dropped significantly – the value of the top 10 completed deals in Q1 2016 was $21.8 billion compared to $134.0 billion in Q1 2015. Deal activity in Q1 2016 was focused on smaller transactions to secure assets and enhance strategic portfolios. US remains the most targeted country, however interest in European assets is strong as market values decline.

DEAL FOCUS AREAS

The 2015 announcement of the Pfizer Inc. – Allergan PLC deal was expected to result in the largest ever M&A transaction in the sector. However, a further clamp down on tax inversion by the US treasury led to Pfizer calling off the deal. Shire PLC, on the other hand, has confirmed its intention to complete its acquisition of Baxalta Inc.

Focus on specialization continues to drive M&A activity in OTC, generics, rare diseases, medical diagnostics and oncology. Big Pharma continues to pursue biotechs to enhance their portfolios.

OTC

In Q1 2016, OTC topped the announced deal list in terms of size with Mylan N.V. announcing the $9.9 billion acquisition of Meda AB to reduce its dependency on generic drugs. The deal adds to Mylan’s portfolio a $0.8 billion OTC business and a $1.4 billion high margin prescription drugs business. In addition, it expands its geographic presence to 16 new markets including China, Mexico and Russia. In 2015, Mylan failed in its attempt to buy OTC maker Perrigo Co. for $26 billion.

Generics

Generics continues to dominate the M&A landscape. A number of transactions in generics were completed in Q1 2016. Teva Pharmaceutical Industries Ltd. bought Rimsa Laboratorios for $2.3 billion, moving from a small presence to a leading position in Mexico, the second-largest pharma market in Latin America.

Further generic deals were completed by British Hikma Pharmaceuticals PLC and Indian players, Lupin Ltd. and Cipla Ltd. Similar to the Indian transactions, the China-based Humanwell Healthcare Group Co., Ltd. announced a US generics acquisition to strengthen its commercialization and manufacturing. PE is also interested in the sector with CVC Capital Partners’ acquisition of DOC Generici S.R.L. making it to the list of top 10 announced deals.

Rare diseases

Rare diseases continue to be an attractive investment area for pharmaceutical companies. Following its Q3 2015 deal announcement of orphan drug maker Baxalta Inc., Shire completed the $6.5 billion acquisition of Dyax Corp. in Q1 2016. This deal adds a blood disorder treatment to its rare disease portfolio.

Through acquiring Crealta Holdings LLC for $0.5 billion in Q1 2016, Horizon Pharma PLC adds the first and only FDA-approved medicine for a rare arthritis disease, KRYSTEXXA, with intellectual property protection until 2027. The deal supports Horizon’s plan to generate 60% of net sales in 2020 from its orphan drug business.

Medical diagnostics

As diagnostic testing moves closer to the patient and away from the laboratory, test results and patient outcomes are accelerated. This is becoming increasingly critical in dealing with deadly viruses. Responding to this trend, Abbott Laboratories has strengthened its capabilities in this area by announcing the $5.8 billion acquisition of Alere Inc.

The deal will help it become the leading provider of point of care testing with sales exceeding $7 billion and expected synergies of $0.5 billion by 2019.

Oncology

The larger oncology deals in Q1 2016 were European-based. The largest oncology player, Roche Holding AG, announced the $0.5 billion acquisition of Tensha Therapeutics Inc., boosting the exploration of Tensha’s TEN-010, a best-in-class BET inhibitor in two Phase I clinical cancer trials.

In Q1 2016, AstraZeneca PLC completed the $4.0 billion acquisition of a 55% stake in Acerta Pharma BV, a leader in covalent binding technology. The deal enables AZ to complement its immunotherapy approach by adding acalabrutinib, a Bruton’s tyrosine kinase (BTK) inhibitor for blood cancers and multiple solid tumors in late-stage development.

REVERSING COURSE IN HIV

Bristol-Myers Squibb exited this therapy area by selling for $2.9 billion its HIV R&D portfolio to ViiV Healthcare Ltd.. GlaxoSmithKline PLC, who owns 76.5% of ViiV reversed a decision to spin it off in 2016 due to promising new drugs and shareholder pressure to retain the business.

