SCDE

Certified Separation, Carve-Out and Divestment Expert

Prepare for the new era of mergers and acquisitions, where divestments will be a strategic option for business focus and optimisation. This program is a must for C-level executives, Corporate Development officers, and functional leaders who will be planning and executing effective divestments to increase corporate value. This training program walks through the entire life cycle of a divestment, from analysing key business drivers and structuring the Transition Services Agreement (TSA), to dealing with the actual implementation and execution of separations with dynamic change management issues and optimising the remaining business.

ONSITE

30

approx hours

US $

5,490

fees

-

New York | Jun 2025

-

Singapore | Sep 2025

-

Amsterdam | Oct 2025

-

New York | Oct 2025

INTERACTIVE ONLINE LIVE

30

approx hours

US $

4,390

fees

-

May - Jul 2025

Next Session -

Oct - Dec 2025

-

Nov 2025

ONLINE

60

approx hours

US $

3,290

fees

-

Self-paced

- Internationally recognized designations

- Physical copies of certifications, presentations & materials

- 1-year IMAA charter-holding membership

- 1-year access to the entire IMAA eLibrary

- Global network of charterholders and experts

- Leading faculty from academia and the industry

PARTICIPANT TESTIMONIALS

Mastering Divestments/Separations in M&A: Strategies, Planning, and Execution

Module 1: M&A Essentials

- Deal types: What are the different types of transactions that you can use in M&A? There is a whole range of deal types and deal continuum that we look at, e.g. the full spectrum from minority stakes to full acquisitions, various ways to arrange a merger, leveraged buy outs (LBOs), initial public offerings (IPOs), divestitures, spin-offs, equity carve-outs-

- M&A Process: The program covers both perspectives from a buyer’s perspective (buy side) and from a seller’s perspective (sell-side). We explore how to seek buyers or potential targets (long list & short list) and how to run a sale in various ways (negotiations and auctions).

- Strategies for M&A: We dive into the strategies for Mergers & Acquisitions. How can you create competitive advantage through M&A, divestitures and equity alliance?

- M&A Negotiation: How can you prepare for the negotiation phase? What are ways to arrange a value creating deal?

- Introduction to Due Diligence: How do you prepare for and execute a smart Due Diligence to assure value creation? What are the different areas that can be covered in the Due Diligence process?

- Success Factors in Transactions: We explore the success factors and key challenges and mistakes to avoid. Which M&A tactics work in which industries?

- Takeover Strategies and Defence Tactics: How can you prepare your company against a hostile takeover attempt and reduce potential threats? Which are the defence mechanisms that you can put into place and how affective are they? Which ways exist to acquire a business successfully in a hostile way

Module 2: Separation Strategy

- Strategic Importance of Divestments in Business – Why Divest?

- Portfolio Management

- Understanding Divestments: Definitions and Types

- Equity Carve Outs

- Complete Full Sale

- Spin-Offs

- Case Study Examples of All Deal Types

- Reviewing the Entire Divestment Lifecycle

- Developing a Divestment Strategy

- Identifying non-core business units

Module 3: Separation Planning

- Preparing a Business for Sale: Key Steps to Optimise Value

- Identifying Value Drivers

- How to Value a Company/Business Unit for Sale

- How to prepare and execute the Sell-Side Due Diligence Admin (e.g., Working with Data Rooms and Information Requests)

- Communicating Across the Sale Process

- The Role of External Advisors

- The Role and Set-up of the Separation Management Office (SMO)

- Building a Divestment Playbook: Key Elements

- Marketing a Company/Business Unit for Sale

- Teaser and CIM Development

- Identifying Potential Buyers

Module 4: Separation Execution

Legal Documents

- NDAs

- Letter of Intent – Key Considerations

- SPA – Key Considerations (Including Reps, Warranties, and Indemnities)

Legal and HR Issues

- Identifying Legal Issues Associated with Divestments

- HR Activities Required During a Divestment

- Minimising Employee Disruptions: Best Practices

- Addressing People Issues During Divestments

Financial and Accounting Issues

- Key Financial and Accounting Issues in the Sell-Side Process

- Financial Reporting and Compliance

Transition Services Agreements (TSA)

- Overview of TSAs and Structuring

- Managing TSA: Challenges and Solutions

- Negotiating TSAs

- Change Management Considerations

Optimisation Strategies

- Rebranding Problems and Solutions

- Disentangling IT and Highly Integrated Shared Services

- Challenges from the Buy-Side

Learning Outcomes:

Participants in this course will:

- Recognise the different transaction types to structure divestments.

- Specify the steps required to divest a company/business unit.

- Recognise the responsibilities of the separation management office.

- Understand the key accounting issues associated with a divestment.

- Specify the human resources activities required during a divestment.

- Identify the legal issues associated with a divestment.

- Recognise the rebranding problems that may be encountered in a divestment.

- Identify the methods used to minimise business and employee disruptions during a divestment.

MEET OUR FACULTY

Our growing faculty of more than 60 professors represent a diverse group of professionals, coming from over 20 countries; they work as corporate executives, entrepreneurs, researchers, consultants and professors. Their expertise makes them subject matter experts, groundbreaking researchers, and award-winning authors.

This intersection of practical industry insight, theoretical knowledge, and passion for teaching that our faculty brings to each training strikes at the heart of what IMAA seeks to be.

Experts and Faculty

PREREQUISITE

- Hold an academic degree (e.g. PhD, JD, DBA, MBA or Bachelor Degree); and/or hold one or more professional designations (such as CPA, CFA, CAIA or equivalent)

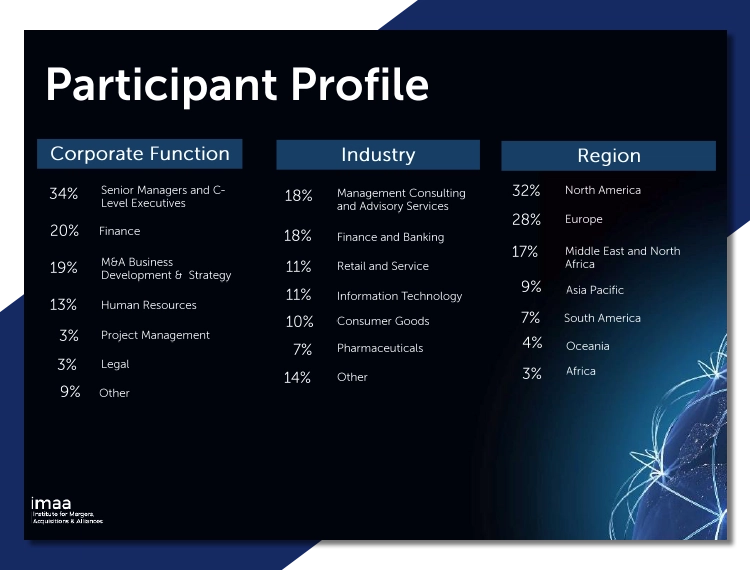

Who Participates

While you will meet an international mix of participants from various industries, the Mergers and Acquisitions program is designed for mid-management to senior executives in the C-Suite, directors of public and private companies, board leaders, and heads of strategy and corporate development. It is also geared toward advisers, investment bankers, transactional lawyers, and private equity investors. Individuals and teams are welcome to attend.

- Click to expand

SCDE May – July 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

14

May

on 13:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date May 14 May 28 June 11 June 25 July 9 EST 9:00 – 10:00 9:00 – 12:15 9:00 – 12:15 9:00 – 12:15 9:00 – 12:15 CET 15:00 – 16:00 15:00 – 18:15 15:00 – 18:15 15:00 – 18:15 15:00 ... Read more

SCDE Onsite New York June 9-13, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

09

Jun

on 00:00 UTC

SCDE Onsite Singapore September 15-18, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

15

Sep

on 00:00 UTC

SCDE Onsite Amsterdam October 6-10, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

06

Oct

on 00:00 UTC

SCDE October – December 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

08

Oct

on 13:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date October 8 October 22 November 5 November 19 December 3 EDT/EST 9:00 – 10:00 EDT 9:00 – 12:15 EDT 9:00 – 12:15 EST 9:00 – 12:15 EST 9:00 – 12:15 EST CET 15:00 – 16:00 15:00 – 18:15 15:00 – ... Read more

SCDE Onsite New York October 20-24, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

20

Oct

on 00:00 UTC

SCDE November 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

03

Nov

on 09:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date November 3 November 10 November 13 November 17 November 20 CET 10:00 – 11:00 10:00 – 13:15 10:00 – 13:15 10:00 – 13:15 10:00 – 13:15 IST 14:30 – 15:30 14:30 – 17:45 14:30 – 17:45 14:30 – 17:45 14:30 ... Read more

No events are scheduled at this time.

SCDE Onsite New York June 9-13, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

09

Jun

on 00:00 UTC

SCDE Onsite Singapore September 15-18, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

15

Sep

on 00:00 UTC

SCDE Onsite Amsterdam October 6-10, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

06

Oct

on 00:00 UTC

SCDE Onsite New York October 20-24, 2025

Onsite

Early Bird Fees:

$5,490.00 Original price was: $5,490.00.$4,890.00Current price is: $4,890.00.

Start:

20

Oct

on 00:00 UTC

No Onsite events are scheduled at this time.

SCDE May – July 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

14

May

on 13:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date May 14 May 28 June 11 June 25 July 9 EST 9:00 – 10:00 9:00 – 12:15 9:00 – 12:15 9:00 – 12:15 9:00 – 12:15 CET 15:00 – 16:00 15:00 – 18:15 15:00 – 18:15 15:00 – 18:15 15:00 ... Read more

SCDE October – December 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

08

Oct

on 13:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date October 8 October 22 November 5 November 19 December 3 EDT/EST 9:00 – 10:00 EDT 9:00 – 12:15 EDT 9:00 – 12:15 EST 9:00 – 12:15 EST 9:00 – 12:15 EST CET 15:00 – 16:00 15:00 – 18:15 15:00 – ... Read more

SCDE November 2025

Interactive Online Live

Early Bird Fees:

$4,390.00 Original price was: $4,390.00.$3,790.00Current price is: $3,790.00.

Start:

03

Nov

on 09:00 UTC

Dates and Time Schedule Session Kick-off Session 1 Session 2 Session 3 Session 4 Date November 3 November 10 November 13 November 17 November 20 CET 10:00 – 11:00 10:00 – 13:15 10:00 – 13:15 10:00 – 13:15 10:00 – 13:15 IST 14:30 – 15:30 14:30 – 17:45 14:30 – 17:45 14:30 – 17:45 14:30 ... Read more

No Interactive Online Live events are scheduled at this time.

No Virtual Live events are scheduled at this time.

No Online events are scheduled at this time.

Related Courses

This course dives deep into the entire M&A process- from strategy and valuation to execution and post merger integration (PMI).

CPMI prepares you for integration issues post-merger, starting with integration planning, up to governance and project management to implement the integration.

The certification dives into the nuts and bolts of the transaction journey—auditing, consulting, deal advisory, and including insights into running a successful M&A practice.

This certification covers the legal aspects of M&A, including best practices, legal contracts, tax considerations, and deal structuring in different geographies and jurisdictions.

HRM&A covers all aspects of the transaction process relevant to human resources, including strategy, due diligence, Post Merger Integration, and compensation benefits.

This training will provide you with the fundamentals of each approach to valuation, with limitations and caveats on the use of each, as well as extended examples in application.

This training covers the entire life cycle of a divestment, from analysing key business drivers and structuring the Transition Services Agreement, to implementation and execution of separations.

This dedicated training for professionals involved in M&A transactions in the hospitality industry is designed and delivered in collaboration with the Modul University in Vienna.

Request a Brochure