Overview

Power transactions and trends

This Q2 2016 edition of Power transactions and trends reviews quarterly deal activity within the power and utilities (P&U) sector and forecasts the trends that will shape future mergers and acquisitions (M&A).

Top factors shaping investment

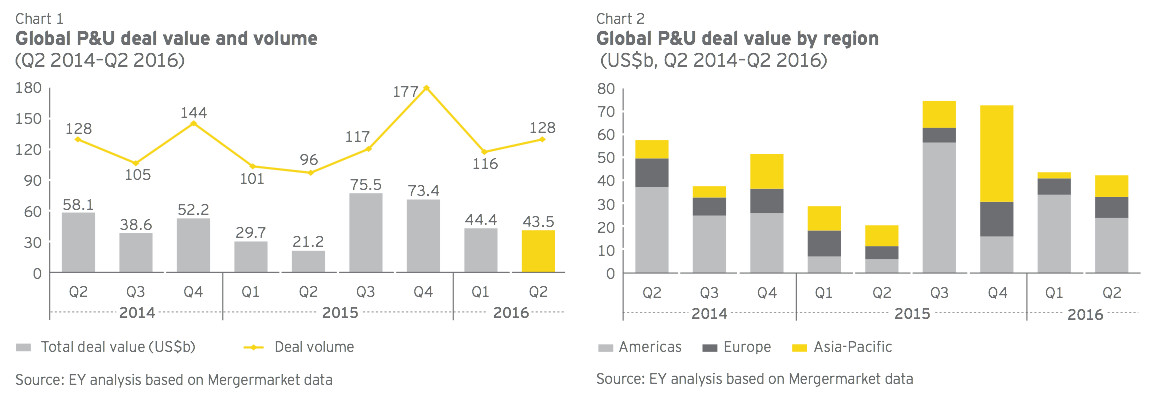

When we consider Q2’s most prominent M&A trends, it’s clear that buyers are still seeking “safe bets” amid ongoing sector and global volatility. Regulated network assets and renewable generation remain targets for many investors globally:

• Renewables continue to win buyers: The move toward cleaner sources of energy in most developed countries combined with an urgent need to meet soaring demand in emerging markets is driving investment in renewables in all regions. Some regulatory uncertainty in Europe may result in investors moving capital to safer markets.

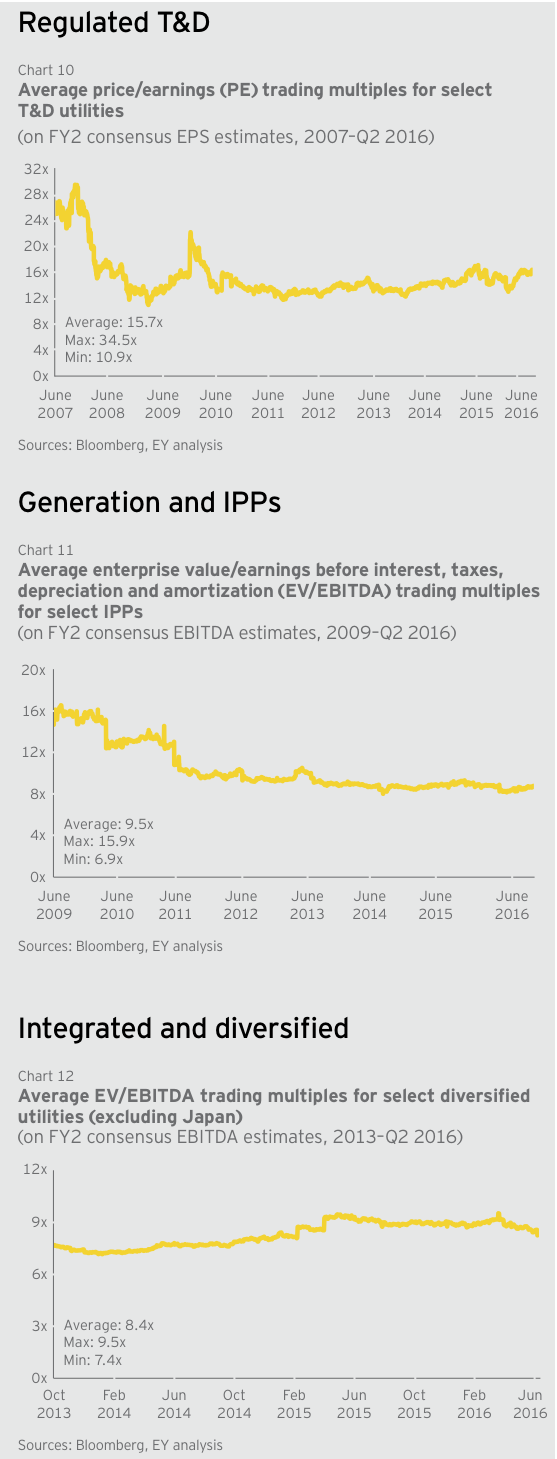

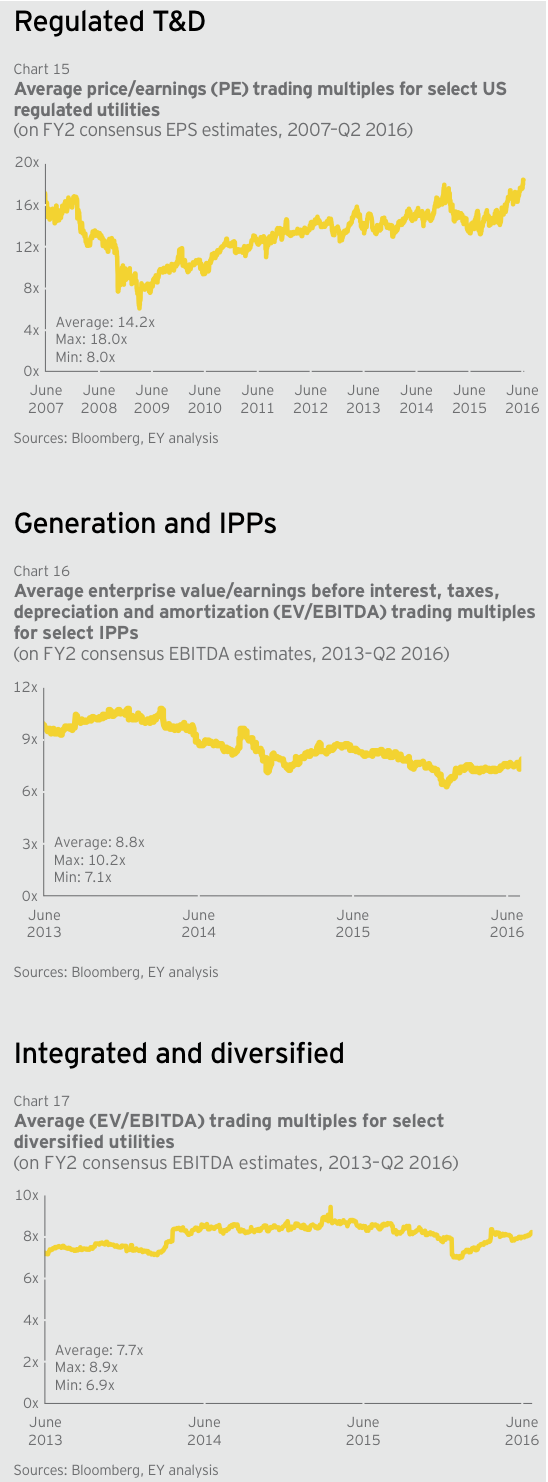

• Network valuations benefit from bidding war: For several quarters now, we’ve seen strong competition from buyers for regulated transmission and distribution utilities. The stable and long-term returns of these assets are appealing amid an otherwise volatile environment. A bidding war for an ever-shrinking number of network assets is pushing valuations to record levels.

But behind the big-ticket deals that dominate transactional reports such as these, some smaller investments are worth attention as they may indicate how our sector’s continuing transformation is beginning to shape investment decisions:

• Disruptive technologies attract investment: Both utilities and non-traditional investors are shifting their focus to the potential of new energy technologies, particularly distributed energy and battery storage. As consumer demand for these technologies increases, we expect more M&A and partnerships between utilities and companies from outside the sector.

Global investment in disruptive energy technologies is growing fast, and the juxtaposition of this trend against that of strong network valuations poses some interesting questions. Are investment decisions based on a clear understanding of the medium-to long-term impact of distributed generation on utilities? Are these investment decisions preparing utilities to become a “utility of the future,” or are they leaving them vulnerable to new competitors? (Matt Rennie, EY Global Transaction Advisory Services (TAS) Power & Utilities Leader)

Regional snapshot

• The Americas contributed the largest share of M&A (US$24.7b), with many deals due to continued US consolidation and convergence. We also saw more deals featuring Chinese buyers and financial investors, particularly from Canada and Asia.

• In Europe, renewables helped drive a strong quarter where deal value rose 44% to US$8.1b. Buyers included more Asian investors — the acquisition by China Three Gorges Corporation of an 80% stake in Germany’s WindMW was Europe’s biggest deal of the quarter at US$1.8b. The Brexit result has created some uncertainly and may see investment decisions delayed — read our perspectives on its impact on utilities and business more generally.

• Thermal generation and renewables deals, particularly in China and India, and booming demand in Southeast Asia are behind much of the investment in Asia-Pacific (deals reached US$9.4b). Accelerating Chinese energy market reforms are boosting cross-border M&A.

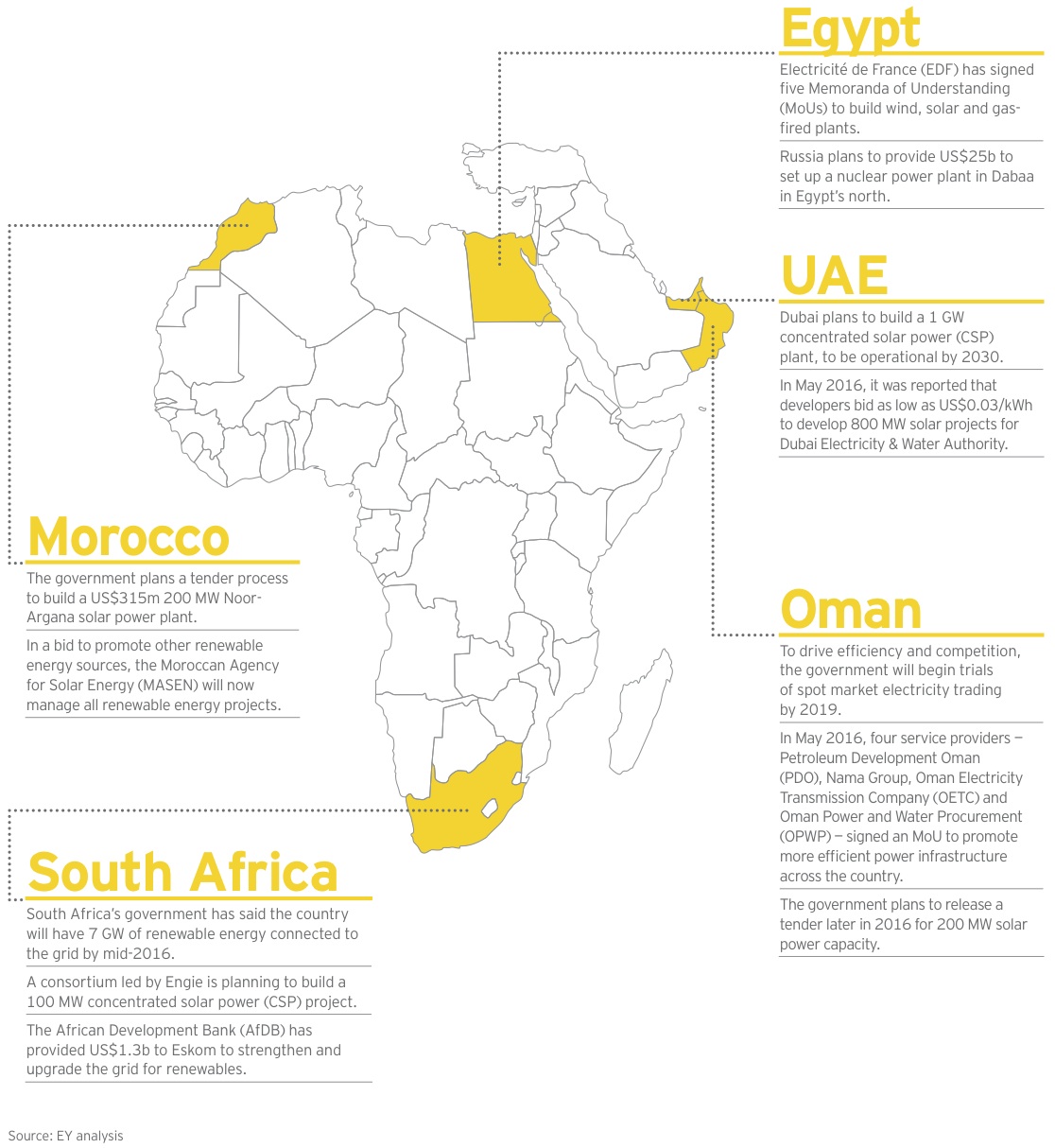

• In Africa and the Middle East, investment in renewables is rising, with Chinese investors behind much of Africa’s rapid energy growth. The decision by some major utilities to invest in mini-grid projects in Africa may be a sign that some emerging markets will “jump” centralized generation and use distributed generation to meet urgent electrification needs. You can read more about this possibility in Matt Rennie’s recent blog.

US$43.5b total Q2 2016 deal value

US$19.2b deal value in integrated and others segment for Q2

US$24.7b deal value in Americas, more than half the total deal value for Q2

20% premium on historical average of transmission and distribution (T&D) valuations in the Americas

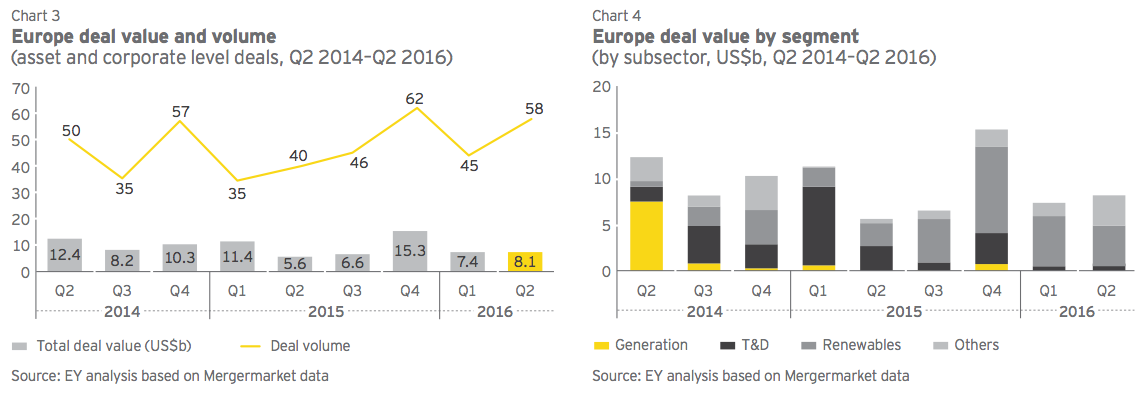

Europe

Renewables drive increased M&A activity

M&A activity within Europe’s power and utilities (P&U) sector rose 44% in Q2 (to US$8.1b) compared to Q2 2015. Across the region, renewable assets continue to attract investors (doing deals worth US$4b), though regulatory uncertainty may impact transactions. While utilities continue to favor small- to midsize bolt-on deals, two billion-dollar acquisitions contributed 35% to the total deal value during the quarter, led by Chinese and Russian investors.

Some utilities are optimizing asset portfolios to raise capital amid an environment of rising impairments, regulatory pressure to invest in grid infrastructure, a weaker currency and increasing inflation. In one example, EDF will sell almost 50% of its transmission operator unit RTE (estimated value of US$5.78b) to redeploy capital into its nuclear power business.

The impact of Brexit is likely to see planned investments and financing of energy infrastructure delayed in the UK, and investors are expected to demand higher returns due to uncertainty surrounding the country’s longer-term energy policies. If some European utilities or investors decide to leave the UK, we will see a reallocation of capital into Europe and elsewhere. More details on what Brexit means for P&U are explained in a recent blog by EY Global P&U Leader, Benoit Laclau.

Q2 2016 highlights:

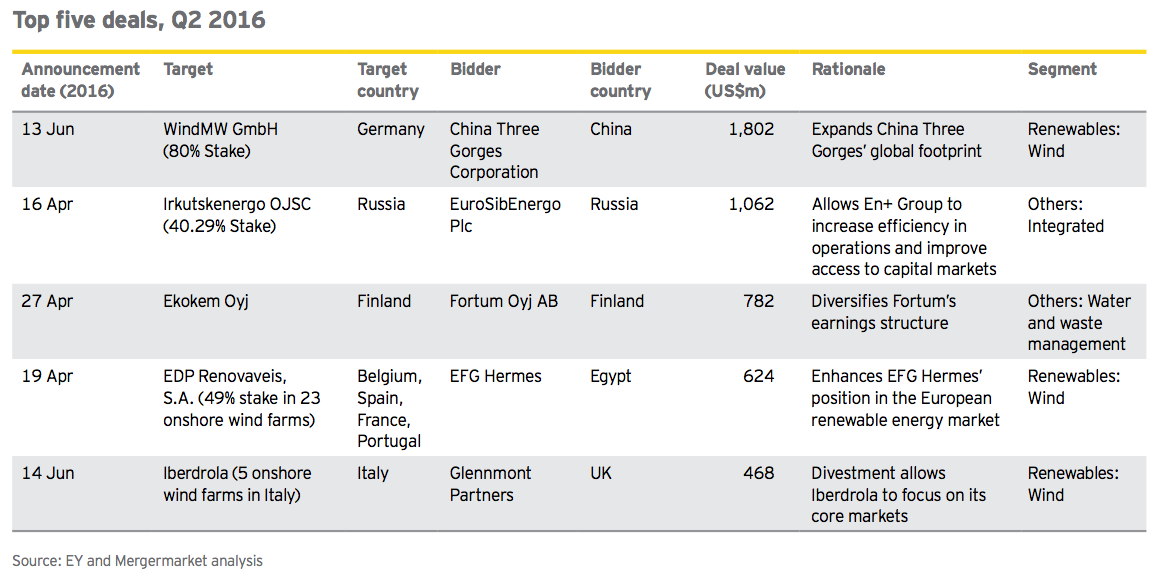

• Utilities sell to Asian corporate buyers at attractive valuations: European utilities attracted corporate buyers from Asia facing limited opportunities at home. In June 2016, China Three Gorges Corporation (CTG) acquired an 80% stake in WindMW GmbH from Blackstone Energy Partners for US$1.8b.

• Integrated oil companies boost investment in downstream assets: Q2 saw a continued trend of upstream oil and gas companies diversifying revenue streams through adding new technologies and downstream P&U assets. In June 2016, Total SA acquired Lampiris N.V., a Belgium-based distributor of electricity and gas, for US$169m. Similarly, Statoil launched BatWind to develop energy storage for offshore wind.

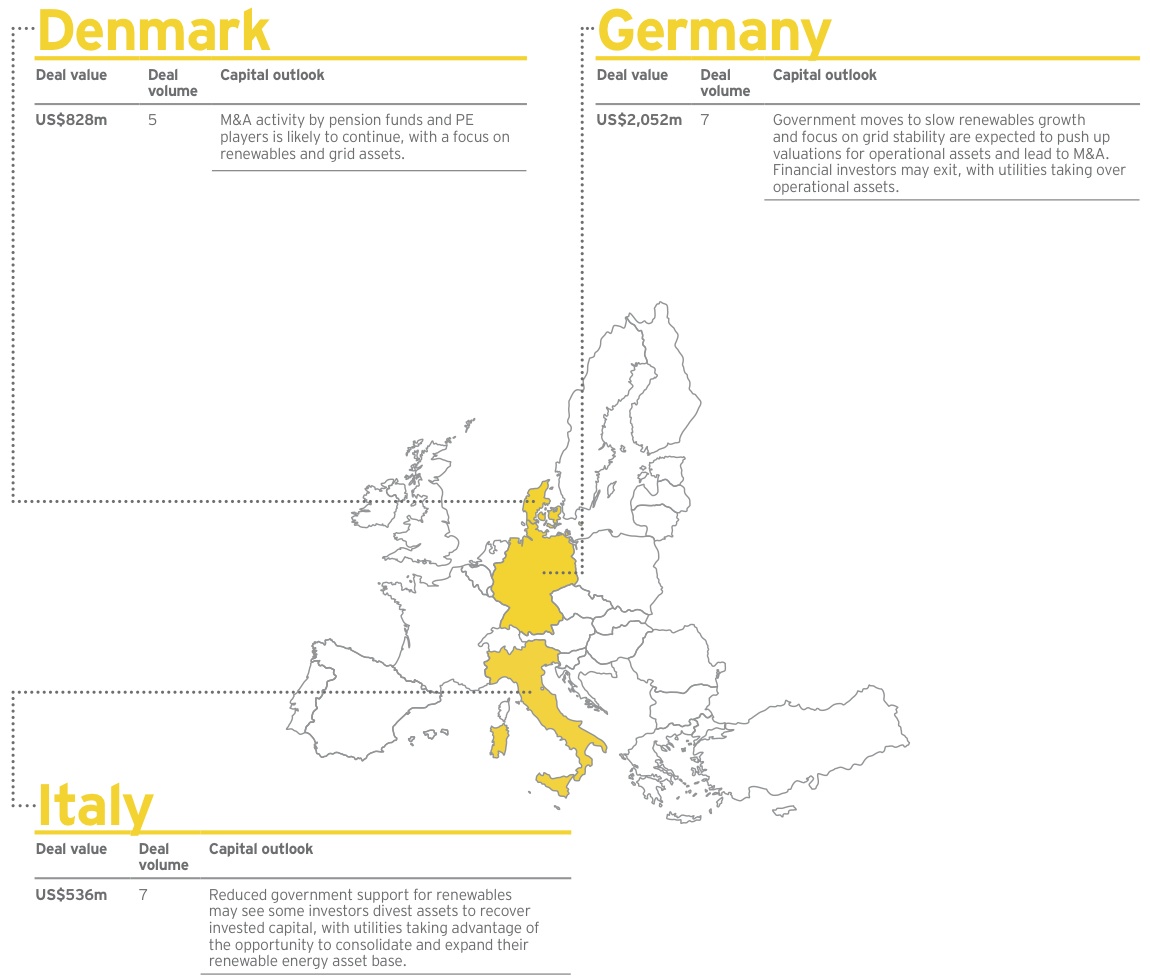

• Renewables remain attractive across Europe: The segment saw 24 deals in Q2 worth US$4b. But regulatory support toward clean energy is mixed across the region. While France and Italy have announced new targets and funding, others, including Germany and the UK, are withdrawing support for renewables.

US$8.1b total deal value for Q2, a 10% increase from US$7.4b in Q1 2016

US$4b of total deal value powered by renewable energy transactions

US$6.2b deal value contributed by corporate investors

56% deal value contributed by cross-border deals

Transaction snapshot

Wind energy and reforms boost deals

Amid a buoyant quarter for clean energy, deals involving wind energy contributed 83% of Q2’s renewables M&A. The acquisition by CTG of an 80% stake in WindMW GmbH was the largest renewables deal of the quarter, at US$1.8b. Buyers also included several private equity (PE) players from the UK, Germany and Egypt keen to boost investment portfolios within a prevailing low-interest-rate environment. In one example, Egyptian PE firm EFG Hermes announced it would buy a 49% stake in 23 onshore wind farms in France, Spain, Belgium and Portugal from EDP Renovaveis for US$624m. Similarly, UK-based asset management firm Glennmont Partners acquired five onshore wind farms in Italy from Iberdrola SA for US$468m.

Energy reforms and the need for domestic and foreign capital are leading to increased deal activity in Europe, including in Estonia, Slovenia and Turkey. During the quarter, Russia-based EuroSibEnergo Plc announced it would acquire a 40% stake in Russia-based Irkutskenergo OJSC from INTER RAO UES OJSC for US$1.1b.

Valuations snapshot

Weak earnings and impairments weigh on valuations

The estimated earnings profile of European utilities remains weak. Earnings per share (EPS) calculated over the period 2015 (actual) to 2018 (estimated) has decreased to 2.2% versus 3% six months ago, dragged down mainly by generation assets. According to analyst estimates, European utilities have impaired 13% of assets since 2009, and goodwill of about US$111b still sits on balance sheets. Further write-offs may adversely impact EPS.

Utilities exposed to thermal generation assets continued to face earnings pressure in Q2. In UK, SSE recorded a decrease of 3% in profit before tax after making significant impairment charges on the value of its coal and gas-fired power plants and gas production business.

Uncertainty surrounding nuclear remains across the region, as some countries proceed with a phase-out and others reconsider the value of their low-carbon base-load production. For example, Sweden, which had planned to decommission nuclear, recently announced a policy turnaround that will see the country cut taxes on nuclear capacity and build up to 10 new reactors in the coming years. Since nuclear assets entail huge investments, even a slight change in the regulatory regime can have a big impact on valuations.

Renewable energy assets continue to command attractive valuations. On average, Europe’s green utilities outperformed the Morgan Stanley Capital International (MSCI) Europe utilities index by 11% in Q2 2016, and we expect this segment to continue to drive M&A in coming quarters.

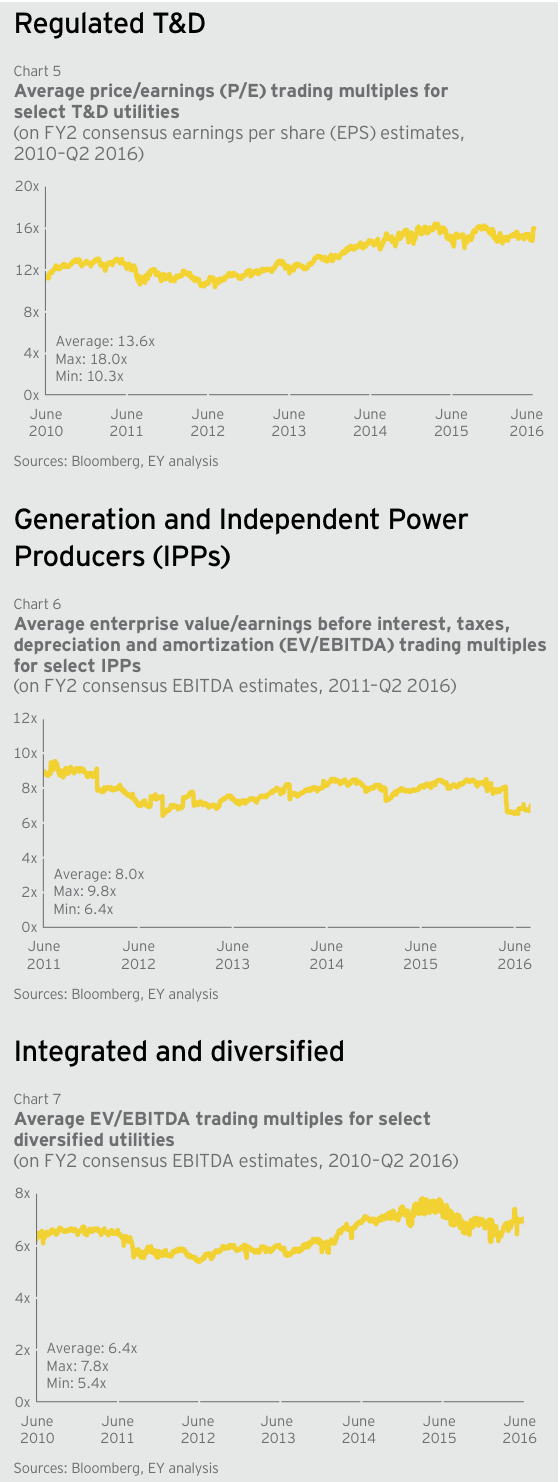

Valuations of transmission and distribution (T&D) assets remain high, trading at a premium of 12% based on FY2 EPS multiples. We expect this trend to continue as more utilities seek the stable, regulated revenues of these assets. Another driver for investment is increasing regulatory pressure to set up new T&D infrastructure to cater for interconnectors and renewables.

Retail business revenues are down as competition from new and nimble entrants increases. According to the UK’s Department for Business, Energy and Industrial Strategy (BEIS), 1.9 million electricity and gas customers switched suppliers in Q1 2016.

Q2 2016 M&A hot spots and capital outlook

Renewables and capex programs maintain momentum

Europe’s P&U M&A and capital agenda is likely to be impacted by several key factors, including:

1. Brexit: The UK’s decision to leave the EU is likely to affect M&A in that country, and potentially across Europe, until the UK’s energy policy and position in the EU energy market become clearer.

2. Renewable energy’s attractiveness: Investors will continue to be particularly interested in those clean energy assets backed by power purchase agreements (PPAs) that provide stable, long-term returns. This was highlighted by the July intercompany transaction that saw Endesa acquire 60% of Enel Green Power Espana from Enel for US$1.34b. We may see some investors redeploy capital from countries that are withdrawing support for renewables toward countries with more supportive environments.

3. Strong medium-term capital investment agenda: A number of utilities plan to make significant investments in renewable sand T&D. In February 2016, Iberdrola announced it would invest US$7b in networks and US$5.1b in renewables from 2016 to 2020. Gas Natural plans to add 2.5 GW of renewable capacity by 2020. EDF will divest as much as €10b (about US$11b) of assets to redirect capital toward new nuclear build, while Engie’s €22b (approximately US$24.3b) capex plan (2016-18) will concentrate on asset optimization and low carbon capacity.

Asia-Pacific

China and India lead recovery in deal activity

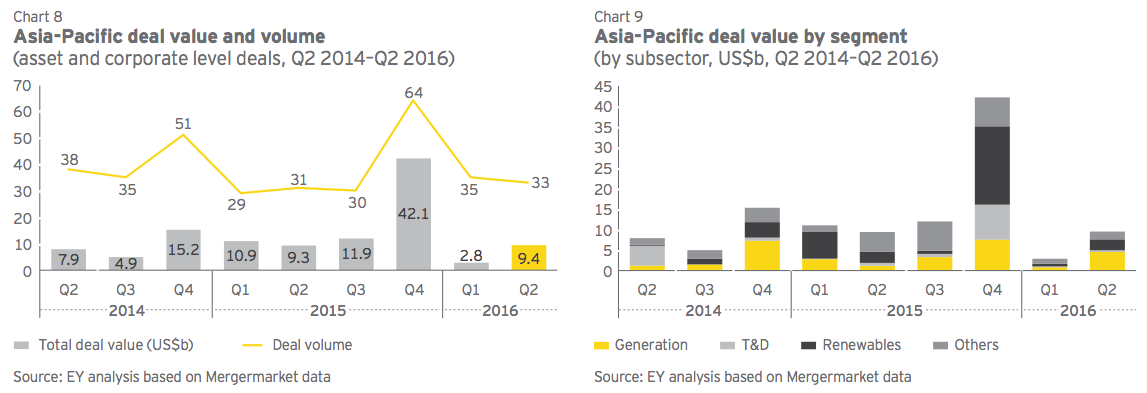

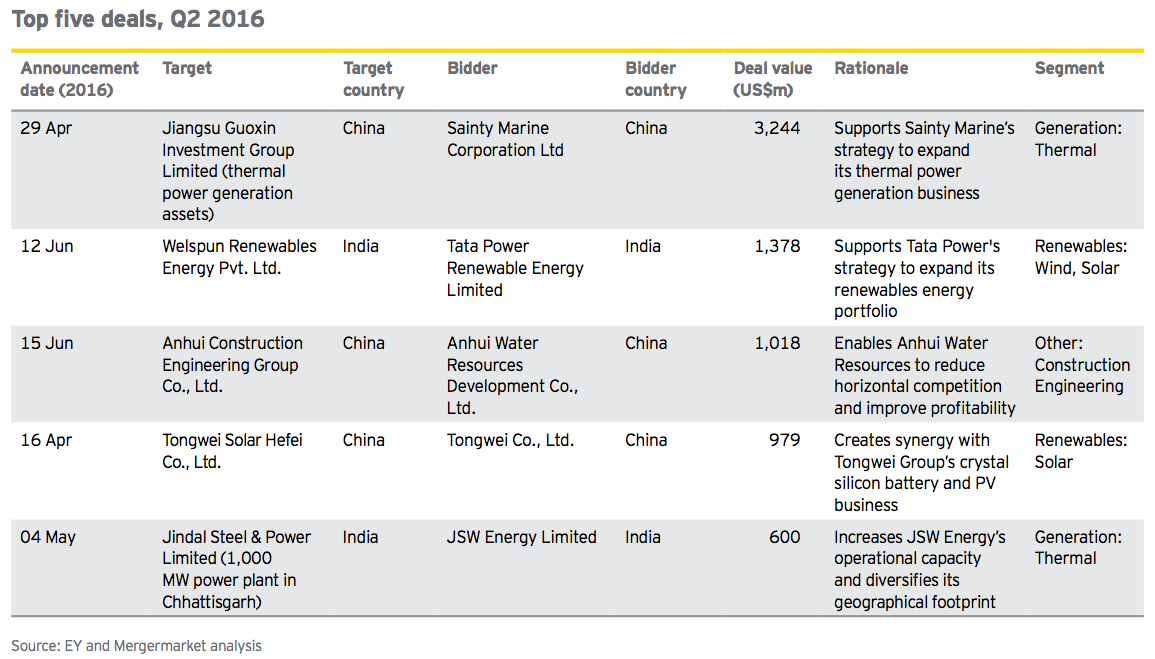

After a slow start to 2016, Asia-Pacific power and utilities (P&U) transactions picked up in Q2, led by deals in China and India, which contributed more than 85% of total deal value.

These deals highlighted a trend by conglomerates toward diversifying into the energy sector, and continued interest in the renewable energy and water and wastewater segments.

With growing electricity demand in Southeast Asia expected to outstrip average regional growth, diverse investors are attracted to both the conventional generation and renewable energy segments in this region, particularly in Thailand, the Philippines and Indonesia. Ten P&U transactions worth a cumulative US$1b took place in the Southeast Asia sector during Q2.

Q2 2016 highlights:

• Indian power sector attracts interest: India’s energy sector hosted deals worth US$2.3b, with investors particularly attracted to operational assets with long-term power purchase agreements (PPAs). Key deals included Malaysian utility Tenaga’s acquisition of a 30% stake in GMR Energy, a generation and transmission and distribution (T&D) company, for US$300m; Hong Kong-based CLP Holdings’ 49% stake acquisition in Suzlon Energy’s 100 MW solar plant; Tata Power’s US$1.4b acquisition of Welspun Energy’s renewable portfolio; and JSPL’s agreement to sell a 1,000 MW thermal power plant to JSW Energy for US$600m.

• Investors take advantage of low generation asset valuations: Non-energy players and conglomerates are entering the region’s energy markets to diversify revenue. Examples include Sainty Marine Corporation’s US$3.2b acquisition of thermal power generation assets in China and Beacon Electric Asset Holding’s US$473m acquisition of a 56% stake in Philippines-based Global Business Power Corporation.

US$9.4b total Q2 2016 deal value, more than double Q1 2016 deal value

US$4.4b deals in generation assets, almost half of total deal value

27% of total deal volume in water and wastewater segment

21% discount to historic valuations for generation and independent power producers (IPPs)

Transaction snapshot

Generation transactions dominate

Generation asset deals contributed almost half (47%) of the region’s quarterly P&U deal value, with many transactions involving large thermal assets in China, India and the Philippines. In India, buyers are snapping up distressed assets, while in the Philippines, it is booming demand that is attracting investors — electricity consumption is expected to reach 111.8 TWh in 2025 compared to 73.2 TWh in 2016.

The region hosted US$2.7b of renewables deals during the quarter. In China, many clean energy deals are a result of cross-border M&A prompted by energy reforms. In May 2016, Thailand-based coal miner and generator Banpu invested in four Chinese solar energy projects worth US$93m and expects to start selling power on-grid by mid-2016. As reforms progress and allow for direct sales to industrial and commercial consumers, expect both traditional and non-traditional players to use M&A to enter the market.

Activity in the water and wastewater segment continued, with the quarter witnessing nine deals. Apart from one Australian deal, all transactions occurred in China, highlighting the ongoing consolidation of the country’s water and wastewater industry.

The T&D segment contributed only 4% (US$0.4b) of the region’s Q2 deals, with the most noteworthy transaction being Sala Corp’s acquisition of Chubu Gas Co. in Japan.

Valuations snapshot

Prices reflect reforms and renewables shift

While regulated assets continue to trade at a premium, investors are exploring operational renewable energy assets that can provide higher returns than bond yields. Renewables have also been boosted by increasingly stringent environment regulations that are prompting utilities to realign portfolios.

In China, IPPs are valued below average as competition from renewables increases. The government’s push toward renewable energy is expected to apply more downward pressure, though market reforms that will allow generators to compete to directly supply large commercial customers may boost the valuations of integrated utilities.

Across the region, renewable energy players are likely to witness increasing competition from a diverse buyer community as more governments switch to renewables to meet baseload demand. This is squeezing the valuations of thermal generation assets, resulting in increasing M&A by buyers looking to bolster their operational capacity. The quarter witnessed multiple deals under US$100m by cross-border and domestic utilities shifting slowly toward clean energy portfolios. Due to the limited availability of operational renewable assets in these countries, valuations are likely to be boosted by competition from buyers.

Indian T&D assets and Korean T&D and integrated assets are valued at a discount compared to the group’s regional average (PE two-year forward estimate of 10.2x compared to group average of 15.7x). Valuations in South Korea have historically been low due to the country’s closed sector, although we may see an increase in EV/EBITDA for the country’s utilities as they face pressure to increase dividend payouts and invest in renewables and new technology.

Q2 2016 M&A hot spots and capital outlook

Reforms and cross-border deals will drive activity

We expect the Asia-Pacific region to witness steady M&A across coming quarters. Two key factors will drive activity:

1. Chinese inbound and outbound M&A to continue: China’s ongoing energy reforms will continue to attract foreign investors into its thermal generation and renewable energy segments. EDF has announced it will acquire a majority stake in wind energy developer UPC Asia Wind Management. Beijing Enterprises is reportedly looking to acquire utilities’ assets in Europe, particularly liquefied natural gas (LNG) distribution and sewage treatment project operators, with an aim to achieve at least 10% internal rate of return.

2. Operational renewable assets attract investors: As returns for greenfield solar projects continue to be squeezed due to aggressive solar bidding, it is likely that investors will prefer to acquire operational assets with proven returns rather than participating in auctions, especially in India. M&A can help companies to quickly ramp up their capacity in a country that has ambitious renewable energy plans. However, this is likely to be a short-term measure due to the limited availability of operational assets.

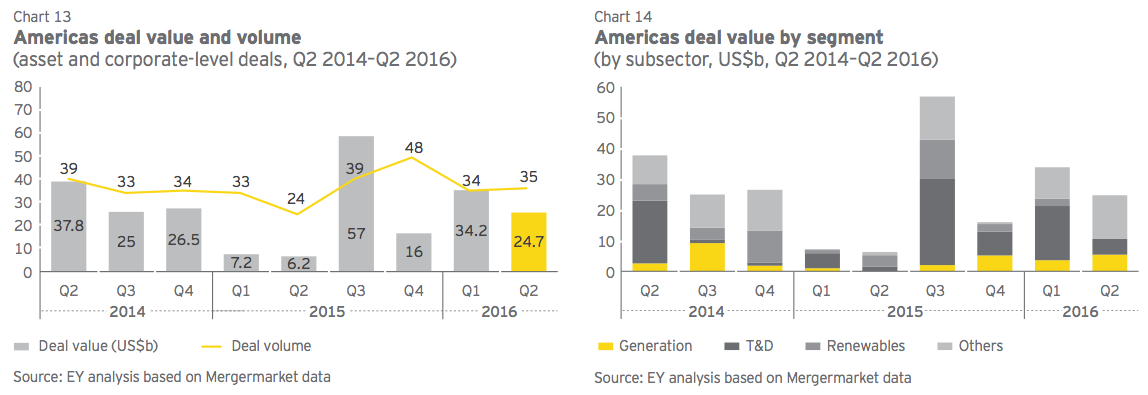

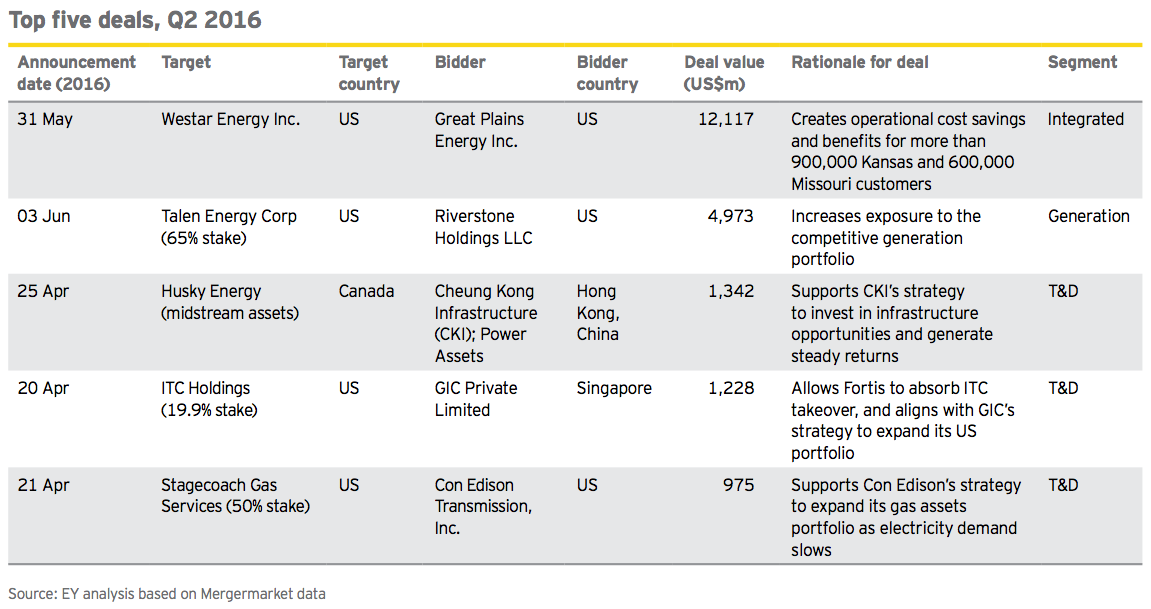

Americas

Utilities redeploy capital to de-risk asset bases

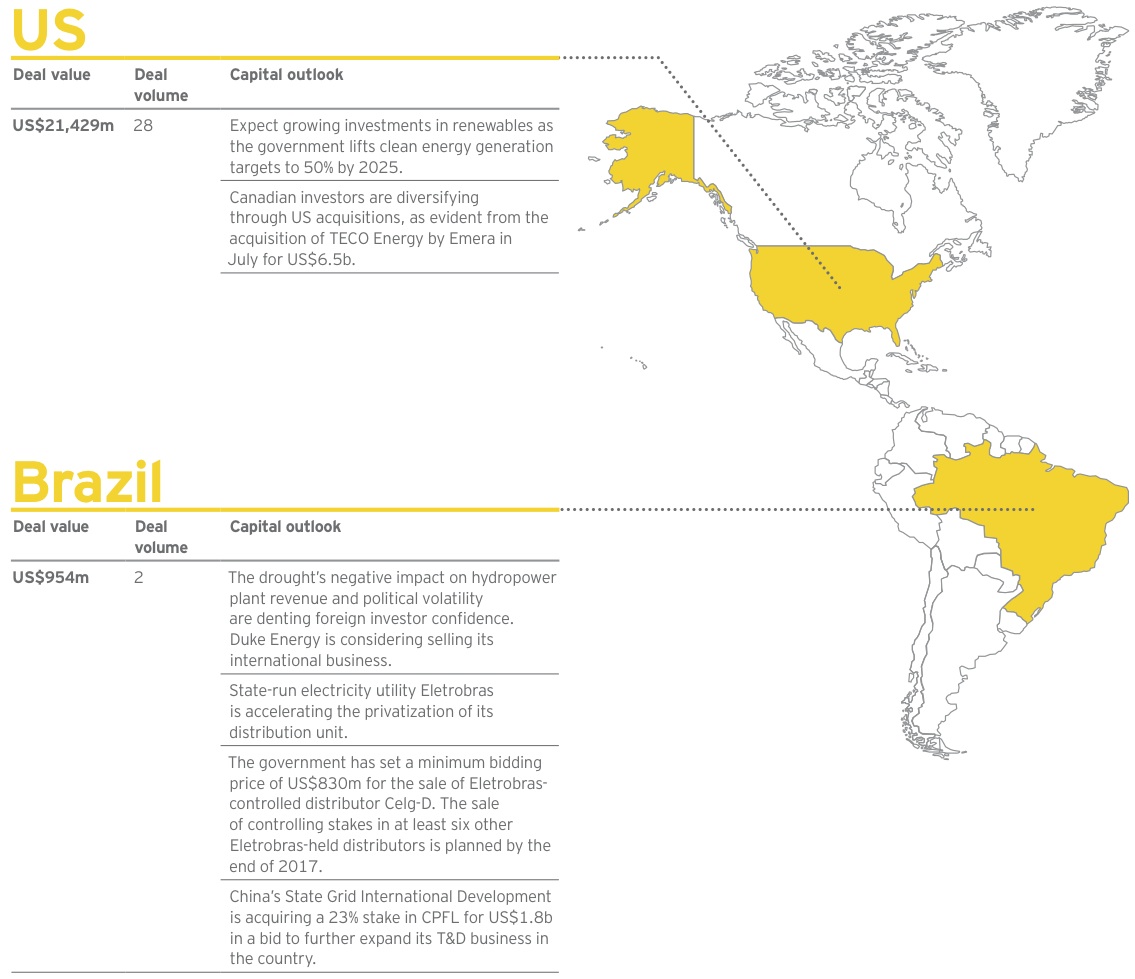

This quarter saw continued strong results in the Americas power and utilities (P&U) sector, with Q2 hosting deals worth US$25b, compared to US$6.2b in Q2 2015.

The potential to offer stable returns in a volatile market has positioned regulated gas and electricity assets as targets for cross-border M&A, with foreign investors entering the market in greater numbers this quarter. The UK’s Brexit result saw some of the region’s large and mid-cap electricity utilities hit 52-week share price highs on 30 June, suggesting that investors sought the safe haven of regulated utilities amid volatility in financial markets.

Generation asset deals remained subdued, with the exception of US-based private equity player Riverstone Holding’s 65% stake acquisition in Talen Energy Corporation for US$4.9b.

Q2 2016 trends:

• US consolidation remained the dominant driver: Utilities continue to consolidate as they adapt to tougher environmental regulations and depressed energy prices. To increase its customer base and drive sustainable growth, Great Plains Energy announced the acquisition of Westar Energy for US$12.1b in May 2016, the largest deal of the quarter.

• Disruption and sector convergence continues: The opportunities created by new energy technologies and rising adoption of renewable energy continue to push sector convergence and drive M&A. Notable examples include Tesla’s June 2016 bid to acquire SolarCity for US$2.8b, EDF Renewable Energy’s April 2016 announcement that it would acquire Global Resource Options (groSolar) and US-based PE firm Vision Ridge Partners’ acquisition of electric vehicle charging network operator NRG EV Services for US$50m.

• Chinese investors eye expansion in the Americas market: Q2 saw Power Assets Holdings Limited and Cheung Kong Infrastructure Holdings announce a 65% stake acquisition in the midstream assets of Canada-based Husky Energy for US$1.3b, in a deal that executes on their North American investment strategy. Similarly, Hong Kong-based Sky Solar Holdings acquired 22 operating solar facilities in California and one operating solar facility in Massachusetts for a combined 22 MW.

• Cross-border financial investors bet big on US power assets: During Q2, financial investors and infrastructure funds from Canada, China, Singapore and Switzerland acquired assets worth US$3.3b in the US. This is an interesting phenomenon, considering that US network utilities are trading at a significant premium to their historic averages. The deal by Singapore-based wealth fund GIC Private Ltd to acquire a 19.9% stake in ITC Holdings Corp, from Fortis Inc., for US$1.2b is one of the biggest investments Asian companies have made in US power lines operators.

US$21.4b total US deal value, triple the deal value of Q2 2015

US$12.1b largest deal of the quarter

US$8b total financial deal value, a seven-year Q2 high

20% premium on historical average of T&D valuations

Transaction snapshot

Activity driven by large diversified and regulated network deals

For many utilities, diversifying into gas has dominated the boardroom agenda and resulted in the continued convergence of electric and gas utilities this quarter. Q2 saw US$5.2b worth of deals in the electricity and gas T&D segment, including Con Edison Transmission’s announcement that it would acquire a 50% stake in Stagecoach Gas Services LLC for US$975m. Stagecoach’s natural gas pipeline and storage business will help Con Edison meet the growing demand for natural gas in the Northeast.

Brazilian utilities, which have taken a hit from weakening political and economic conditions, are planning to privatize assets to attract private and foreign capital. In April 2016, China’s state-owned grid operator expressed interest in buying a controlling stake in a Brazilian power distributor for US$1.8b, to further cement its position in the country’s electricity sector. CPFL Energie S.A. is also looking to acquire assets in Brazil.

Valuations snapshot

Brexit boosts regulated utilities; merchant generators continue to suffer

With the UK’s vote in late June to leave the European Union, a potential US Federal Reserve rate hike is likely to be delayed on the expectation of slower economic growth. As a result, utilities are attracting new buyers, despite trading at high premiums, as investors abandon relatively risky hybrid or unregulated utilities in favor of regulated assets. We expect that utilities with higher exposure and dependency on international earnings will witness short- to medium-term underperformance, as Brexit strengthens the US dollar. For example, the share price of PPL Corp, which has a large UK operation, has slipped more than 5% since the vote.

Coal plant retirements, renewable energy growth and aging grids are driving investment in electric and gas grid infrastructure. Exelon will spend US$18b on reliability, smart grid investments and other electric grid improvements across its utilities from 2016 to 2020. According to Fitch, capital expenditure across the gas utility distribution sector in 2016 is likely to reach US$5b, a 15% increase from 2015. These investments make US-based T&D companies attractive to buyers, with regulated utilities trading at a premium of 20% compared to their historical averages, despite flattening energy demand.

Merchant generators remain challenged by the weak commodity environment and are trading at a discount of 10% compared to historical averages. In some recent merchant asset deals, the median $/KW multiple dropped to 341 compared to 683 in 2015, moving ever further away from replacement build cost.

Despite subdued renewables M&A activity in the quarter (with deals worth just US$500m), several large and integrated utilities have announced significant investments into the segment to comply with state mandates. Southern, for example, plans to invest about US$5b in renewable energy over the next three years, more than double what it plans to spend on other new technologies, while Duke will nearly double its production and purchase of renewable power to 8,000 MW by 2020.

Q2 2016 M&A hot spots and capital outlook

Several large corporate and merchant deals in the pipeline

Expect growing consolidation in the diversified and regulated segments as utilities use M&A to create synergies and drive growth:

1. Oncor acquisition touted as biggest deal of the year: The proposed acquisition of Texas-based electric distribution utility Oncor is likely to be the biggest deal of 2016. Among several financial and corporate bidders, NextEra Energy is seen as the preferred buyer. According to Bloomberg, NextEra’s bid of cash and debt for Oncor could be as high as US$18b, exceeding the valuation for the utility in a recently dissolved acquisition bid by a consortium led by Hunt Consolidated Inc.

2. Private equity players emerge as preferred bidders for merchant assets: As highlighted in our previous edition, PE investors may acquire distressed merchant assets currently trading at discounts. In recent months, American Electric Power Co. Inc., Dynegy Inc. and TransCanada Corp. have expressed intentions to sell off merchant portfolios. These proposed divestments provide financial investors an opportunity to enter merchant space at a time when public markets are shying away from the sector.