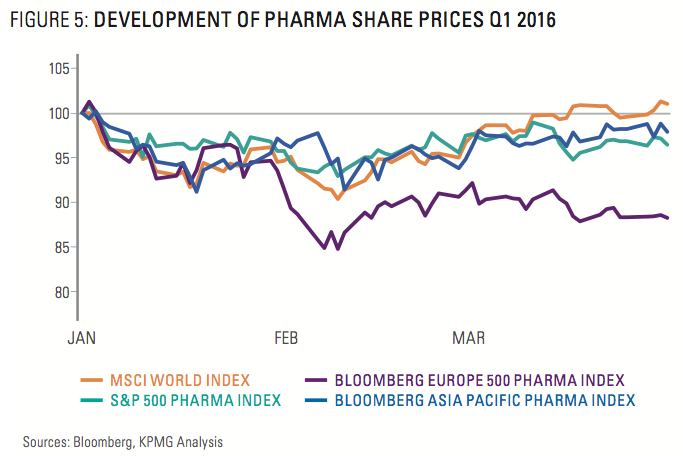

CAPITAL INDEX

In Q1 2016, pharma indices lost ground and underperformed the MSCI World Index which grew by 1.1%. The US S&P 500 index (-3.7%) and the Bloomberg Asian Pacific index (-2.2%) declined moderately, whereas the Bloomberg European index (-12.1%) closed the quarter significantly lower.

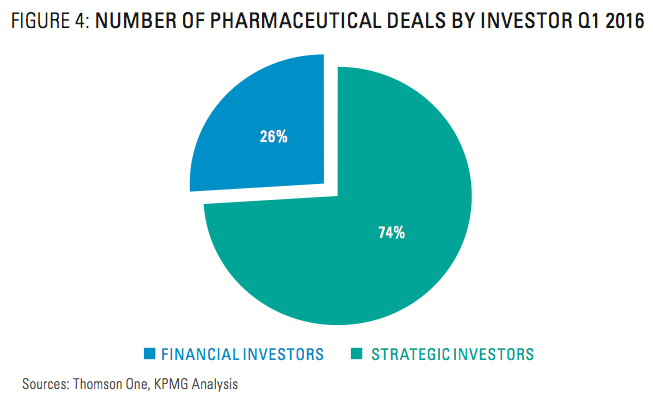

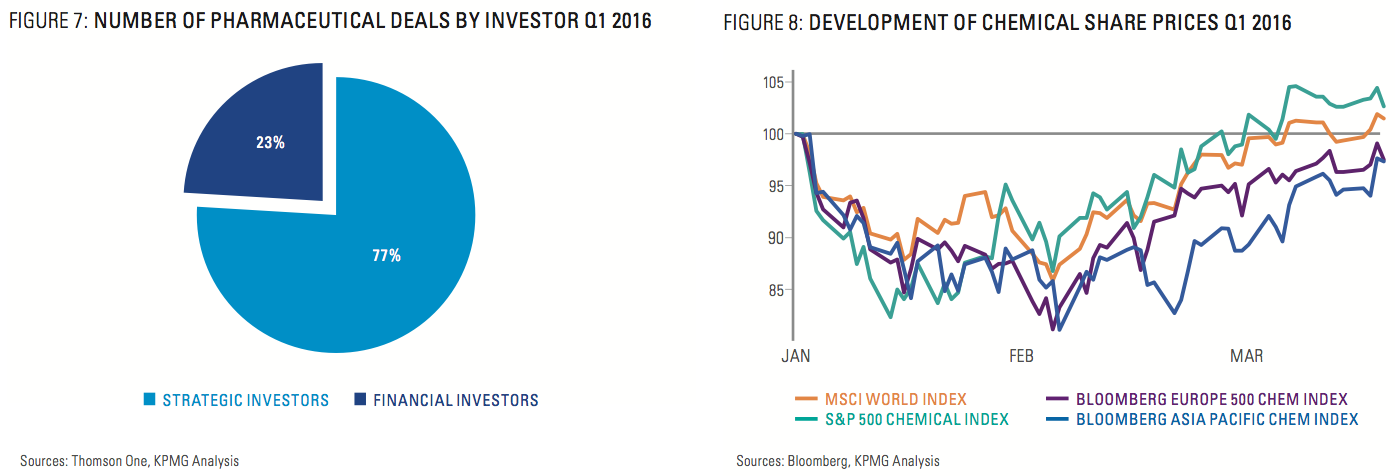

FINANCIAL INVESTORS

Financial investors are also showing keen interest in the sector, particularly in OTC and generics.

British Private Equity investor Charterhouse Capital Partners LLC completed the acquisition of OTC-maker Cooper Pharma for $0.8 billion from French investment firm Caravelle. Charterhouse further announced the sale of DOC Generici S.R.L, a leading Italian generics company with a market share of over 15%, for $0.7 billion to PE-firm CVC Capital Partners.

EUROPEAN BIOTECH FUNDING

In Q1 2016, Index Ventures, known for its early investments in Skype and Dropbox, spun off its biotech unit, creating Medicxi Ventures, one of the largest independent Life Sciences-centric venture capital firms worth $1 billion. A new $0.2 billion fund focused on investing in European early-stage drug development was created backed by GlaxoSmithKline PLC and Johnson & Johnson each contributing 25%. Although GSK and J&J have no rights to the companies backed by the fund, they will benefit from the knowledge and insights gathered around R&D.

Also in Q1 2016, J&J, GSK and AstraZeneca provided financing for a $0.1 billion fund with several UK universities to facilitate commercialization of academic research.

CHINA

In Q1 2016, domestic deals dominated M&A activity in China with the exception of two deals, one of which is Humanwell’s acquisition of US generics player, Epic Pharma LLC.

Chemicals

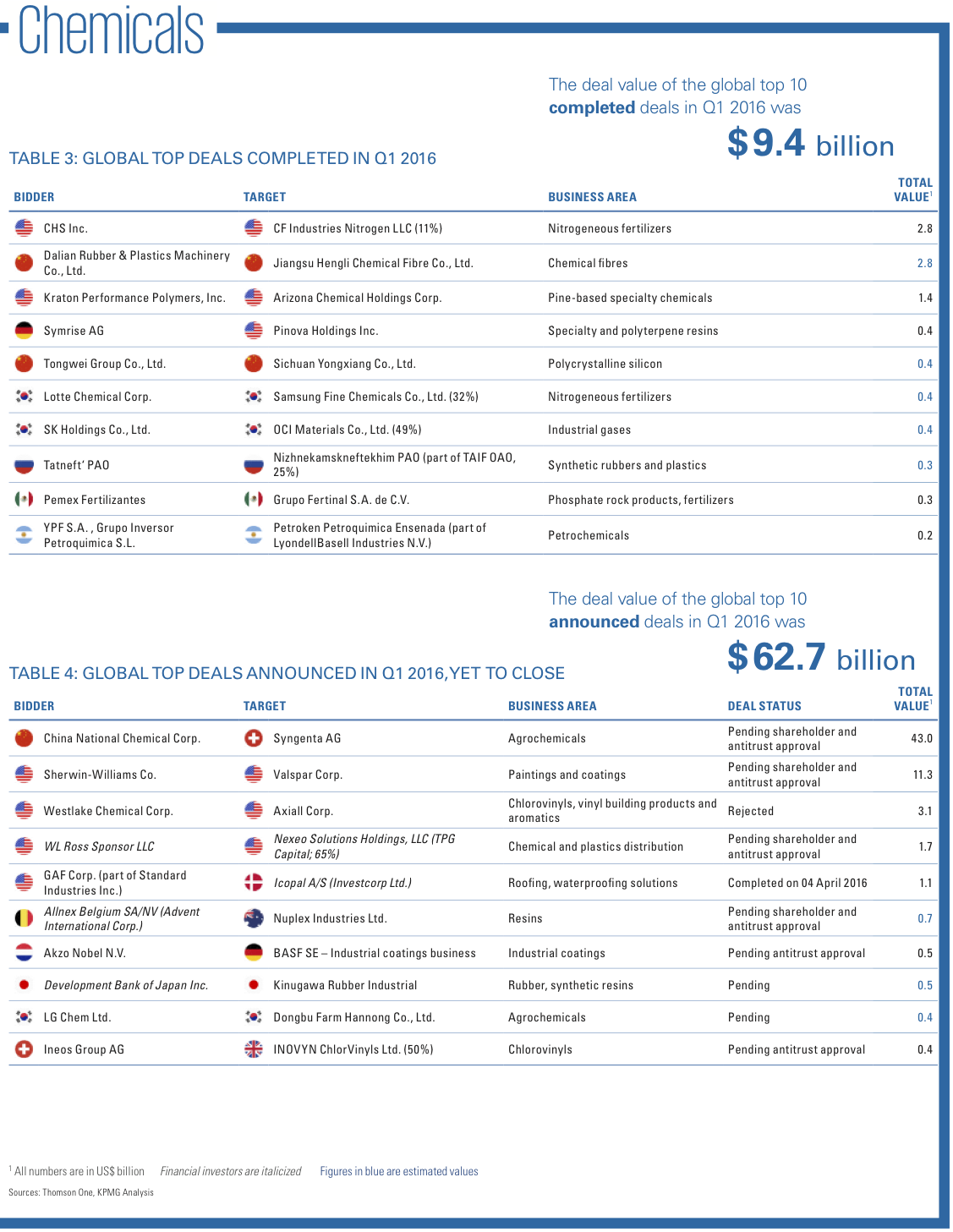

Chemical deals in Q1 2016 were mainly focused on downstream specialty chemicals, such as application-oriented businesses, resins and agrochemicals. The value of the top 10 announced deals topped $62 billion due to ChemChina’s bid for Syngenta. The US followed by Germany and China are the most active countries.

DEAL FOCUS AREAS

In Q1 2016, chemical companies were interested in application-oriented investments with a special focus on the coatings and paintings sector.

The Sherwin-Williams Company announced the acquisition of US-rival Valspar Corporation for $11.3 billion, creating a global market-leader for paints and coatings with combined revenues of $15.6 billion. Both companies offer complementary products which will enhance market positions in the sector. Additionally, annual synergies of up to $0.3 billion are expected.

BASF SE announced the sale of its industrial coating business to Netherlands-based AkzoNobel N.V. for $0.5 billion, enabling AkzoNobel to boost its market-leading position for industrial coatings.

Chemical companies pursued investments in other application-oriented segments as well. Kraton Performance Polymers, Inc. closed its $1.4 billion acquisition of Arizona Chemical Holdings Corp., a producer of pine-based specialty chemicals. Kraton enlarges its portfolio with Arizona’s complementary products to offer a broad range of highly-engineered polymers and specialty chemicals for everyday products.

GAF Corp., North America’s largest roofing manufacturer, seeks to acquire Danish Icopal S/A, a European market-leader for roofing products and waterproofing solutions, from Investcorp Ltd., an alternative investments firm. Icopal is in particular renowned for its modified bitumen membranes. The deal, worth $1.1 billion, is expected to create the sector‘s leading company under the umbrella of GAF’s parent company, Standard Industries Inc. Global sales are projected to reach around $4 billion.

The acquisition of Pinova Holdings, Inc. by Symrise AG provides the German company with access to Pinova’s complementary ingredients for fragrances, perfumes and oral care products, thereby strengthening the competitiveness of Symrise’s Scent & Care division. Additionally, Symrise diversifies its business portfolio through Pinova’s performance specialties segment. The deal is worth $0.4 billion.

The board of PVC producer Axiall Corp. rejected two offers from US-rival Westlake Chemical Corp. The latest bid totaled $3.1 billion including Axiall’s outstanding debt. Despite the rejections, Westlake continues to pursue Axiall’s shareholders in the hope of striking a deal.

