M&A News M&A News: Global M&A Deals Week of Aug 5 to 11, 2024

- M&A News

M&A News: Global M&A Deals Week of Aug 5 to 11, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

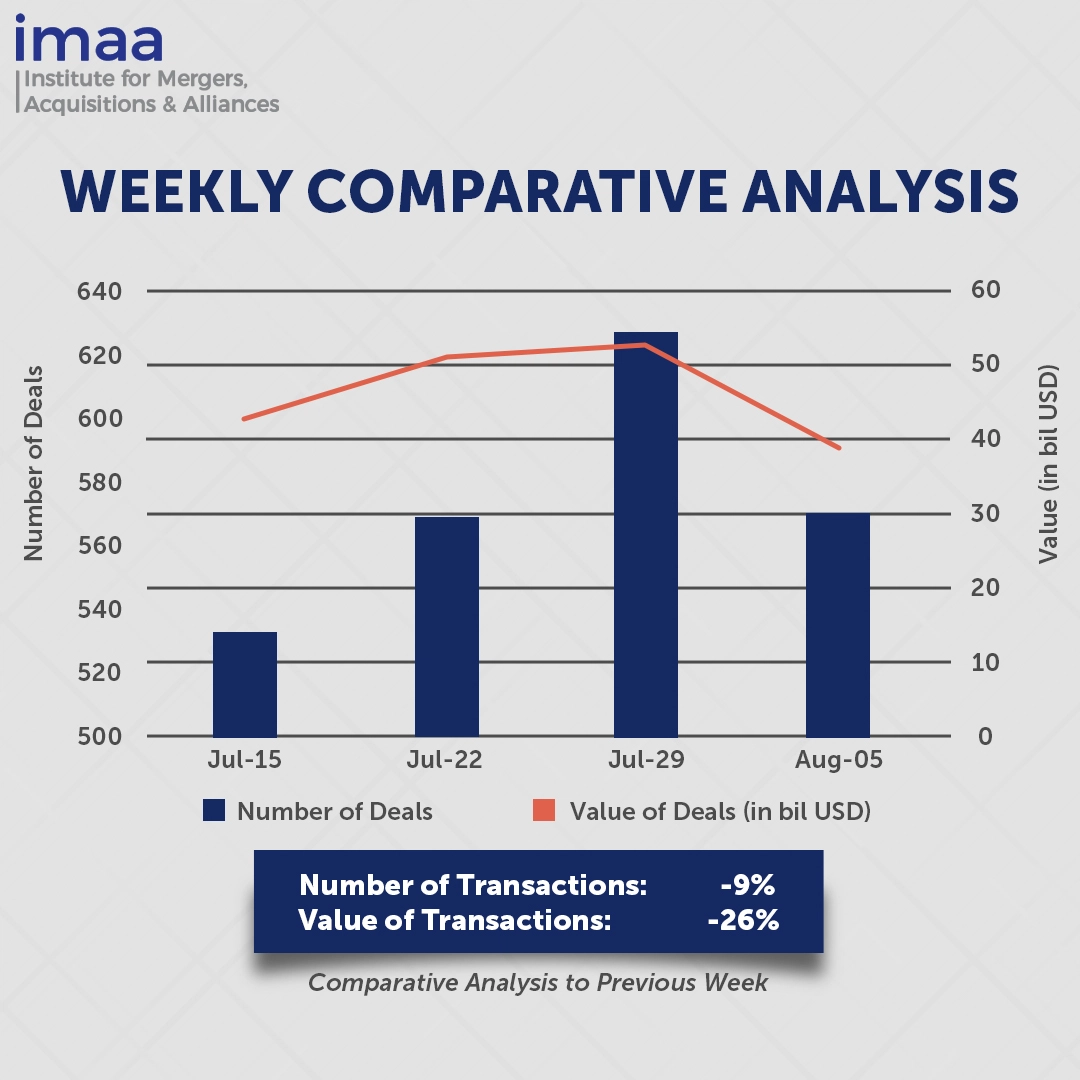

The global mergers and acquisitions (M&A) market saw 570 deals totaling USD 38.85 billion during the week of August 5–11. Of these, 23 deals each exceeded USD 500 million, collectively accounting for USD 31.04 billion, which represents 80% of the week’s total transaction value.

The largest deal was KKR’s acquisition of Fuji Soft, a leading Japanese IT services provider, for USD 3.8 billion. This buyout marks a strategic move for KKR in Japan’s fast-evolving IT services sector. Over the years, KKR has invested over USD 8 billion across various asset classes and strategies in Japan, with USD 18 billion currently under management. Among KKR’s digital investments in Japan are Yayoi, a cloud accounting software leader; DataX, a data-driven marketing SaaS platform; Netstars, a QR code multi-payment gateway; and SmartHR, an HR software-as-a-service provider.

Comparing week-on-week data, there was a 9% drop in the number of deals, decreasing from 627 to 570. Similarly, the total value of deals witnessed a significant decline of 26%, falling from USD 52.73 billion to USD 38.85 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of August 5 to 11, 2024 in detail:

Deal No. 1: KKR & Co. Inc. to Acquire Fuji Soft Incorporated for USD 3.80 Billion

Deal No. 2: Quantum Energy Partners, LLC to Acquire Cogentrix Energy Power Management, LLC for USD 3.00 Billion

Deal No. 3: Veritas Capital Fund Management, LLC to Acquire Cloud-based digital banking business of NCR Voyix Corporation for USD 2.55 Billion

Deal No. 4: LS Power Development, LLC to Acquire Renewable Energy Business of Algonquin Power & Utilities Corp. for USD 2.50 Billion

Deal No. 5: Woodside Energy Group Ltd to Acquire 1.1 million metric tonnes Clean Ammonia project under construction in Beaumont, Texas for USD 2.35 Billion

Deal No. 1:

KKR & Co. Inc. to Acquire Fuji Soft Incorporated for USD 3.80 Billion

KKR has announced plans to acquire Fuji Soft, a major Japanese systems developer, in a deal valued at approximately USD 3.8 billion, with the intention of taking the company private.

