By KPMG

Deal Trends / Executive Summary

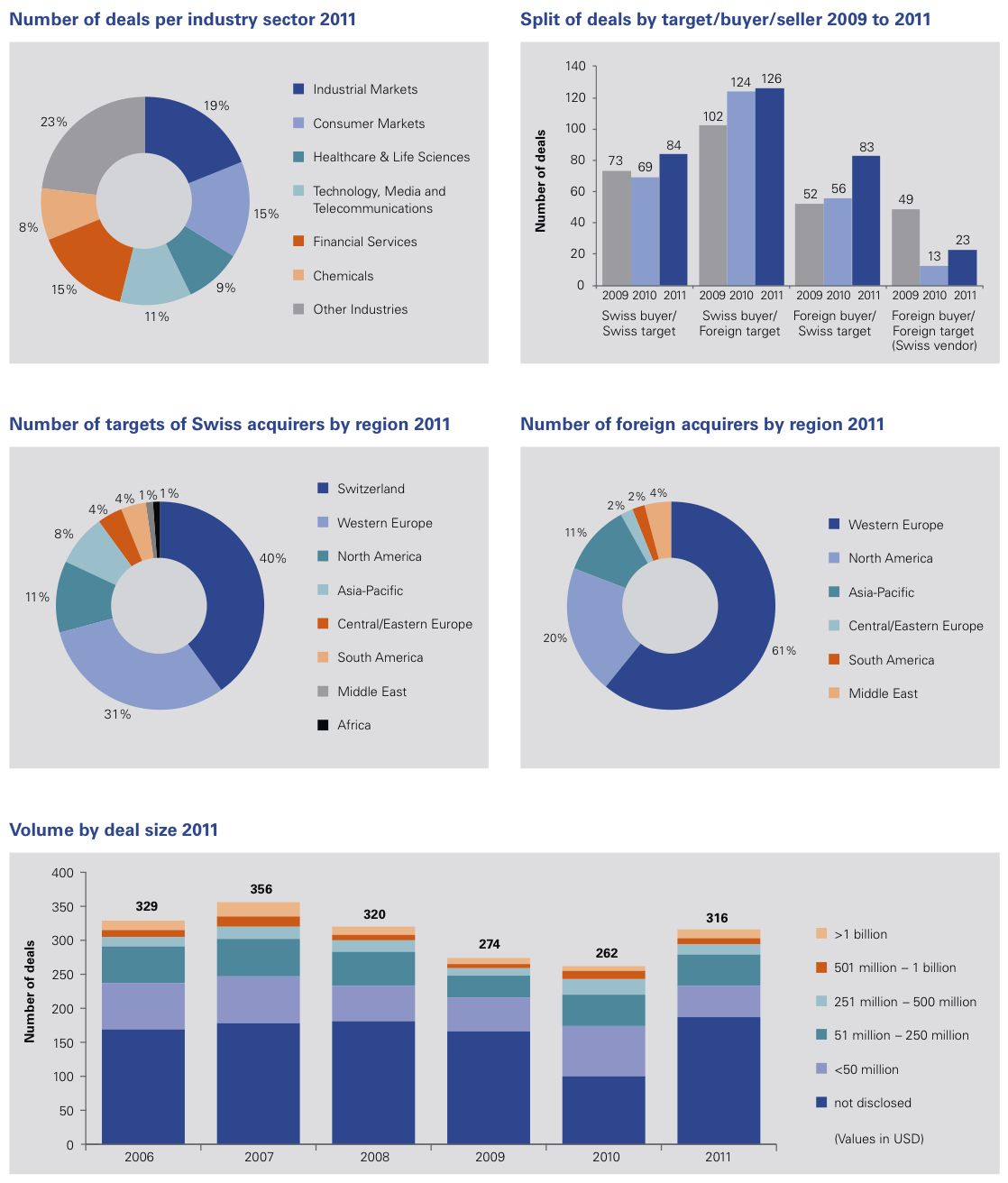

Emerging market interactions

Deals over the past year are noted as being increasingly driven by interest in and from the high growth markets, especially China, India and Brazil, but certainly not limited to these few. The “Next 11”, which includes countries closer to home, such as Turkey, as well as South Africa, Indonesia and South Korea, among others, are also proving attractive destinations for Swiss businesses.

Those industries suffering saturated markets at home are naturally keen to view growth opportunities around the world, which for many might be a means of survival.

Nestlé’s major stake acquisition in Chinese confectionery manufacturer Hsu Fu Chi and Brazil’s Grupo Safra’s acquisition of Sarasin are major deals in each direction that reflect the continued attractiveness of Swiss industry. Furthermore, it is to be noted that the acquisition of Nycomed by Takeda represented the largest inbound deal into Europe in Japanese corporate history.

A healthy performance

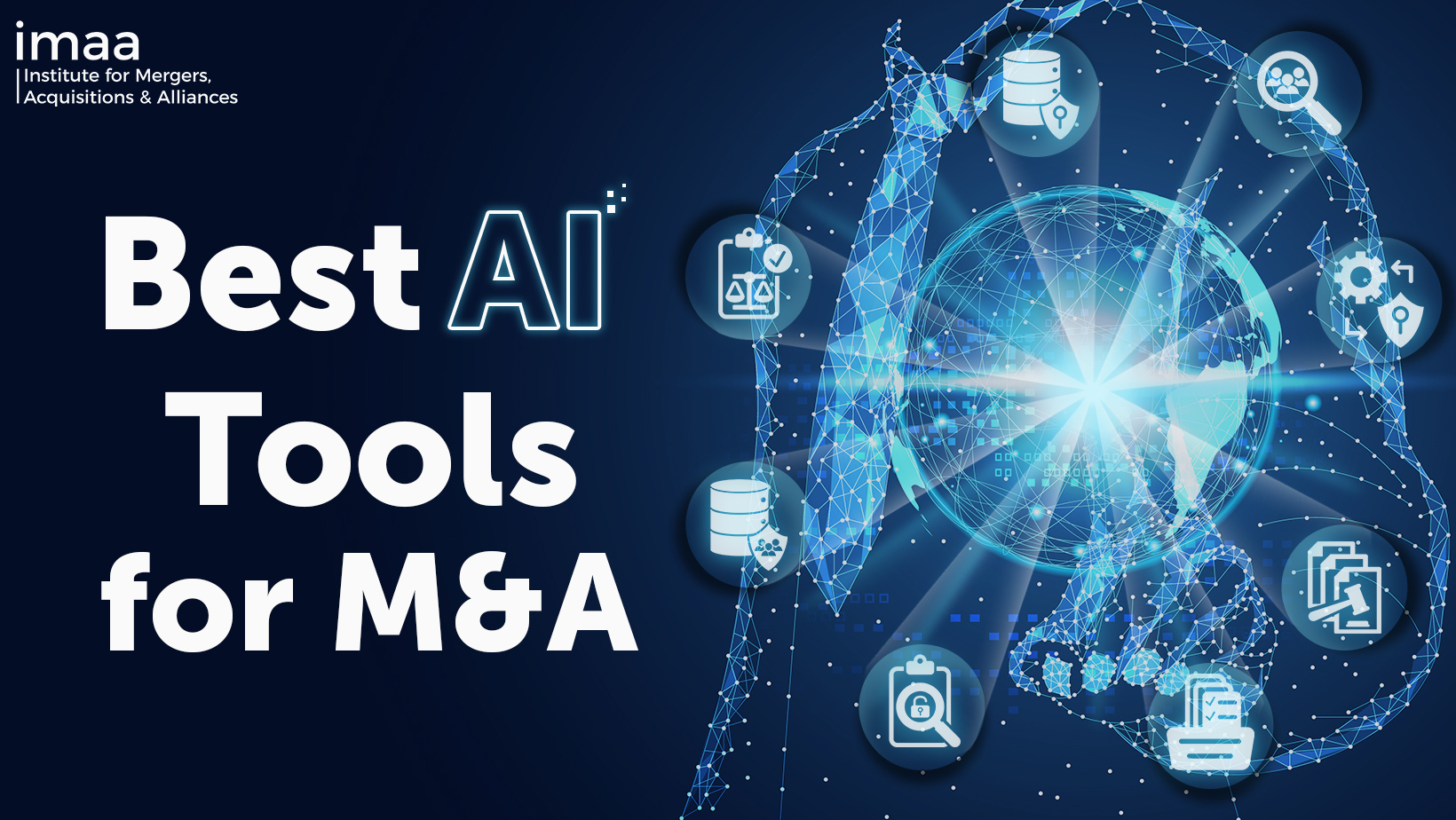

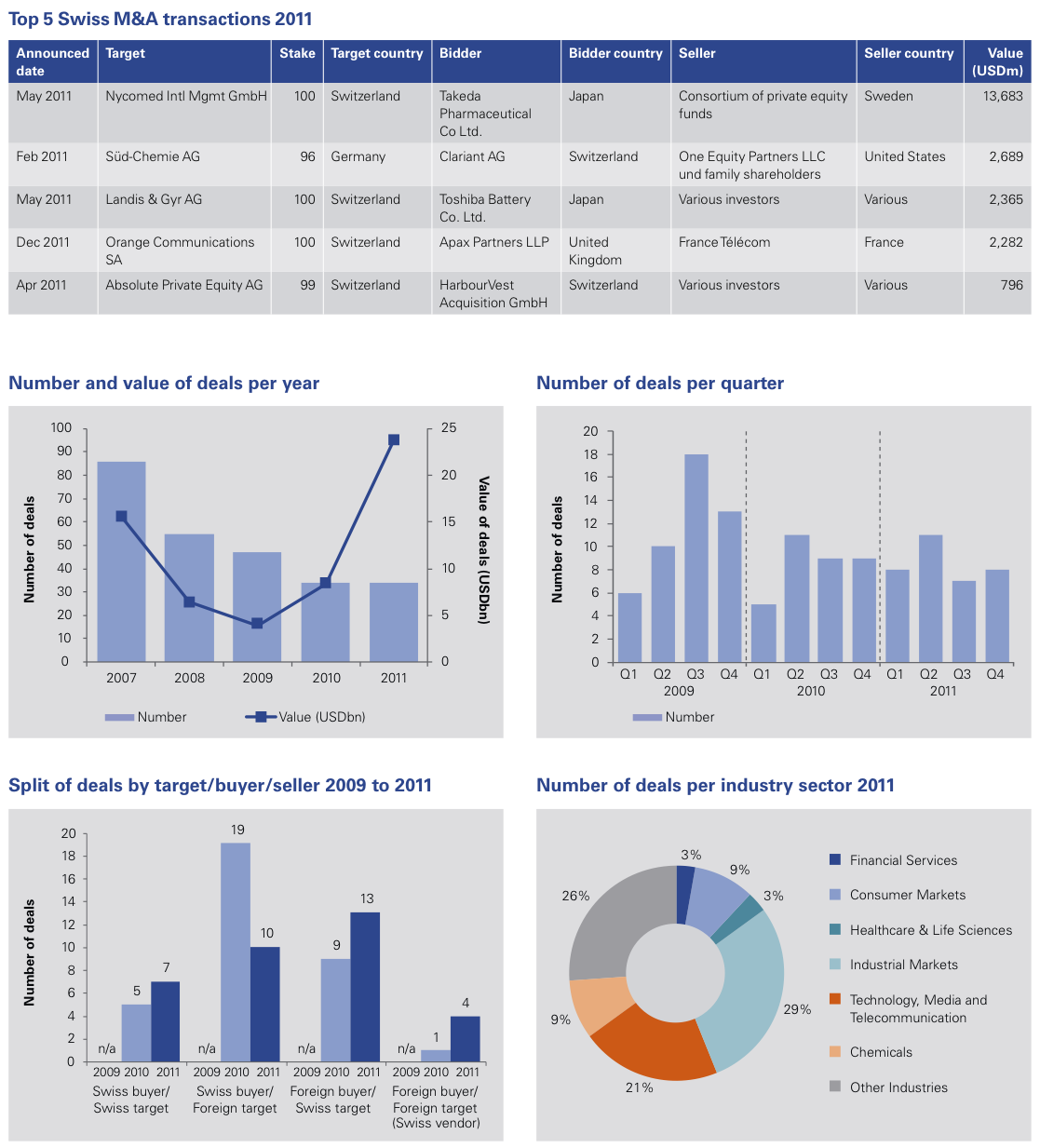

Our 2011 Yearbook predicted a number of mega deals (the largest in 2010, with the exception of the Novartis – Alcon deal, was USD4.2 billion). 2011 did indeed give rise to two very large transactions, being Johnson & Johnson’s USD21.3 billion acquisition of Synthes and the above-mentioned purchase of Nycomed by Takeda Pharmaceutical for USD13.7 billion.

It is noteworthy that these two largest deals of 2011 were both in the Healthcare & Life Sciences sector. Patent expiries and lower product pipelines are adding to the pressures being put on Healthcare providers by governments keen to ensure the industry is delivering value for money. The industry looks set to produce further transformational deals over the next year or two.

Return of Private Equity?

The return of Private Equity houses to the deal table has been delayed by uncertain economic conditions, but as funds come under pressure to invest cash and to divest portfolio assets that are nearing the end of their holding period, more deals are expected to result. An ongoing challenge for Private Equity is the erosion of their traditional competitive advantage in dealmaking, of relatively inexpensive financing. With banks reluctant to lend, funds may struggle to secure financing to undertake deals. Many must look to drive greater efficiencies in their portfolios through enhanced operational improvement capabilities, improving performance and ultimate returns on exit.

Friend or foe?

The Swiss Franc has suffered a bad press recently, accused of being responsible for many of the ills affecting the Swiss economy. However, while the currency’s strength has hit Switzerland’s export-oriented industries and damaged inbound and domestic tourism, it should not be forgotten that it has also reduced the cost of raw materials and other imports on which Swiss businesses rely.

The introduction by the Swiss National Bank of a CHF1.20 to EUR1.00 exchange rate floor was broadly welcomed but alone is unlikely to fix the problem. Expectations are that 2012 might see the Bank being forced to intervene once more, with a potentially higher floor desirable to many parties.

Outlook for 2012

The global economic situation and further margin pressures across various industries may force deal activity in 2012 – whether the firms are on the receiving end of take-overs or are compelled to undertake deals to build critical mass. One such example where we expect to see consolidation gather pace is in the field of Private Banking, where international regulatory trends are exacerbating squeezed margins.

Low gearing and high liquidity in some industries – especially in Consumer Markets and partly in Industrial Markets – as balance sheets recover following a period of strategic reviews and divestments, mean there remain plenty of Swiss firms with sufficient firepower to pursue large transactions both domestically and abroad. Others, such as Chemicals or Technology, will further commit to transactions, though they are likely to spread their spend also over a number of smaller, strategic acquisitions, rather than going primarily for high ticket deals.

Overall, pricing and multiples are expected to remain firm as the year progresses. Of course, a caveat on this is developments in the Eurozone and broader European and North American economies as well as the drive of the defined global growth markets. (Patrik Kerler, Partner, Head of Mergers & Acquisitions)

“Primarily in the areas of wind and solar power, there is a feeling that a certain level of catch up is required.” Alex Fries, Managing Director, EOS Holding SA

“In the mid-market segment, key will be how lenders look towards financing private equity-backed deals in 2012. It will most likely come down to smaller processes, more one-on-one situations, trust and eventually deliverability of the financial buyer.” Rogier D. Engelsma, Partner, Gilde Buy Out Partners

“Driven by sellers looking to pre-empt a double hit of deteriorating economic conditions in Europe and the effect of the strong Swiss Franc, current deal flow is at an all-time high… The current climate has accelerated the rate of change and restructuring in Swiss manufacturing businesses in particular and should provide continued opportunities in 2012.” Guy Semmens, Partner, Argos Soditic SA

“2012 will be another decisive year for Swiss Private Banking. Prevailing players will have a clear white money strategy, a focused and client-centric business model and solid capital base.” Peter Fanconi, Head of Private Banking of Vontobel Group

“Top line growth remains a key objective. Many large and mid-sized companies continue to look for strategic acquisitions to grow and strengthen existing categories or expand into new ones. Strong balance sheets and solid cash positions of many companies will support acquisition activities despite economic uncertainties. Many segments of the market are still highly fragmented with many small, owner-managed businesses looking for succession or exit scenarios. This, together with an increasing pressure on sourcing cost, will accelerate consolidation through acquisitions in order to enhance economies of scale and further improve the competitive position of companies.” Sepp von Arx, CEO DKB (Diethelm Keller Brands)

Swiss industry snapshots

The two largest deals in Switzerland in 2011 arose in Healthcare & Life Sciences, helping the sector to keep its ranking as one of the most dynamic industries at present. Swiss players are likely to feature more on the buy-side in 2012 as margin pressures and slowing growth in developed markets encourage expansion strategies.

Swiss Chemicals groups delivered on their promise to expand heavily into emerging markets, flexing their financial muscles to complete a number of deals across China, Brazil, South Africa and elsewhere. Outbound transactions should continue to dominate in 2012 as groups follow opportunities in their primary end markets.

An uptick in Financial Services deal activity in the second half of 2011 reflected renewed vigour among Swiss Private Banks where the long awaited consolidation appears to be finally gaining pace. Insurance transactions also surged as business models are being adapted and growth is sought abroad.

Swiss Industrial giants remained in hot pursuit of attractive acquisition targets in 2011, with most of the majors undertaking sizeable transactions. 2012 promises to be a challenging year for the industry, but low gearing and strong cash holdings mean there is plenty of capacity to do deals, especially for securing supply chains and building a basis for differential growth in emerging markets.

Food & Drink groups led the charge for Consumer Markets deals, with emerging markets once again topping the agenda for both inbound and outbound interest. Luxury Goods is a sector to watch this year as it demonstrates a thirst for tapping into the growing wealth of Asian markets in particular.

Technology, Media and Telecommunications sectors produced healthy deal activity in 2011. Many more interesting Technology-related deals are anticipated in 2012, with Communications players also expected to be on the look-out for further capability-building assets.

The Swiss construction industry stepped up to the mark last year, building around 7,000 more new homes than the average over the previous 10 years. As Real Estate continues to attract funds diverted from low yield bond and volatile equity markets, concerns over an overheating mortgage market are likely to bring forward new regulation by the national authorities.

In Other Industries, Commodities posted yet another outstanding year, primarily through the public offering and acquisition activities of Glencore. Meanwhile, nuclear power plans were revised following the Fukushima disaster, channelling money into alternative Renewable Energy projects, though dampened by cuts in government subsidies.

Deteriorating leveraged financing opportunities and the holding of Euro-denominated funds caused some Private Equity houses to cancel planned exits in late 2011. Funds remain keen to do deals, however, with many acquisitions and portfolio disposals due to take place in 2012 if macro-economic conditions allow.

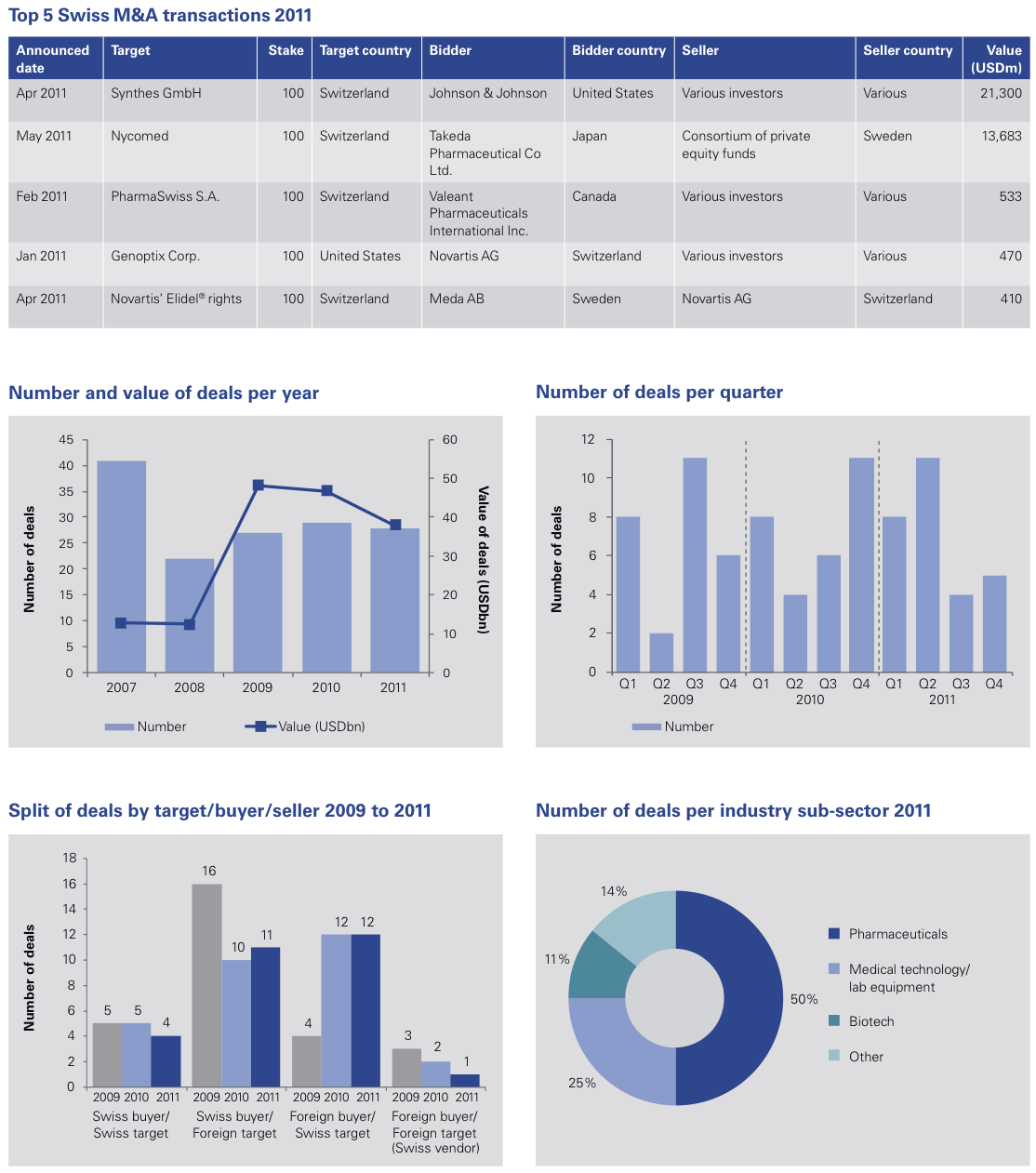

Healthcare & Life Sciences

Healthcare & Life Sciences once again hosted the largest Swiss transaction of the year, reflecting ongoing fundamental changes to the industry. Patent expiries and falling returns on R&D pipelines are putting increasing pressure on margins and are causing firms to explore new avenues of growth and profit enhancement.

The strategic imperative to consolidate and to expand into new growth areas has never been stronger for the industry. Pressure from the impact of patent expiries and falling returns on R&D pipelines has intensified as a result of governmental attempts to reduce Healthcare spending given present macro-economic conditions. It is therefore no anomaly that the two largest Swiss deals in 2011 and the largest in 2010 arose in the Healthcare & Life Sciences sector.

Johnson & Johnson’s acquisition of Synthes for USD21.3 billion represents the largest transaction in Switzerland in 2011 and is a classic case of horizontal integration. By purchasing the market leader in trauma devices, Johnson & Johnson complements the product range of its existing DePuy business, giving it potentially broader appeal in one of its core target markets.

Meanwhile, Takeda Pharmaceutical’s acquisition of Nycomed strengthens Takeda’s product pipeline and affords it greater access to emerging markets. As the largest Japanese acquisition into Europe in corporate history, the deal also demonstrates Switzerland’s continued role as a focal point for the global Healthcare industry.

Many commentators see Personalised medicine and its related diagnostics as being an effective route forward for the industry that is both better for the patient and better demonstrates effectiveness and value for money to cost-conscious governments.

Further evidence arose during 2011 supporting our assertion in last year’s M&A Yearbook of a growing convergence of the Healthcare and Food & Drink sectors. Nestlé Health Science’s purchase of Prometheus Laboratories, a maker of treatments for cancer and gastrointestinal illnesses for an undisclosed value (estimated by Bloomberg at between USD567 million and in excess of USD1 billion) was a significant step forward in Nestlé’s ambition to become the world leader in health-science nutrition within ten years.

Overall, the proportion of Pharmaceutical deals in 2011 grew to 50 percent of all deals in the sector compared to 42% in 2010. This is in part due to a decline in the number of Biotech transactions, with investors shunning the high risk of failure associated with early-stage Biotech investments in particular.

Outlook for 2012

The fundamental pressures that are reshaping the industry and driving M&A remain unchanged, and as such, M&A activity is likely to remain high. Given the relative scarcity of assets on the market, multiples are likely to be sustained or even rise further as tough competition among corporate bidders for the most attractive targets is played out in auction processes. As such, it will continue to be a highly competitive market in 2012.

Specific to Switzerland, we anticipate greater deal activity arising from the impacts of the impending Swiss Diagnosis Related Groups (DRG) legislation, causing a rethink of hospitals’ operating models. In particular, standardised pricing for hospital procedures looks set to squeeze margins and promote favourable conditions for the merger of hospital support services. A likely result is the transferring of laboratory facilities into private companies, collectively owned by a number of hospital establishments. (Joshua Martin, Director, Transaction Services)

Chemicals

A predominance of outbound deals demonstrates the continued firepower of Swiss Chemicals groups, with a clear strategic focus on expansion and capacity building in the major emerging markets. As pricing looks set to remain firm throughout 2012, the year could potentially see a number of divestments by Swiss players.

Outbound deals dominated the sector in 2011, with some notable acquisitions by Swiss players in emerging markets. Indeed, a clear geographic expansion rationale underpinned many of the transactions in the year, such as Lonza’s acquisition of Arch Chemicals for USD1.5 billion, helping the group to deliver on its desire to bolster its presence in India, China, Brazil and South Africa, among other countries. Similarly, Sika undertook no fewer than seven acquisitions over the course of the year, including in China and Brazil.

Meanwhile, Clariant confirmed its focus on business units where it sees realistic growth prospects and potential for improved margins, such as specialty chemicals and personal care. Through buying Germany’s Süd-Chemie (the largest deal in the sector in 2011, at USD2.7 billion) Clariant complemented its portfolio of high growth businesses, helping it to counter cyclicality and to gain access to new market segments and research opportunities.

At the lower end of the transaction market, there were fewer bolt-on acquisitions than had been anticipated, reflecting a general mood of caution among prospective dealmakers in the present macro-economic environment and limiting the possibilities of inbound deals from struggling Eurozone economies in particular.

Inbound activity was hampered by a scarcity of assets on the market, though some came to market such as Forbo Group’s successful divestment of its industrial adhesive activities, sold to a US acquirer for USD395 million. This could herald the start of a wave of disposals arising from strategic reviews.

Outlook for 2012

Cross-border transactions look set to be sustained as Swiss-based players follow their primary end markets. Interesting will be whether Agrochemicals, for example, follows in the footsteps of other sectors such as Textiles and Automotive in moving production eastwards.

Conversely, the growing influence of China’s Chemicals industry may yield some inbound transactions into Switzerland, driven by a desire to strengthen technological capabilities. Potential divestments by Swiss groups may entice Asian buyers looking for European assets and help to fuel an upward trend in inbound deals going forward.

In general, pricing levels and multiples are likely to remain stable, having recovered substantially since the onset of the financial crisis, though firm pricing may result in lower M&A activity than might otherwise be the case. (Pablo Ljaskowsky, Partner, Transaction Services, and Patrick Schaub, Senior Manager, Transaction Services)

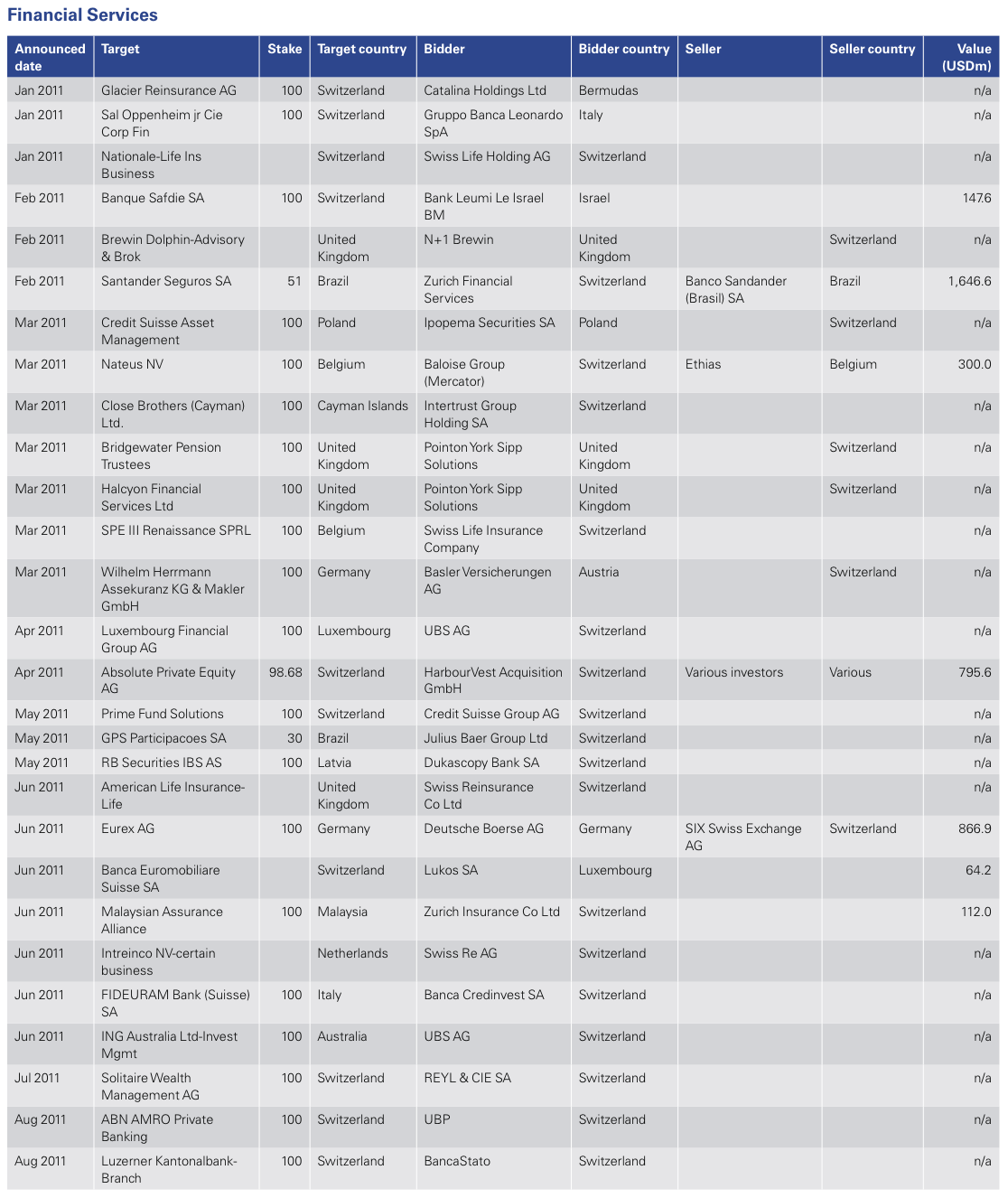

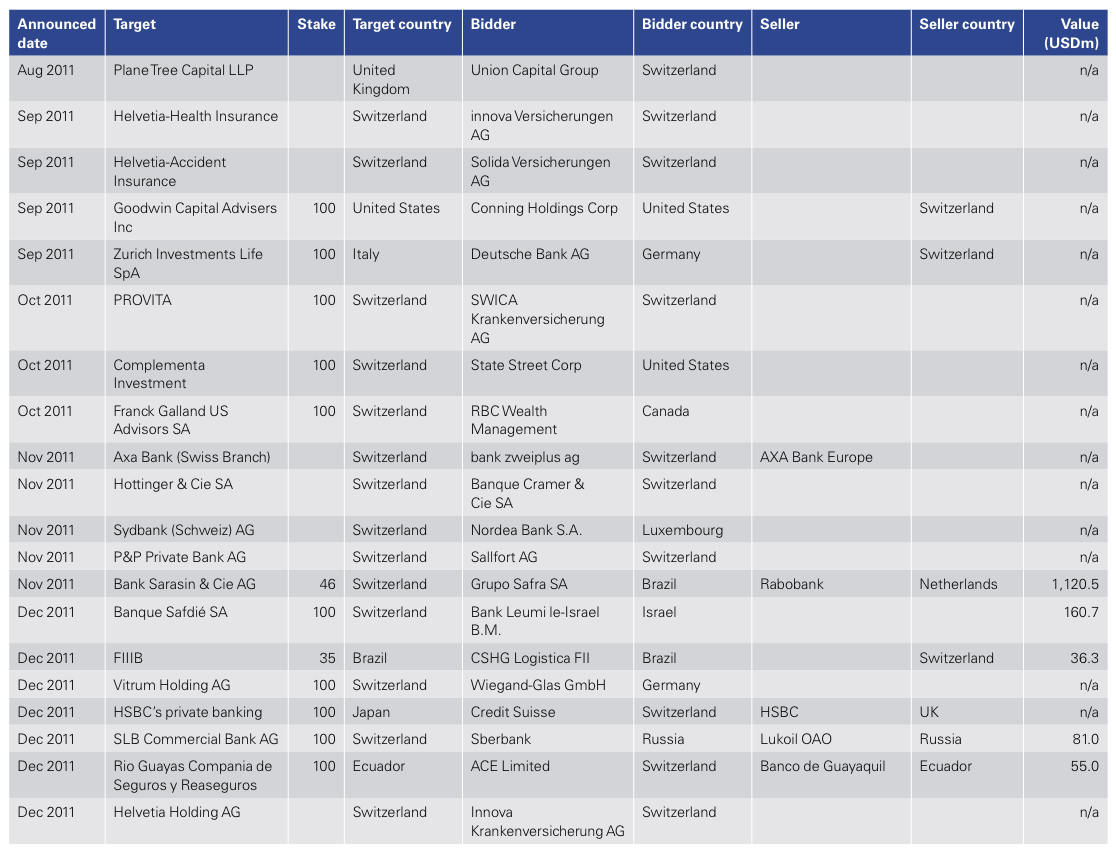

Financial Services

Accelerated deal activity in the second half of 2011 reflects renewed vigour among dealmakers following the completion of many business model reviews. Indeed, deal volumes over the year were the highest since 2007, although the average transaction was smaller due to a lack of major, transformational deals. Despite equity and profitability constraints making conditions on the acquisition trail tough across the industry, Insurers are well positioned to acquire abroad and the long-awaited consolidation in Private Banking is finally gaining momentum.

Strategic reviews were high on the agendas of the largest Swiss Universal Banks, particularly with regard to restructuring investment banking arms. UBS and Credit Suisse therefore maintained a relative distance from the M&A arena, with deal activity focusing on only minor adjustments to their international set ups.

By contrast, consolidation among Private Banks has gained traction, in part due to smaller players coming under considerable margin pressure, with many posting losses for more than one year in a row. Depleting their reserves in a bid to ride out the storm, some now face the crunch and must either seek a buyer or not expect to survive under current market conditions. Pricing levels reflect these difficult circumstances, often falling to below book value. While a buyers’ market thereby prevails, prospective purchasers are exercising caution when assessing business plans and asset quality in what is fundamentally an attractive sector undergoing a period of uncertainty around changing market, client and regulatory dynamics.

Large Insurance groups on the other hand benefited from a more solid financial basis, enabling ZFS and Baloise among others to undertake substantial acquisitions abroad. Insurers in general continue to review their portfolios and adjust for the more capital consuming parts of their business – this review process is likely to continue well into 2012.

Outlook for 2012

We expect to see an increased number of banking and insurance assets coming to the market in 2012. The market continues to be a buyers’ market and it is unclear whether there are many buyers prepared to pay the asking price. This combines with pressure on sellers to divest quickly in order to protect their core business.

Swiss Insurers could benefit from regulatory change, snapping up assets domestically or internationally from sellers who struggle to meet increased solvency requirements and are thus compelled to sell quickly. Acquirers look set to continue looking globally for opportunities, as the highest growth markets are located outside Europe and North America. In this, they may be assisted by the strong Swiss Franc.

Deal activity looks set to soar in Private Banking over the coming years as market dynamics encourage consolidation. The result of difficult trading conditions, changing client demands and sometimes unsustainable business models and cost levels, however, means that many would-be sellers might struggle to find buyers. Falling prices may sustain deal volumes, though it may be unavoidable that Switzerland will see a number of banks moving towards liquidation as 2012 and 2013 progress.

Margin pressure at Asset Managers continues to be a prevailing theme, with outflows from several asset classes making conditions difficult for many firms. Large banks may seek to divest their Asset Management operations, yielding some interesting opportunities, although prospective acquirers are likely to be circumspect over the viability of these sometimes under-performing assets. (Christian Hintermann, Partner, Transactions & Restructuring Financial Services)

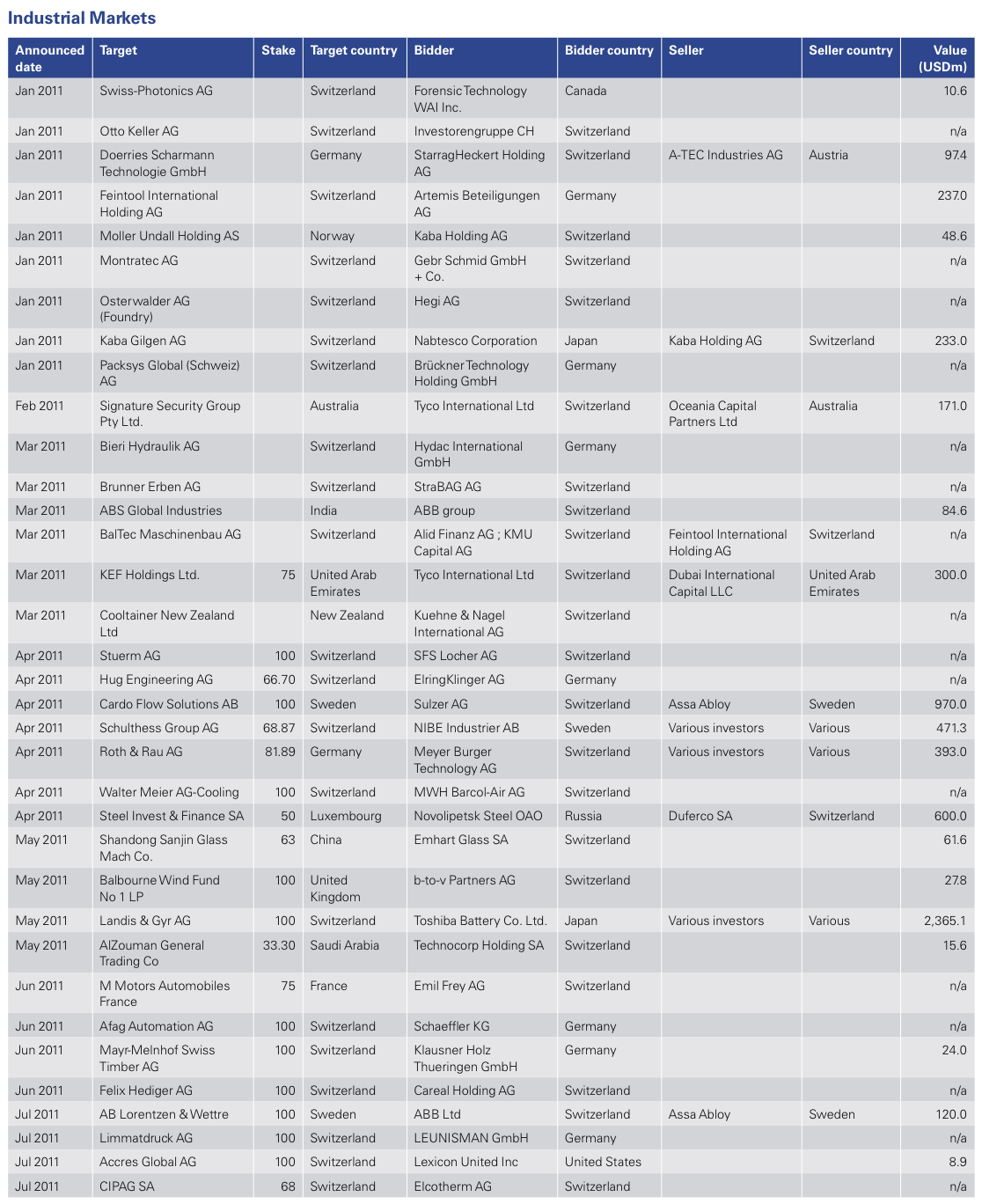

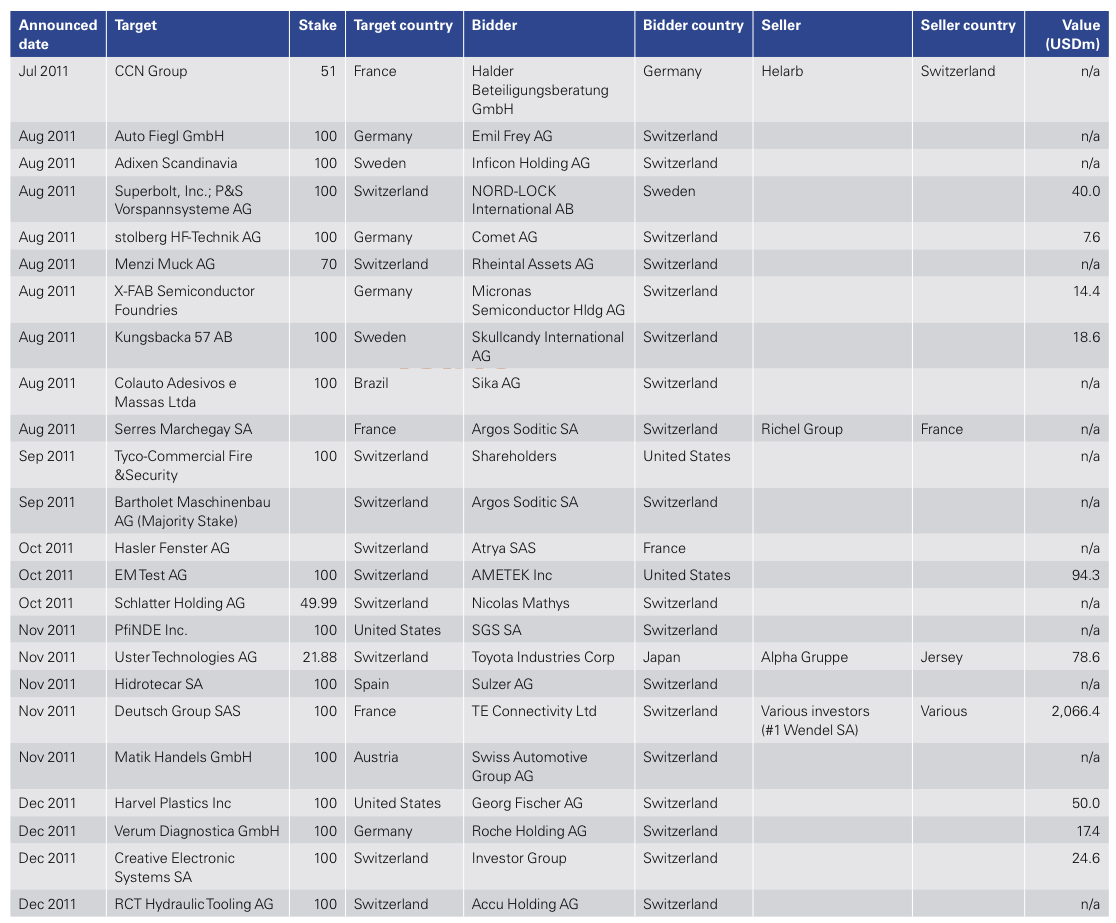

Industrial Markets

A weak fourth quarter ended what was otherwise a strong deal market in 2011. Swiss Industrial giants remained in pursuit of attractive assets – Sulzer, ABB, Georg Fischer and Meyer Burger being just a handful of the names that undertook significant transactions during the year. Caution reigns among dealmakers as 2012 commences, nervous of committing in uncertain economic times, although also optimistic as they anticipate better pricing conditions ahead. Leading the charge on transactions into Switzerland are likely to be Asian players, whose strong home markets equip them with the means necessary to acquire sought-after Swiss technologies.

Deal activity in the first three quarters of 2011 benefited from still favourable market conditions, but a dip in M&A volumes in the final quarter of the year reflected the increasingly uncertain economic outlook. As well as generally exercising caution, prospective purchasers struggle to assess business plans in such volatile markets. The strong Swiss Franc also deterred inbound transactions.

Swiss blue chip industrials continued on the acquisition trail as expected. Many have sizeable customer bases in the high growth markets of Asia and Latin America, feeding their success despite more stable Western markets. A focus on expanding market share and on new market entry is high on these businesses’ agendas. The more saturated European and North American markets still have a role to play, however. Sulzer and ABB each made interesting acquisitions in Sweden (Cardo Flow and L&W respectively, both purchased from Assa Abloy); ABB also closed the Baldor deal. Another Swiss industrial giant, Georg Fischer, undertook a smaller transaction in the US, demonstrating all these groups’ continued appetites for – and more importantly, capabilities to acquire – attractive assets globally.

Inbound deals centred around Asian buyers and were premised largely on the attractiveness of Swiss high tech expertise. Such transactions included Nabtesco’s purchase of Kaba’s automatic door division, a leading global supplier of automatic and platform screen doors; Toshiba Battery’s acquisition of Landis + Gyr, a global leader in energy management solutions for utilities; and Toyota Industries’ public offer for Uster Technologies, the world’s market leader in textile control. 2011 also saw inbound transactions by Europe-based buyers, such as the acquisition of the listed Schulthess Group by the Swedish heating company Nibe, a key driver being Schulthess’s heating pump division.

Outlook for 2012

A challenging but positive year is ahead for M&A due to Swiss groups’ relatively lean structures and strong market positions in their respective niches. Relatively low gearing and reasonably healthy cash reserves permit them to pursue acquisitions, leveraging skills gained over recent years of executing deals in difficult and volatile economic conditions. This combines with many CEOs’ beliefs that ongoing economic travails might result in lower prices, enabling the striking of better deals.

Margin enhancement is likely to be fed chiefly by emerging markets, with possibilities for differential growth in China, India, Brazil and other high growth markets such as Indonesia and Turkey, to name but a few. Swiss firms will also look to secure their supply chains and continue relocating production facilities to lower cost, weaker currency countries, which are often also closer to their customers.

A need to invest in adapting products to different, specific customer demands in many of these growth markets may combine with the need to reassess and reengineer existing supply, manufacturing and distribution models in order to enhance competitiveness on the global stage.This can pose significant transformational challenges, in particular for small and mid-cap firms, in terms of cost and technical and change management capabilities required. While such challenges may accelerate the sale of many family-run businesses facing succession issues, they must be balanced against a desire by many owners to sit tight rather than sell at an inopportune time. (Sean Peyer, Partner, Transaction Services, and Andreas Poellen, Senior Manager, Mergers & Acquisitions)

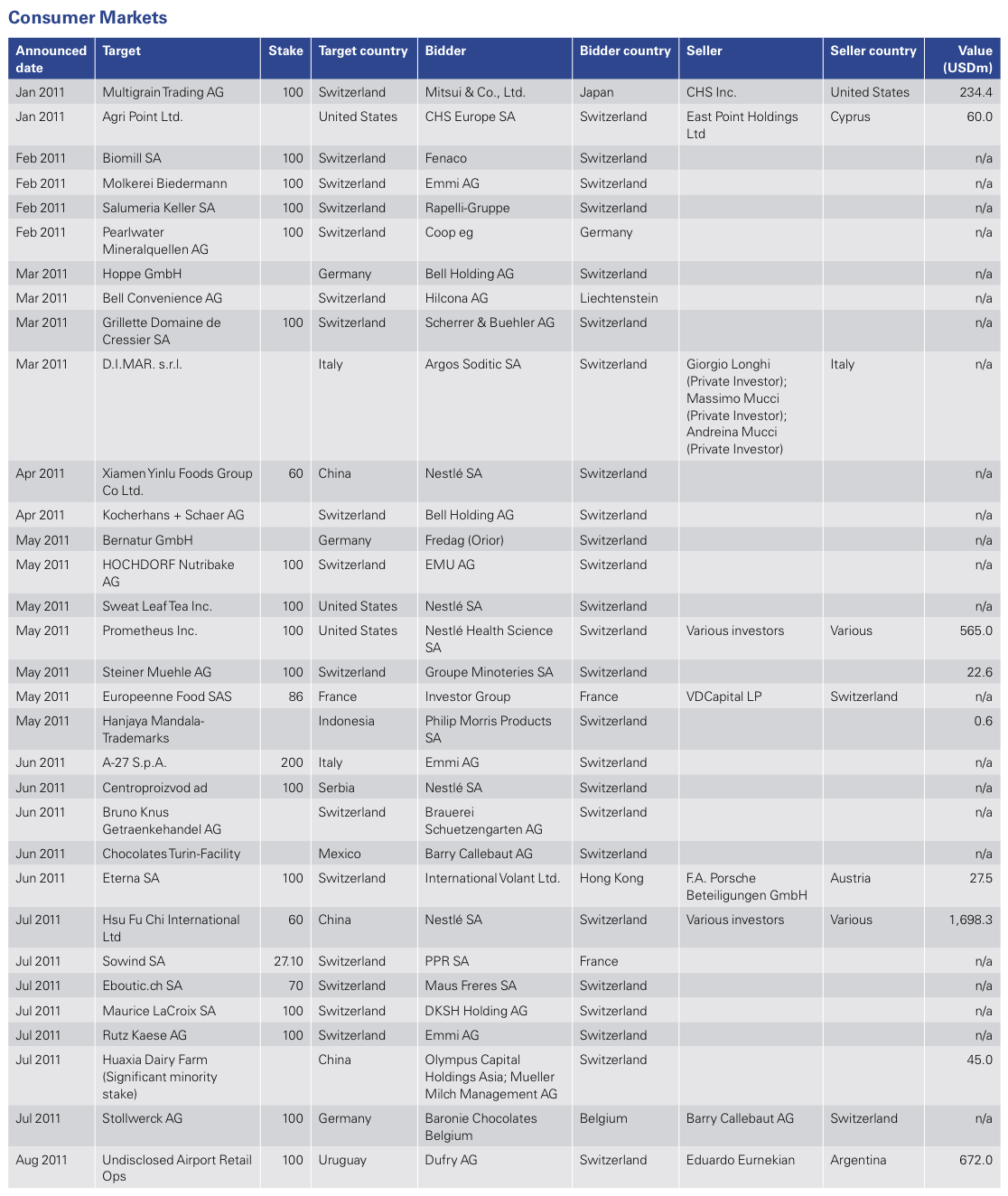

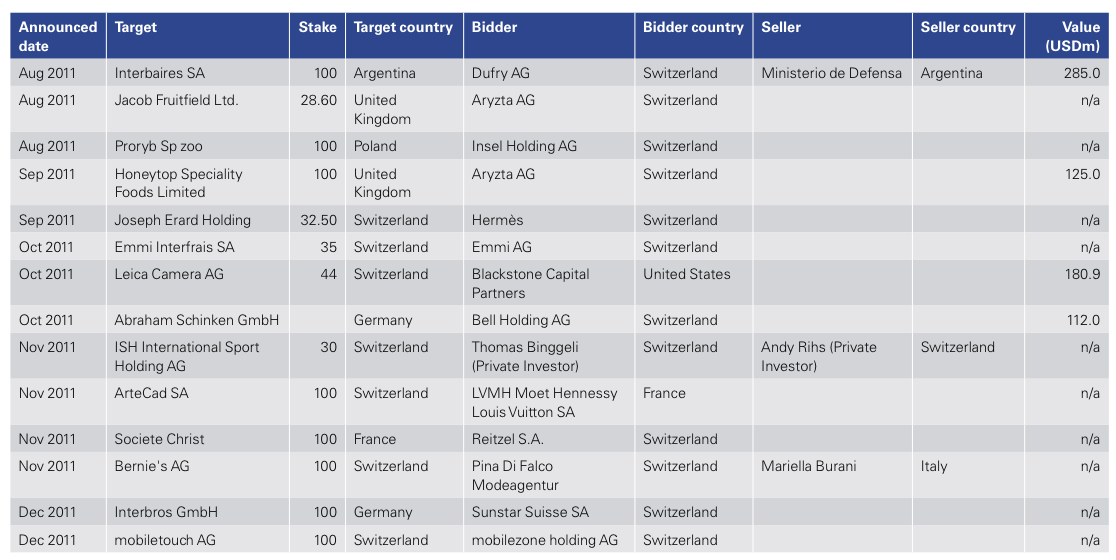

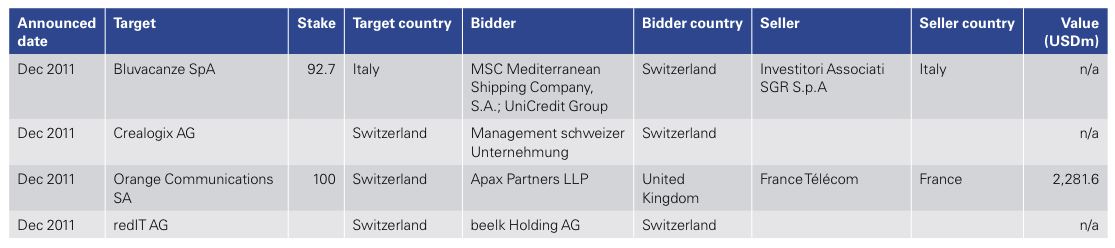

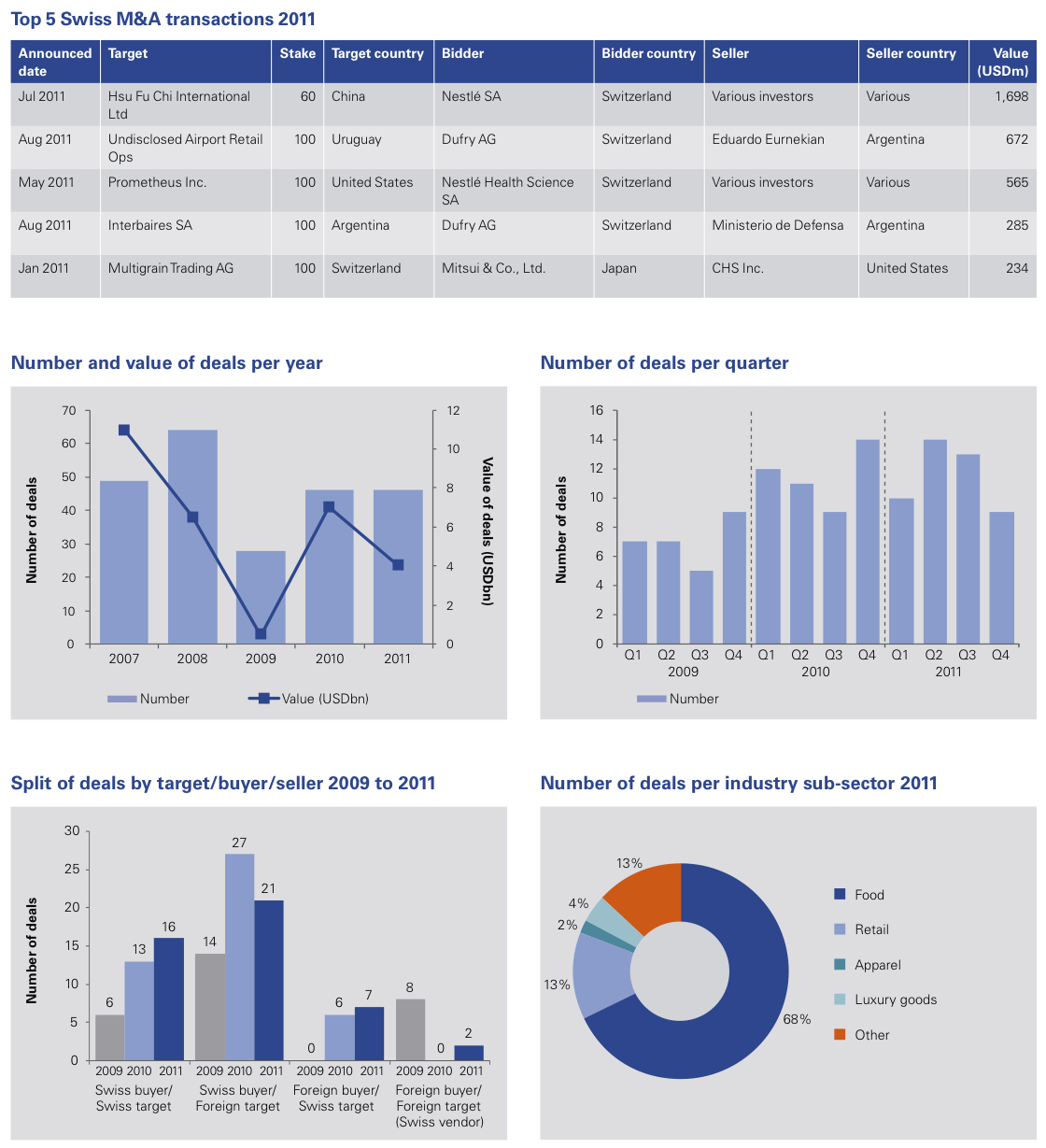

Consumer Markets

The word ‘stable’ characterized Consumer Markets deal activity in 2011, with volumes lower than in 2010 but higher than 2009. Greatest M&A activity was again in Food & Drink, particularly involving strategic key markets with promising growth potential. While Luxury Goods continued to attract Swiss and foreign buyers alike, a series of outbound deals expanded Switzerland’s specialist Retail footprint globally.

Competition for brand leadership and appetite for promising brands – especially those with international reach and potential – helped to keep activity high, with buyers being prepared to pay high prices for attractive targets. At the same time, underlying consolidation is being seen across the board as firms respond to margin pressures by seeking to capture revenue and cost synergies.

High growth markets – including not only BRIC but also the “Next 11” such as Mexico, Vietnam, Indonesia and Turkey – are playing an increasingly vital role in Switzerland’s Consumer Markets industry, whether it is Swiss firms chasing differential growth in such markets or interest from Asian firms in acquiring Swiss specialist capabilities.

Dufry was especially active in South America, acquiring local tax-free Retail businesses to further strengthen its expanding global network.

Spearheading the outbound transactions in 2011 was Food and Drink giant Nestlé through its USD1.7 billion acquisition of a 60% stake in confectionery manufacturer Hsu Fu Chi International. Driven by a need to tap into China’s booming middle class spend, this transaction helps Nestlé to exploit changing Chinese consumer trends – notably a move away from basic foodstuffs towards discretionary foods and snacks.

A key challenge for the sector was the price development of commodities and raw materials, negatively impacting margins throughout the industry. This will also affect the risk profile of firms, and potentially the M&A appetite, going forward.

An ongoing area of focus is nutrition, health and wellness. Although not yet delivering transactions on a large scale, this developing issue is giving rise to alternative forms of collaboration, such as food companies and smaller R&D firms looking jointly at new product development.

In Luxury Goods, takeover activity among Swiss watch and watch part manufacturers continued apace, though deal activity may lessen in future years as the number of independent manufacturers falls. Particular interest is shown by both Swiss and foreign firms in businesses across the Luxury Goods space that have potential to build solid distribution channels abroad, especially in Asia. A key acquisition rationale is to complement existing distribution channels, helping target firms to compete globally.

Outlook for 2012

Boding well for deal activity in 2012, the gearing of leading Consumer players is relatively low, which together with above average liquidity in the sector provides considerable purchasing power with which to undertake acquisitions. With such a positive outlook, pricing is expected to remain firm, the potential dark cloud on the horizon being further economic volatility in key European markets.

Food and Drink is likely to lead the charge due to the sheer scale of its players, but the appetite for global reach among Luxury Goods manufacturers should not be under-estimated given growing wealth in emerging markets. Expansionist corporates such as Dufry and Aryzta may invest heavily in building their worldwide presence.

A lesser trend may be seen around Private Equity interest, which is likely to centre on specialised Retail or gastro concepts as well as Luxury Goods. (Patrik Kerler, Partner, Head of Mergers & Acquisitions)

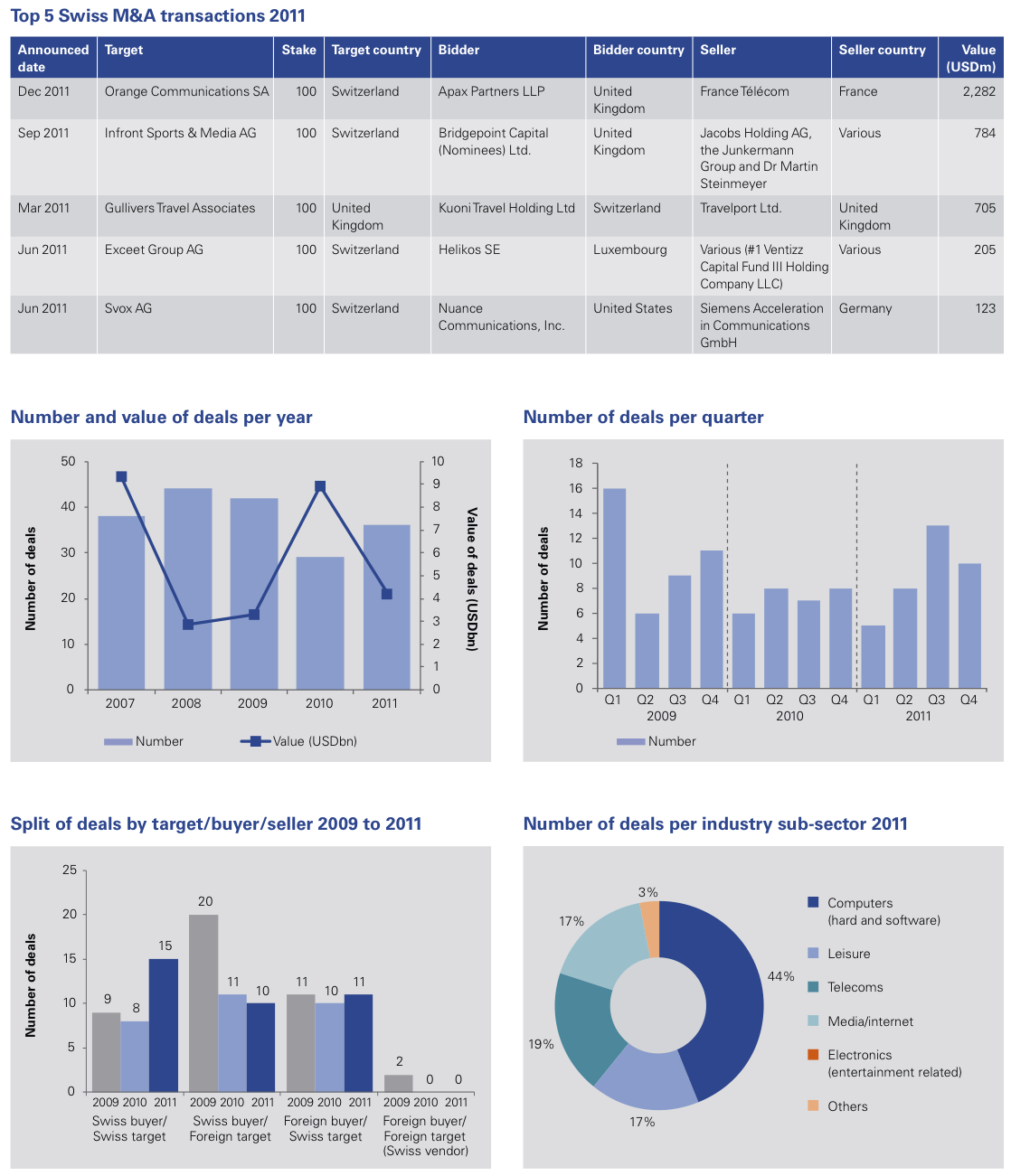

Technology, Media and Telecommunications

Deal volumes across the Technology, Media and Telecommunications sectors held up well in 2011 despite often difficult market conditions. Growing interest in technology assets, especially ecommerce and software, helped to sustain deal activity over the course of the year. Media players were particularly busy pursuing portfolio shuffles and consolidation, while key Swiss Telecoms firms undertook acquisitions aimed at complementing and boosting their capabilities.

The key transaction in the Communications market was the sale in December of Orange Communications to Apax Partners for USD2.3 billion. Meanwhile, Swisscom maintained its focused M&A strategy aimed at building its solutions capabilities. This included acquiring a video and TV streaming firm, Solutionpark, to complement its broadcast unit, and SAP specialists EFP Group and Cirrus Group to bolster its IT division. Sunrise also returned to the deal table last year with the takeover of NextiraOne’s Swiss business, reinforcing its enterprise solutions capability.

The Swiss Media sector experienced intensive activity, as consolidation and portfolio reshuffles continued throughout the year, hopefully putting the industry in better shape going forward.The largest transaction was Bridgepoint Capital’s acquisition of Infront Sports and Media for USD784 million, while Ringier continued its steady stream of acquisitions by purchasing DeinDeal.ch (Switzerland’s leading group buying platform) and taking over Edipresse’s Romanian operations.

A high level of deal activity across a broad array of sub-sectors characterised the Technology and Software industry, the largest transaction in which was the merger of Helikos Group and embedded solutions provider Exceet in a deal worth USD205 million. Banking software disappointed by yielding fewer deals than expected, perhaps reflecting a banks’ continued focus on re-aligning their operating models. An exception was Temenos’s acquisition of Canadian business intelligence firm Primisyn. Meanwhile, Ascom completed the small but key purchase of Finland’s Miratel (nurse call solutions), adding to its core wireless technology platforms.

Concerns persist over the sustainability of the traditional tour operator business model, with Thomas Cook’s financing troubles in late 2011 reflecting the difficulties of competing with online Travel businesses and exposing underlying weaknesses in the industry internationally. By contrast, Kuoni achieved strong growth in 2011 and undertook a significant acquisition in the shape of GTA (at USD705 million), while Hotelplan took further steps to stabilise its business.

Outlook for 2012

The trends experienced in 2011 are expected to continue into 2012, with a particular deal focus anticipated around European technology assets. Many more ecommerce and software deals are in the offing, as industry players (most prominently, ABB) move aggressively to harness productivity gains arising from enhanced technology.

Multiples should remain largely unchanged, being relatively low in Telecoms (and likely to remain so given limited growth in the industry) and higher in ecommerce and software – maintainable if industry participants prove able to deliver on growth expectations. A caveat on pricing levels, and indeed overall transaction levels, is that performance depends on developments in the Eurozone and other economies across Europe and North America. (James Carter, Director, Transaction Services)

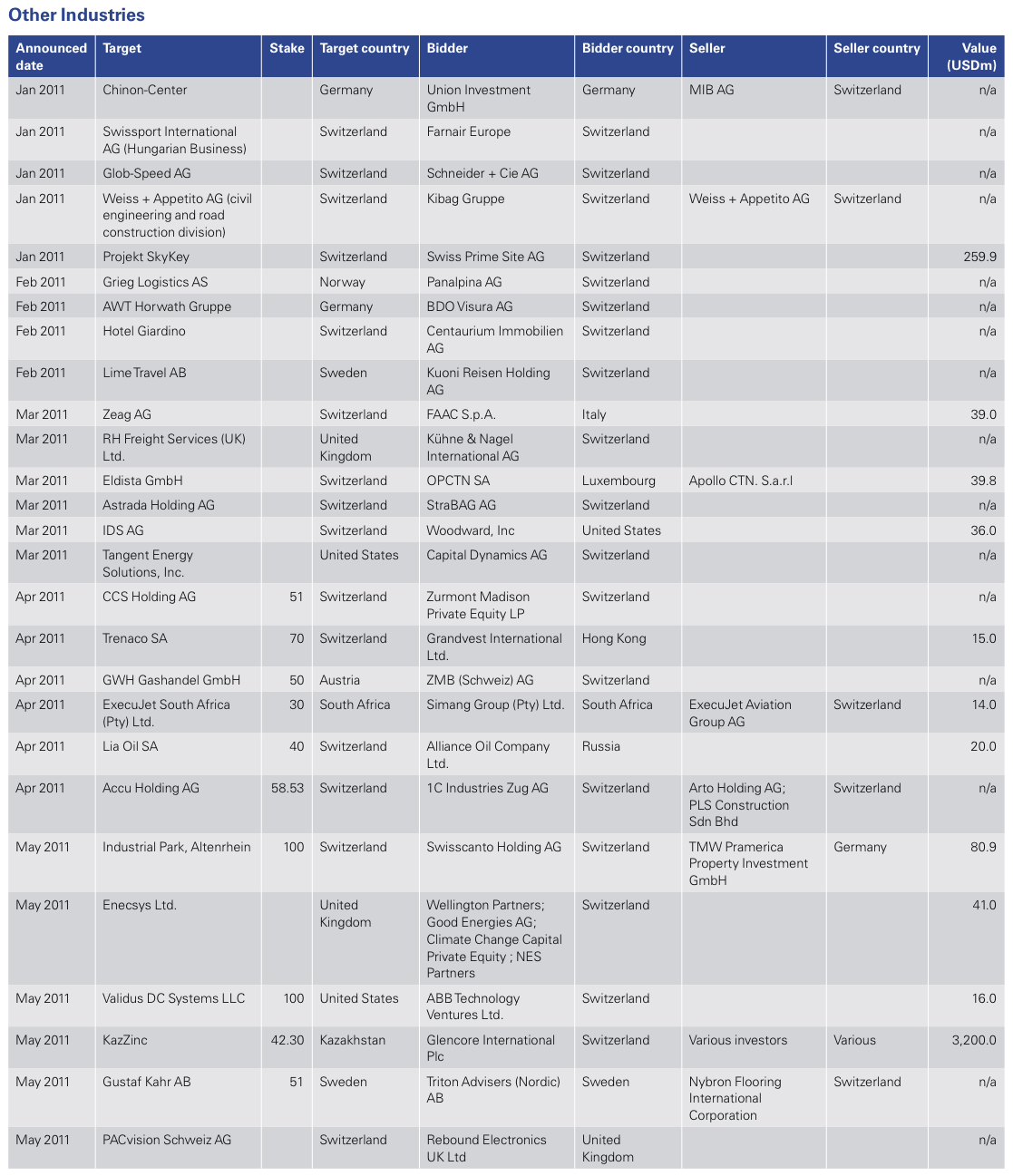

Other Industries

In what looks set to be a tough 2012 with difficult trading conditions, a few industries nevertheless promise to shine through. Commodities in particular is an active sector, and Renewable Energy should be hot on its heels in terms of providing some noteworthy transactions.

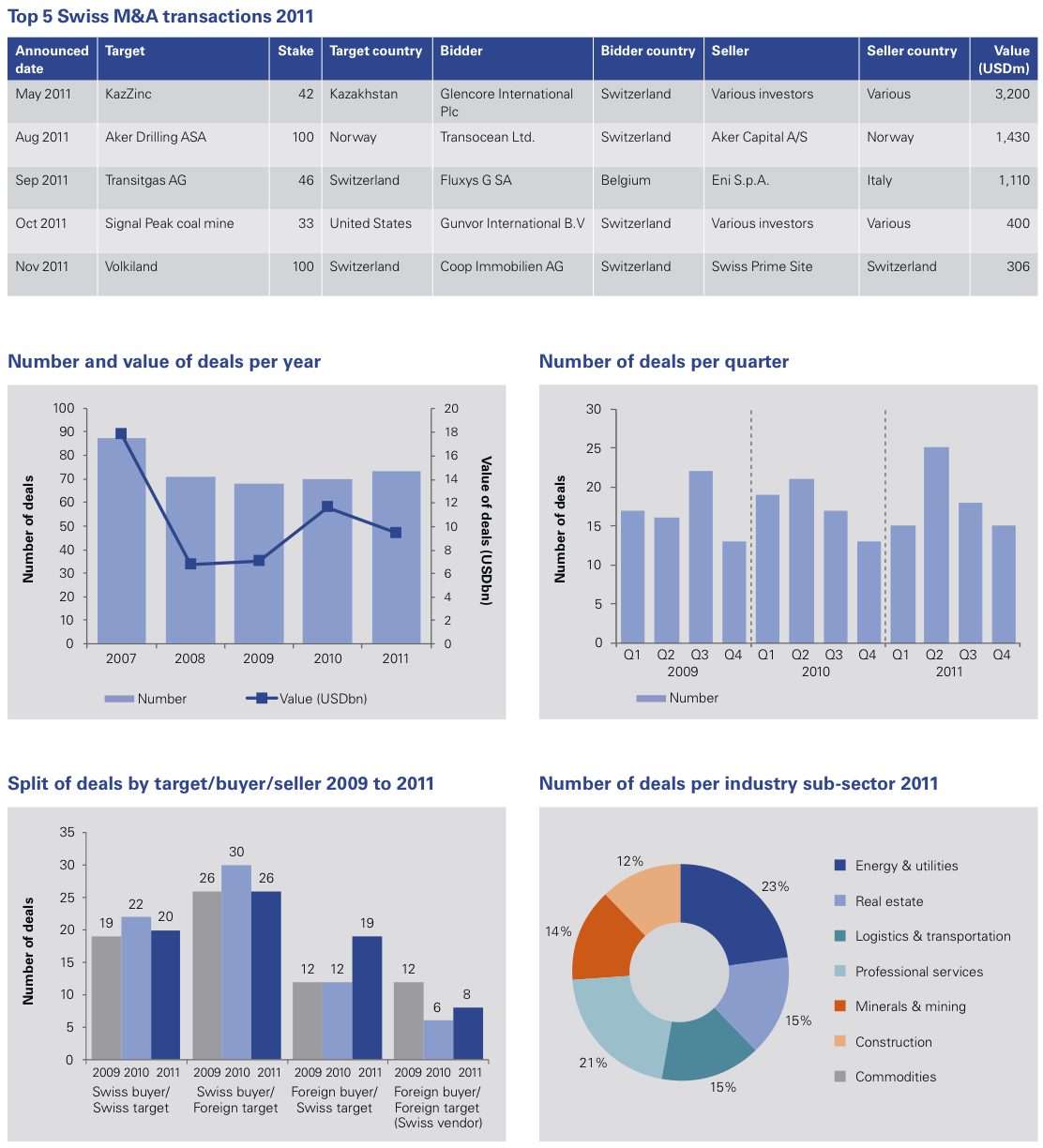

In the Commodities field, Glencore not only topped the 2011 deal list for Other Industries by way of its acquisition of KazZinc for USD3.2 billion, but the group also successfully listed on the London and Hong Kong stock exchanges. Providing additional funding to fill its war chest, Glencore is set firmly on the acquisition trail, on the back of a steady stream of acquiring stakes in mining operations.

Renewable Energy continued as a key focus for many investors. The disaster concerning the nuclear power reactor in Fukushima, Japan, adversely affected nuclear energy plans in various countries and diverted substantial interest towards other Renewable options. There is some recognition that Renewable Energy industries are not developing as quickly as they ought to, and that firms may struggle to catch up with foreign competitors. Despite the potential, investment interest is somewhat diminished by cuts in government subsidies.

Kühne & Nagel meanwhile continued to be highly acquisitive, focusing on growth in areas of Logistics such as the road network and the rail network in Europe.The strength of the Swiss Franc may afford them some additional comfort as they chase deals abroad, continuing their global expansion with a focus on India, China, Brazil and Colombia.

Outlook for 2012

An uncertain economic outlook appears set to keep a lid on M&A activity in the coming year, although it may still post a respectable number of transactions due to the diversity and underlying attractiveness of some of its sectors. Ongoing problems across the European Union in particular and a lack of market recovery might trigger forced sales, providing a limited number of additional opportunities for well-funded buyers.

Some outbound deals are expected in the Renewable Energy sector, particularly for offshore wind projects. ABB also looks set to remain in hot pursuit of attractive targets such as technology-based assets relating to the energy grid, though it might be towards the end of the year or into 2013 before the deals start to come through.

2012 is also likely to see Glencore remain at the top of its game, flexing its newly listed muscles with a high value budget for acquisitions around the world. (Rolf Langenegger, Director, Valuation Services)

Private Equity

A healthy deal flow in the first half of 2011 gave way to a weakened mid to large cap buy-out market later in the year, reflecting a deteriorating climate for leveraged financing opportunities. Stressed bank financing and the strong Swiss Franc are expected to have an impact well into 2012. A recovery in deal activity in the second half of the year in the primary and secondary markets may be fuelled in part by spin-offs of non-core assets by Swiss corporates.

Bank financing has long been a key advantage for Private Equity when competing with corporates for attractive assets. A steady erosion of this benefit over recent years constrains the price range funds are prepared to pay. Consequently they have lost out to corporate bidders on many deals they might historically have secured. The fact that most houses hold Euro-denominated funds exacerbates the challenges, making acquisitions in Switzerland more expensive than in the Eurozone.

Uncertain economic conditions combined with the sovereign debt crisis in the second half of 2011 constituted a difficult market for prospective vendors, with a number of planned exits cancelled in the fourth quarter as sellers lacked confidence that they would achieve the desired price. On the buy-side, funds had to cope with stiff competition for attractive targets, long M&A processes and negotiations, and hurdles in obtaining the required bank financing. Senior debt multiples for A and B tranches were relatively low compared to past years and terms were fairly expensive. Banks were unwilling to provide any financing for certain sectors. Furthermore, banks tended to commit very late in the transaction, sometimes changing their initial commitment close to the signing of the transaction. The larger the transaction, the greater the difficulty in obtaining finance.

Despite the challenges, some houses successfully completed a number of interesting deals in 2011, including Argos Soditic, which closed three transactions in Switzerland. Gilde Buy Out Partners acquired Swiss-based Spandex Group from the US’s Gerber Scientific, Inc., and Bridgepoint successfully purchased Infronts Sports & Media.

Outlook for 2012

Private Equity will face the same problems as during the end of last year. Firstly, funds retain a substantial amount of cash, yet available targets – especially in the primary market – continue to be limited. Attractive assets will solicit interest also from strategic bidders, many with strong balance sheets, providing tough competition.

Many portfolio assets are also due to be refinanced in the course of the year. Depending on the specifics of the asset and its industry, available refinancing terms might be severely constrained and/or relatively expensive, impacting on the overall return on the investment and therefore the performance and perception of the fund.

Certain funds are coming to the end of their lifecycles, necessitating exits from portfolio companies. Some were acquired at a high price in the bullish 2006 – 2007 period, meaning it is possible that an exit could result in a relatively low return.

Finally, operational skills are increasingly important to successful private equity funds, in part substituting for weaker financial leverage. Funds may need to reduce their target IRR or work more intensively on driving operational efficiencies in the business.

The outlook for the coming year therefore depends on a number of internal and external factors, some of which are outside funds’ control. Contrary to the crisis in 2009, we expect vendors to be more forthcoming with assets they have to sell, either due to reaching the end of their investment cycle or due to strategic reorganizations. This should present opportunities for Private Equity. From a deal generation perspective, however, funds must become more active in identifying potential targets, which in turn may enable them to avoid expensive auction processes with resultant higher purchase prices (and thereby reducing the required debt funding). (Tobias Valk, Partner, Head of Transaction Services, and Andreas Poellen, Senior Manager, Mergers & Acquisitions)

Real Estate

Depressed bond and equity markets in 2011 helped to drive funds towards Real Estate; this looks set to continue into 2012 as interest rates are expected to remain low. Professional property investors are exercising caution, however, amid signs of overheating in certain market segments and due to growing pressure on commercial rents.

It is a green light for deal activity in Swiss Real Estate, as the low interest rate environment and the high volatility in listed assets continues to drive funds towards property. For many private individuals it is a question of wealth protection, with Real Estate representing a relatively stable investment compared to equities and offering higher returns than bonds, including a partial inflation hedge.

Investment activity and premium prices persisted in “Grade A” locations such as Zurich, Geneva and areas in or close to Switzerland’s other largest cities, especially for residential or commercial buildings with solid tenancy. A scarcity of investment class assets meant that even B and C locations were sought after, despite being viewed as riskier investments and consequently less popular. By contrast, non-core real estate is sometimes hardly marketable at all.

Pension funds and other institutional investors seem to have lowered their yield expectations on the one hand but show a risk aversion on the other, only seeking properties that are certain to produce yields capable of upholding existing dividend expectations.The result is ongoing premium prices and net yields below 4% with substantial competition for high quality assets. Insurance groups meanwhile proved rather aggressive over the course of the year, demonstrating a need to find new sources of profits and cash flows in order to settle their balance sheet liabilities in an era of diminishing margins.

Mortgage demand hit record levels among private individuals, as prospective buyers rushed to take advantage of low interest rates. According to the Swiss National Bank, outstanding mortgage value increased by more than 50% since 2001 to CHF800 billion as at end of September 2011.The construction industry has responded accordingly, with around 45,000 new apartments being built in 2011 compared to an average of 38,000 per annum over the last ten years. The Swiss National Bank and Swiss Financial Market Authority expressed severe concerns at these trends, seeking greater regulation of the mortgage industry in order to prevent overheating. As well as obtaining reassurance from lenders that loan affordability is adequately assessed, they plan that banks shall back their mortgage loans with additional equity capital. The establishment of an anti-cyclical capital buffer is also being discussed at national level to protect against a property crisis.

Outlook for 2012

Sector dynamics look unlikely to change over the course of 2012, continuing to attract funds as a result of low interest rates. A dark cloud on the horizon is a possible Swiss recession as the result of continuing Eurozone difficulties, which could cause immigration to fall, thereby lowering residential and commercial occupancy rates. In the meantime, the scarcity of investment assets should be capable of sustaining high prices.This in turn fuels the popularity of project developments, which may be one of the few ways investors can access the property market and add to their portfolios. However, regional oversupply and slower absorption of new space may become a risk in economically peripheral areas.

New product development is an area to watch in 2012. Last year saw the establishment of some major new Real Estate investment foundations and funds, such as those by Swiss Life and Swisscanto. Rothschild also founded the first Real Estate SICAV in March 2011, with assets under management of CHF340 million as at 19 December 2011. Meanwhile, MZ Immobilien announced an IPO, the first substantial such deal in the sector over the last four years. (Ulrich Prien, Partner, Real Estate)

The Swiss Franc: help or hindrance?

The strength of the Swiss Franc is truly a double-edged sword. Blamed for ongoing difficulties in the Swiss economy, it is simultaneously praised for enhancing Switzerland’s buying power abroad. The Swiss National Bank responded to growing concerns by introducing an exchange floor in 2011 and there is a high chance it will be forced to intervene again this year.

Half of Swiss businesses reported in February 2011 that they were being seriously affected by the Swiss Franc – rising to two-thirds later in the year. Some exporters are moving to counter the effect of the exchange rate by reducing sale prices in real terms, helping to maintain demand but negatively impacting margins.The net effect of the strong Swiss Franc must be recognized, however, as it provides some relief in the form of cheaper raw materials and other imports.

Many larger Swiss businesses had already been actively pursuing opportunities to relocate production facilities abroad even before recent economic troubles, to take advantage of lower cost economies as well as to move closer to the growing number of customers in emerging markets, for instance. The currency trend merely accelerates this development, making it an even greater business imperative.

Hans Hess, President of Swissmem, notes that Swiss goods are trading at a 10% to 15% premium to European competition, stating “We will have to reduce that gap either by directly cutting jobs or by moving production to neighbouring countries, which would also result in a loss of jobs in Switzerland.”

Directly hit also are industries that rely on consumer spend in Switzerland itself, such as inbound and domestic tourism. With many people deciding to forego skiing trips or other holidays due to the pressures on their wallets, others – both Swiss- and foreign-based – choose to vacation in relatively inexpensive destinations such as France or Italy.

In an attempt to mitigate the challenges faced, the Swiss National Bank introduced an exchange rate floor of CHF 1.20 to EUR 1.00 in September 2011. While the move was broadly welcomed, many do not believe it goes far enough and that the bank may be forced to impose a higher floor in 2012. A rate approaching CHF 1.35 to EUR 1.00 may be necessary to better protect the economy.

This exchange rate floor at least provides heightened certainty over forecasts. However, the real – and longer-term – concern is developments in Switzerland’s neighbours. If exchange rates are to be rebalanced, recovery in the major Eurozone economies and a successful resolution of related debt crises are prerequisites. Otherwise, Swiss firms may need to get used to living with lower margins or seek more innovative means of reducing costs. (Thomas Küng, Director, Management Consulting)

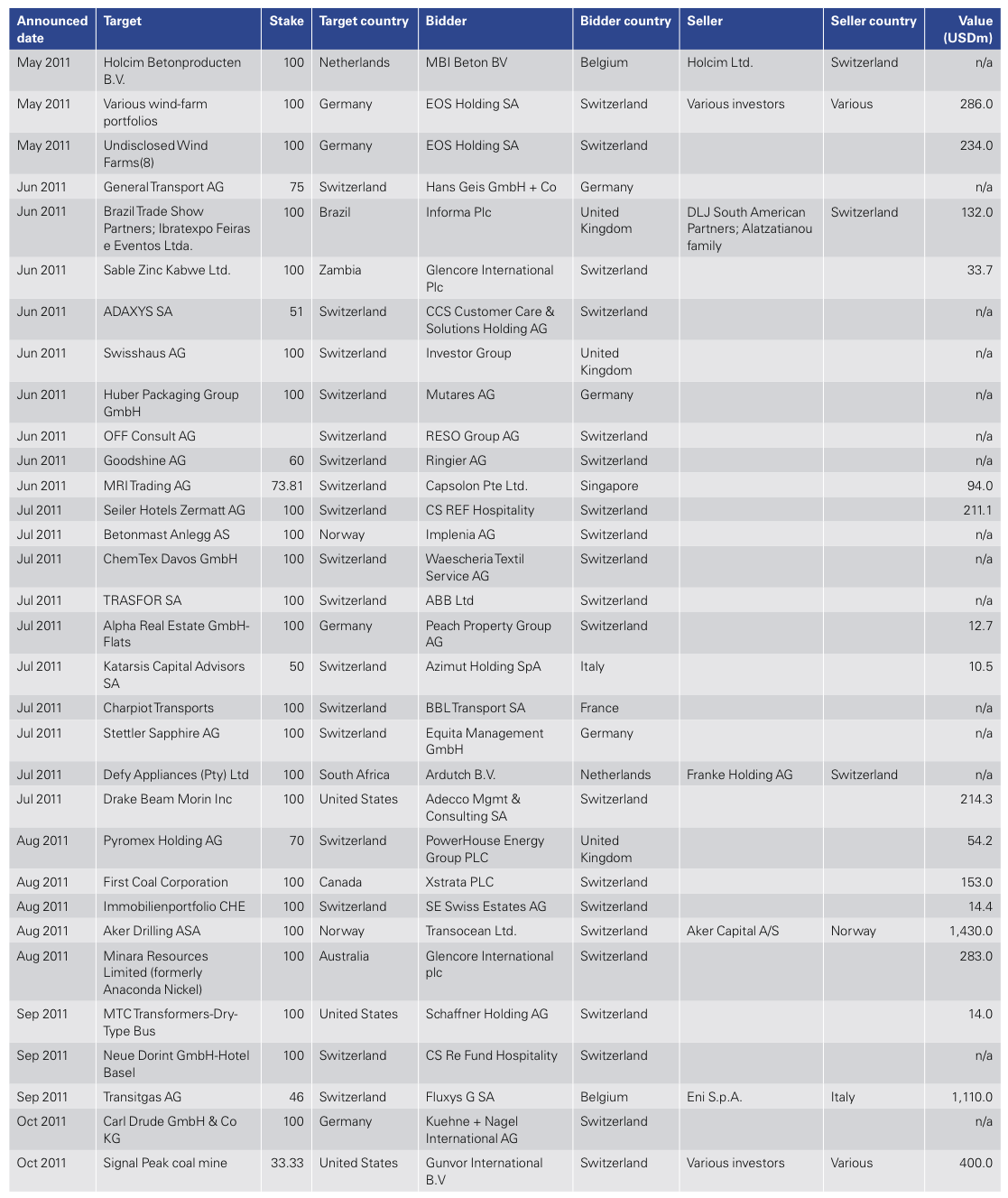

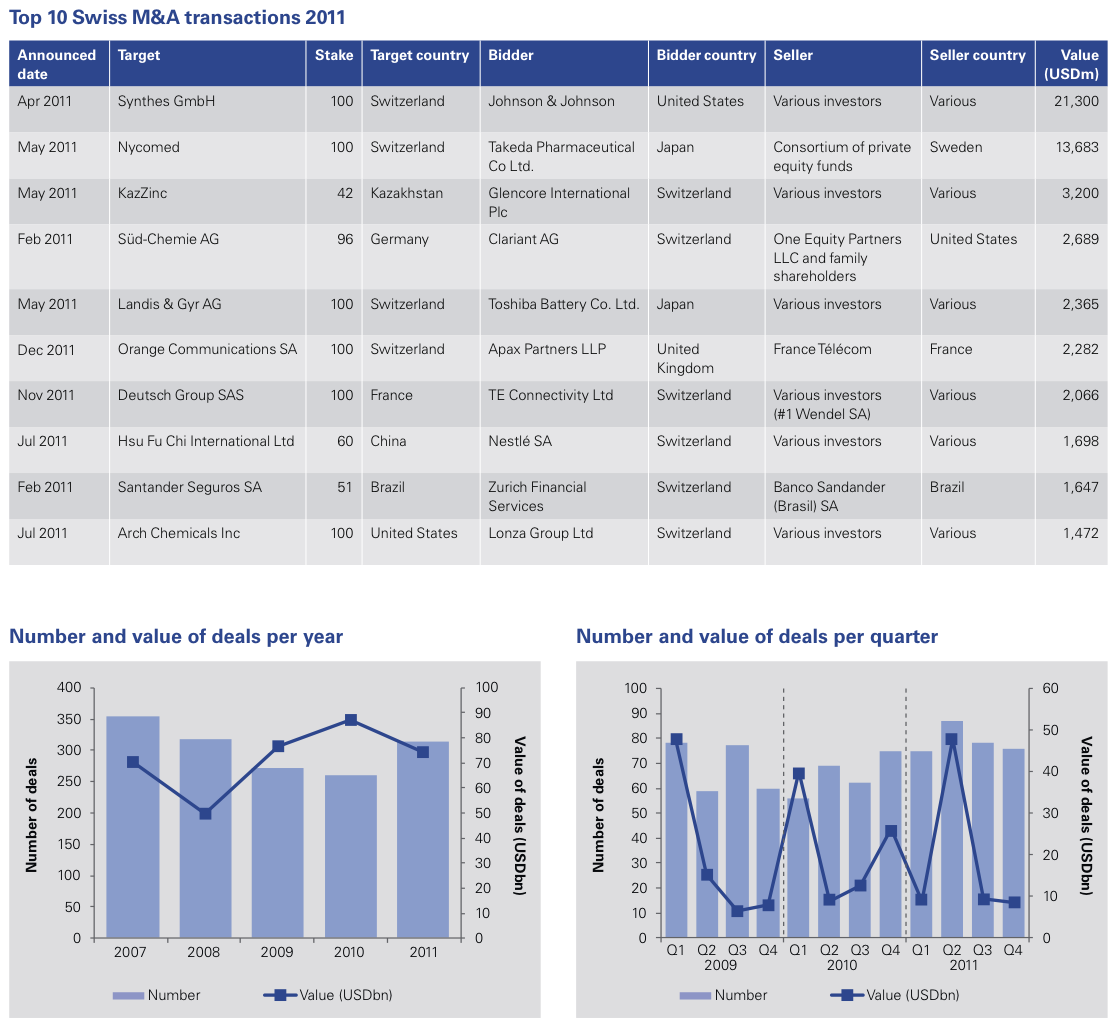

List of 2011 Swiss M&A Transactions