By Greg Forsythe, Erik Dilger, Heather Harris – Deloitte

The use of data analytics in the financial reporting arena is expanding rapidly among both businesses and regulators. What do corporate boards and senior executives need to know about opportunities that analytics present and the risks in ignoring their potential?

“Company Invests Millions in Data Analytics to Boost Internal Compliance, Its Image in the Marketplace, and Stock Price Performance”

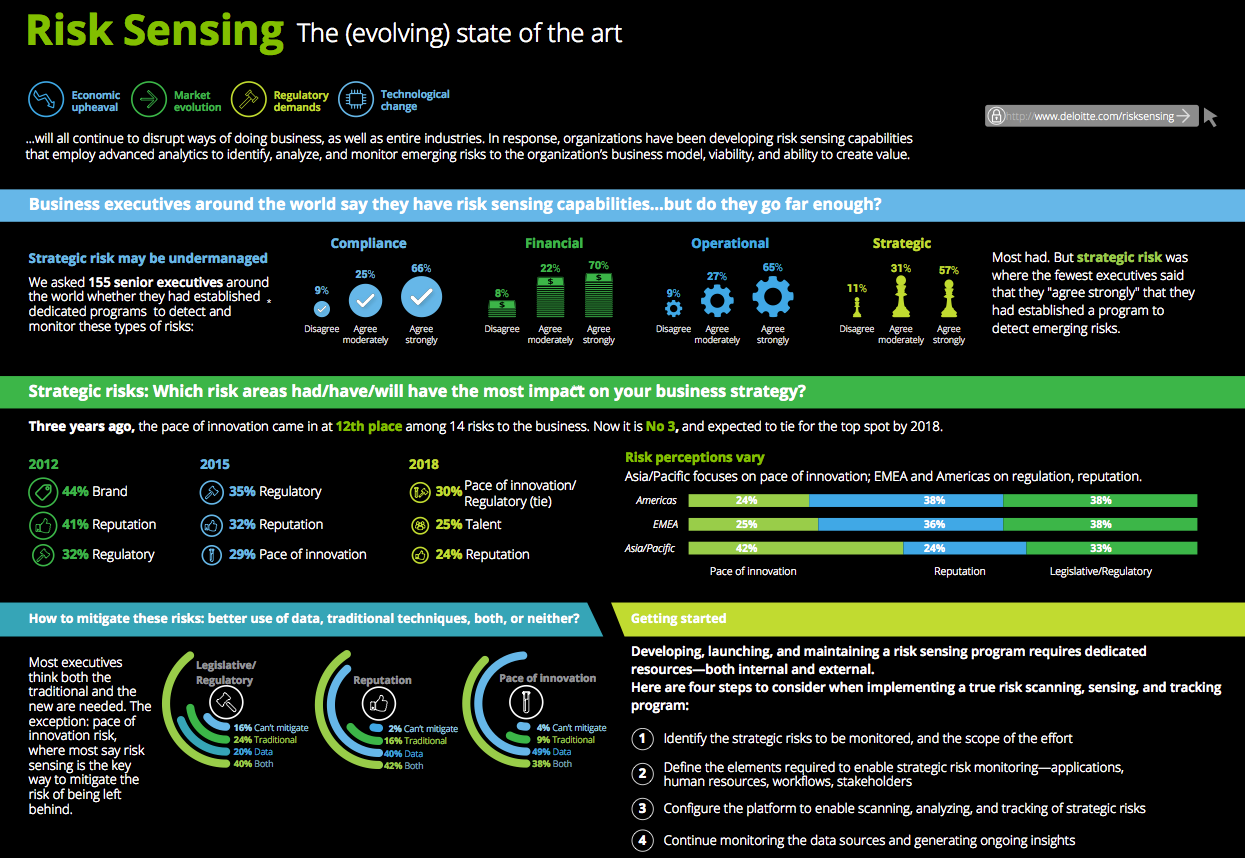

Could that headline be real? Perhaps we haven’t seen it yet, but developments in the US marketplace, now reverberating around the world, suggest it’s a serious possibility. Ongoing growth in both the power and affordability of data analytics technology is driving permeation of analytics tools across businesses today, from sales and marketing, to finance and compliance. In fact, risk sensing—using human insights and advanced analytics capabilities to identify, analyze, and monitor emerging risks—has become an important component of many organizations’ arsenals for managing risk. According to a recent Deloitte survey “Risk Sensing the Evolving State of the Art”, 81 percent of respondents indicate that their companies leverage risk sensing tools. But do those capabilities go far enough to mitigate risks? The infographic below contains insights into how 155 senior executives responded to questions about their current risk sensing capabilities, use of techniques for mitigating risk, and how the pace of innovation is impacting their business strategy.

Concurrently, the US Securities and Exchange Commission (SEC) remains focused on uncovering fraudulent public company activities, with potentially devastating effects on violators. The SEC is collaborating with regulators around the world to improve financial data quality and reliability for the investing public. To strengthen investigative efforts, the SEC and other authorities are using sophisticated analytical tools to assess the likelihood of potential management bias and fraudulent activities. Under this intensifying regulatory spotlight, fair value measurement is among the urgent and promising fairways for data analytics deployment. Development of fair value measurements requires significant management input, along with strong valuation policies and procedures including oversight of valuation specialists. Ultimately, management must review, understand, and endorse fair value conclusions.

The potential for material misstatement of a fair value estimate represents a significant financial reporting risk to some companies, whether caused by inadequate knowledge, lack of oversight, error, management bias, or fraud. Strong internal controls over financial reporting (ICFR), particularly related to fair value estimates where significant judgment is often present, are increasingly important for investor confidence. This paper provides senior executives, boards of directors and shareholders with insights into how analytics can help.

Data analytics in fair value estimates

US regulators and their counterparts around the world are targeting more corporate filers for potential financial reporting mistakes and unsupportable fair value estimates, an enforcement emphasis discussed in a 2015 Deloitte paper. Global enterprises are particularly susceptible to inadequate oversight of the valuation process, especially companies with valuation needs arising in different jurisdictions and business units. Companies are rightly lauded for enhancing shareholder value, and at times the public good, through R&D investments that drive revenue and earnings growth. However, those same businesses may not have taken steps to protect against the downside risk of potential financial reporting mistakes. They may be underinvesting in internal controls that would help protect the enterprise and potentially bolster investor confidence.

Fully 96 percent of survey respondents feel that analytics will become more important to their organizations over the next three years.

Regulators, not typically viewed as leading-edge innovators, may well be ahead of the curve with respect to the benefits of data analytics in the compliance arena.

Facing growing scrutiny, some innovative corporate filers are investigating the use of data analytics to help make valuation activities and financial reporting disclosures more transparent, supportable, internally consistent, and efficient. These forward-looking businesses recognize the value of implementing an ethical and transparent corporate culture. They are keeping up with compliance developments and the increasing expectations of the regulatory authorities. And they are making strategic investments, such as in data analytics, to mirror the emphasis and actions of regulatory authorities.

Corporate executives and board members can apply the valuation intelligence and insights gained through analytics to improve regulatory compliance. Analytics can also help elevate the important role of investor relations and how it influences the company’s perception in the marketplace, thereby protecting and enhancing enterprise value.

Regulatory scrutiny amid a lack of transparency

Perhaps one of the best reasons for companies to invest in data analytics for valuations is to consider the SEC’s rapid adoption and use of such tools. In 2009, the SEC began employing proprietary risk analytics to identify and evaluate suspicious financial returns in its investigation of hedge funds. These efforts led to eight enforcement actions against funds and private equity firms through 2014.

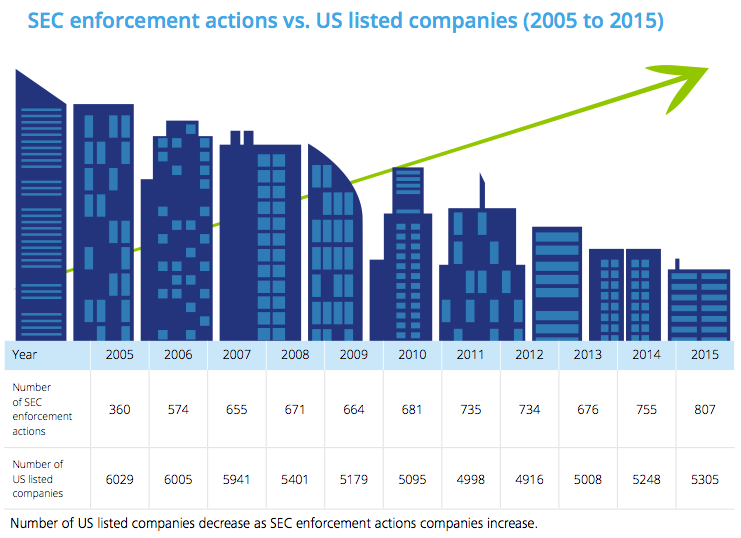

The number of companies listed on the US exchanges has seen a dramatic 40-percent decline over the past 20 years—from 8,783 in 1996 to only 5,305 as of October 2015 according to a January 2016 report issued by NERA Economic Consulting. On the other hand, the number of SEC enforcement actions has increased over the last 10 years. The chart on this page illustrates a 10 year trend, showing the enforcement actions and number of US listed companies.

Prior to 2009, the SEC had also noted a sizable trend in stock options backdating. Enforcement actions followed, along with criminal charges for the more serious cases involving intentional wrongdoing.

Today, the SEC has continued to step up efforts to fight financial reporting improprieties and other forms of fraud, leading to an increase in enforcement actions. Regulators are making wide use of analytics to help assess corporate issuer risk and identify financial reporting irregularities that may indicate financial fraud.

The Financial Reporting and Audit Task Force, now known as the Financial Reporting and Audit Group (“FRAud Group”), is one of several major initiatives announced by the SEC in July 2013.

“The Enforcement Division’s leveraging of data, quantitative analytics and the expertise of our other divisions contributed significantly to this year’s very strong results.” — SEC Chair Mary Jo White

Using both externally and internally developed analytics tools, the mandate of the FRAud Group is to help the SEC more accurately detect fraudulent or improper financial reporting. For example, a tool they created called the Corporate Issuer Risk Assessment Program (CIRA) is an intuitive dashboard which contains over 100 custom metrics, enabling staff to detect anomalous patterns in financial reporting.

According to a recent report issued by the NYU Pollack Center for Law & Business and Cornerstone Research, cases involving issuer and disclosure violations increased sharply following the July 2013 announcement of the SEC’s new initiatives. The data shows that in FY13 through FY15, these cases on average represented more than 65 percent of public company defendant actions.

Annual research conducted by Forbes and MSCI ESG Research highlights increasing attention in the marketplace on analyzing whether companies are doing the right thing. In creating its annual “100 Most Trustworthy Companies in America” list MSCI ESG Research screens more than 5,000 publicly traded companies in North America. Their list attempts to identify companies that most consistently demonstrate transparent accounting practices and solid corporate governance. They assess high-risk factors including regulatory actions, amended filings, revenue and expense recognition methods, and bankruptcy risk, and rank companies accordingly. Similar “trustworthiness” type efforts are being undertaken around the globe.

Companies can reduce exposure to risk by developing robust valuation policies and procedures

In a 2014 speech, Norm Champ, then director of the SEC Division of Investment Management, suggested a framework for developing robust valuation policies and procedures. While directed to a private equity audience, the concepts behind his recommendations apply more broadly to companies with significant fair value and other valuation estimates. The concepts that Mr. Champ recommended include:

• Monitor operations and developments for circumstances that may necessitate the use of fair value prices.

• Provide a methodology for determining fair value.

• Implement a process for price overrides.

• Assure that controls are in place to review, monitor and approve all overrides in a timely manner.

• Promptly notify and secure the review and approval of persons not directly involved in asset management to mitigate conflicts of interest.

The need for policies, procedures, and supportable valuation conclusions

Fair value measurement is important and often difficult. As regulators, auditors, audit committees, and company executives are discovering, valuation is also potentially ripe for misapplication or, in the extreme, fraud. Valuations are neither art nor science, but instead emerge from bringing together many variables in quantitative and qualitative analysis and then arriving at supportable conclusions applying professional judgment. Unfortunately, tweaking the variables inappropriately is sometimes cast as “professional judgment” by those so inclined, perhaps to secure performance-based bonuses, avoid an impairment charge, or present a rosier-than-reality picture to potential investors. In some companies, potentially hundreds of employees and numerous specialists spread around the world can be involved in providing data for fair value estimates and other related “public interest” valuations; for example, for corporate tax purposes. Fair value estimates are a significant aspect of many public companies’ financial statements, and executives who sign off on financial reports can find themselves responsible for both unintentional errors and willful manipulations, as well as inconsistencies in valuations performed for numerous other reasons.

Analytics and valuation: Opportunities and imperatives are growing

Emphasizing the importance of such policies and procedures, the SEC has recently begun examining how mutual funds value startups. According to wsj.com, “Examiners… are asking about the procedures and tools funds are using to land on the prices they are placing on the startups.” This thrust comes amid growing concern that investments in the same private companies are being valued by different funds on the same date at different amounts. Global financial market complexity has increased at lightning speed in the last fifteen years compared to the preceding one-hundred years.

Many, if not all, of the above market factors affect financial statements, and fair value estimates in particular. While many large organizations have ramped up personnel, technology, and other resources to accommodate an ever-changing and complex marketplace, questions remain. Is the internal infrastructure truly robust enough to keep up with these increased demands? Is management forward-thinking enough?

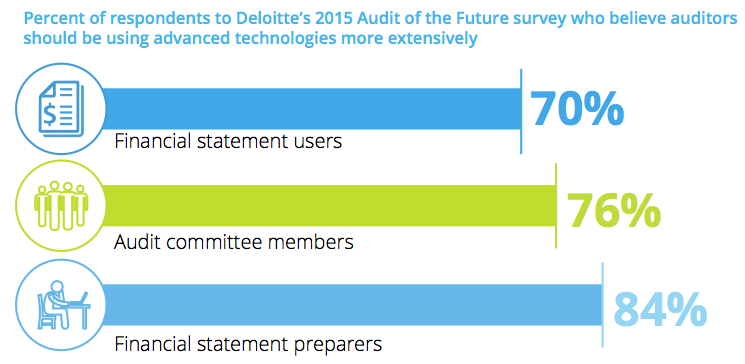

More than 250 financial statement preparers, audit committee members and financial statement users responded to a variety of questions in Deloitte’s 2015 Audit of the Future Survey. One theme of the survey was that traditional audits need to evolve. In fact, an overwhelming number of respondents believe auditors should be using advanced technologies more extensively.

Data analytics and fair value measurement? Some questions remain to be answered:

• Organizations increasingly seek valuation specialists with appreciation and understanding of the power of analytics. Are those who perform, review, and use valuations appropriately equipped for the job?

• Familiarity with and a working knowledge of analytics are becoming powerful, necessary tools for operating in the fair value arena. Are educational institutions updating their curricula to accommodate for these dramatic shifts?

• Are organizations equipping their professionals with opportunities to expand their skill sets through internal education and knowledge sharing?

• Is an increasing focus by the SEC and others on detecting fraudulent or improper financial reporting enough to improve behavior?

Addressing valuation risk and opportunity: Three key considerations

Senior executives and boards of directors can gain insights into how analytics can potentially help address valuation risks and opportunities through the consideration of three main factors:

01. Compliance risk. As noted earlier, regulators are now more focused on valuation processes and procedures. An example driving this interest is discounted cash flow (DCF) analysis, a longstanding, fundamental way of valuing businesses and assets. A forward-looking exercise, DCF analysis can yield highly misleading conclusions absent thoughtful analysis or appropriate assumptions. Due to its incorporation of many subjective inputs, both market-based and management-provided, it is susceptible to purposeful abuse and can be affected by lack of analytical expertise. Performing a DCF analysis in isolation, which often occurs, makes it even more difficult to assess whether conclusions are meaningful or meaningless. Similarly, evaluating “contradictory information” is an important focus area for auditors and regulators and the discovery of such information can cause company management to spend a considerable amount of energy addressing questions. Data analytics can help financial statement preparers proactively and efficiently discover, evaluate, dispose of and disclose contradictory evidence as an aspect of the company’s valuation procedures. In a speech from 2014 at the Private Equity International Private Fund Compliance Forum, Andrew Bowden, then director of the SEC’s Office of Compliance and Inspections, commented on other things that can often be seen in a biased valuation, such as “cherry picking comparables.” when performing a market approach, or “changing the valuation methodology from period to period…”

Senior executives on boards and audit committees can discourage and help prevent such behavior, which could potentially cause an ICFR failure, by understanding valuation concepts and how analytics can help identify flaws in fair value estimates, unintentional or otherwise, before they become the target of auditor, regulator, or investor scrutiny.

02. Internal process efficiency. Businesses can use analytics to proactively build the case that their financial reporting is based on sound data and fair value estimates are derived from supportable valuation practices. They can also use analytics to proactively identify potential “soft spots” and mitigate areas of risk prior to the fair value estimate being finalized, reviewed by auditors, and reported in the financial statements.

For example, consider companies that are serial acquirers, have many reporting units or cash-generating units, or otherwise conduct valuations globally. Using analytics, such organizations can identify variables or assumptions that in certain areas of the business may be out of line with other areas for no explainable reasons, or are inconsistent with the market’s view of the broader enterprise. Executives can focus in on such anomalies to quickly gain insights into why there are differences and if key assumptions need to be modified or made more supportable to withstand scrutiny. Consider a company that needs to value subsidiaries in different countries, a process that can typically involve hundreds, or even thousands, of data points. In the previous DCF analysis example, with such information easily at hand, variables such as discount rates, future growth rates, gross margins, and R&D expenditures can be more appropriately selected and supported. Data visualization tools can also provide insightful graphics that support easy interpretation and communications with others. For example, a dashboard can be created utilizing a traffic light concept to categorize potential flaws—green for factors consistent with benchmarking, amber for those that raise eyebrows, and red for areas demanding urgent attention.

Increasing financial market complexity, combined with ever-changing accounting standards to comply with rapid expansion and other factors, is driving companies to make strategic, forward-thinking choices about their risk strategies—that it’s not a matter of “if” but “when”—use of data analytics will need to become an integrated component of their operational structure, as a way to mitigate risk and increase operational efficiency.

03. Enhanced quality. In the same way that regulators are increasing their use of analytics to assess companies’ disclosures and the reliability of fair value estimates in financial statements, companies can employ analytical tools to help improve their fair value estimates and disclosures. In recent years, valuation professionals have begun leveraging data aggregators more often to enhance the valuation process. Aggregators are equipped to provide more consistent and reliable data, allowing quicker analysis and insights. Using data analytics is a natural progression for those who are able to invest and understand the benefits of even quicker and more reliable analysis. Freeing more time to focus on the important task of selecting and supporting critical valuation inputs is among those benefits. Professional services firms with significant scale can amass troves of data and create innovative analytical tools for their own use or uniquely for clients. Without revealing proprietary information, financial advisers can use these tools to help companies benchmark valuations internally, against industry norms, and among market competitors. Such efforts can yield insights that enrich financial reporting disclosures, thereby mitigating compliance risk and enhancing shareholder value.

Operationalizing the new lease accounting standard

Consider the new lease accounting standard, ASC Topic 842, Leases. This long awaited accounting change introduces significant implementation challenges for lessees, including: complexities of data collection, analysis, storage, and maintenance; enhancements to information technology systems; and potential refinements to internal controls and other business processes related to leases.

From a financial analysis and valuation standpoint, these changes require that lessees make professional judgments and provide evidence for many estimates. A valuation of a lessee’s business will be impacted by changing income statement and balance sheet data and the need to estimate future cash flows while lacking comparable historical financial data.

More opportunities ahead…

New challenges are likely to arise as companies strive to upgrade policies and procedures related to fair value measurements, whether performed internally or by outside valuation specialists. Companies are likely to seek improvements in how they handle the huge and growing volumes of data surrounding their business activities and, by extension, their approach to valuation for fair value measurement purposes. Refinement of data collection and normalization processes will continue. And many businesses may see fit to increase their oversight of the reasonableness and supportability of assumptions underlying internal or external valuation analyses.

The ongoing development of technology and processes should open new doors to effective compliance and improved efficiency. Already, cognitive computing platforms such as IBM Watson combine natural language processing, machine learning, and real-time computing power to sift through massive amounts of unstructured data—documents, emails, journals, social posts, and more—to answer questions fast.

With an eye to the future…

Valuation is indeed entering a new era. Artificial intelligence, machine learning, and predictive analytics capabilities are already entering the picture. There is an increasing likelihood that certain elements of valuation work could soon become automated, allowing valuation professionals to spend even less time on detailed, quantitative calculations and more time focused on supporting assumptions made, interpreting results, and seeking ways to create shareholder value. The fusion of IT and business through collaboration between CIOs and other C-suite leaders is a growing trend and one that is ripe with opportunity, a major theme noted in Deloitte’s Tech Trends 2015 report.

What’s next? There is still more to do

Whatever the future holds, companies can expect continuing scrutiny of valuation analyses and their underlying assumptions and inputs. Valuations remain susceptible to manipulation and potential management bias, while continuing to have significant impact on financial reporting and the reliability of financial statements for investors.

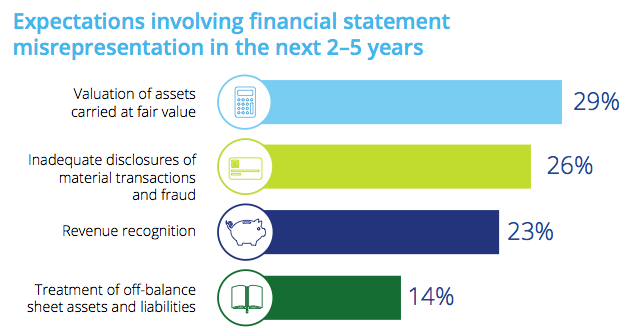

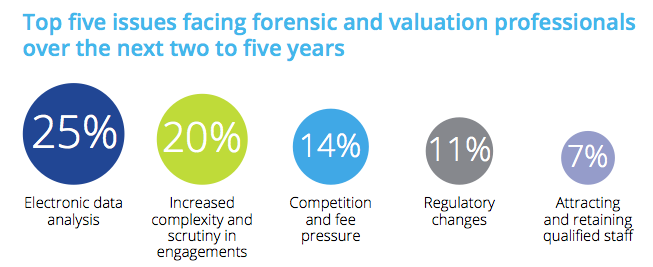

In a 2014 AICPA Survey of International Trends in Forensic and Valuation Services, the majority of respondents indicated that fair value would be the most prevalent financial statement disclosure issue in the next two to five years. Not surprisingly, the topic of electronic data analysis (big data) came in at the number one spot of the issues facing forensic and valuation professionals in the next two to five years (and for the very first time) as one of the most notable findings.

As Bill Schneider, director of accounting at AT&T, recently observed, “Valuation—this is an area where judgment really comes into play. While it’s not your job to be a valuation expert, you at least need to understand how the valuation experts’ model works. You need to know what the critical assumptions are. And you need to know how sensitive those assumptions are. If one assumption varies the valuation by 50%, you obviously want to make sure you’re really comfortable with that assumption … valuation is something everybody should have at least some knowledge of.” Investor expectations regarding companies’ focus on compliance, or lack thereof, and public awareness of the extent of the issue may need to increase. Tilting the risk/reward equation such that the importance of compliance is ultimately rewarded in the marketplace for those that are striving to do the right thing may be necessary. In fact, senior executives are being encouraged to roll up their sleeves, take a good look at their corporate culture and the way their clients and customers perceive them in the marketplace, and be mindful that this perception is largely driven by the effectiveness of their compliance programs. Andrew Donohue, SEC Chief of Staff recently put himself in the shoes of the Chief Compliance Officer by observing: “If I were a Chief Compliance Officer… I would absolutely need to grasp the culture of the firm. I would insist that the customer/client comes first and that the firm will endeavor to ‘do the right thing.’Rather than fostering a culture of “Can I do this?” you really want to develop a culture of “Should I do this?”

Mr. Donohue also stressed the drastic shifts in the environments people work in—the increasing complexity, rapid advancements in technology, innovative products constantly being introduced—are making CCOs’ (and senior executives’) jobs that much more important. It is imperative that they consistently challenge themselves to evolve to meet the demands of their profession.

Businesses can use analytics to strengthen their ability to meet financial reporting requirements, particularly valuation processes, procedures, and analyses. Companies should consider putting the necessary infrastructure in place to help meet the increasing demands they face in this rapidly-evolving environment and be rewarded in the financial markets for their investments through strong stock price performance. By doing so, they can help their boards and executives sleep soundly knowing they are in good hands.