Fuji Soft is a leading system integrator in Japan, renowned for its expertise in embedded, control, and operational software and systems. With a workforce of over 10,000 engineers, Fuji Soft provides advanced technological solutions across a diverse range of industries, drawing on decades of experience. The company’s strategy focuses on enhancing the profitability of its current operations, strengthening group synergies, and pursuing new growth opportunities.

KKR aims to leverage its global resources and IT services expertise to support Fuji Soft’s long-term growth and increase value for Japanese enterprises and their clients.

Japan remains a vital market for KKR in the Asia Pacific region and globally, particularly as the country’s IT services industry undergoes significant digital transformation, characterized by the expanded use of cloud computing, IoT, and generative AI. This acquisition is part of KKR’s broader strategy in Japan, where the firm has been active since 2006, having invested over USD 8 billion and currently managing USD 18 billion in assets across various sectors.

Deal No. 2:

Quantum Energy Partners, LLC to Acquire Cogentrix Energy Power Management, LLC for USD 3.00 Billion

Quantum Capital Group, through its subsidiary Quantum Energy Partners, has reached an agreement to acquire Cogentrix Energy, a prominent U.S. independent power producer, for USD 3 billion from funds managed by Carlyle Group.

This acquisition aligns with the surging demand for electricity driven by rapid growth in data centers and artificial intelligence.

Cogentrix Energy manages a portfolio of 5.3 gigawatts of efficient and flexible natural gas-fired power plants across PJM Interconnection, the Electric Reliability Council of Texas (ERCOT), and ISO New England. These assets are vital for ensuring the reliability, resilience, and affordability of the U.S. electricity grid.

Quantum’s deep understanding of energy markets, successful track record in business development, and effective risk management are expected to deliver significant long-term benefits to Cogentrix’s customers, employees, investors, and other stakeholders. Quantum plans to drive substantial growth for Cogentrix by emphasizing gas-fired power generation, renewable energy, and battery storage.

The deal is expected to close between the fourth quarter of 2024 and the first quarter of 2025. Guggenheim is acting as Quantum’s financial advisor, while Lazard is advising Carlyle.

Deal No. 3:

Veritas Capital Fund Management, LLC to Acquire Cloud-based digital banking business of NCR Voyix Corporation for USD 2.55 Billion

Veritas Capital, a leading investor in technology and government sectors, is poised to acquire NCR Voyix’s cloud-based digital banking business for USD 2.45 billion in cash, with potential additional consideration of up to USD 100 million.

NCR Voyix’s digital banking platform is the largest independent system of its type in the United States, offering a robust, digital-first suite of products aimed at enhancing both consumer and business banking experiences. The platform currently supports over 1,300 financial institutions and 20 million active users, positioning itself for continued growth and innovation as an independent entity.

Veritas Capital views this acquisition as a strategic move to capitalize on the platform’s advanced capabilities and significant growth opportunities.

NCR Voyix is divesting this unit to focus on its primary software and service offerings for the restaurant and retail sectors.

Goldman Sachs & Co. LLC served as the financial advisor to NCR Voyix, while Evercore advised Veritas Capital.

Deal No. 4:

LS Power Development, LLC to Acquire Renewable Energy Business of Algonquin Power & Utilities Corp. for USD 2.50 Billion

Algonquin Power & Utilities has reached an agreement to sell its renewable energy business to LS Power for USD 2.5 billion. This amount includes USD 2.28 billion in cash, with an additional potential USD 220 million contingent on an earn-out agreement tied to specific wind assets.

The business being sold includes wind and solar projects across the U.S. and Canada. It encompasses 44 operational assets with a combined generating capacity of over 3,000 megawatts (MW), plus a development pipeline of 8,000 MW covering wind, solar, battery energy storage, and renewable natural gas projects. This acquisition will expand LS Power’s portfolio, which already includes more than 19,000 MW of leading renewable energy, energy storage, flexible gas, and renewable fuel projects.

The deal is expected to be finalized between Q4 2024 and Q1 2025. Scotiabank and BMO Capital Markets Corp. are serving as financial advisors to LS Power.

Deal No. 5:

Woodside Energy Group Ltd to Acquire 1.1 million metric tonnes Clean Ammonia project under construction in Beaumont, Texas for USD 2.35 Billion

Woodside Energy Group has agreed to acquire OCI’s Clean Ammonia project in Beaumont, Texas, for USD 2.35 billion in cash.

OCI, a global producer and distributor of hydrogen products, will continue to manage the construction, commissioning, and startup phases of the facility until it becomes fully operational, at which point Woodside will take over. The payment structure includes 80% of the purchase price at closing, with the remaining 20% due upon project completion.

The Clean Ammonia project, initiated in 2021, is the world’s first large-scale facility designed for low-carbon intensity ammonia production. The project utilizes Linde’s advanced hydrogen production and carbon capture technology alongside OCI’s established infrastructure for ammonia production, storage, and transportation. Once operational, the facility will produce 1.1 million metric tonnes of blue ammonia annually, with plans to potentially double this capacity. It will also capture and sequester 1.7 million metric tonnes of CO2 each year, significantly reducing its carbon footprint.

The transaction is expected to close in the second half of 2024. Morgan Stanley & Co. International plc is advising OCI on the deal.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of August 5 to 11, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter