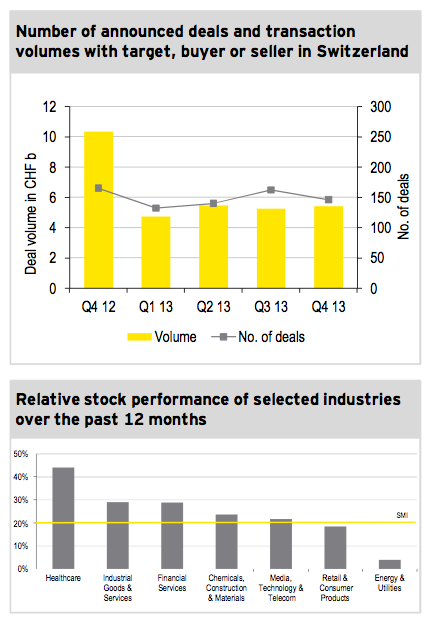

Deal volume in the last quarter of 2013 remained nearly unchanged compared to the previous quarter, confirming the pattern observed throughout 2013 of modest disclosed deal volume in the Swiss M&A market. Moreover, the number of deals decreased compared to both the previous quarter and the same quarter of the preceding year.

The full year 2013 was characterized by low disclosed deal volume which totaled less than one fifth of the 2012 volume. For 2014, rising investor confidence, favorable financing conditions as well as positive market fundamentals are expected to boost M&A activity, even though selected risks remain with the potential to disrupt the bright outlook.

Swiss M&A market Q4 2013 and outlook 2014

M&A market Q4 2013

► Compared to Q3 2013, the number of deals decreased by 10 percent, from 162 to 146, while disclosed deal volume remained nearly unchanged at CHF 5.4b, compared to the previous quarter.

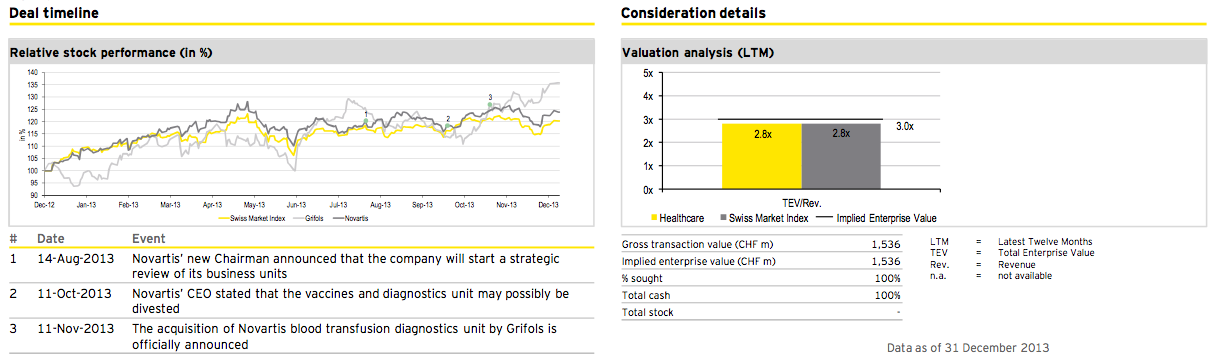

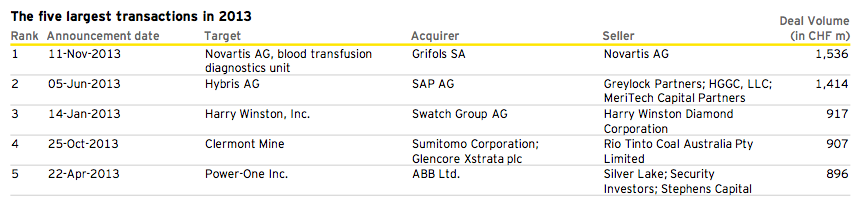

► The largest deal of the fourth quarter of 2013 – also the largest of the calendar year 2013 – was the sale of Novartis’ blood transfusion diagnostics unit to Grifols for CHF 1.5b.

► For the full year 2013, the number of announced deals totaled 580, a decrease of 4% compared to 2012. At CHF 20.8b, disclosed deal volume in 2013 was less than one fifth of the deal volume recorded in 2012.

► The Swiss Market Index (SMI) closed the fourth quarter of 2013 with plus of 2%, which was generated in the second half of December after the FED announced plans to begin tapering its expansionary monetary policy in January 2014, confirming that economic recovery is underway.

► In the calendar year 2013, the SMI demonstrated strong growth, increasing by approx. 20% over the last 12 months.

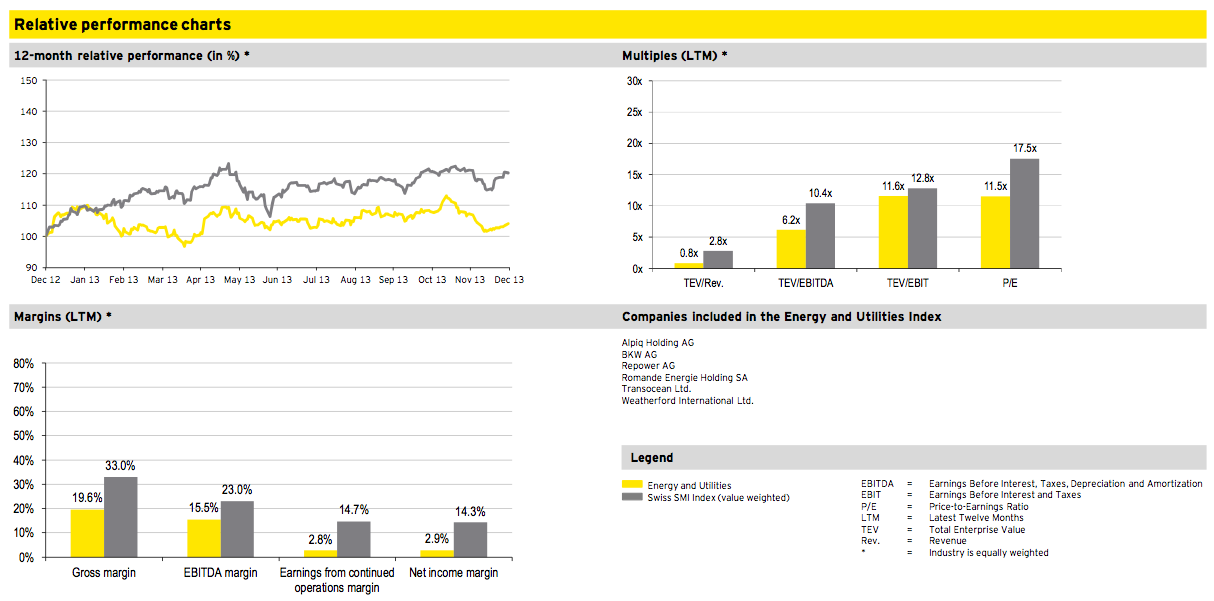

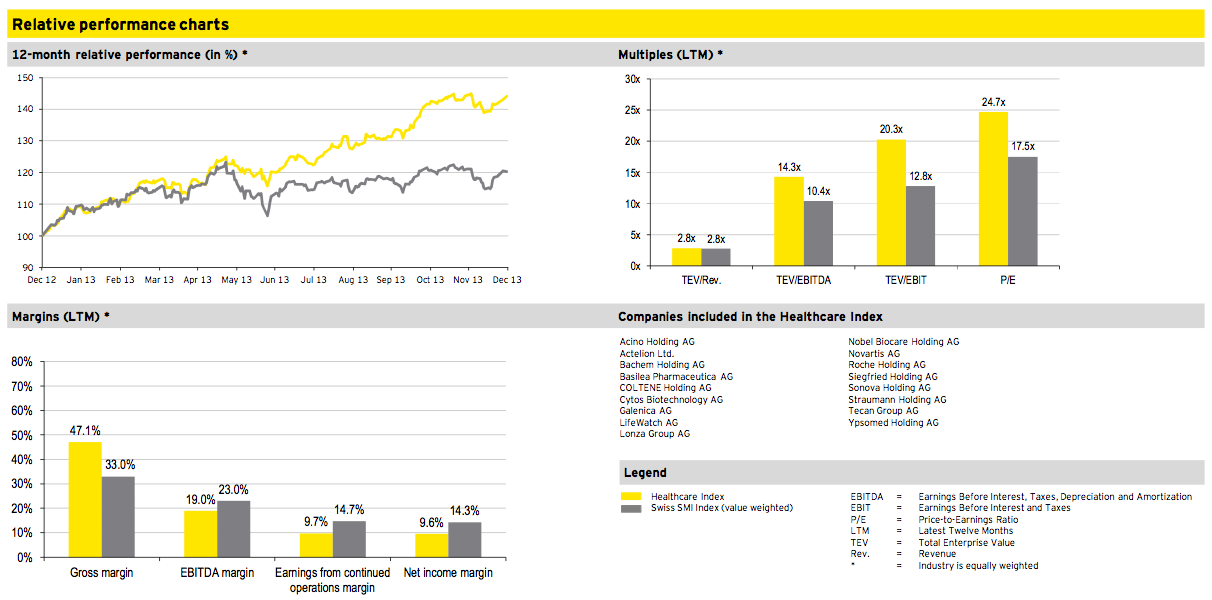

► While shares of Swiss Healthcare companies showed exceptional performance over the past 12 months, companies from the Energy and Utilities index only increased slightly over the same period.

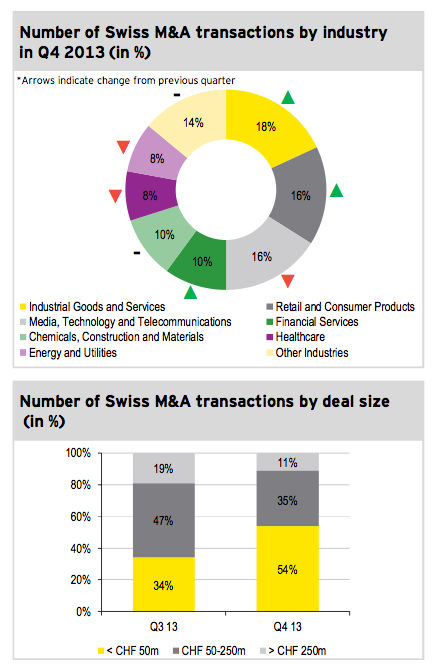

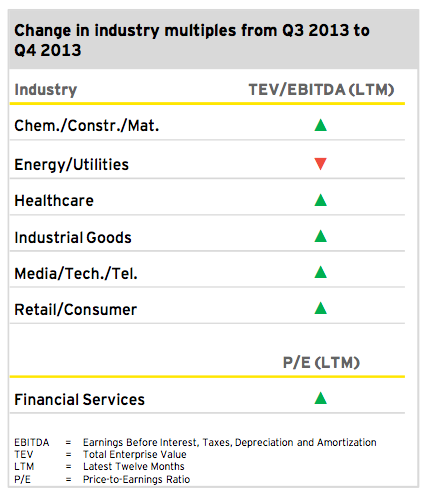

Transactions by industry

► In Q4 2013, Industrial Goods and Services contributed 18% to the total number of deals, putting this sector in first place in terms of deal activity in a comparison of all industry sectors. Retail and Consumer Products took second place alongside Media, Technology and Telecommunications, with a share of 16% each.

► The largest deal with disclosed deal volume stemming from the Industrial Goods and Services sector involved Walter Fust’s public takeover offer for the remaining 67% of Tornos for about CHF 60m.

► The percentage of Retail and Consumer Products deals increased by 6 percentage points compared to the previous quarter, reflecting the largest gain among all industry indices.

► With 5 percentage points, Media, Technology and Telecommunications recorded the largest decrease among all industry sectors.

► In 2013, the most active industries were Industrial Goods and Services as well as Media, Technology and Telecommunications, each accounting for 19% of total transactions in the Swiss M&A market throughout the calendar year.

Transactions by size

► The fourth quarter of 2013 was underpinned by a significant increase in small transactions with a deal size below CHF 50m, and a corresponding decrease in transactions in the ranges CHF 50m-250m and above CHF 250m, when compared to Q3 2013.

► Large deals valued above CHF 250m accounted for 11% of all disclosed deals, marking the lowest value recorded throughout 2013. However, as the individual deal sizes of large transactions above CHF 250m were relatively high in Q4 2013, overall deal volume increased slightly compared to the previous quarter.

► Compared on a year-on-year basis, the share of large transactions above CHF250m decreased significantly, from 29% in 2012 to 17% in 2013. On the other hand, the share of both, small and mid-market M&A transactions, increased from 39% in 2012 to 45% in 2013 and 32% in 2012 to 38% in 2013, respectively.

► Deal size was disclosed in approximately one quarter of all announced transactions in Q4 2013.

Outlook 2014

► In December 2013, the Swiss State Secretariat for Economic Affairs (SECO ) confirmed its previous annual GDP growth forecast of 2.3% for 2014, reflecting an increase of 0.4 percentage points in comparison to 2013. In contrast to its previous forecast released in September 2013, anticipated growth is not underpinned only by strong domestic demand but also by increasing export activity.

► According to the latest EY Capital Confidence Barometer, rising investor confidence, favorable financing conditions as well as recovering market fundamentals are expected to spur M&A activity across mature and emerging markets. However, significant risks still remain and might dampen the positive outlook. In particular, renewed policy uncertainty regarding monetary tightening as well as any signs of weakness in economic data would have the potential to disrupt the bright outlook.

► Recent surveys among M&A professionals in Europe indicate a positive M&A outlook, especially for German-speaking countries where a majority of respondents expect increasing M&A activity. According to the professionals, buy-side activity is to be driven mostly by rising interest of potential buyers outside of Europe. From a sell-side perspective, M&A activity is to be triggered by businesses looking to sell in order to raise capital for investments in faster growing markets.

► As actual M&A market performance was below expectations in recent quarters, forecasts have become more cautious, but continue to reiterate an increase in M&A market activity, mostly due to strong fundamentals. In addition, private equity funds are well-prepared to invest using their record-high amounts of cash collected during 2013 and thus contribute to an upward trend in the market.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q4 2013

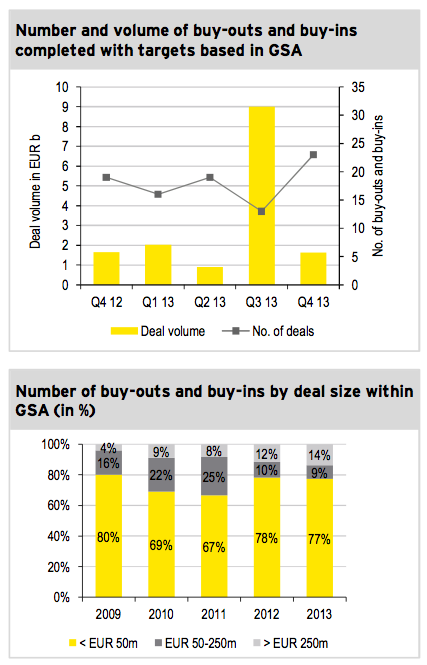

► Number of PE deals from Germany, Switzerland and Austria (GSA) totaled 23 transactions in the fourth quarter of 2013, representing an increase of four and ten deals in comparison to Q4 2012 and Q3 2013, respectively.

► Disclosed PE deal volume fell 82% on the previous quarter and is virtually unchanged compared to Q4 2012. The significant drop is due to the extraordinarily large deal volume recorded in Q3 2013, which mainly comprised three large German deals.

► The largest PE deal of the quarter was the completed sale of the Austrian-based AHT Cooling Systems by Quadriga Capital and Partners Group to Bridgepoint for EUR 585m.

► For the full year 2013, 71 buy-outs and buy-ins were recorded in GSA representing a decrease of two deals compared to 2012.

► The recorded PE deal volume of approximately EUR 13.6b in GSA marks a five-year peak. However, this large volume did not affect the breakdown of buy-ins and buy-outs by deal size, which was virtually unchanged compared to the previous year.

► With respect to the number of deals, GSA accounted for approximately 19% of all completed European buy-outs and buy-ins in Q4 2013 compared to 10% in Q3 2013.

► GSA’s share of disclosed European PE deal volume dropped significantly, from approximately 45% in Q3 2013 to approximately 16% in Q4 2013; this is mainly due to the completion of several large PE deals in Germany during Q3 2013.

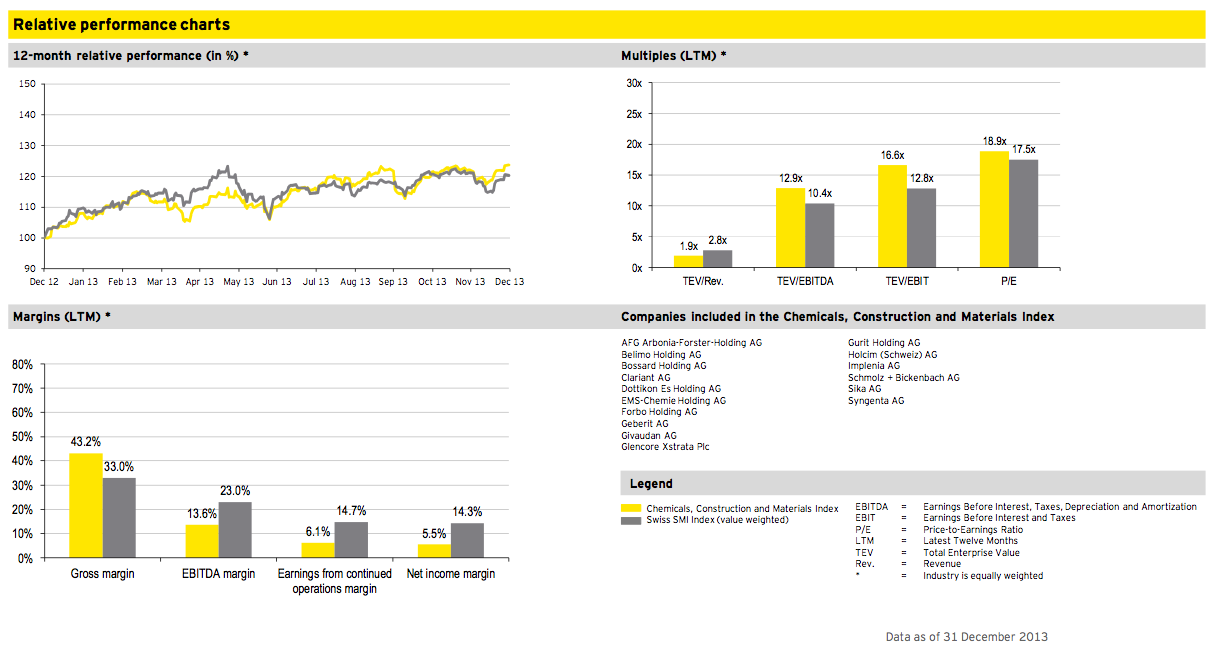

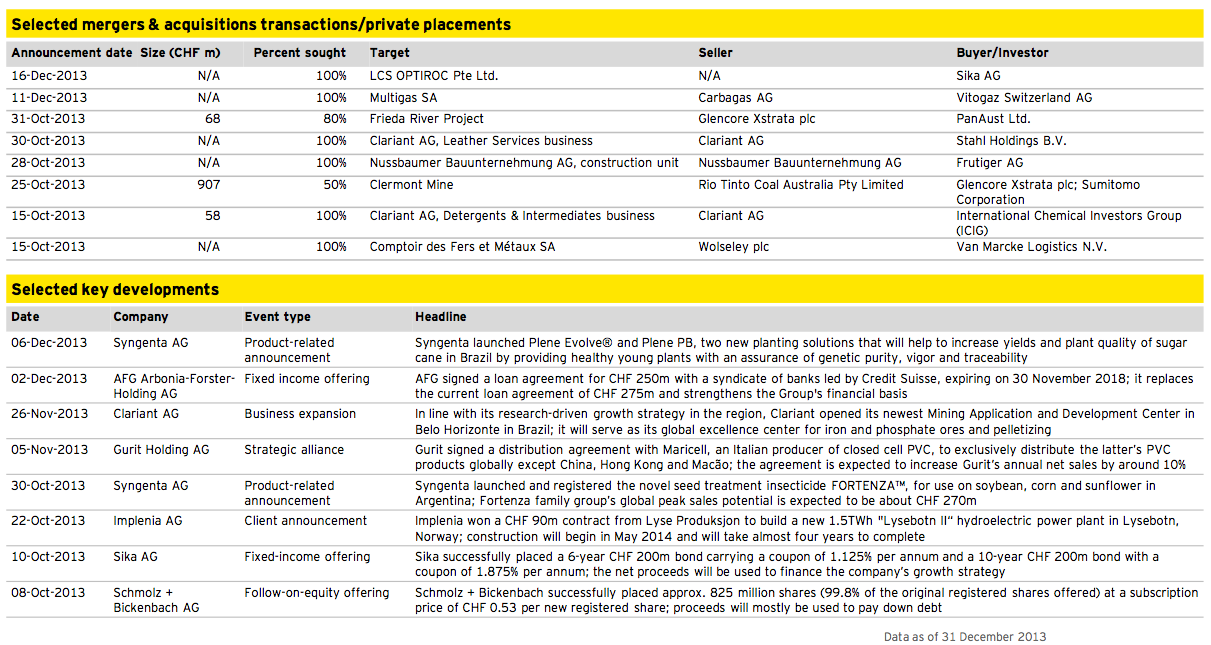

Chemicals, Construction and Materials

Energy and Utilities

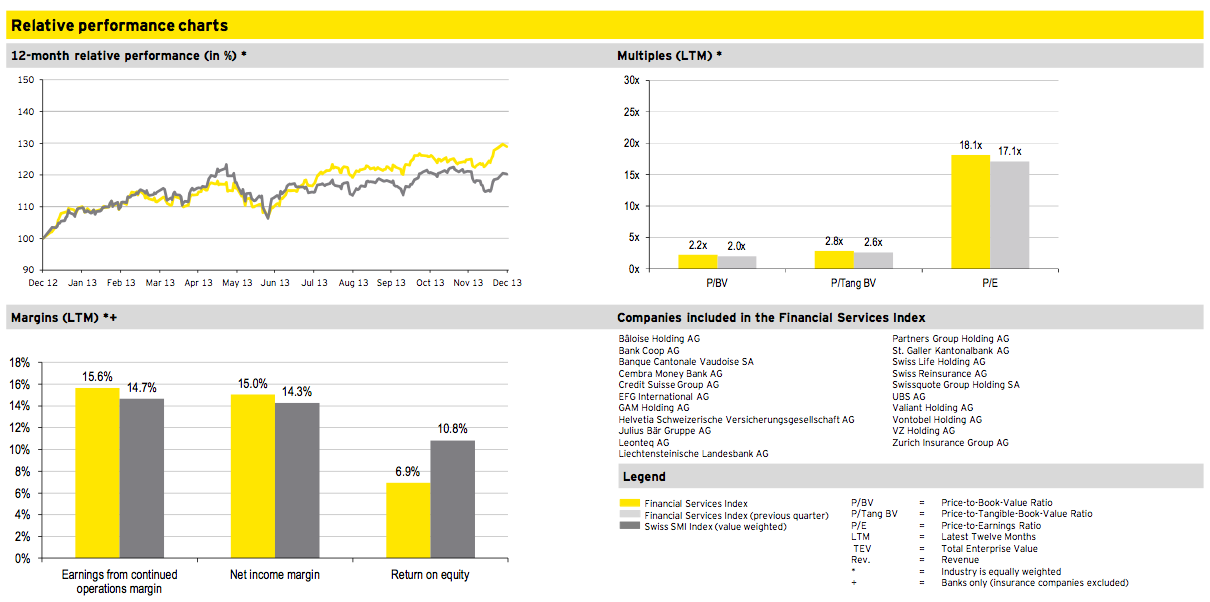

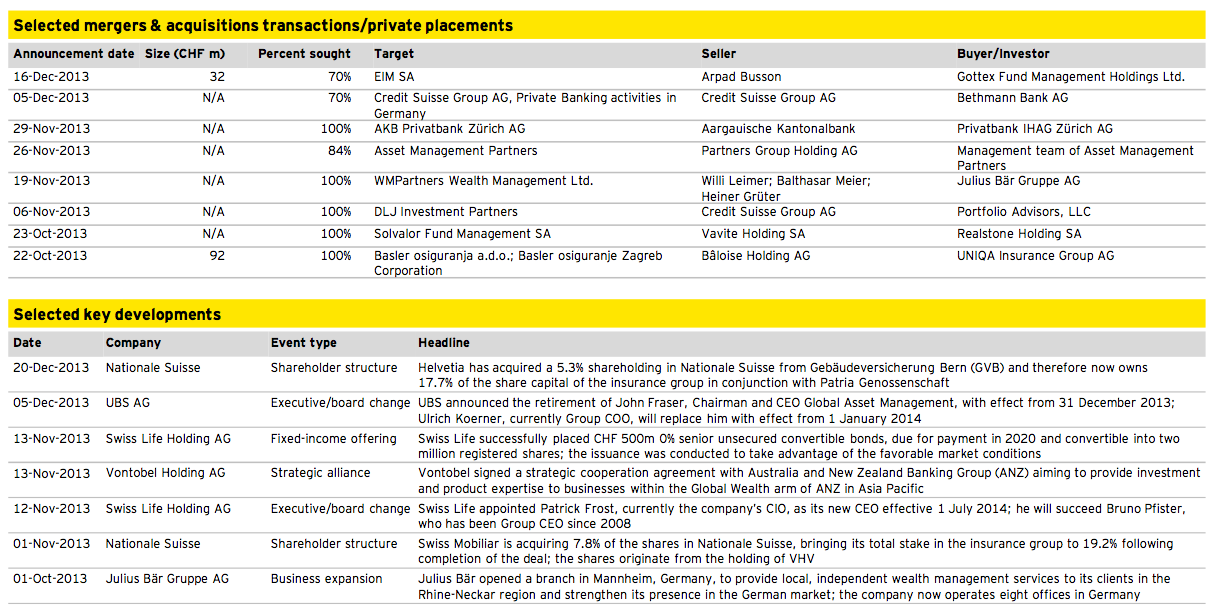

Financial Services

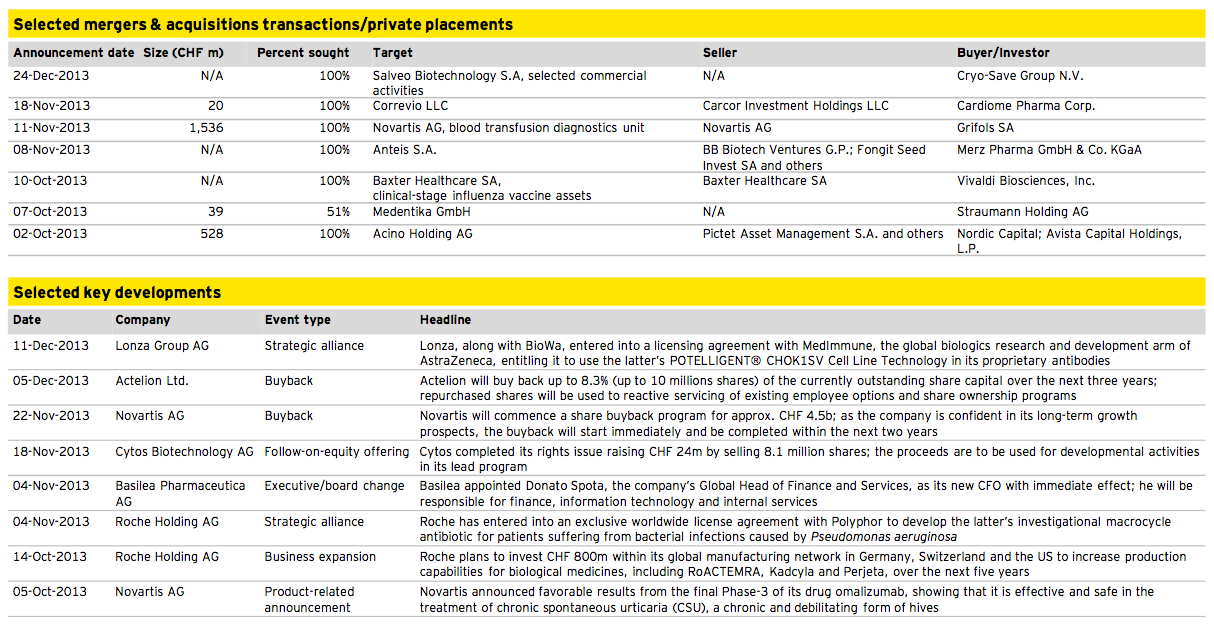

Healthcare

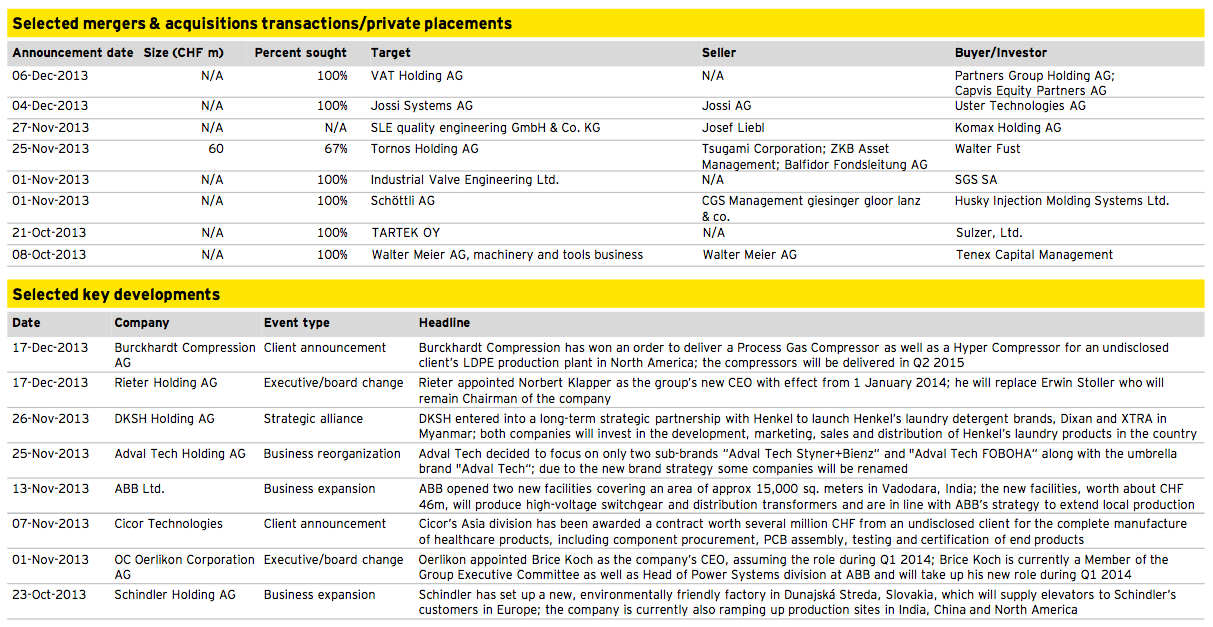

Industrial Goods and Services

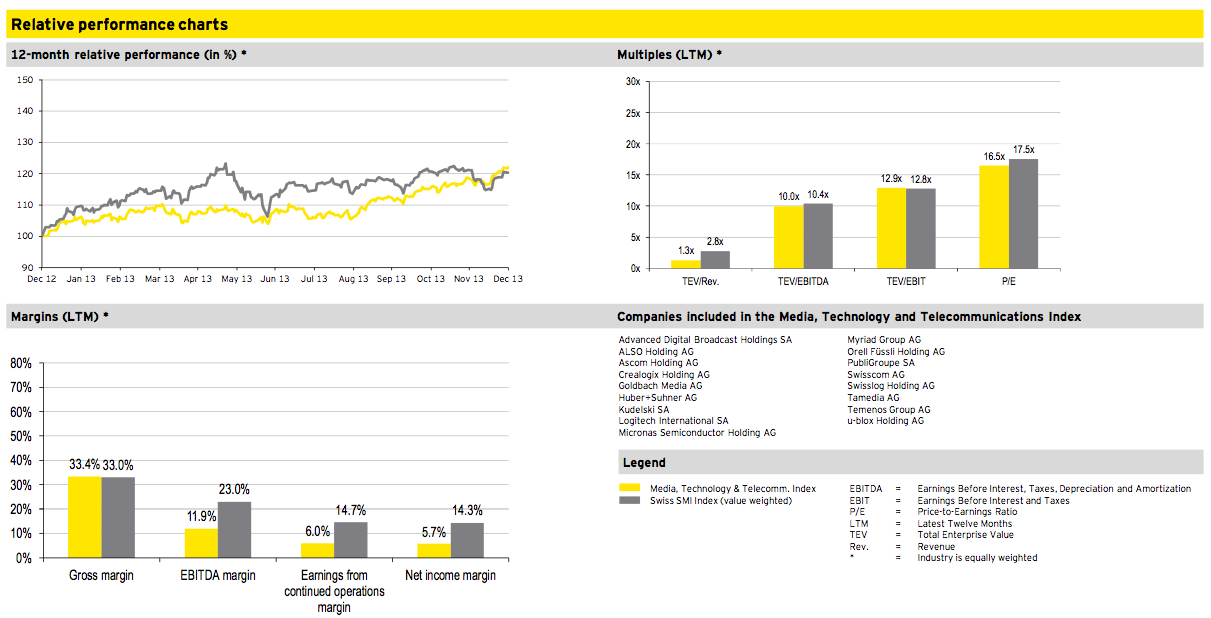

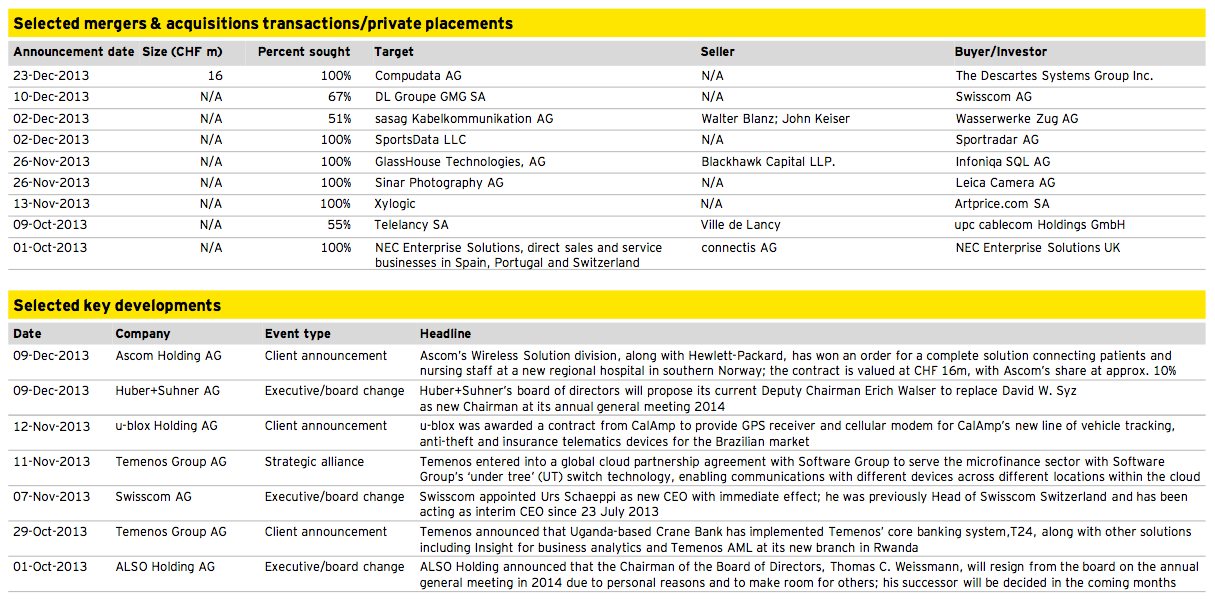

Media, Technology and Telecommunications

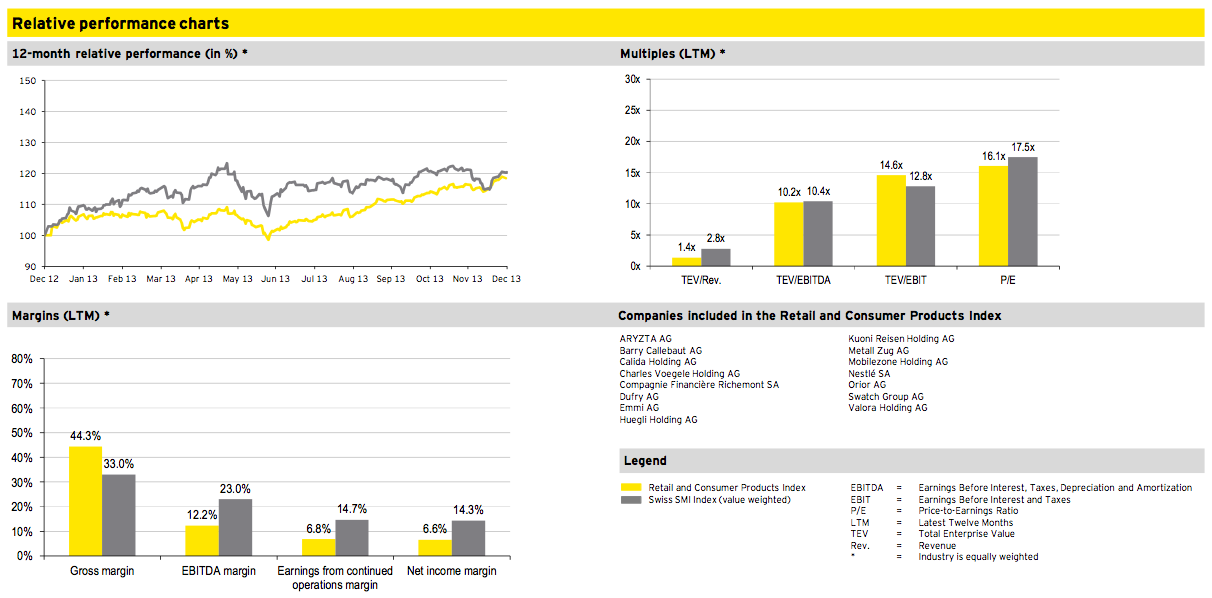

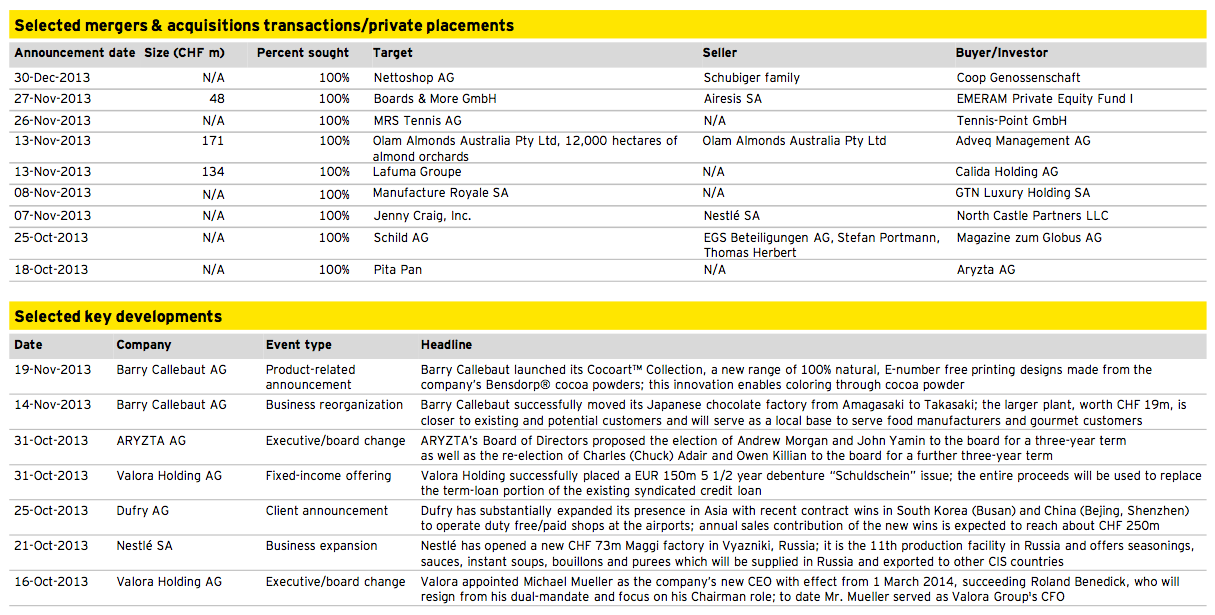

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

Our deal of the quarter in Q4 2013 features the divestment of the blood transfusion diagnostics unit by Novartis AG to Grifols SA. The transaction is expected to be completed in the first half of 2014, subject to regulatory approval. The blood transfusion diagnostics unit was acquired by Novartis from Chiron in 2006. Spanish-based Grifols is the world’s third largest producer of plasma-derived therapies. The acquisition will contribute about one fifth to Grifols’ revenue and will be financed by a USD 1.5b bridge loan provided by Nomura, Banco Bilbao Vizcaya Argentaria SA and Morgan Stanley.

Novartis’ blood transfusion diagnostics unit engages in nucleic acid testing, blood testing products and immunoassay reagents that detect infectious disease. The unit is headquartered in Emeryville, California, and generated sales of around CHF 515m in 2012.

Deal rationale

► The divestment is in line with an ongoing portfolio review at Novartis, following the departure of the former Chairman and CEO Daniel Vasella.

► This sale allows Novartis to sharpen the focus on its strategic business including pharmaceuticals, eye care and generic drugs. There are no synergies between the transfusion diagnostics unit and the remainder of Novartis, according to analysts.

► By acquiring Novartis’ blood transfusion diagnostics unit, Grifols’ previously small diagnostics business is planned to reach critical mass and enable the company to establish a significant US presence while also serving as a platform for global expansion.