Publications Taxation Of Cross-Border Mergers And Acquisitions: Panama 2014

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Panama 2014

- Christopher Kummer

SHARE:

By KPMG

Introduction

The signing of several Free Trade Agreements (FTA) and the ambitious Panama Canal expansion are tangible signs that Panama is opening its economy to the global market. As a result, Panamanian companies are working to increase their competitiveness. Mergers and acquisitions (M&A) are increasingly common in Panama in recent years, and they are seen as the best way for companies to position themselves in the regional and global economies. Panama’s largest banks have merged during a period of strong growth in practically every industrial sector, which is expected to continue.

Merger procedures in Panama are mainly governed by Law No. 32 of 1927, which regulates corporations in general, and also by Executive Decree 18 of 1994, which sets out the accounting procedures that must be applied to effect a tax-exempt merger.

Demerger procedures are governed by Law 85 of 2012, which is applicable to corporations regulated by the Commerce Code. These provisions provide for tax-free demergers if certain conditions are met by taxpayers, basically that:

(i) corporations involved in the demerger procedure shall be owned by the same shareholders; and (ii) the transfer of any assets involved in the demerger procedure shall be made at book value.

Recent developments

Some recent legal developments relating to M&A should be borne in mind: the opinion to demerge corporations based on Law 85 of 2012 and the entry into force of a number of conventions for the avoidance of double taxation.

In the last couple of years, Panama has signed such tax treaties with the following countries: Mexico, Spain, Barbados, the Netherlands, Luxembourg, Singapore, Qatar, Portugal, Ireland, Czech Republic, United Arab Emirates, France, South Korea and United Kingdom (all of which are now in effect), and Italy and Israel (both ratified by Panama and awaiting ratification by the other state). The provisions of these treaties may benefit merger procedures involving companies that are resident in states with which Panama has signed tax treaties.

Asset purchase or share purchase

Sales of shares and assets are subject to a 10 percent capital gains tax. However, there are certain advance taxes that may reduce even further the capital gain tax.

In Panama, most acquisitions take the form of share purchases. This usually results in lower taxes because buyers are required to withhold 5 percent of the transfer price as an income tax advance. The vendor can regard this advance as the final tax, which is often lower than the tax that would have been paid if the 10 percent rate were levied on the actual gain arising from the sale of shares or assets.

In some cases, 10 percent of the gain from the sale of the assets can be less than 5 percent of the purchase price of the shares. In these circumstances, tax refunds are available if certain conditions are met. Also in these circumstances, acquisitions by means of an asset purchase are preferable unless a tax treaty provides for a lower capital gains tax on the sale of shares or exempts the transaction altogether.

Purchase of assets

The taxable income in a real estate purchase is the purchase price less the basic cost of the asset, the value of the improvements made to it and the costs associated with the sales operation. As of 17 September 2009, taxpayers are obliged to pay an income tax advance equivalent to 3 percent of the total value of the transfer or the cadastral value, whichever is higher. This advance can be considered as the final tax; however, if the advance is higher than the result of applying the 10 percent rate to the profit arising from the transfer, the vendor could file a tax refund or tax credit request.

If such tax is paid, the income from the sale is not considered as part of the company’s taxable income subject to the ordinary 25 percent corporate tax rate. The purpose of this provision is mainly to protect natural persons from being taxed at inappropriately high rates because of abnormally high personal income resulting from the sale of a property. For companies, the provision establishes a sort of preferential regime applicable to the transfer of real estate.

Purchase price

Previously, Panama imposed no rules to set the prices at which such transactions should be made. Panama has recently enacted transfer pricing legislation that largely follows the Organisation for Economic Co-operation and Development (OECD) transfer pricing guidelines. Compliance with these rules should be considered when setting the price of transactions between related parties.

Goodwill

A legal provision allows the deduction of certain intangibles, although not specifically goodwill. Certain challenges made by the Tax Administration in this regard are currently under review by the Administrative Tax Court.

Depreciation

Panamanian tax laws envisage three main methods of depreciation calculation, which can be chosen individually for each asset. Taxpayers are not required to apply the same depreciation method to all of their assets. The three methods are as follows:

- direct or straight-line calculation, in which a fixed percentage is applied to the value of the original cost

- decreasing value, in which a fixed percentage is applied to the decreasing remnant of the cost value

- digit sum, in which the number of years of the asset’s expected life are divided by its original cost value. Each year, the result of that division is multiplied by the digit of that year, in either increasing or decreasing order.

Taxpayers could also use other methods for some or all of their assets.

Real estate cannot be depreciated in less than 30 years, and chattels, in less than 3 years.

Tax attributes

In most situations, mergers have no effect on fiscal rights or benefits or on the amortization of assets that can be used by the new company in the future. However, any losses carried forward by the absorbed entity are not deductible by the subsisting company.

Value added tax

The sale of real estate is not subject to ITBMS (Panama’s value added tax – VAT), which is levied at a rate of 7 percent on the transfer of chattel and on the provision of services. Asset purchases are subject to ITBMS if assets other than immovable property are involved in the transaction (e.g. equipment, machinery, vehicles). Mergers that take place in accordance with Executive Decree No. 18 of 1994 are specifically excluded from ITBMS.

Transfer taxes

Mergers in accordance with the above-mentioned Executive Decree are not subject to stamp tax.

Mergers under a share purchase agreement are subject to stamp tax. The tax does not apply to mergers under an asset sale agreement, provided ITBMS has been applied.

Purchase of shares

The sale of shares, bonds, quotas and other securities is taxable. Income that arises from a public offer of stock is treated as capital gains and taxed at a fixed rate of 10 percent.

The buyer must withhold 5 percent of the purchase value and remit it to the tax authorities within 10 days of the payment date as an advance income tax payment. The seller is entitled to consider the withheld amount as the final income tax payment.

If the advance sum exceeds 10 percent of the total purchase value, the seller can submit a request to the tax authorities for the excess to be deemed an income tax credit for the year in which the purchase of shares took place.

Where a tax treaty is applicable, the sale of shares may be exempt from taxes in Panama and taxable only in the seller’s state of residence.

Tax losses

In a share purchase, losses are not considered deductible items against other income obtained by the seller.

Pre-sale dividend

If a company has undistributed profits and it is about to be sold, in some cases, it may be better to distribute such profits, pay the corresponding 10 percent dividend tax and deduct the profits from the sale price. Distributing the profits reduces the taxable basis for the 5 percent capital gains withholding.

Since, in most cases, the company has already paid the dividend tax advance (known as complementary tax), the applicable dividend tax is a maximum of 6 percent (rather than 10 percent). This may result in a lower overall tax than would be the case if the company were simply sold without distributing the retained profits. Moreover, the dividend tax may be reduced or exempted by an applicable tax treaty.

Transfer taxes

The share purchase agreement would be subject to stamp tax at a rate of 0.10 per 100 US dollars (USD) of the purchase price stated in the agreement.

Choice of acquisition vehicle

There are several possible acquisition vehicles, but some are more convenient than others. The characteristics of each vehicle are summarized below.

Local holding company

A Panama holding company must pay dividend tax at the rate of 10 percent on the dividends it received from the purchased company. The holding company can be merged with the purchased company in order to use the goodwill as a deductible expense.

Foreign parent company

A foreign company is subject to a 10 percent dividend tax on the acquired Panamanian entity’s distributed profits. However, no merger may take place. Panamanian corporate law does not allow mergers between local and foreign entities unless the foreign entity is itself registered in Panama.Therefore, the goodwill cannot be used as a deductible expense.

Panama has signed tax treaties with the following countries: Mexico, Spain, Barbados, the Netherlands, Luxembourg, Singapore, Qatar, Portugal, Ireland, Czech Republic, United Arab Emirates, France, South Korea and United Kingdom. Panama’s tax treaty network should be considered when establishing a foreign parent company.

Non-resident intermediate holding company

A non-resident intermediate holding company is also subject to a 10 percent dividend tax and cannot be merged with the Panamanian entity. Again, the goodwill cannot be treated as a deductible expense.

As noted, Panama’s tax treaty network should be considered when establishing a foreign parent company.

Local branch

A Panama branch could merge with the acquired company and treat the goodwill as a deductible expense.

Joint venture

Joint ventures cannot be used as acquisition vehicles in Panama.

Choice of acquisition funding

The purchaser may choose to fund the acquisition with either debt or equity. The characteristics of each option are summarized below.

Debt

When funding a merger with debt, interest deductibility and withholding taxes (WHT) are key factors that must be taken into account.

