Publications M&A In The Global Automotive Supply Industry: Study Finds A Bull Market With Room To Grow

- Publications

M&A In The Global Automotive Supply Industry: Study Finds A Bull Market With Room To Grow

- Christopher Kummer

SHARE:

Executive summary

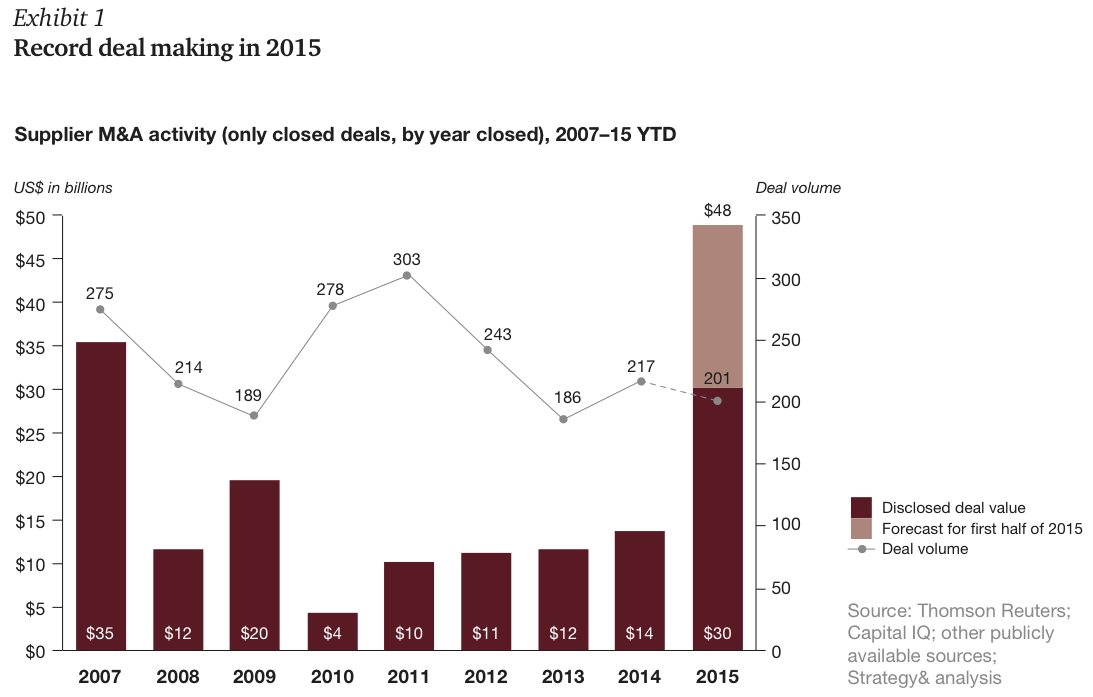

Mergers and acquisitions in the global automotive supplier sector are occurring at an unprecedented level in 2015, according to the Strategy& seventh annual “Consolidation in the Global Automotive Supply Industry” report. Based on data from the first six months of 2015, Strategy& anticipates that deal value will top US$48 billion for the full year, a 340 percent increase over 2014. What is particularly striking about the current trend is the rise in deal value. The figures indicate a slight decrease in the overall number of deals for the year, but a vast increase in the number of megadeals.

The gains in deal value are themselves the payoff from a host of positive factors in the supplier sector: several years of healthy profitability; technological advancements in the areas of fuel efficiency, lightweight materials, connected cars, and autonomous driving; and increased private equity interest.

For the third year in a row, the report identified North American suppliers as the largest consolidators, followed by European, South Korean, Japanese, and Chinese companies. The majority of global consolidators and their targets were powertrain and chassis suppliers.

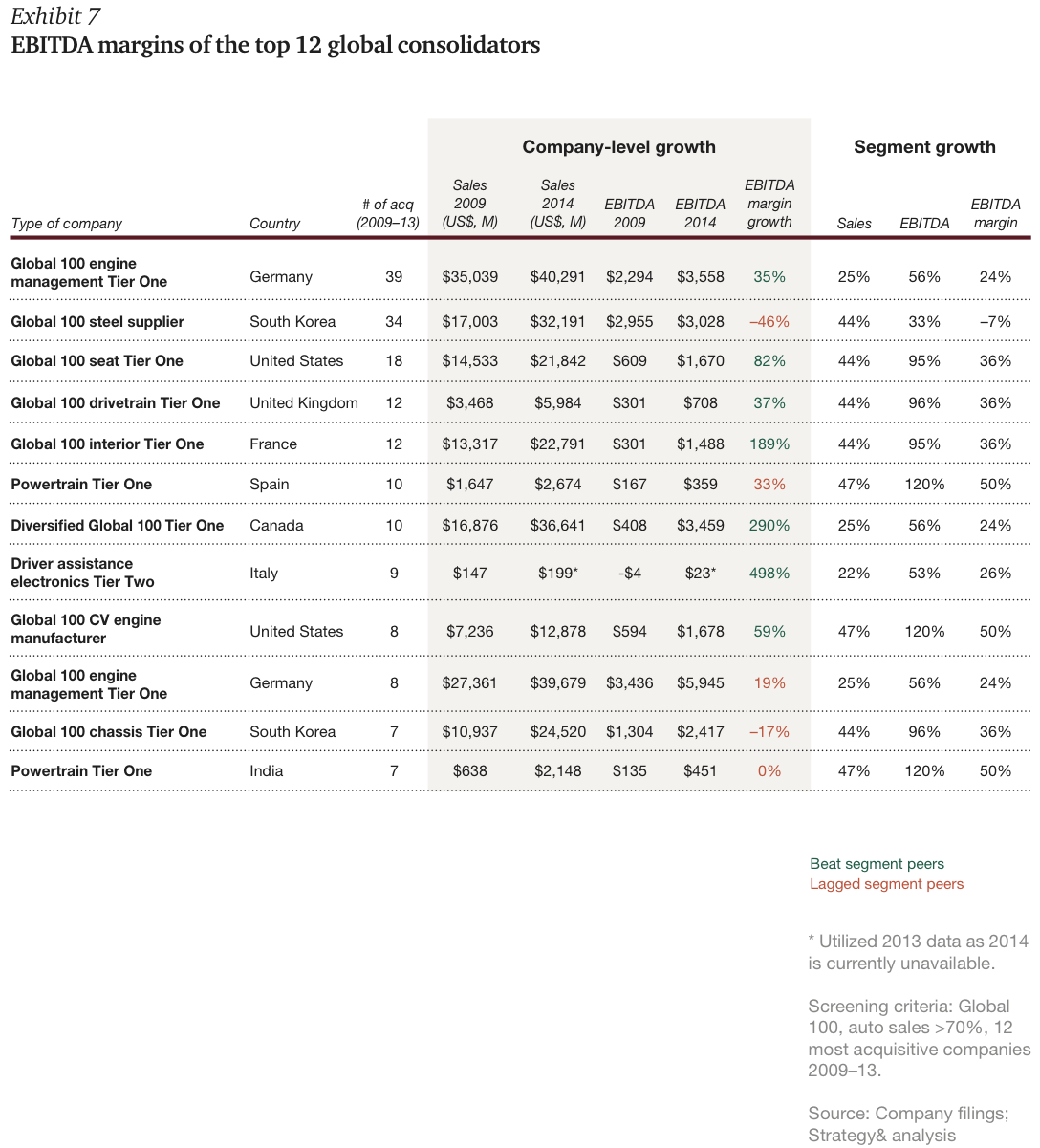

The study’s findings also proved that it pays for automotive suppliers to be acquisitive: Strategy& analyzed the top consolidators over five years, from 2009 to 2013, and found that more than 70 percent of top consolidators outperformed their peer group in EBITDA growth. Moreover, five of the 10 top consolidators grew EBITDA margins by more than 50 percent.

Based on this analysis, we believe that the M&A boom in the supplier industry still has room to grow, and there are plenty of opportunities for significant returns on investment.

Strategic shifts under way

Since 2007, consolidation has been a familiar theme among automotive suppliers. Suppliers have been jockeying to build the scale and capabilities that will ensure profitability and keep them near the top of the automotive value chain. But something unprecedented related to suppliers’ mergers and acquisitions activity is occurring this year: The value of these deals is skyrocketing to uncharted levels. In 2015, we expect the total price tag of auto supplier M&A to reach nearly US$50 billion, more than three times that of the year before (see Exhibit 1). The previous high was $35 billion in 2007.

These numbers are more than just statistics. They reflect real and significant changes in the auto supplier sector, involving global auto manufacturing expansion, new vehicle technologies, regulatory requirements, an abundant capital pipeline, and lucrative opportunities for profitability and growth. These trends are a galvanizing force for the sector; as auto supplier companies realize they have to make strategic shifts to adapt, they are turning to M&A deals to acquire the assets and expertise they need.

That finding is at the core of the latest Strategy& “Consolidation in the Global Automotive Supply Industry” report. This study — conducted for the seventh consecutive year — emerged from an in-depth analysis of financial, operational, and strategic data covering the top 100 global automotive suppliers as well as 715 additional suppliers from Brazil, China, Europe, India, Japan, North America, South Korea, and Southeast Asia.

Positive economic signs

The most curious aspect of the supplier M&A explosion is that the number of global deals has actually fallen in 2015, to about 200, down from 217 in 2014. And the average acquisition price tag — between $50 million and $100 million — has barely budged. What has changed in 2015 is the number of deals worth more than $500 million. There were twice as many of these mega-transactions in 2015 as in prior years.

The hefty premium placed on supplier acquisitions is the result of a series of extremely positive macroeconomic factors in the industry. First, the auto supply sector is girding up for a period of stable, multiyear growth in global vehicle manufacturing. Annual worldwide automobile production is forecast to increase at a compound average growth rate (CAGR) just shy of 4 percent between 2014 and 2021, according to PwC’s Autofacts (see Exhibit 2). China is expected to experience the most dramatic growth, producing more than 9 million vehicles over that seven-year period. Second, average global auto supplier profit margins are at extremely high levels — about 11 percent earnings before interest, taxes, depreciation, and amortization (EBITDA) — bringing them on par with the average margin of the five largest original equipment manufacturer (OEM) alliances.

There were twice as many mega-transactions in 2015 as in prior years.

And finally, these attractive growth and profit numbers have enticed private equity (PE) firms, which have begun to pour money into the auto supplier sector, churning up industry M&A activity. Typically, PE firms are involved in 10 percent of auto supplier deals, but thus far in 2015, they are spearheading more than 25 percent of acquisitions. And these are not small bets: Three of the top 10 deals in the last 12 months were PE driven, including the acquisition of Gates by Blackstone and the purchase of TI Automotive by Bain Capital. Clearly, PE firms have increased the ante.

Impact of technology

Many supplier acquisitions are prompted by the need to keep up with recent rapid changes in automotive technology. Globally, OEMs are racing to improve engine technology to satisfy government-mandated fuel standards and consumer demand for more connected vehicles with autonomous driving capabilities and new infotainment equipment. In order to meet the pace of innovation and regulation, automotive suppliers are acquiring firms that have track records for delivering next-generation technology.

For example, in its $12.6 billion acquisition of TRW, ZF Group essentially purchased fundamental radar and vision systems and advanced electronic control units, which ZF hopes will give it leverage in pursuing its goal to become a leader in autonomous vehicle equipment. “We’re following a building block approach to automated driving functions showcasing what is achievable today using proven technology,” Peter Lake, executive vice president of sales and business development at ZF TRW, announced in July.

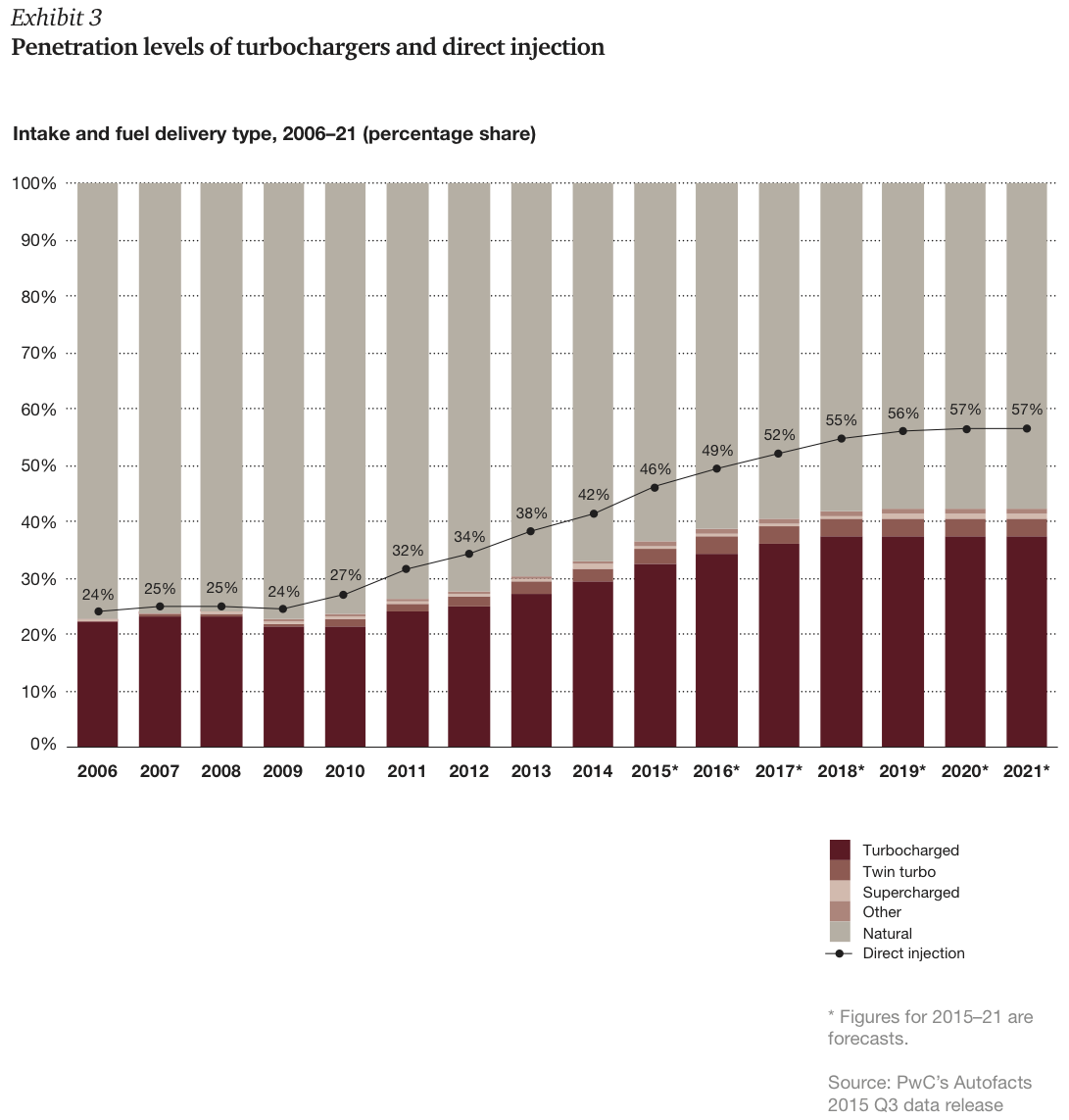

Other mega-suppliers are using M&A to better compete in offering fuel-efficient powertrains in all types of engines as automakers are facing new standards in the U.S. and Europe that will require fleet averages above 50 miles per gallon in 2021 and beyond. That was the thinking behind BorgWarner’s recent purchase of Remy International, a deal that will give BorgWarner a foothold in advanced electronics for turbocharged engines in traditional cars and hybrids. The payoff for suppliers attaining the skills to improve engine fuel efficiency could be significant. Technologies that address this problem, such as direct injection and turbo- or supercharging, are forecast to reach a global vehicle penetration rate of 57 percent and 40 percent, respectively, by 2021, according to PwC’s Autofacts (see Exhibit 3).

New digital components, particularly electronic backbones of connected car and infotainment features, are similarly attractive to OEMs — and, thus, M&A targets for suppliers seeking to expand their offerings and revenue streams. That goal was behind Harman International’s decision to purchase two software companies that make programs to manage Wi-Fi–based computer updates in vehicles.

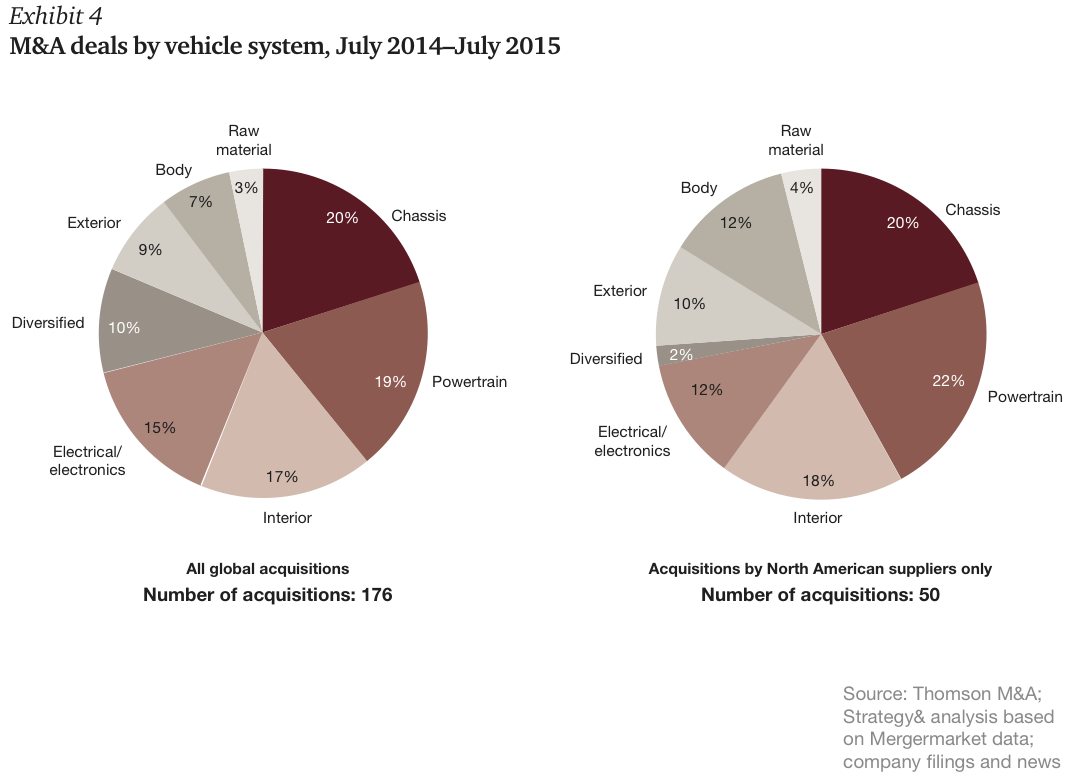

Our analysis shows that most auto supplier deals in the last 12 months targeted chassis (20 percent of all global supplier M&A) and powertrain subsystems (19 percent). Electronics was the fourth most-active category, at 16 percent (see Exhibit 4).

The relatively high M&A activity in interior systems is a different story altogether: During the past several years, automakers and their Tier One interior equipment suppliers have been in something of a tug-of-war over design and integration. OEMs have tried to assert more control over the costs for interior parts by commoditizing designs and materials for, say, instrument panels and door trim. In response, some Tier One suppliers have turned to vertical integration, bringing more of the manufacturing under their roof, hoping to eke out earnings from a wider revenue stream. For the most part, OEMs have succeeded and profitability for the Tier Ones in this auto supply sector has flagged measurably. In the last five years, average global EBITDA margins were about 8 percent for interior suppliers, a whopping 5 percent lower than for chassis or powertrain system providers. As a result, some of the largest suppliers have boosted their EBITDA margin and, with that, their value, by selling their interior operations to competitors and exiting the business. That was the case in Grupo Antolin’s acquisition of Magna’s interior operations and in Yanfeng’s purchase of Johnson Controls’s interior unit.

The biggest global consolidators

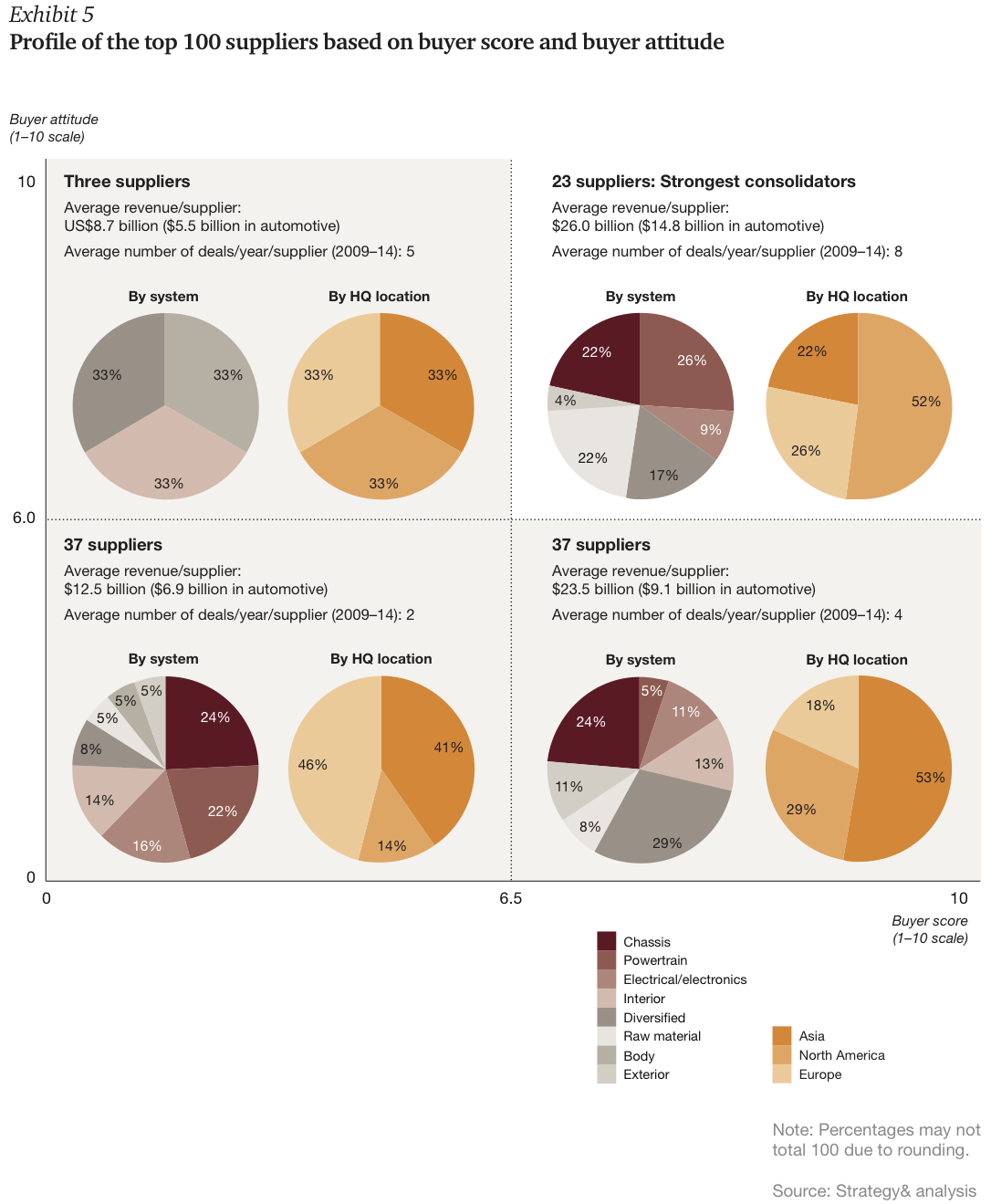

For the fourth year in a row, North American automotive suppliers were dominant global consolidators measured by buyer score and buyer attitude score in the Strategy& supplier industry report. The buyer score assesses the ability to make acquisitions, based on financial and operational factors, while the buyer attitude score gauges a supplier’s likelihood to acquire another company, based on its recent M&A record and announced future inorganic growth strategies, among other indicators. Nine of the top 10 ranked consolidators (and 12 of the top 23) were North American suppliers (see Exhibit 5). Only six of the top 23 were European, two were Japanese, two were South Korean, and one was Chinese. On average, each of these suppliers was involved in eight deals over a five-year period — or about 1.5 deals per year over a half decade.

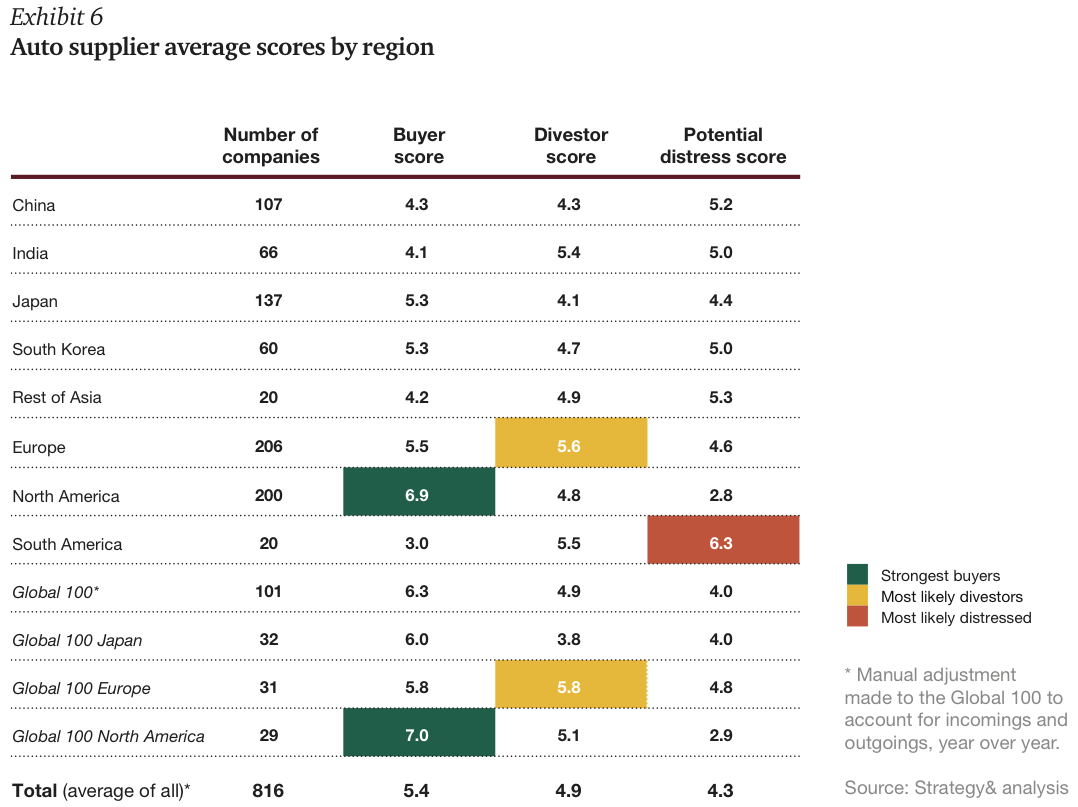

Besides enjoying the highest regional average buyer score of 6.9, North American suppliers also had the lowest potential distress score, only 2.8 (see Exhibit 6). The distress score measures the viability of a supplier; a lower rating means that it is less likely that the company will fail. Also of interest, the Global 500 European automotive suppliers topped our divestor rankings, which gauge the possibility that a diversified supplier will sell off underperforming units, with a score of 5.8. This makes sense: In each of the last six years, European suppliers have been the most likely to be acquired. In 2015 alone, European companies were targeted in 37 percent of all deals.

Besides enjoying the highest regional average buyer score, North American suppliers also had the lowest potential distress score.

On the other hand, Japanese suppliers are relatively stable. As a group, their divestor score was only 4.1, whereas the Japanese companies in the Global 100 scored 3.8, the lowest rankings of any region. And with a low distress score to go along with this, Japanese suppliers have been mostly immune from being acquired; they were the focus of only 4 percent of M&A deals in 2015. The most troubled group of suppliers is in South America. Their distress score ranked well above all other regions, at 6.3.

Does M&A translate into profits?

It’s common wisdom in the business world that more often than not, mergers and acquisitions do not translate into improved performance. The top line may grow as a result of an acquisition, but profits often lag. However, Strategy& found that between 2009 and 2013 the most acquisitive automotive suppliers were in fact rewarded for their M&A activities. During that period, seven of the top 12 consolidators and more than 75 percent of the top 25 consolidators easily outpaced their competitors in increasing EBITDA margins (see Exhibit 7). The top consolidator, a German-based Tier One primarily focused on engine management, made 39 acquisitions and improved its EBITDA margin by 35 percent, compared with only 24 percent for its major competitors.

A value game ahead

In our view, the M&A explosion in the automotive supplier sector is just beginning to heat up. Perhaps the primary catalyst for more activity will be the efforts among many automakers to gain efficiency, improve margins, and increase scale by implementing more global architectures and platforms for their vehicles, designs that can be used in any market around the world with minor modifications. This shift and the desire to decrease wasteful complexity in the supply chain will significantly reduce the number of direct material suppliers that OEMs will contract with, in some cases by 50 percent or more. For example, Ford has already publicly stated its plans to reduce its global supplier base in the next few years, from around 1,500 now to 750.

Suppliers that hope to survive this round of massive consolidation will have to be active and innovative partners for automakers, offering new answers to connectivity, safety, and autonomous driving questions and fresh ideas that sell vehicles. Supplier technology skills, lean capabilities, and geographic reach will be at a premium and precisely what automakers will look for before engaging in long-term supplier relationships.

Strategy& estimates that the number of Chinese families that can potentially afford to buy a car will more than double by 2021.

The outsized price tags in recent deals in the supplier sector might naturally scare off some acquirers that are also hesitant to pour significant money into an industry already feeling the pressure of feverish competition. But we believe that, in fact, the high valuations are frequently justified and there is more headroom for performance gains. The Autofacts forecast CAGR of about 4 percent from 2014 to 2021 could even be an underestimate, particularly if the economies of emerging nations rebound from their current doldrums. In spite of the slowdown in growth and sales, China still has a growing consumer market, and Strategy& estimates that the number of Chinese families that can potentially afford to buy a car will more than double from 150 million today to more than 300 million by 2021. Growth like that could result in significantly higher orders for suppliers that are fortunate enough to make the global cut.

However, although optimism about the overall automotive supplier sector is justified, investments in these companies must be made carefully and diligently. Both private capital firms and suppliers that want to be active in M&A should make acquisition decisions based on the value of the products, innovation, and capabilities that the targeted company has — and not on merely the desire to expand revenue. Suppliers today should be focused on taking leading positions in connectivity, fuel efficiency, component electronics, and the like — in other words, the features that OEMs find most attractive, which may change over time — and, hence, their acquisitions should be based on furthering their ability to fuel the most critical industry trends.

In many ways, the automotive supplier sector is in a privileged position, providing products to an expanding and creative industry. Yet simultaneously, suppliers have perhaps never faced a more difficult landscape, littered by too many companies chasing customers that want to do business with fewer firms. M&A will shrink the competition a bit. But only innovation in design, development, partnerships, and acquiring critical capabilities will separate the survivors from the also-rans.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter