By KPMG

Introduction: Ready for action

In these times of great uncertainty and rapid change, we all recognize the need for successful businesses to remain innovative and to keep evolving. Fortunately, Switzerland continues to attract world-class talent from around the globe, with immigration of well-educated workers complementing domestic skills and expertise and helping to keep Switzerland at the cutting edge of technology and ingenuity.

As the high growth markets of Asia, Africa and Latin America beckon, there is literally a world of opportunity for Swiss firms of all sizes and sectors. Except for the largest few, many have only just begun to actively move into these markets in a capacity other than export-based. Yet such a transition is key if operating models are to keep pace with global trends and our businesses are to remain sustainable for the longer-term.

While much of the West remains pre-occupied with austerity, we have seen a number of home-grown Swiss businesses expand and transform into truly global players through a series of eye-catching acquisitions, supported by strategic divestments and healthy organic growth. (Stefan Pfister, Partner, Head of Advisory, Switzerland)

M&A Market Press Headlines

Even after making investments and distributing dividends, the 1,000 top non-financial businesses in the world are still sitting on roughly US$3.5 billion in cash, according to Bloomberg’s statistics. – L’AGEFI, 30.03.2012. Spring is back for M&A.

All in all, direct investments by Swiss firms abroad are making a significant contribution to the success of the national economy. – Balser Zeitung, 30.08.2012. Little Switzerland is buying big.

Reports of mergers and acquisitions are suddenly becoming more frequent again … Budgets and business plans must be drawn up based on principles that contain considerable uncertainties and risks. – Finanz und Wirtschaft, 02.03.2012. No “business as usual” in M&A.

BASF has made an offer of EUR664 million to purchase the Norwegian pharmaceutical group Pronova. The Board of Directors at Schiff Nutrition has already recommended the acceptance of Reckitt Benckiser’s takeover offer of US$1.4 billion … Glencore and Xstrata have progressed further with their merger after receiving a green light from the EU Competition Commission. – Finanz und Wirtschaft, 24.11.2012. M&A fever in the chemical sector.

The high national debt is burdening the economy – a situation that will not improve in the medium term. The export-oriented Swiss industry is therefore reorganizing itself, with a view to exploring new growth markets. Swiss companies are investing in young growth markets like Vietnam, Indonesia and Mexico – Switzerland is becoming a preferred long-term production location for efficient specialists. – SonntagsZeitung, 18.11.2012. Swiss industry is under pressure.

The mergers and acquisitions business is languishing. Nevertheless, the persistently optimistic M&A bankers are seeing signs of a change in the trend, because companies have plenty of liquid assets and financing costs are low. – Finanz und Wirtschaft, 08.11.2012. Latent merger fever.

In the financial sector they think it is possible that the long-awaited consolidation is gaining momentum, particularly among the private banks … with regard to the health sector, they point out that the change in hospital financing to case-specific flat rates and the general cost pressure on several companies could give rise to ’forward strategies’ with the aim of expansion or displacement. – NZZ, 22.03.2012. Companies in a buying mood.

Deal Trends / Executive Summary

Bucking the trend of most of its Eurozone neighbors, the Swiss economy is putting in a strong performance given volatilities in its primary export markets.Thanks to a robust domestic economy and healthy demand for recognized quality products, even the strong Swiss Franc does not quite spell disaster.

Demographics play their part. A steady flow of immigration (around 75,000 in 2012) feeds Swiss industry, with well-educated people attracted by opportunities at some of the world’s leading companies. Indeed, the pool of prospective global employers is expanding. While Switzerland has historically been known for exciting roles at its banks, commodities trading is a sector fast emerging as a provider of tremendous opportunity to gain global experience in a world-class environment. Across industries, high numbers of companies migrate their headquarters to Switzerland each year. Although some of these moves are mainly tax-driven, for the time-being they are helping to drive the Swiss Real Estate market, confident consumer sentiment and business growth.

Valuations remain a challenge

Dealmaker confidence remained reasonably strong throughout the year despite economic uncertainties.The expectation gap between buyers and sellers appeared to close somewhat by mid-2012 but began to grow again in the second half of the year.

Challenging dealmakers is how to assess business plans. European targets may look cheaper, but it is difficult to ascertain accurate valuations in these uncertain times. If economic recovery returns, they could be fantastic investments, but if there is no turnaround in the foreseeable future, even cheap acquisitions could become a financial drain. Valuations – and overall M&A activity – are therefore heavily dependent on the complexities of Eurozone performance.

Few are feeling the pressure as much as family-business owners asking when is the right time to sell. Succession planning has been a huge issue for many years. Sell in a down market or try to hold on until the good times return?

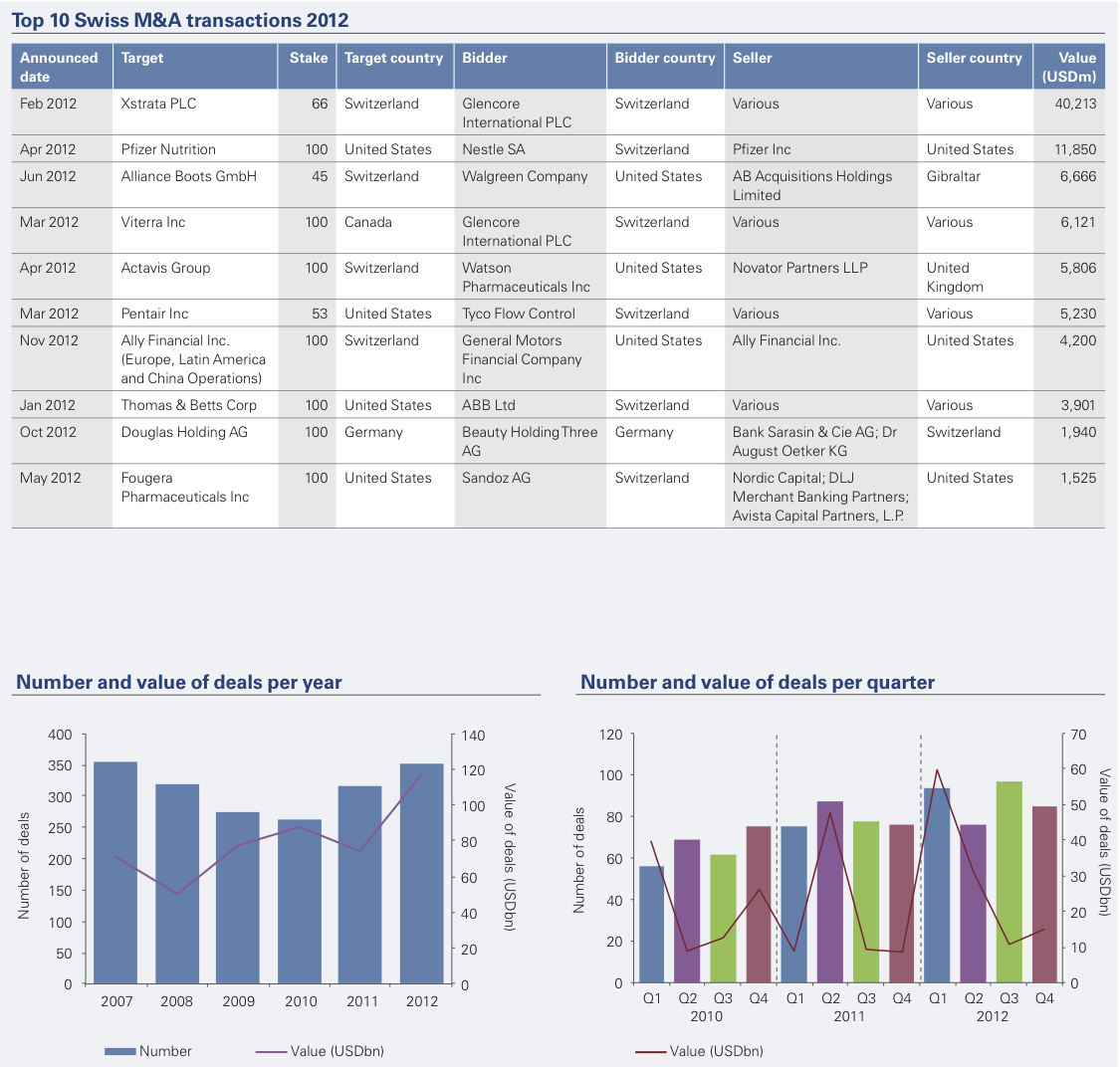

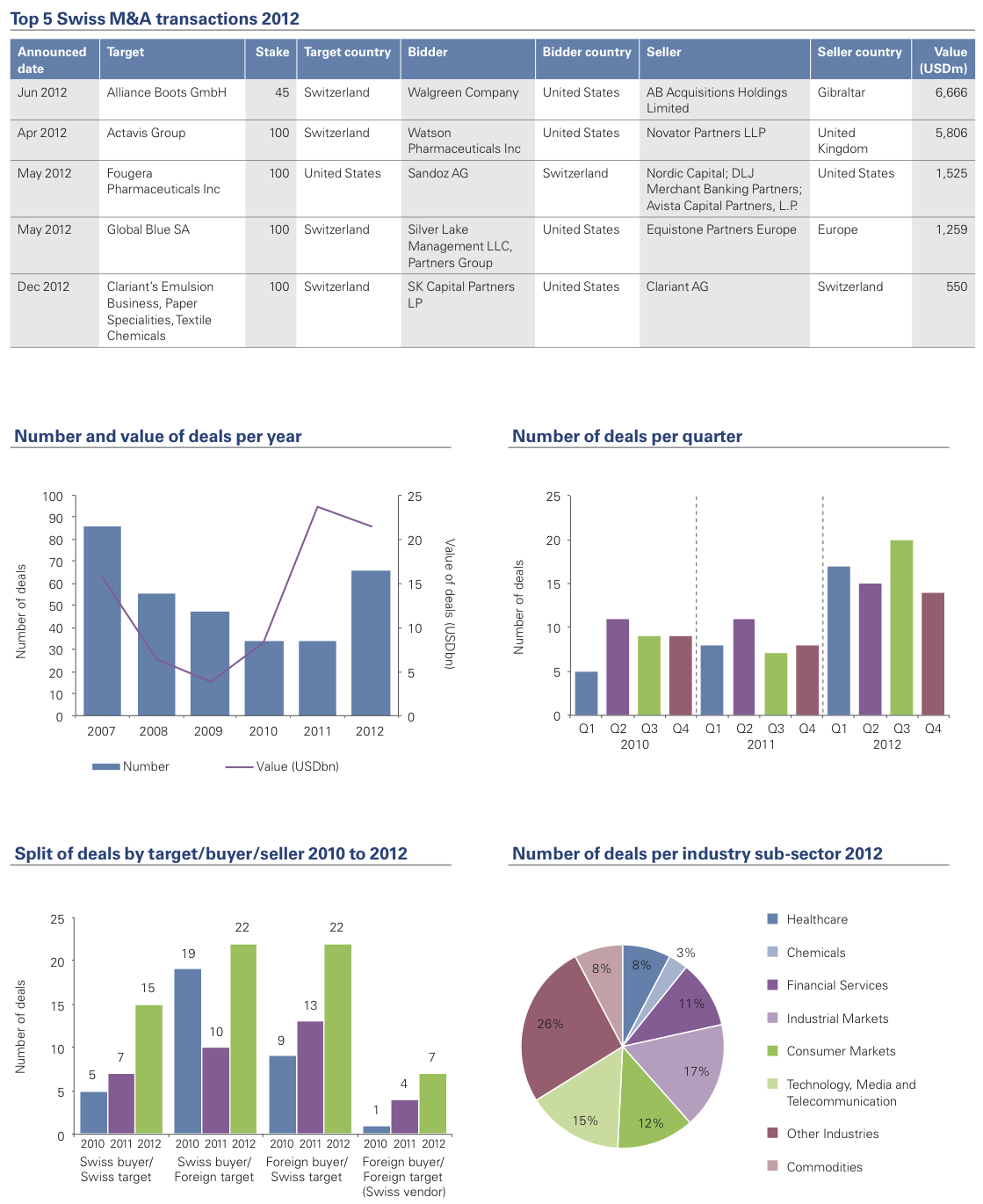

The emergence of new giants

2012 saw M&A create some truly world-leading businesses. The Sandoz – Fougera Pharmaceuticals deal created the world’s largest generic dermatology player and the Watson Pharmaceuticals – Actavis acquisition resulted in the world’s third largest generics business. The year also marked a step-change in Julius Baer’s business when it added 50% to its AUM by acquiring Bank of America Merrill Lynch’s non-US wealth management business. Meanwhile, Barry Callebaut became the world’s leading cocoa processor. And no mention of 2012 deal activity would be complete without the mammoth Glencore – Xstrata deal at USD40 billion, the largest Swiss transaction of the year furthering Glencore’s efforts to diversify and build critical scale.

Boasting the world’s largest Food & Drinks group, some of the biggest banks and leading Pharmaceutical and Chemicals firms, Switzerland has good reason to be proud of its performance. Building on historical success, it has expanded its global footprint and placed itself firmly at the forefront of key industries.

Outlook for 2013

Following the growth

We must remember that while headlines are preoccupied by conditions in fellow European states, the future of our export industries lay arguably in markets that are further afield. The US looks as though it is recovering (and may rebound as the fiscal cliff discussions are resolved) and increasing numbers of Swiss firms of all sizes recognize the need to move out of their comfort zones and actively seek opportunities in the high growth markets of Asia, Africa and Latin America.

Swiss companies that are not already looking at new markets need to start doing so. Of particular note is that dealmakers would do well to remember that Asia- Pacific does not just mean China. From vast markets in India and Indonesia to the opening up of Myanmar to foreign trade and investment, the potential is huge and continues to grow. We feel that except for some of the largest Swiss players, companies are missing out on this growth or are unsure how to access it, preferring to stick to more traditional and familiar markets in the West.

This is a lost opportunity, as Swiss companies are well positioned to chase market prospects. Even smaller businesses tend to have an international set-up and are not too badly exposed to negative revenue or earnings developments. While they may understandably struggle to set up facilities in unfamiliar, far-flung territories, alternatives such as finding local partners do exist. Business-as-usual, which for many means relying on an export model, is a diminishing option for all but high tech and/or niche market players. Even for these, product commoditization would spell disaster for firms with production facilities in high rent, high labor cost Switzerland.

Positioning for the future

2013 will see many firms shedding non-core assets, which may prove rich pickings for acquirers. Consumer Markets firms in particular are likely to look ever-more closely at rationalizing their brands and moving forward only with the stronger ones.

Other industries are being encouraged by the regulatory environment to review activities. Wealth Managers are tending to cut down on the number of jurisdictions in which they have an active presence as MiFID requirements take hold. Even the Power & Utilities sector looks set to see rapid consolidation and a refocusing on the Swiss domestic market as firms divest of foreign assets in the wake of the government’s recently released Energy Strategy 2050.

We do not view this as a necessarily negative development. “Necessity is the mother of invention” as the old adage goes. Portfolio reshaping and a period of introspection is generally a healthy thing, as long as the focus on growth and improvement is not lost.

As many of Switzerland’s neighbors continue to struggle, Swiss firms have a real opportunity to move forward.Through streamlining, portfolio management and strategic M&A, there exists an unprecedented chance to build true, long-lasting competitive advantage. Leveraging Switzerland’s many positive attributes to leapfrog competitors and reap the rewards once widespread economic recovery is underway. (Patrik Kerler, Partner, Head of Mergers & Acquisitions)

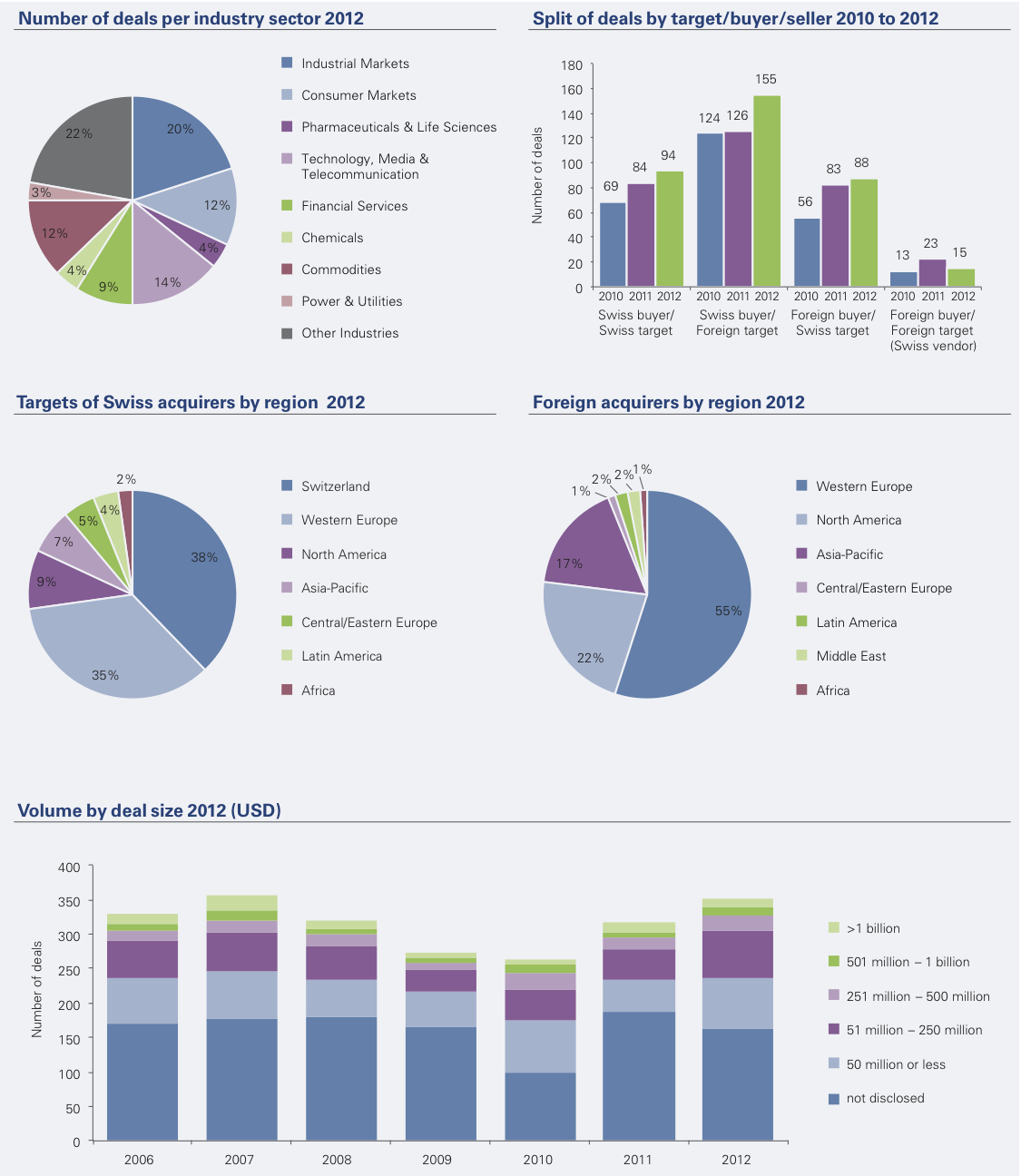

Cross-border Deal Flows

The US was once again Switzerland’s most important partner for M&A transactions in 2012. With combined deal values of approximately USD 50 billion flowing between the two, 7 of the top 10 deals involving Swiss firms also involved a bidder or target company based in the US.

Industry Tables

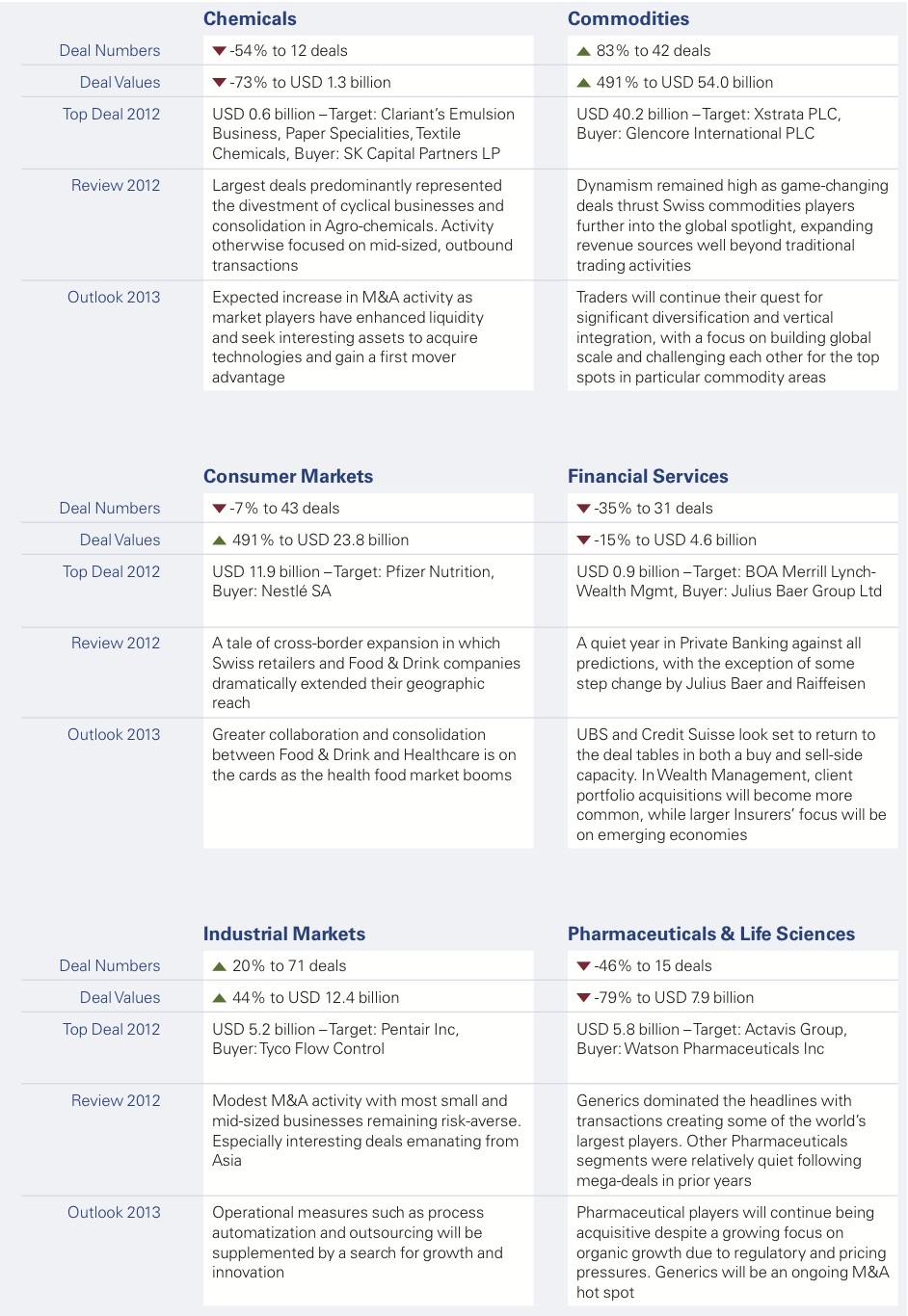

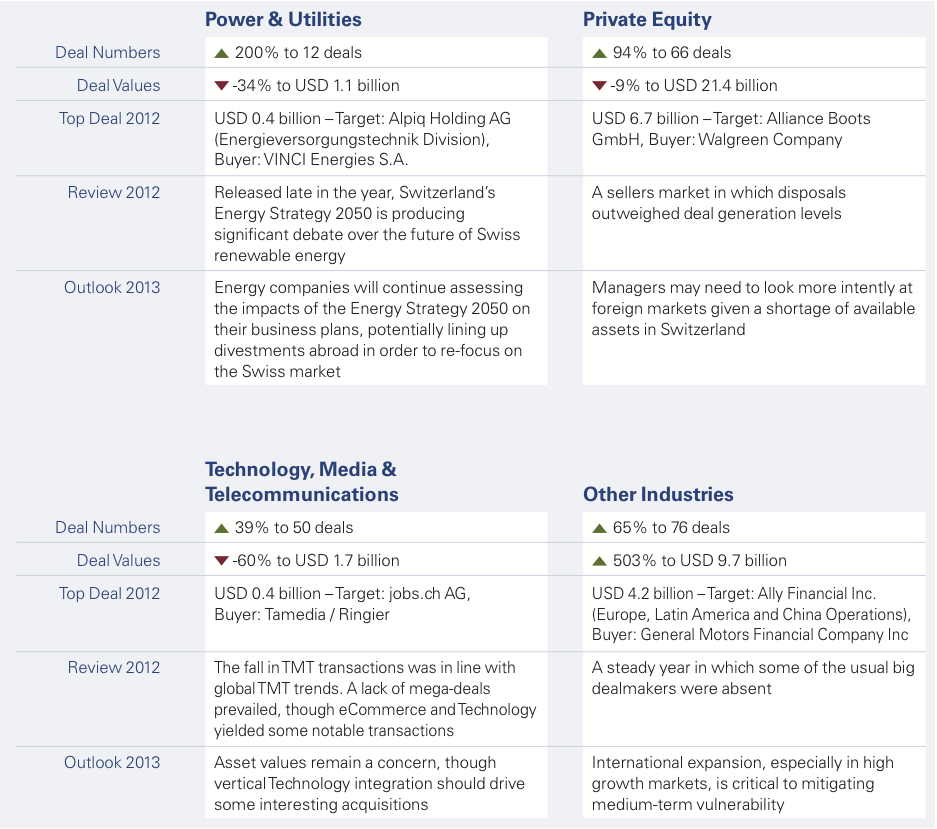

Chemicals

The relative lack of deal activity in 2012 was a misleading barometer of activity, masking much preparation behind the scenes. Renewed economic volatility discouraged many would-be sellers from divesting, while buyers who would have been in a position to complete continue to search for available targets. The result was lower than expected activity, with a slight upturn in the second half of the year.

The larger players led what little consolidation was experienced in 2012, undertaking primarily small and mid-sized acquisitions.They were driven by a common rationale: to gain first mover advantage by securing access to new technologies and innovations.

Notable acquisitions tended to be outbound transactions. Syngenta’s purchase of Devgen represented a concerted effort by the group to strengthen its product offerings in one of the most important crops, by acquiring a best in class hybrid-rice portfolio. The acquisition of DuPont Professional Products’ insecticide business is a further example of Syngenta’s goal of broadening its service offerings, which may help propel the group towards further growth in what they consider to be vital areas.

The final quarter of the year saw a number of deals close, including Clariant’s divestment of their Textile, Paper and Emulsions businesses to SK Capital, after having undertaken a strategic review in order to identify parts of its portfolio that are ripe for divestment, enabling it to focus on less cyclical areas. The sale represented the largest transaction of the year. Clariant did, however, still have an eye on growth, forming a joint venture based in Singapore with Wilmar International, an Asian agri-business group, which provides access to a new plant in China.

Lower activity levels overall were due in part to firms still digesting some substantial deals undertaken in the previous year. Many sellers also exercised caution, with economic uncertainty preventing them from bringing assets to market at what they would consider to be acceptable valuations. Prospective purchasers were therefore forced to scour the market for assets that remained unattainable.

Management resource across the sector took advantage of a break in large scale M&A activity to streamline processes and refining structures, largely maintaining earnings in a difficult business environment.

Outlook for 2013

The pause in activity in 2012 heightens the prospect of an uplift this year, as some of the larger 2011 deals are being more fully integrated and companies once again actively seeking targets. Indeed, annual reviews across the board indicate acquisitive strategies in the short to medium-term.

The persistent problem will be whether there are any interesting assets for sale, and transaction multiples being driven up by intense competition for such. M&A values will otherwise remain healthy by dealmakers focusing on selective, smaller transactions that focus on unique technologies to strengthen portfolios in the face of megatrends such as enhancing crop yields or the use of renewable materials.

We expect inbound activity to yield a number of interesting transactions, as Swiss technologies and know-how are still highly desirable attributes that many chemicals groups around the world keenly pursue. (Patrick Schaub, Senior Manager, Transaction Services)

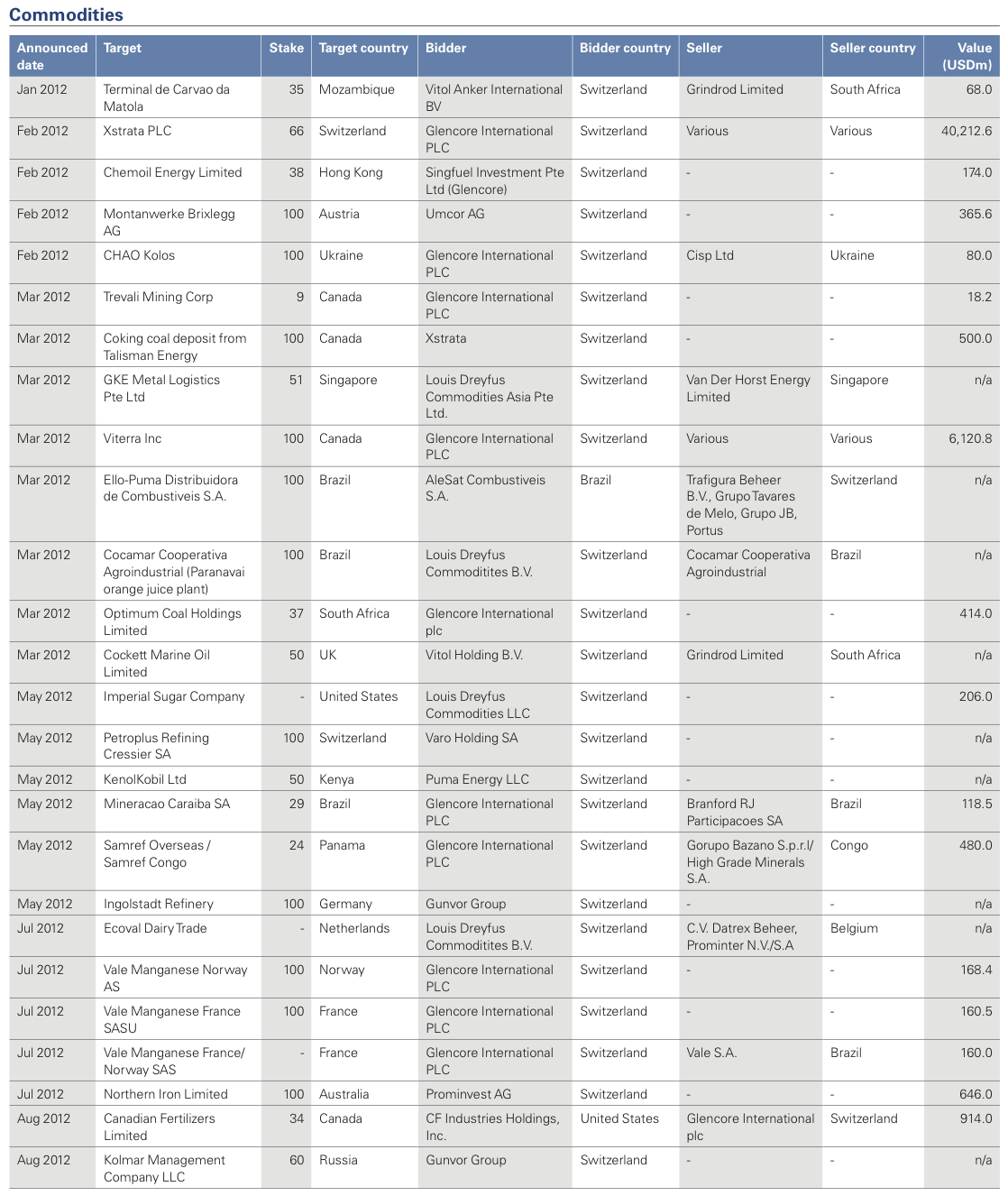

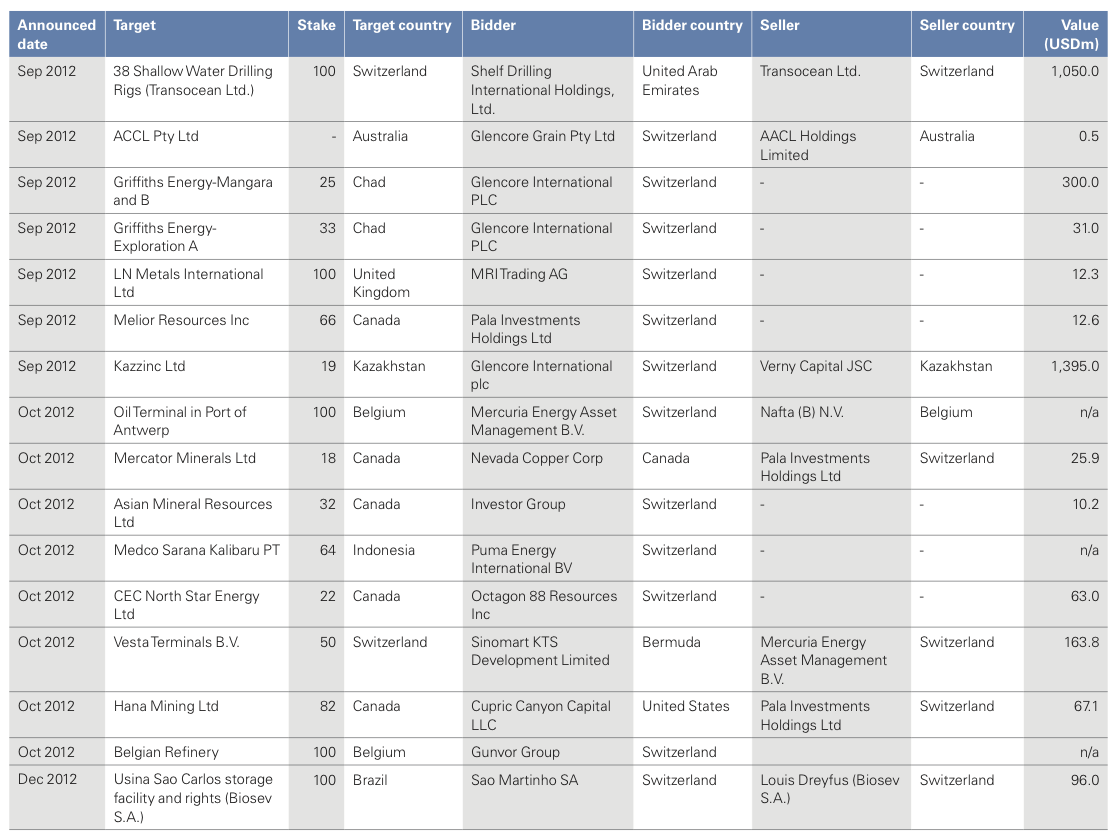

Commodities

The building of a new age in Swiss commodities continued at speed in 2012, with Switzerland placed firmly on the global map as its players seek to diversify their offerings beyond traditional trading activities. Hitting the headlines again was Glencore, this time for its USD 40 billion acquisition of Xstrata. Together with impressive expansion and transformation by Gunvor, Trafigura, Mercuria, Vitol, Louis-Dreyfus Commodities and others, the sector is undergoing a tremendous period of dynamism and expansion.

Traditional commodity players continued to buy assets in their quest to enhance trading profits via greater optionality in their business models, extending revenue sources into upstream production, blending, refining, storage and other logistics services such as freight. With an eye also on geographic and sector diversification, 2012 gave rise to some ground-breaking transactions. The most striking deal was the USD 40.2 billion acquisition of the Xstrata mining group by commodities trading giant Glencore. Far from satisfied with this single transaction, however, Glencore also extended its reach in grain handling services by buying Canada’s Viterra for USD 6 billion as well as increasing its stake in metal miner Kazzinc to almost 70%. Further acquisitions ranged from South Africa to Panama, from France to the Ukraine.

Well-publicised challenges at some of the oil majors prove good hunting ground for other Swiss-based commodity firms such as Vitol. A number of smaller deals by other players, including by Louis-Dreyfus Commodities in the Americas, Singapore and the Netherlands show a host of Swiss firms moving well beyond pure trader status. Oil trader Gunvor has also been extremely active in recent years, most recently acquiring the former Petroplus oil refinery in Ingolstadt, Germany, on the back of purchasing its Antwerp refinery earlier in the year. Meanwhile, Gunvor entered the Russian coal market by acquiring a 60% stake in Kolmar Management through its joint venture with Volga Resources.

Firms continued to prime themselves for expansion, divesting selected assets where appropriate to secure funds and strengthen their balance sheets ahead of acquisitions to drive growth in key areas. Mercuria’s sale of half of its terminals business to a subsidiary of Sinopec, and Arcadia’s sale of storage assets in the US, are types of deal that competitors may emulate as they pursue growth. Indeed, Trafigura’s divestment of 20% of Puma Energy in late 2011 to Angola’s Sinangol preceded Puma’s offer in early 2012 Puma Energy for Kenya’s largest oil marketer Kenokolbil, a deal that had not completed at the time of writing.

Outlook for 2013

Size matters in the commodities business – in particular building a presence and ability to react quickly across all the world’s major physical trading markets. As with Gunvor, Mercuria appears to have set itself the challenge of entering metals trading on a huge scale, a market presently dominated by Glencore and Trafigura. One of the biggest challenges will undoubtedly be building credibility through scale and breaking into suppliers to the effective duopoly. M&A must assuredly be at the heart of such ambitious plans to achieve critical mass, with organic growth proving too slow to be an effective route in the short to medium-term.

The oil majors may be a good source of future deals as they re-focus on oil production, thereby freeing up other assets. There is unlikely to be a lack of prospective acquirers for good assets, especially as it is an area in which some of the biggest players such as Glencore have yet to undertake a large deal, and intense competition may push up prices.

Should volatility return to the commodity markets in 2013, the profits of the major players may be improved yet further, putting them in an enviable position to be the most powerful hunters on the M&A scene. (Pablo Ljaskowsky, Partner, Transaction Services and James Carter, Director, Transaction Services)

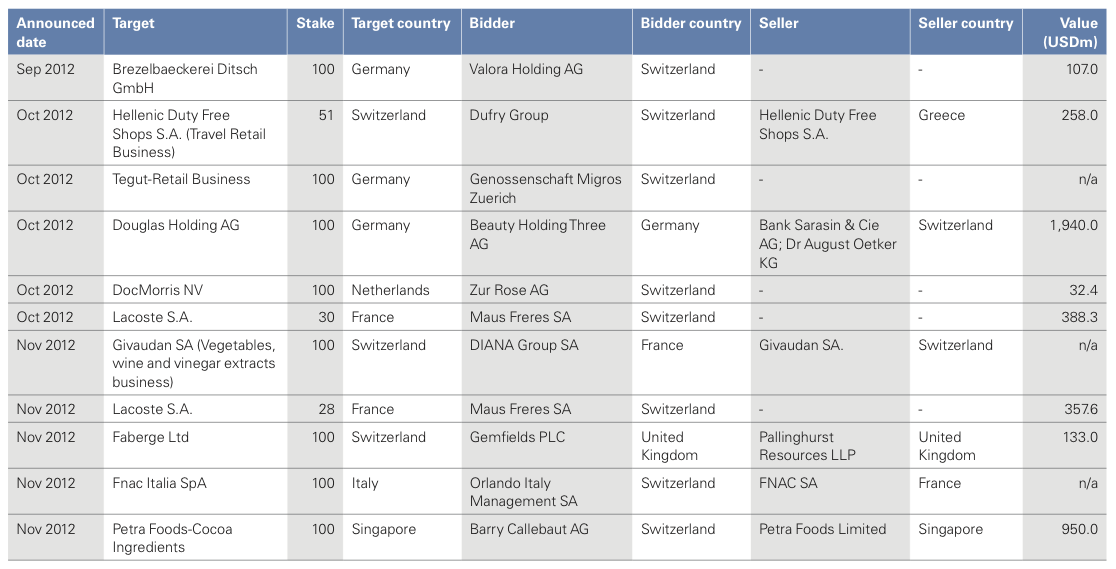

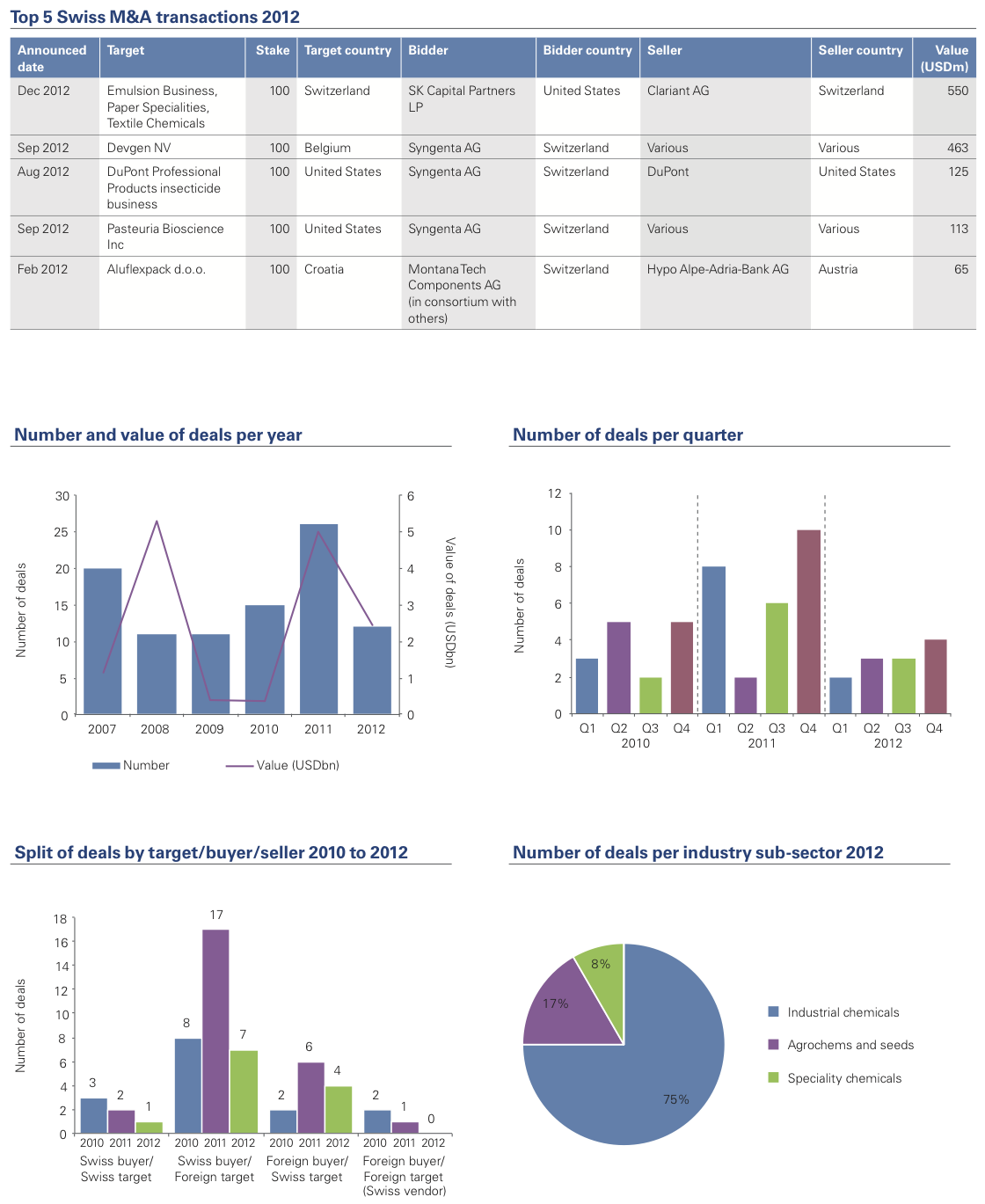

Consumer Markets

Management attention is turning to sustainability, as supply chains and market growth opportunities come under greater scrutiny. Strategic expansion in the high growth markets is a primary concern for those with broader global reach, while many others focus on looking for bargains in the Eurozone economies. Rationalization of excessive brand portfolios is being observed as well as innovation in meeting evolving customer expectations through more convenient shopping and better health food options.

Catapulting Barry Callebaut to a 30% global market share in cocoa processing, the company’s acquisition of Singaporean Petra Food’s cocoa ingredients business serves to boost Callebaut’s presence in Asia and Latin America. Although eclipsed by Nestlé’s USD 11.9 billion acquisition of Pfizer’s Nutrition business, both deals are hugely important for Switzerland’s Food & Drink sector. Each is a sign of major trends in the industry: a quest for scale, especially in high growth markets; and the convergence of the healthcare and food industries to focus on nutritious foodstuffs and wellness products. Taking advantage of opportunities in the struggling Spanish and Italian industries, Emmi stayed on its expansion trajectory. Building its international presence, success was reflected in an 18.4% rise in international sales for the first half of 2012, starkly contrasting with a 4.1% decline in Swiss sales. The deals saw Emmi raise its stake in Spain’s Kaiku to 66% and Italy’s Venchiaredo to 26%.

Following a period of relative quiet, Retailer Migros launched itself once more onto the M&A scene by purchasing 290 German stores from Tegut and raising its stake in Swiss Cash & Carry Angehm from 30% to 80%. As ever in Retail, economies of scale are key contributors to success. It is not only the large grocers that were busy shopping. While Maus Freres was acquiring the remaining 65% of Lacoste that it did not already own, Valora continued its growth plans through the purchase of the Swiss business of Germany’s Bretzelbaeckerei Ditsch.

Disappointing some, Swiss Luxury Goods dealmakers had a quiet year in which transaction volumes were considerably down. Those deals that did complete tended to be smaller, concerned with the sale of brands rather than operations. Despite this, there is no doubt that foreign interest in quality Swiss brands and know-how remains strong. This is unlikely to change as Asian and Latin American markets maintain high growth rates.

Outlook for 2013

The blurring of lines between food, health and wellness businesses will accelerate as Food & Drink players develop their offerings to suit evolving consumer tastes. More formal collaborations between the Food and Healthcare industries, as well as consolidation within and between them, is likely to result from these trends and from the need to meet demographic changes (population growth, an emerging middle class and generally rising wealth and consumption).

Retailers continue searching for new concepts to attract customers. From combining services with restaurants or providing collection facilities for items ordered online, creativity and convenience are key to success. Leading retailers are especially looking to make food shopping a socially interactive affair.

M&A will be led by a need to pursue expansion in the high growth markets; increased focus on supply chain optimization given commodity price rises and sustainability requirements; cleaning up brand portfolios with a future focus on fewer, stronger brands; and continued consumer interest in health and wellness. Balance sheets remain reasonably healthy, though the sector is unlikely to yield many mega-deals in the coming year, with transactions clustering at the smaller end of the market. That said, the largest players such as Nestlé always retain the capacity to surprise and to employ their considerable financial muscle and international presence to conclude any number of landmark deals.

We expect Luxury Goods firms to return to the deal tables in 2013, completing a number of higher profile acquisitions while remaining on the hunt for selected, smaller deals that offer complementary technologies or distribution opportunities. (Patrik Kerler, Partner, Head of M&A)

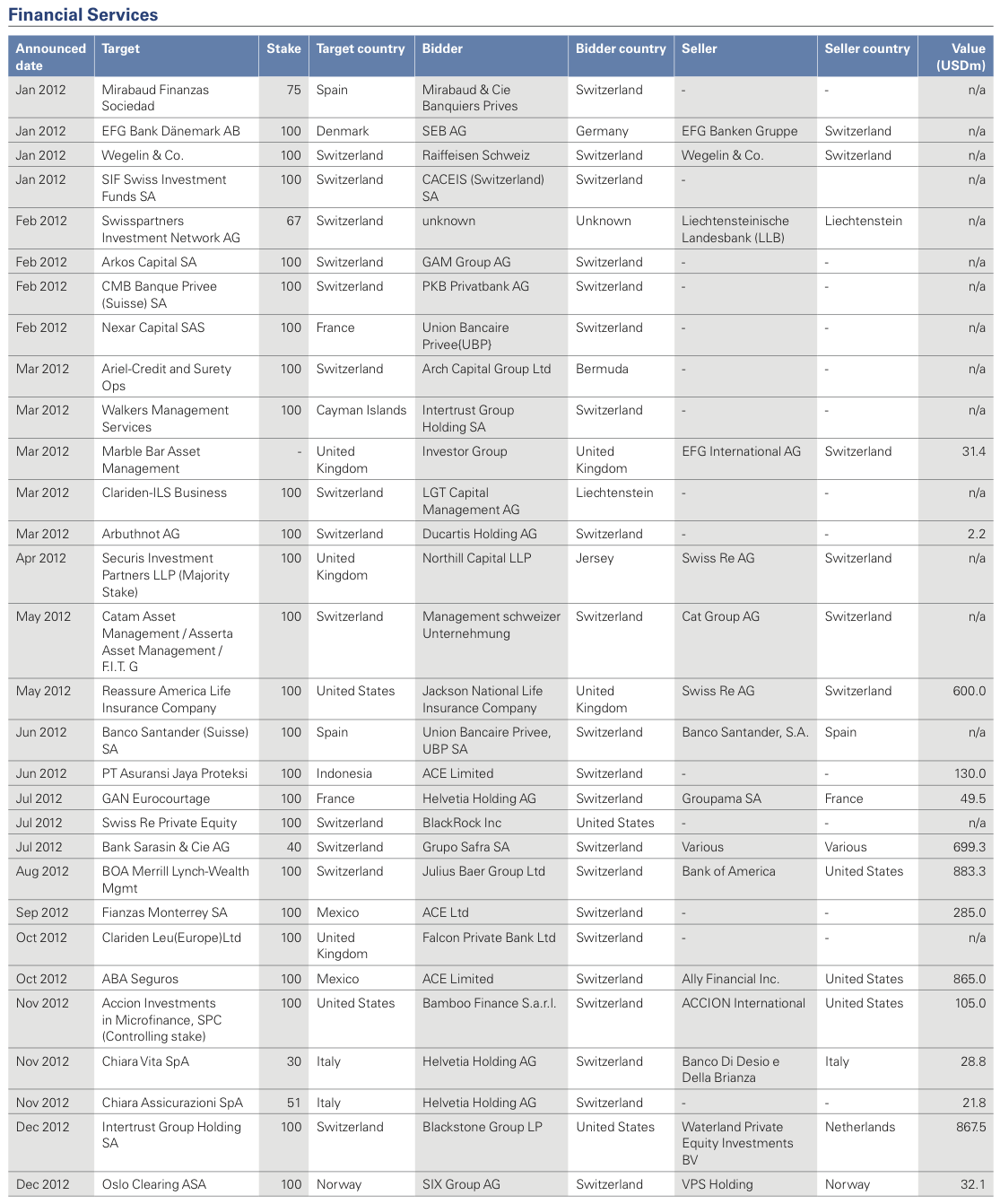

Financial Services

The relative absence from the deal tables of large players such as ZIG, UBS and Credit Suisse, as well as surprisingly low consolidation in the domestic Swiss private banking space, partially explains the slight slowdown in 2012 M&A activity. Julius Baer on the other hand was greatly active, adding significant scale through acquisitions that mark out the bank as an increasingly powerful global contender, while Safra took over Sarasin following a successful public offer. Insurance meanwhile was dominated by ACE’s focus on emerging economies, with key deals in Mexico and Indonesia.

Private Banking and Wealth Management generated greatest interest in the year. While consolidation did not come to pass to the expected extent – a lack of deals in the Swiss small and mid-sized space surprising observers – Julius Baer bucked the trend by concluding some landmark deals. Its purchase of the non-US wealth management business of Bank of America Merrill Lynch added around 50% to the bank’s size at a price tag of USD 900 million. With its acquisition of Bank of China Geneva and its joint venture with Kairos Investment Management in Italy, Julius Baer further strengthened its position in selected core markets. Action by the US Justice Department contributed to another of the year’s more interesting transactions, seeing Wegelin & Co. transfer most of its operations into Notenstein Privatbank, which was sold to Raiffeisen. This shows that even smaller Swiss banks are not safe from foreign regulators’ attention to business practices.

Notably absent from deal tables in 2012 were UBS and Credit Suisse, neither of which undertook any sizeable transactions during the year. Both banks have been undergoing a period of introspection and strategic review.

ACE proved to be the most expansionist Swiss-based Insurer. Eyeing growth in emerging economies, it announced two acquisitions in Mexico and one in Indonesia at a combined deal value of USD 1.3 billion. Swiss Re’s divestment of Reassure America was part of the group’s efforts to strengthen its capital base and refocus its closed life book business on Europe, while Helvetia’s acquisition of France’s GAN Eurocourtage’s maritime insurance business represented the only transactions involving a Swiss mid-tier insurer.

Outlook for 2013

UBS and Credit Suisse are likely to initiate the sale of selected non-core businesses as they seek to satisfy strategic priorities, though they retain the financial muscle to reinforce core businesses with substantial acquisitions should suitable opportunities arise. With pressure on small and medium-sized Private Banks to adjust the focus and size of their operations to align with regulatory requirements, the sale of client books will be more common, reducing the number of jurisdictions in which they are active and compliant. Foreign owners may also divest Swiss operations.The number of private banks in Switzerland fell from 181 in 2005 to 160 in 2011 – this is expected to accelerate.

Independent Asset Managers may be subjected to takeover talks as the sector remains ripe for consolidation due to increasing regulatory requirements, declining profitability and business successions. While we expect to see a few sizable transactions in this space, the majority of deals will be small.

Swiss Retail Banking has seen very low M&A activity, but additional capital and liquidity requirements, margin pressure and lack of growth potential may challenge smaller players. December 2012 saw the news that Valiant and Berner Kantonalbank were discussing a possible merger. Although since called off, this could encourage similar discussions and ultimately consolidation.

As larger Swiss Insurers seek to strengthen their positions outside Europe and North America, mid-sized players are likely to add scale within Europe, organically and inorganically. The domestic Swiss insurance market will probably see little M&A activity, though some exits of foreign-owned and small-scale players. (Christian Hintermann, Partner, Transactions & Restructuring, and Philipp Arnet, Partner, M&A Financial Services)

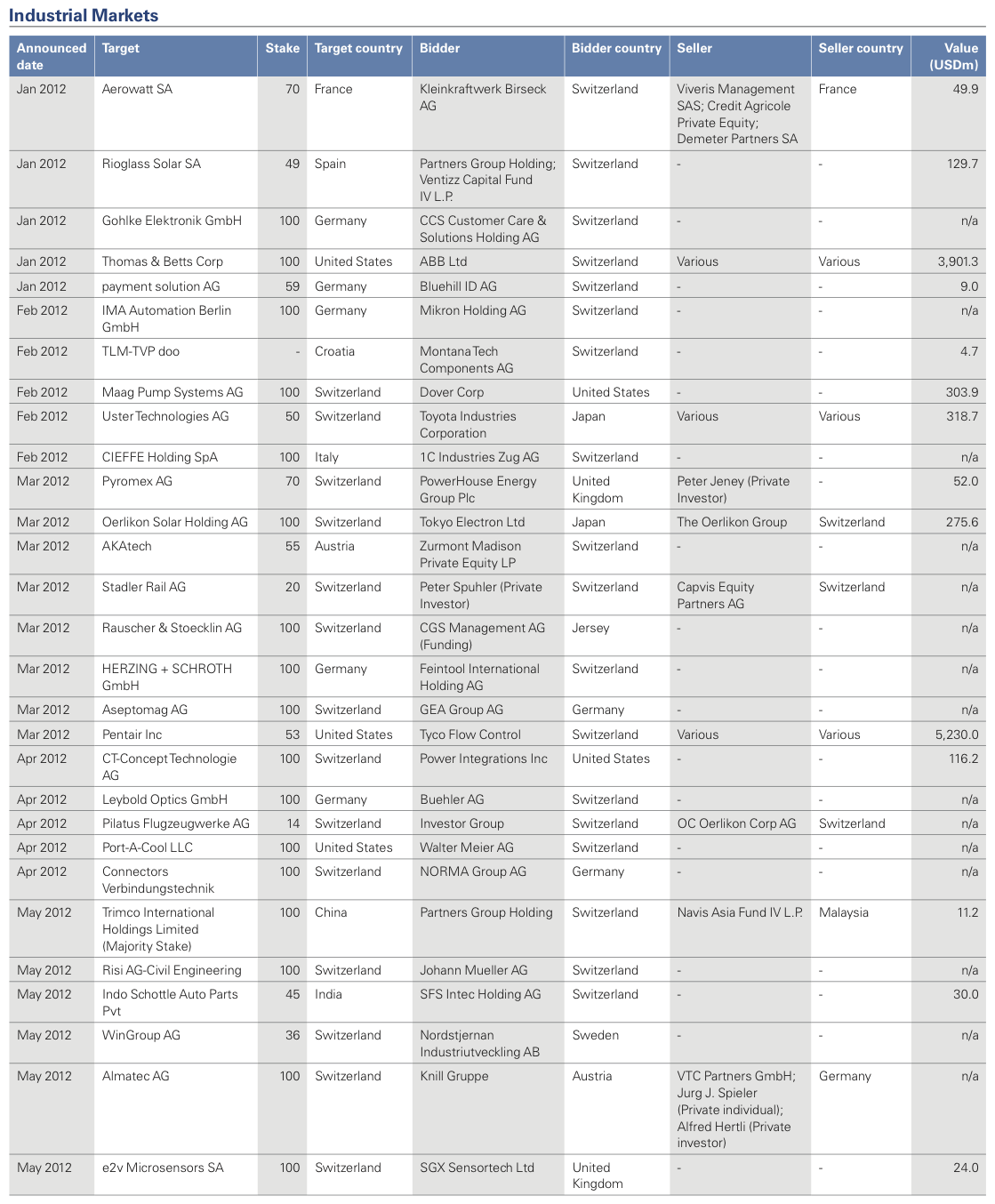

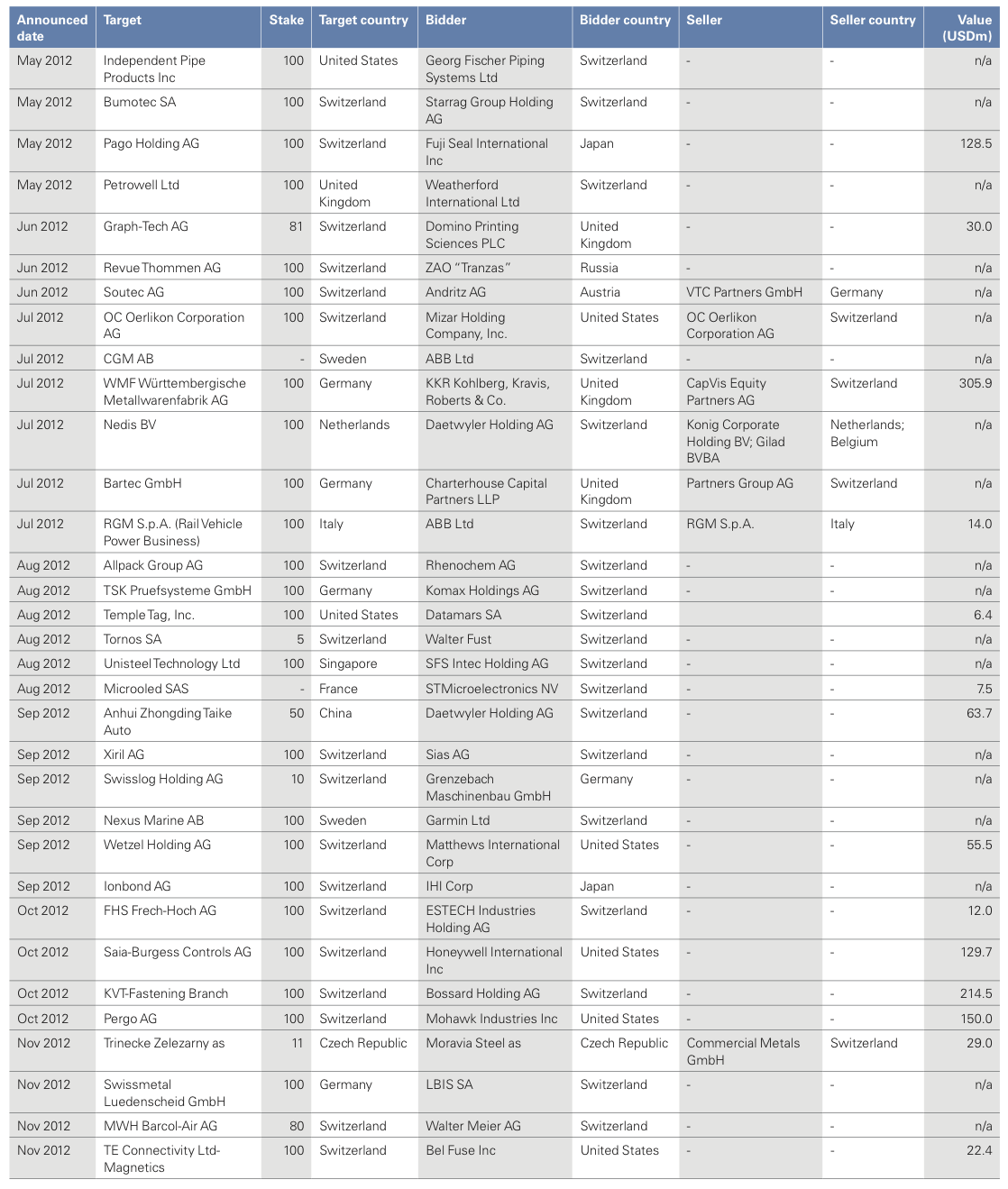

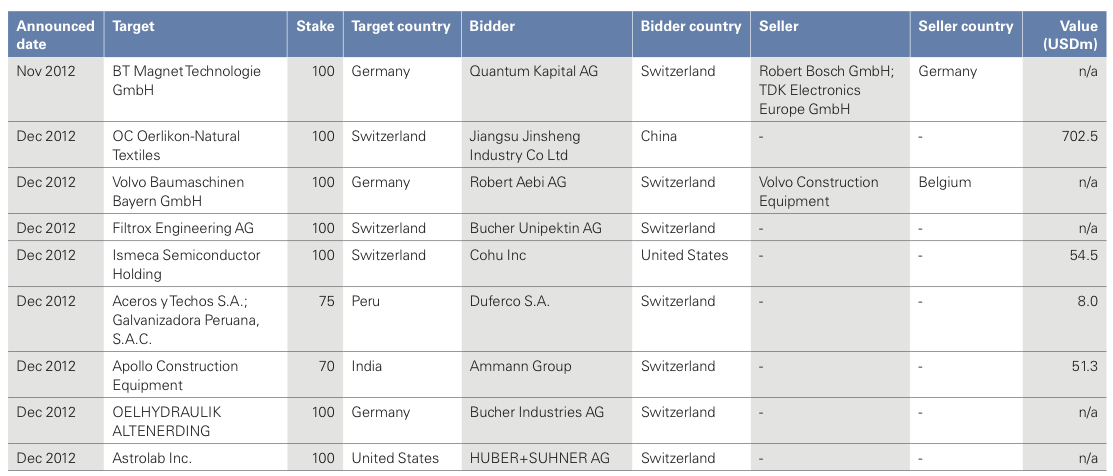

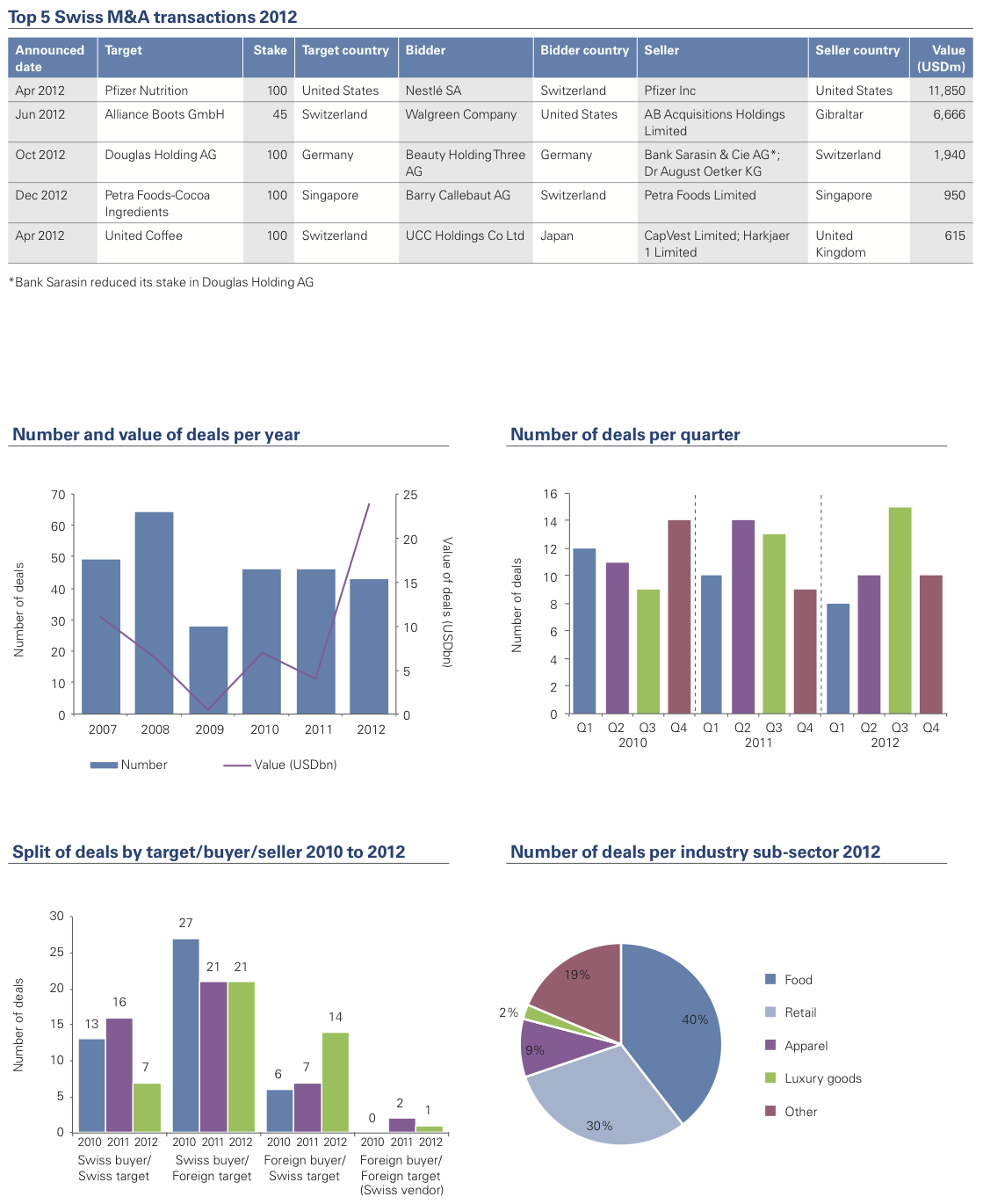

Industrial Markets

At the heart of issues facing Swiss Industrials in these challenging and changing markets is sustainability of earnings. Many small to mid-sized firms have relied in recent years on organic growth and margin protection, which are insufficient to secure future success. Reducing dependency on saturated European markets by orienting towards high growth markets is rational but may be a severe challenge for smaller firms lacking financial resources and direct operational experience in unfamiliar geographies and cultures.

“Could sell, won’t sell” sums up the mood of many high tech firms with strong brands and market niches. Partly protected from negative exchange rate and market trends and at lower risk of being substituted, earnings may be down slightly but continue to generate healthy profits and cash flows. With little incentive to sell – due also to a lack of investment options for sale proceeds – many family-owned companies are awaiting more conducive sale conditions. By contrast, less specialized Swiss industrials had a difficult year. Exports to the Eurozone are the lifeblood of many, and less specialized manufacturers in machinery, components and steel-related industries that compete mainly on price were hit hard. Small and mid-sized family-owned businesses were the most risk-averse in terms of M&A, pursuing organic growth and protective strategies such as improving efficiencies and earnings rather than developing the top line.

Notable inbound deals arose from strong deal rationales coupled with well-funded Asian buyers. Tokyo Electron Ltd acquired OC Oerlikon’s Oerlikon Solar business, giving the Japanese firm access to desirable conversion efficiency technology and – rare in a Swiss business – an opportunity for the buyer to reduce production costs. OC Oerlikon also sold its technical components and natural fiber business to China’s Jinsheng Group while Toyota Industries acquired Uster Technologies. Fuji Seal’s purchase of Pago widened its offering in self-adhesive labels and labelling technology. Previously distressed companies taken over by banks were a further source of activity as results since improved, such as the sale of lonbond by Credit Suisse and Barclays Ventures to Japan’s IHI Corporation.

The outbound picture is more varied. Larger businesses such as ABB continued their inorganic growth strategy by acquiring targets across Latin America, China, India and South-East Asia. Securing distribution or manufacturing facilities closer to their customer base, building a global brand with local production is increasingly key to success. European acquisitions also played a vital role for larger Swiss firms. Technology group Bühler extended its advanced material division by acquiring Germany’s Leybold Optics, for example.

Outlook for 2013

If Eurozone difficulties and limited target availability persist, M&A levels will be comparable to 2012. This may pick up if smaller Swiss firms move to secure product and geographic diversification. Long-term independence depends on occupying a market niche, avoiding product commoditization and gaining access to new intellectual property, qualified workforce and growth markets.

While more specialized firms rely on sizeable cash-generating core businesses, other production cost-sensitive industrials will face significant challenges. Depending on Eurozone developments, another difficult year may prompt difficult decisions over operating models such as outsourcing production to lower cost economies or further automatization of production processes in order to reduce high labor costs. Due to the inherent risks of acquiring in unfamiliar markets, some may decide to enter into strategic alliances with local partners. Some owners, especially those facing succession issues, may decide to divest in 2013.

Larger companies should continue acquiring in high growth economies, also looking for distressed mid-size European firms with value-adding technologies. Targets may arise out of Private Equity portfolio exits as many funds are close to new fundraising rounds. Auction processes should help to sustain prices. (Andreas Poellen, Director, M&A)

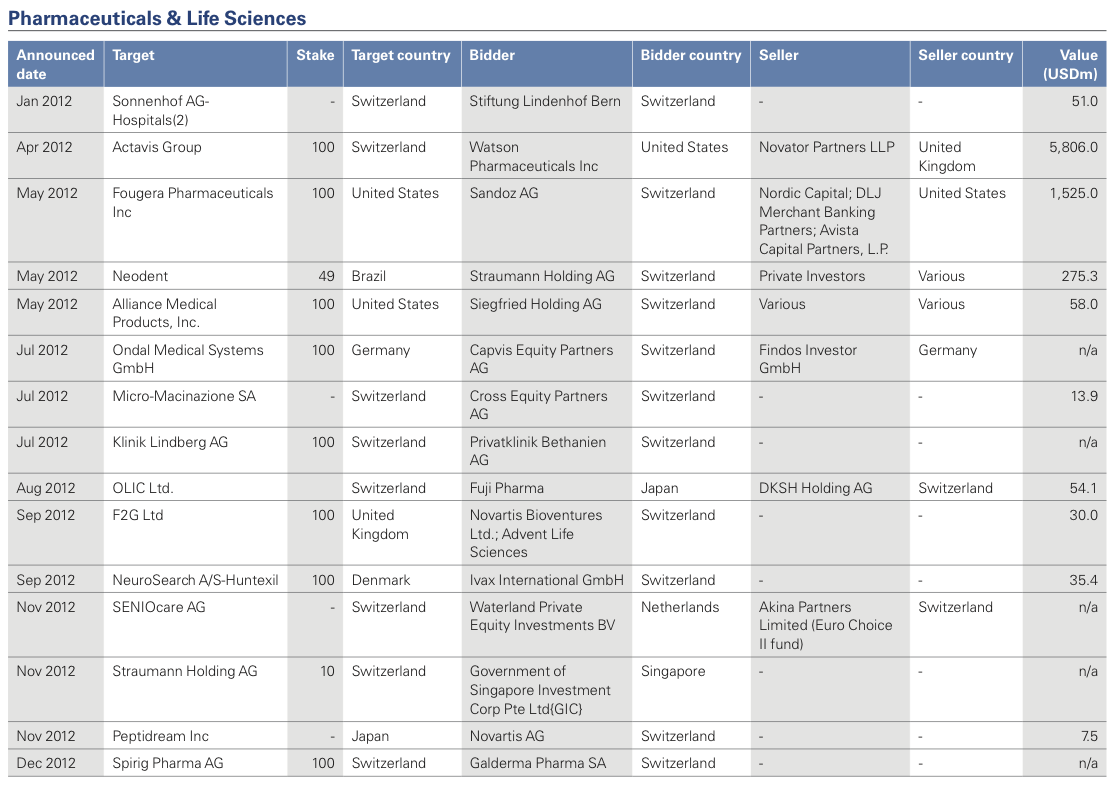

Pharmaceuticals & Life Sciences

With a lot to live up to following a high profile 2011, Pharmaceutical deals once again featured prominently on the Swiss M&A scene in 2012. Two US – Swiss transactions took pride of place, creating the world’s largest generic dermatology player and the world’s third largest generics business respectively. For many Pharmaceutical groups, however, organic growth will continue to be the order of the day as pricing and regulatory pressures cause them to focus on core businesses.

With many of the more obvious larger Pharmaceuticals deals having been completed in 2010 and 2011, last year saw a lack of sizeable assets available on the market. A repeat of deals on the scale of Johnson & Johnson’s acquisition of Synthes and the Takeda Pharmaceutical – Nycomed transaction was therefore unlikely and indeed did not occur. In fact, the five largest Pharmaceuticals deals of 2012 totalled USD 8.8 billion compared to USD 36.4 billion in 2011. Some potentially high profile deals, such as Roche’s expression of interest in Illumina, meanwhile failed to progress.

Of those deals that did take place, some represented truly landmark moves for the players involved. The continued importance of Swiss – US corporate interactions was once more evident, with two transactions in particular significantly impacting the Generics competitive landscape. Watson Pharmaceuticals’ USD 5.5 billion acquisition of Actavis Group created the third largest generics business in the world. Meanwhile, with a price tag of USD 1.5 billion, Sandoz’s purchase of Fougera Pharmaceuticals produced the world’s largest generic dermatology player.

2012 saw a drop in the number of outbound transactions, reflecting that while access to new technologies and products continues to be a common rationale for deals, pure geographic expansion is being assigned a lower priority. While demographic and socio-economic growth in many emerging markets makes them attractive to the sector, the rapid adoption of tough pricing regimes in many such countries is resulting in potential investors exercising greater caution in assessing whether to expand into a new market.

Inbound acquisitions of Swiss Biotech firms by foreign groups also fell significantly, with the usual European and US bidders being deterred by the strong Swiss Franc and ongoing macro-economic troubles in their home markets.

Outlook for 2013

With the patent cliff continuing to loom, M&A remains on the agenda as a means of further diversification as well as margin enhancement. However, the mood among Pharmaceutical dealmakers will continue to be one of caution, with M&A plans reined in by the tough regulatory and pricing backdrop against which firms are operating. Ensuring that attention is fixed firmly on strategic reviews and margin protection rather than inorganic growth, 2013 looks set to be relatively quiet in terms of mega-deals. Any major acquisitions will most likely be cross-border due to the continuing scarcity of Swiss assets for sale.

We expect to see greater caution being observed when acquiring in emerging markets. However, acquisitions bringing complementary products and technologies will be more attractive if they possess an emerging market angle.

Despite this, the largest Swiss Pharmaceutical groups – notably Novartis and Roche – retain considerable firepower that can be directed at inorganic expansion should the right targets cross their paths at the right price. (Joshua Martin, Director, Transaction Services)

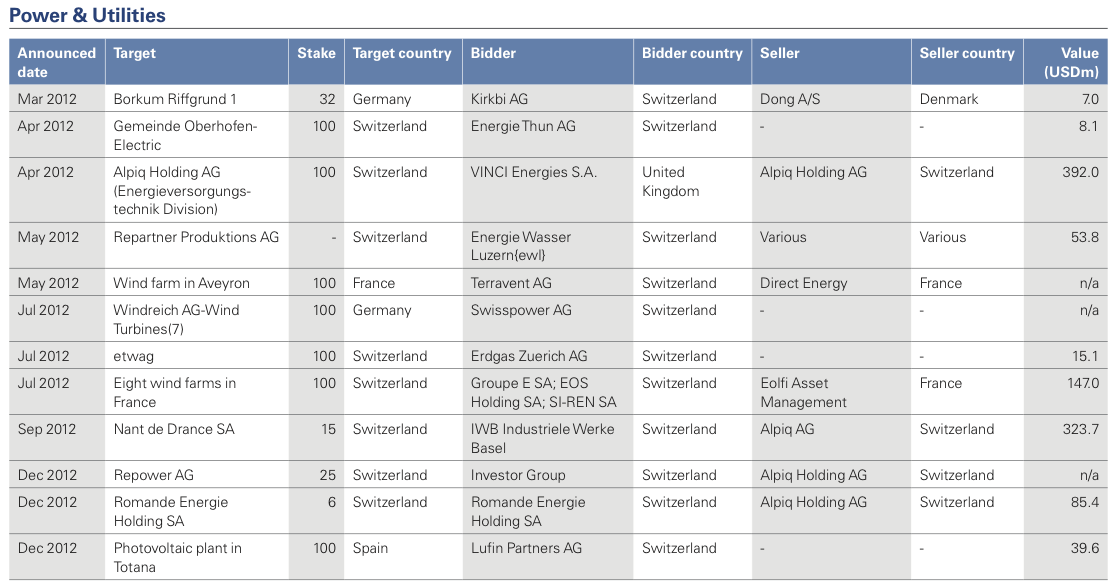

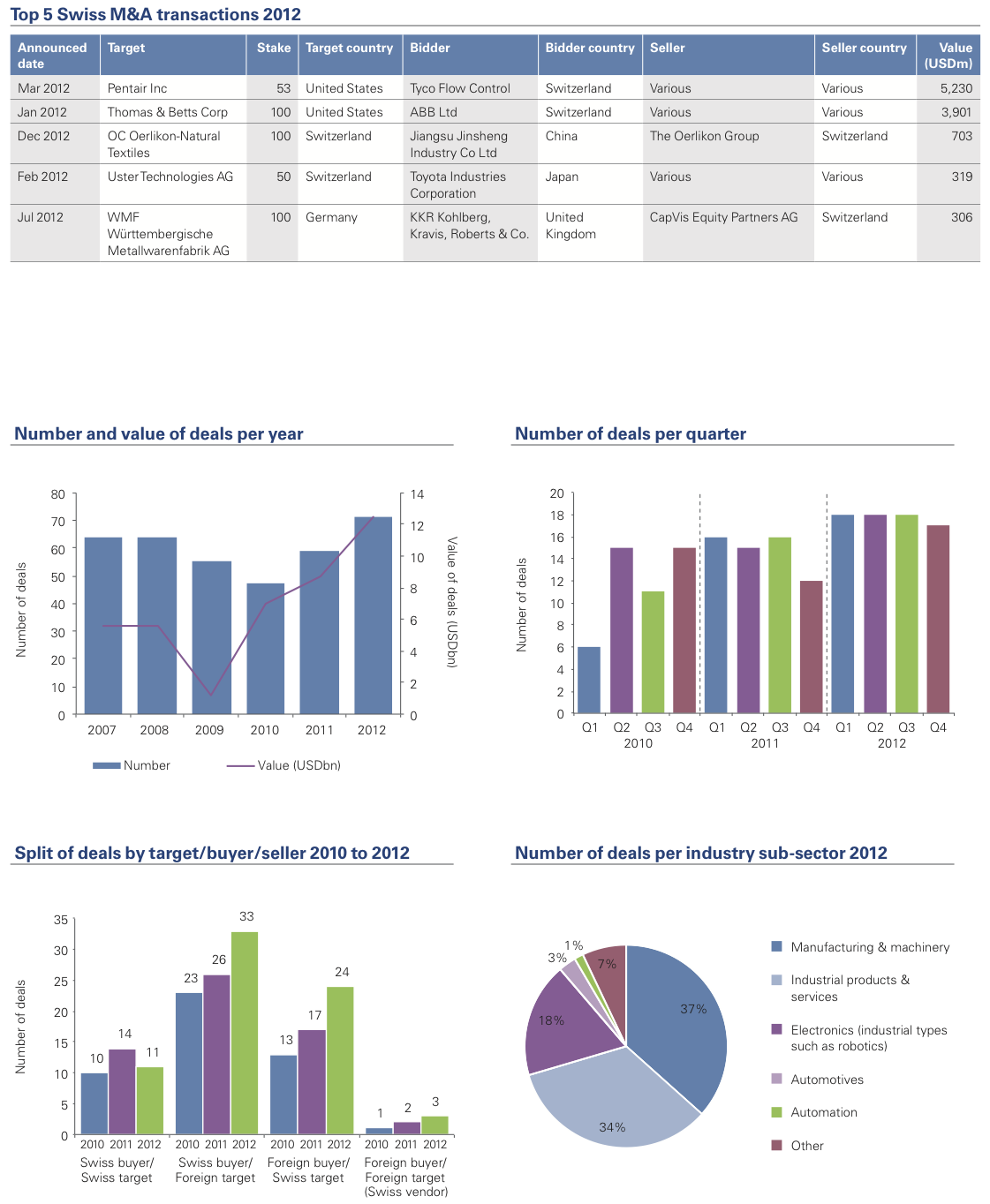

Power & Utilities

Switzerland’s Energy Strategy 2050 looks set to dramatically transform the Power & Utilities sector in the medium-term. Requiring a wholesale shift from nuclear power to predominantly domestic renewable energy, the changes required of energy companies are immense and, along with expected market liberalization, could lead to substantial consolidation.

Outlining the proposed path for energy transition from nuclear to renewables, the Swiss government’s recently released Energy Strategy 2050 has been the subject of much debate. With five nuclear reactors in Switzerland generating around 40% of the country’s current electricity and scheduled to go offline by 2035, significant changes are afoot.

Pressure on firms such as Alpiq, BKW and Axpo stems from their existing heavy investments in nuclear and hydro-electric power. In order to survive under the new rules, they will be required to invest in new renewable plants as well as incurring the costs of transitioning away from nuclear, including dismantling and decontaminating existing facilities.

The potential of large-scale photovoltaic (PV) solar and wind plants is considered by many to be limited due to demographic and geographic considerations. There is also deemed to be insufficient capability and capacity in the National Grid to effectively manage alternative micro-energy production. Many are therefore questioning whether Switzerland even possesses the capacity for energy independence or whether a degree of reliance on energy imports is unavoidable. The answer to this question will hugely impact future M&A strategies.

The historical tendency has been for Swiss energy groups to secure renewable energy production assets outside Switzerland, especially in French and German onshore wind power. Indeed, a number of such transactions arose in 2012 by EOS Holding, Terravent, Swiss Power, on top of previous years’ deals from a range of other power groups including BKW, Alpiq and Axpo.

Not that foreign power projects are all plain sailing. Alpiq’s restructuring comes on the back of sub-optimal performance as some of its foreign assets have failed to meet expectations. As a result, non-core (foreign) assets are being divested in order to focus on the firm’s domestic market, re-establishing it as a predominantly Swiss business.

Outlook for 2013

Legislative changes should give rise to opportunities from supplier industries as the Energy Strategy 2050 looks set to support micro-solar projects such as roof solar panels, requiring supporting technology such as smart controls and metering. As well as boosting significant players in the field such as ABB, this would necessitate power suppliers modifying their business and operating models to accommodate micro-level generation assets, especially smart metering and regulating end-user energy efficiency.

With around 700 power suppliers operating in Switzerland, anticipation of continuing electricity market liberalization will almost certainly trigger substantial consolidation to pare this down to a more sustainable number. How many domestic power suppliers a more liberal market policy could support is open to debate.

In the meantime, industry associations such as Swissmem and Scienceindustries are lobbying the federal government, citing that higher energy prices arising from the Energy Strategy 2050 would jeopardize the long-term competitiveness and sustainability of Swiss industry. Few Swiss groups are therefore likely to place all their bets on the domestic energy market until such arguments are resolved. Cross- border M&A in the renewables space appears to be safe for some years to come. (Sean Peyer, Partner, Head of Power & Utilities)

Private Equity

Thanks to the solid financial performance of many portfolio companies, Private Equity firms were eventually able to divest many assets at attractive valuations in 2012. This is of crucial importance, as 2013 will see new rounds of fund-raising by many Swiss-based Private Equity houses.

Private Equity deal numbers in 2012 will hearten many fund managers, with divestments at good returns as well as exits of poorer performing assets ahead of new fund-raising this year. As predicted in last year’s M&A Yearbook, the hunt resumed for buy-side opportunities, resulting in fewer Swiss proprietary and secondary deals. As a result we saw Swiss houses investing abroad, most notably in Germany, France and Italy.

Competition from corporates continued to intensify. All things being equal, the odds of victory in a head-to-head between Private Equity and a credible corporate bidder are presently stacked in the corporate’s favor.This is in part due to stricter bank lending for Private Equity deals – which looks set to continue in 2013 – but also as corporates continue to become more professional in their deal approaches.

Having narrowed in the first half of 2012, the pricing expectation gap between buyers and sellers widened once more later in the year as uncertain economic prospects made valuations increasingly debatable.

Outlook for 2013

In an environment in which “business as usual” is no longer good enough, it will be interesting to see the level of Swiss Private Equity interest in acquiring in struggling European economies. While there are bargains to be had, valuations are tricky and returns put at risk by potentially volatile or negative market performances. However, a focus on sub-performing economies may be a necessity for a very simple reason – a severe shortage of corporate spin-offs in growing markets. A further source of deals may be corporates teaming up with Private Equity in place of bank loans, with consequent changes to ownership structures.

We expect the beginning of a revival in secondary buy-outs in Switzerland as PE houses exit portfolio investments, realizing proceeds ahead of new fund-raising. Preparatory moves may continue as in 2012’s Global Blue sale by Barclays Capital and the sale of Stadler Rail, Bartec, WMF and parts of KVT by Capvis.

The next round of fund-raising may be more difficult than the last, however. Investors are more demanding, scrutinising from where fund managers expect growth in their portfolios to come. PE houses citing markets in Latin America, Asia and Africa may face investors cautious over management’s track record of operating in such markets without incurring excessive risk. PE houses must become more proactive in the following fields:

• Operational efficiencies and in-house business improvement capabilities

• Continuity within the deal and management teams

• Demonstrate past success as an indicator of future returns to investors

• Transparency, providing more data on portfolio performance and returns.

This last point above may prove a tremendous challenge, though the industry may have no choice given discussions about Private Equity falling under the European Commission’s Alternative Investment Fund Manager’s Directive (AIFMD). Private Equity houses that are perceived not to comply or to be sufficiently transparent may find themselves disadvantaged among potential investors under growing pressure from their own stakeholders.There appears to be some way to go before fund managers are prepared for the looming implementation deadline of July 2013.

Private Equity will remain attractive to family businesses owners, but success may depend on bridging the expectation gap with sellers regarding valuations. (Tobias Valk, Partner, Head of Transaction Services)

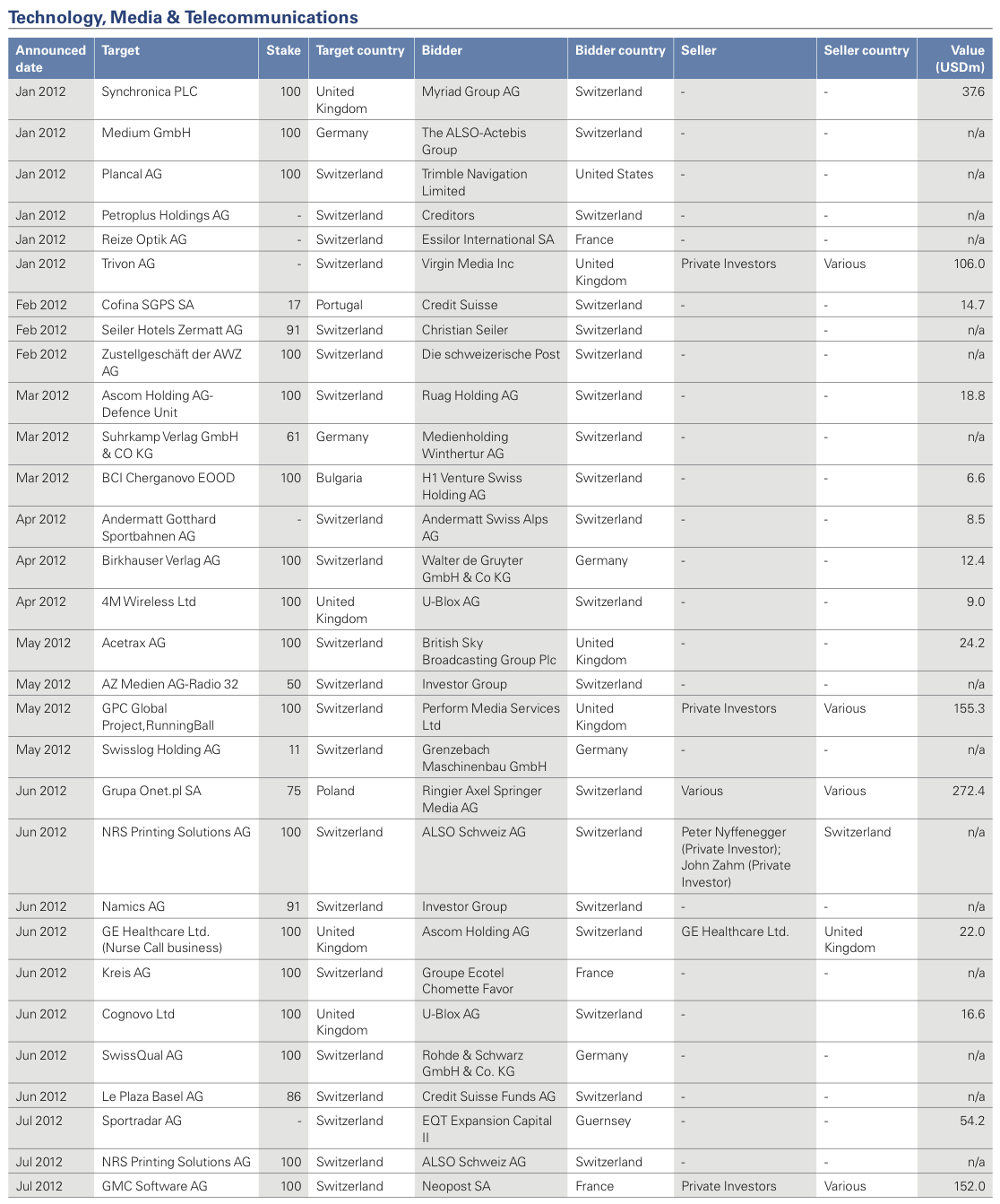

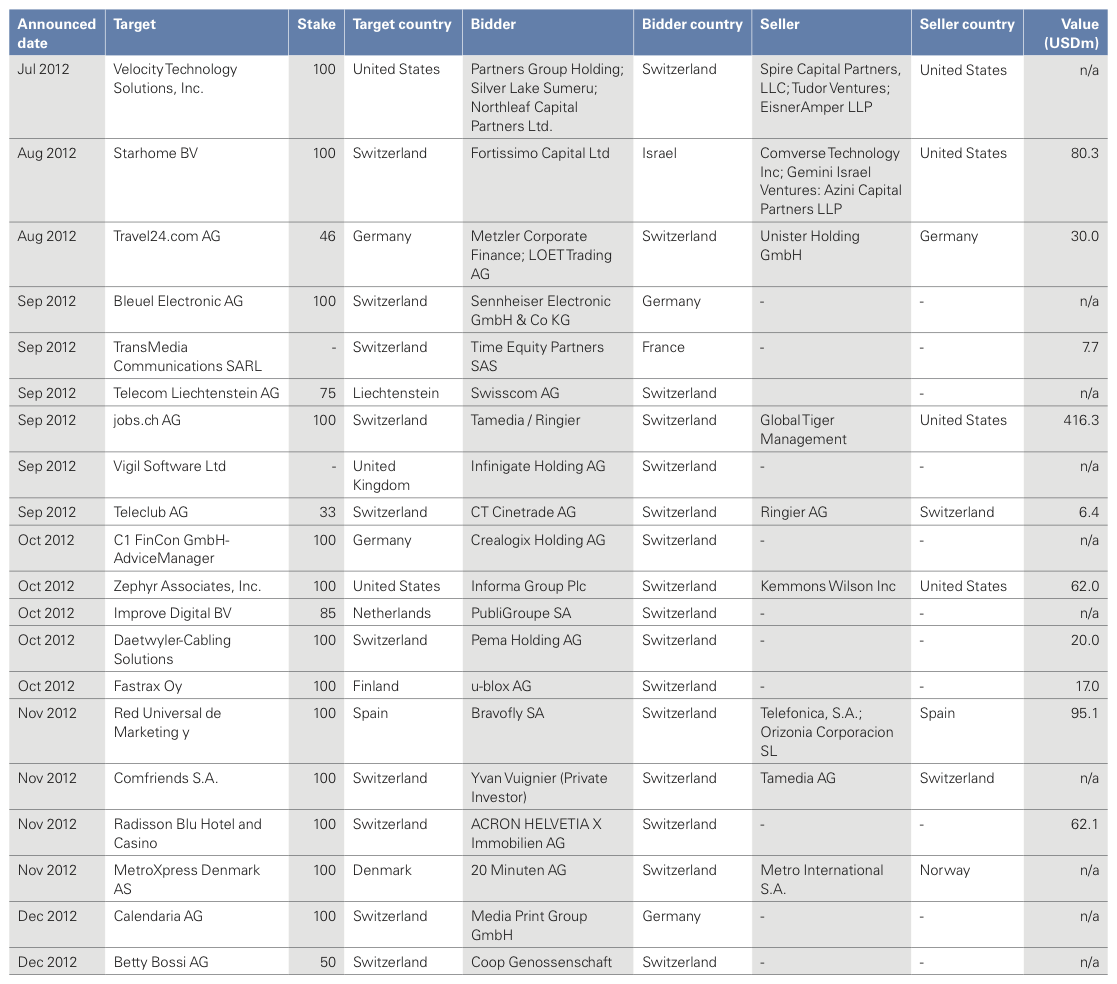

Technology, Media & Telecommunications

The key trends shaping the Technology sector maintained their pace in 2012. These range from an accelerating shift to mobile applications (driven by smartphone and tablet penetration), social networking, eCommerce expansion, big data analytics, and cloud computing (in turn driving deals around security solutions and Software as a Service (SaaS)), among others. 2013 could augur an increase in industry-specific developments (e.g. banking, health, logistics) as corporates seek to leverage productivity gains generated through TMT.

While deal volumes across TMT held reasonably firm, transactions tended towards lower values, reflecting the absence of typically larger Telecoms and Semi-conductor transactions. A couple of sizeable Private Equity-led Telecoms buy-outs in 2011 were the precursor of reduced activity in 2012 as available assets remained scarce and funds devoted time to streamlining and restructuring their assets. Swisscom did remain on the hunt for acquisitions, however: primarily its planned purchase of 75% of Telecom Liechtenstein in addition to acquiring a 33% stake in Ringier’s Teleclub through subsidiary Cinetrade. In the Semi-conductor market, Swiss fabless module solution providers continued to extend their portfolios. u-blox completed three acquisitions to strengthen its leading role in the positioning sector.

Deal volumes in Technology and Software recovered somewhat with activity being driven largely by European and US players and boosted by an accelerating demand for apps and tablets and integration of these elements. Cloud computing injected further energy into the sector, driving deals across data centers, security solutions and Software as a Service (SaaS). Combined, these factors are encouraging more formal collaboration between firms. Most progress appears to be being made by US-based firms such as Google, Oracle, Apple and Cisco, with consequent deals in Europe also being driven by the success of these players. The downturn in the global photovoltaic market added a negative note toTechnology, meanwhile, with many firms either exiting the area or restructuring their operations to meet the challenges of a shrinking market in the short-term.

The hunt remains on for ever-more effective linkages between social networking and eCommerce, such as cross-promotions to encourage customers to visit online stores through featured advertisements and links. In fact, the ecommerce space was the setting for a number of interesting transactions over the course of the year such as the acquisition of immostreet.ch, travel24.com and jobs.ch.

Outlook for 2013

Caution over asset values will persist for the foreseeable future, especially while a Eurozone recovery remains questionable. Swiss firms will nonetheless remain at the deal tables, with dealmakers seeking acquisitions that will bolster international presence, particularly in the US and high growth Asian markets. Activity will not necessarily translate into mega-deals, however. Many players such as Ascom will pursue predominantly smaller bolt-on acquisitions as they migrate towards their strategic objectives. On the back of improving results and benefiting from some restructuring in 2012, Kudelski could also have capacity to undertake acquisitions as it looks to strengthen its offering in the wider conditional access market. Interest in conditional access firms is strengthened on the heels of Cisco’s acquisition of NDS in 2012.

Posting double-digit growth in Europe and the Americas in the first half of 2012, u-blox is likely to continue actively hunting selected, smaller targets, perhaps building on its success in positioning and wireless products in the Americas and navigation products globally. Given its announced exit from the ST-Ericsson joint venture, ST Microelectronics could also move to strengthen its market position.

As big data analytics take on an increasing role in IT strategy, executives are being prompted to consider vertical integration into Technology firms. Healthcare, advertising and banking players have already made moves in this direction, which could become an expanding trend. (James Carter, Director, Transaction Services)

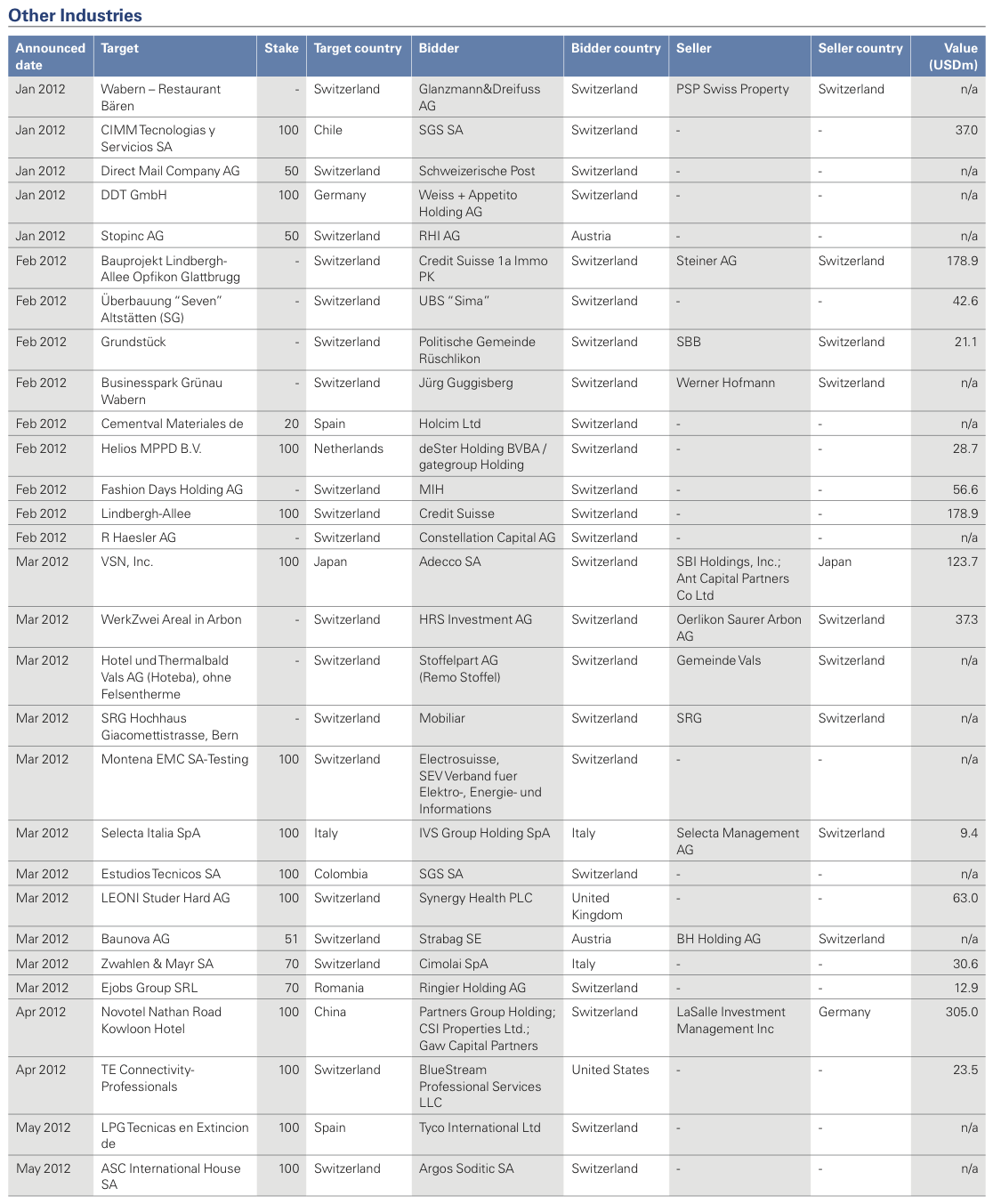

Other Industries

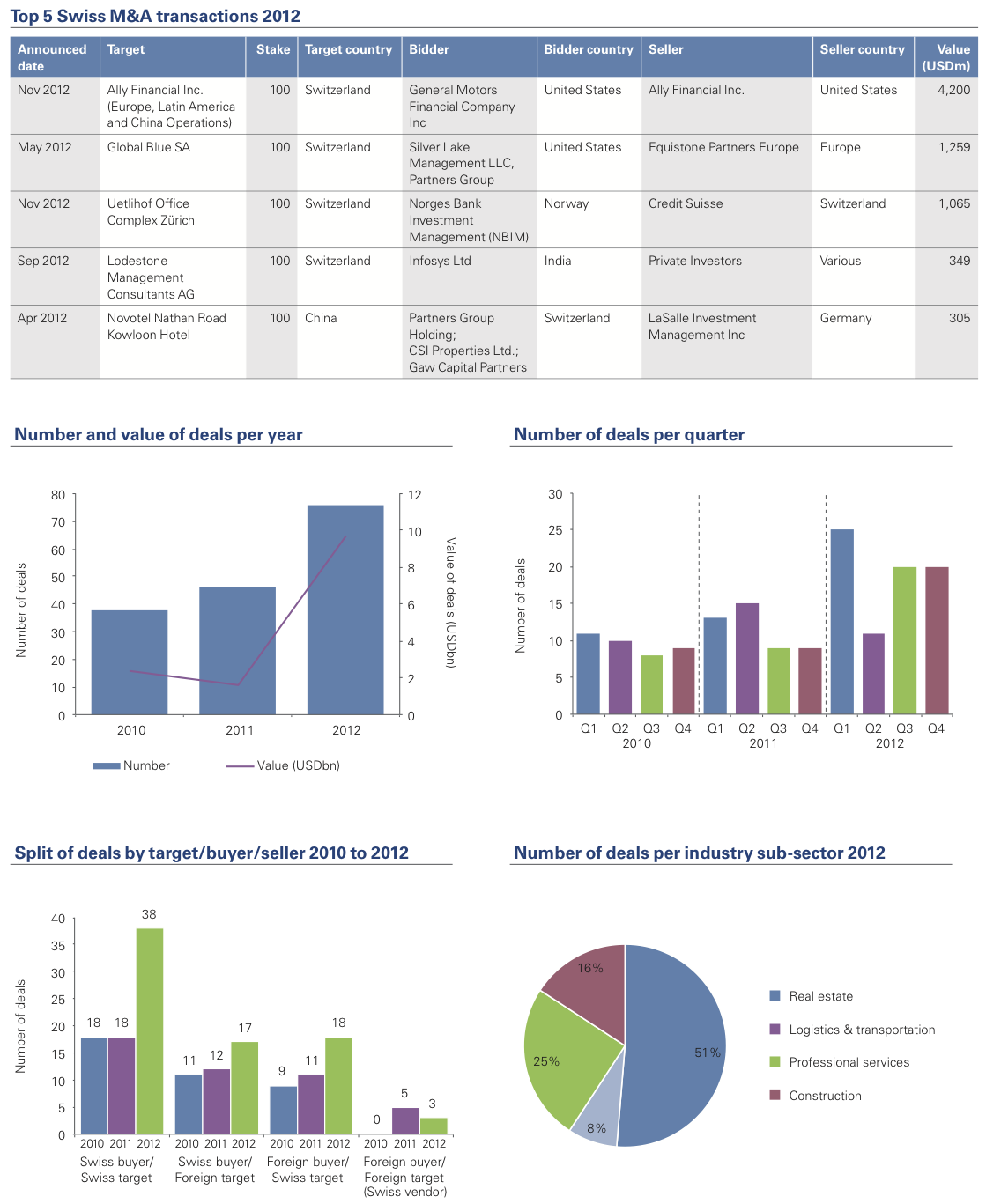

As some logistics groups seized opportunities thrown up by the struggling Eurozone economies, the usual Transportation and Logistics suspects were missing from the M&A action due to being adversely affected by macro-economic conditions in Switzerland’s neighbors. SGS meanwhile maintained its track record of acquisitions as it continues to pursue global expansion.

A year in which deal volumes and values were up substantially over 2010 – 2011 saw notable absences from the deal tables.The Transportation and Logistics sector was largely inactive, with typically serial dealmakers such as Kuehne & Nagel and Panalpina showing reluctance to enter the M&A arena. Much emphasis on protecting margins and achieving efficiencies may yield future consolidation opportunities, but in 2012 it was not to be. Rather than expanding operations, many firms actually sought to outsource more of their activities.

Some Swiss groups did act upon opportunities thrown up by the more struggling Eurozone economies. Swissport’s acquisition of Flightcare from Spain’s FCC Versia is one example, extending its reach in Spain and Belgium. Swissport’s confidence is no doubt encouraged by airports’ forecasts of tremendous passenger growth over the coming decades, which will require substantial additional services such as catering, security and ground handling. This in turn requires the building of all-important scale if market and customer demands are to be met and economies of scale achieved. Especially as competition in the sector remains intense, raising the prospect of significant consolidation in the short to medium-term.

Of the larger Professional Services firms, Adecco maintained a low M&A profile in a recruitment market hit by contracting demand for contract and temporary workers. Showing that some think inorganic growth is the best means of expansion in such a tight market, Adecco’s only acquisition of the year was of Japan’s VSN, offering synergy potential and the prospect of significantly expanding Adecco’s Japanese revenues. In a Swiss – Asian transaction in the opposite direction, Lodestone Professional Services succumbed to a takeover by India’s Infosys. Although a relatively small deal at USD 349 million, this is a key step by India’s IT giant to enhance its focus on higher end business. SGS continued as a reliable serial dealmaker, completing more than 15 deals over the course of the year as part of its stated 2014 growth strategy.

Outlook for 2013

A degree of recovery in the Eurozone could inject a dose of deal-making confidence into Transportation and Logistics firms Panalpina and Kuehne & Nagel among others, giving them the boost they need to return to the acquisition trail. Changing consumer buying habits – in particular the continuing trend towards online retail – has capacity to provide considerable additional opportunities for logistics firms in providing higher volumes of swift, reliable deliveries. Scale can be key to such activities, leading to consolidation in the sector.

In the struggling Eurozone, the degree of competition in the impending sale of Portugal’s Lisbon, Porto and Faro airports could be interesting, with Zurich airport being among the bidders.

Working hard to meet demand for new residential and commercial properties – especially in Grade A locations such as Zurich, Geneva and Basel – the Construction industry looks set to post another successful year in 2013. Consolidation is unlikely to be the order of the day, however, in an industry that is generally performing well. Any deals are likely to be at the smaller end of the market. Larger deals are only likely to be triggered by cuts in infrastructure spending say in Switzerland’s neighboring countries.

In Professional Services, SGS will continue on its acquisition drive as it seeks to achieve its robust sales targets through a combination of organic and inorganic expansion. (Rolf Langenegger, Director, Valuation Services)

Hot property: Opportunities and risks in Swiss Real Estate

Yet another year of historically low interest rates prompted continuing interest in Real Estate investments. With yield spreads and refinancing conditions remaining attractive, we observed a flight to core, quality real estate assets, with both private and institutional investors allocating funds to property as a steady and predictable investment opportunity where risk-adjusted returns can out-strip equity markets.

Attractive to most investor classes

Record prices are being observed in Grade A locations, with Swiss centers of economic gravity attracting investment and high levels of construction activity. Residential buildings are in particular demand. However, the overall high performing nature of the sector masks extremes – exceptionally high activity in the top locations but balanced with low levels of interest in more peripheral, sparsely populated, non-commercial centers.

Our 2012 “Swiss Real Estate Sentiment Index” cited a scarcity in the residential segment and strong interest in well- located and long-leased commercial properties. Far from demand being confined to institutional investors who see real estate as a substitute for bonds, private investors are also seeking more lucrative investments than those found on volatile stock markets and in an environment of persistently low interest rates.

Insurance groups and pension funds in particular have been getting in on the action, the latter increasing their allocation in real estate from around 10% in 2005 to an average of 20% in 2012.

Confidence in the segment has been further boosted by the successful public listing of Zug Estates on the SIX and capital raising of several companies such as SPS and Allreal. The trend to securitization continued with UBS, Swisslife and Helvetia spending time and resource in 2012 launching new real estate foundations and funds. Cross-over investments were again a topic in the market, with Zurich (ZIG) raising capital for a European Core Fund to diversify the often home-bound allocation in the sector.

An interesting field will be the healthcare market where investment encouraged by recent Swiss legislation promoting economic independence will lead to new financing schemes for hospitals. Many facilities are in need of funds, which will henceforth come from the private sector rather than the public purse.

Investment activity remained predominantly domestic, with only a few (though prominent) transactions involving foreign capital. Credit Suisse sold its main banking hub in Zurich to the NBIM (Norges Bank Investment Management) acting for the Norwegian sovereign wealth fund for CHF1 billion. Meanwhile in the leisure sector, a Qatari body purchased Hotel Atlantis in Zurich and a Chinese investor acquired Frutt Lodge & Spa. Interesting activity has also been seen in Züblin Immobilien Holding with Viktor Vekselberg increasing his holding in the company.

Cooling down a hot market

In such conditions, prices have continued to rise, prompting an ongoing discourse between the Swiss National Bank (SNB), the federal government and analysts over whether the real estate market is sound or is becoming overheated.

Current discussions focus on the possible introduction of a Countercyclical Capital Buffer to calm the markets by mandating banks to require a greater proportion of equity in mortgage lending.

Further, tightened regulations might lead to higher costs of capital, thereby calming the property market but representing potentially bad news for heavily committed investors.

Risk-aversion prevails

Money is not simply being thrown at real estate in an unquestioning manner, however. Hidden away in the detail of the sector’s strong performance are often discounted properties of lower quality. Indeed, the market is becoming generally more risk-averse, with investors exercising considerable caution over the assets in which they seek to invest. While investors generally do not expect a sudden rise in interest rates, they are keeping a keen eye out for any signs of an economic slowdown. In this, attention is very much focused on any structural impacts from the European debt crisis and whether there will be economic contagion from the growing list of struggling Eurozone economies.

At the core of these considerations is a concern that real estate revenues may decline due to payment shortfalls by commercial or residential tenants, impacted also by falling turnover in the retail segment due to the strength of the Swiss Franc.

Industry observers and participants alike are on the alert for indicators of regional oversupply, closely scrutinizing the construction industry and broader market developments. While investors are generally prepared to take on calculated risks, but they are demanding a higher yield if cash flows relating to the property are not secured.

Future focus on residential

These trends and lower growth expectations are causing commercial properties in particular to be subjected to more rigorous appraisal, and a worsening of economic conditions would most likely prevent prices from rising substantially further. We therefore expect commercial property prices to stabilize, while residential buildings remain the main focus of investment activity, with prices in central locations continuing to climb.

Simultaneously, the recent boom in private mortgages looks set to slow down as banks become more restrictive in their lending and consumers become increasingly prudent. Stability is the watchword – smashed only if there are dramatic macro-economic developments in Switzerland and the Eurozone and/or if interest rates substantially change, encouraging funds to seek alternative investments.

While activity is almost certain to remain high in 2013, buyers will become increasingly critical of assets and more reserved in the prices they are prepared to pay. (Ulrich Prien, Partner, Head of Real Estate)

Evolve or dissolve: M&A in a world of change

In a relatively protected and affluent environment, it can be easy to forget that Switzerland is part of a hugely dynamic globalized system of economies, industries, political and social systems. Yet major Swiss firms provide a constant reminder of Switzerland’s interactions and inter-dependencies with the rest of the world. Representing some of the world’s largest businesses in their respective fields, they not only operate in a multitude of economies and cultures, but also employ countless Swiss and foreign nationals here at home.

The possibilities to which these inter-dependencies give rise are hugely varied. Events far from Switzerland’s borders can have significant implications for our businesses. Floods in Thailand; the tragic events surrounding Fukushima in Japan; the opening up of Myanmar to foreign trade and investment; changes in attitude in and towards North Africa and the Middle East in the aftermath of the Arab Spring; the increasing frequency and severity of extreme weather events as a result of climate change… Opportunities and threats constantly arise and evolve, impacting directly owned operations as well as the entire length of the supply chain.

And that is before we come to technological developments that are reshaping the way we do business and communicate. Every generation tends to believe that life is changing faster than ever before, but consider the fundamental changes experienced over the past decade in the way we live and work – and the evolutions in mobile technology that continue to accelerate.

Beware the company that thinks it is safe and that it can stand still, “secure” in its reputation and the quality of its brand. For events constantly demonstrate to us the inter-connected nature of the global economy and the rapid pace with which events can outpace corporate approaches.

Thank goodness we live in Switzerland

In the midst of this upheaval, Switzerland has the good fortune to appear a harbor of wealth, peace and political stability. Despite complex challenges arising from the Swiss Franc / Euro exchange rate, pressures on export industries and the reshaping of the financial industry, confidence remains strong as the economy continues to grow. It may often seem as though Switzerland develops against the odds – BIP growth is estimated at 1.3% for 2013, which for many Eurozone companies would be a dream come true given present conditions.

A renewed economic crisis would hit not only the usual suspects.The Greeks, Portuguese, Italians and Spaniards already face a critical situation. After that it may well be the French, whereupon even the Germans may be vulnerable. And occurrences in Germany have a tendency to spill over into Switzerland given the closeness of the two economies. Ongoing problems in the European capital markets could therefore spell significant trouble for Switzerland, whose export-oriented industry is exposed given record real estate prices and high labor costs. However, Swiss businesses have the potential to come out of the crisis stronger than those of most other Western nations thanks to relatively strong balance sheets and high levels of liquidity, as well as the international association of Swiss goods with quality and reliability.

Keep your friends close but your enemies closer

Some of the drivers of Switzerland’s perceived success come at a bad moment in European affairs, however. Inter alia, the refusal of the German Bundestag to ratify the proposed tax agreement with Switzerland, issues surrounding flight paths in and out of Zurich airport and upcoming negotiations concerning the free movement of people with the EU’s new member state, Croatia. Now is not the best time for foreign governments to notice companies seeking tax advantage in the Swiss Cantons. Migration to Switzerland such as that seen by Coca-Cola Hellenic or the rapid growth of the commodities businesses around Zug and Geneva/Lausanne have the capacity to excite passions among economies that are struggling for tax revenues, triggering sharp responses and counter-actions by EU member states.

Governments and publics are indeed becoming more vocal in their sentiments towards multi-nationals’ tax structures, most notably in the US and UK where the media is full of reports of major global firms paying close to zero tax on hundreds of millions of dollars turnovers in a given jurisdiction. Outrage against corporates minimizing their tax bills when ordinary citizens are facing severe austerity measures could easily turn to anger against the governments seen to be offering refuge.

It is not difficult to see how quickly things can change or how advantage can be used as a basis for criticism and action. While no-one is suggesting that the Swiss economy will suddenly become an international pariah and its businesses suffer hugely, the fact is that we must all be ready to deal with change, and indeed embrace it.

The CEO’s challenge: M&A as true corporate development What do visionary CEOs seek to do in a restless and instable market? Control costs? Of course. Move to secure profits and avoid unnecessary risks?Yes, certainly. But most of all they will think about where their businesses can generate new and additional earnings in the years to come. They determine how to hedge their bets and how their company can not only survive the current crisis but also seize previously unrealized opportunities to stride forward and emerge as a market leader when the crisis has past.

Achieving efficiencies, product development and organic growth are all key elements, but more fundamental and radical changes may ultimately require an M&A transaction. Whether through a landmark deal, a solid bolt-on acquisition or a divestiture, optimizing assets and product portfolios is key to the sustainable long-term development and positioning of a successful company. The TMT sector is a classic example of this. Some years ago, Nokia was king of the mobile telephone universe, controlling the mobile market and being praised by the financial community and industry observes for their innovation, success and unbreakable market position. However, typical in any dynamic landscape, competitors such as Apple – for some time a perceived “cheap” potential takeover target – were busy being creative behind the scenes, eventually launching products that not only rivalled but leapfrogged existing handsets in terms of style, usability and desirability, almost decimating Nokia’s presence in the mobile market.

Progressive thinkers across many industries have become experts at seeking out and acquiring smaller players with bright ideas or competitors with complementary technologies. Recognizing that they must stay one step ahead of the market, or preferably drive the market changes themselves, they are never satisfied with the know-how their company currently possesses, always thinking – and in fact knowing – that a start-up somewhere will have an idea that becomes the next big thing, whether in media or in biotech, to name but two.

Retaining the lead

M&A is, and will remain, at the heart of business strategies. This is as true for mid-sized Swiss businesses as it is for the largest entities. New customers must be found, market entry secured, market share built. For all but the lucky few, this is a task that cannot be achieved through organic growth alone.

The leading Swiss companies have generally shown tremendous vision and strategic logic in undertaking transactions. Such opportunities are also open to mid-market businesses that might use M&A as a tool for injecting entrepreneurism and new capabilities.

Swiss players can, do and should take a leading role in the global M&A market, focusing on:

• Portfolio optimization to achieve true focus

• Acquiring sustainable growth opportunities

• Securing market positions (defensive M&A) and occupying new, high potential markets.

In a restless and ever-changing world, it is often the company that can respond quickest that will succeed – the company that can obtain access to new technologies and secure admission to new markets. M&A is not the solution to all ills, but compared to its sluggish cousin, organic growth, it can offer speed, dynamism and an injection of new competitive advantage when it is most needed. (Patrik Kerler, Partner, Head of M&A and Stefan Kuhn, Partner, Head of M&A Tax)

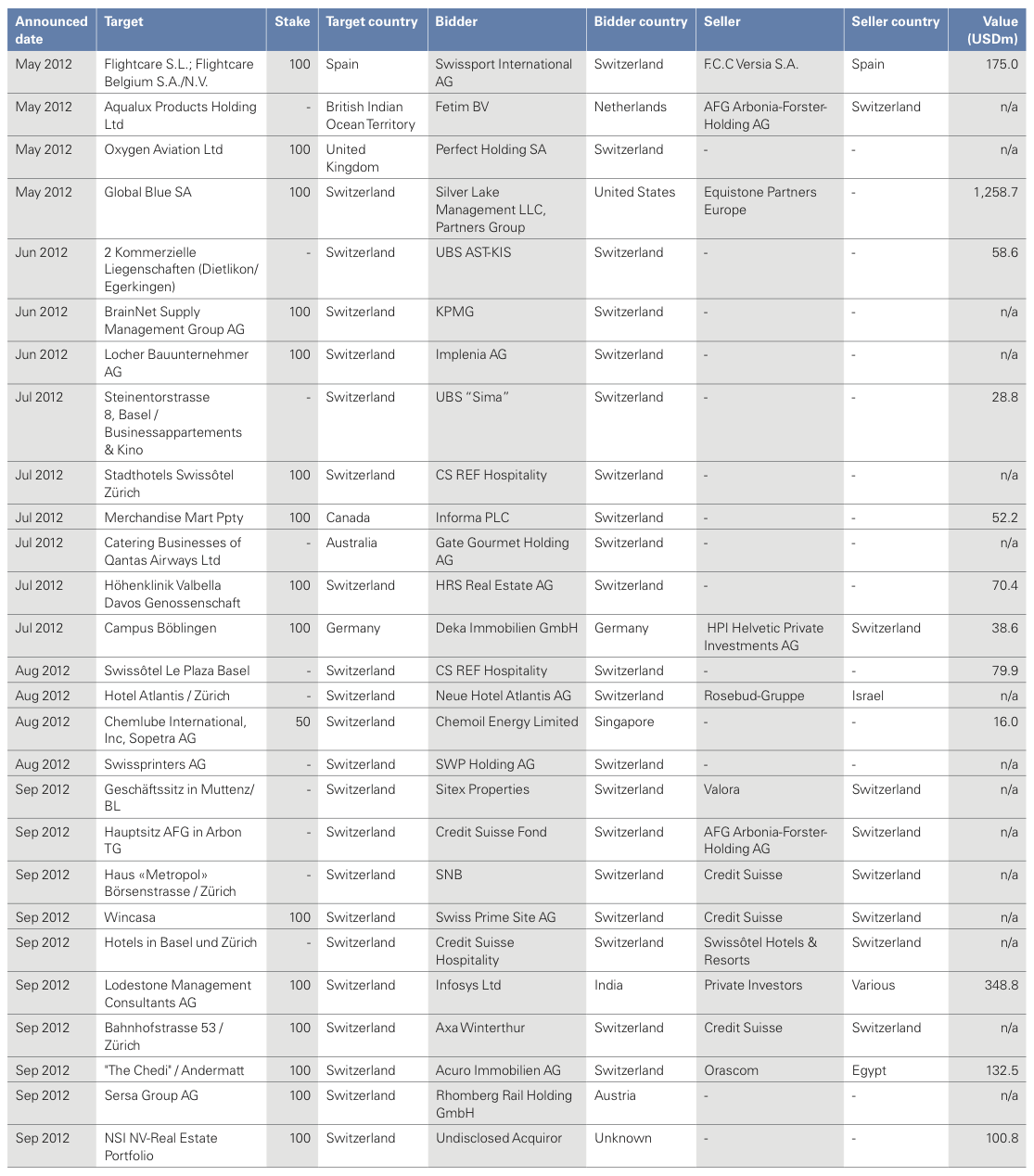

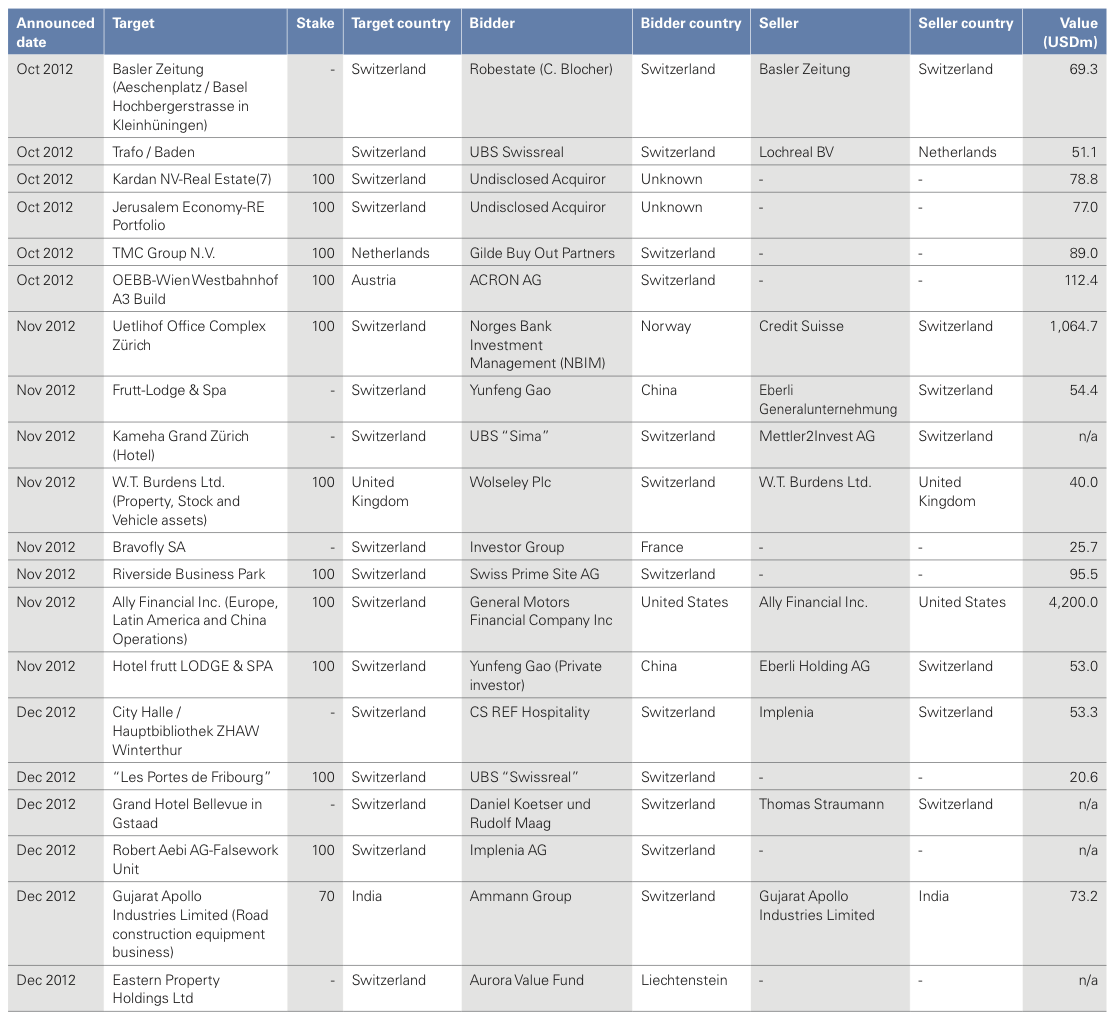

List of 2012 Swiss M&A Transactions