M&A News M&A News: Global M&A Deals Week of March 18 to 24, 2024

- M&A News

M&A News: Global M&A Deals Week of March 18 to 24, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

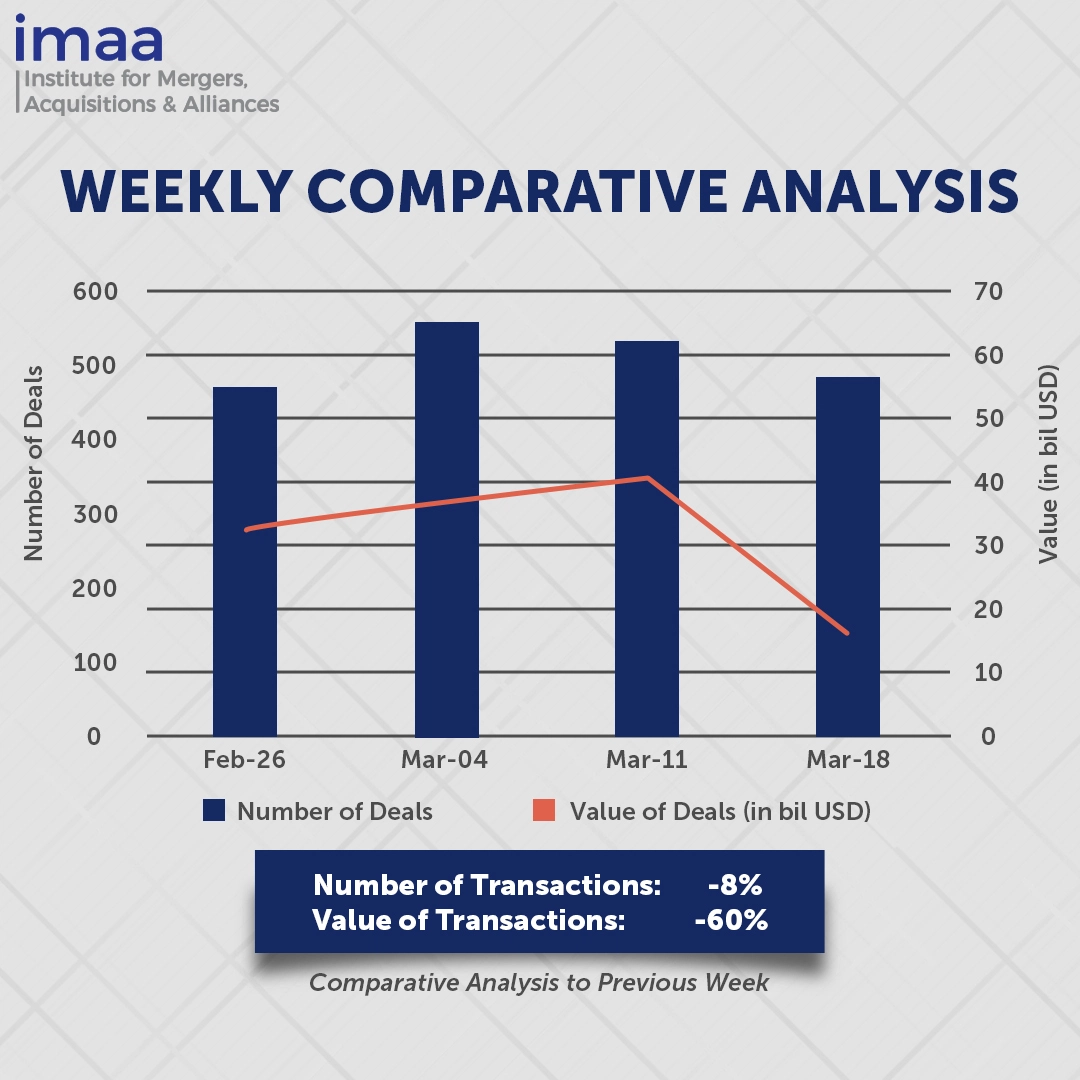

During the week of March 18 to March 24, the global market saw 485 Mergers and Acquisitions (M&A) transactions, amounting to a total of USD 16.44 billion. Seven of these transactions exceeded the USD 500 million mark, contributing to a combined value of USD 10.18 billion, making up around 62% of this week’s total value.

Leading the pack in this week’s M&A landscape is Roquette Frères S.A.’s acquisition of the Pharma Solutions Business from International Flavors & Fragrances Inc., valued at USD 2.85 billion. This strategic move aims to solidify Roquette’s standing as a key player in the pharmaceutical industry. Similarly noteworthy is AstraZeneca’s acquisition of Fusion Pharmaceuticals for USD 2.4 billion, marking the company’s second billion-dollar-plus acquisition in under a week. Just days prior, AstraZeneca had announced the acquisition of Amolyt Pharma for USD 1.05 billion, further demonstrating its proactive growth strategy.

Notably, three out of the top five deals for the week held a value of USD 1.2 billion each, spanning across different industries.

A comparative analysis of week-on-week data reveals an 8% decrease in the number of deals, declining from 526 to 485. Similarly, there was a substantial 60% decrease in deal value, plummeting from USD 40.63 billion to USD 16.44 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of March 18 – 24, 2024 in detail:

Deal No. 1: Roquette Frères S.A. to Acquire Pharma Solutions Business of International Flavors & Fragrances Inc. for USD 2.85 Billion

Deal No. 2: AstraZeneca AB to Acquire Fusion Pharmaceuticals Inc. for USD 2.41 Billion

Deal No. 3: Lonza Group AG to Acquire Genentech Manufacturing Facility in Vacaville, California for USD 1.20 Billion

Deal No. 4: H.I.G. Capital, LLC to Acquire Payroll and Professional Services Business of Alight, Inc. for USD 1.20 Billion

Deal No. 5: Francisco Partners Management, L.P. to Acquire Jama Software, Inc. for USD 1.20 Billion

Deal No. 1:

Roquette Frères S.A. to Acquire Pharma Solutions Business of International Flavors & Fragrances Inc. for USD 2.85 Billion

Roquette, a prominent French leader in plant-based ingredients, has announced its acquisition of the Pharma Solutions Business of International Flavors & Fragrances Inc. (IFF Pharma Solutions) for USD 2.85 billion. This acquisition marks a strategic move for Roquette, aiming to strengthen its presence in the pharmaceutical sector.

IFF Pharma Solutions is recognized for its expertise in developing and manufacturing pharmaceutical excipients, along with supporting industrial and methyl cellulosic food applications through its Global Specialty Solutions business. With 10 research and development and production sites globally and approximately 1100 employees, Pharma Solutions achieved a revenue of approximately USD 1 billion in 2023.

By integrating these complementary businesses, Roquette aims to rebalance its portfolio around the pillars of Health and Nutrition. This acquisition will expand Roquette’s range of pharmaceutical products and is expected to accelerate the company’s growth significantly.

The deal is projected to be finalized in the first half of 2025, pending regulatory approvals and customary closing conditions.

Deal No. 2:

AstraZeneca AB to Acquire Fusion Pharmaceuticals Inc. for USD 2.41 Billion

AstraZeneca, a global pharmaceutical giant, recently disclosed its acquisition of Fusion Pharmaceuticals, a clinical-stage biopharmaceutical company, in a deal valued at USD 2.4 billion. This strategic move aims to enhance AstraZeneca’s oncology portfolio. AstraZeneca’s oncology segment accounted for over a third of its total revenue, with sales reaching USD 17.15 billion in 2023.

The agreement entails an initial cash payment of USD 2 billion, equivalent to USD 21 per share, along with a potential contingent payment of up to USD 400 million, or USD 3 per share, contingent upon reaching specified regulatory milestones.

By integrating Fusion Pharmaceuticals, AstraZeneca gains access to novel expertise and cutting-edge research and development capabilities, particularly in actinium-based Radioconjugates (RCs). This acquisition not only expands AstraZeneca’s global footprint but also reinforces its commitment to the Canadian market.

RCs, a rapidly advancing modality in cancer therapy, leverage a combination of targeted agents for identifying cancer cells and radioactive isotopes for precise tumor eradication. This innovative approach holds promise for transforming cancer treatment paradigms, aiming to improve outcomes for patients by shifting away from conventional therapies such as chemotherapy and radiotherapy.

Fusion Pharmaceuticals will transition into a wholly-owned subsidiary of AstraZeneca, maintaining its operations in both Canada and the United States. The deal is anticipated to conclude in the second quarter of 2024. Centerview Partners LLC has been enlisted as the exclusive financial advisor to Fusion, facilitating the transaction process.

Deal No. 3:

Lonza Group AG to Acquire Genentech Manufacturing Facility in Vacaville, California for USD 1.20 Billion

Roche has agreed to sell its large-scale biologics manufacturing site in Vacaville, California, to Lonza, a Swiss multinational company specializing in pharmaceuticals, biotechnology, and nutrition sectors. The acquisition, valued at USD 1.2 billion in cash, represents Lonza’s strategic move to enhance its capacity in large-scale biologics manufacturing.

This transaction aims to augment Lonza’s capabilities in commercial mammalian contract manufacturing to meet the industry’s growing demand. The Vacaville facility, with a total bioreactor capacity of approximately 330,000 liters, is recognized as one of the significant biologics manufacturing sites globally. By acquiring this facility, Lonza aims to better serve its clients’ needs in the United States, providing access to increased production capabilities.

Furthermore, Lonza plans to invest around CHF 500 million (equivalent to USD 557 million) in additional capital expenditure to improve and upgrade the Vacaville facility, ensuring its alignment with market demands.

Upon completion of the deal, the Vacaville site will integrate into Lonza’s network of biologics network. The transaction is expected to be finalized in the second half of 2024, with Lonza receiving financial advice from BofA Securities.

Deal No. 4:

H.I.G. Capital, LLC to Acquire Payroll and Professional Services Business of Alight, Inc. for USD 1.20 Billion

H.I.G. Capital, a globally recognized investment firm, has finalized an agreement to acquire Alight’s professional services division and payroll and outsourcing business for USD 1.2 billion, with USD 1 billion in cash and up to USD 200 million in seller notes.

Alight’s Payroll and Professional Services Business is esteemed for its technology-driven solutions in payroll, human capital management, and professional services. Serving a diverse clientele of over 1,500 multinational companies, it offers comprehensive services including U.S. and international payroll, HR administration, cloud technology advisory, and application management, bolstered by strategic partnerships with industry leaders like Workday and SAP.

This acquisition marks a strategic shift for Alight, separating its professional services arm to focus on employee well-being and benefits platforms. Post-transaction, Alight and the Payroll & Professional Services business will forge a commercial partnership to leverage their combined strengths and deliver enhanced value to clients.

The transaction, approved by Alight’s Board of Directors, is expected to close by mid-2024. J.P. Morgan Securities LLC advised Alight, while Guggenheim Securities, LLC advised H.I.G. Capital.

Deal No. 5:

Francisco Partners Management, L.P. to Acquire Jama Software, Inc. for USD 1.20 Billion

Francisco Partners, a renowned global investment firm specializing in technology and technology-enabled ventures, has announced its acquisition of Jama Software, a leading company in requirements management and traceability solutions, for a substantial USD 1.2 billion.

Jama Software stands out in the industry for its exceptional customer satisfaction ratings, high NPS scores, extensive SaaS infrastructure, robust security measures including SOC2 compliance, user-friendly interface, outstanding performance, wide array of integrations, and proficiency in areas such as measured process improvement, benchmarking, and natural language processing (NLP). By empowering companies to intelligently enhance their development processes, Jama Software effectively reduces defects, delays, cost overruns, and recalls.

This strategic alliance promises mutual benefits for both entities. Jama Software stands to leverage Francisco Partners’ extensive expertise to further propel its rapid expansion across enterprises, industries, and global markets. Positioned at the forefront of a pivotal transformation within the engineering management sector, Jama Software is poised to capitalize on emerging opportunities.

Facilitating this transaction, Evercore served as the exclusive financial advisor to Jama Software, while J.P. Morgan Securities LLC provided financial advisory services to Francisco Partners.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of March 18 – 24, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter