Valuation Training

with Prof. Aswath Damodaran

Training in numbers:

Live Sessions

0

+

Hours teaching

0

+

Satisfied participants

1000

+

Prof. Aswath Damodaran

He received his MBA and PhD from the University of California at Los Angeles. He teaches the corporate finance and valuation courses in the MBA and executive programs. Being at NYU since 1986 he has received the Stern School of Business Excellence in Teaching Award. His research interests lie in valuation, portfolio management and applied corporate finance. He has published papers in the Journal of Financial and Quantitative Analysis, the Journal of Financial Economics and the Review of Financial Studies. He has published several books on valuation and corporate finance.

VIRTUAL LIVE

30

approx hours

US $

1,290

fees

PARTICIPANT TESTIMONIALS

Carlos Aizpurúa

- Executive Vice President

- CEO Advisors

I decided to take the valuation training because I wanted to expand my knowledge in this matter, and to reintroduce myself into the world of M&A, since I had been doing consulting mainly in strategic planning and financial analysis. To accomplish this, I trusted the combination of the Institute for Mergers, Acquisitions and Alliances (IMAA) and Prof. Aswath Damodaran, known as the “Dean of Valuation”. The virtual classroom format was appropriate, since it allowed me to receive the knowledge of and carry out live interactions with prof. Damodaran, without having to travel and from the comfort of my home. After the live sessions, I was able to review the recorded classes. Definitively, I do recommend this training to any professional who wants to expand their knowledge of valuations. In the course, I learned the following: 1) valuations should be simple; 2) valuations should follow a narrative; and 3) try to eliminate biases and preconceptions when making assumptions in valuations.

Brad Albert

- Manager, M&A Integration

- Salesforce

I participated in Prof. Aswath Damodoran’s valuation training in May 2023. The course was a practical deep dive into various valuation methods and a breath of fresh air, addressing a range of topics from what makes up a good valuation (e.g. narrative AND numbers), the key drivers of value (e.g. cash flows, growth, risk) and how the internet age as defined by zero distribution/marginal costs has changed the way we need to look at valuing companies in the modern world. Prof. Damodaran’s engaging teaching style, iconoclastic perspectives, and hands-on learning made this week-long training an entertaining and can’t miss seminar. Overall, the course was an enriching experience that stepped outside of classroom theories, zeroing-in on real-world valuation scenarios from early stage private ventures to mature, Fortune 500 public companies undergoing digital transformation. If you’re new to valuation and looking to develop your own framework, open to challenging conventional wisdom, or are simply interested in how Prof. Damodoran cooks up engaging content that adds spice to important topics in corporate finance, his materials extend well beyond the conventional training program and would highly recommend to others looking for the same.

Dr. Jürg Stucker

- Partner

- Oaklins

Carlos Gutiérrez, FRM

- Head of Equity

- Dunas Capital

I have been following Prof. Damodaran for a long time, reading some of his books, his blog and papers. I think that Prof. Damodaran has a “gift” for everything to make sense within a valuation, while keeping it simple and transparent. During my career of more than 20 years as a fundamental institutional investor, I have dealt with extreme scenarios like the 2000 Internet bubble, 2007/2008 GFC, QE, negative interest rates, COVID-19, etc. I think it is convenient to come back to fundamental basics, from time to time.

The online classroom was quite dynamic, with different profiles and interesting discussions. Prof. Damodaran is an excellent communicator and perfectly manages the time and attention to capture the audience. I found the course useful. I was afraid it was too basic but, on the contrary, it is quite actual, and it helped us to better undertake valuations of non-traditional businesses and startups, always from a fundamental and common-sense perspective.

I strongly recommend the course, both to junior practitioners to strengthen the basic pillars of valuation, and to senior professionals as a healthy upgrade of the valuation foundations and its application to new businesses.

Subhasis Roy

- Chief Operating Officer

- Novaremed

Peter Huber

- Chief Financial Officer at Uster Technologies

Lorenzo Brandi

- Project Leader Business Development

- Oerlikon

Dr. Stephan Zwerschke

- Director Marketing M&A

- Robert Bosch GmbH

Thomas Hartzsch

- Private Equity at Freemont Management

Benefits of Certified Valuation Training

- Access to live online program

- Interaction with Q&A throughout the live sessions

- Presentation slides (soft copy)

- 3 months free access to our e-library (incl. Prof. Damodaran's book)

- Certificate of attendance signed by Prof. Damodaran (soft copy)

- Access to recorded sessions (in case you miss a live session)

- Digital seal for social media (e.g. LinkedIn)

- Approx. 10 CPE Credits

Objectives

The objective of the training is to provide the fundamentals of each approach to valuation, together with limitations and caveats on the use of each, as well as extended examples of the application of each. At the end of the seminar, participants should be able to:

- Value any kind of firm in any market, using discounted cash flow models (small and large, private and public)

- Value a firm using multiples and comparable firms

- Analyze and critique the use of multiples in valuation

- Value “problem” firms, such as distressed companies or start ups

- Estimate the effect on value of restructuring a firm

Syllabus

Session 1

- The Discounted Cash Flow Model

- Setting up the Model

- The Big Picture of DCF Valuation

- Valuation Examples

- The Discount Rate Question

Session 2

- Risk premiums and Betas

- The Cost of Debt

- Estimating Cash Flows

- Estimating Growth Rates

- Estimating Growth Patterns

- The Terminal Value

- Closing Thoughts on DCF

Session 3

- Cash, Cross holdings and other assets

- The Value of Control, Synergy and Transparency

- The Liquidity Discount

- Employee Stock Options

- Challenges in Valuation

- Valuing young, growth companies

- Valuing mature companies in transition

- Valuing declining and distressed companies

- Valuing cyclical companies

- Valuing commodity companies

- Valuing financial service companies

Session 4

- Valuing private businesses

- Relative Valuation

- Deconstructing multiples

- Comparable company valuation

Reasons

Comprehensible

Experience or take a refresher in valuation in-depth – made comprehensible by one of the world’s best and motivating instructors on valuation.

Network

Network with your peers and industry professionals that face similar challenges when it comes to valuation. A great opportunity to meet old colleagues and make new contacts during this program. In addition we provide access to our global network of other participants from past trainings as well.

Continued Education

Invest in your continued education! Various professional associations accept this training as Continued Education. Take this training as a stand-alone or have it count towards the completion of our IM&A Certificate and M&AP Certificate programs

Prof. Damodaran Live

Reading books or watching videos is nothing like experiencing and enjoying Prof. Damodaran in the room teaching and interacting with you in person.

Great Value

As we are a non-profit research organization, we offer this training at a very affordable fee – great value for money.

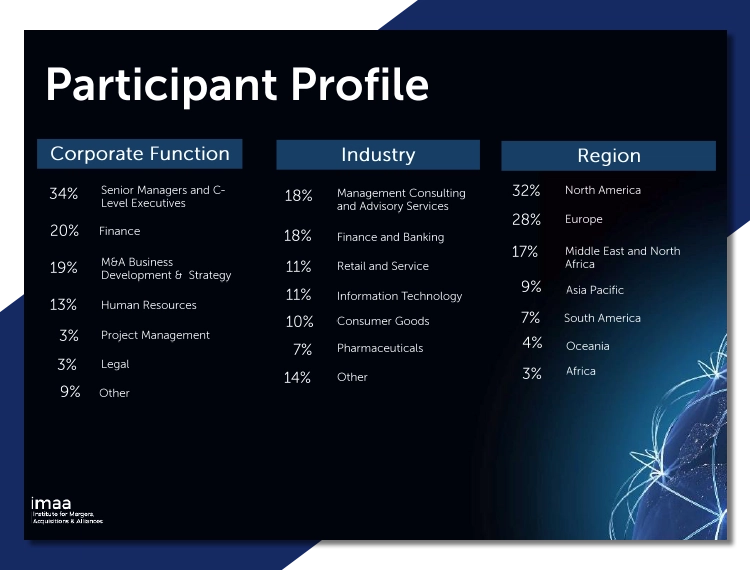

WHO ATTENDS

The mix of valuation techniques and applications provided in this training has attracted a widely diverse audience in our past trainings. In particular, it is useful for:

- Chief Executive Officers, Board Members and Business Owners

- Chief Financial Officers and Other Corporate Financial Staff

- Head of Business Development, Strategy and M&A

- Chartered Accountants, Investment Bankers and Management Consultants

- Equity Research Analysts

- Portfolio Managers

- Business Angels, Venture Capital, Private Equity, and Family Offices

Who Participates

While you will meet an international mix of participants from various industries, the Mergers and Acquisitions program is designed for mid-management to senior executives in the C-Suite, directors of public and private companies, board leaders, and heads of strategy and corporate development. It is also geared toward advisers, investment bankers, transaction lawyers, and private equity investors. Individuals and teams are welcome to attend.

- Click to expand

No events are scheduled at this time.

Get Personalized Insights

Let’s talk about your goals and explore how we can help. No pressure, just valuable insights. Discover how professionals and organizations have leveraged our expertise to achieve real results – improving governance, streamlining processes, enhancing their skills, and ultimately driving transaction success. Get personalized insights how you can do the same!

Discover More -

Get Your Free Brochure

Related Courses

This course dives deep into the entire M&A process- from strategy and valuation to execution and post merger integration (PMI).

CPMI prepares you for integration issues post-merger, starting with integration planning, up to governance and project management to implement the integration.

The certification dives into the nuts and bolts of the transaction journey—auditing, consulting, deal advisory, and including insights into running a successful M&A practice.

This certification covers the legal aspects of M&A, including best practices, legal contracts, tax considerations, and deal structuring in different geographies and jurisdictions.

HRM&A covers all aspects of the transaction process relevant to human resources, including strategy, due diligence, Post Merger Integration, and compensation benefits.

This training will provide you with the fundamentals of each approach to valuation, with limitations and caveats on the use of each, as well as extended examples in application.