FINANCIAL INVESTORS

The PE firm, WL Ross Sponsor LLC, announced the acquisition of Nexeo Solutions Holdings LLC, a worldwide leader in chemical and plastics distribution, for $1.7 billion. WL will acquire Nexeo from TPG Capital, another investment firm, which plans on retaining a 35% stake in the company.

Allnex S.A., backed by PE firm Advent International Corp., placed a $0.7 billion bid for Nuplex Industries Ltd., a producer of resins used in paints, coatings and structural materials. The deal allows Advent to further increase its stake in the coating resins business after its acquisition of Allnex for $1.2 billion in 2013.

The Development Bank of Japan (DBJ) will acquire Kinugawa Rubber Industrial, a producer of rubber autoparts, for $0.5 billion. Kinugawa seeks to diversify its client portfolio with the help of the state-owned bank and its broad business contacts. Currently over 50% of Kinugawa’s sales are to Nissan Motor Group. For the DBJ, it will be the first acquisition of a public company.

CAPITAL INDEX

The S&P 500 Chemicals Index rebounded from a steep decline in January to close Q1 2016 up 1.8%, slightly ahead of the MSCI World Index (+1.1%). However, the Bloomberg chemical indices for Europe (-1.8%) and Asia (-1.9%) underperformed the MSCI World Index.

CHEMCHINA SHOPPING SPREE

China National Chemical Corp (ChemChina) announced the acquisition of Swiss-based seeds and pesticides giant Syngenta AG for $43.0 billion. The deal will be the largest overseas acquisition by a Chinese company. It is also the second largest takeover in the history of the chemicals sector, the first being the $62.1 billion merger of Dow Chemical Co. and E.I. du Pont de Nemours and Co. announced in Q4 2015.

Syngenta ranks among the world’s leading agrochemical companies with revenues of $13.4 billion in 2015. It attracted interest from rival Monsanto last year but rejected several offers of up to $46.0 billion. The deal gives Syngenta the opportunity to break into the Asian market with lower costs and helps ChemChina to reduce the dependency on oil and oil-related products through the diversification of its business portfolio.

The deal follows the announced takeover of KraussMaffei Group, a world-leading manufacturer of machinery for the plastics and rubber processing industry, by a consortium of investors including ChemChina. The $1.0 billion deal represents the largest Chinese bid for a German company ever. In addition, ChemChina acquired a 12% minority stake in Swiss-based Mercuria Energy Group Holding SA, a global energy and commodity group. ChemChina’s recent acquisitions are part of a growing trend of Chinese overseas acquisitions aimed at industrial upgrading and global diversification. This strategy has become increasingly attractive in the light of sluggish domestic growth.

BASIS OF DATA PREPARATION

Values and volumes used throughout the report are based on completion date as provided by Thomson Reuters’ database Thomson One as of 31 March 2016, extracted up to and including 7 April 2016, and supplemented by additional independent research. This report includes disclosed and undisclosed values for M&A transactions including minority stake purchases, acquisitions of remaining interest, and recapitalizations and it explicitly excludes self-tenders and spinoffs. The published numbers of deals and deal values are based on the analysis of target companies which operate in the following subsectors:

Pharmaceuticals

— Medicinal chemicals & botanical products

— Pharmaceutical preparations

— In vitro and in vivo diagnostic substances

— Biotechnology – biological products, except diagnostic substances

— Pharmaceutical wholesale (added starting in Q2 2014)

Chemicals

— Clay, kaolin, ceramic & refractory minerals

— Chemical and non-metallic mineral mining, except fuels

— Fertilizers and agricultural chemicals

— Industrial gases

— Specialty chemicals

— Chemical wholesale

— Plastics and rubber components

KPMG’s Deal Thermometer is based on financial data as provided by S&P Capital IQ of public companies in the same sector as noted above with a market capitalization at quarter end of at least a $1 billion. For the pharmaceutical sector, this comprises 178 public companies. For the chemical sector, this comprises 180 public companies.

All figures in this report are shown in US Dollars ($) unless otherwise stated.

Sources

Online databases:

— Thomson One (Thomson Reuters)

— Bloomberg

Publications

— Various companies’ press releases

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter