Blog Webinar Recap: M&A Integration Success, Telecom Insights

- Blog

Webinar Recap: M&A Integration Success, Telecom Insights

- Ces Natividad

SHARE:

In a webinar hosted by the Institute for Mergers, Acquisitions and Alliances (IMAA), seasoned M&A expert Jonas Darke shared valuable insights and actionable strategies in enhancing M&A outcomes. Drawing from his vast experience in the Telecommunications Industry, he dove deep into the complexities of integration in this industry as well as the considerations necessary to make M&A a success.

At the beginning of the webinar, he posed a thought-provoking question to the participants: Should you, as an M&A professional, put your hat on and leave once a Telecom M&A has been signed? Read on to find out how he guided the audience to find the answer to this question.

Key Takeaway: M&A in Telecommunications is distinguished by much complexity

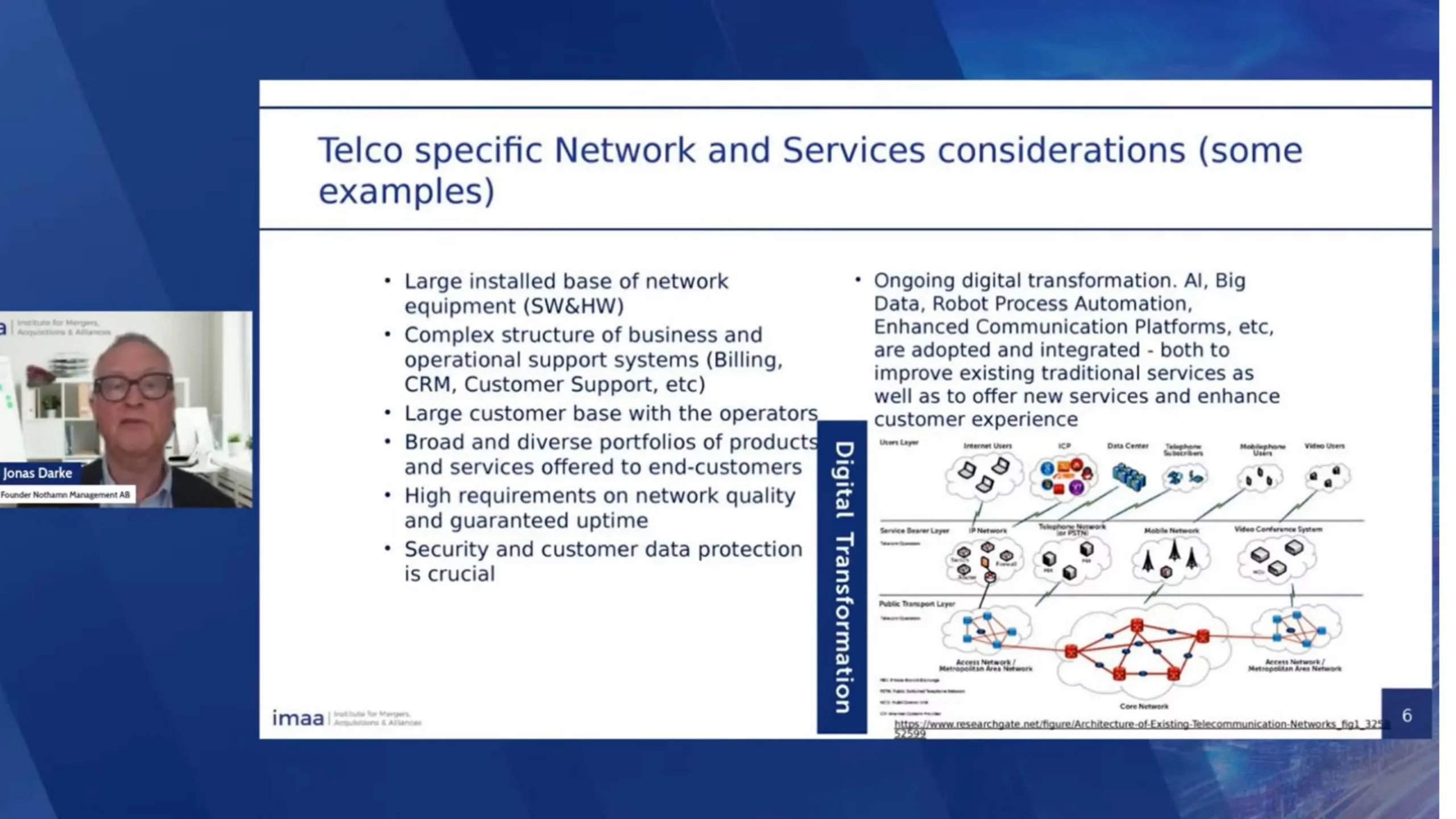

The telecom industry has particular characteristics. The market is mature, competitive, and evolving. The sector requires intensive R&D and rapid innovation. Technological considerations include large installed bases of network equipment and customers. Digital transformation is underway with the adoption of AI and Robotic Process Automation.

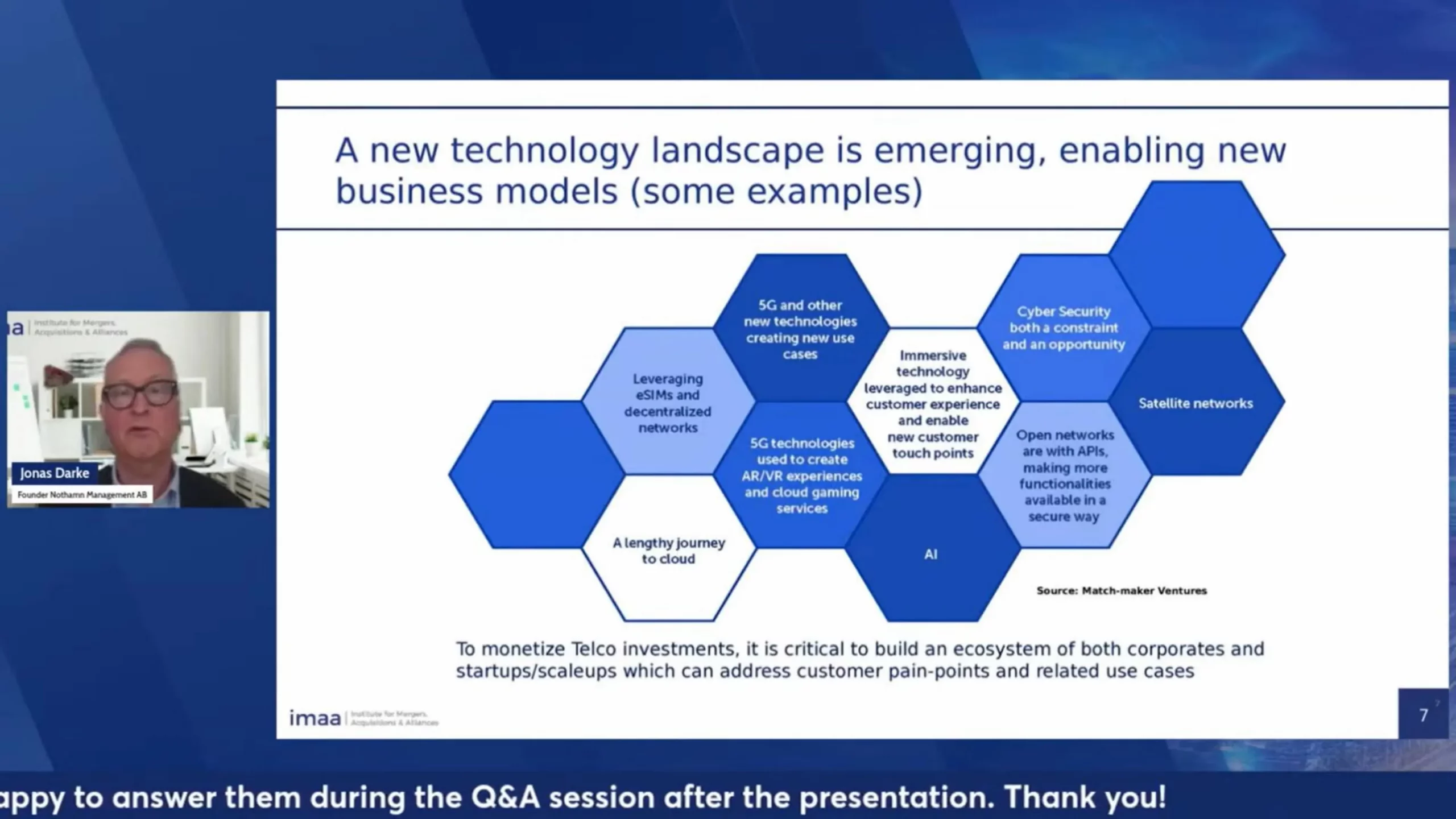

The industry’s rapidly evolving landscape is enabling new business models. A number of themes interplay, such as 5G, open APIs, eSIMs, satellite networks, cloud development, and the overarching issue of AI. Security is also a consideration to add further complexity.

In this complex and evolving landscape, the implications for the Telecom M&A transactions are:

- Technology is key. You need to understand the impacts of digital transformation.

- M&A will affect the whole ecosystem. You need to consider the impact on the entire ecosystem of clients, suppliers, and partners.

- Relatively complex M&A. Which means you have to address a wide range of issues to succeed.

