By KPMG

Executive Summary

2008 Highlights

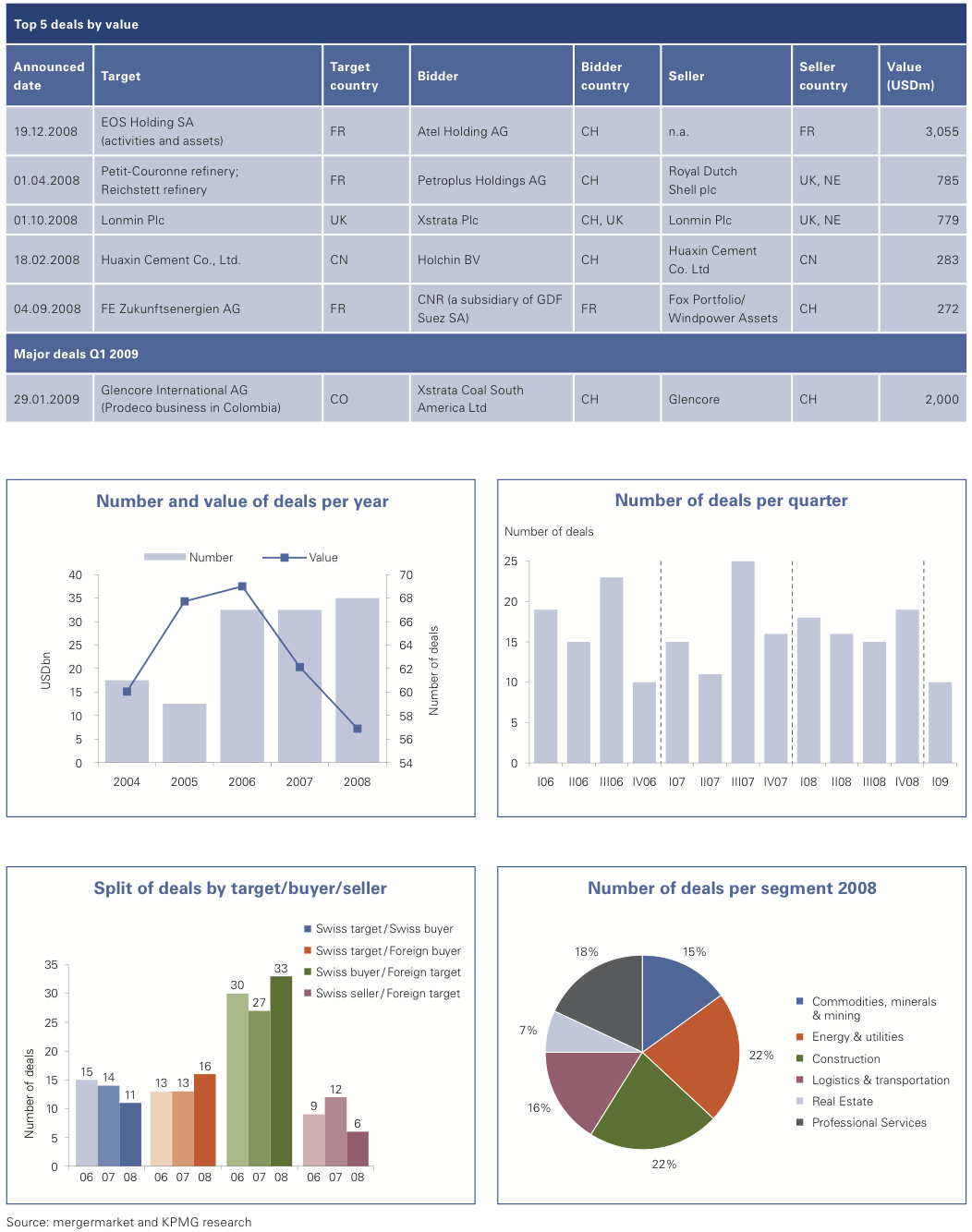

■ Swiss buyers outnumbered foreign buyers by 2 to 1 on cross-border transactions

■ Double digit billion dollar deals have become rare; average transaction values have diminished by 30% over 2007

■ Germany continues to be the most important transaction partner

2009 Outlook

■ Swiss companies generally have strong cash positions and healthy balance sheets and are well positioned to benefit from market opportunities

■ Small and mid-sized companies are the backbone of the Swiss economy and expected to be the focal point of M&A activity in 2009

■ Given the difficulties for financial investors, we expect fewer auctions in 2009

■ The number of multibillion dollar deals will continue to be depressed

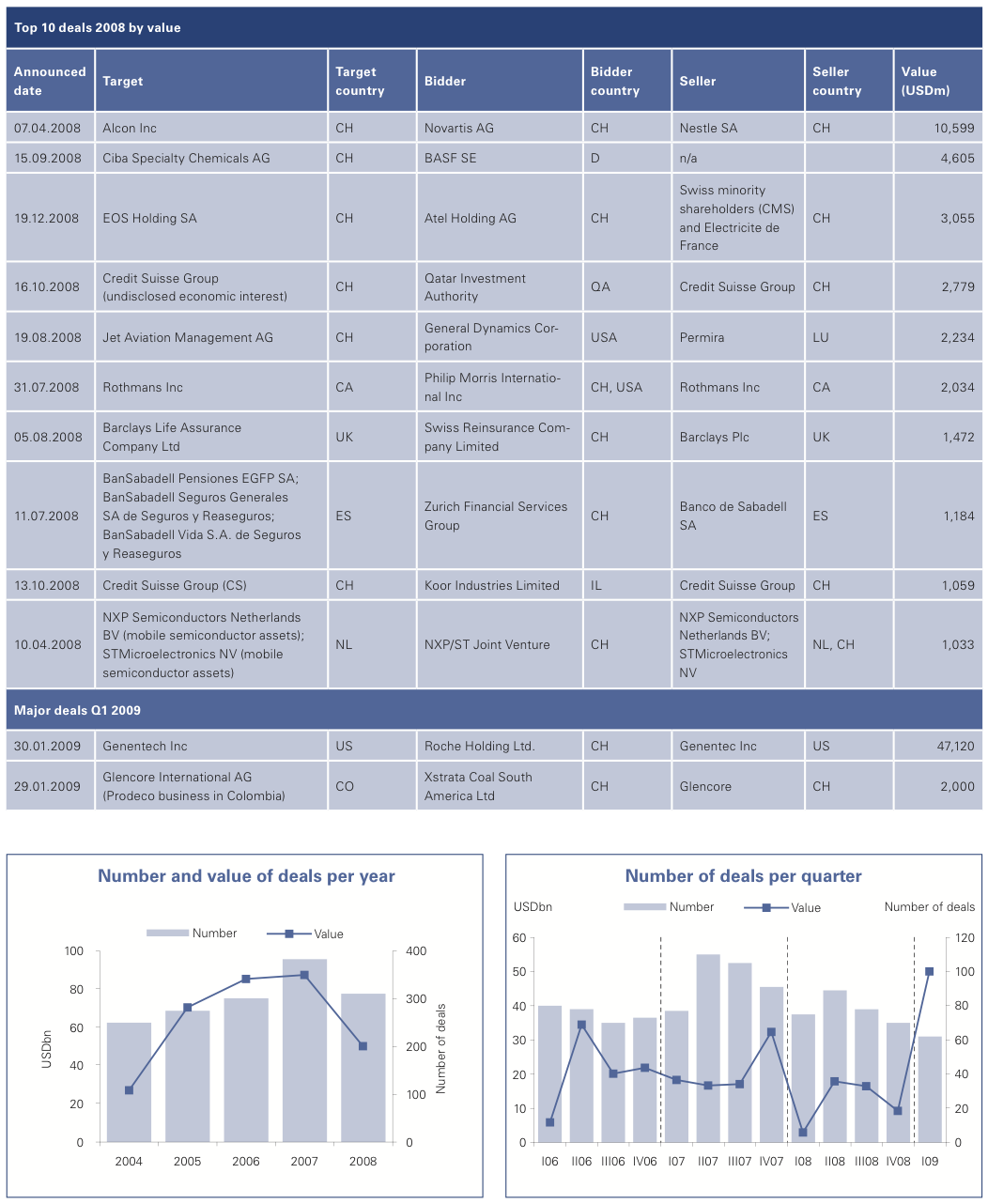

Deal volume was largely comparable to 2006 levels, when today’s economic climate was largely unforeseen. Deal values, however, tell a different story. Only one transaction in 2008 exceeded the USD 10 billion threshold, and the aggregate value of deals announced in 2008 was USD 50 billion – roughly 40% below the nearly USD 90 billion aggregate value seen in 2007. It remains to be seen whether Roche’s drawn-out battle for Genentech is a one-off or indicative of a resurgence in major league deals.

The relative weakness of the US dollar during the first half of 2008 does not appear to have led to significantly more foreign acquisitions in the USA. A marginal increase in Swiss companies buying in North America compares to a drop of seven percentage points in North American companies buying in Switzerland. This suggests that dire economic conditions have significantly curbed their appetite for Swiss targets, with the strong Swiss franc being a possible further hurdle.

The weaker Euro and British pound do not appear to have affected deals between Switzerland and western Europe. While the strong Swiss franc is an obstacle for the heavily export-oriented Swiss economy, there remain a number of companies sitting on comfortable cash reserves. Of these, most will tread carefully until they can better assess the duration of the current crisis, though some will profit by using their war chests to make strategic acquisitions.

Industries

With the exception of Consumer Markets, deal volumes fell by between 20% and 50%, with the Chemicals and Processing Materials sector experiencing the steepest decline. Ironically, some of the sectors showing a sharp dip in deal volumes boast relative (Healthcare and Life Sciences) or even absolute (Chemicals and Processing Materials and Industrial Markets) peaks in terms of aggregate deal values. The latter two, however, were distorted by Swiss flagship companies (CIBA and Jet Aviation) being acquired by foreign buyers.

Geographical spread

Domestic Swiss M&A activity in 2008 fell back to 2006 levels, as did acquisitions of Swiss companies by foreign buyers. Swiss acquisitions abroad, however, remained at (high) 2007 levels. These patterns seem to reflect a combination of factors:

■ The reasonably healthy status of the Swiss economy (with the possible exception of Financial Services) in the first half of the year while larger European or North American economies were impacted much sooner by the credit crisis

■ Strong strategic rationale

■ The strong Swiss franc and the weaker currencies of potential Euro or Dollar zone acquirers

Only minor changes were noted in transaction volumes with Asia-Pacific, Russia/CIS and elsewhere.

Strategy focus and further consolidation

The 2007 trend towards core business focus and strategic portfolio enhancements continued in 2008. Distressed sales were rare, with strategic acquisitions dominating the scene. Going forward, growth and consolidation strategies will largely depend on the appearance of a silver lining on the horizon. In most cases, companies will manage their cash reserves very carefully, shoring up their liquidity until future prospects become clearer.

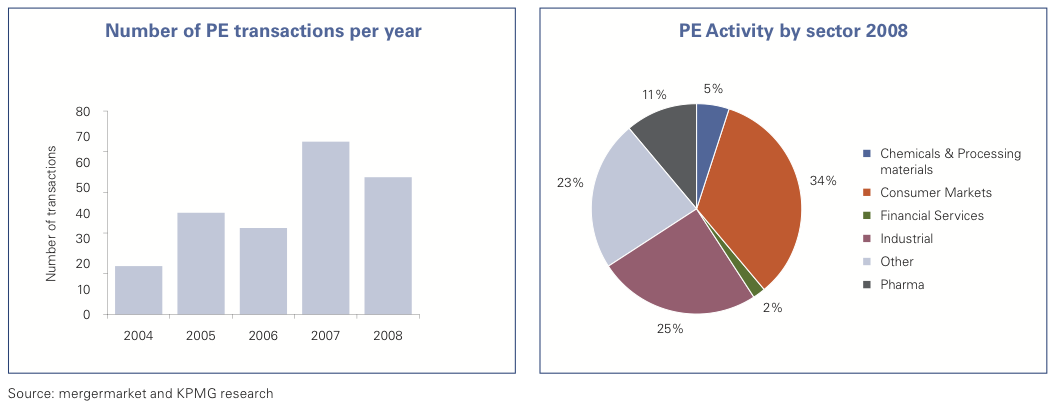

The role of private equity houses, sovereign wealth funds and activist shareholders While the number of private equity deals declined by 20% compared to 2007 (remaining noticeably above 2004–2006 levels), total disclosed deal values slumped to approximately one third. 2007 saw five PE transactions exceeding USD one billion; there was only one deal of that magnitude in 2008. Private Equity houses may need to redefine their business models, while corporates may need to become more proactive in identifying targets given the lack of auctions.

Sovereign wealth funds were heralded either as the saviours of the financial services industry in 2007, or feared as potential poachers in other strategically important sectors. A number of these players are now steering clear of the market, having lost a great deal of value in the stock market crash. Other than the CHF 3 billion investment in Credit Suisse by the Qatar Investment Authority, sovereign wealth fund activity has been severely limited.

Activist shareholder activity, be it by watchdog organizations or by hedge funds who had often assumed such a role, seems to have abated. With a number of hedge funds in acute difficulties of their own, it remains to be seen how they will react to the new economic climate.

Unsolicited takeovers

2008–2009 saw two major drawn-out take-over bids, with Xstrata’s offer for Indophil being rejected, while Roche’s bid for Genentech finally succeeded in January 2009. Laxey continue to eye Implenia and recent board changes at Sulzer have triggered speculation about whether Sulzer will play a role in the restructuring of OC Oerlikon. Overall, due to the continuing impact of the credit crisis, we expect the number of such takeovers to rise.

Outlook

The impact on M&A of interventions by various governments in bailing out key domestic industry players is as yet unknown. Generally speaking, protectionism within EU member states and the USA could curb shopping sprees by foreign acquirers. Another open question is the effect of the government’s agreement to comply with OECD Model Tax Convention; private banks whose core business is in the off-shore sector will likely need to rethink their strategies. It is too early to assess whether the National Bank’s efforts to maintain the Swiss franc’s rate against the Euro and the US dollar at meaningful levels has any effect on M&A activity. The same applies to the Swiss government’s efforts to boost investments in the infrastructure and energy conservation sector.

Cantonal banks and similar institutions retain large pools of funds and are widely regarded as the main credit source for small and mid-sized businesses. Nevertheless, many of these players – particularly those with extended research cycles, such as biotech companies – might turn to larger players for support, and we expect the number of distressed sales to increase.

At this point, all eyes are looking for light at the end of the tunnel. Until there are vital signs of a potential economic recovery, it is difficult to forecast what 2009 will bring. Q1 M&A activity provides few clues to further developments in 2009, but we would expect further consolidation in the Healthcare and Life Sciences, Chemicals and Processing Materials, Financial Services and Industrial Market sectors – with domestic deal activity and Swiss acquisitions abroad dominating the scene. (Tobias Valk, Head Transaction Services and Patrik Kerler, Head Corporate Finance)

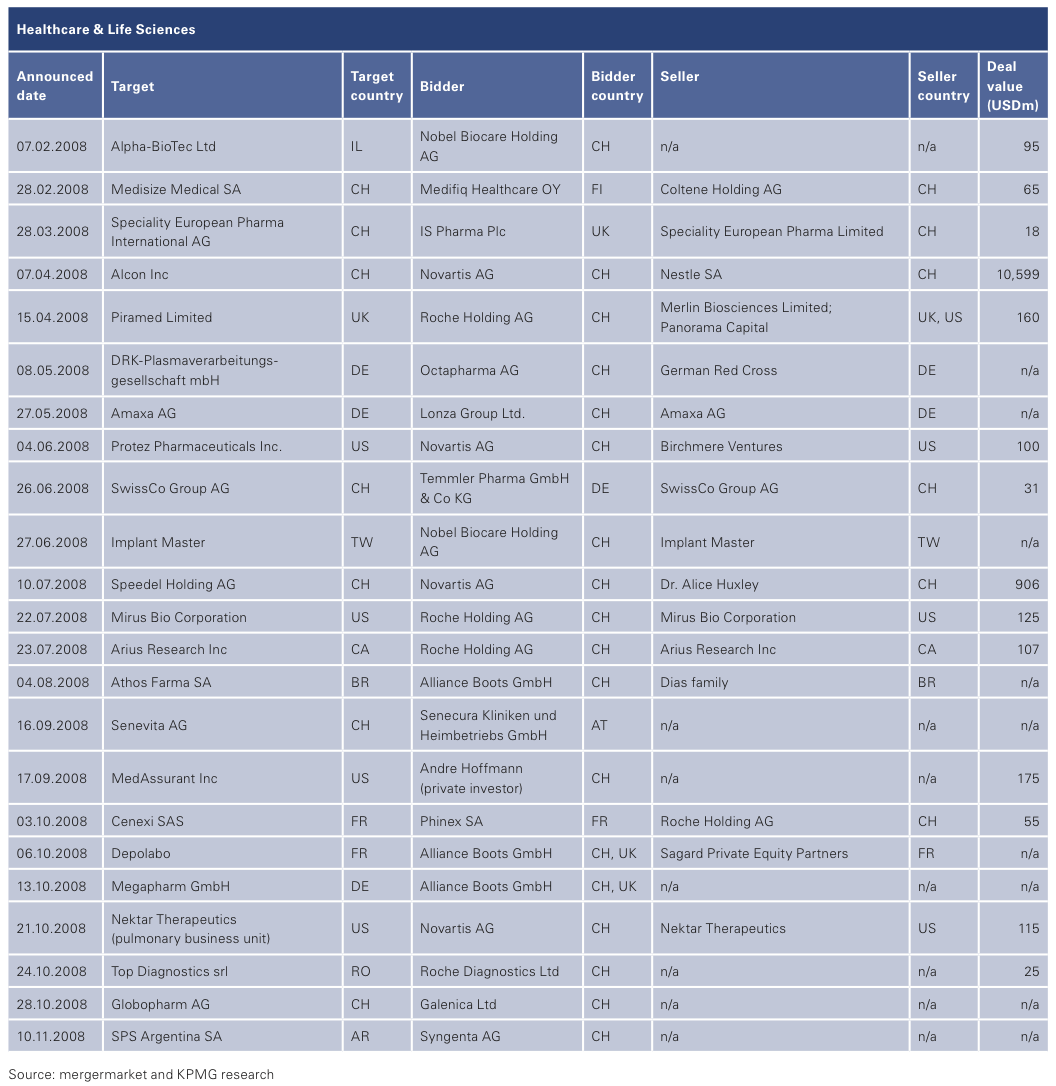

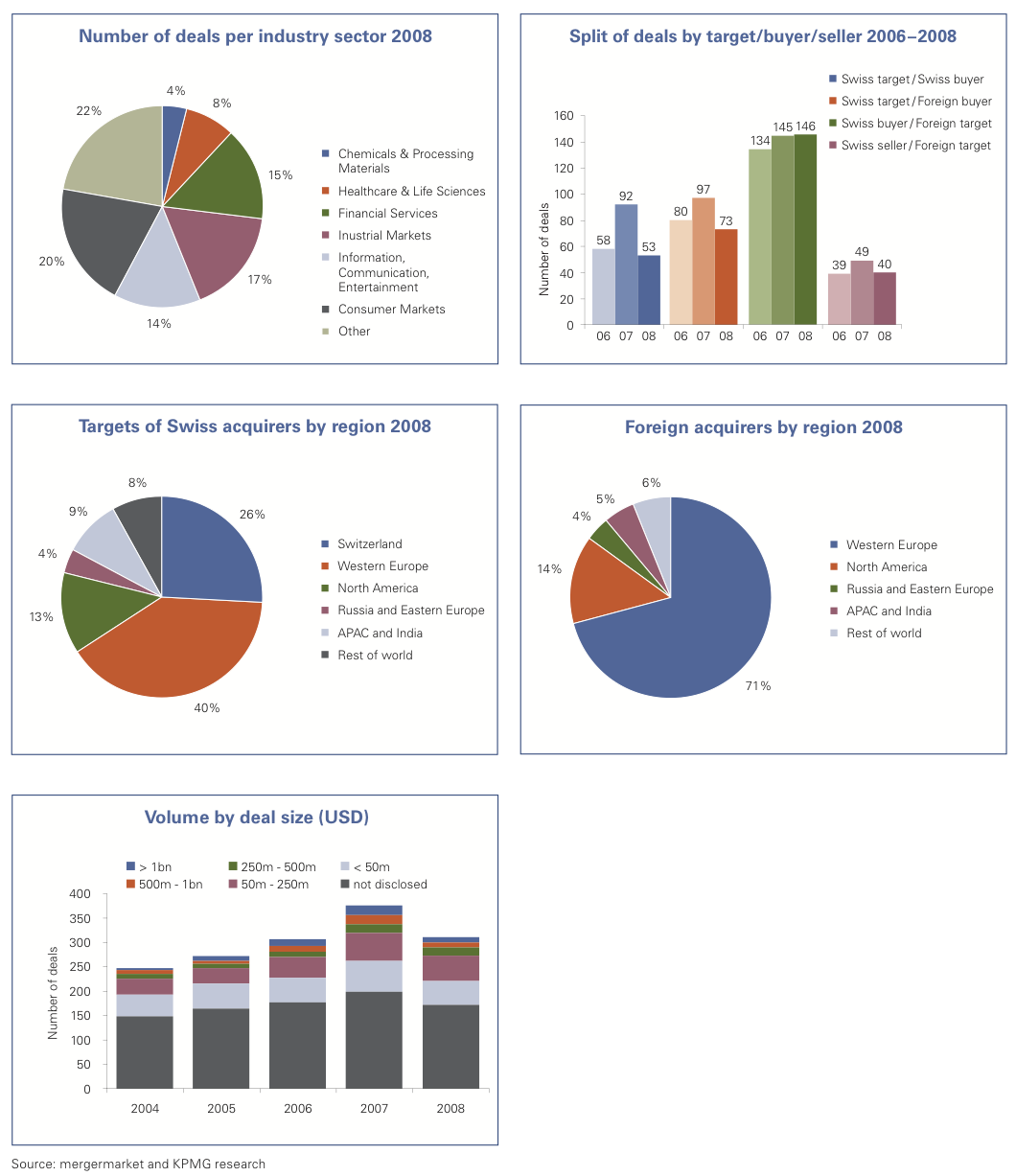

Healthcare and Life Sciences

Longer term challenges, such as expiring patents and the threat of generic substitutes by competitors, continue to persist in the global Healthcare and Life Sciences industry. Compared to prior year, there was a sharp decline in M&A activity in terms of numbers and values. The outlook for 2009 seems more promising.

2008 Highlights

Low equity market valuations and the global financial crisis have made financing difficult to obtain, hurting smaller biotech and research companies in particular. Unable to finance their research and development projects, many of them are on the market at “bargain” prices. Given the comparatively low take-over cost and the potential to acquire new products, these companies seem to be attractive targets for larger cash-rich drug companies.

Roche’s 2008 acquisitions of Memory Pharmaceuticals Corp., a US biopharmaceutical company engaged in the discovery and development of drugs for the treatment of central nervous system disorders; Arius Research Inc., a Canadian biotechnology company active in the field of antibody therapeutics to treat cancer; Mirus Bio Corporation, a US based biopharmaceutical company engaged in the development of nucleic acid based technologies; and Piramed Ltd., a UK based biotech company operating in the field of cancer and immune inflammatory disorders such as arthritis and asthma, all appear to fall into this category. Novartis acquired the pulmonary business unit of Nektar Therapeutics, the remaining shares of Speedel Holding AG, a Swiss based biopharmaceutical company developing innovative therapies for cardiovascular and metabolic diseases, and Protez Pharmaceuticals, a US based company engaged in the discovery and development of new antibiotics for difficult-to-treat infections.

The largest transaction in 2008 was Novartis’ acquisition of a 24.85% stake in Alcon Laboratories Inc., a US/Swiss based company involved in the research and manufacture of pharmaceuticals, surgical equipment and devices, contact lens solutions and other vision care products, from Nestlé SA.

Nearly half of the 26 Healthcare and Life Sciences M&A transactions announced in 2008 were led by large Swiss players such as Roche, Novartis and Nobel Biocare.

2009 Outlook

We expect the economic crisis to generate more opportunities for multinational healthcare and life sciences companies to acquire new product lines and competitors in niche markets at favourable prices, leading to more and larger deals in 2009.

In the first quarter of 2009, Roche finally succeeded in its attempt to buy the remaining shares of Genentech Inc., concluding a long battle to acquire the American biotech company and its lucrative cancer drugs. Elsewhere, Pfizer Inc. acquired Wyeth for USD 64 billion, becoming the world’s largest drug company. Further consolidation in the global drug market is reflected by Merck’s acquisition of Schering-Plough Corp for USD 43 billion. We would expect Swiss global players in the healthcare and life sciences industry to follow the global trend of consolidation. (Miriam Thomas, Director, Transaction Services)

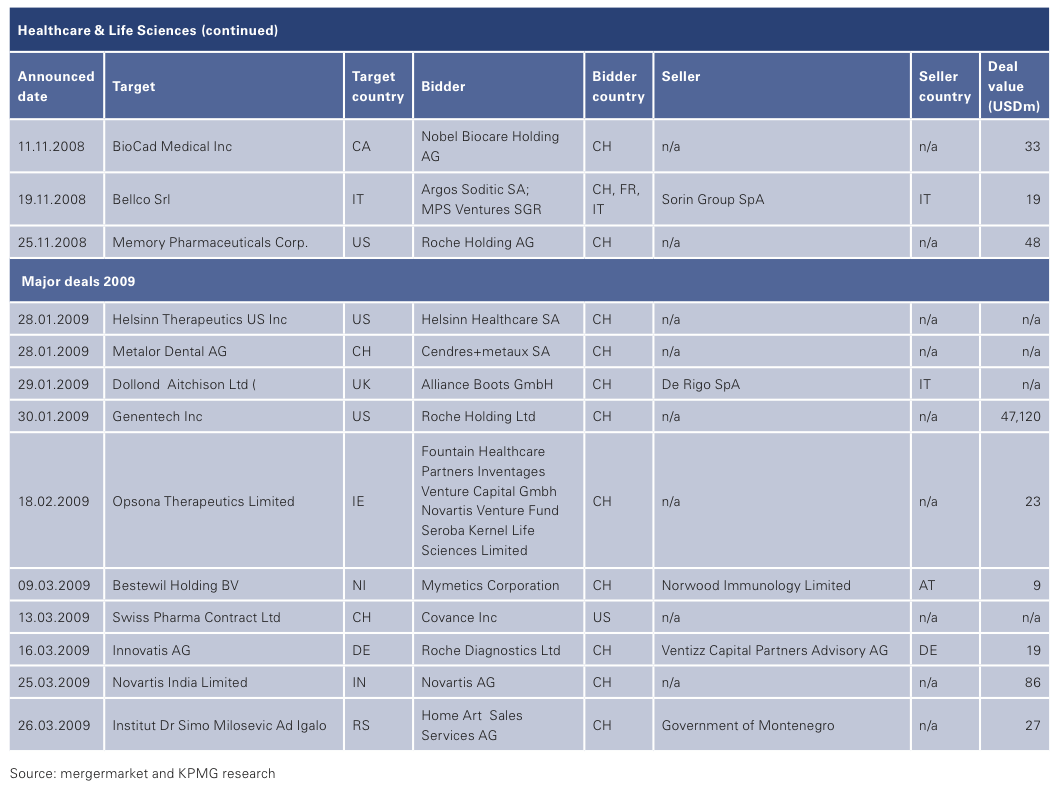

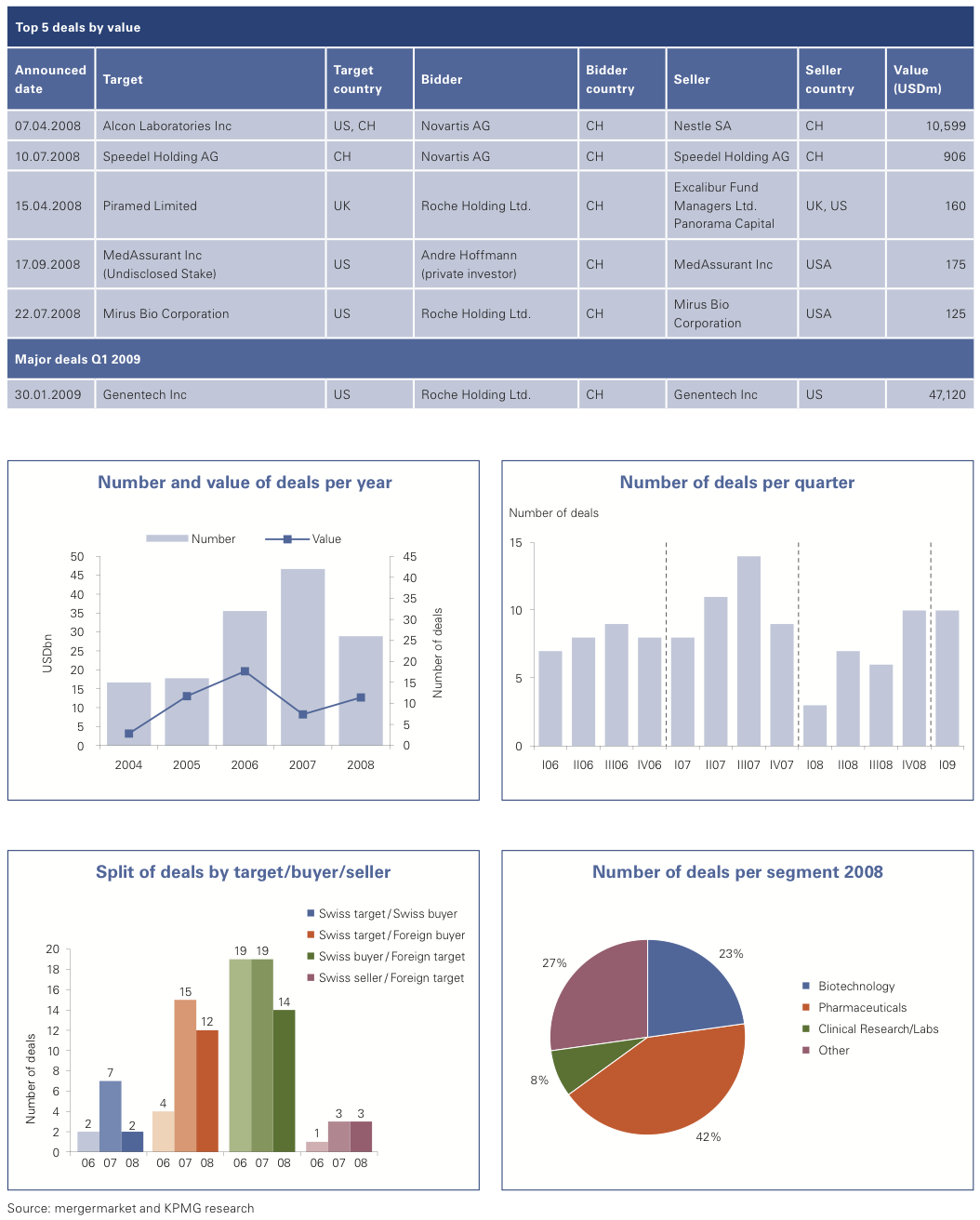

Chemicals and Processing Materials

The industry faced a number of significant challenges in 2008, with raw material costs reaching unprecedented levels in the first half and a dramatic drop in their order books towards the end of the year, as the economic downturn took hold. Many companies acted quickly to mitigate the effect of these factors; reducing capacity and inventory levels, as well as limiting capital expenditures and attempting to keep costs to a minimum.

2008 Highlights

The trend towards product portfolio specialization continues in the Swiss Chemicals and Processing Materials industry. Companies focus on their core competencies and high value add products rather than a broad product portfolio. In addition to large players like Clariant, Switzerland has a vast number of small and midsized companies in this sector, thus offering continuing potential for M&A activity.

Deal volumes fell sharply by 48% in 2008, the pace of decline accelerating during the second half of the year. Total deal values, however, rose from USD 1.5 billion in 2007 to USD 5.6 billion in 2008, mainly driven by BASF ́s acquisition of Ciba, one of the leading global specialty chemicals companies, a world leader in plastic additives and strong global player in coating effects materials as well as water and paper treatment. With this acquisition BASF is able to expand its position in specialty chemicals and aim to become the leading supplier with an extensive portfolio in paper. From a Swiss perspective, the transaction marks the end of 100 years of Swiss industrial history in the chemicals sector with the disappearance of one of the historical Basle flagships.

Many of the deals reflect the acquirers’ strategy of strengthening their product portfolios; targets were often operating in the same market as the acquirer. For example, Syngenta’s acquisition of Goldsmith Seeds and Yoder Brothers Inc. bolsters its position in the flowers and crop sector. Other acquisition rationales seem to be better access to overseas markets, as exemplified in Clariant’s acquisition of Ricon Colors, or the search for R&D synergies. Bosch’s acquisition of SIA Abrasives can be seen as an example of an IP-driven acquisition.

2009 Outlook

Economic uncertainty persists. Raw material costs have started to ease, but experts are not expecting market demand to show any meaningful recovery until late 2009 at the earliest. Price pressure from customers is further squeezing margins. Many chemical companies are struggling to meet debt obligations, triggering divestiture activity, which we expect to increase in the next few months unless industry demand picks up. Concerns over liquidity and distressed conditions are likely to increase the number of assets for sale as companies restructure to weed out poor performers or simply to raise cash. The industry has already seen a wave of restructuring announcements which will likely bring certain assets to market.

Some segments in the chemicals and processing materials industry are in relatively good shape and are likely to maintain M&A activity, e.g. base materials for personal care, fine chemicals, water treatment, and agricultural chemicals. Even sectors that have been hit hard, such as coatings, remain ripe for further consolidation. Large and medium sized companies with strong balance sheets could take advantage of cheap asset prices by entering into small but synergistic deals in 2009 to broaden their portfolio. (Pablo Ljaskowsky, Partner, Transaction Services and Gloria Glang, Manager, Transaction Services)

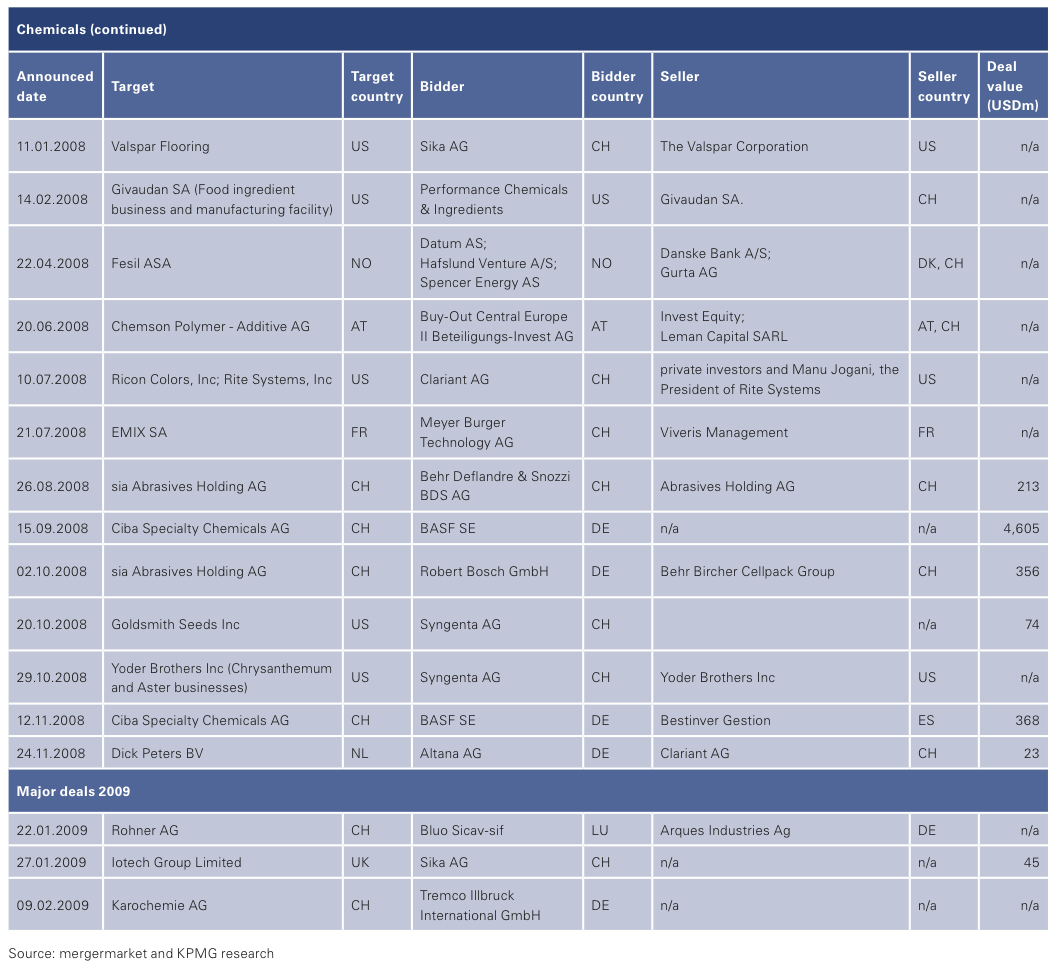

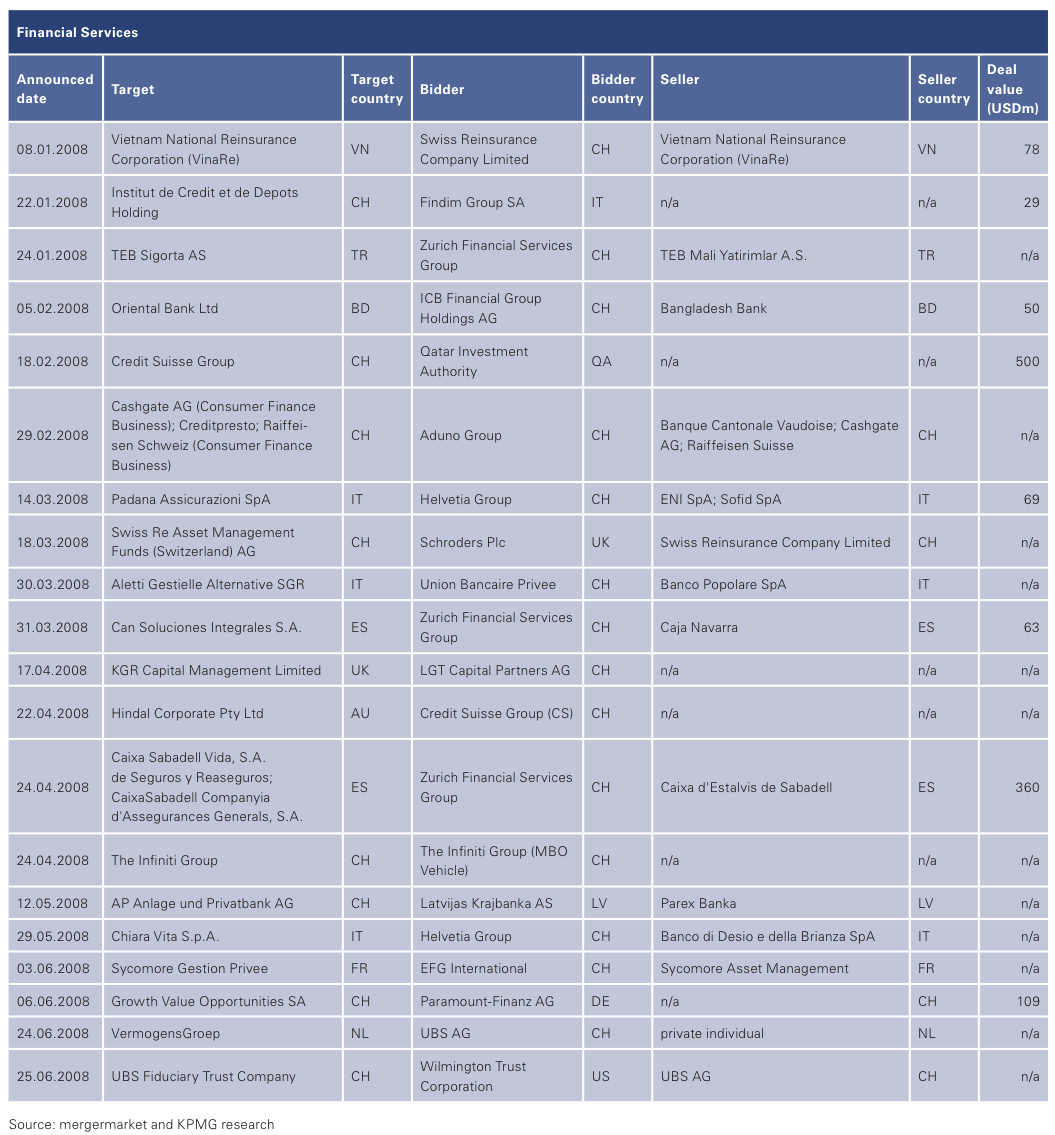

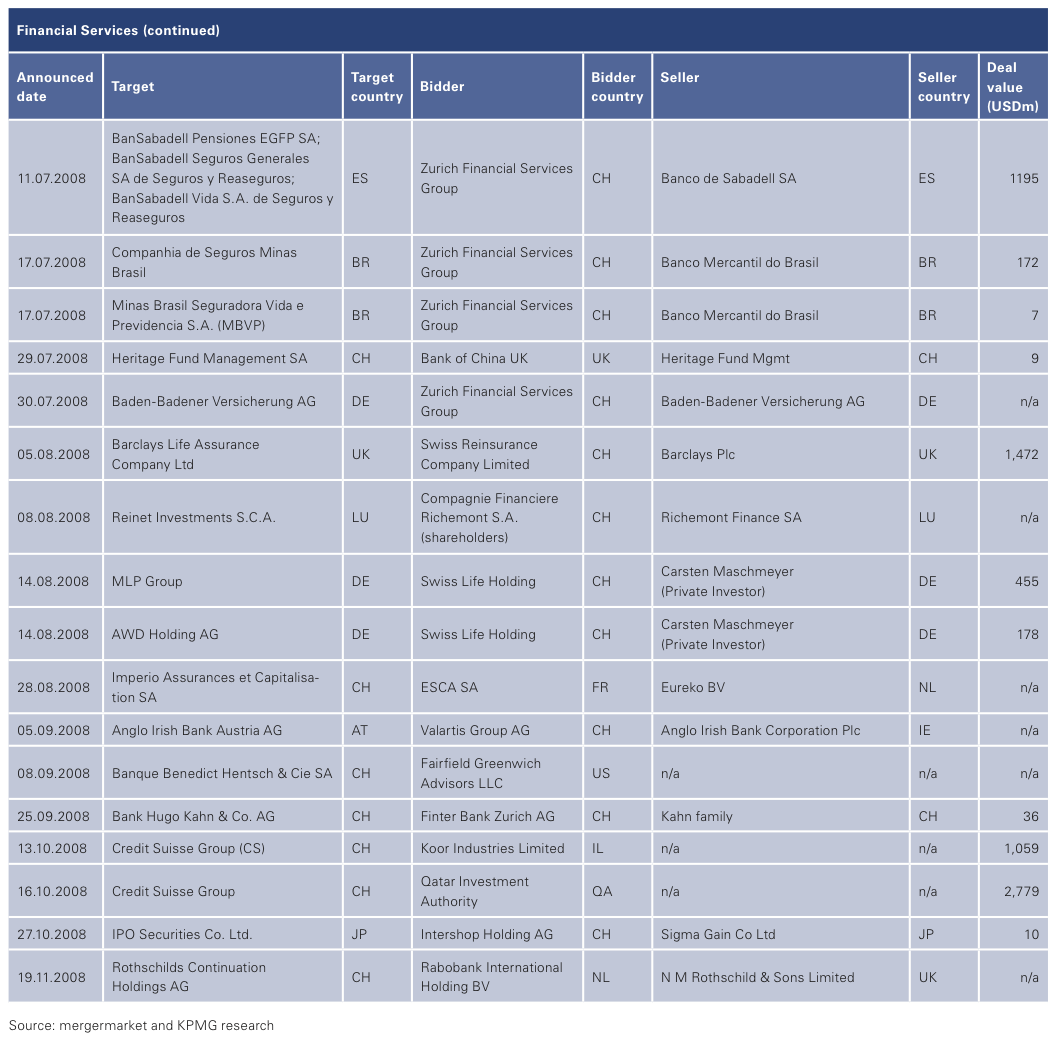

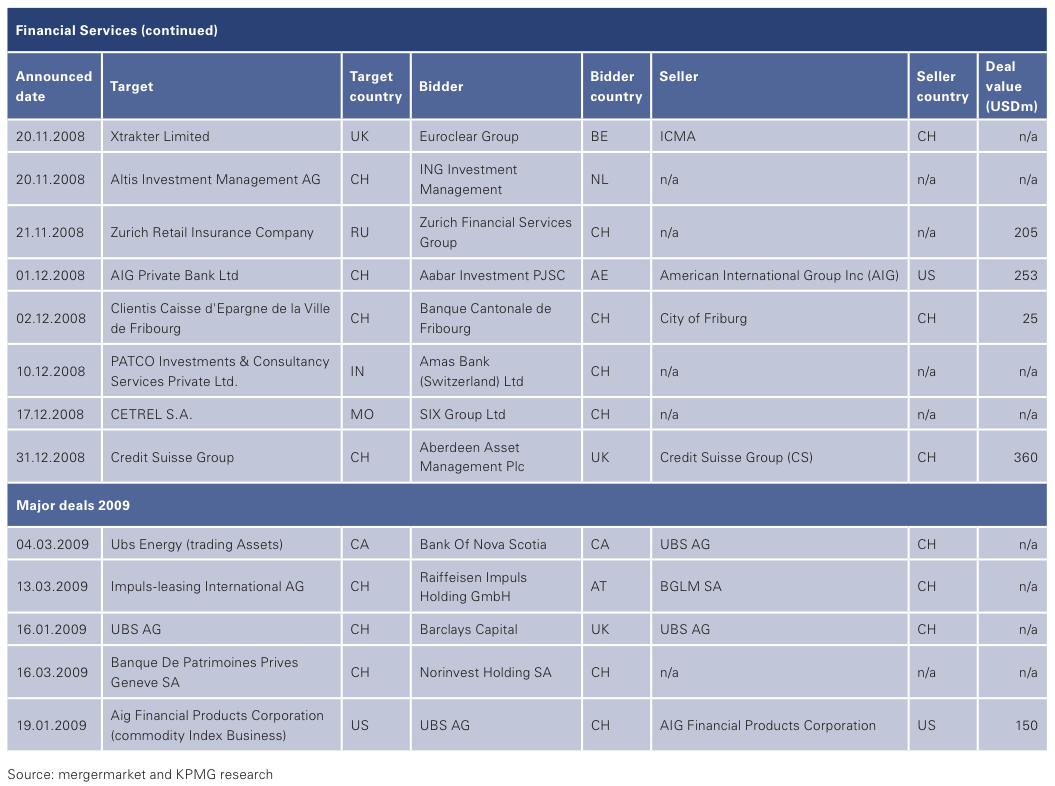

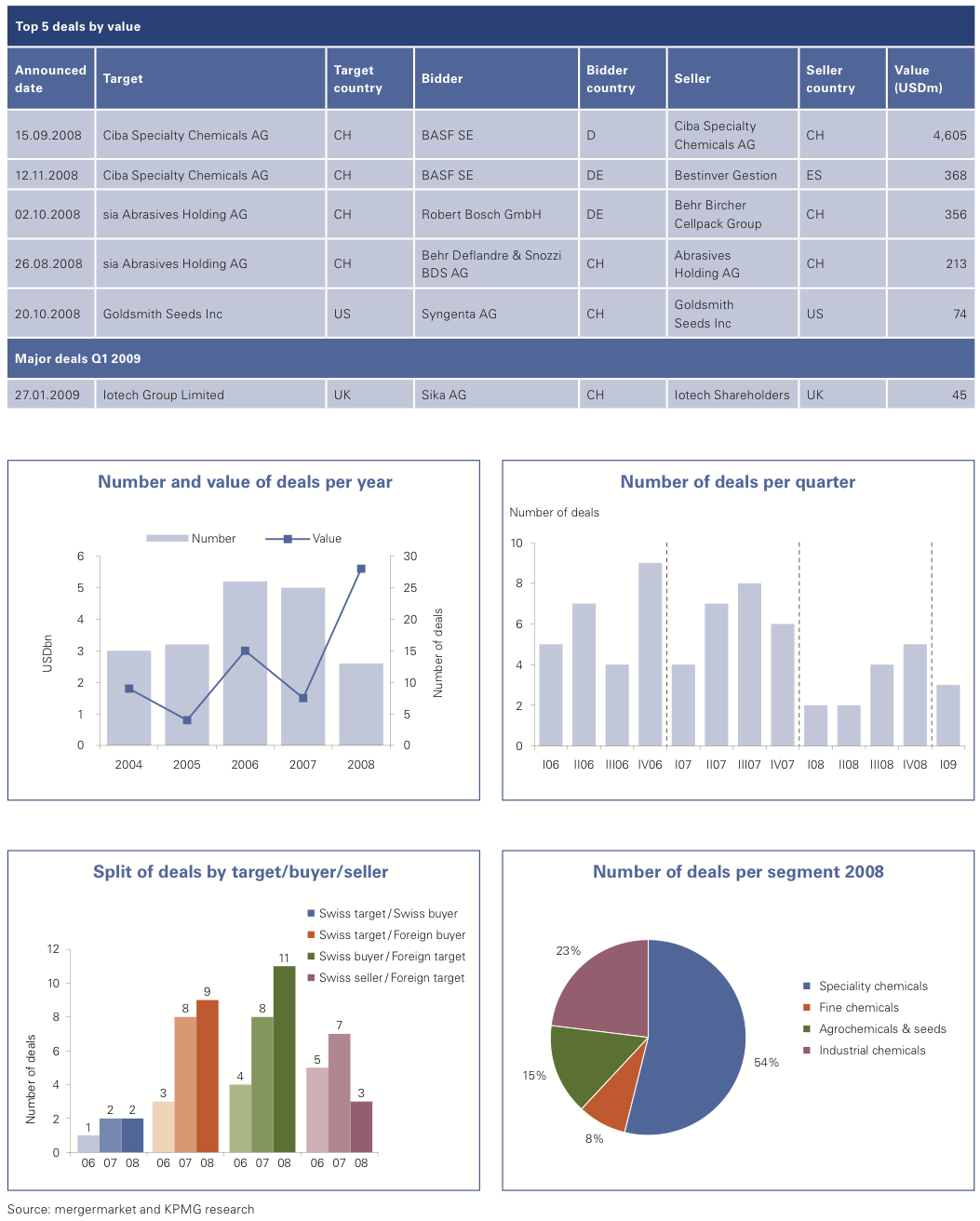

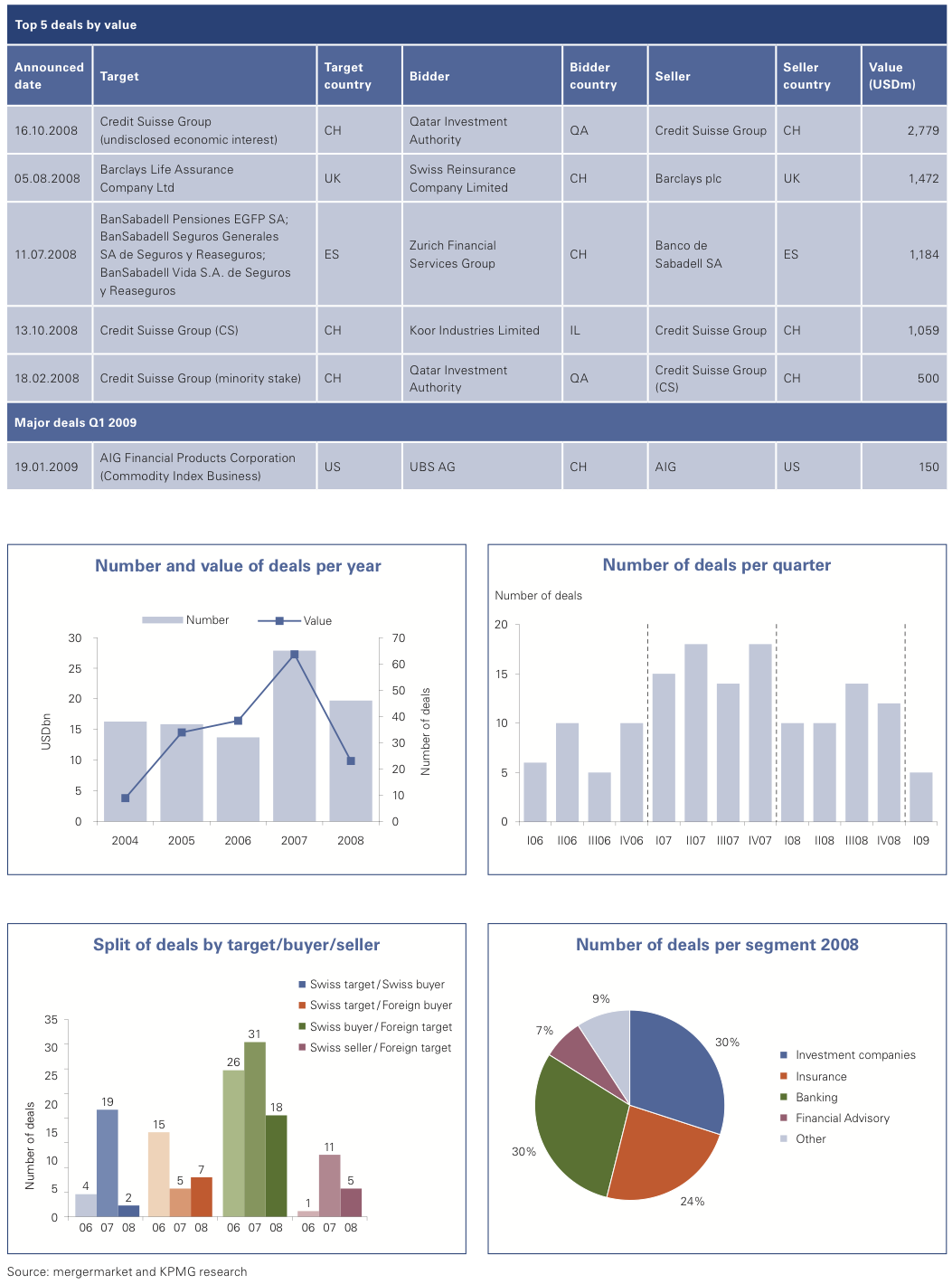

Financial Services

The magnitude of the global financial crisis in 2008 has triggered unprecedented levels of government assistance and will likely result in a new global financial landscape. The resulting low level of Swiss financial services M&A transactions in 2008 is expected to reverse sometime in 2009 as private banks address the implications of the OECD Model Tax Convention’s impact on banking secrecy, and other financial institutions implement their “back-to-basics” strategies.

2008 Highlights

The impact of the credit crisis on global financial services has been widely reported and trust in the industry badly damaged. Severely restricted credit and a precipitous fall in asset prices have harmed the capital positions of financial institutions, requiring unprecedented levels of government assistance and, in some cases, nationalization.

Radical changes being discussed at a global level to address serious financial sector deficiencies will permanently alter the global financial services landscape. Such deficiencies include the failure to regulate hedge funds and rating agencies, no settlement and clearing of OTC derivatives, insufficient capital requirements, limited cross-border supervision, and counter-productive incentive schemes.

As a result of external pressure regarding banking secrecy and offshore funds (Switzerland is a primary target as it holds approximately one-third of global offshore wealth), Switzerland has committed to relaxing its banking secrecy law and is planning to renegotiate a number of bi-lateral double taxation agreements with various governments.

2008 saw limited buyer appetite and a reluctance to sell in a down market, the number of M&A deals falling by around 30%. This downward trend continued with only six transactions in Q1 2009. Announced deal values also fell significantly even after considering the capital injections by Sovereign Wealth Funds in Credit Suisse in 2008 and UBS in 2007.

Despite the economic slowdown, M&A activity in the Swiss insurance industry was robust. Zurich Financial Services (ZFS) led with eight acquisitions, acquiring 50% stakes in the insurance arms of three Spanish bancassurers and securing exclusive distribution agreements with those groups. ZFS also bought in Brazil, Germany and Turkey, as well as entering into a joint venture in the UAE. Further, ZFS purchased the remaining minority interest of its Russian subsidiary.

Private banking transactions in 2008 were limited, the most notable being AIG’s disposal of its Swiss private banking subsidiary, AIG Private Bank, to Aabar Investment PJSC of the UAE.

2009 Outlook

Swiss insurance M&A may be driven by well capitalized Swiss insurers with good access to funding taking the opportunity to acquire market share.

Due to the expected adoption of the OECD transparency standards, small-to-mid sized private banks with significant non-resident assets may be forced to establish onshore operations to retain clients. Lower “Assets under Management” values and margins are expected to lead to even more aggressive cost cutting. Accordingly, consolidation in private banking may accelerate in 2009. (Christian Hintermann, Partner, FS Transaction Services and Kevin Cloughesy, Senior Manager, FS Transaction Services)

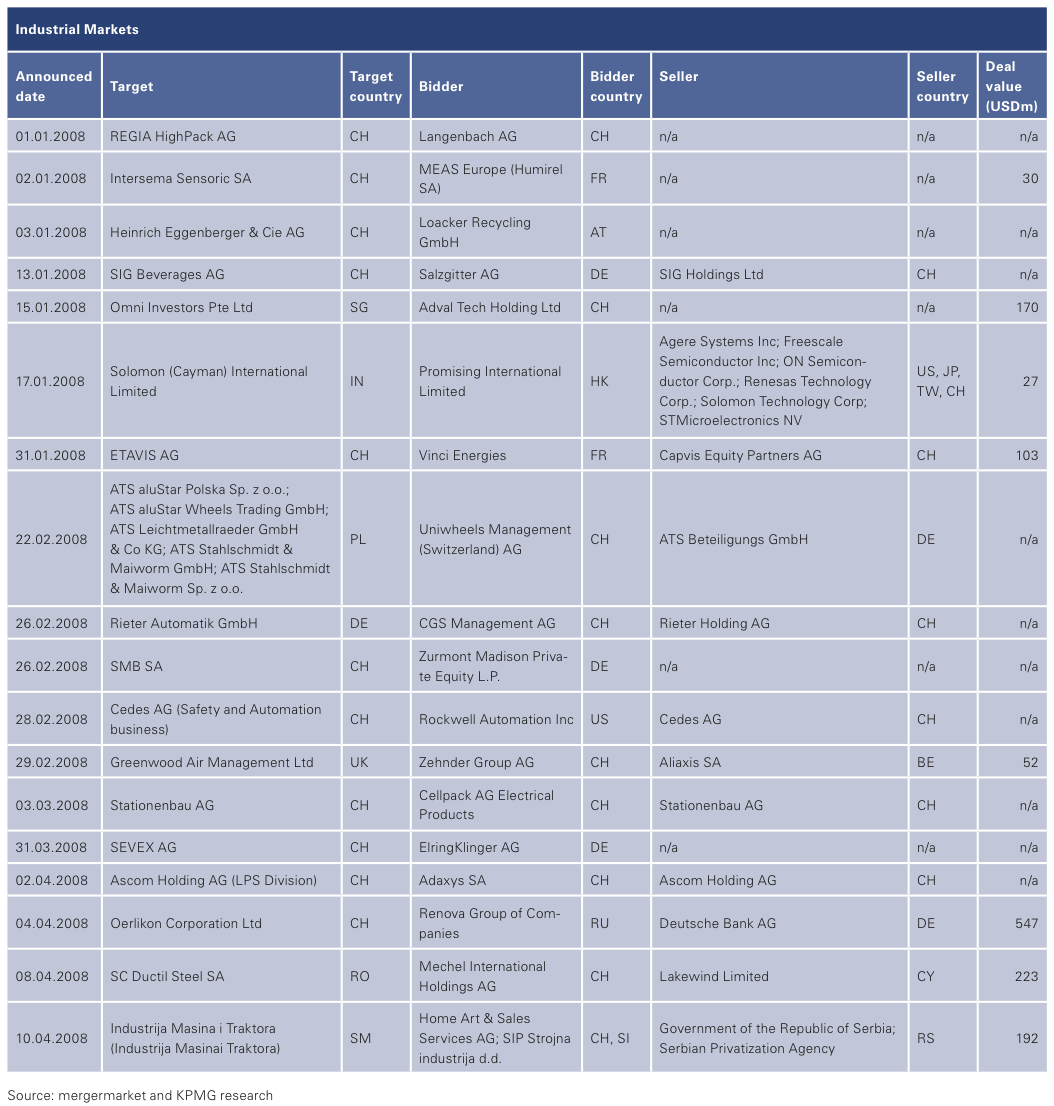

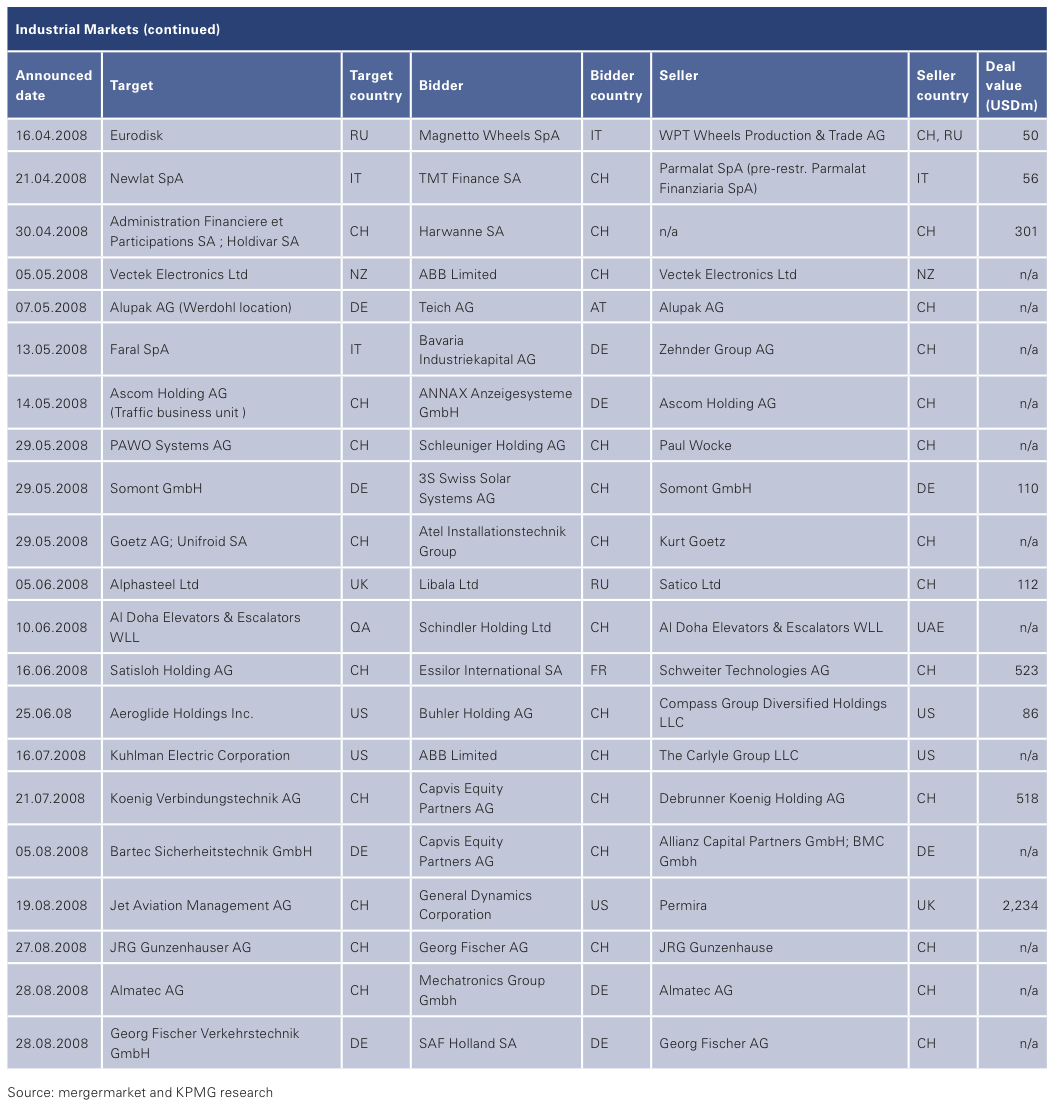

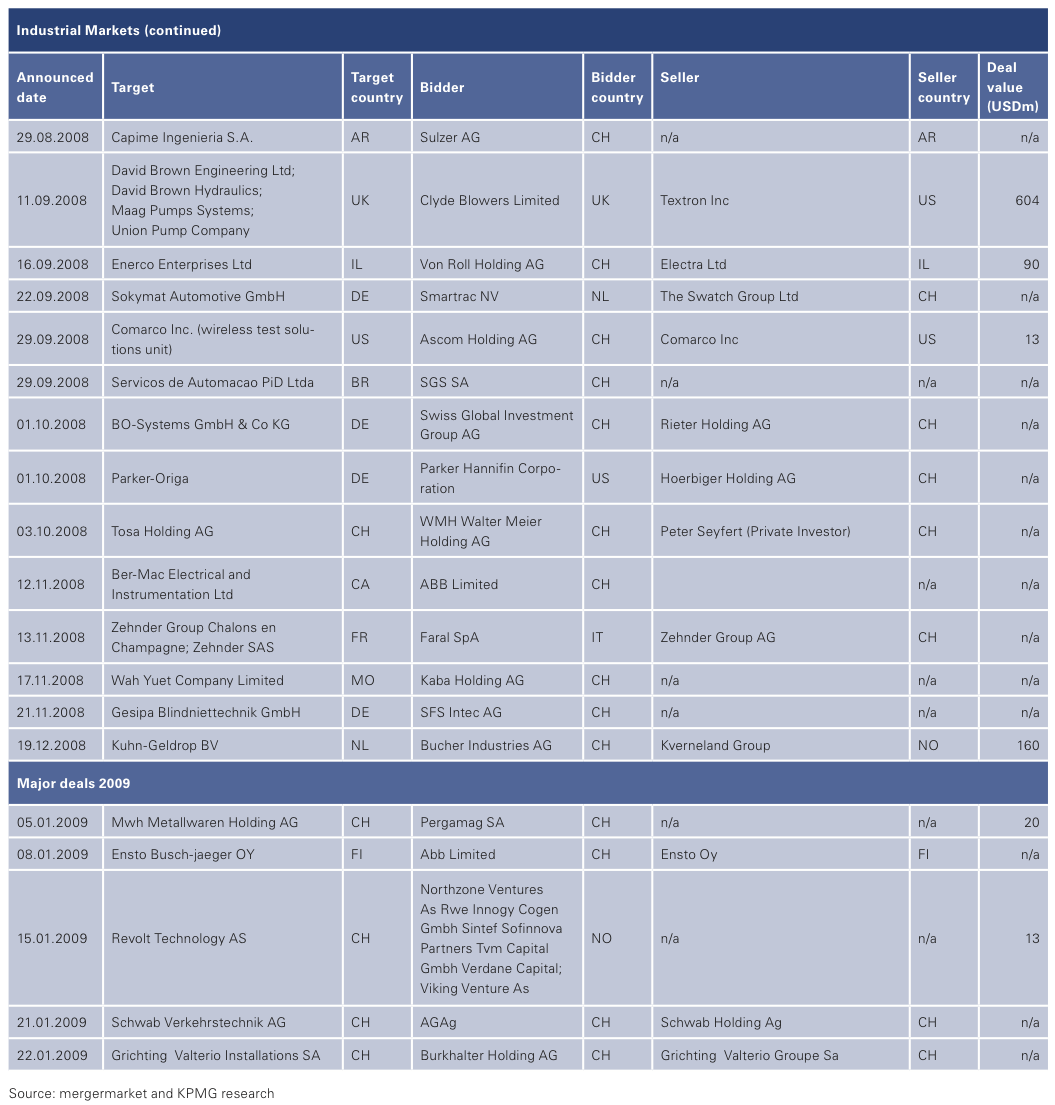

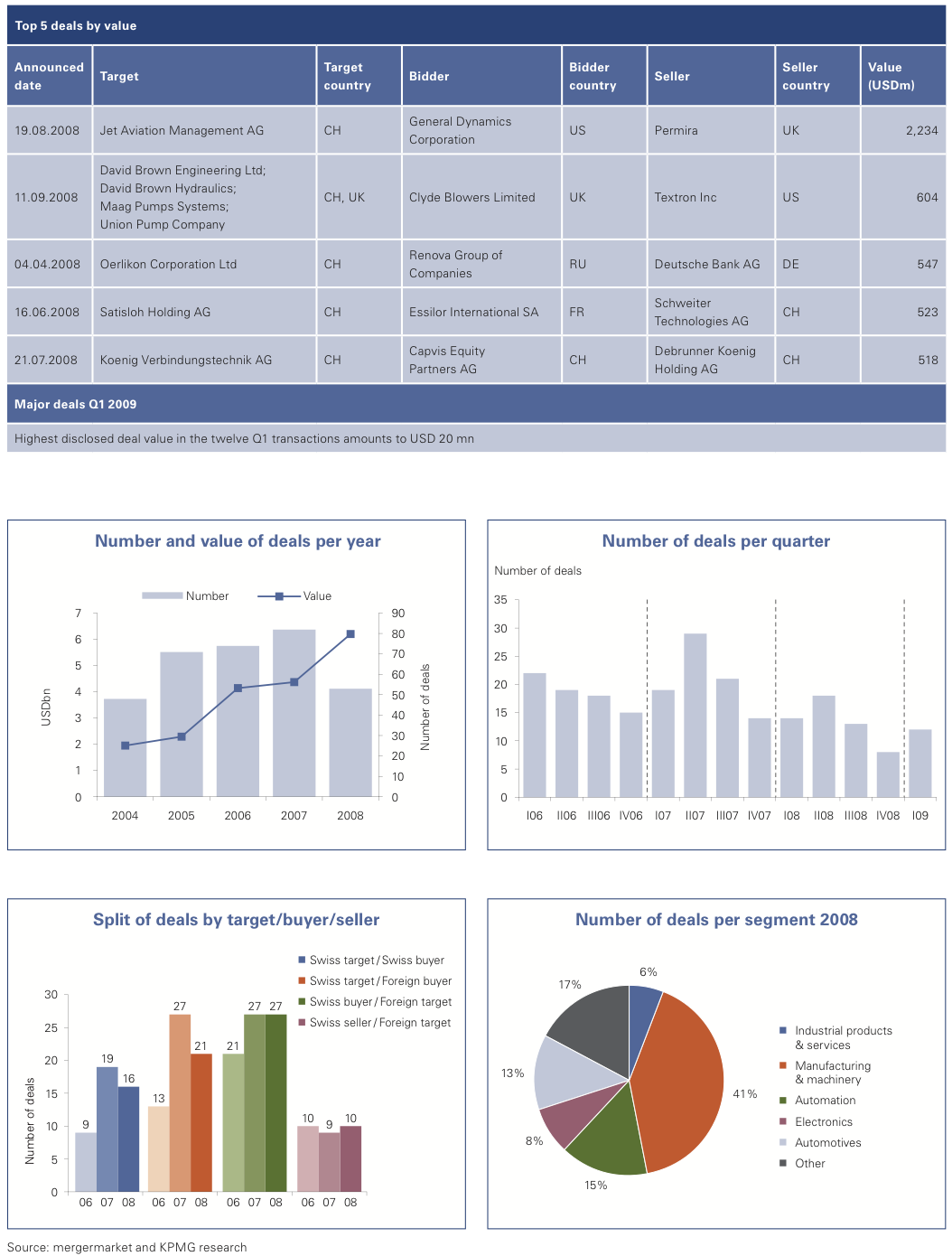

Industrial Markets

While M&A in the first half of 2008 remained reasonably healthy, the current macroeconomic conditions hit the industry in the second half, culminating in a near stand-still in the last quarter. Order intake fell sharply and clients started to de-stock and to postpone planned investments. The strong Swiss Franc and the tail end of investment cycles in various industries, such as textile machinery and automotives, exacerbated the situation. The stock market reacted with a sharp downwards correction of share prices and market multiples.

2008 Highlights

Of the 55 deals in 2008, more than half involved Swiss buyers. Fewer than ten were undertaken by financial investors. Among the most active companies were ABB, Ascom and Zehnder, continuing their strategy of complementing their product portfolios, divesting non-core units, or enhancing geographic diversification. However, the industry segment shows a wide range of family-owned, technology driven businesses with a leadership position in their segments.

One of the most prominent deals was Permira’s sale of Jet Aviation to the US based General Dynamics Corporation with a transaction value exceeding USD 1 billion. With a total deal volume of approximately USD 604 million the disposal of the Fluid and Power division of Textron to Clyde Blowers was the second largest deal. However, Maag Pump Systems AG was the only Swiss asset in the package, accounting for an estimated third of the total transaction value.

The trend towards Swiss-led cross-border transactions continued in 2008. Notable examples were the acquisitions of Israel’s Enerco Enterprises by Von Roll, Sulzer’s acquisition of Argentina’s Capime Ingenieria, and Bucher Industries AG buying the Netherlands based Kverneland Group Geldrop BV. On the private equity side, Capvis proved its strong position in the Swiss market with the acquisition of Koenig Verbindungstechnik (KVT), a Swiss based manufacturer of metal products, for a purchase price of approximately USD 500 million.

The most significant of the 21 Swiss disposals was the sale of Satisloh Holding by Schweiter Technologies.

2009 Outlook

The first quarter continued the pattern of Q4 2008. In the context of financial year-end announcements and deteriorating economic forecasts, share prices slumped and went through periods of high volatility. Although companies might have the necessary cash and balance sheet structure to fund acquisitions, current low valuations will not trigger transactions as long as management remains unable to predict the amount of cash required for seeing them through a potentially protracted recession. Current management focus clearly lies on cost cutting and cash preservation.

With the exception of a few companies facing both financial and operational hurdles, we expect limited divestment activity. The conservative financial structure of Swiss industrial companies (high equity ratios combined with generally low valuations) are likely to assist vendors in postponing disposals. A prominent exception is OC Oerlikon, which has already made (Esec and Optics business) or announced further potential disposals. If the economic crisis endures, other companies might feel pressure and begin to divest, particular in the automobile and textile related industries. However, M&A activity will rise as soon as the prospect of healthy earnings returns. Swiss companies are well positioned to exploit their strong war chests. (Andreas Poellen, Senior Manager, Corporate Finance)

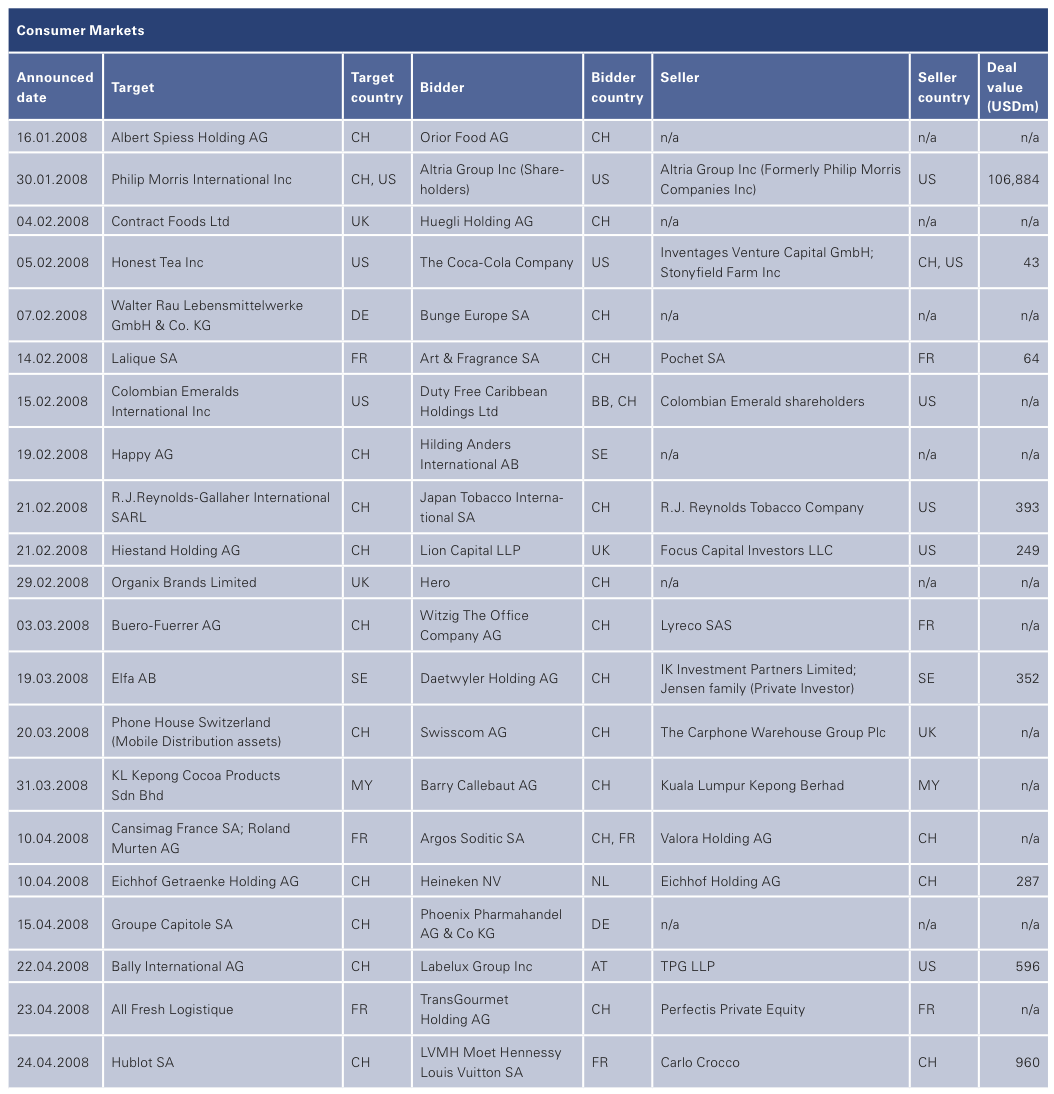

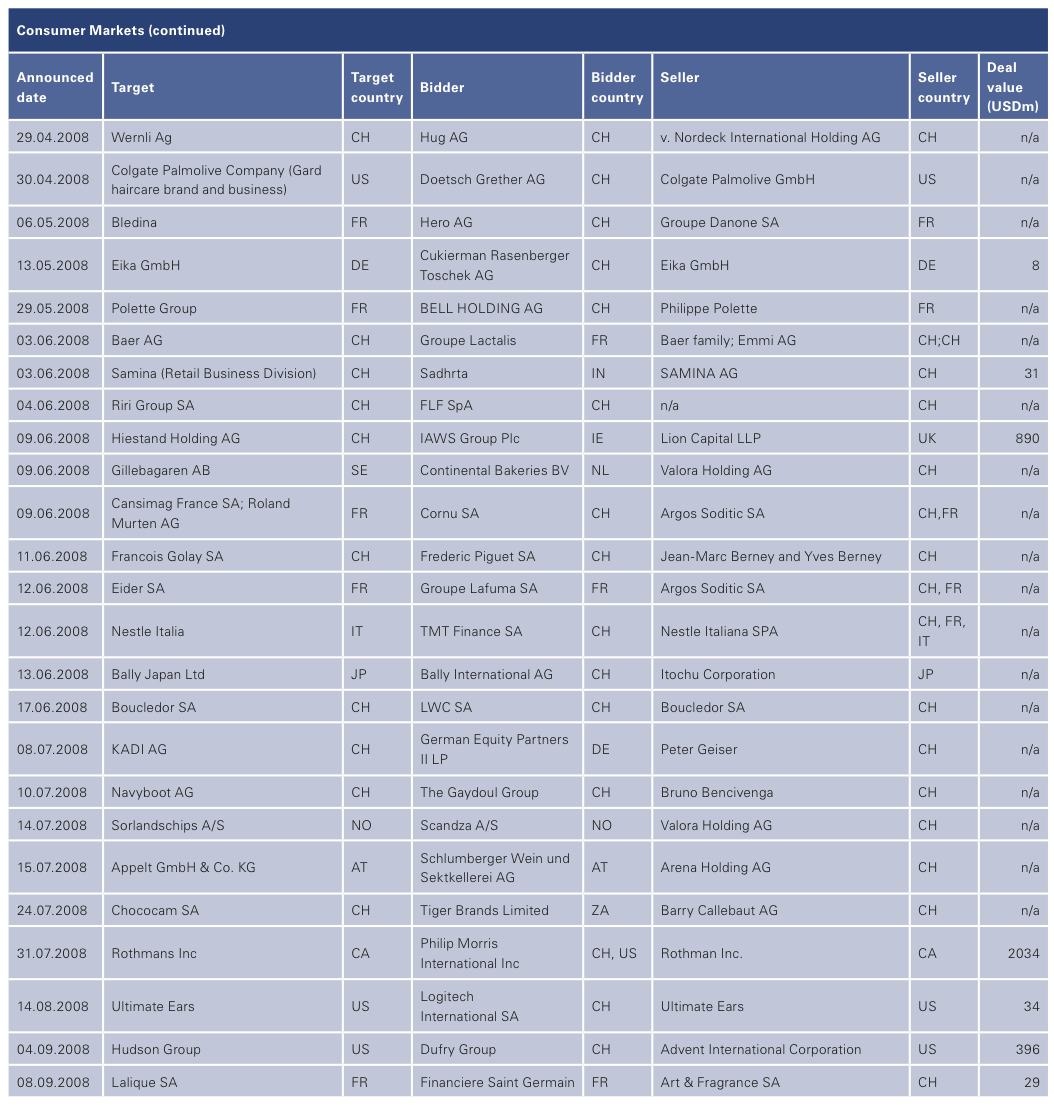

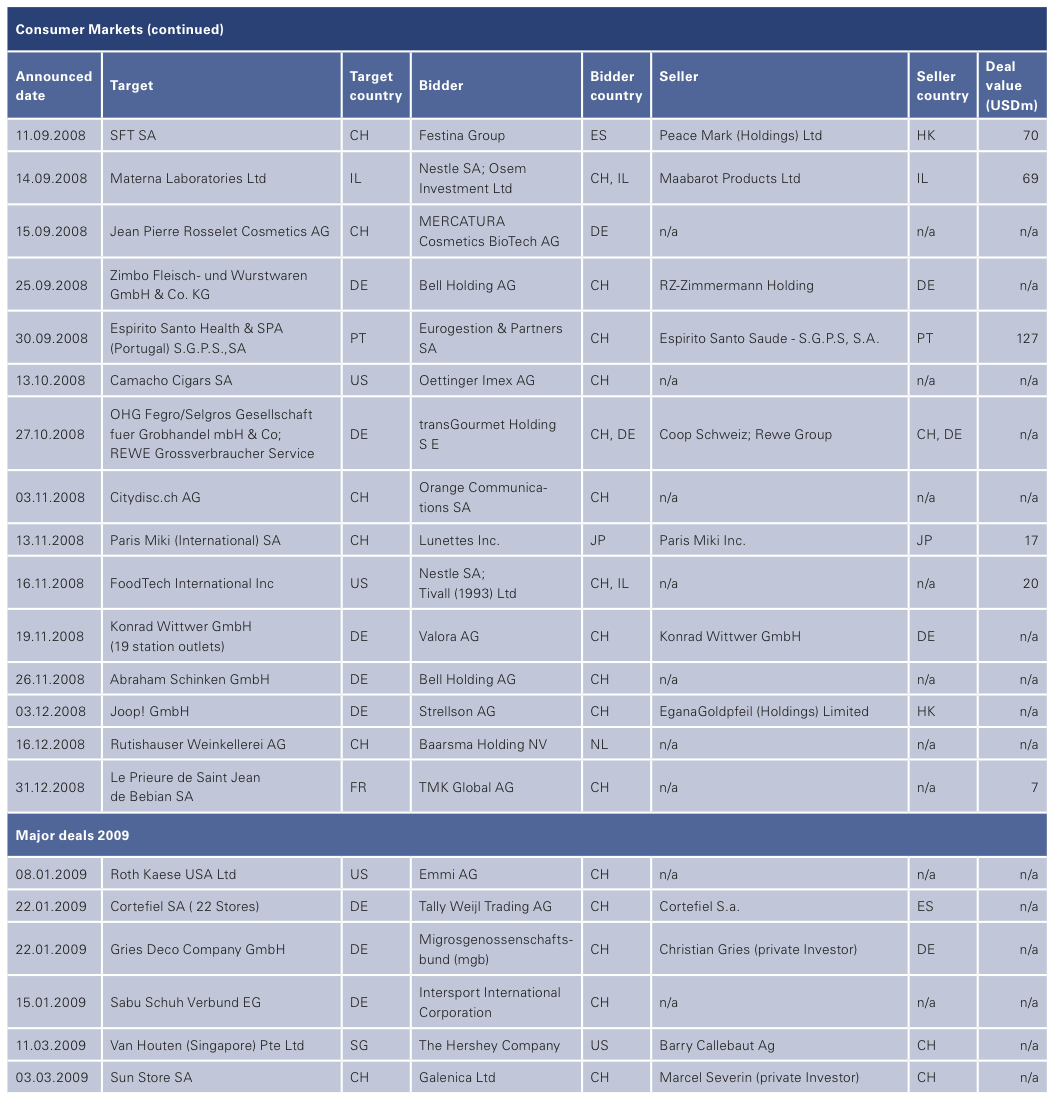

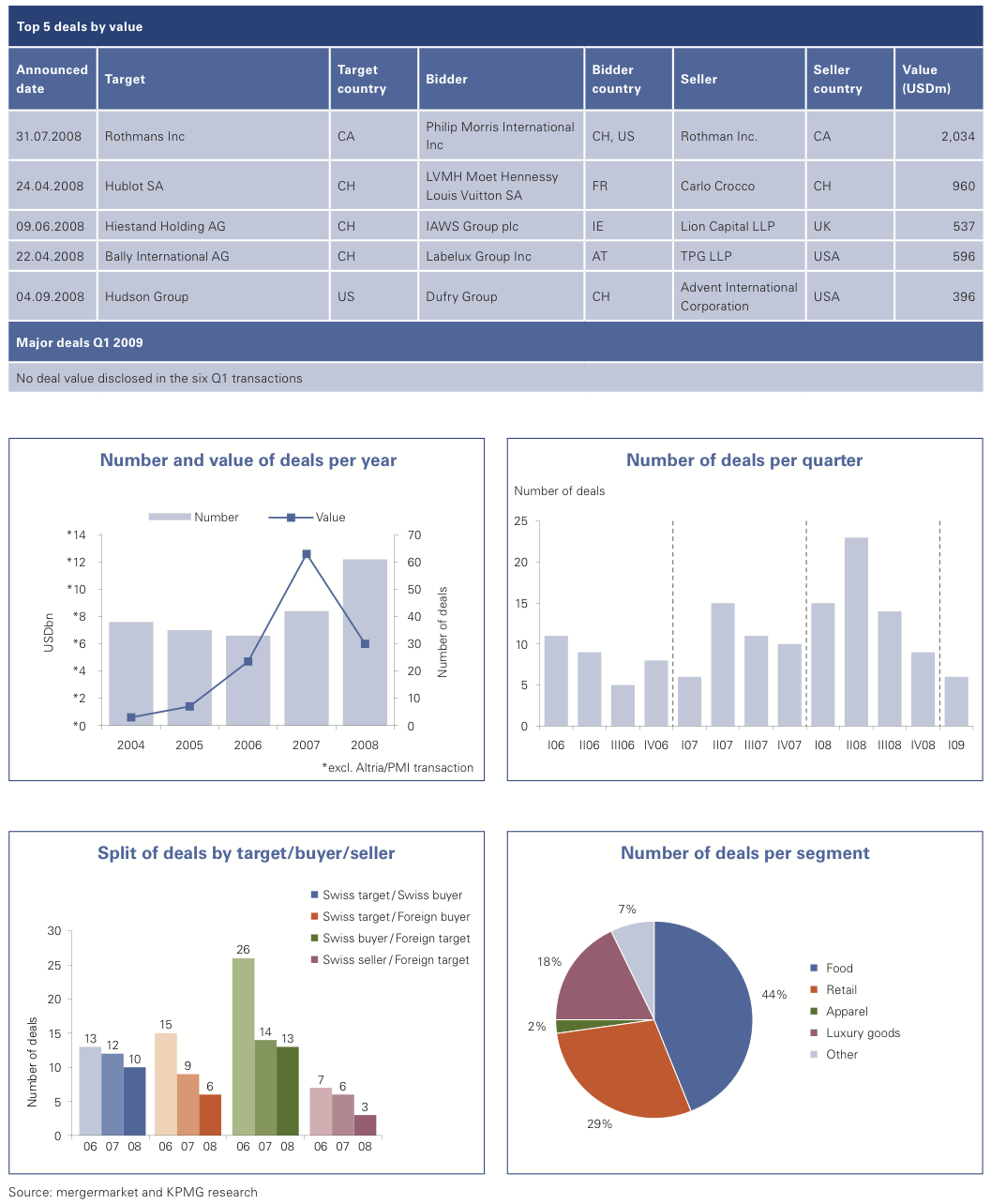

Consumer Markets

In contrast to the overall M&A trend in 2008, deal volume in Swiss consumer markets continued to grow, reaching a new record with 62 transactions, or an increase of 45% over 2007. Aggregate deal value, on the other hand, dropped by more than 50%. Philip Morris International’s acquisition of Rothmans was the only 2008 deal above one billion US dollars in this sector, while in 2007 there were three such deals. The luxury goods group LVMH comes in second with its acquisition of Hublot Group, a top of the range watchmaker, from its founder for USD 960 million. The trend of Swiss consumer market companies to make acquisitions abroad continued in 2008.

2008 Highlights

The steep rise in Swiss buyers acquiring targets abroad could indicate that Swiss consumer market companies were able to turn the challenging economic situation into interesting growth opportunities. Expanding geographical reach and broadening product portfolios seem to be the key rationale for most of the announced deals. Hero, the global food processing company, acquired two baby food businesses, one in France and one in the UK, to strengthen its international position in the baby food segment. Dufry further penetrated its target markets in the Americas and acquired a majority in Hudson Group, a US based retailer, and Colombian Emeralds, a US based manufacturer, wholesaler and retailer of jewellery. Realigning product portfolios was frequently mentioned as rationale for announced divestments. Among the four transactions announced by Valora in 2008, three of them related to divesting non-core activities; in a simultaneous effort to strengthen its core business, Valora acquired 19 railway station bookstore outlets in Germany.

Private Equity companies were involved in approximately one-third of announced deals – acting as seller in 60% of all PE deals. The London based Private Equity house Lion Capital Partners played a significant role in facilitating the merger of the operations of IAWS and Hiestand to form Aryzta AG. Another major transaction was Texas Pacific Group (TPG) exiting its investment in Bally, the Swiss manufacturer and retailer of footwear and accessories. During its eight years of ownership TPG had significantly restructured Bally.

Several Swiss consumer companies executed multiple transactions in 2008: Bell, the Swiss meat producer controlled by the retailer Coop, acquired producers in Germany and France in line with their international expansion strategy. Nestlé acquired Materna Laboratories, an Israel based manufacturer of baby food, expected to complement the Gerber business purchased in 2007 from Novartis. Nestlé also purchased Food Tech, a US based meat substitute producer, providing access to new food technology. Also in line with the expansion strategy of Nestlé’s Water Division, the addition of a mineral spring in Brazil increases its market share in that region.

2009 Outlook

During the first quarter 2009, six transactions were announced in the Swiss consumer markets industry. This volume is below the average of 11 transactions per quarter for the last three years, indicating a slowing down of transaction activity in this sector. As in 2008, the majority of first quarter 2009 transactions involved Swiss buyers acquiring abroad. This seems to confirm the healthy balance sheets of many Swiss players – in spite of the current economic circumstances. (Monika Tschanz, Senior Manager, Transaction Services)

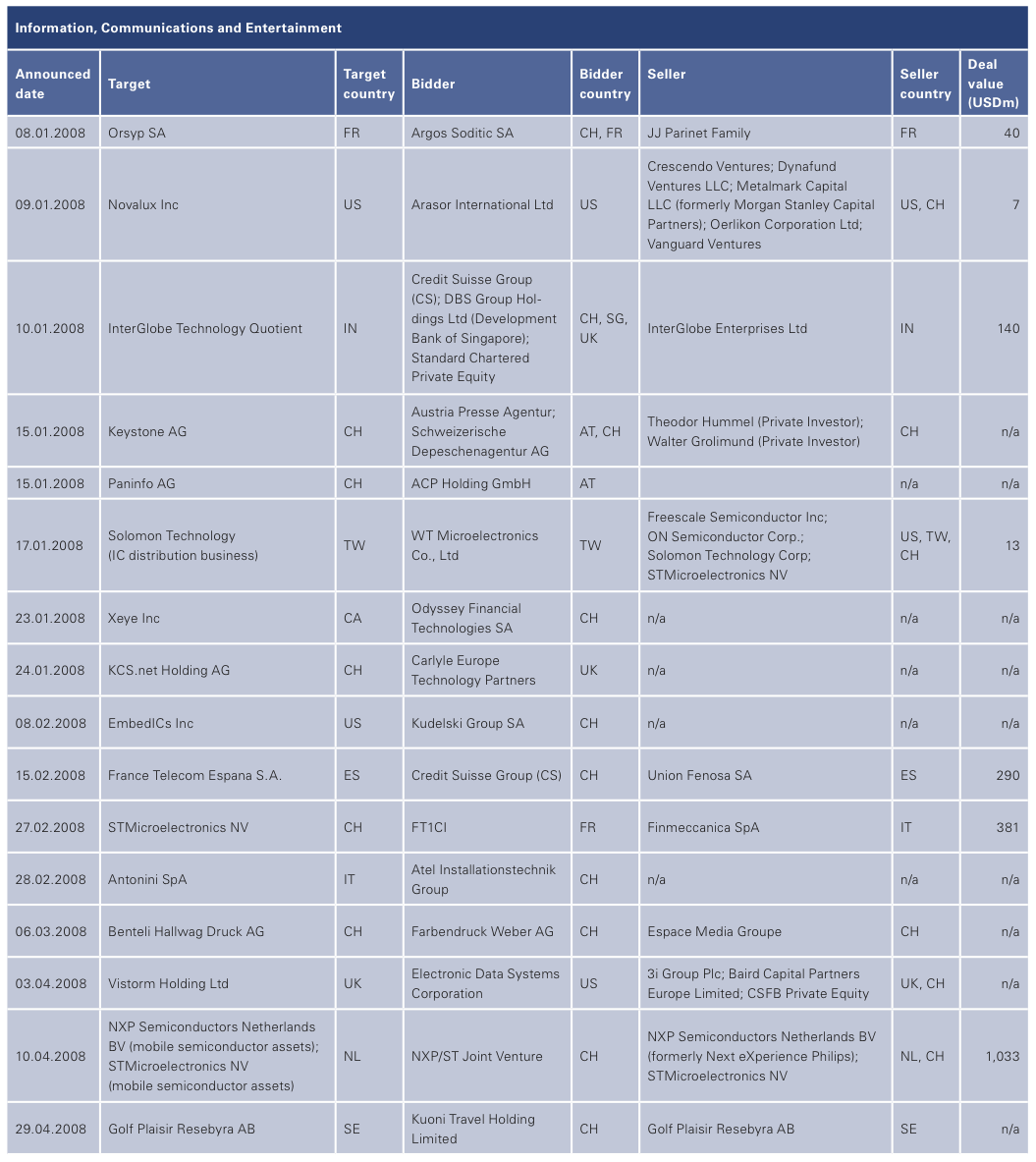

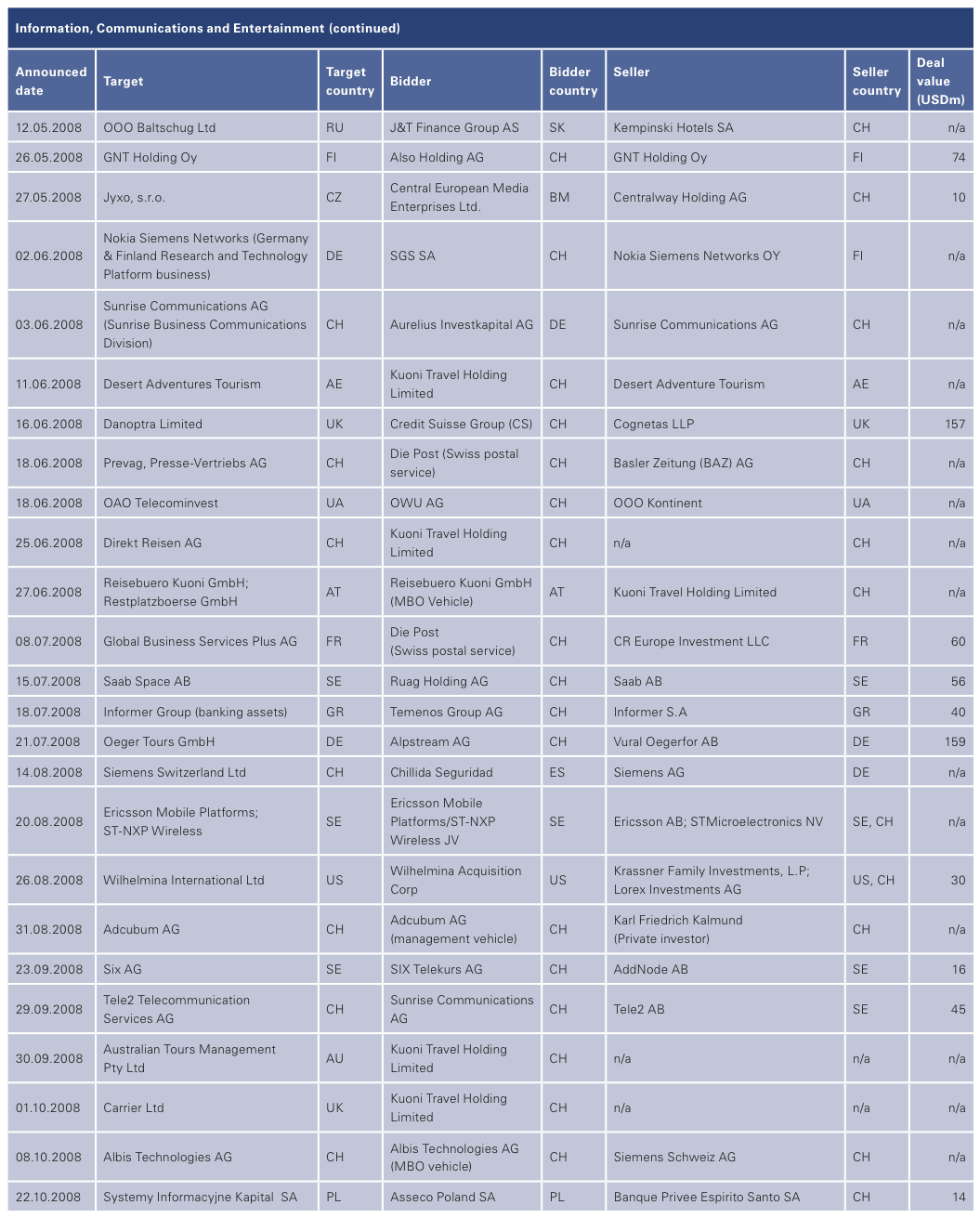

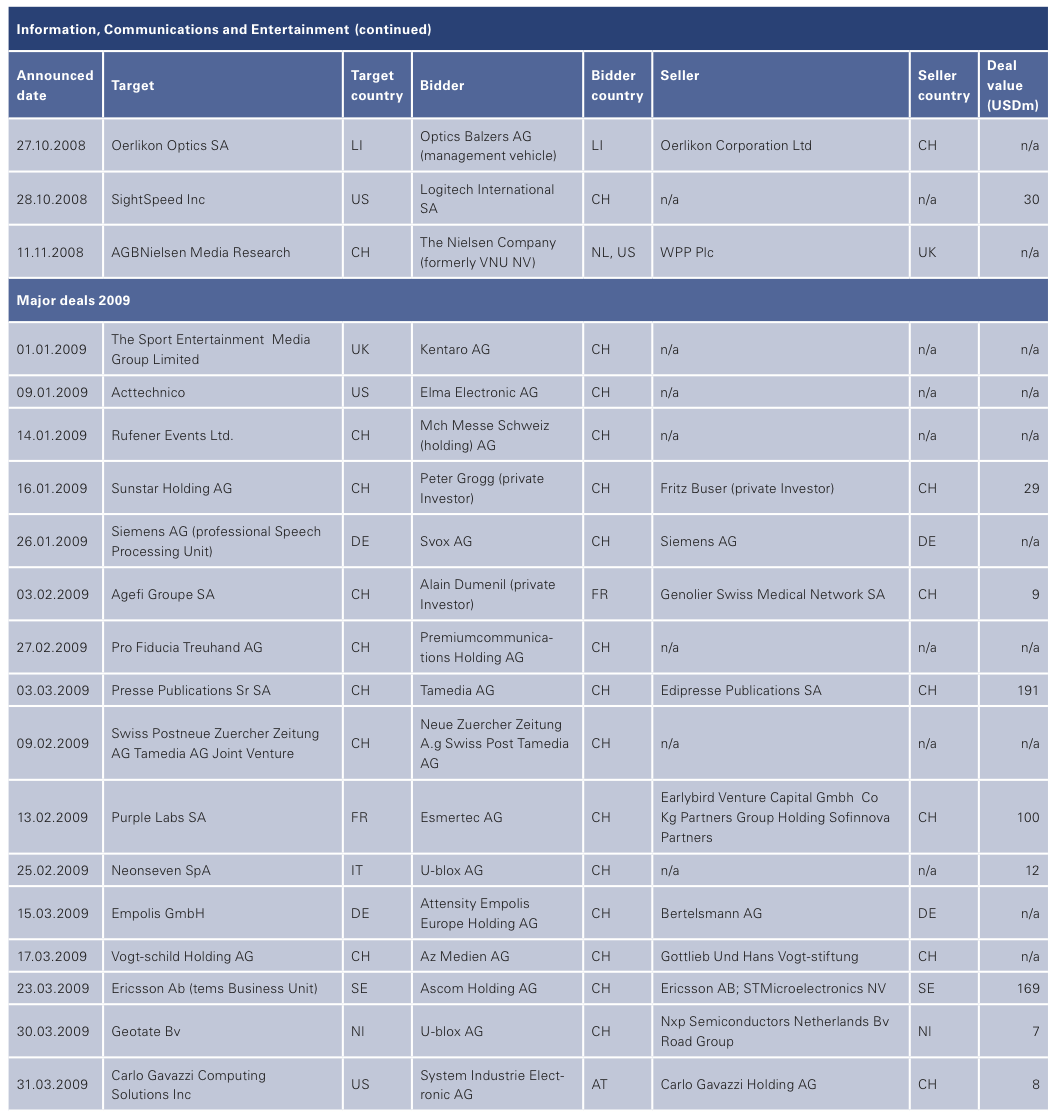

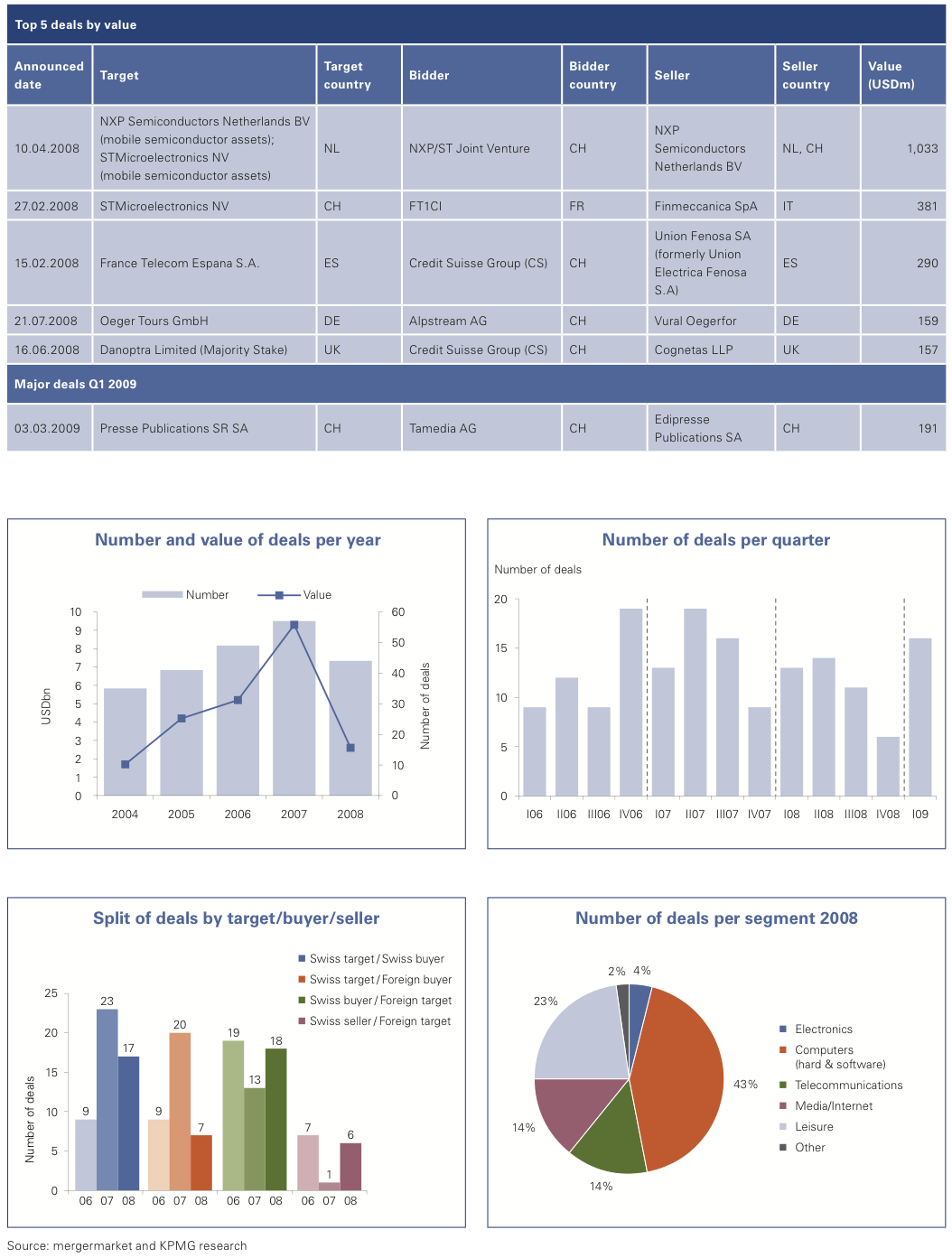

Information, Communications and Entertainment (ICE)

2008 provided further evidence of the strong consolidation trends that have been impacting the sector over recent years. In 2008, 44 ICE transactions were reported (down from 57 in 2007), of which 80% were cross-border deals. Deal volume dropped significantly in Q4 2008, with just 6 transactions registered. Q1 2009 witnessed a rebound to 16 transactions.

2008 Highlights

The key deals took place in the electronics sector, with STMicroelectronics (STM) strengthening its position in the global wireless semi-conductor sector. It first entered an 80:20 joint venture (JV) with NXP, followed by a 50:50 JV with Ericsson, with STM contributing its NXP JV operations, and Ericsson its mobile semiconductor technology platforms. The latter deal was worth some USD 2.3 billion. This strengthens STM’s transformation to an asset-light business model, incorporating strong IP assets. In the JV with Ericsson, it will access vital patents for 3G mobile phones, and is expected to become a stronger competitor to the top two, Qualcomm and Texas Instruments.

PE firms were involved in five ICE sector transactions. These were concentrated in the software/IT services sectors and were often tied to build-up strategies. One example is Carlyle’s European Technology fund backing of KCS.net AG, which provides ERP solutions based on Microsoft platforms. The transaction was followed by the acquisition of another Swiss IT company with a mid-market consulting positioning, Apos Informatik, in June 2008. A German listed holding company/fund acquired Sunrise’s Business communications division, allowing Sunrise to better focus on its core services, including local access services.

The most active acquirer in the ICE sector was Kuoni Travel, which carried out five transactions over the year, only one of which was Swiss-based. These were small, niche bolt-on acquisitions strengthening Kuoni’s destination services offerings.

The telecoms sector saw few deals in 2008. One of the principal deals for sector consolidation trends was Sunrise’s purchase of Tele2’s Swiss business, including GSM frequencies, for USD 45 million. Distribution reach was a second theme, with Orange Suisse purchasing the retail network of Citydisk in March, a music and film retailer. This was quickly followed by Swisscom’s acquisition of Phone-House Switzerland (The CarPhone Warehouse’s Swiss subsidiary) in April.

2009 Outlook

The beginning of 2009 has witnessed a continuation of technology deals, with Ascom acquiring Ericsson’s mobile network testing unit for USD 169 million, becoming the de facto sector leader. uBlox strengthened its portfolio with two transactions. Esmertec also carried out two transactions, one for part of Sagem Wireless (Safran Group spin-off) and subsequently for French mobile software platform Purple labs, with both deals being influenced by Esmertec’s main shareholder, VC fund Soffinova.

The most prominent media deal in 2009 to date has been Tamedia’s acquisition of 49.9% of Edipresse’s Swiss business. The two parties are focusing on the potential synergies – such as combining their free daily newspapers – as Tamedia strengthens its Swiss newspaper position and Edipresse strengthens its balance sheet.

We expect 2009 to see consolidation with relatively low deal values. (James Carter, Director, Transaction Services)

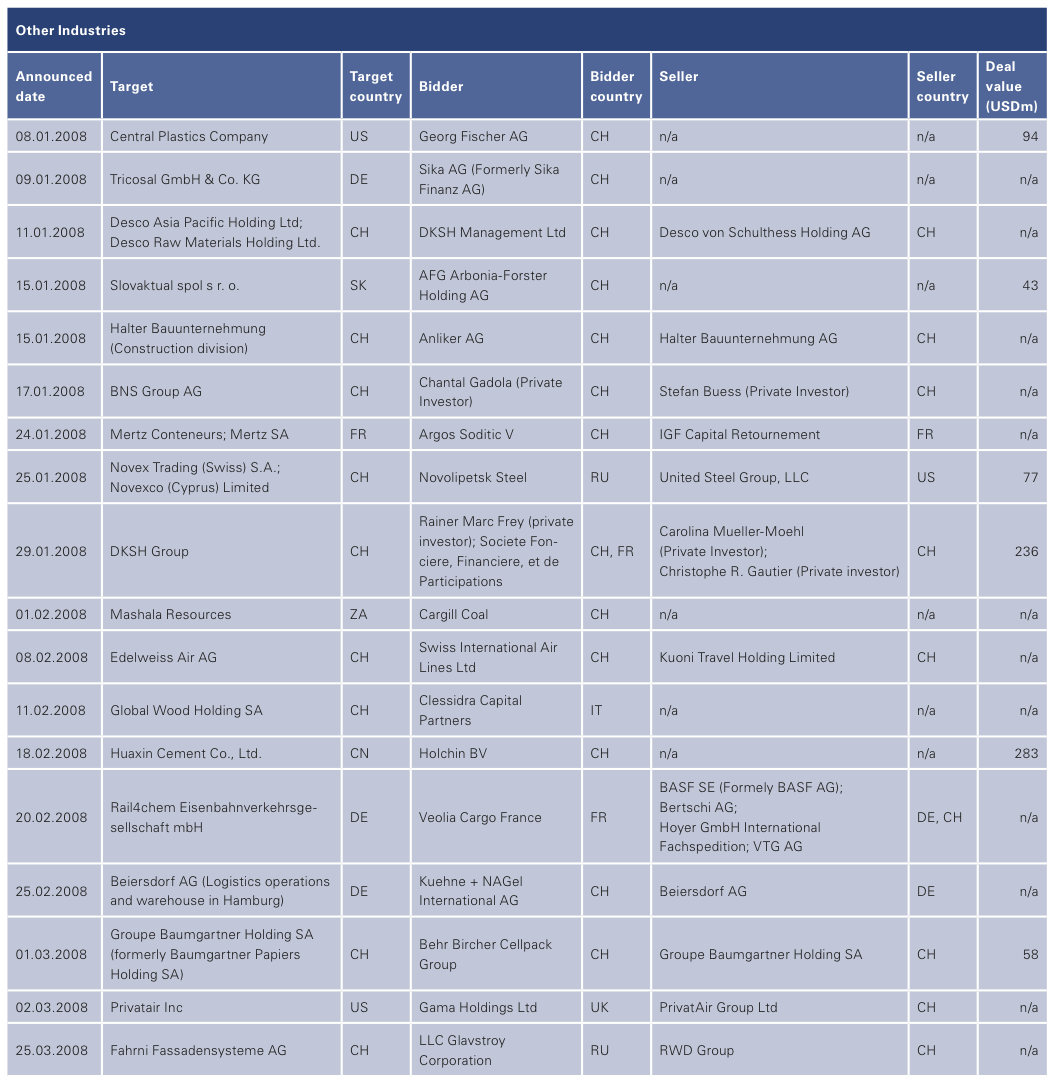

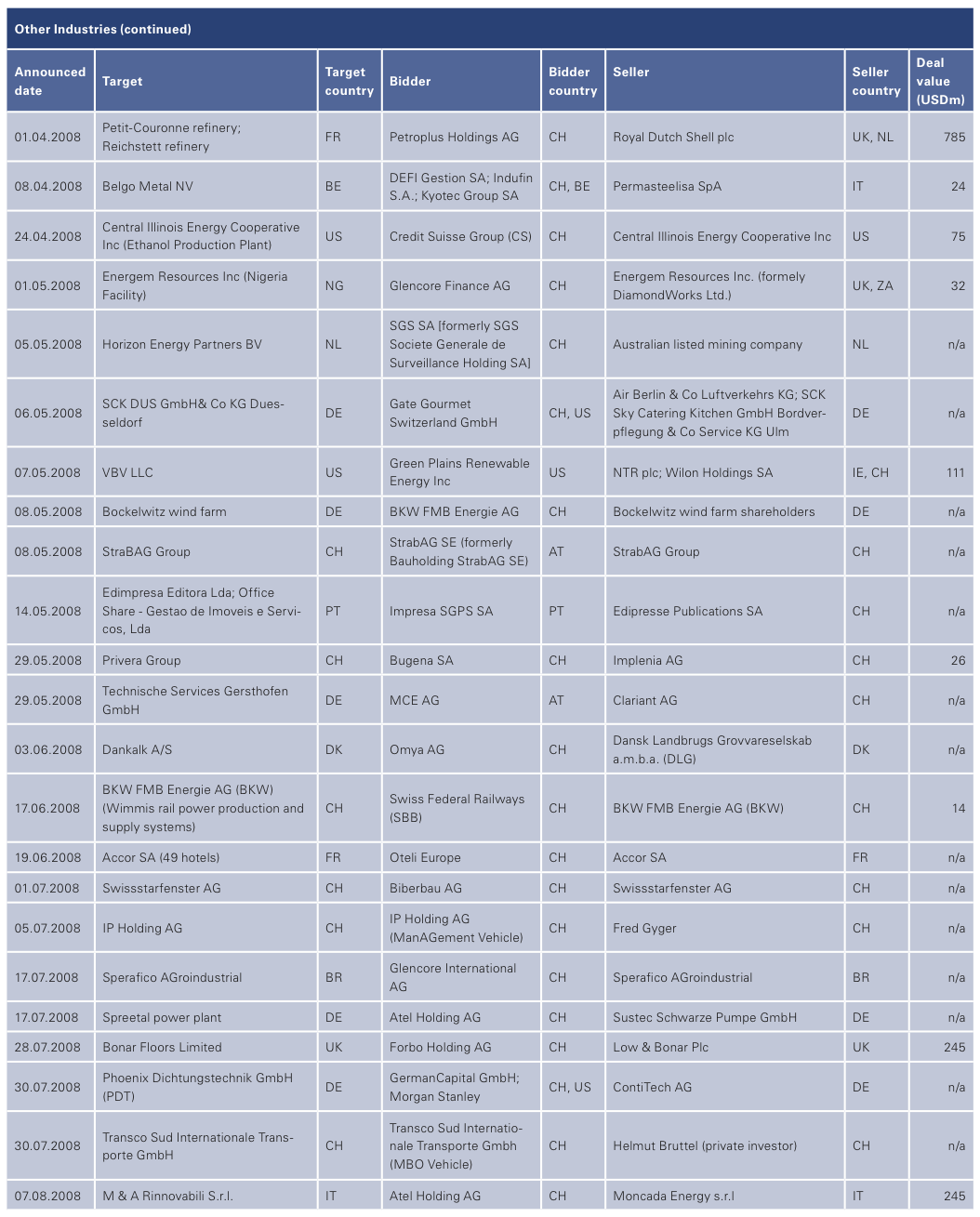

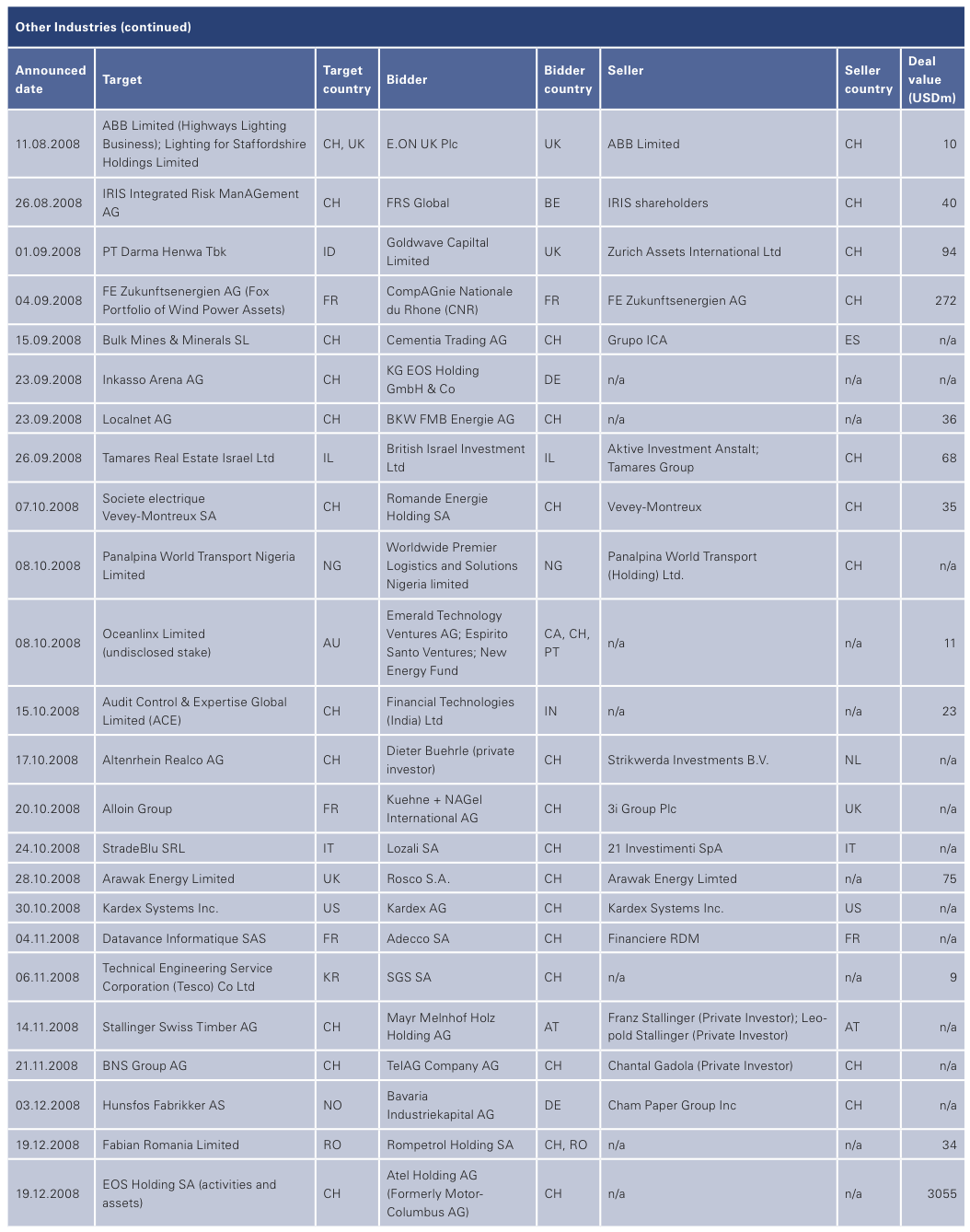

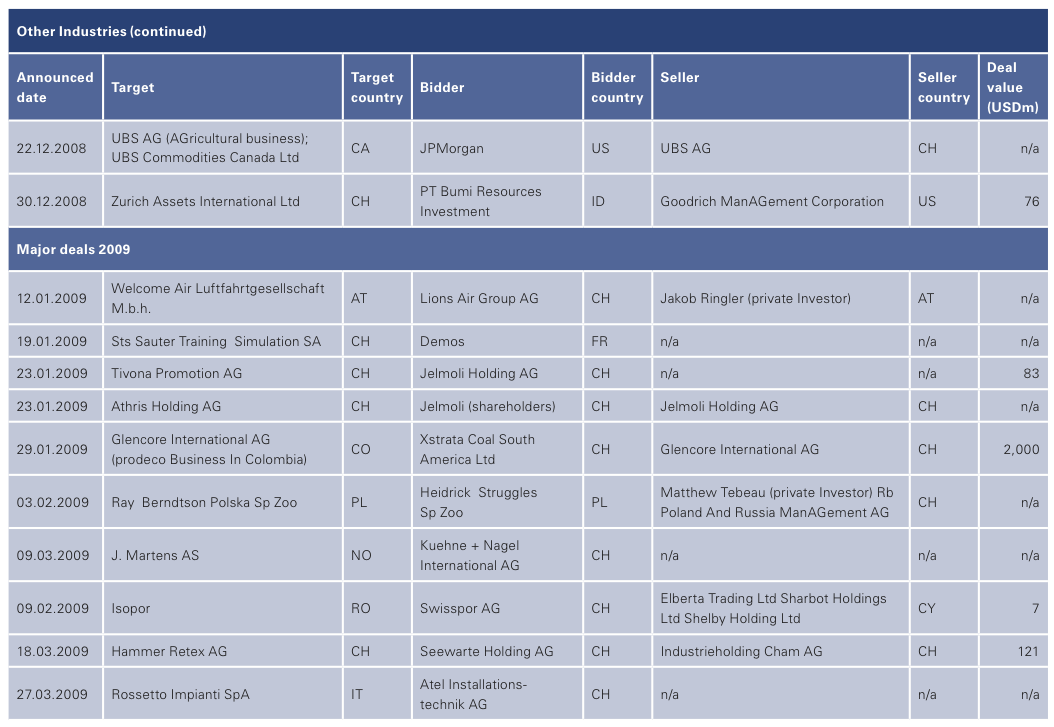

Other Industries

While the number of M&A transactions in 2008 represents a five-year peak, the aggregate disclosed values were at a five-year low. Atel’s acquisition of EOS Holding for USD 3.1 billion was the largest deal in 2008. As in previous years, most of the transactions were between Swiss buyers and foreign targets. In comparison to 2007, 2008 saw a significant increase in the number of deals in the construction industry, while that of logistics and transportation declined somewhat as compared to 2007.

2008 Highlights

Commodities, minerals and mining: Xstrata plc, the Zug-based global mining company, announced two transactions in 2008. Its May announcement of a voluntary conditional cash offer to acquire all of Indophil Resources NL, however, was promptly snubbed and after another few attempts ultimately rejected by Indophil shareholders in November. With the successful acquisition of an additional 14.2% stake in Lonmin Plc, a UK based Platinum producer, Xstrata increased its stake in Lonmin Plc to 25%.

Energy & Utilities: Atel Holding AG and EOS Holding SA concluded an agreement to merge both companies into a new entity, Alpiq Holding AG – the third largest transaction in 2008. Atel continued its growth strategy in the European energy industry by acquiring additional production capacities in Germany (100% of Spreetal power plant) and a 30% stake in the Italian activities of Moncada Energy Group to set-up a joint venture called M & A Rinnovabili.

Professional services: This segment saw a number of smaller transactions, such as SGS’s acquisition of Horizon Energy Partners BV, a provider of consultancy services to the oil and gas industry. In November 2008, Adecco, the global market leader in human resource services, announced the acquisition of Datavance Informatique SAS, a French provider of personnel for IT projects.

Construction: Holcim, one of the world’s leading cement producers, agreed to participate via its wholly-owned subsidiary Holchin BV in a private placement of Huaxin Cement Co Ltd., increasing its holding in Huaxin Cement Co. Ltd to 40%. In July 2008 Forbo Holding AG agreed to acquire Bonar Floors Limited for USD 245 million. AFG Arbonia Forster Holding AG acquired the Slovakia based window manufacturer Slovaktual to strengthen its position in Central Europe.

Logistics and transportation: Consolidation in the transportation sector continues. Swiss International Air Lines acquired Edelweiss Air, the Swiss based charter airline. In February Gama Holdings Ltd., the UK based business aircraft company acquired Privatair Inc. from the Swiss based PrivatAir Group Ltd. Kühne+Nagel strengthened its portfolio of logistics companies with the acquisition of Alloin Group in France.

Real Estate: It remains to be seen whether the increase in real estate related transactions is due to the fact that investments in more tangible assets are – at least in Switzerland – still considered as having a solid value basis.

2009 Outlook

The largest announced deal in 2009 so far is Xstrata’s intended acquisition of Glencore’s Prodeco business in Columbia for USD 2 billion. With various governments looking at different ways of curbing a major recession by investing massively into infrastructure, renewable energy or other domestically relevant industries we would expect a correspondingly high number of deals in the relevant sectors to follow suit. (Rolf Langenegger, Director, Transaction Services)

Private Equity

The financial crisis is severely affecting the Private Equity industry; transactions are reduced to pure equity deals, risk exposure is high and leverage practically gone. During the hype of 2006 and 2007, banks lent almost unlimited sums of money for PE deals, often at discount terms. The tide has turned and in the current environment PE houses will need to present strategically sound propositions in order to generate value for their investors. “Mega” leveraged buy-outs have become scarce while smaller deals are still possible but often require more extensive analysis and meticulous funding rationales, as well as generally taking much longer to complete.

2008 Highlights

Whereas the number of PE deals in Switzerland declined by 21% from 2007, the total value of PE transactions slumped by 74% from a record of USD 23 billion with many multi-billion dollar deals to just USD 6.1 billion. Permira scored the largest deal in 2008 with its exit of Jet Aviation at a price of USD 2.2 billion. Further, Texas Pacific Group disposed of its investment in Bally to Austrian Labelux Group. In the first quarter of 2009, the total number of deals stood at six with a total deal value of USD 155 million, marking a very slow start to the year.

As the financial crisis filtered into the real economy, sending many economies into recession, a number of PE houses began to face critical issues: those that had burdened their companies with huge acquisition debt are now seeing decreasing earnings and have started debt buy backs to recapitalize ailing investments. European private equity firm Candover is even considering winding down its existing funds as a last resort, and Babcock & Brown, the Australian investor in infrastructure assets, has filed for bankruptcy.

In Switzerland, sectors like “Consumer Markets” and “Information, Communication and Entertainment (ICE)” saw the highest PE related activity in 2008 compared to the previous year, whereas “Chemicals & Processing Materials” and “Industrial Markets” companies were less involved.

With the acquisition of Koenig Verbindungstechnik from Debrunner Koenig Holding in Switzerland and Bartec from Allianz Capital Partners in Germany, Capvis also recorded the most significant deals in terms of value – the clear leader among Swiss PE houses in 2008. Other noticeable transactions were made by Barclays Private Equity with the investment in Schild AG. Besides such primary deals, many houses focused their activities on supporting their portfolio companies with add-on acquisitions.

2009 Outlook

The situation will remain very challenging for PE houses: With fewer attractive targets on the market, deals need to be sourced and negotiated individually. PE houses will need to define new business models and cope with a completely changed auction environment. Lower company values still offer interesting opportunities for PE houses, and large funds will be a key source for acquisition capital once the markets begin to recover. We expect deal activity to pick up again at the end of 2009 or beginning of 2010 with PE likely to be a front runner. (Tobias Valk, Partner, Head Transaction Services)

List of 2008 Swiss M&A Transactions