By Martina Fuchs, Martin Schalljo

Abstract

In times of globalisation managers are often involved in crossborder acquisitions. This contribution analyses how German managers interpret their new business partners after acquisition of their companies by foreign investors from China and India. At first glance, managers appear to extend a cosmopolitan welcome to the new owners. However, the methodology of structural hermeneutics reveals that the construal of managers of their foreign counterparts conflicts with sociocultural patterns of interpretation relating to legitimate leadership and functional administration. While regarding themselves as masters, the German managers also develop clear lines of demarcation in order to distance themselves from their international counterparts. The patterns of interpretation revealed in interviews are firmly rooted in the ’Western’ professional ethics of managers, which becomes even clearer when analysing interpretations of ‘Western’ acquirers such as private equity investors. Economic geography can benefit from analysing how managers mobilise patterns of interpretation in a globalising world as such patterns reveal the limits of cosmopolitanism and the motives for lived practices of power within international organisations.

1. Introduction

In times of globalisation cross-border acquisitions of companies frequently occur. For the people involved, such acquisitions often represent drastic events, challenging not only perceptions of their own role in a global context but also interpretations of international business partners. Economic geography, as a sub-discipline, knows little about how actors and, in particular, managers interpret such events, resulting in limited knowledge of the drivers of international management practices and the formation of underlying work identities. This contribution suggests that managers’ interpretation of their foreign counterparts should be given a more prominent role in economic geography, in order to better understand the motives and practices of managers in cross-border encounters and how these in turn are shaped by general socio-cultural patterns of interpretation. The study presented here asks how CEOs construe the actions of their international counterparts in cases of takeovers by foreign investors in order to refine the understanding of cross-cultural practices and cosmopolitanism in economic geography. The particular focus is on investors from China and India who have recently begun to acquire long-established companies in Europe and North America (Duysters et al., 2015).

As Chinese and Indian acquirers are usually financially strong and oriented towards the long term, media reports suggest that such newcomers are mostly highly welcome (Golinski and Henn, 2015). This is confirmed by the interviews in our own research project. All managers of the acquired companies expressly stated – during an early and prominent stage of the interviews – that they welcomed the new owners in the pre-merger and initial post-merger stage. However, the methodology of structural hermeneutics reveals a more differentiated picture, showing that early patterns of cosmopolitan openness and welcome are increasingly replaced by a growing distance to the new owners. During the post-merger process, the expectations and self-attributions of German managers as cosmopolitan leaders are increasingly challenged by the new cross-cultural work setting. The study illustrates that managers’ immediate interpretation of the acquisition process (expressed in their descriptions of perceptions, interpretations, views, etc.) conflicts with how they experience the later post-merger process and results in distanced relations in global encounters (see Cranston, 2016 and Jones, 2008).

The contribution reveals the existence of socio-cultural patterns of interpretation related to ‘Western’ professional ethics guiding managers’ actions and practices during the merger process. These patterns work as underlying normative touchstones for managers against which to measure the business practices observed in the new owners. The finding of managers distancing themselves from their Chinese and Indian counterparts becomes even clearer when compared to a reference base of German managers in takeovers by ‘Western’ investors.

Our argument begins with an overview of economic geography’s perspective on managers’ interpretation. Behavioural views drawn from the geography of enterprise and discursive approaches provide useful starting points; studies of mergers and acquisitions (M&A) serve to deepen the understanding of socio-cultural ascriptions of distance and contribute to broadening economic geography’s view of socio-cultural distance and cross-cultural management practices in global encounters. We then provide a summary description of so-called ‘Western’ professional ethics. The methodological part explains the procedure of structural hermeneutics and clarifies the study design. The empirical part highlights the influence of underlying patterns of interpretation that are linked to ‘Western’ professional ethics. Chinese and Indian investors are found to disrupt such patterns, unlike ‘Western’ private equity investors which are found to conform to them. The conclusion explains why it is relevant and moreover necessary to analyse the influence of patterns of interpretation on the global economy and in cross-cultural management settings, arguing in favour of intercultural learning to sensitise managers to the requirements of socio-cultural cooperation within international companies.

2. Managers’ interpretation as a contribution to economic geography

How managers of companies interpret their international counterparts in globalising enterprises is an underexplored issue in economic geography. Mostly, economic geographers are concerned with the organisation of multinational companies and company strategies within their respective institutional environments; the focus tends to be on the spatial structures and processes and less on how space itself is construed. The prevailing perspective thus tends to ignore managers’ motivations and with these the ‘mental’ component as a decisive element of their practices.

Managers’ decision-making has been an issue since critics of the general Walrasian postulation questioned the assumption of complete and perfect information of all agents (Simon, 1957). However, in such behavioural approaches perception was usually related to companies as a whole; managers’ mindsets were not a subject of research (Dicken, 1971: 429; McDermott and Taylor, 1979; see Maskell, 2001: 329). Perception geography was an exception (e.g. Bunting and Guelke, 1979 and Johnston, 1972), yet such studies had no discernible influence on economic geographers’ perceptions of ‘the firm’. Early calls for opening the black box of ‘the firm’ came from enterprise geography (Hayter and Watts, 1983); at the same time, managers’ minds remained another black box in economic geography despite a surge of interest in the topic in neighbouring disciplines such as organisational studies and psychology (e.g. Cannon-Bowers and Salas, 2001 and Tindale et al., 2001). For a long time, the understanding of companies in the globalising world thus suffered from an ‘undersocialised’ view of economic agents (Dicken and Thrift, 1992 and Taylor and Asheim, 2001), as it did not include understanding of socio-cultural patterns of interpretation within cross-border engagements.

Currently, economic geographers are addressing the issue of mindsets in the context of two discourses. The first relates to knowledge in global company networks (see Bathelt and Glückler, 2011). Approaches within this discourse often address the local knowledge base of international companies; thus their focus is on knowledge as a resource, competence or capability. Their aim is to explain how knowledge contributes to the competitiveness of companies and regions (see Fuchs, 2014). The second discourse is inspired by the cultural turn which has initiated a broad range of new methods and often hermeneutical approaches in economic geography (see Leyshon, 2011). Such contributions analyse a wide array of topics, including for instance the contradictory narratives and diversity of logics that drive a company (O’Neill and Gibson-Graham, 1999), corporate strategists as social agents (Schoenberger, 1994 and Schoenberger, 2001), borders as a construal and practice in firms (Berndt, 2013), managers’ experimental knowledge (Hinchliffe, 2000), managers’ voice, i.e. the language representing managerial elites in their different roles and social relationships (Oinas, 1999), and imaginaries, i.e. visuals as tools for spatial planning (Boudreau, 2007 and Wetzstein and Le Heron, 2010). Cranston (2014) examines the performative nature of the economy by using narratives to uncover performance as a way to understand the specific practice of knowledge in international encounters. Gertler, 2001 and Faulconbridge, 2008 and Jones (2008) investigate organisational distance, cultures of work and identities in a global context and interfirm practices of learning, and thereby explicitly refer to the ‘underlying social actions within the firm’ (Schoenberger, 1997: 116). Still, managers’ interpretations of their international counterparts, and how these in turn are related to wider socio-cultural principles (including managers’ professional ethics) has not yet been explored in detail. The methodology of structural hermeneutics presented here is a new arrival within the broad range of existing approaches in economic geography. It offers a useful method for uncovering how managers mobilise socio-cultural patterns of interpretation in international encounters and a refined way to analyse how the particular international counterpart is imagined in local practices (Cranston, 2014). How meaning is produced in practices of the economic world (Jones and Murphy, 2011) can be analysed from the various milieus and the social spaces that constitute work (Jones, 2008).

2.1. Socio-cultural patterns

Culture is a prominent concept in economic geography’s analysis of multinational companies operating in different local settings (Depner and Bathelt, 2005 and Cranston, 2016). In this context, ‘culture’ can be understood as the ‘norms, rules, convictions, moral codes, and philosophies of life (…) [which] have developed through a history of social relations and are shaped, produced, and reproduced in everyday practices of human action and interaction (and) help create meaning and a cultural identity (…). Through this cultural identity, it is possible for the actors to distinguish “insiders” from “outsiders”’ (Depner and Bathelt, 2005: 58; see also Mullings, 1999) and to differentiate between ‘identity’ and ‘otherness’ (Si and Liefner, 2014).

Socio-cultural patterns are discussed more frequently in management studies and organisational studies than in economic geography, where empirical research often focuses on how the variety of managers’ views in cross-border M&A affects a firm’s competitiveness (Ghosh Ray and Ghosh Ray, 2013 and Gomes et al., 2013). Hofstede (1984) was an early proponent using quantitative modelling; he thus suggested ex ante categories for analysing culture. Hofstede (1984) shows that many emerging economies have a higher power distance and thus are more hierarchical than core economies or countries with a democratic tradition. Such acceptance of hierarchy is found particularly for the case of Chinese company organisations (Jürgens and Krzywdzinski, 2016: 9). Current M&A studies are aware of differences people ascribe to each other, and avoid concepts such as ‘cultural fit’ or ‘cultural clash’ ( Rottig et al., 2013, Teerikangas, 2007 and Weber and Drori, 2008). This view also relates national socio-cultural patterns to the specific corporate culture(s) in cross-border encounters.

Within this research domain, there is a vivid discourse on the gradual rapprochement of business partners during the post-merger process (Zhang and Stening, 2013), where metaphors such as ‘the open marriage’, ‘the honeymoon period’ or ‘making the marriage work’ express pathways of integration (Cartwright and Cooper, 2001: 77, 126) and how ‘us versus them’ turns to ‘us’ (Cartwright and Cooper, 2000: 79). M&A studies frequently illustrate a continuous mental rapprochement of business partners during the post-merger process (Schweiger and Goulet, 2005), or alternatively continued guardedness between the partners (Stahl and Voigt, 2008). Even if the distance between the new management colleagues in M&A can appear unproblematic (Stahl and Voigt, 2008), most contributions suggest that the construal of ‘us versus them’ is critical for successful cross-border takeovers, because such distancing often reduces efficiency, profitability and competitiveness of the firm (Rottig et al., 2013).

Hence, after the early ‘honeymoon period’, ‘othering’ becomes the predominant pattern of interpretation (see Cranston, 2016). Here we put forward the notion of ‘distancing’, which is related to the economic geography topic of distance in cross-border organisations (Jones, 2009). Currently, this debate strongly focuses on proximity (topographical, institutional, organisational, etc.) as a promoter of learning and innovation (e.g. Balland et al., 2015, Boschma, 2005, Knoben and Oerlemans, 2006 and Torre and Rallet, 2005) and also distance as an asset in virtual communities, fostering learning unattainable in face-to-face communication (Grabher and Ibert, 2014). However, little research has been carried out on how (individual) cognitive/mental distance relates to social distance, i.e. to commonly shared (socio-cultural) patterns of interpretation of distance. Ibert and Müller (2015) should be mentioned in this context as they analyse relational distance and identify patterns of e.g. complicity, rivalry, mentorship, etc. as factors driving different steps of the innovation process, as the stages of induction, validation, mobilisation and concretisation. The difference is that they address such patterns in the context of communities of practice (Wenger, 1998) rather than as socio-cultural patterns related to professional ethics. In this contribution, inspired by a dynamic perspective on managers’ interpretation and construal (Ibert, 2007), we use the term ‘distancing’ rather than ‘distance’ to underline our process-oriented view of managers’ construal of the post-merger process. We argue that distancing is a latent pattern of interpretation that guides spatio-cultural imaginings (see Cranston, 2016).

2.2. ‘Western’ professional ethics of managers

Patterns of interpretation generally relate to a broad range of latent socio-cultural norms and principles within society and civilisation at large. The study presented here refers to German managers, which is why patterns of interpretation are placed within the context of a postulated ‘Western’ professional ethics. As the study was unable to systematically analyse socio-structural milieus at the macro level, we can only provide some brief reference points to clarify our argument. ‘Western’ patterns of interpretation can be traced back to normative ideas surrounding large organisations. Weber (1922/1985: 35–37) for example described rational modern organisation as legitimate leadership and functional administration, while Schumpeter (1928) introduced the notion of innovative entrepreneurs as ‘doers’ and responsible company leaders (von Alemann, 2015: 178ff). Today, universities, management schools and consultancies specify and propagate ‘Western’ rationality by referring to a particular understanding of functional hierarchies and administrative clarity. This includes e.g. key performance indicators, transparent management schemes, detailed controlling, standardised processes and schemes. By using and teaching such tools, the future is thought of as controllable and predictable (Corpataux and Crevoisier, 2007 and Strauss, 2008).

At the same time, in the face of an increasingly global commercial world, cosmopolitanism becomes an important issue (Bird and Mendenhall, 2016), simultaneously positioning the subject in local and global spheres of identity and belonging (Schueth and O’Loughlin, 2008). Cosmopolitanism is the normative idea that people of different countries form part of a common and universal community. As an approach cosmopolitanism focuses on different forms of sociality and on challenges for persons shifting from one form of sociality to another (Earle and Cvetkovich, 1997). In these contexts managers’ open-minded attitudes towards globalisation reveal the concept of cosmopolitanism as a strategic need in global encounters; hence cross-cultural management systems can represent a competitive advantage for international companies (Skrbis et al., 2004 and Woodward et al., 2008). From that point of view, cosmopolitanism can be interpreted as a counterpart to othering and a counterforce to non-reflective stereotyping.

In German companies, there is a particular pattern of interpretation related to mastery in the context of skill development. Often attributed to German, Rhenish or Teutonic professional ethics (see Bathelt and Gertler, 2005 and Gertler, 2001) this represents normative assumptions concerning education and training and respect for professional expertise (Hall and Soskice, 2001).

This contribution uses the label ‘Western’ management to describe such patterns of interpretation, including the particular German, Rhenish or Teutonic variant of management. We use quotation marks to illustrate that ‘Western’ professional ethics is a heuristic analytical construct employed here to better understand a particular management rationality; it is neither a closed system, nor homogeneous. Still, it is the predominant bundle of patterns of interpretation (see Reichertz, 2004 and Wagner et al., 2010). In the empirical part, we use the notion of ‘Western’ professional ethics to characterise the particular normative logic reconstructed from the interviews with managers.

3. Methodological approach and research design

3.1. Methodological approach to structural hermeneutics

Geography today offers a wide range of qualitative approaches (DeLyser et al., 2010). This study draws on speech acts, language and semantics (e.g. Oinas, 1999). Thereby, it goes beyond immediate speech acts (as observed practices) and refers to deeper patterns of interpretation as touchstones; it employs the method of structural hermeneutics which to our knowledge has not previously been applied in economic geography. Patterns of interpretation are defined as commonly held, broadly distributed, normative and stable assumptions; they are the socio-cultural backstage rules which direct and control how immediate perceptions are generated (Oevermann, 1973/2001a, Oevermann, 2001b and Oevermann, 2001c).

The subject of underlying patterns of interpretation is frequently addressed in interdisciplinary research. Patterns of interpretation are taken-for-granted assumptions and expectations (Weber and Drori, 2008); as such they are quite similar to the persistent and collective socio-cultural ‘interpretive schemes’ (Giddens, 1993: 113) or socio-cultural ‘frames’ which organise daily experiences based on their relevance (Goffman, 1974). Patterns of interpretation give structure to perception and create stability and cohesion (Nooteboom, 2012). They are the hidden rules, unspoken everyday theories and imprints or scripts, or the ‘inner sphere’ of interpretation (Ferreira et al., 2013: 58). They fit Popper’s ‘World 3’ (1967/1983: 67): a book remains a book even it is never read (i.e. the book contains a latent and ‘objective’ content). Similarly, although patterns of interpretation are part of individual persons, they are latent in society and thus independent of the becoming and fading of the individual. Such a view is obviously related to the long tradition of transmitted institutional habits of thought (Veblen, 1910 and North, 1991) and internalised rules of conduct (Dutraive, 2012).

Patterns of interpretation are not simply prejudices imposed on a situation in an unreflexive manner, generating stereotypes of othering (Valentine, 2010). In our interviews, managers’ narratives of their international business partners were vivid, witty and metaphorical, indicating that the post-merger integration stage is characterised by ongoing consideration of how to understand their international counterparts (i.e. the new owners) in the face of conflicting interpretations constituted by openness on the one hand and distancing on the other. This demonstrates that although they represent latent socio-cultural backstage rules, patterns of interpretation especially come to the fore in critical situations (Oevermann, 2001b and Soeffner, 2004).

In applying the method of ‘structural’ hermeneutics, we concur with the recent ‘poststructuralist’ view that patterns of interpretation do not directly determine immediate perceptions, as there are no distinct and unambiguous rules of transformation between the two (Flick, 2009: 19). Instead, (partially competing) patterns of interpretation are ‘mobilised’ in particular situations, i.e. activated according to the specific situation at hand.

Structural hermeneutics of course does not deny that the structures analysed are influenced by the researchers’ own construction of reality. The terms ‘objective’ or ‘structural’ hermeneutics refer to the fact that socio-cultural rules not only exist in individuals but also in society in general. The patterns of interpretation found in an individual interview thus always represent a particular expression of general socio-cultural rules – in this sense, ‘objective’ or ‘structural’ patterns. Still, it should be acknowledged that we, as German researchers and authors, are also influenced by ‘Western’ patterns of interpretation, although we act in an academic context and not within an international company. This implies that research matters need to be ‘cooled down’ as far as possible, using criteria such as relevance, explanatory power, evidence, adequacy and intersubjective proof (Oevermann, 2001c: 40).

Oevermann’s (2001c) structural hermeneutics centres upon the hidden structural logics of argumentation. The method focuses on the use of language in speech acts, enabling it to explore the semantics behind the actual statements. Rather than reconstructing the facts and contents referred to, in this case by an interviewee, it analyses the structural logic of argumentation to identify implicit socio-cultural backstage rules. Patterns of interpretation are identified sequentially, first by reading the interview transcript exhaustively and thoroughly and then selecting relevant phrases for precise analysis of each sequence. To develop a hypothesis of the hidden logics of the text, each sequence of text is analysed with regard to possible other versions that might occur in order to understand the key intentions behind it. The text is analysed from within, and the reconstructed hidden logics preferably discussed with further academic investigators. The empirical categories presented were derived by abductive analysis of managers’ argumentation to elucidate the underlying motives of action from the text itself. Abductive categorisation develops hypotheses about an empirical structure from within and ‘verifies’ or ‘falsifies’ hypotheses about the structure and dynamics of social relations from the text itself (Oevermann, 2001b and Oevermann, 2001c).

3.2. Research design

In this contribution we focus on interviews in complete, majority-owned acquisitions of medium-sized and large companies in Germany that took place between 2010 and 2014. This study aimed to calibrate individual insights with further cases, resulting in 14 interviews being conducted and analysed. In 2016, the companies considered were analysed in a follow-up survey to deepen the insights from the analysis of the initial post-merger process.

The study design did not include interviews with the international investors themselves but rather with German managers. Although a cross-examination of how those involved in the takeover perceive each other would be interesting, the sophisticated procedure of structural hermeneutics is difficult to apply to translated material.

The interviews were designed as semi-structured, mostly narrative expert interviews with a flexible guideline that allowed the interviewees to introduce their own topics as narratives (Oevermann, 2001c and Flick, 2009). Major topic blocks of the interview included – inter alia – the pre-merger phase, cooperation and communication with the new investor and an evaluation and experiences of the takeover.

Given the extremely elaborate procedure of structural hermeneutics, this places the study close to the limits of feasibility for this kind of exploration. Results are based on each authors’ individual interpretation, followed by joint fine-tuning and further calibration through discussion with experts in hermeneutic methodology, in particular Ulrich Oevermann and his team. To better assess managers’ views of Chinese and Indian owners (eight interviews), the study included six further interviews in takeovers by ‘Western’ private equity investors with headquarters in the USA, Canada and Europe. This approach brings into greater focus the particularities of how German managers interpret their Chinese and Indian counterparts.

As ‘Western’ managers, all interviewees had experienced similar socialisation and habituation, and had their professional ethics shaped by a similar socio-structural milieu (Oevermann, 2001c). For the most part, they were born in Germany and had lived there for a long time, although all had international experience. In addition, most of the companies examined are German not by virtue of being established in Germany some decades ago (they were formerly owned by BASF, Hochtief, Thyssen, Siemens, etc.), but also because they represent a type of manufacturing company with a long-standing tradition in German capitalism. Hence, managers have internalised ‘Western’ professional ethics, or more specifically a particular ‘Rhenish’ type (of long-term, reliable labour relations and participation) that further explains the results presented below. Most of the companies investigated are geographically located in the manufacturing regions in the western part of Germany, especially in the metropolitan areas of Rhine-Ruhr and Rhine-Main. These locations are characterised by a long-standing manufacturing tradition in Germany.

All of the takeovers examined were ‘friendly’ takeovers, and all interviewees stressed that the new owners strategically aimed to invest money in the acquisition (rather than shutting it down, for example). Rather than the tangible regional effects of M&A such as impacts on the regional labour market, which is a topic usually addressed by economic geographers (e.g. Bathelt and Kappes, 2009, Bollhorn, 2015, Green, 1990/2012 and Zademach and Rodríguez-Pose, 2009), this study therefore examines distancing as a latent pattern of interpretation in cross-border encounters, offering a perspective of how managers construe space in multinational organisations (see Cranston, 2016) to better understand managers’ strategies and thus the mental drivers of company development in times of globalisation.

4. Epirical finmdings: from cosmopolitan openness to distancing

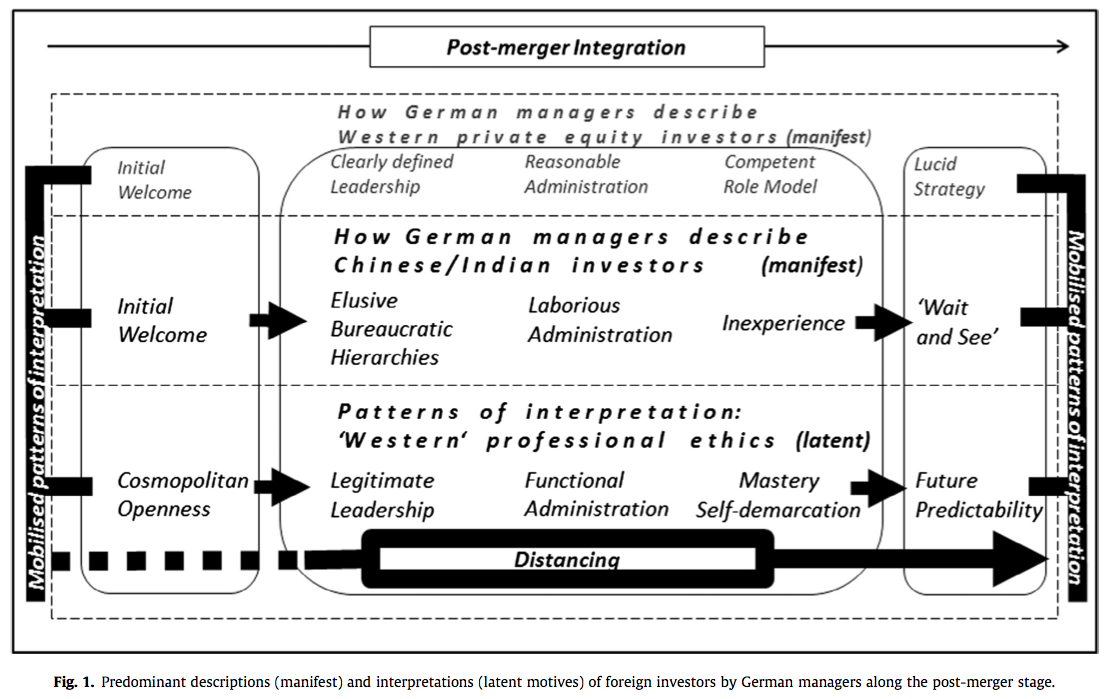

Structural hermeneutics is a sophisticated procedure; we therefore cannot give a detailed account of how to discover patterns of interpretation. The results presented summarise the essence of the extensive process of interpretation. Fig. 1 shows how German managers described their international counterparts during the merger process, and the related latent socio-cultural patterns of interpretation that were mobilised during the different stages. In showing the underlying logics of argumentation, the figure can serve as a heuristic framework to better understand German managers’ interpretation of Chinese and Indian investors, which differs from their interpretation of private equity investors.

Prominently and early in the interviews, all interviewees stressed that the investors were welcome because they brought fresh money and contributed to the further growth of the company. Before, the companies were facing financial difficulties, or they needed money to drive further growth and make substantial investments. This initial welcome was expressed equally for Chinese and Indian and private equity investors. The early welcome can be explained by the voluntary merger situation, where the interviewees had consciously and actively chosen their new owners from various prospective acquirers, or had decided to take the post in the foreign-owned company. Moreover, the initial welcome also relates to a normative pattern of interpretation of cosmopolitan openness to foreign counterparts which is part of the ‘Western’ understanding of professional ethics. Interestingly, such openness survived nearly unbroken during the entire post-merger stage in the case of the private equity investors; there, managers felt confirmed in their professional ethics. This differs from the case of Chinese and Indian acquisitions, where managers felt a discrepancy between their own normative expectations and how they perceived their international counterparts to behave. Analysis of the underlying logics of argumentation shows that after extending an immediate welcome, managers began to distance themselves from their Chinese and Indian counterparts.

For all interviewees, a common starting point of the subsequent logics of argumentation was the view that they were primarily responsible for the success of ‘the company’, and ‘not the foreign cash investor’, be it a Chinese, Indian or private equity investor. To the German managers, welcoming the new owners meant willingness to pragmatically adapt, irrespective of where the new owners came from, but this adaptive pragmatism reaches its limits when managers felt interrupted in their role as the principal responsible ‘doers’. A clear tendency emerged for the managers to attempt to retain and even broaden their autonomy, for the purpose of shaping the future of the company (and their own career) and thus limiting the ‘external’ influence of the new owners. Although the self-image of managers as responsible movers and shakers is clearly part of a positive self-image related to their role as CEOs, the interviews reveal further implications: Interviewees mobilise a pattern of interpretation which sees managers as responsible for ensuring the company’s compliance with ‘Western’ professional ethics, in particular conformity with the underlying touchstones of legitimate leadership and functional administration.

With regard to legitimate leadership, the interviewees particularly in Chinese and Indian takeovers stated that their counterparts were following elusive bureaucratic hierarchies. While ‘Western’ private equity investors were seen to follow the principles of clearly defined leadership, particularly in the case of Chinese takeovers, managers explained that the German companies had become a small part of mostly very large state-owned Chinese corporations, giving them the impression of manning an irrelevant outpost. Leadership was seen to be based on political power rather than legitimate competence, and it seemed difficult to find somebody who made decisions and then stood up for these. Interviewees often noticed surprise of the new owners when German recipients of orders did not merely follow instructions but argued instead ‘we do not do this because…’ Also, there was a view that Chinese investors were too focused on the influence of ministers and other politicians given that political influence is much lower in a less state-driven society, such as Germany. Except for this issue of hierarchy, we did not find any noticeable differences between German managers’ descriptions of Chinese and Indian investors. German managers’ views were similar irrespective of whether the new owners were Chinese or Indian.

In a few cases, interviewees described how the new owners occasionally ignored set rules. One interviewee reported that the Chinese investor attempted to introduce a weekly evaluation of staff performance and a corresponding fluctuating payment for highly skilled staff, which conflicts with labour regulation in Germany. Another interviewee described a considerable difference between his current situation and his self-perception as a responsible manager working within the German regulatory environment. He reported on ‘hair-raising instructions’ issued by the new owners in contradiction to German law and labour relations, and described himself as a guardian of the workforce and defender of ‘Western’ values such as civil society, democracy and legislation, e.g.: ‘That is, for a German management, who is aware of defined decision making processes, and who cares about them, and is educated in this manner – to our culture that is partly an imposition.’

Such cases of conflict with current law and other regulatory or institutional settings tended to be the exception. In general, interviewees referred to minor but frequent disruptions of company organisation. Participation of subordinate levels of management, for example, was described as not permitted even when needed: ‘If the boss is at the table, nobody speaks’. Some of the problems which occurred were thus interpreted as the results of ‘lese majesty’. To the German managers, such observations conflicted with their notion of leadership, which implied that solutions had to be found in a pragmatic and goal-oriented process and that hierarchies were only legitimate if contributing to the superior goal of economic success. The interviewed managers’ observations fit with academic findings about hierarchies in the conceptual part 2.1 above; still both (academic findings and interviewees’ patterns of interpretation) refer to a ‘Western’ view on the global economy and socio-cultural differences.

Administration in the case of Chinese and Indian takeovers was often described as laborious. Instead of functional administration, German managers felt that the Chinese and Indian investors failed to apply the usual management schemes and practices in their administrative processes, such as not introducing standardised processes or not following common lines of reporting. Interviewees missed prioritisation of management objectives, stating that the new owners had no clear strategies and conceptions for the future but were instead obsessed with details: ‘The guys [from China] have no scruples to extend a half-day meeting to 1½ days, to ask 37 times: Why?’ Again, German managers expressed a sense of disruption in how they expected everyday company business to be administered.

Such insights become even clearer when comparing the findings to the views of managers whose firms were taken over by private equity investors. In these cases, managers perceived the practices of the new owners as mostly in line with their own patterns of interpretation. Private equity investors were seen to follow the principles of economic rationality, leading to reasonable administration. Interviewees reported that the private equity investors introduced key performance indicators, clear management schemes, detailed controlling, standardised processes and an advisory board with a high level of expertise. Reorganisation of the company was accepted in this context as a ‘normal’ task to be performed by the private equity investors. In view of the discussion of corporate raiders in the media, interviewees stressed that their counterparts behaved moderately, making the company prosper and grow. At the same time, managers reported strong pressure to achieve profitability, translating to pressure in their own life, as the infusion of investor money represented risky credit. Their salaries were dependent on the successful merger process. This pressure was intensified by the fact that companies were ‘prettied up’ before the takeover, and that the private equity investors’ ‘excel-sheet reality’ did not match the problems experienced by the practitioners. However, the pressure exerted by private equity investors resulted from the requirements of Western management rules and not – as was the case with Chinese and Indian investors – from conflicts with these rules.

The perceived lack of legitimate leadership and functional administration led the German managers to regard Chinese and Indian investors as inexperienced counterparts. Interviewees reported that the foreign executives installed on the German Board of Management often did not speak sufficient English, and that their general inexperience made it impossible to integrate them into German daily management operations. Chinese and Indian investors were thus characterised as ‘learning investors’ keen to obtain ‘Western’ management know-how and practices. Here, interviewees clearly saw themselves in the role of masters responsible for setting the goals of the company, including the provision of direction to the new owners. One interviewee stated that he actively tried to ‘einnorden’ the Chinese and Indian investors, which literally translates as re-orienting the Southern investors towards northern practices and metaphorically means to bring them into line with current company strategy and principles. Reconstruction of the relevant patterns of interpretation revealed that mastery here meant that German managers rated their own competencies as superior and indispensable for the success of the company. Interviewees always expected the new investor to adapt to ‘Western’ practices, without any serious willingness to learn from the practices of the Chinese and Indian investors, e.g.: ‘Well, I think in every respect the Chinese can learn a lot from us, really a lot. But I think this learning process will last for a very long time’. They justified their practices of mastery with ‘rationality’, stating that the Chinese and Indian investors had bought the whole prosperous company including its competent and successful management. At the same time, some emphasised as problematic that the Chinese owners now controlled the supervisory board, that they asserted their own HR policies at executive level and that they confronted the German management with an extreme growth expectation which was judged by Chinese standards but could not be transferred to other parts of the world.

In general, the ‘Western’ patterns of interpretation about legitimate leadership and functional administration are the overall normative setting, implying managers’ incapacity to adjust to the different Chinese and Indian management cultures. Given such discrepancies between the interviewees and the new owners, such distancing was unbroken over time, as the follow-up survey revealed. Actually, some of the managers completely distanced themselves from the new owners by leaving the company.

In contrast, managers whose companies were taken over by private equity investors describe a different situation. They also referred to the same underlying rule of mastery, rooted in their respect for professional expertise. Here, however, the managers interviewed saw themselves in the role of learners rather than teachers: Interviewees saw private equity investors as having the right competencies; i.e. knowledge of the rules of the game in Western management. Private equity investors were competent role models and thus taken seriously, respected and regarded as counterparts of high renown, with interviewees often stating they liked the opportunity to experience management of a private equity firm and hence learn from the new owners.

At the same time, managers in Chinese and Indian takeovers sometimes did not mobilise mastery as a pattern of interpretation (see above in this paragraph), drawing clear lines of self–demarcation instead. This was noted in cases where managers referred to insurmountable differences between themselves and the new owners and where they did not see any opportunity for influencing their international counterparts. Often, this was related to the opportunistic insight that their own career opportunities were better served by maintaining the status quo and keeping the investor out of daily decision-making (e.g.: ‘And this [distance] enables us actually to have this foreign body here’). An interviewee, for example, was content with the fact that the Chinese executives did not have their office within his factory (which was located in the Ruhr area), as was the case for the rest of the management team; rather, the Chinese executives were located in a prestigious shopping area of the nearby city of Düsseldorf (‘Düsseldorfer Königsallee’). There, so the interviewee mockingly stated, the Chinese executives ‘watched people stroll up and down the boulevard’. In this particular case, self-demarcation goes hand in hand with physical distance.

Asked about their outlook for the coming years, future predictability appeared as an essential pattern of interpretation. While managers described the strategy of private equity investors as lucid and clearly defined, in Chinese and Indian takeovers they regarded the post-merger integration phase as somewhat unsettled and opaque due to the ‘wait and see’ strategy pursued by the investors. The German managers often enjoyed their more or less undisturbed freedom as leaders of a company financed by a foreign investor with long-term perspectives on growth and returns. Sometimes, interviewees compared their Chinese and Indian counterparts to an image of Western investors, stressing that the new counterparts gave them broad room for maneuver: Investors from emerging economies ‘do not come in with a bible and say: “These are the requirements for reporting” and do not impose their system on [us], [and] unquestioningly substitute [our] heads with their own’. Only some interviewees reported on unrealistic growth expectations of their Chinese owners; still, they were easily able to reject such ‘five-year plans’. Once again, interviewees portrayed themselves as crafty ‘doers’ who are able to cleverly broaden their elbowroom and keep the Chinese and Indian investors out of daily business.

At the same time, they often wondered if their freedom might just be a stage in the process of post-merger integration, and voiced concerns about the watch-and-wait situation and the hazy future strategy of their Chinese and Indian counterparts. German managers are challenged by such indeterminacy. They are used to clear time frames and schedules in line with the company’s mission, vision and planning. Here, the interviewees had to instead endure an opaque future.

5. Conclusion

The present study illustrates the particular influence of patterns of interpretation related to the ‘Western’ professional ethics of managers and shows how such patterns are mobilised. While Chinese and Indian investors disrupt these rules during the post-merger process, private equity investors are seen as examples of compliance. In the case of Chinese and Indian investors, the logic of argumentation put forward by the German managers suggests a conflict between welcome and cosmopolitan openness on the one hand and active distancing on the other. Mastery may represent willingness of managers to bridge the perceived distance via teaching; at the same time, it also directly expresses distance as it implicitly elevates the interviewees to a superior level. A similar pattern of hidden supremacy occurs in the cases where managers draw clear lines of self-demarcation and confidently enjoy the broad elbowroom within the opaque ‘grey zone’ of the takeover (Alvstam and Ivarsson, 2014). At the same time, German managers can come to assume an inferior position, given by the opaque watch-and-wait situation in the Chinese and Indian merger process, which restricts managers’ ability to develop future strategies and related detailed analytical modelling. Such discrepancies reveal the diverse drivers of lived practices of power within international encounters and the ‘messy ways’ in which global management and work is produced and practised on a local scale (Cranston, 2016: 60).

If, as suggested by M&A-studies, the reduction of an ‘us versus them’ mentality is critical for successful cross-border takeovers, because distancing often reduces efficiency, profitability and competitiveness of the firm (Rottig et al., 2013), this study illustrates remarkably steady and strong practices of distancing. Given that socio-cultural approximation is considered necessary in the first place, a deeper sense of unity needs time to develop. In this context, it should be acknowledged that Chinese and Indian investors represent young players operating within a hegemonic ‘Western’ paradigm in the global market and may adapt over time (Grimes and Sun, 2014). Alternatively, the German managers may need to adapt, either because the new owners are their formal superiors and use their (internationally emerging) power (Carmody, 2013), or because the Chinese and Indian counterparts might themselves respond to the ongoing distancing by their German counterparts and enter into a dialogue with them.

In general, such insights into distancing do indicate the limits of inter-cultural learning and commitment within the companies. In order to move away from underlying stereotypes, a higher sensitivity and reflexivity may support cosmopolitan thinking and a global mindset, which is something that managers can develop ‘through experiencing difference’ (Cranston, 2016: 65). In fact, the study illustrates that patterns of interpretation are not immobile stereotypes, nor managers mere puppets directed by underlying patterns of interpretation, as legitimate leadership, functional administration, mastery and self-demarcation. The self-critical considerations put forward by the managers show their ability to reflect on how patterns of interpretation are mobilised. Such international learning processes raise normative issues: On the one hand, distancing can be related to stereotypes of intolerance and discrimination of the counterpart; on the other hand, distancing is part of an ongoing discourse about participation, efficiency and professional expertise.

Understanding how managers construe their international counterparts is relevant in order to better comprehend behind the scenes patterns of openness and distancing in the ongoing process of globalisation. Economic geography can benefit from analysing how managers mobilise patterns of interpretation as these patterns show actors’ motives in international organisations. Focusing on deeper layers of meaning in expert interviews can help to refine the understanding of how local management practices are challenged in cross-cultural management settings. Deriving abductive categories of argumentation helps to deepen the methodological understanding of cross-border management practices beyond ex ante categories of cultural distance.

This contribution shows that managers’ interpretations are more than irrelevant mindsets and that managers’ words (in this case expressed in interviews) are more than simple speech acts. Instead, interpretations are part of the ongoing social practices within international and ‘multicultural’ organisations. Structural hermeneutics can expose the hidden logics of power practices within a company, including the positioning of those deciding on the respective habits, norms and rules.

Acknowledgements

We thank the German Scientific Foundation for supporting our research project. We also thank Ulrich Oevermann who inspiringly discussed interview extracts with us and supported us in tracing relevant patterns of interpretation. We thank Kira Gee for linguistic editing.