By KPMG

Introduction

Cross-border merger and acquisition (M&A) activity in Colombia has been increasing in recent years, as the government has been reforming the tax system to enhance tax benefits for foreign investors.

This report analyzes the main tax issues that potential foreign investors should consider when deciding to invest in Colombia.

Recent developments

In December 2012, the national government enacted a tax reform introducing important structural changes to the tax system and regulating cross-border transactions.

The tax reform incorporated anti-abuse, thin capitalization, permanent establishment and place of effective management rules. New comparability criteria for transfer pricing regulations were established, a list of tax havens was issued, the tax effects of M&As were specifically regulated, and control mechanisms for international operations were enacted.

The corporate income tax rate was reduced to 25 percent for national companies.

By virtue of Act 1607 of 2012, a new tax on income was created: the income tax for fairness (‘CREE’ by its Spanish abbreviation), which applies at the rate of 9 percent rate.

In the latest tax reform (Act 1739 of 2014), the Colombian legislature introduced a CREE surtax. The surtax applies to taxpayers having a CREE taxable base equal to or greater than 800 million Colombian pesos (COP; approximately 250,000 US dollars — USD) per year. The surtax rate is 5 percent for 2015, 6 percent for 2016, 8 percent for 2017 and 9 percent for 2018.

Therefore, current effective income tax rates are:

- for national companies — 40 percent (25 percent income tax, plus 9 percent CREE tax, plus 6 percent CREE surtax)

- for non-resident individuals — 33 percent

- for non-resident entities — 39 percent for 2015, 40 percent for 2016, 42 percent for 2017, and 43 percent for 2018.

The tax reform of 2013 introduced a tax on wealth (Impuesto a la Riqueza) for taxpayers whose net equity (gross equity less liabilities) on1 January 2015 is equal or greater than COP1 million (approximately USD312,500). Foreign corporations and entities are subject to the tax regarding their wealth owned directly within the country and their wealth owned indirectly through branches or permanent establishments within the country, notwithstanding exceptions provided in international conventions and domestic provisions.

The wealth tax is accrued on 1 January of 2015, 2016 and 2017, on the net equity of the taxpayer at 1 January of those years. Rates vary for each year from a minimum of 0.15 percent to a maximum of 1.15 percent.

As of 2015, the implementation of International Financial Reporting Standards (IFRS) commenced in Colombia. However, during a 4-year transition period, Colombian generally accepted accounting principles (GAAP) will be considered for tax purposes exclusively.

Colombia has started to develop a network of tax treaties that generally follow the principles of the Organisation for Economic Co-operation and Development (OECD). Treaties with Chile, Mexico, Canada, Spain, Switzerland, Portugal, Korea and India have been signed and are currently in force. A treaty with France is in the process of approval. Treaties with the Netherlands, France, Japan and the United States are being negotiated. The Colombian government has immediate plans to negotiate treaties with another 15 countries.

A special free trade zone regime has been implemented, granting users classified as ‘industrial users of goods and services’ a reduced income tax rate of 15 percent. Such users authorized before 2012 are not subject to CREE tax. By contrast, free trade zones declared and users authorized after 2012 are subject to CREE tax.

A special deduction is available for investments in science and technology of 175 percent of the invested value, subject to previous qualification by the national government. The benefit can be transferred to the shareholders. This incentive is not applicable for CREE tax purposes.

Asset purchase or share purchase

A foreign investor may acquire a Colombian company by purchasing either its shares or its business assets. Usually, acquisitions are carried out by purchasing shares in a Colombian entity because this creates no direct tax liability for the foreign investor. Additionally, dividends paid to foreign investors are not subject to withholding tax (WHT), provided they are paid out of profits that have been taxed at the company’s level. Nevertheless, in each case, it is important to analyze the option of purchasing the business assets.

Whether shares or business assets are sold, their subsequent sale produces a taxable capital gain taxed at a rate of 40 percent for 2016, 42 percent for 2017 and 43 percent for 2018, or at 10 percent, depending on the length of time that the shares or business assets were owned.

Purchase of assets

In a purchase of business assets, real estate tax (land/property tax) liabilities remain attached to the acquired assets, so the purchaser could be liable for such tax.

Profits from the use of the acquired assets are subject to income tax. Since permanent establishment rules have been introduced, owning assets in Colombia could come with an obligation to register with the tax authorities and keep tax accounts. Repatriations of profits are deemed to be dividends even if a legal vehicle is incorporated in the country.

Profits derived from the sale of assets could produce a taxable capital gain.The sale of inventories could be subject to value added tax (VAT).

Purchase price

The purchase price is the price agreed by the parties, provided it does not diverge by more than the 25 percent from the fair market price of goods of the same kind at the date of the sale. The sale price of real estate cannot be lower than its fiscal cost, the valuation recorded in the land registry office, or the price recorded in the previous year’s real estate tax return. Transactions carried out between Colombian taxpayers and foreign related parties are subject to transfer pricing rules.

Goodwill

With the implementation of IFRS in Colombia, on the acquisition of assets or commercial establishments, it will be possible to recognize the goodwill to the extent that its value is duly supported in technical valuations. Its amortization is subject to several requirements. In the case of share acquisitions, the recognition of the goodwill is available and its amortization could be deductible subject to requirements, e.g. proof of the impairment. Goodwill is understood to be the difference between the acquisition price and the book value of the shares, provided that the purchaser takes control of the entity.

Depreciation

Depreciation expenses of a company’s fixed assets used during the tax year are recognized and accepted by the tax authorities. Useful life terms are established by law and are mandatory. Taxpayers can use the straight-line and the reducing-balance depreciation methods, or they can request permission to use another depreciation method from the tax authority.

Tax attributes

In principle, tax benefits attached to business assets cannot be transferred to the purchaser.

Value added tax

VAT is levied at the rate of 16 percent on the sale of tangible movable goods located in Colombia at the time of the sale, services rendered within Colombian territory, and importations of tangible movable goods. Sales of fixed assets and/or shares are excluded from VAT.

Transfer taxes

Real estate tax (land tax) is a municipal (local) tax levied on real estate in the municipality at rates ranging from 0.10 to 0.33 percent of the real estate’s value.

A registry tax is levied on the registration of the documents transferring the ownership of real estate with the property registration office. In this case, the tax is 1 percent of the price of the real estate included in the registered public deed.

Purchase of shares

Investing in a Colombian company by purchasing its shares does not lead to a direct tax liability for the investor. Dividends paid abroad are not subject to WHT, provided the profits have already being taxed the level of the company.

The Act 1607 of 2012 introduced place of effective management rules. Where commercial and management decisions of a foreign company are made in Colombia and the company does not receive active substantial income in its country of origin, the foreign company is liable to file tax returns in Colombia on worldwide income.

Dividends paid out of profits that have not been taxed at the company’s level are subject to a 33 percent WHT, unless they are paid to a resident of a country that has an enforceable tax treaty with Colombia. In such cases, the tax rate is as stipulated in the treaty.

Where the tax profit available to be distributed without WHT (profits that have been taxed at the distributing company ́s level) exceeds the amount of accounting profits of the respective year, the excess can be carried back for 2 years and carried forward for 5 years.

By contrast, the sale of a Colombian company’s shares to residents or non-residents generates a tax liability in Colombia for the seller. The taxable income is the positive difference between the sale price and the tax cost of the shares. The sale price must be determined using accepted technical valuation methods.

The tax cost corresponds to the acquisition cost, plus tax adjustments. Transactions between related parties are subject to transfer pricing rules.

Tax indemnities and warranties

In a share acquisition, the purchaser takes over the target company, including all related liabilities, so the purchaser usually requires more warranties and indemnities than in the case of a business assets acquisition. Where significant sums are at stake, it is common for the purchaser to carry out a due diligence exercise, including a review of the target’s tax issues.

Tax losses

The general tax losses regime establishes that:

- In the case of mergers, losses can be used where the merging companies share the same economic activity before the merger.

- In the case of mergers, losses originating in each merging company can be used only to offset the taxable income of the merged company at the same percentage as the absorbed company’s net equity represents to the absorbing company’s equity.

- No time or percentage limitations have been imposed since 2007. However, the taxpayer should have taxable income in order to offset the respective loss.

- Losses incurred in fiscal year 2006 and earlier have 8-year and 25 percent limitations, and losses related to non- taxable income and non-deductible expenses cannot be offset.

Transfer taxes

The applicable national stamp tax rate is 0 percent. Local jurisdictions (municipalities) are entitled to levy their own stamp duties.

Choice of acquisition vehicle

Several acquisition vehicles are available to a foreign investor purchasing a Colombian company, and the tax effects for each vehicle differ.

Local holding company

Acquisitions can be structured through Colombian holding companies to recognize the goodwill in Colombia. Keep in mind that amortization of the goodwill is not available for tax purposes, but the demerit (loss of value) is deductible.

In the case of acquisitions via merger, the goodwill cannot be utilized by the same company whose shares have been acquired or by the entities resulting from the merger, spin-off or liquidation of the same entity.

Foreign parent company

A foreign parent company can be used as an acquisition vehicle to push debt down to the Colombian target. However, Colombia’s new thin capitalization rules require a 3:1 debt-to-equity ratio. Interest paid in excess of the ratio is not tax-deductible. In any case, the anti-abuse rule needs to be analyzed in this case.

The transactions also must comply with transfer pricing regulations. Where the transaction is not within the applicable ranges, the interest is re-categorized as dividends.

Non-resident intermediate holding company

Where the foreign country taxes capital gains and dividends received overseas, an intermediate holding company resident in another country could be used to defer such taxes. The intermediate holding company can be incorporated in a country with an enforceable tax treaty with Colombia.

Local branch

The foreign investor could purchase the business assets of a Colombian company through a branch incorporated in Colombia. However, branches are Colombian taxpayers and subject to income tax, VAT, financial transactions tax, customs duties and all local (municipal) taxes, such as industry and commerce tax and municipal stamp duties. Branches are liable for all formal obligations related to these taxes and required to file periodic tax returns.

Under new rules for branches and permanent establishments (PE), where branches or PEs transfer their profits abroad, the transfer is considered a dividend that could be subject to WHT at a 33 percent rate (unlike the abolished regime where such transfers of profits were not taxable).

Note that branches are subject to income tax at rates of 40 percent for 2016, 42 percent for 2017, and 43 percent for 2018, but only on their national (Colombian) income and their national net worth. Colombian regulations do not allow branches to acquire shares in Colombian companies.

Joint venture

Certain activities can be carried out through joint ventures. However, since joint ventures are not considered legal entities separate from their members, each member is liable for tax on profits earned from the activities performed directly by the joint venture.

Choice of acquisition funding

A foreign investor can use a Colombian acquisition vehicle and finance it with capital contributions, debt or a combination of both.

Debt

The main advantage of debt is the potential tax deduction of installments, interest and related expenses, such as guarantee fees, bank fees, financial costs and exchange rate differences. Bear in mind that Colombia’s new thin capitalization rules could limit the deductibility of interest.

Foreign loans to Colombian companies are subject to income tax withholdings. Short-term loans (less than 1 year) are subject to a 33 percent withholding. The rate for long-term loans is 14 percent. Where the lender is a related party, the transaction is subject to transfer pricing rules.

Deductibility of interest

Interest payments are deductible, provided the loan was used in income-producing activities and WHT was applied to the payments. Interest payments should be deducted in the same fiscal year in which they are made. Financial costs and expenses related to the debt are also deductible, provided they are related to the income-producing activity.

Under the new thin capitalization rule, interest paid on debts is only deductible where the average total amount does not exceed 3 times the taxpayer ́s previous year’s net equity (i.e. 3:1 ratio). For this purpose, only interest-generating debts are considered.

The thin capitalization rule is applicable to debts with local or foreign entities, whether they are related or non-related parties. Operations with foreign related parties should be reviewed to determine the impact of the transfer pricing rules.

Withholding tax on debt and methods to reduce or eliminate it

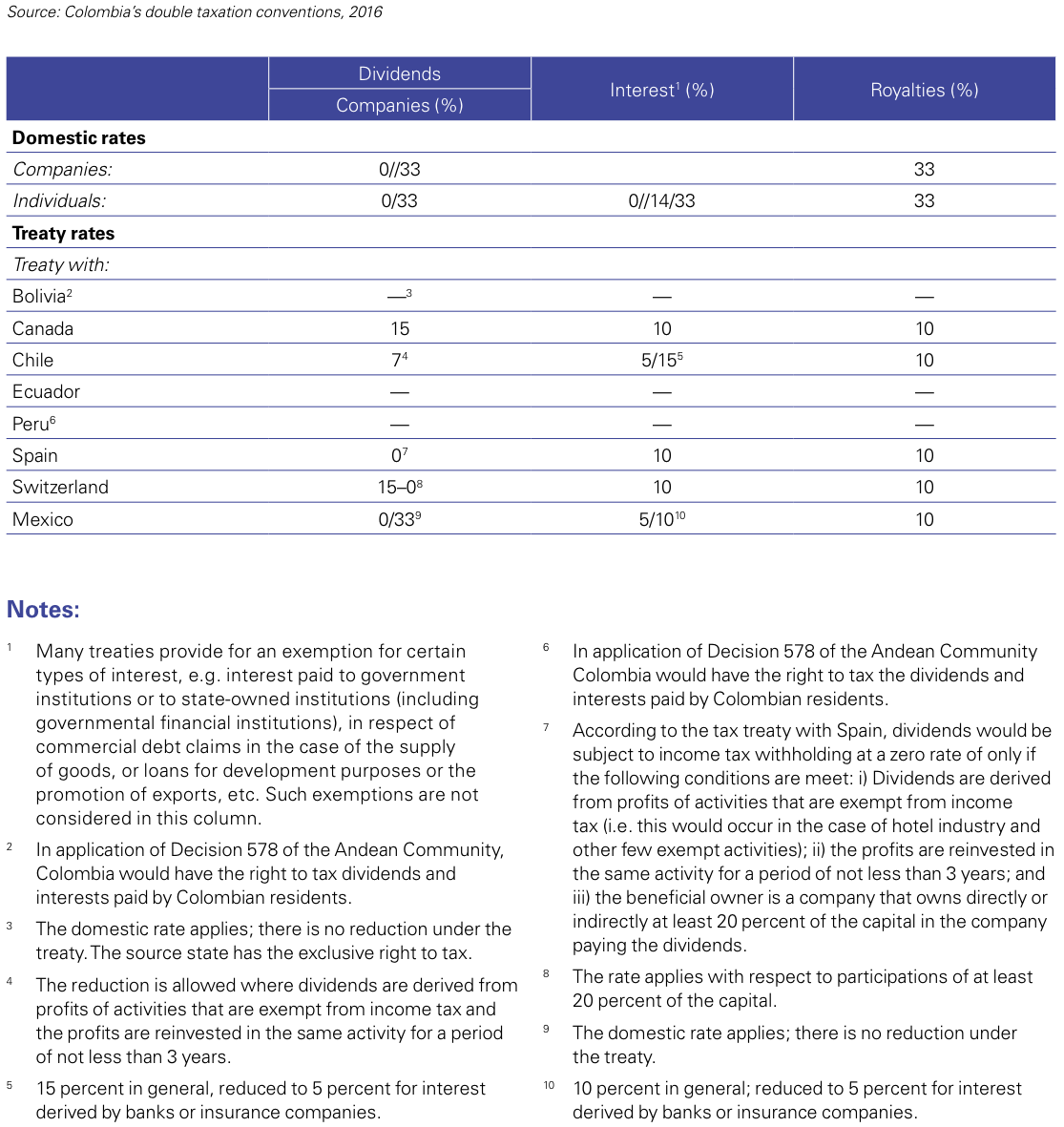

Interest paid on debt is subject to income tax withholdings at the rate of either 14 percent or 33 percent. Reduced withholding rates are applicable to interest on foreign loans with entities located in countries with enforceable tax treaties (0, 5, 10 and 15 percent). See the table of WHT rates under Colombia’s tax treaties at the end of this report.

Checklist for debt funding

- Bear in mind the thin capitalization rule.

- For indebtedness with foreign lender, inform the Colombian Central Bank before the disbursement of the loan.

- Where the lender is a related party, transfer pricing rules apply.

- Interest payments, financial costs and expenses are deductible, subject to certain requirements.

Equity

Foreign investors can fund the Colombian vehicle through direct contributions to the capital of the vehicle. Profits transferred from the vehicle to the investor are subject to WHT where they were taxed at the company’s (Colombian vehicle) level. Profits that were not taxed at the level of the vehicle are subject to a 33 percent WHT. Where such profits are paid to a resident of a country with an enforceable tax treaty, the WHT rate may be reduced.

Discounted securities

The investment could be channeled through the acquisition of certain discounted securities, such as the ‘BOCEAS’, the Spanish acronym from bonds that convert into shares at a certain price or at a discount once the bonds reach maturity or a predetermined time has elapsed.

Other considerations

Concerns of the seller

A sale of shares or business assets to residents or non-residents generates a tax liability in Colombia for the seller. The taxable income is the excess of sale price over the tax cost of the shares or business assets.

For non-listed shares, the sales price agreed by affiliates is determined based on acceptable technical studies.

The tax cost of shares is the acquisition cost plus tax adjustments. The tax cost of business assets is the historical cost less the relevant depreciation.

In a share transaction, the portion of retained profits already taxed at the Colombian company level that would not be subject to WHT if distributed and corresponds to the shares being sold can be subtracted from the taxable income derived from the sale.

A Colombian taxpayer should include in the income tax return as a capital gain the profits derived from the sale of shares or business assets owned for more than 2 years, which are taxed a 10 percent rate.

Where the shares were owned for less than 2 years, capital gains should be included in the return as ordinary income, which is taxed at a rate of 40 percent for 2016, 42 percent for 2017 and 43 percent for 2018.

Foreign investors must file an income tax return following a sale of shares within 1 month of the sale. Transfer pricing requirements might be adhered.

A transfer of shares that result from a merger or a spin-off transaction between foreign companies could trigger a taxable event where the value of the assets located in Colombia represents more than 20 percent of the total assets owned by the group to which the entities involved in the merger or spin-off belong.

Finally, keep in mind that under new anti-abuse rules, the taxpayer is required to prove that the merger or spin-off follows a business purpose (rather than only the purpose of obtaining tax benefits, if any).

Company law and accounting

Transfer pricing rules apply to transactions with foreign related parties.

The commercial code governs how companies may be incorporated, operated, reorganized and dissolved. The principal types of companies are described below.

Corporation (Sociedad Anónima — SA)

A corporation must have a minimum of five shareholders. Each shareholder is liable up to the amount of its capital contribution as represented by negotiable shares. The corporation’s capital is divided into authorized share capital, subscribed share capital and paid-up share capital. At the time of the company’s incorporation, at least 50 percent of its authorized share capital must be subscribed, and at least 33 percent of its subscribed share capital must be paid-up. The balance must be paid during the year following the incorporation of the company.

Some characteristics of these corporations are as follows:

- Where a corporation needs to be capitalized, it may issue shares or bonds convertible into shares.

- When new shares are issued, they may be offered at a price higher than their face value to increase the corporation’s net worth. This excess of the price of the shares over their face value, also known as the premium on share placement, is exempt from income and complementary taxes at the time of the capitalization, but it becomes part of a corporation’s taxable income at the moment of its distribution.

- Stock maybe sold at any time without any restrictions other than those contained in the company’s issuing regulations or if the by-laws provide for a special procedure or for a preferential purchase option in favor of existing shareholders. Where a corporation’s shares are registered on the stock market, they may be freely traded.

- The shareholders assembly can deliberate and reach decisions in a place other than the corporation’s main offices, and even abroad, provided the total of the corporation’s shares are represented at the meeting.

- Corporations must have a statutory auditor (revisor fiscal). They are also under the supervision of the Superintendency of Companies where their supervision is not undertaken by any other superintendence and their assets or revenues are higher than 30,000 legal minimum monthly wages — approximately USD9.6 million for 2012.

Limited liability company (Ltda)

A limited liability company may be organized with a minimum of two partners and a maximum of 25. The partners are liable up to the amount of their capital contributions, except for tax and labor liabilities, in which case partners can be severally and jointly liable along with the company in accordance with particular provisions. The capital of the company must be fully paid at the time of the incorporation and is divided into capital quotas of equal amounts, which may be assigned in accordance with the provisions in the company’s by-laws and Colombian law. The partners also are jointly liable for the attributed value of any contributions in kind.

The limited liability company’s highest direction and administration body is the board of partners, in which the partners have as many votes as they own capital quotas in the company.

Capital quotas (stock) may be assigned to other partners or third parties, subject to pre-approval of the board of partners. Every stock assignment implies a statutory amendment that must be legalized by a public deed and registered with the chamber of commerce of the company’s domicile.

Partners are jointly and severally liable for the tax and labor debts of the company in proportion to their capital contributions, taking into account the number of capital quotas they possess and the period during which such quotas have been owned.

A statutory auditor is mandatory where the bylaws so provide, the assets are higher than 5,000 legal minimum monthly wages (approximately USD1.02 million for 2016), or the revenues are higher than 3,000 legal minimum monthly wages (approximately USD616,000 for 2016).

The limited liability company is under the Superintendency of Corporations’ supervision where its supervision is not undertaken by any other superintendence and its assets or revenues are more than 30,000 legal minimum monthly wages (approximately USD6.16 million for 2016).

Limited partnership (Sociedad en Comandita Simple y en Comandita por Acciones)

A limited partnership involves one or more managing partners who commit themselves to a joint and unlimited liability for the entity’s operations (partners with unlimited liability) and one or more non-managing partner(s) whose liabilities are limited to their respective capital contributions (limited liability partners).

The partnership capital consists of the limited liability partners’ contributions and those of the managing partners or partners with unlimited liability. However, responsibility for the company’s management lies solely with the managing partners.

Limited partnership entities can be sub-categorized into simple limited partnerships and general shares partnerships. A simple limited partnership’s capital is divided into partnership quotas, while a general shares partnership’s capital is divided into shares.

Partnership (Sociedad Colectiva)

A partnership is a type of corporation in which every partner is a manager of the entity and has an unlimited and joint liability for the acts developed by the company. Known as one of the least flexible of Colombia’s corporation types, any decision that entails a statutory amendment must be taken unanimously and must be legalized by a public deed and registered with the chamber of commerce of the company’s domicile.

Each partner has a single ‘share of interest’ and a single vote in the assembly regardless of its contributions to the company.

Simplified joint-stock corporation (Sociedad por Acciones Simplificada — SAS)

An SAS can be incorporated with only one shareholder, and these entities have separate legal personalities from their shareholders (the equity of the SAS is completely independent of the shareholders’ equity). The liability of the shareholders is limited to the amount of capital contributed unless the entity was used for fraudulent purposes, in which case the liability of its shareholders is joint and unlimited.

The administration and structure of the SAS is simpler than other companies for several reasons:

- An SAS does not need a board of directors (all management and representative activities can be carried out by the legal representative appointed by the shareholders) unless otherwise required in the by-laws.

- The shareholders can directly make decisions usually implemented by directors, such as approval of financial statements, dividend distributions and all the corporate accounts.

- It may be incorporated with a single shareholder.

Additionally, an SAS may be incorporated and its organizational documents amended by means of private documents. Therefore, it is not necessary to sign a public deed before a notary, unless the shareholder(s) contribute real estate property to the SAS. Thus, the costs of incorporation are generally lower for an SAS than for other legal vehicles. On incorporation, the capital contribution does not need to be fully paid upfront but within a period of 2 years following the incorporation date.

Bill 70 of 2015 (Proyecto de Ley No. 70 de 2015)

On 12 August 2015, an important bill was presented before the Colombian Congress to amend aspects of Colombian corporate law and change certain general rules for corporations in Colombia.

Among many other modifications:

- Companies other than the SAS may now be incorporated by means of a private document.

- Companies may have an undefined corporate purpose and or duration.

- The manager’s responsibility regime is updated in order to align with the latest regulations thereon.

- Sanctions imposed by the Superintendency of Companies are greatly increased.

Merger

Under Colombian law, a merger of companies is a complex legal transaction by which one or several companies are dissolved but not liquidated and absorbed by another company or combined to create a new company. The merger is achieved by means of an equity transfer representing all the assets and liabilities of the absorbed companies into another absorbing company, which may be newly formed or pre-existing.

In this situation, the absorbing or new company acquires the rights and obligations of the dissolved companies as they were at the time of the execution of the merger agreement.

Tax effect of company merger

The Act 1607 of 2012 established two kinds of mergers: acquisitive mergers and reorganizational mergers. Acquisitive mergers take place where the merging entities are not related parties, while reorganizational mergers take place where the merging entities are related. In both cases, the merger is tax-neutral, provided certain requirements are met.

For acquisitive mergers, the shareholders of the merging entities must meet the following requirements:

- At least 75 percent of the shareholders of the merging entities must have a participation in the resulting entity equivalent in substance to the participation previously owned in the merging entities (although in proportion to the resulting entity).

- The participation in the resulting entity must constitute at least 90 percent of the consideration that the respective shareholder receives, on a commercially reasonable basis as reflected in the valuation method adopted for the operation.

For reorganizational mergers, the shareholders of the merging entities must meet different requirements:

- At least 85 percent of the shareholders of the merged entities must have a participation in the resulting entity equivalent in substance to the participation previously owned in the merging entities (although in proportion to the resulting entity).

- The participation in the resulting entity must constitute at least 99 percent of the consideration that the respective shareholder receives on a commercially reasonable basis as reflected in the valuation method adopted for the operation.

In both cases, where the shareholders alienate or assign their shares or economic rights before the second taxable year ends (counted as of the finalization of the operation), they are liable to pay the income tax that would have arisen had the operation not been considered tax-neutral, plus an additional 30 percent of such tax. In all cases, the tax is at least than 10 percent of the value of the respective shares in accordance with the valuation method used for the merger process.

Tax regulations stipulate that the absorbing or new company is responsible for paying the taxes, advances, withholdings, penalties, interests and other tax obligations existing in the merged or absorbed companies.

Demerger or spin-off of companies

In accordance with applicable commercial regulations (law 222, dated 20 December 1995), a spin-off can be carried out in two ways:

- A company, without being dissolved, transfers in a block one or several portions of its net worth or patrimony to one or more existing companies or uses such portion(s) to set up one or more new companies.

- A company is dissolved but not liquidated and splits its net worth or patrimony into two or more portions that are either transferred to several existing companies or used to create new companies.

Tax effect of demerger or spin-off

The tax reform of 2012 established two kinds of spin-offs: acquisitive spin-offs and reorganizational spin-offs. Acquisitive spin-offs occur where the spun-off entity and the beneficiary entities (if any) are not related parties. Reorganizational spin-offs occur where the spun-off entity and the beneficiary entities (if any) are not related. Both types are considered tax-neutral operations, provided certain requirements are met.

The requirements for spin-off entities and shareholders follow the same rules that apply for mergers.

Keep in mind that, under the new regulations, a spin-off would be tax-neutral only if the assets involved can be considered an ongoing concern or an economic exploitation unit.

Transfer pricing

Transfer pricing rules apply to income taxpayers engaged in transactions with foreign related parties. All operations with foreign related parties must be reported in the relevant return, and the supporting documentation must be prepared and kept available at any time for the tax authorities.The OECD’s transfer pricing principles are followed as guidelines for transfer pricing purposes in Colombia.

The tax reform introduced new comparability criteria between operations with related parties, new operations subject to transfer pricing rules, and new methods for determining profit margins in operations with related parties.

Foreign investments of a local target company

Colombian entities can invest in foreign companies, but they must register such investments with the Central Bank. Taxes paid abroad can be credited against the Colombian liability (Colombian taxpayers pay their income tax on worldwide profits).

Comparison of asset and share purchases

Advantages of asset purchases

- The price paid to acquire a fixed asset, adjusted for inflation up to 31 December 2006, can be used as the basis for depreciation or tax amortization.

- When used goods are acquired, the assets can be depreciated over the remainder of their useful life, after deducting the depreciation period used by the seller.

- An asset purchaser does not take on any risk or contingency relating to the commercial or tax obligations of the selling company, unless the asset acquired carries a mortgage or pledge or in the case of real estate where the real estate tax (land tax) liability is transferred.

- Possible to acquire only part of a business.

Disadvantages of asset purchases

- A permanent establishment could arise.

- Possible need to renegotiate supply, employment and technology agreements and to renew licenses.

- Sale generally requires access to greater cash resources.

- Benefit of losses incurred by the target company remains with the seller.

- A public deed to formalize the deal could be required to be executed and registered, generating a notary fee (approximately 0.3 percent) plus a registration tax of 1 percent of the total price stated in the document.

Advantages of share purchases

- Sale generally requires less capital outlay.

- Purchaser may benefit from existing supply and technology agreements.

- Dividends are not subject to WHT where they are paid out of profits that have already been taxed at the company’s level.

- A share sale does not require registration duties, but the transaction must be reported to the Central Bank.

- Target keeps its losses and tax attributes, which can be offset in the future against taxable income.

- Indirect sales of shares do not result in tax effects in Colombia.

- An anti-abuse rule introduced in 2012 that penalizes taxpayer behaviors aimed at evading taxes might be applicable. Based on the ‘substance over form’ principle, the rule states that, for tax purposes, transactions that do not have a real business purpose other than obtaining a tax benefit are not accepted.

- Transactions with parties in jurisdictions on the government’s tax haven list may be restricted in terms of deductibility for income tax purposes and attract higher tax withholdings.

Disadvantages of share purchases

- Purchaser acquires liability for the commercial obligations of the company up to an amount equal to their capital contribution (limitation applicable to SAS and SA).

- The partners of limited liability companies (Ltda) are severally and jointly liable with their own equity for tax debts.

- Partners are also jointly liable for some labor liabilities of the partnership.

Colombia — Withholding tax rates

This table sets out reduced WHT rates that may be available for various types of payments to non-residents under Colombia’s tax treaties. This table is based on information available up to 1 January 2016.