By Chris Adams, Andy Neely – Accenture

According to a long parade of authoritative studies, mergers and acquisitions have no better than a 50-50 chance of creating value for the acquirer. Mergers go sour for many reasons: poor strategic concepts, personality problems at the top, cultural differences, poor employee morale and incompatible information systems. But the most ubiquitous cause is the failure by management to successfully integrate the two entities. In the maelstrom of deal-making, executives invariably fail to install effective post-merger integration tracking and monitoring processes.

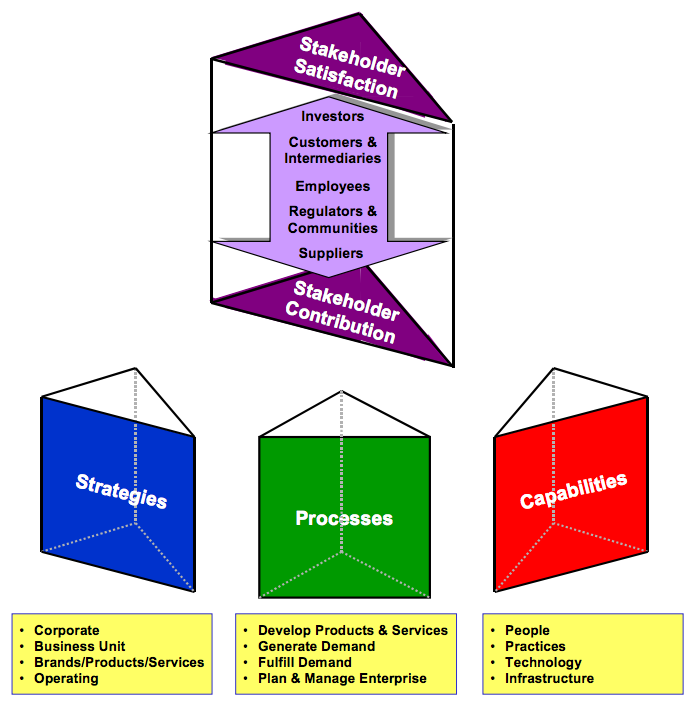

Following a two-year research effort, we have devised a measurement framework and process, the Performance Prism, which helps to extract maximum value from performance management systems. Its chief merit for business combination applications is that it embraces all of a merger’s critical success factors, many of which are not addressed by other approaches.

Beyond the Balanced Scorecard

While the commonly used (and abused) “balanced scorecard” approach addresses only the needs of two stakeholders, investors and customers, the Performance Prism goes further and considers employees, suppliers, intermediaries, regulators and communities. Uniquely, it also addresses both stakeholder satisfaction and contribution. Because it drills down from strategies to processes and then to underlying capabilities, the Performance Prism achieves a comprehensiveness and wide-angle view that is lacking in other business performance measurement frameworks. The result is a much more realistic picture of the drivers of business success.

Tracking all the elements of post-merger integration at the appropriate level of detail is critical. Comprehensiveness is particularly important in merger situations, where integration of two businesses often involves complex trade-offs and specific interdependencies. The Performance Prism prompts managers’ thinking, ensuring attention to all the key post-merger integration success factors and potential pitfalls.

The Performance Prism in Practice

Each of the Performance Prism’s five interrelated facets represents a key area that determines success. The weight given to each will depend on the particular strategic objectives of the deal: e.g. cost reduction, brand enhancement, research synergies and so on. The fundamental questions to ask are:

• Who are our key stakeholders and what do they want and need?

• What strategies are we pursuing to satisfy these wants and needs?

• What processes do we need to put in place to achieve these strategies?

• What capabilities are necessary to operate and enhance these processes?

• What do we want and need from stakeholders to maintain and develop those capabilities?

Let us now briefly consider each of the five facets of the Performance Prism:

Prism Facet One: Stakeholder Satisfaction

The goal of mergers and acquisitions is to enhance shareholder value — everything else can be considered “damage limitation.”

Notwithstanding some cost-driven post-merger redundancies, it is vital that those executives and employees selected for retention do not become disaffected by the decline in morale that frequently occurs. A merger also has to ensure that customers’ wants and needs are better satisfied after the merger than before. Measurement can help to detect and prioritize solutions to declining morale and service to customers.

The Performance Prism makes a broad range of stakeholders, including employees, customers, suppliers and regulators, the focus of measures design.

Prism Facet Two: Strategies

The key elements of a business combination’s strategy will typically be to:

• Leverage the merged companies’ brands, products and services to customers

• Strengthen market share or competitive positioning Improve net cash flows through substantial cost savings

• Deliver the benefits anticipated at the business unit level

• Manage budgeted costs for the post-merger integration.

The Performance Prism enables relevant monitoring to determine whether strategic goals are being met and to provide the data for informed executive

decisions.

Prism Facet Three: Processes

Business processes play a vital cross-functional role in post-merger integration. They are the engines that enhance value:

• Supporting revenue generation through integration

• Spurring cost reduction through shrinking headcount and facilities

• Optimizing procurement and logistics channels.

Prism Facet Four: Capabilities

Capabilities are the amalgam of people skills, business practices, leading technologies and physical infrastructure that create value for stakeholders. They are the fundamental building blocks of a corporation’s ability to compete distinctively and thus present many challenging issues for post-merger integration implementation teams. What is the right level of employee headcount and facilities? What functions should be moved from one place to another? Which are the unique product and process technologies and best operating practices of the merging organizations?

Prism Facet Five: Stakeholder Contribution

The Performance Prism addresses not only what all stakeholders want and need from the newly merged enterprise, but also what the company reciprocally wants and needs from them. Most importantly:

• A stronger investor profile

• A positive response from securities analysts and business media

• Retained employees loyal to the new enterprise

• No erosion of its combined customer base by opportunistic competitors.

The Performance Prism is a broad-gauged tool that deploys a deliberately wide variety of measurement perspectives. These should be installed early in the merger planning phase and maintained for as long as they provide the data on which insights and judgements are needed to ensure a merger’s benefits realization.