The Panamanian Fiscal Code states that all costs and expenses necessary for the production of income and the conservation of its source are deductible from income tax. Thus, all interest arising from loans necessary for any of the above-mentioned purposes are considered deductible expenses. On audit, however, tax authorities have questioned whether loans taken out to purchase the shares of other companies generate deductible interest.

If the loan is granted by a foreign banking or financial institution, the interest it charges to the Panamanian company is subject to WHT at 12.5 percent. Where the bank is resident in a state with which Panama has signed a tax treaty, the withholding tax rate may be reduced, in some cases, to as low as 5 percent.

Deductibility of interest

In principle, the acquiring company cannot deduct the interest paid on a loan obtained to purchase the shares of the acquired company. Merging both entities may create an opportunity to deduct interest incurred in the acquisition.

Withholding tax on debt and methods to reduce or eliminate it

Interest, commissions and other charges paid to foreign creditors on loans or financing are subject to a 12.5 percent effective income tax rate, which must be withheld by the debtor. Since Panama now has a number of tax treaties in force, it is possible to reduce or eliminate WHT.

Equity

Capital contributions are not taxable, but any capital reduction shall be preceded by a distribution of any retained earnings.

Note that Panama does not tax the issue of shares or corporate capital contributions.

The notice of operation tax is levied on the patrimony of the company, not only on the capital, with a USD60 thousand cap.

Deferred settlement

If the shares will be paid in several installments over a period of time, it could be agreed that such shares are to be transferred in separate packages with the capital gains tax being assessed on each batch.

Other considerations

The buyer is obliged to withhold 5 percent of the transfer price as an income tax advance. If it does not, the tax authorities can demand either the selling company or the target company to pay the corresponding tax.

Concerns of the seller

The seller’s main concern is the lengthy process to obtain a tax refund where the 5 percent withholding made by the buyer turns out to be higher than 10 percent of the actual gain.

Company law and accounting

Mergers that do not comply with the above provisions are considered as taxable transactions. The merger agreement between the merging companies must comply with the provisions of Law 32 of 1927, which regulates companies. For the merger to become effective, the agreement must be registered at the public registry.

All registered properties of the merging companies should be registered under the name of the surviving or merged company, according to the merger agreement and subject only to the payment of the applicable public registry rates.

The Directorate General of the Revenue should be informed of a merger within 30 days of its registration at the public registry. The surviving or merged company acquires the tax obligations of the merging companies but cannot deduct the merging company’s losses.

Mergers by creation (consolidation) are subject to the registration rates applicable to the registration of a new company, and mergers by absorption are subject to the registration rates applicable on the increase of authorized capital, if any, of the surviving company. Where there is no increase in capital, the applicable registration rate is the rate for the registration of company minutes.

Shareholders of the extinguished company are not subject to income tax, income tax on dividends or complementary tax if they only receive share certificates in return for the shares they held in the extinguished company. They also are exempt from the above-mentioned taxes where they receive small cash payments to avoid the elimination of the surviving company’s stock, as long as the payments do not exceed one percent of the value of the shares received by the shareholders in return of their shares in the extinguished company.

Demergers governed by Law 85 of 2012 are subject to a tax-free treatment if certain conditions are met by taxpayers, basically that: (i) corporations involved in demerger procedure are owned by the same shareholders; and (ii) the transfer of any assets involved in the demerger procedures are made at book value.

Foreign investments of a local target company

Mergers involving one or more foreign companies are recognized by the Commercial Code, subject to the condition that those companies are registered with the Public Registry of Panama. Where the surviving company is a foreign company, a five-year period of registration is required after the merger has taken place.

Comparison of asset and share purchases

Advantages of asset purchases

- If the capital gain is low, the applicable 10 percent tax on the gains may be lower than the 5 percent tax on the total value of the transfer that would apply in a share transfer.

Disadvantages of asset purchases

- The transfer of real estate is subject to a 2 percent transfer tax.

- The transfer of movable property (e.g. machinery, equipment, vehicles) is subject to the 7 percent ITBMS (Panama’s VAT).

- The tax is ultimately levied on the capital gain, at a rate of 10 percent. The taxpayer is still obliged to pay 3 percent of the total value of the transfer as capital gains tax; where this amount is higher than 10 percent of the actual gain, a refund or a tax credit may be requested from the Tax Administration.

Advantages of share purchases

- Seller may choose to treat the 5 percent withholding on the purchase price as the final tax.

- Transfer is not subject to any other taxes.

Disadvantages of share purchases

- In some circumstances, the 5 percent withholding on the transfer value exceeds the 10 percent of the actual gain. In this case, the withholding must still be made and the seller must then apply to the Tax Administration for a refund. The refund process may be lengthy.

- Challenges related to the pushdown of goodwill and/or debt should be carefully analyzed.

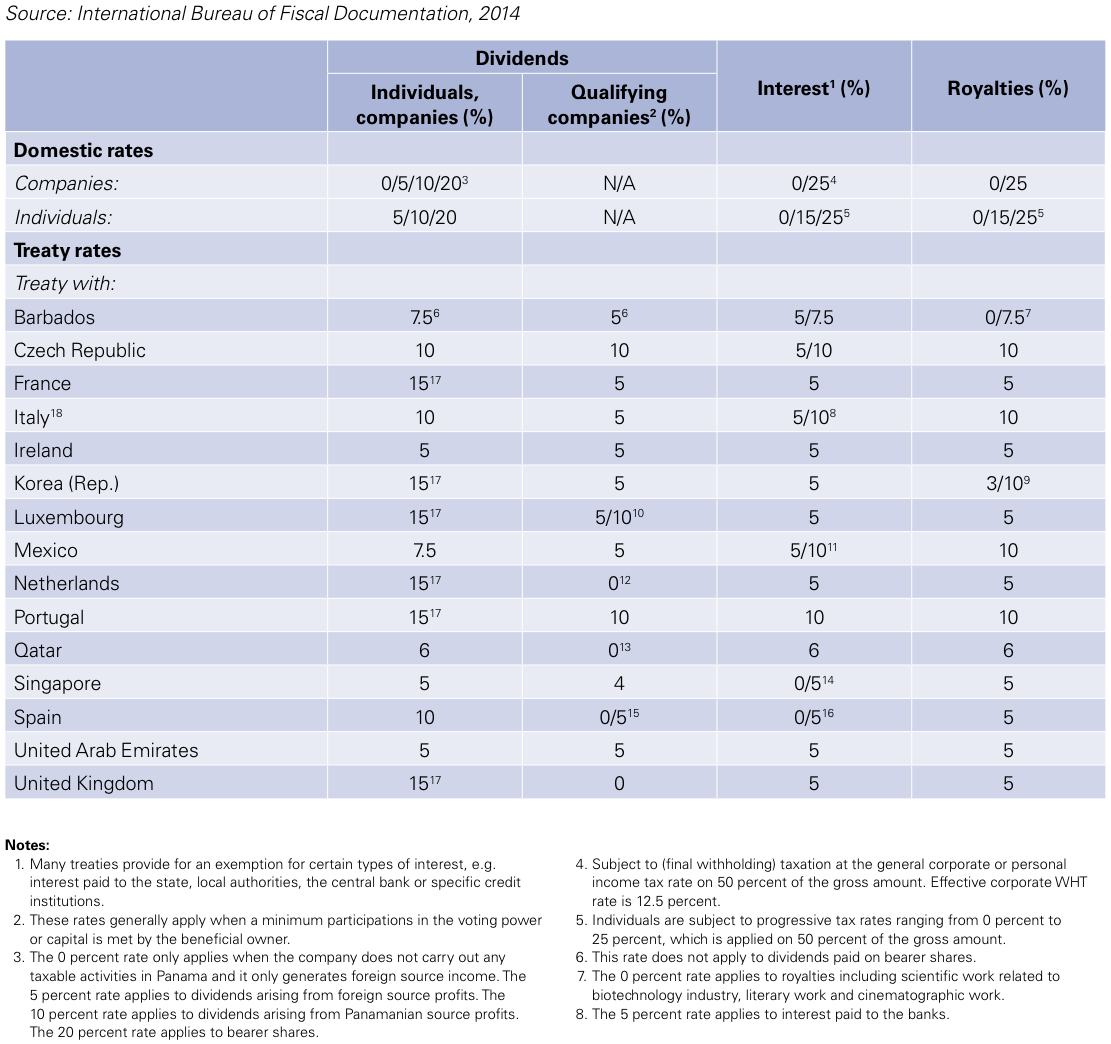

Panama – Withholding tax rates

This table sets out reduced withholding tax rates that may be available for various types of payments to non-residents under Panama’s tax treaties. This table is based on information available up to 1 January 2014.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter