By Adnan Fazli, Alex Law and Kenneth McKellar – Deloitte

Introduction

Whilst North African countries are returning to “business as usual” post Arab Spring, legacy risk remains around off-take contracts with NOCs, presenting challenges to working capital management

Whilst global oil and gas (O&G) transactions have suffered a modest decline in both deal count and total value in the first half of 2012, we have seen increasing merger and acquisition (M&A) interest by MENA-based exploration and production (E&P) companies and investors looking to utilize excess cash to fund geographical expansion which in a number of cases involves the acquisition of financially distressed assets.

In recent months, the MENA region has seen some significant developments and opportunities for upstream M&A. The final withdrawal of US troops from Iraq, the end of the Libyan civil war in 2011 and regime change in Egypt signaled increased optimism around the supply of oil, especially as nations that are importing move away from Iranian oil, as a result of the US embargo.

Libya is now poised to return to full-scale oil production in the not-too-distant future and Iraqi production, which has now passed the 3 million barrel per day level, is benefiting from foreign investors with the expertise to exploit these resources. The question remains as to whether these nations will achieve optimum production levels or whether they will continue to face constraints due to outdated infrastructure, political challenges (such as in Iraq), policy uncertainty and continued security threats.

North African countries are seen to be returning to the ‘business as usual’ mode, in the post Arab Spring climate with an increase in foreign investments, especially in Egypt and Libya. Legacy risks remain, however, as off-take contracts with national oil companies (NOC) continue to experience disruption during the transition period of governments with E&P companies in the region facing significant challenges to working capital management.

Further afield, more unconventional sources of hydrocarbons, such as US shale gas exploration, oil production from the bituminous sands in Canada and deep water production in Brazil’s pre-salt blocks, have provided new opportunities and a recent surge in interest from international oil companies (IOCs). The bid for Nexen by CNOOC highlights the continued appetite for these alternative asset types. Whilst a number of factors, including low US natural gas prices and relatively high production costs in these areas, have raised uncertainty around future development and capital deployment, this may present opportunities, particularly for larger foreign companies with the required technological resources, to acquire these assets at low prices.

In this whitepaper we set out the upstream O&G environment in the MENA region, the M&A issues that face investors looking to transact here, and how these are being managed through the screening, diligence and valuation phases of the transaction. (By Adnan Fazli Financial Advisory Services, Middle East)

Fiscal regime and pricing uncertainty

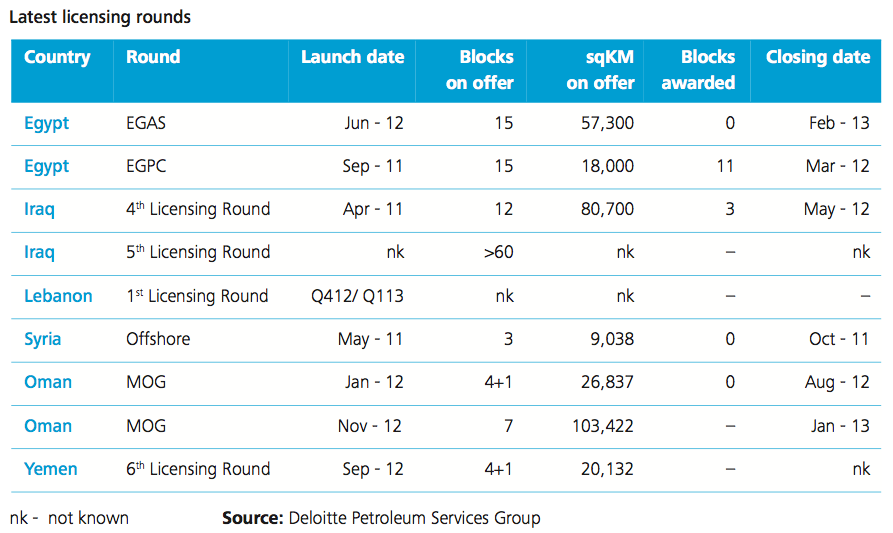

The fiscal terms being offered by governments have been on the top of the agenda for contractors with assets in countries affected by the Arab Spring and consequent regime change. This issue has been under the spotlight recently in Iraq and the semi-autonomous Kurdistan Regional Government (KRG) in the north.

Whilst some E&P companies have been involved in the auctions for new exploration rights during the first half of 2012, the fee-based service contracts on offer by the Government of Federal Iraq, rather than the production sharing framework, have discouraged many investors who have been required to price in additional risk as seen in the fourth Iraq licensing rounds in May 2012.

Contracts on offer by the KRG that require more development expenditure are offering production- sharing arrangements which are attracting more interest, although there is pressure from Baghdad on IOCs and super-majors from operating in Kurdistan; however, this has not prevented ExxonMobil, Total, Gazprom and Chevron from entering into such agreements.

Although Iraqi oil is generally regarded as ‘Easy oil’ (low cost to produce), IOCs have been reluctant to commit to costly exploration projects on the terms on offer, especially as a Federal Oil Law has yet to be ratified and adopted.

Recent press coverage about Exxon Mobil’s intention to leave the giant West Qurna-1 project in Federal Iraq is conceivably a result of less attractive terms currently on offer.

Based on recent transactions we have seen uncertainty around the fiscal terms being offered, especially in territories which have undergone regime change in North Africa. The mechanism available for cost recovery, especially those agreed under earlier regimes, may not necessarily incentivize contractors under the new higher risk environment. These new terms impact the project economics and are at the top of the agenda for our clients looking to value assets. Whilst some regimes allow almost immediate recovery of costs, cash flows from regimes with lower cost oil allowances, or longer amortization periods on cost recovery, might warrant some downward adjustment while arriving at the present value of the net cash flows.

To deal with uncertainties around fiscal frameworks, clients need to be assisted to undertake more robust due diligence around the cost recovery mechanism, the unrecovered cost pool, approval status of past submissions, and modeling of new terms which feed into the economic model.

Operational challenges and valuing risk

In Libya and Egypt, regime change post Arab Spring has involved the reorganization of ministries and issues around the timely payment to operators in-country by the national oil company (NOC) and government, who are the primary off-taker of the hydrocarbons to meet local demand. Although it is unlikely that there will be any radical overhaul to the current systems in place, the transitional challenges around cash collection by the operators has led to financial distress for a number of operators, who are offering such assets for sale. Investors are factoring in different levels of discounts when assessing the value of assets with such risk exposures. Currently the market is seeing many instances where buyers and sellers cannot get together on pricing, due to their differing views on risk, with distressed deals being the primary driver of activity, where cash-rich companies are picking up these assets at large discounts.

As investors target new geographies, it is vitally important to understand the risks associated with unfamiliar geographies such as off-take agreements or counterparty risk of receivables, even when dealing with NOCs, in locations with socio-political uncertainties.

Some techniques considered while pricing these politically riskier assets include increasing the return expectations to match the high uncertainties, delaying the time of first oil and flattening the production profile due to expected disruptions. These adjustments have a negative impact on asset pricing in the region, which enjoys one of the lowest finding costs.

Outside of MENA, although Brazil and more recently East Africa may offer interesting new prospects, there is also significant uncertainty with regards to the fiscal terms on offer as the local and federal government continues to argue over how to distribute oil royalties. Current estimates are that the first auction for the Brazil pre-salt blocks may not occur until 2013.

The government carry obligations on contractors in new O&G geographies can be sizeable. Accurately assessing the timing and quantum of the recovery of such costs are key in valuing such assets

Capital and carry commitments and decommissioning liabilities

Currently the main topics being considered by companies attempting to enter the Africa upstream sector are around adequate consideration of asset retirement obligations that are being introduced into new agreements or renewals and their impact on the project economics, the government’s take and operator’s carry obligations. Prospective bidders or investors in upstream assets are required to undertake a thorough technical assessment of the condition of the existing infrastructure to fully understand future capital commitments.

In North and Sub-Saharan Africa, there is a general move towards the requirement to link the award of contracts to meet local content obligations and to undertake social expenditure, which also needs to be factored into the overall investment proposition.

New geographies in Africa may require the contractor to carry the government’s share of capital expenditure, which in offshore developments, such as those off West Africa and recently off the coast of Madagascar and East Africa, can be sizeable. Accurately assessing the timing and quantum of the recovery of the carry obligations are key in valuing such assets.

From a cashflow perspective, similar considerations are required in relation to decommissioning liabilities. Frameworks vary considerably by region, ranging from the requirement for restricted cash pools, to lump sum payment at the end of the field life, or in some instances no requirement for decommissioning at all. In many cases provisions for decommissioning cost may not be included in older Production Sharing Arrangements (PSA); however renewal of the arrangements is likely to trigger such obligations.

In the current global energy environment, pricing upstream O&G assets in these uncertain times requires a significantly higher level of diligence and pooled expertise to get the most value out of these transactions and mitigate risks to investors.

Unconventional assets

The operational resources and effort required to develop unconventional assets are more complex, and the costs significantly higher than development of conventional assets. These development costs, coupled with pricing concerns, particularly around US shale gas and the evolving regulation surrounding hydraulic fracturing and managing the environmental impact of such development, have created uncertainty for potential investors in this space. However, technological improvements continue to benefit the industry, lowering overall costs and increasing efficiency.

The current depressed US gas prices may in fact provide opportunity. Low prices have already contributed to a resurgence in the US petrochemical industry and a major shift is underway by utility companies away from coal to natural gas for electricity generation, as Gary Adams, Vice Chairman US Oil and Gas at Deloitte, notes. The current pricing level also creates potential for the US to become a major exporter of LNG, thus providing opportunities for companies with the relevant knowhow to make strategic acquisitions.

Tax considerations

The tax provisions applicable to oil and gas exploration and production companies vary significantly according to the specific terms included in their contract with the Government, and the type of the contract agreed – such as Concession, Production Sharing Contract, Technical Service Contract or Joint Venture. In some cases, specific fiscal terms may be negotiated between the oil company and the Government resulting in different tax provisions applying to contracts within the same country, with the terms of such contracts not always made publicly available.

The confidential nature of oil and gas contracts in some Middle East countries, such as the UAE, can make it challenging for new entrants coming into the market, as there is limited publically available information regarding issues such as fiscal terms and royalty rates, on which they can prepare their business plans.

Oil and gas contracts are also generally subject to much higher rates of corporate income tax (up to 85 percent in some Middle East countries) and, in addition, may be subject to industry taxes, such as royalty and petroleum taxes, and other general and environmental taxes.

Oil and gas companies provide for a significant source of taxation revenues in many Middle East countries and we have seen several countries changing their tax regimes for companies operating in the oil and gas sector in order to increase tax revenues. This has been particularly in point in Iraq over the last couple of years following the introduction of the 2010 Oil and Gas Tax Law.

Notwithstanding the higher rates of corporate income taxes, oil and gas companies typically benefit from a number of wider tax exemptions which may also be available under certain Government contracts, such as exemption from stamp duties, indirect taxes, withholding taxes and customs duties, etc.

The taxation of upstream oil and gas contracts is made more complex due to the interaction of specific oil and gas taxation laws, together with domestic tax laws and cross border tax agreements as well as the constantly changing tax landscape. There is also the issue of different authorities to consider, such as the Ministry of Oil and Ministry of Finance, which do not always have consistent approaches to applying tax on oil and gas contracts. It is therefore particularly important to get a good understanding of the applicable fiscal framework in order to plan any new investment in the oil and gas sector.

Conclusions

While oil and gas prices rise and fall, a resurgent regional and global energy market, driven by increased demand from the Asian economies (China, India and Korea) and the MENA region, and the investment needs that accompany that resurgence, should set the stage for sustained M&A activity over the longer term.

With such investment activity, investors will need to price more accurately, to reflect the operational, commercial and financial risks associated with these geographies, to deliver sustainable returns on their projects.