Extract from KPMG’s Insurance M&A report for Africa, including country by country analysis

Key trends impacting the insurance sector in Africa

Overview

■ We expect to see an increasing level of M&A activity as new investors are attracted to the continent and there is an uptick of inter regional activity, particularly from South Africa

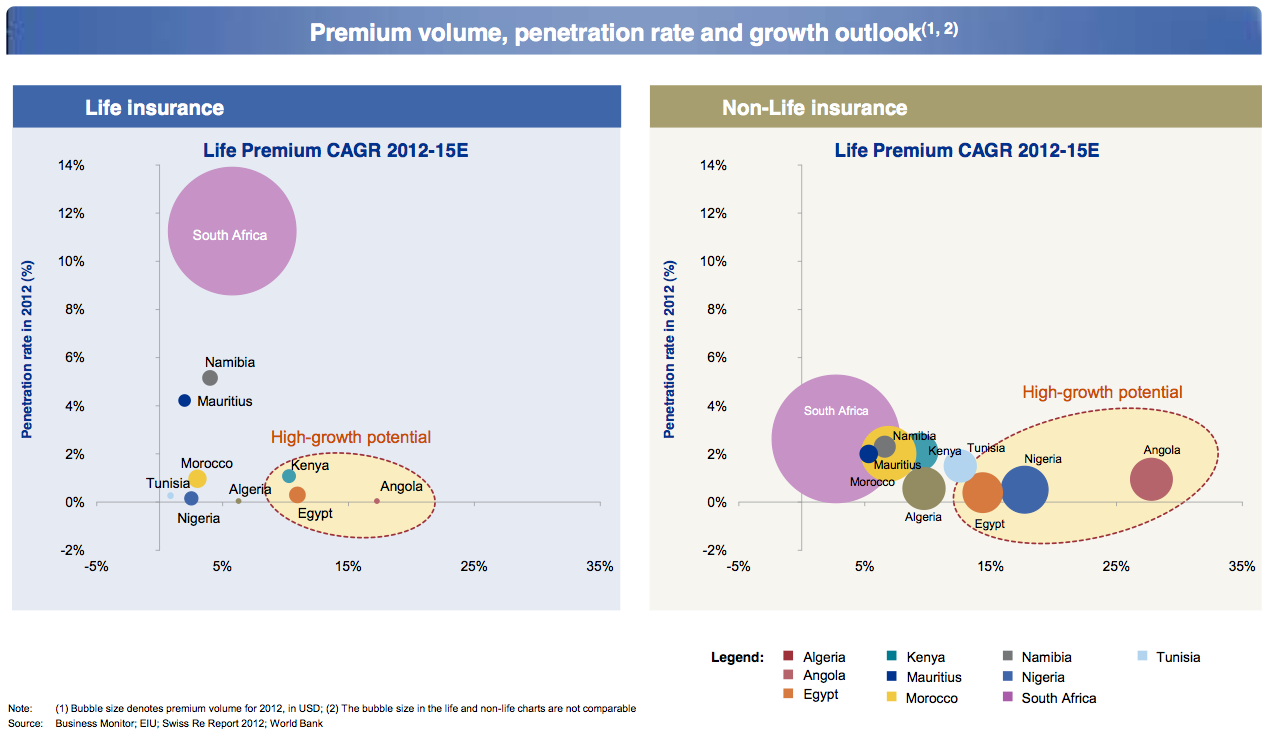

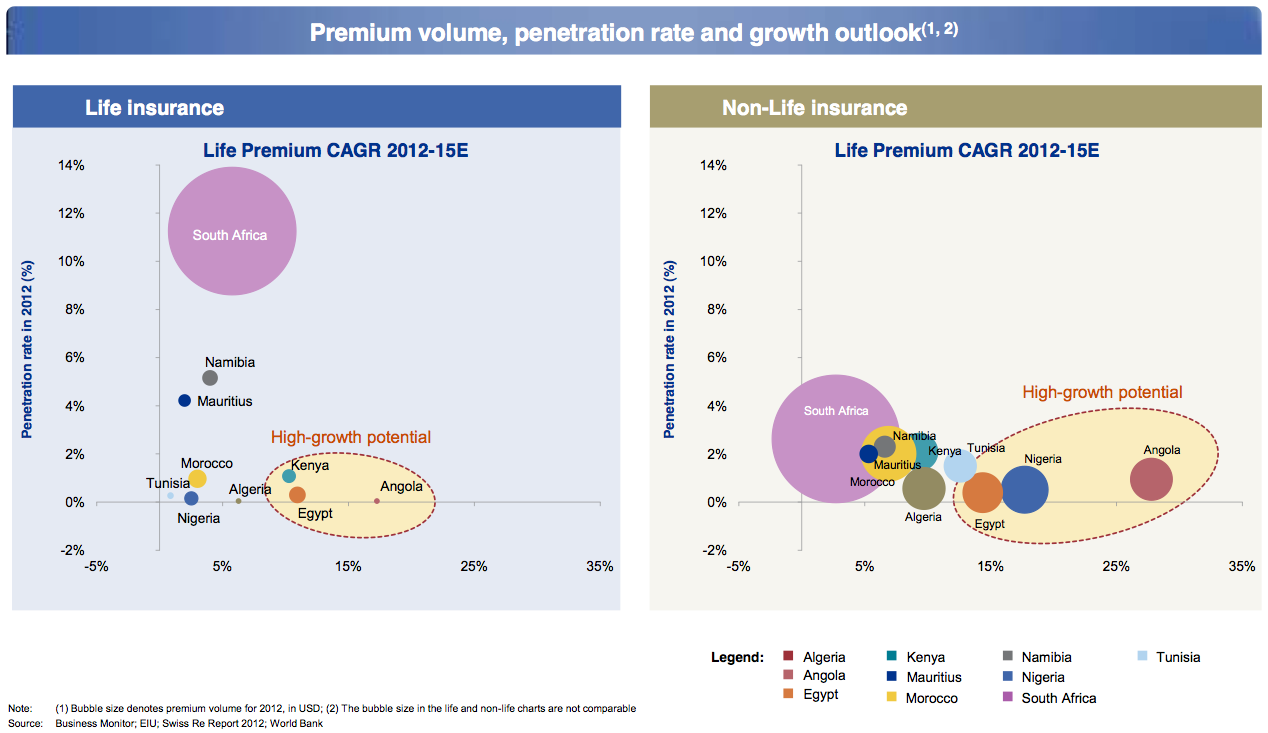

■ Macro economic and demographic trends continue to support the underlying investment thesis, combined with low insurance penetration levels and a developing sector

■ High growth potential exists in a number of markets but we expect sub-Saharan Africa to be particularly attractive over the next 5-10 years, with an active M&A environment as insurers look to capitalize on the opportunities.

Development of the industry

■ Many markets in Africa are experiencing a step forward in terms of the sophistication of the insurance market. However, in comparison to other global high growth markets, there are still significant areas requiring development

■ We believe positive influencers for the industry are:

– an active regulatory agenda and reform (leveraging the IAIS Insurance Core Principles)

– increasing collaboration between regulators to show best practice and agree common framework for future reform (e.g. CIMA and EAC)

– development of bancassurance model in some countries which will encourage growth of the life insurance market – innovation, in terms of new products and developing direct capability, leveraging mobile technology (opportunity to leapfrog more mature markets)

– strong approach taken in many markets to improve poor market practice (e.g. payment of premiums by agents) which will help reduce fraud and improve compliance standards

– commercial insurers will benefit from the continued development of the oil sector and growth of related and other infrastructure

– continued focus on micro insurance which will help improve education and awareness (currently a major barrier, with insurance lagging behind the banking sector).

Challenges in undertaking transactions

■ We highlight that the challenges in undertaking transactions should not be underestimated and potential investors should expect to face lengthy and delayed processes with potentially unexpected developments

■ Investing in the relationship and building a consensus view of the transaction structure and perimeter, valuation expectations and need for detailed due diligence is recommended.

Key trends impacting business models in Africa

Products and markets■ Non life products tend to dominate given the savings market is still in its infancy in many countries

■ Overall penetration remain very low, highlighting the opportunity

■ Livestockandagribusinessgainingtractionin rural areas

■ Significant opportunities remain in commercial lines (oil, real estate, infrastructure, shipping, etc) driven by GDP growth and regional/ global expansion of corporates

Distribution and operations

■ Distribution varies across countries:

– brokers and agents are typically an important channel;

– bancassurance is at an early stage of development (and will be key in increasing penetration in both the non life and life markets); and

– direct is important and growing (particularly leveraging mobile technology and associating insurance with local “trusted” brands)

Governance and people

■ High incidences of fraud provide opportunities to improve claims management.

■ WeakITenvironmentandpoordata quality

■ Shortage of talent with deep insurance experience.

■ Governance and transparency is being improved in some markets, particularly around agency management

■ JVs are difficult to operationalise – few players operate truly jointly.

Regulation and capital management

■ Evolving regulatory environment with modernization of regulatory framework, such as ICPs, RBC, IFRS.

■ Customer protection is of increasing importance.

■ Immature local capital markets provide limited “local” investment opportunities for insurers.

Snapshot of Africa premium volume, penetration rate and growth outlook