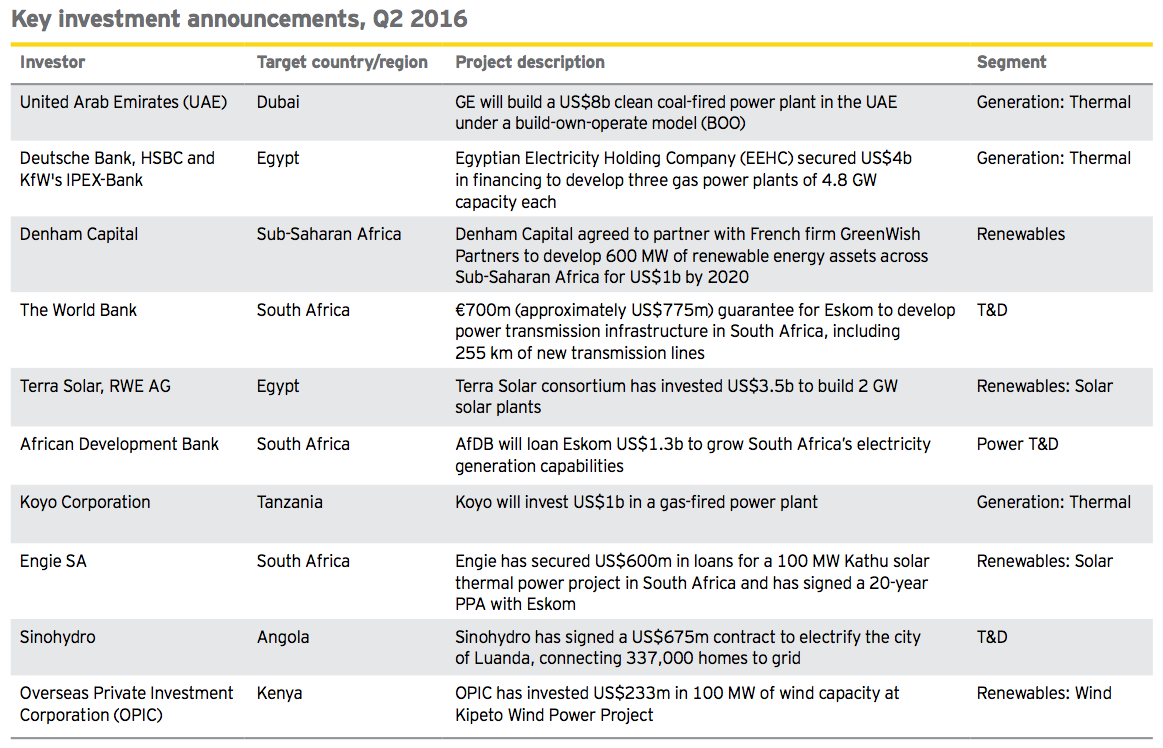

Africa and the Middle East

Investor confidence buoyed by higher returns

Brownfield M&A in the region’s power and utilities (P&U) sector continues to increase, though greenfield deals still dominate. Electrification and economic growth agendas, as well as low oil prices and untapped renewable resources, encourage private and foreign investment, especially by Chinese buyers.

Solar projects are attracting particular interest, as opportunity (demand for electricity, favorable solar resources, policy support) combines with risk (political, sovereign credit and financial) to deliver an average unlevered internal rate of return (IRR) of 10.3% compared to 8.4% in Europe.

The decision by Zambia’s Industrial Development Corporation to award France’s Neoen and US First Solar a 47.5 MW utility-scale solar power project at a tariff of US$60/MWh — the lowest tariff price in Sub-Saharan Africa (SSA) to date — is a game-changing move for the region’s solar photovoltaic (PV) market. The auction was part of the World Bank Group’s Scaling Solar program that aims to procure 1 GW of solar power across SSA over the next three years.

Q2 2016 trends:

• China remains the leading investor in the African power sector: According to the International Energy Agency (IEA), China accounts for 30% of Africa’s energy growth, with more than 200 greenfield power projects contracted to Chinese companies in the last five years. In April, Kenya’s Rural Electrification Authority announced construction of a 55 MW, US$126m solar power plant funded by the Chinese Government. In May, the governments of Sudan and China agreed to build Sudan’s first nuclear power plant. In June, China’s Sinohydro agreed to invest US$533m in an additional 300 MW capacity in Zimbabwe’s Kariba hydroelectric power plant by 2017.

• Rising investment in renewables: Renewable energy remains an attractive investment. Mainstream Renewable Power secured a US$117m financing deal to fund the development of 1.3 GW of wind and solar energy projects in Africa by 2018. Meanwhile, Abu Dhabi’s Masdar is constructing a US$800m, 800 MW solar plant in Dubai, as part of the country’s plan to invest US$14b in solar parks to generate 5 GW of power by 2030.

• Big utilities are going off-grid: Engie and Enel SpA have announced investments in mini-grid projects in Kenya and other African countries during the quarter. In May, Enerdeal signed a deal with Forrest Group to develop one of the largest fully off-grid solar power plants in Africa — a 1 MW solar power plant with 3 MWh battery storage in Congo.

• Financial investors see merit in investing: Deutsche Bank, HSBC and KfW’s IPEX-Bank are investing US$4b to fund the development of three Egyptian gas power plants, with a combined capacity of 14.4 GW. Also, US-based IFC has lent US$75m, and plans to mobilize a further US$200m, for a combined cycle gas-fired power plant in Jordan.

US$13b worth of Chinese investment in 2010–15 in Sub-Saharan Africa

US$100b investment in renewable energy by Gulf Cooperation Countries in the next 20 years

9.5 GW of new renewables in Saudi Arabia by 2030

10.3% average internal rates of return for solar projects in Africa and the Middle East

Transaction snapshot

Brownfield M&A continues to increase

Strong policy support for renewables, technological advances and rising energy consumption are creating multiple opportunities for private and foreign investors. Brownfield M&A is increasing, with highlights this quarter including:

• The US$1.3b acquisition by YTL Power International Berhad and Guangdong Yudean Group of a 60% stake in Attarat Power, a Jordan-based power plant and mine operator

• The agreement by two Africa-based investors, Harith General Partners and Africa Finance Corporation, to merge their renewable and fossil fuel-based generation assets in 10 African countries, at a valuation of US$3.3b, primarily to create operational synergies

• The US$7.3m acquisition by the energy storage solution arm of South Africa’s Metair of a 25% stake in Kenya-based Associated Battery Manufacturers East Africa Ltd

• The acquisition by Lekela Power, a pan-African renewable energy generation platform, and a joint venture between Actis and Mainstream Renewable Power, of rights to invest in the Senegali 158 MW Taiba Ndiaye Wind Project

• Norway-based SN Power Invest AS agreed to acquire a 50% stake in the Bujagali Hydropower Project, a Uganda-based hydropower project, from Sithe Global Power LLC.

The SN Power Invest deal highlights the continuing expansion by European utilities into Africa, with many pursuing growth through local partnerships. Other examples include EDF SA’s partnership with the Cameroon government to build (and hold a 40% share in) a 420 MW hydropower plant at a cost of US$1.2b, and Engie SA’s partnership with Morocco’s Nareva Holding to develop 5 GW of renewable energy projects in North and West Africa.

Access Power, based in Dubai, also announced a US$500m investment to fund, develop and operate renewable energy projects in Africa.

Q2 2016 Investment hot spots and capital outlook

Renewables and nuclear to drive generation capacity growth

1. Renewables investment set to soar: Rising energy demand and supportive government policies will spur investment in renewables across the region. In South Africa, more than 500 MW of solar projects are currently being considered. Qatar aims to produce 20% of its electricity from solar energy by 2030, while Saudi Arabia plans to develop 3.5 GW of renewable energy by 2020.

2. IPPs remain critical to Africa’s power sector: According to a recent World Bank report, there are currently 126 independent power producers (IPPs) in 18 countries, with a cumulative installed capacity of 11 GW and US$25.6b in investments. But the report suggests Africa must do more to create the right conditions to attract additional IPPs to meet the continent’s urgent need for power.

3. Nuclear to play a greater role in Africa’s energy mix: Many African countries are planning to add nuclear into their energy mix to meet rising demand. In June, Kenya, Nigeria and Zambia signed separate deals with Rosatom, the Russian State Atomic Energy Corporation, to develop their first nuclear plants by 2025. Nigeria is looking to add more than 4 GW of nuclear capacity to its energy mix by 2035. In addition, Russia, China and France are seeking to secure the contract for 9,600 MW of new nuclear power in South Africa.