In Q3 2014, the Swiss M&A market continued its strong performance and recorded an above average number of transactions as well as deal volume. Although deal volume in this quarter could not reach the watermark set by the previous quarter – which was the highest deal volume recorded since inception of our publication in 2008 due to the Holcim/Lafarge mega deal – it still achieved respectable volume, mainly due to large transactions announced in the Healthcare sector.

Looking ahead, projections of economic growth have undergone small downward adjustments but still remain positive overall. Combined with the low interest rates currently prevailing, the strong M&A market performance is expected to continue in the upcoming quarters. However, it may be difficult to sustain performance at such high levels going forward, especially if the risks anticipated in connection with conflicts in the Middle East and Eastern Europe materialize.

Swiss M&A market Q3 2014 and outlook 2014/2015

M&A market Q3 2014

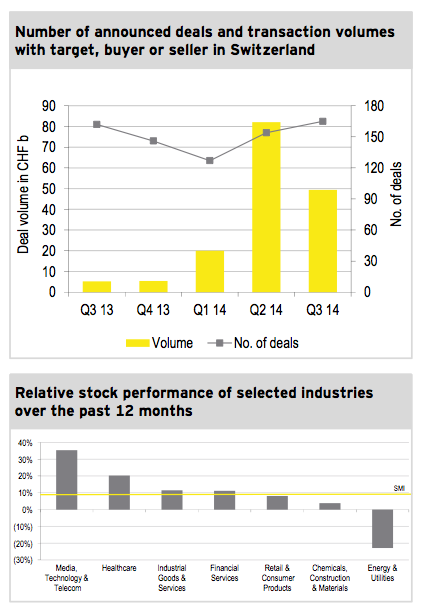

► With 165 Swiss M&A transactions announced in Q3 2014, the number of deals increased slightly compared to the previous quarter (154 deals).

► In terms of volume, the Swiss M&A market continued to show high traction with disclosed deal volume totaling CHF 49.4b in Q3 2014. Even though this

represents a decrease by 40% compared to the record deal volume in Q2 2014, this was still the fifth strongest volume recorded since our publication was launched in 2008.

► Year to date, Swiss M&A activity remained nearly unchanged with 446 transactions announced in the first three quarters of 2014 compared to 434 deals in the same period of the previous year. However, disclosed deal volume increased nearly tenfold, i.e., from CHF 15.4b to CHF 151.5b.

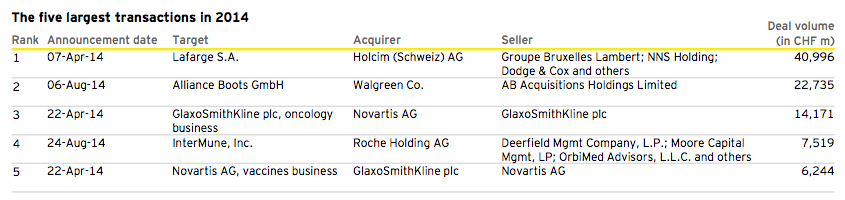

► High market volume in 2014 was mainly driven by the amount of large deals announced. This development continued this quarter, as two of the five largest deals in 2014 were announced in Q3, both totaling a deal volume of CHF 30.3b or 61% of Q3 volume.

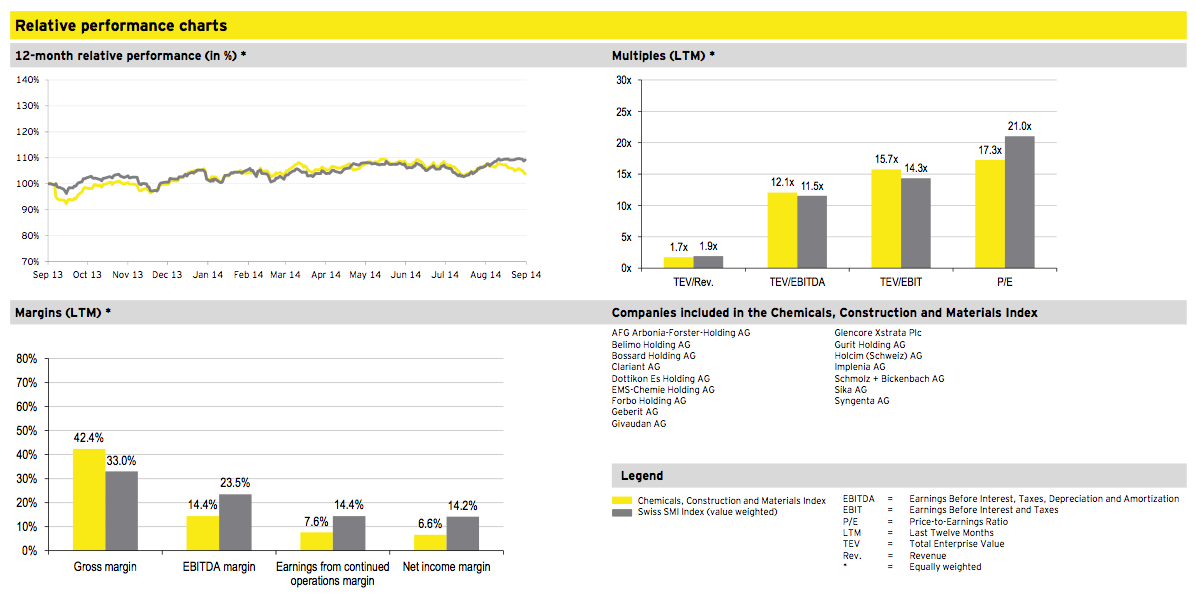

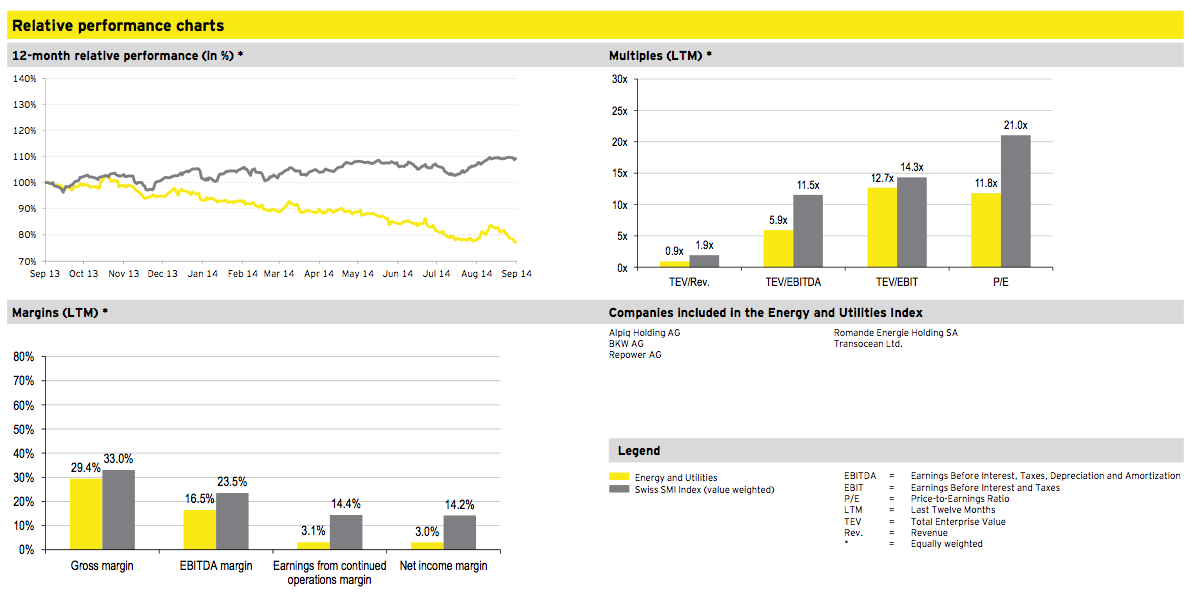

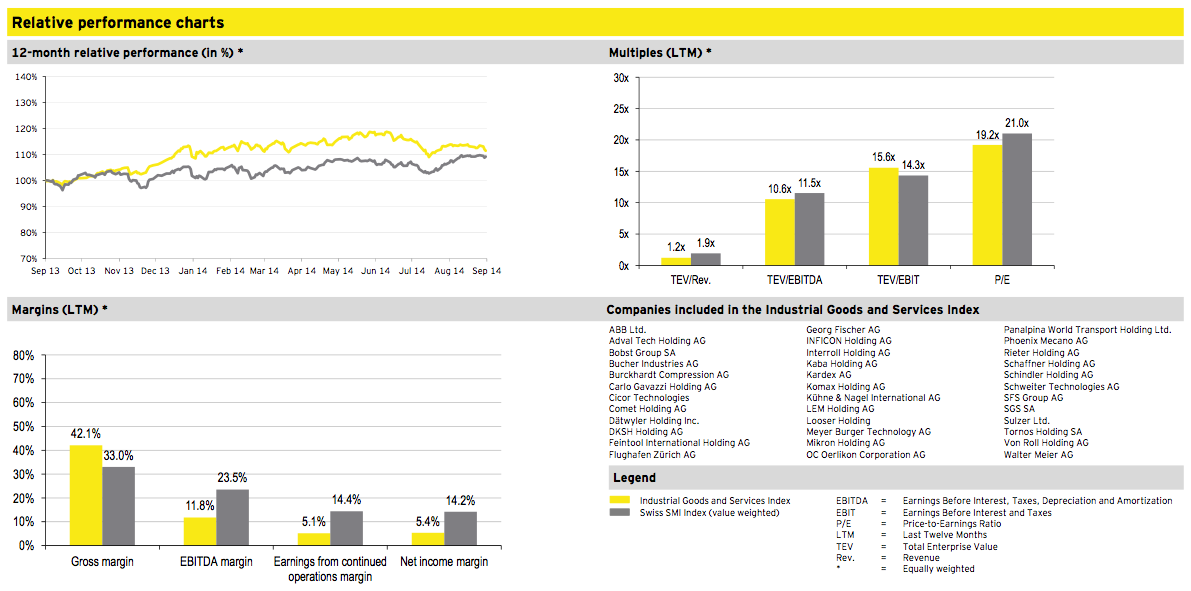

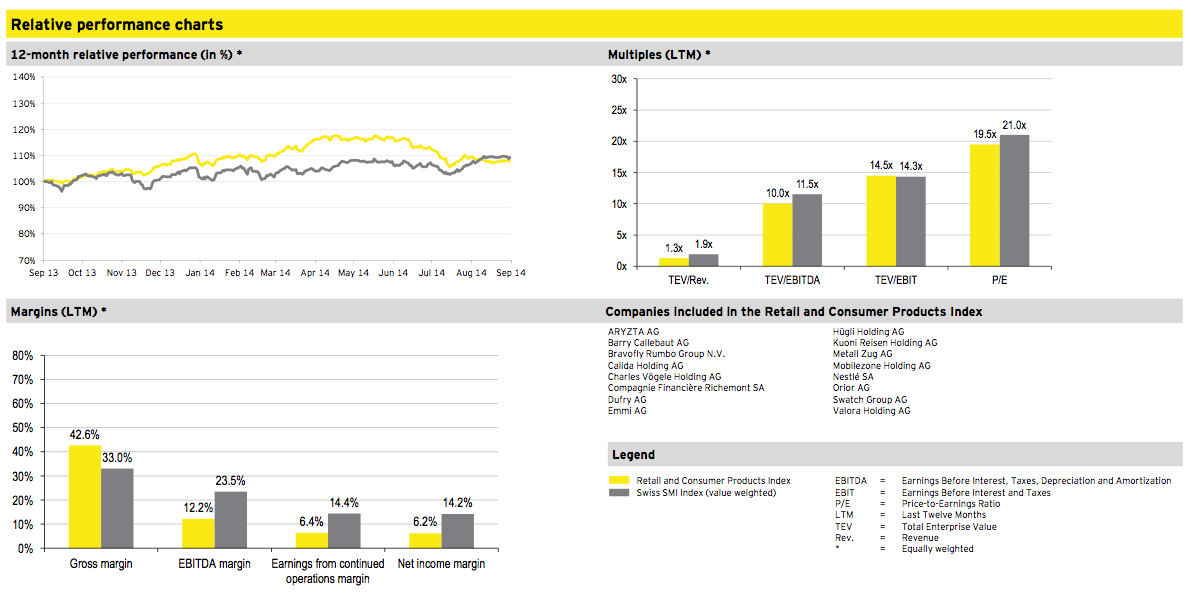

► The SMI gained 9.2% over the last twelve month period, showing positive performance across all sectors, except Energy and Utilities. Compared to the twelve month period ended last quarter, i.e. 30 June 2014, the SMI witnessed a slight fall in performance with a decline of 2.1 percentage points.

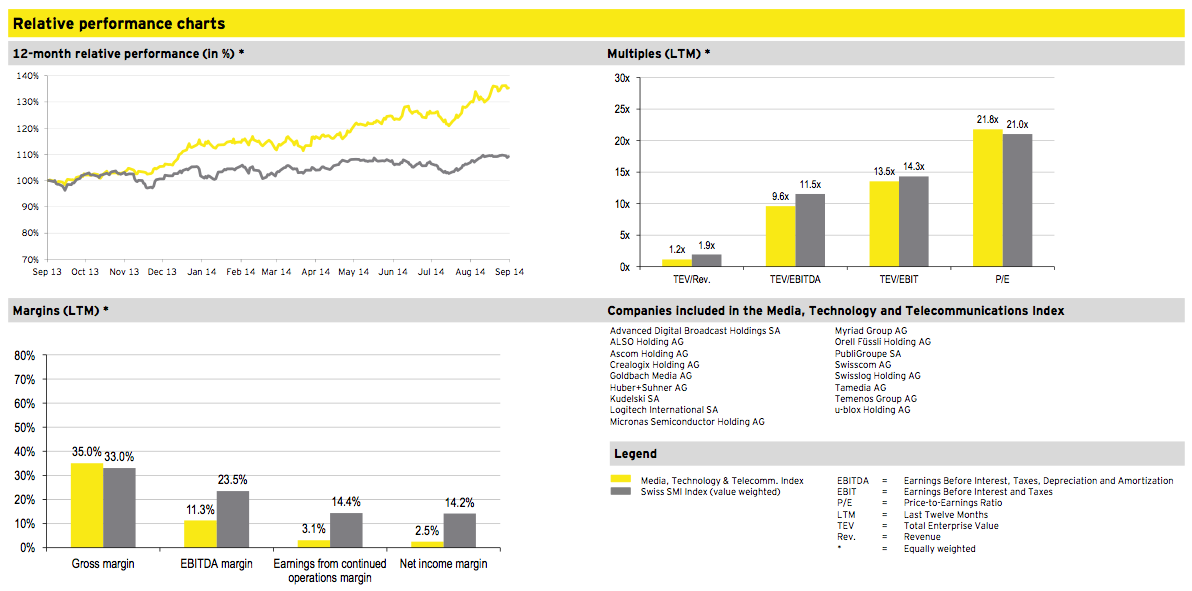

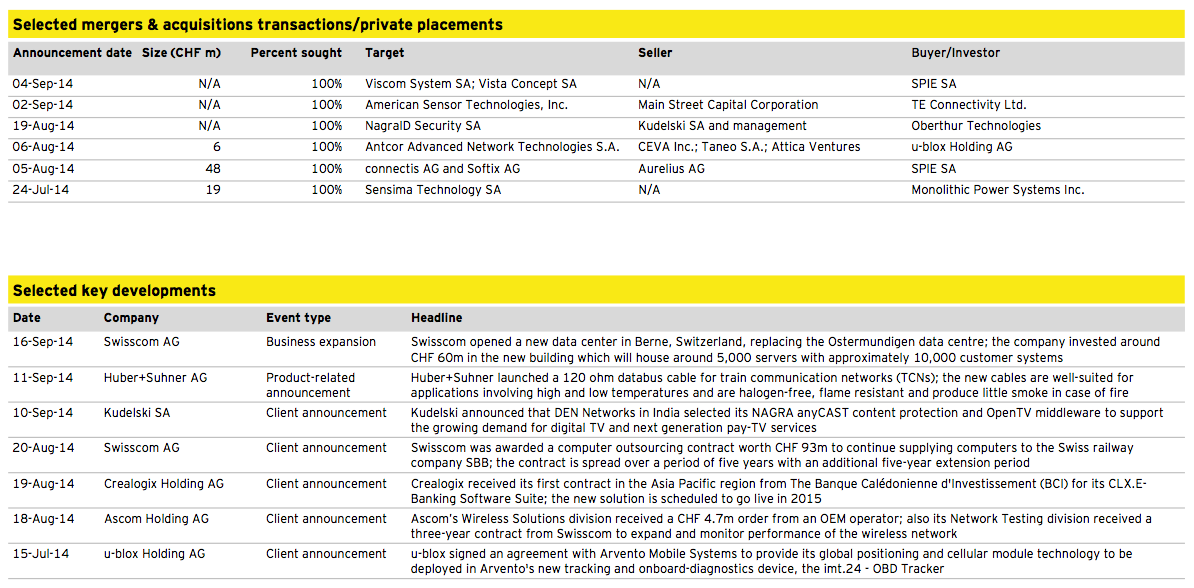

► Media, Technology and Telecommunication displayed the strongest industry performance with an improvement of 35.3% over the last twelve month period. This represents approximately 3.8 times the SMI performance.

Transactions by industry

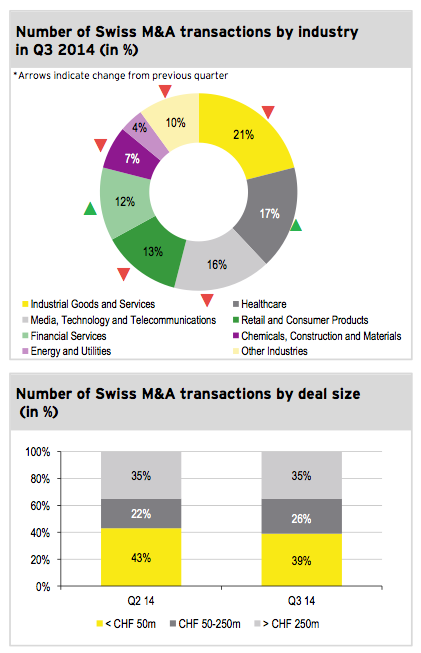

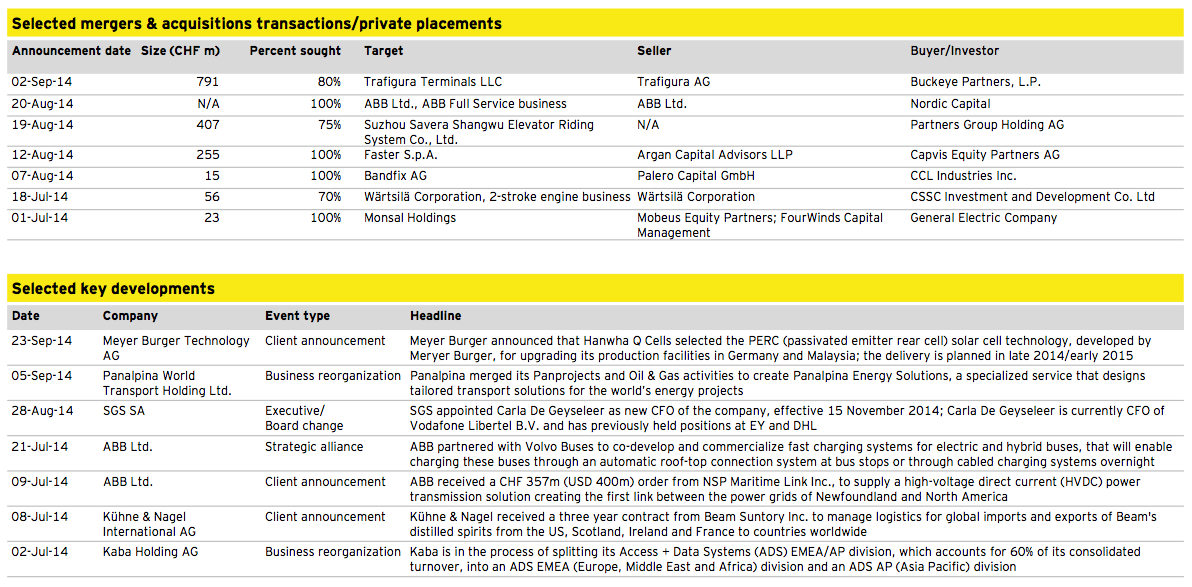

► Although Industrial Goods and Services was the most active sector in Switzerland for the fourth consecutive quarter, its share in deal activity declined from 25% in Q2 to 21% in this quarter. Overall, the sector contributed 34 transactions to all 165 deals announced in Q3 2014.

► Healthcare demonstrated exceptional growth this quarter, recording an increase of seven percentage points in its share of transactions compared to the previous quarter. This makes it the second largest sector in terms of the number of transactions.

► Furthermore, Healthcare accounted for this quarter’s two largest deals, namely Alliance Boots/Walgreens and InterMune/Roche. In total, the sector’s deal volume of CHF 38.5b represents 78% of total deal volume in Q3. Year to date, the exceptional performance of the sector was rounded off by its strong deal flow, with four out of the five largest transactions in 2014 being Healthcare deals.

► After two consecutive quarters of rather low M&A activity in Financial Services, the number of announced deals increased to 19 transactions in Q3 2014, representing a contribution of 12% to overall deal count (plus four percentage points compared to Q2 2014).

Transactions by size

► After two consecutive quarters with an increase in the number of large transactions with deal size above CHF 250m, the trend continued in the third quarter. In total, 16 large transactions were announced, representing 35% of all deals with disclosed deal value.

► Large transactions were primarily recorded in Healthcare and Financial Services – both sectors combined accounted for 63% of all transactions valued above CHF 250m this quarter.

► Overall, the distribution of deals by size was similar to the previous quarter, i.e. above average share of large transactions with little fluctuation of shares attributable to small and mid-market transactions.

► Deal size was disclosed in 28% of all announced transactions in Q3 2014.

Outlook 2014/2015

► Overall, investor confidence in the economy has weakened in 2014 due to smaller than expected growth, globally as well as in Switzerland.

► The latest consensus forecast released by the KOF Swiss Economic Institute in September 2014 projects a reduction in Swiss GDP growth for 2014 from 2.1% (as published in June 2014) to 1.8%. The revised economic outlook for the remainder of 2014 is mainly driven by continuing poor prospects on export growth.

► For 2015, KOF projects Swiss GDP to grow by 1.9% compared to 2014, indicating that the robust economic development will continue.

► In its most recent assessment of monetary policy released on 18 September 2014, the Swiss National Bank (SNB) reaffirmed its floor of CHF1.20 on the CHF/EUR exchange rate and left the target range for the three-month Libor unchanged at 0.0–0.25%.

► While the US economy continues to gain strength, the Eurozone recovery remains fragile. Major economies are still struggling to gain economic momentum and conflicts in the Middle East and Eastern Europe add further uncertainty for corporates and governments alike.

► Next to economic factors, recent changes to US-taxation regulations are also expected to influence the M&A market going forward. Overall, these changes are designed to stop transactions motivated by tax inversion and may for example result in a company being excluded from the Dow Jones Index, when undertaking such transaction. However, as these measures were introduced as recent as September 2014, its effectiveness will need to be evaluated over the coming months.

► Despite the moderate economic outlook, Swiss M&A activity is expected to remain steady for the remainder of 2014 as Swiss firms still tend to have strong balance sheets and cash reserves available for investments or alternatively to pay out to shareholders. As the current interest rate environment remains low, companies struggle to invest cash reserves at reasonable rates of return and may seek more profitable endeavors through external growth.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q3 2014

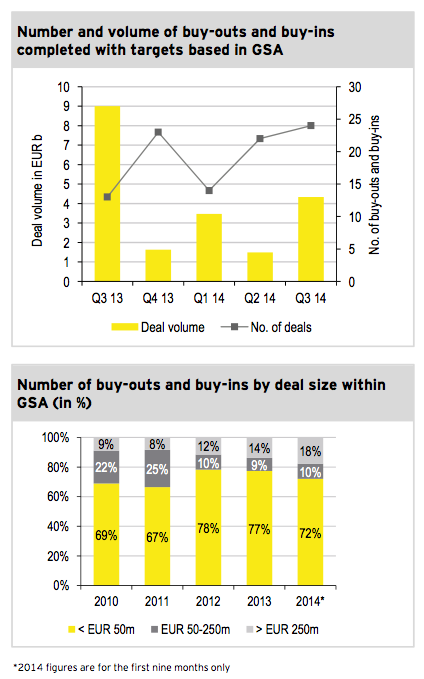

► In Q3 2014, 24 private equity (PE) deals were completed in Germany, Switzerland and Austria (GSA). This reflects an increase of two deals compared to Q2 2014 and eleven deals compared to the same quarter of the previous year.

► This quarter’s deal volume of buy-outs and buy-ins in GSA added up to EUR 4.3b, indicating an increase of EUR 2.8b or 191% compared to Q2 2014. In contrast, deal volume decreased by 52% compared to the same quarter of the previous year, due to several large PE deals being completed in Q3 2013.

► On average, deal size increased from EUR 68m in Q2 2014 to EUR 181m in Q3 2014.

► In GSA, the largest PE deal completed this quarter was the sale of Mauser Group, by Dubai International Capital, the private equity arm of Dubai Holding, to Clayton, Dubilier & Rice for EUR 1.2b. Mauser Group, held by Dubai International Capital since 2007, operates as a producer of rigid industrial packaging solutions. The company generates a turnover of around EUR 1.2b with 4,400 employees.

► In comparison to the rest of Europe, the UK PE market had the largest share of all deals completed in Europe (39%). However, in terms of deal volume, GSA accounted for the largest contribution, representing 27% of the entire European deal volume. Regarding number of deals, transactions in GSA represented 20% of all European PE deals.

► In the first nine months of 2014, PE deals of less than EUR 50m still constituted the bulk of PE activity in GSA and accounted for more than 70% of all PE deals. Further, the contribution of deals larger than EUR 250m has doubled since 2010.

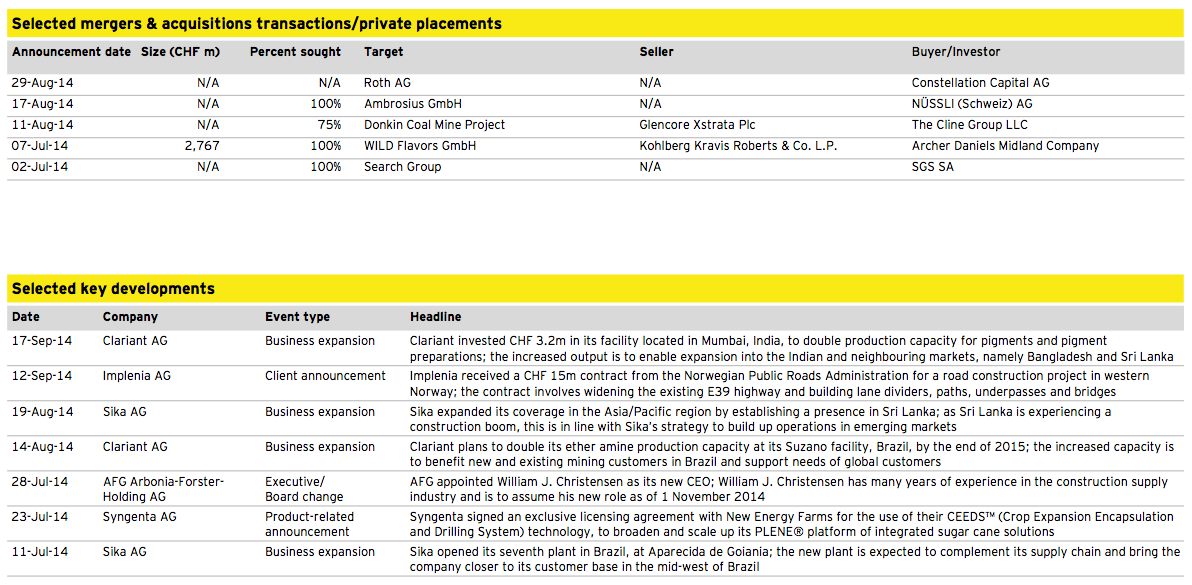

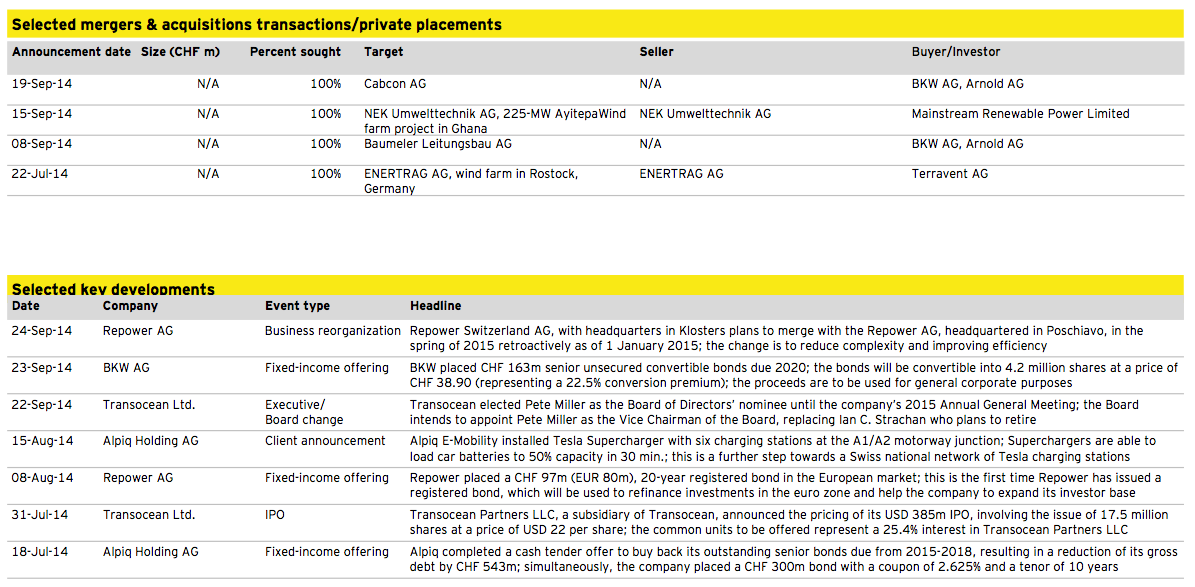

Chemicals, Construction and Materials

Energy and Utilities

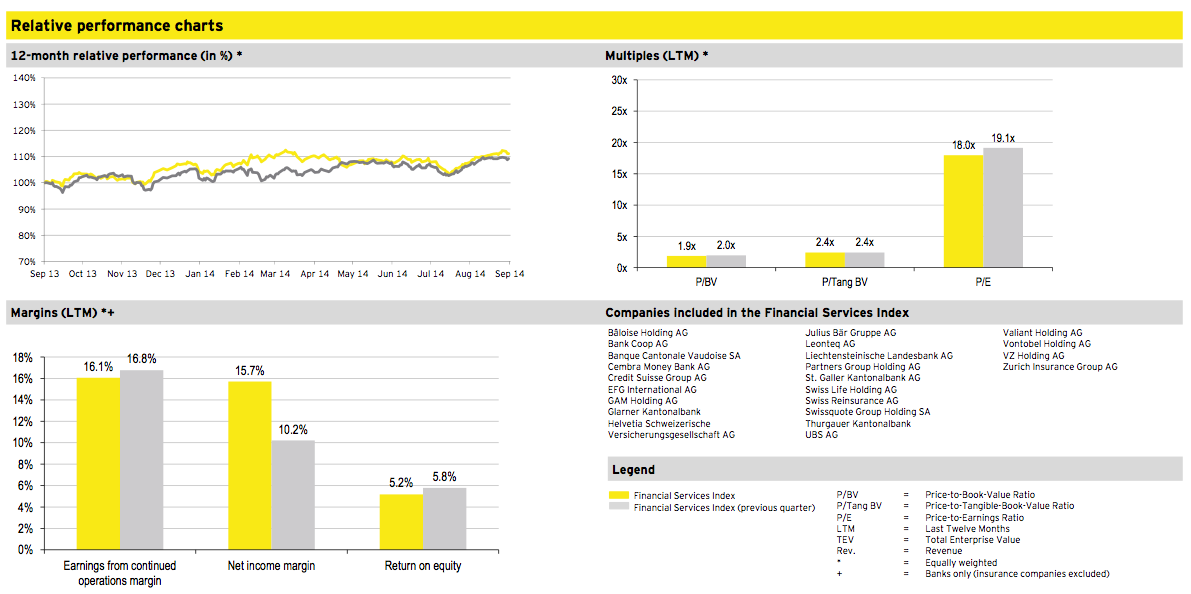

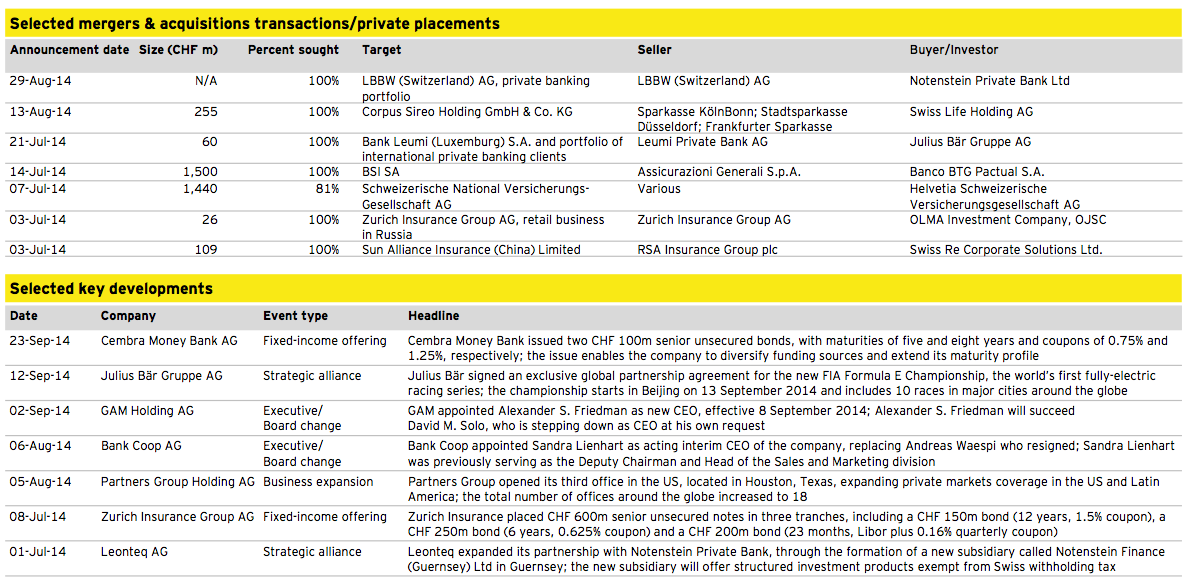

Financial Services

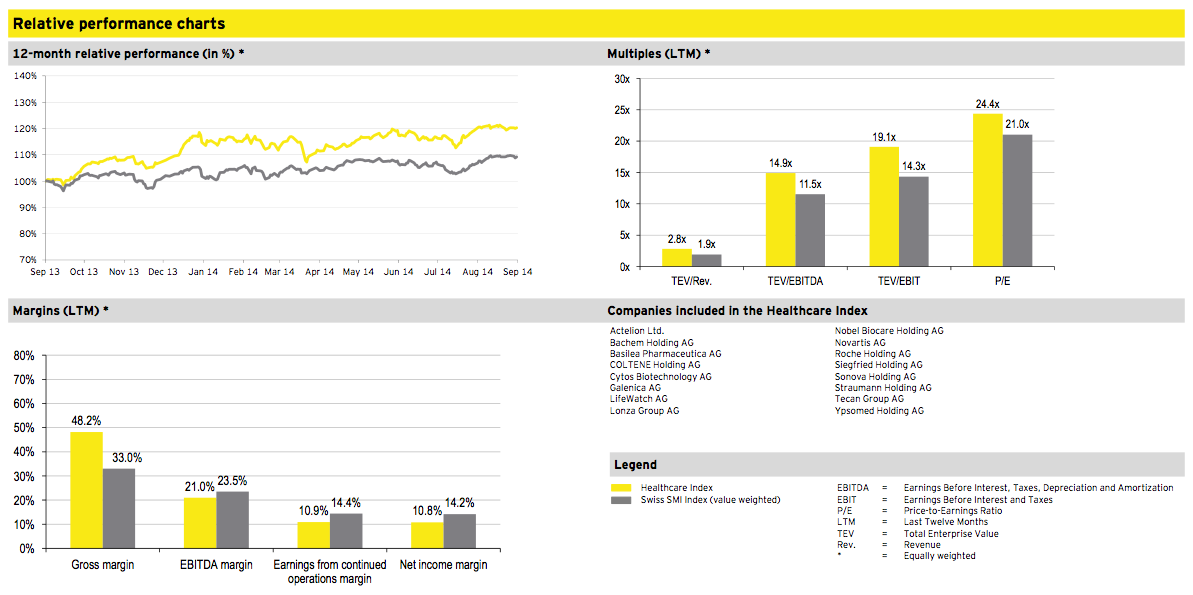

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

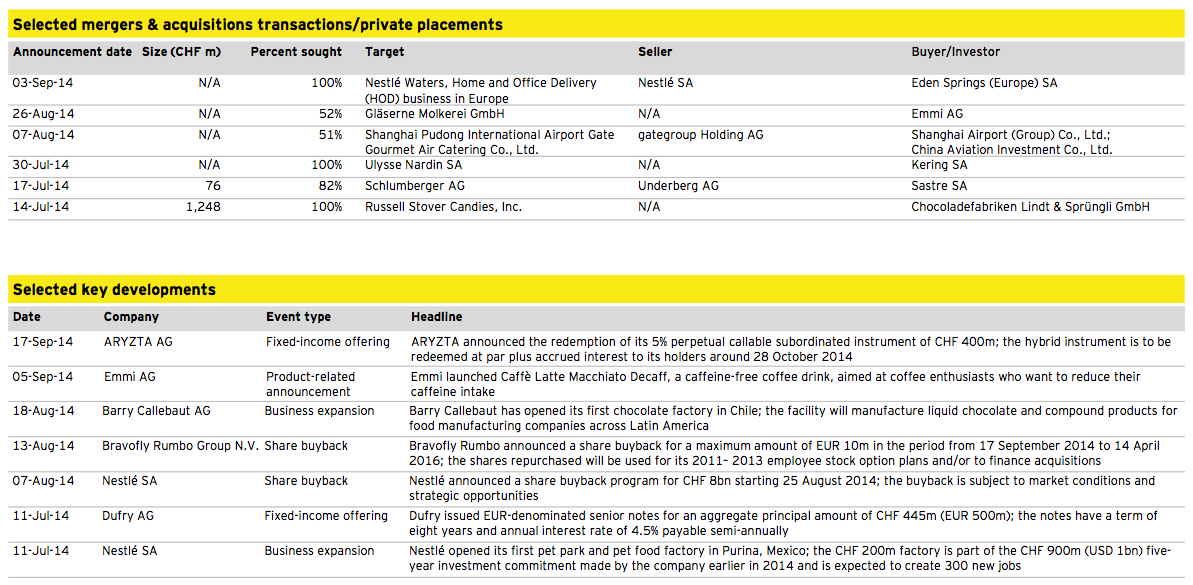

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

On 6 August 2014, Walgreen Co. announced to merge with Alliance Boots GmbH, by acquiring the remaining 55% stake in Alliance Boots. In June 2012, Walgreens had already acquired a 45% stake in Alliance Boots with an option to purchase the remaining 55% stake in three years’ time in exchange for USD 5.3b in cash and 144 million shares of Walgreens’ common stock. The combined company, Walgreens Boots Alliance Inc., is to be based in Chicago and will employ 350,000 people. Subject to shareholder and regulatory approval, the transaction is expected to be closed in the first quarter of 2015.

Alliance Boots is legally based in Switzerland, but has its operational headquarters in the UK. The company operates as a pharmacy-led health and beauty retailer and pharmaceutical wholesaler. It employs over 108,000 people.

Deal rationale

► Walgreens Boots Alliance is to become a global pharmacy-led, health and well-being enterprise with more than 11,000 stores in 10 countries. The combination is set to strengthen the distribution network with more than 370 distribution centers.

► Walgreens and Alliance Boots are considered complementary with regard to their capabilities and assets, geographic footprint as well as retail and business brands.

► The combined size, scale and expertise shall enable the combined company to expand supply and address the rising cost of prescription drugs in America and worldwide.

► Synergies of over USD 1b are expected to be realized in the next three years, through corporate, distribution and store-level cost reductions.