Key Takeaway: Creating value and ensuring a successful integration

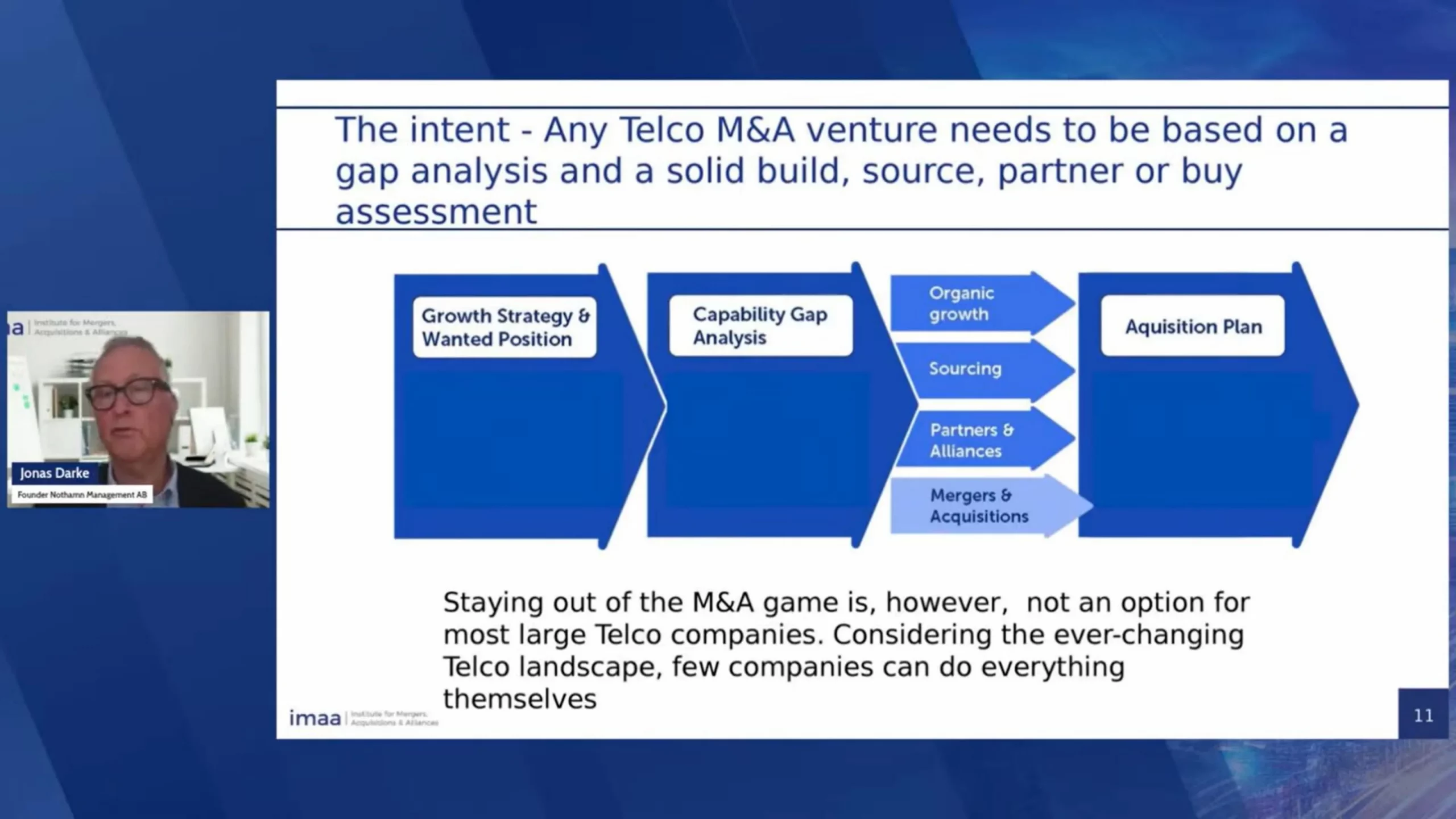

To reach goals and create value, you must do everything right in at least two dimensions. Building the foundation, being clear about the intent, communicating synergies, and getting the integration strategy straight is important. You also need to understand the ways of working both the Acquired and the Acquiring sides.

There are many things to consider before an M&A deal, and a gap analysis is necessary. For instance, the company needs to assess its growth strategy, market position, and operational gaps. Organic growth or partnerships may fill these gaps. However, without M&A, a large corporation risks losing innovation and lagging in growth. Even though the success rate may be poor, M&A is crucial to stay competitive in today’s changing landscape.

Deals in Telecommunications can also bring about various synergies.

- Positive Synergies: revenue, operational, technological, SG&A synergies

- Negative Synergies: negative revenue and integration synergies, transaction and integration costs

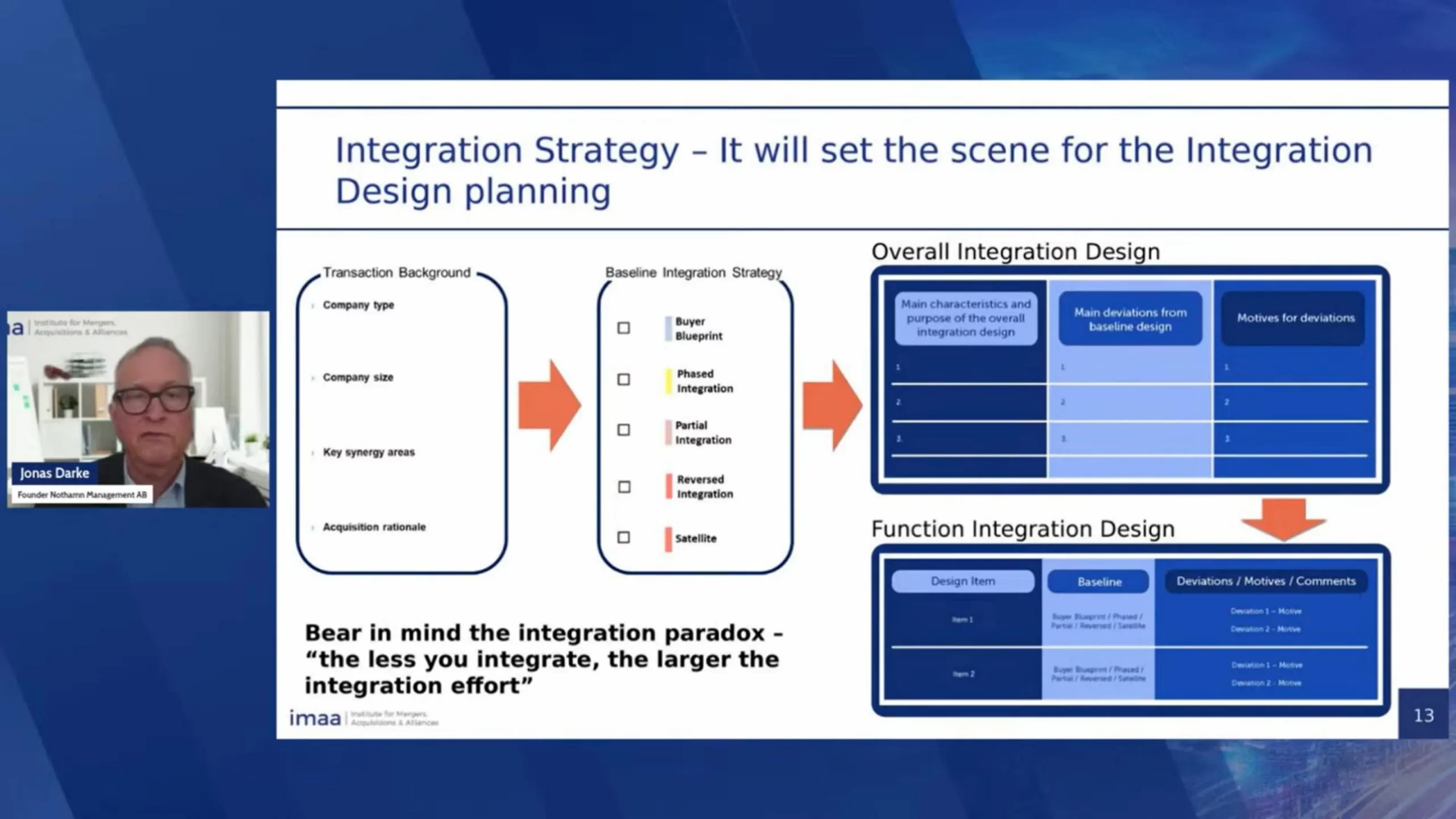

In crafting the Integration Strategy, you need to consider several factors, including the background of the company you’re buying, its size, the key synergy areas, and the intent of the acquisition. This will lead you to the baseline scenario for the integration.

Remember: The Integration Paradox is that the less you integrate, the larger the integration effort will be.

Key Takeaway: Effectively Handling M&A Challenges

There are also critical challenges that need to be addressed.

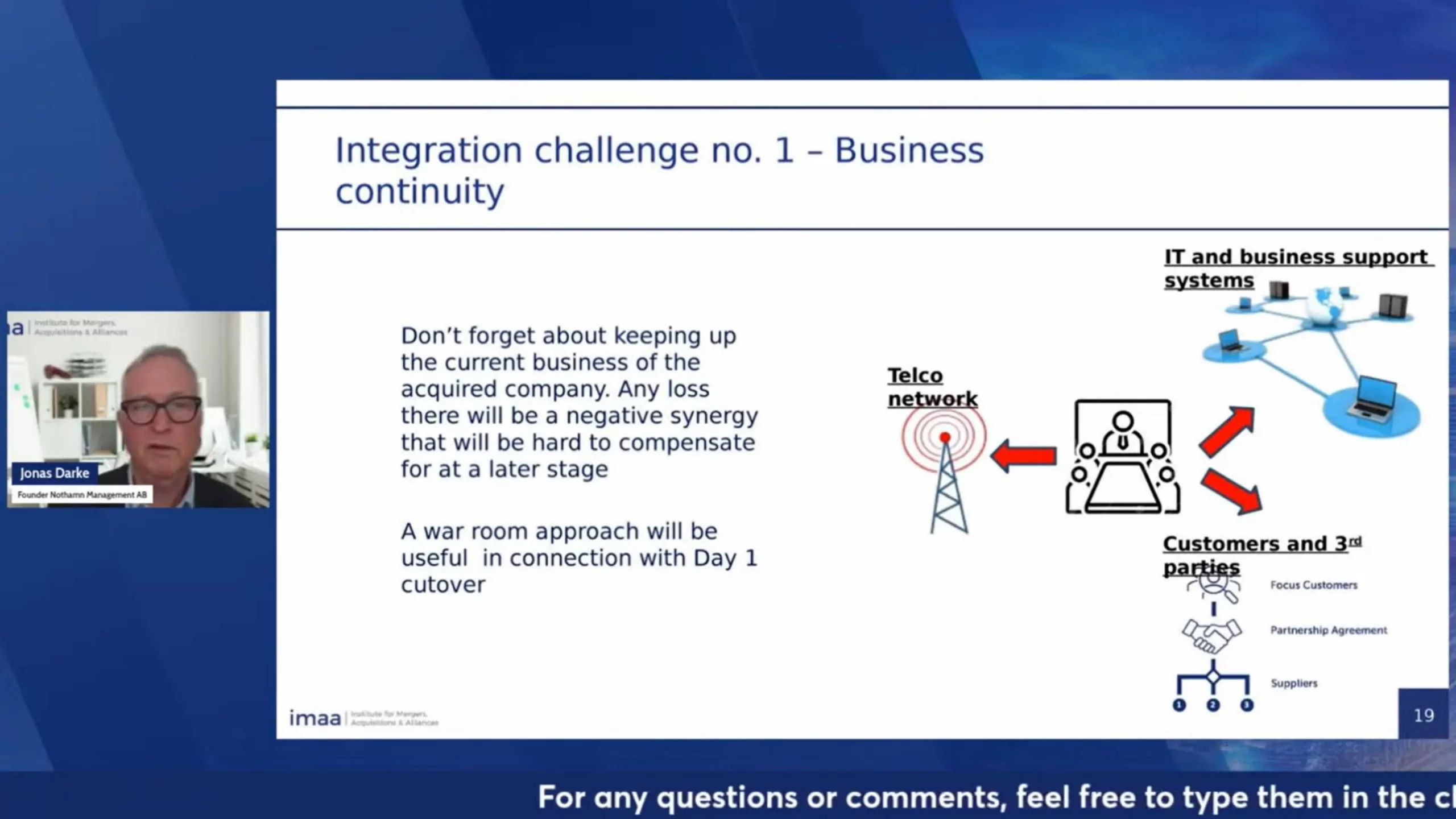

- Business Continuity. It is important to keep up with the acquired company’s current business, as any loss there will be hard to compensate for at a later stage. A “war room” approach will be useful at the Day 1 cutover.

- Be prepared to make decisions. Post-Merger Integration calls for an increased number of management decisions (up to 10-100x compared to steady state) within a short period of time. Management at all levels needs to have active involvement.

- Change management and handling internal resistance. In the process of integration, when you have the highest workload, you will have the lowest motivation. A frequent concern is also about redundancies. In this case, be prepared and be firm in executing the integration intent while maintaining respect for the individual. Be watchful of stakeholder agendas.

- Retain the best people. The way to do this is to keep the momentum going while ensuring that decisions regarding people are not rushed and that employees are kept motivated. Special attention should be given to the career development of Integration Directors.

Considering the complexities of integration in the telecommunications industry and all the relevant factors discussed, if we revisit the initial question posed at the beginning of the session, the answer is “no”. The person responsible for project management or mergers and acquisitions should stay for a minimum of 9 to 12 months and remain focused on ensuring successful integration.

Q&A Highlights:

Answer:

Several factors make it more complex, including regulatory impact and changing technology. While other industries, like pharmaceuticals, are also highly complex, the key point is not really which is the most complex, but given the many considerations, where should you focus?

Answer:

It’s more of a corporate issue in setting the profit margins you expect from a deal and your product strategy. Part of the consideration is whether it is strategic to have this kind of product portfolio integrated or included in your overall portfolio and what the implications are on your total profitability. Look at the effects on the balance sheet and the share price. We need to go through this analysis before the deal is signed.

Answer:

Yes, it’s a big integration challenge, but it’s not because of the industry’s nature; it’s more based on the global nature of the Telecommunications.

Answer:

Change management has to be the accountability of the project sponsor, meaning someone from the executive management level. The integration director’s role is to execute, ensure the plan is completed, and measure KPIs. HR handles one aspect of change management, but overall accountability has to be at the project sponsor level.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter