1. Global financial services deal activity

Overview of deal activity in 2013

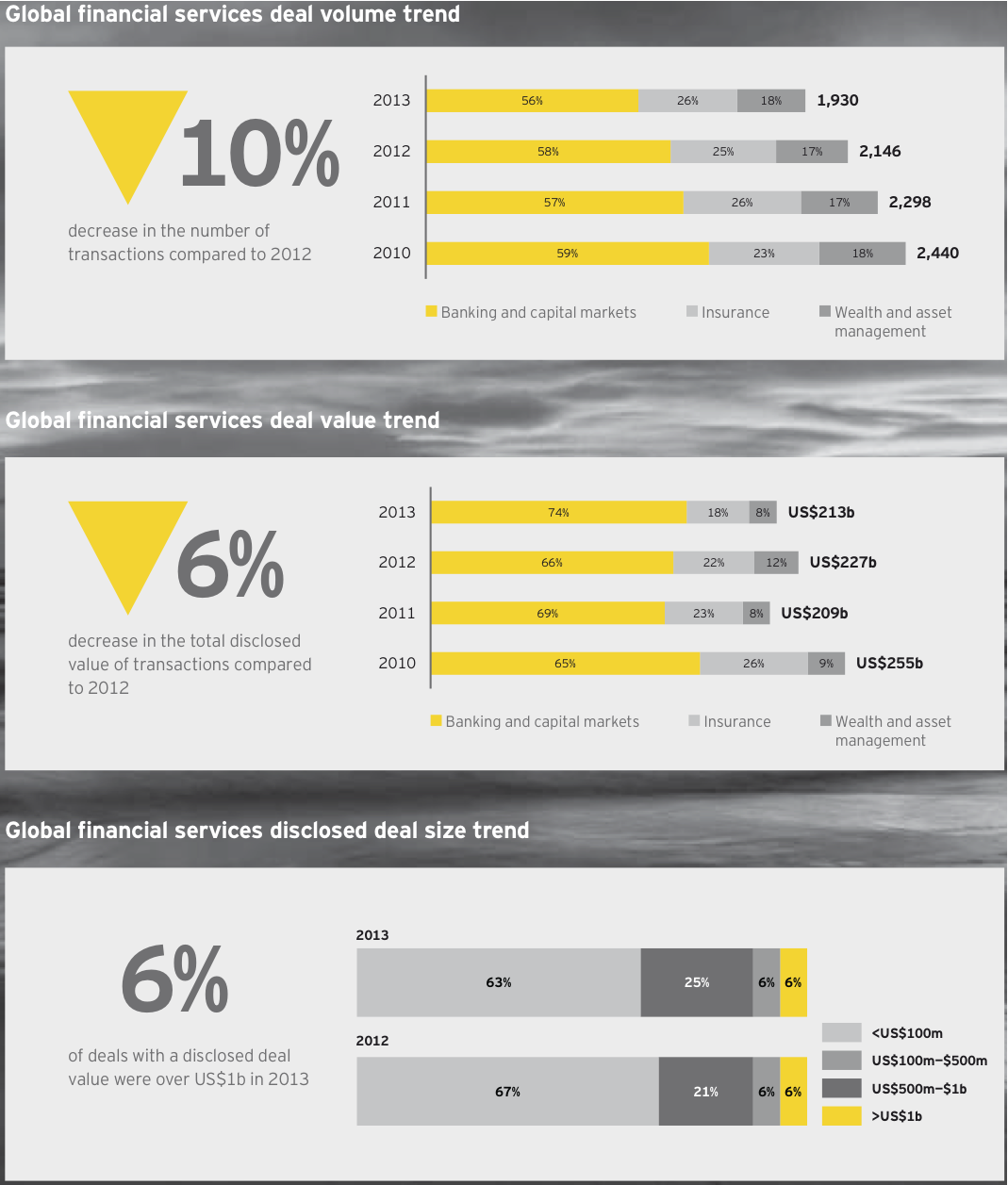

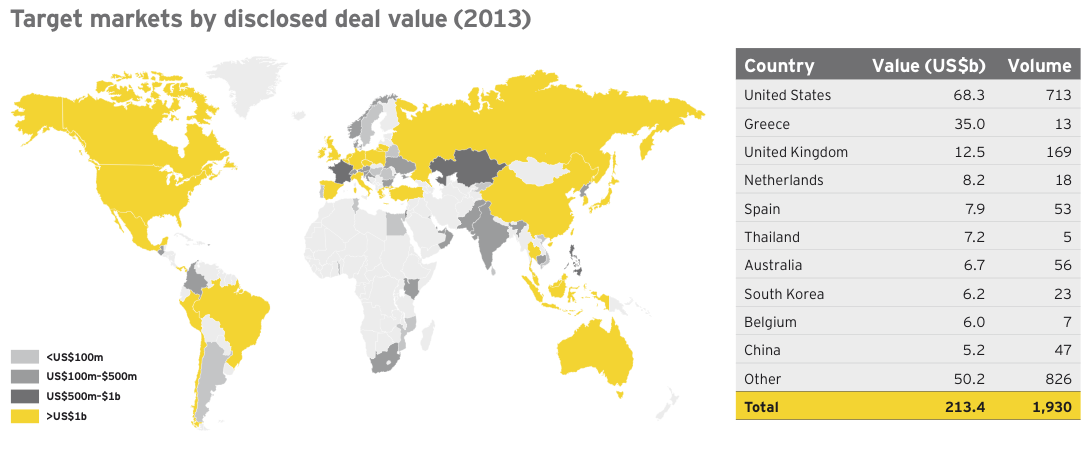

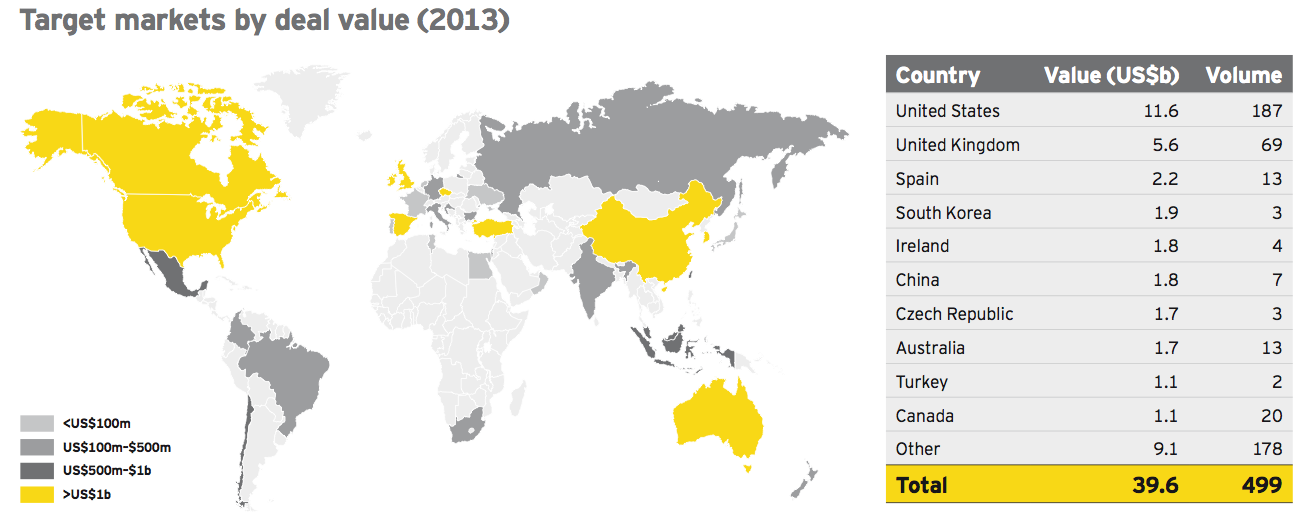

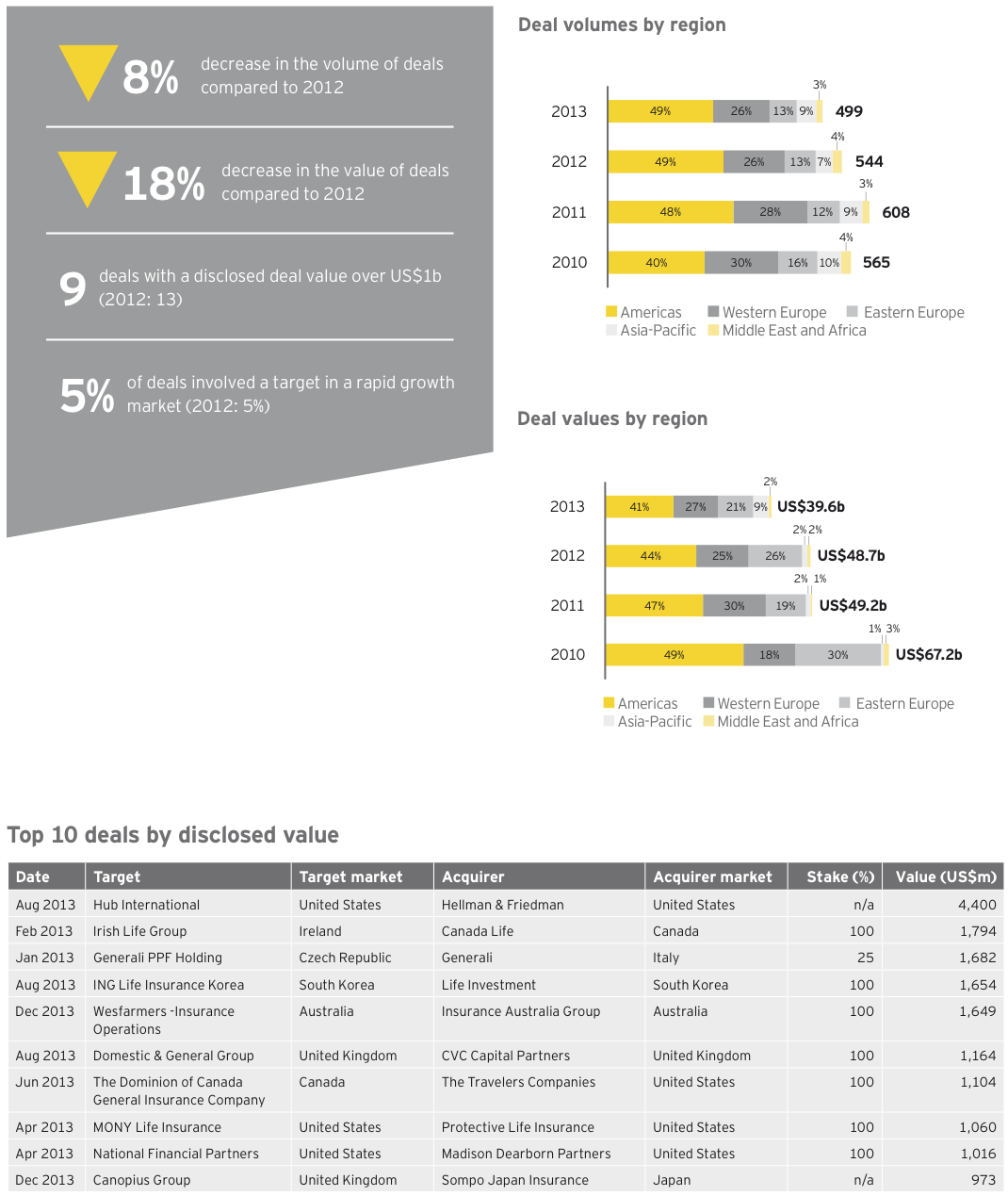

In 2013, the financial services sector recorded a further slow-down in global financial services M&A activity. This is the fourth year in succession that deal volumes have fallen. Overall, deal activity was 10% down on 2012 and some 21% lower than 2010. Disclosed deal values also fell 6% from 2012 and 16% from 2010.

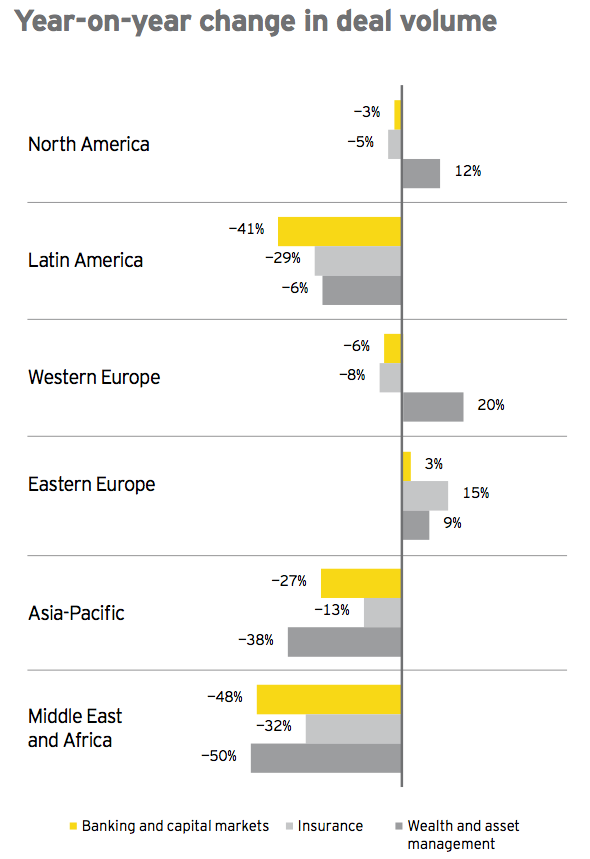

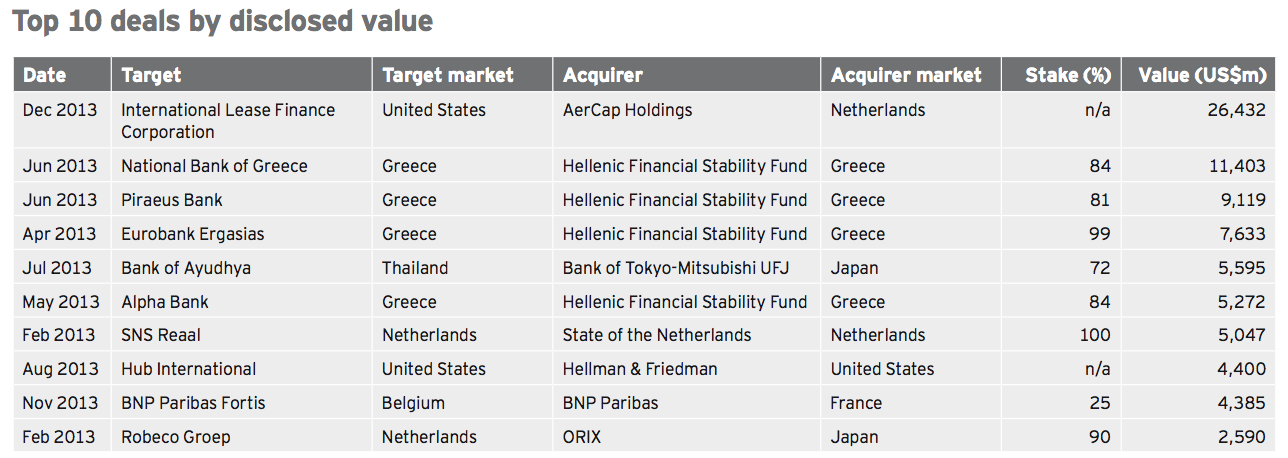

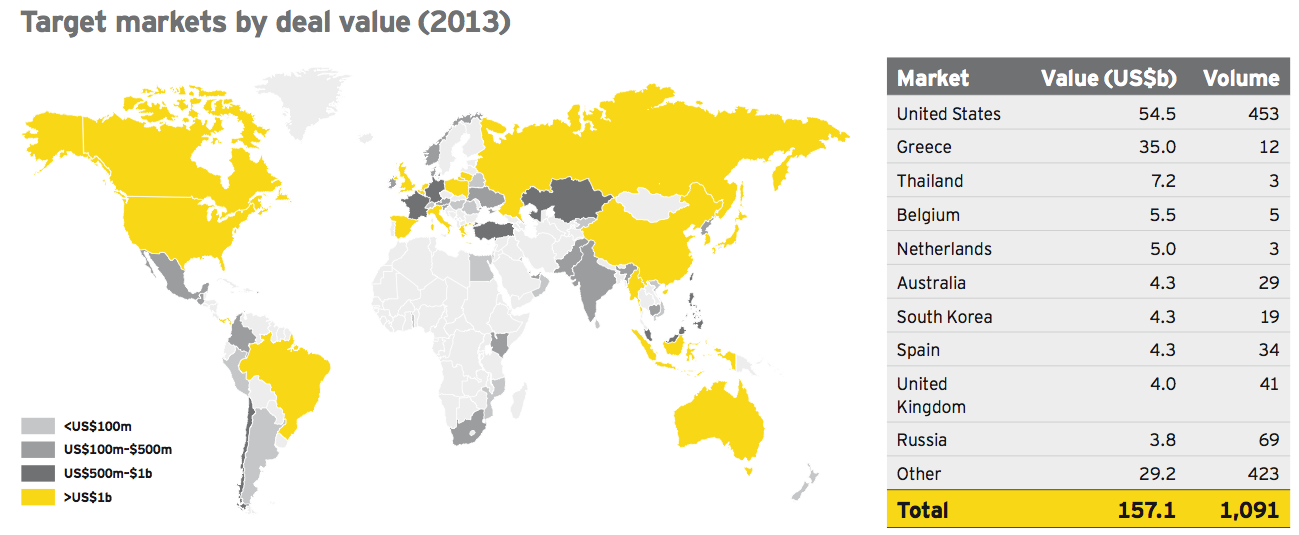

The banking sector witnessed the sharpest drop in deal activity, with a 13% drop in deal volumes compared to 2012. Disclosed deal value was up 5% compared to 2012; however, however this is not a true reflection of M&A activity as 5 of the top 10 banking transactions globally were state-backed bailouts in Greece and the Netherlands, representing an aggregate disclosed deal value of US$38.5b. If we exclude these statebacked transactions, then 2013 disclosed deal values fell by 6% compared to 2012.

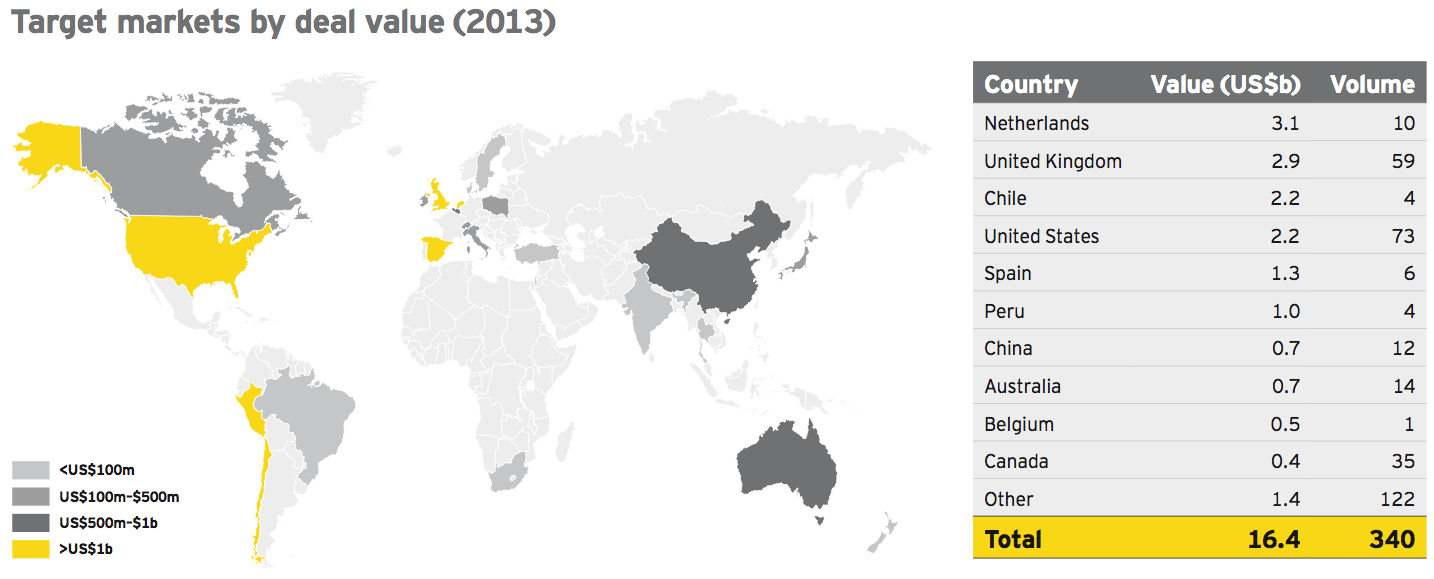

The insurance sector also witnessed a drop in deal activity in 2013, with a 9% drop in deal volumes and an 18% fall in disclosed deal values. The drop in deal activity is consistent across all regions, with the exception of Eastern Europe. Ukraine was one of the most active markets in terms of deal activity, with a total of 10 deals in 2013.

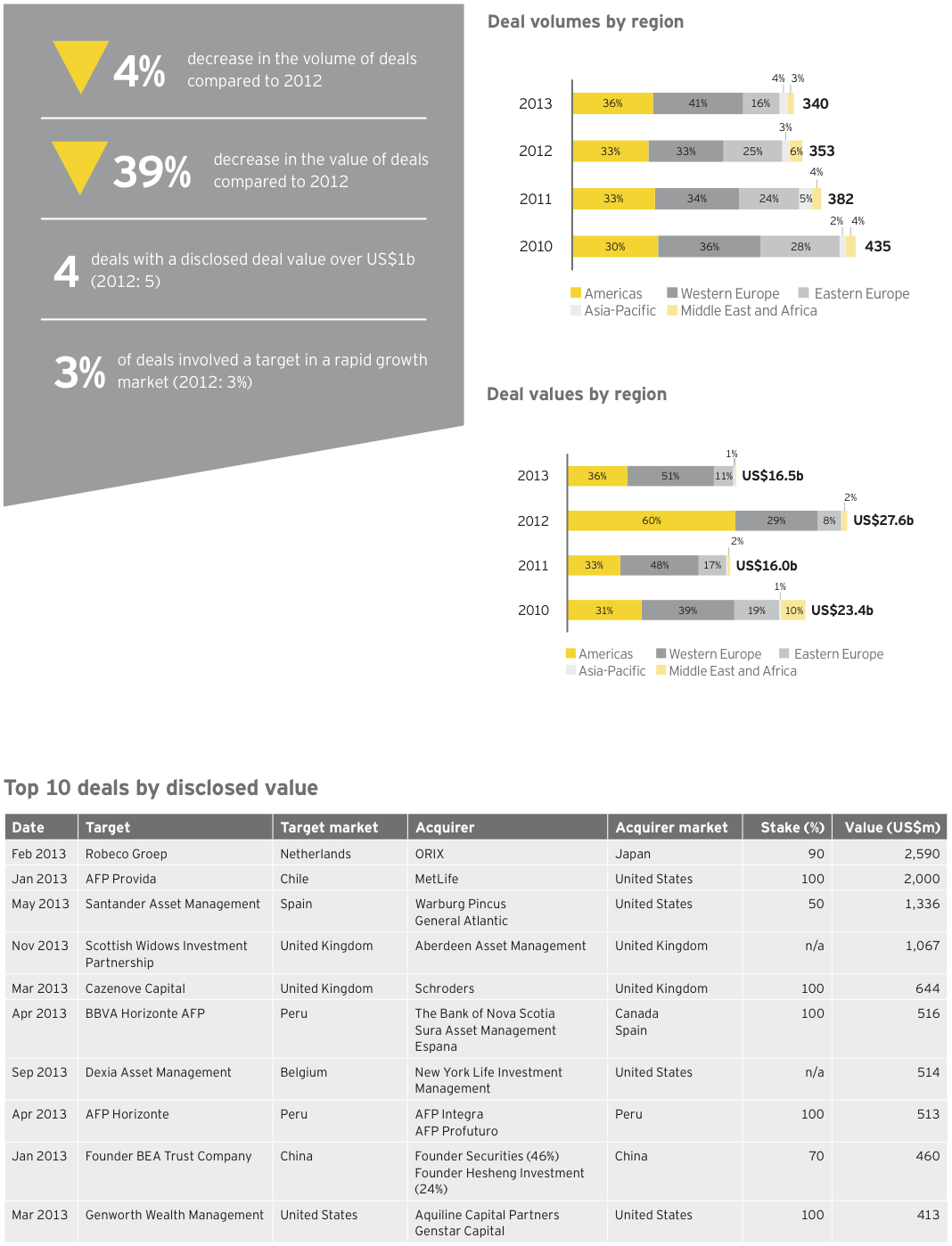

Despite a number of landmark transactions in Europe, there was a 4% decline in the volume of deals in the global wealth and asset management sector and a steep 39% drop in disclosed deal values. Notable transactions in Europe included Robeco, Santander Asset Management and SWIP as targets, but these were not enough to lift the overall level of activity in the sector.

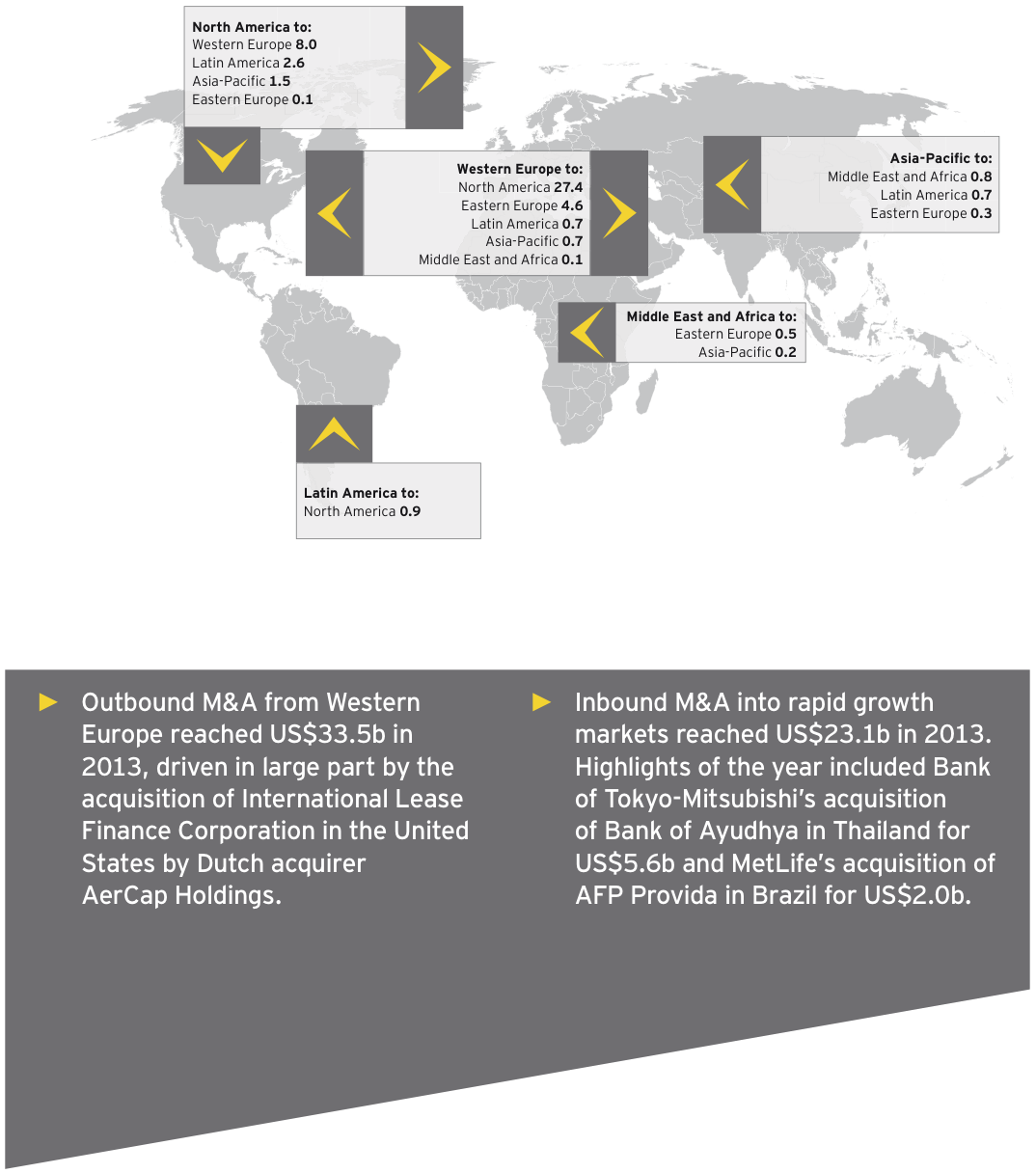

Cross-border activity remains buoyant across all the three financial services sub-sectors, with inter-regional transaction flows of US$53b (over 25% of aggregate disclosed deal value).

Investment into rapid growth markets remains a key theme, with Eastern Europe attracting significant inbound activity in 2013.

Global deal flow (US$b)

2. Banking and capital markets

Global deal activity in 2013

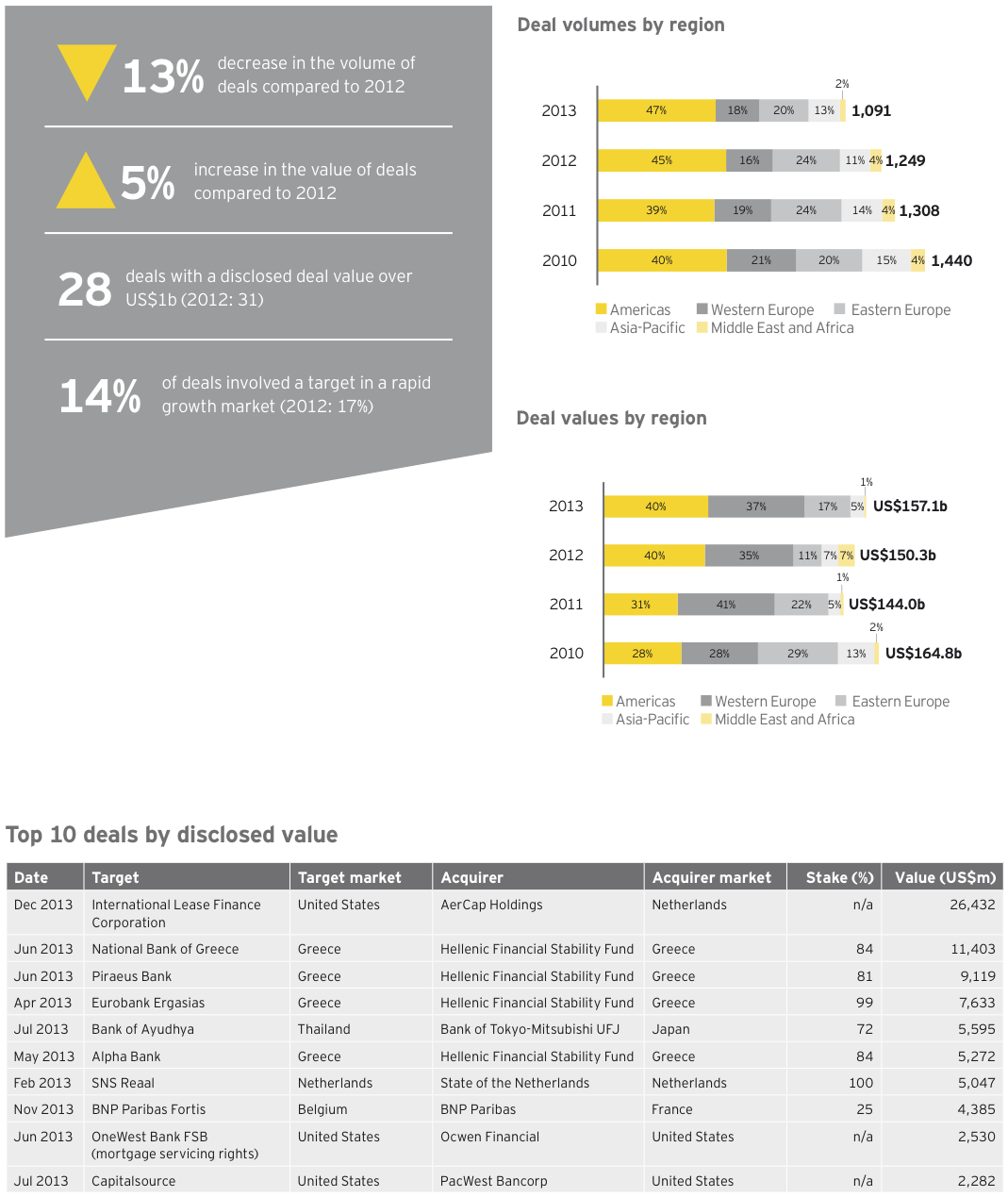

Americas

Consolidation within core banking continues: The vast majority of deals within the core banking sector took place in the community and regional banking sub-sector as banks took opportunities to acquire both local peers and non-core branch networks from larger banks. We expect this trend to continue as increasing costs associated with regulation and infrastructure as well as competition squeeze margins for all banks. Among the larger commercial banks, transaction activity continues to be driven by the identification and sale of non-core assets.

Alternative lending market boom: The specialty finance market is demonstrating strong growth. Two sub-segments — equipment finance and leasing, and auto finance — show increased level of deal activity and potential for growth.

Brokerage consolidation set to continue: As the brokerage industry continues to become more commoditized and technology is no longer a significant differentiating factor, specialization on industry groups and unique access to niche markets will drive transaction opportunities.

Active payments market: The rapid and robust digitization of money, coupled with a sharp focus on investments in technology, has brought about a revolution in the payments industry. We expect deal activity to increase as large industry players acquire new lines of revenue.

Canadian banks seek out high margin businesses: Using their strong domestic retail franchises, Canadian banks continue to report solid earnings and improving capital ratios. However, operating in a persistent low interest rate environment has resulted in banks focusing on ways to improve their net interest margin. One solution is for domestic banks to acquire higher-margin lending businesses; in 2013, Toronto-Dominion Bank acquired 50% of the existing Aeroplan credit card portfolio, and Royal Bank of Canada acquired Ally Financial Inc.’s Canadian auto finance business. We expect this trend to continue as banks examine both the credit card and alternative credit sectors for opportunities.

Continued interest in Latin America: The Latin American banking market remains highly attractive to both local and international banks. Regional players will continue to build out their footprint by participating in consolidation opportunities across the region. Meanwhile, international interest in the region remains high, with a number of foreign banks looking to enter the market. In October 2013, China Construction Bank (CCB) announced the acquisition of a controlling stake in Banco Industrial e Comercial for US$724m. CCB, one of China’s big four lenders, said Brazil had been one of its target markets, facilitating future expansion of the bank’s networks in Latin America.

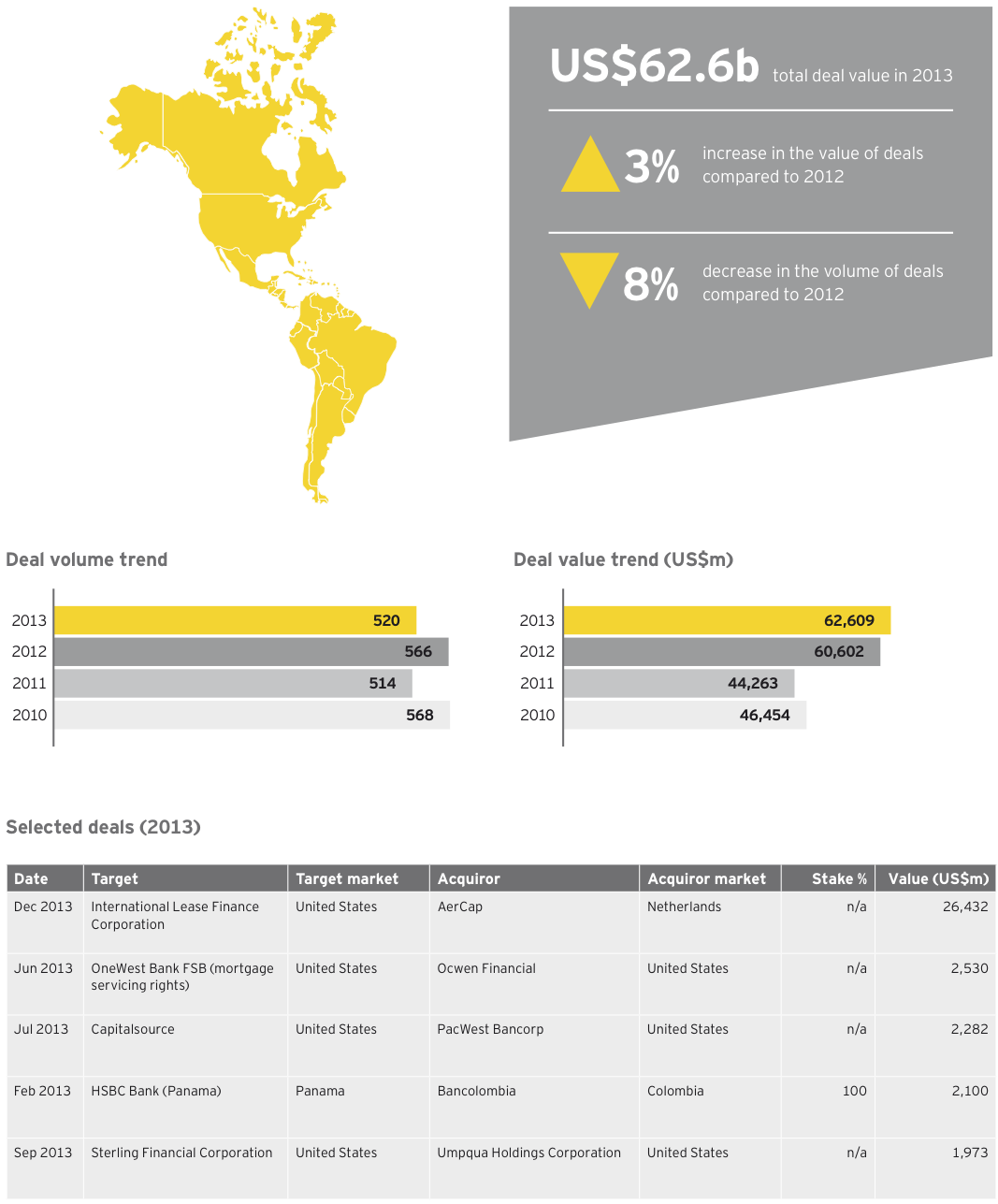

Western Europe

Banks to further shrink balance sheets as regulatory pressure intensifies: We expect smaller deals to dominate the M&A landscape as larger transformational deals face greater regulatory scrutiny.

Flow of loan portfolio transactions to accelerate: Banks are evaluating deleveraging strategies focused around disposals of specific portfolios of performing as well as non-performing loans. Investor appetite remains, especially for distressed debt.

Supervisory Mechanism and associated asset quality reviews will spur capital raising by Eurozone banks: European Central Bank has announced an asset quality review (AQR) for Eurozone banks. As a result, banks could be forced to make additional provisions. This could drive further capital raisings and deleveraging from late 2014 onward.

Rise in dual-track disposals: The return of growth in global equity markets, stabilizing European economies and the fading sovereign debt crisis have given new confidence to governments looking to privatize their stakes they were forced to bail out. We expect to see an increase in dual-track processes as governments seek the best return for their taxpayers. Future processes include a 30—50% of Lloyds’ stake in 631 branches (rebranded as TSB in mid-2013) and ABN Amro in early 2015.

Banks increasingly realize they are not the right owner of certain financial assets: European banks are re-examining their strategies as they struggle to increase profitability above their cost of capital. Desire to return to growth through investment in products and geographies may require disposals to unlock capital. Banks are considering whether they should be the owners of businesses that are complex, capital-intensive, with low margins and in non-core geographies. Banks are adopting various structures such as separate bad banks, non-core units within banks or run-offs to sell or manage these newly identified non-core assets.

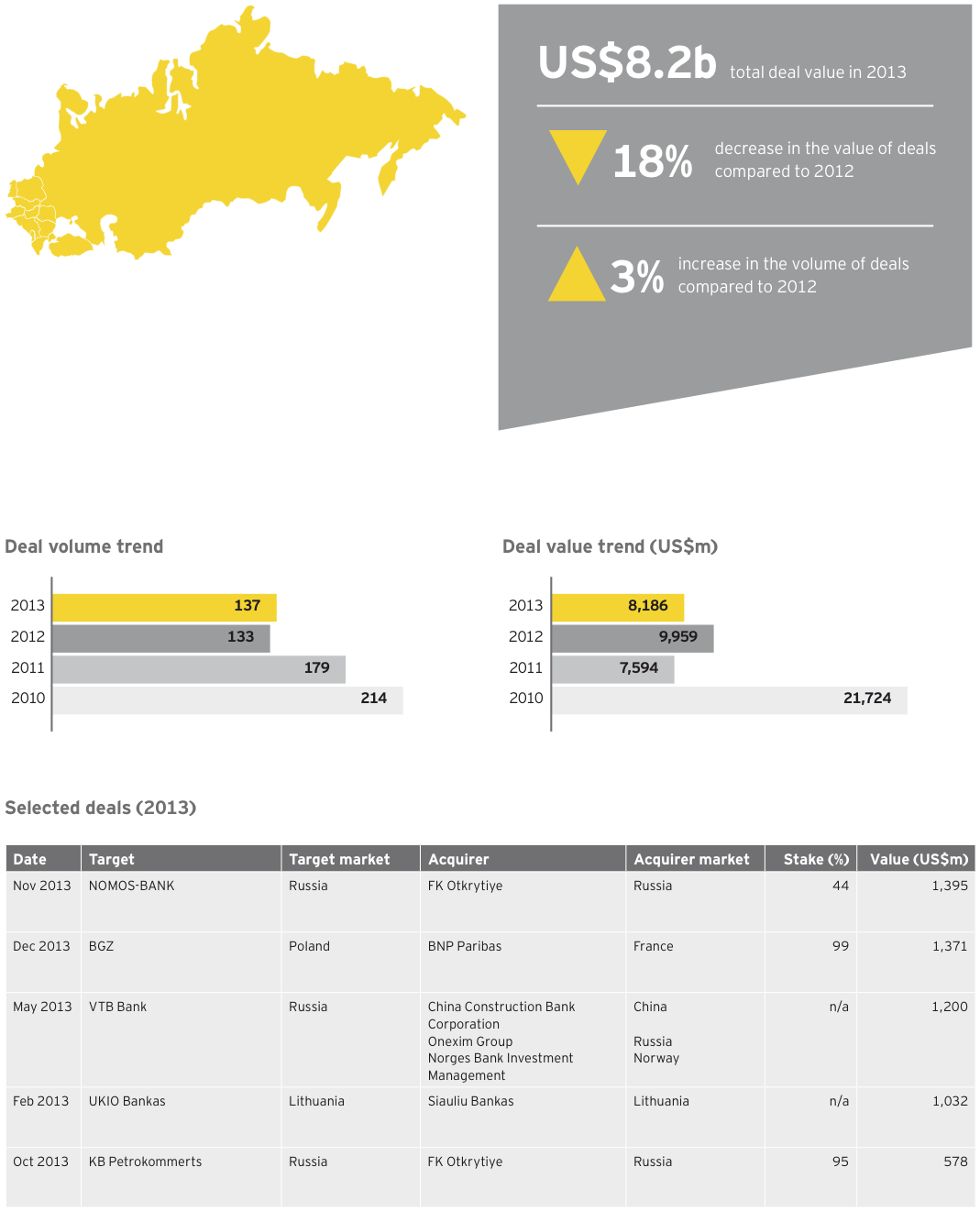

Eastern Europe

Subdued deal volumes in Eastern Europe; AQRs unlikely to be a catalyst for more activity: Deleveraging by Western European banks has been a key factor driving deal activity in Eastern Europe since 2009. Overall, however, the number of deals in Eastern Europe has remained low, indicating that foreign banks are not in a rush to exit the region. While some banks have been leaving the region, we have seen others selling minority stakes through public offerings (Unicredit sold 9.1% stake in Poland’s Bank Pekao for about €890m; Santander and KBC sold their stakes in Poland’s Bank Zachodni WBK SA for US$1.5b). We could yet see an upturn in deal activity as a result of the asset quality process that is currently

Buyers of the Eastern European banking assets are largely local: We expect to see deal activity in Poland. In Kazakhstan, the sale of banks that required a government bail-out will drive deal activity. There are also long-term opportunities in terms of privatization of state-owned banks in Hungary and Turkey.

Market consolidation may be imminent in overpopulated Russian banking sector: The Russian banking sector has more than 1,000 banks, with foreign players having a significant market share. Despite this, many state-owned banks have focused on expanding outside of Russia into Central and Eastern Europe.

Turkey holds promise in long run: The banking sector has continued to see increased interest from the Middle East and Asian banks that are looking to expand in growth markets beyond home. Asset sales by Western European banks, moderate economic growth and strong capital levels are a few factors that will drive deal activity in the country in the coming years.

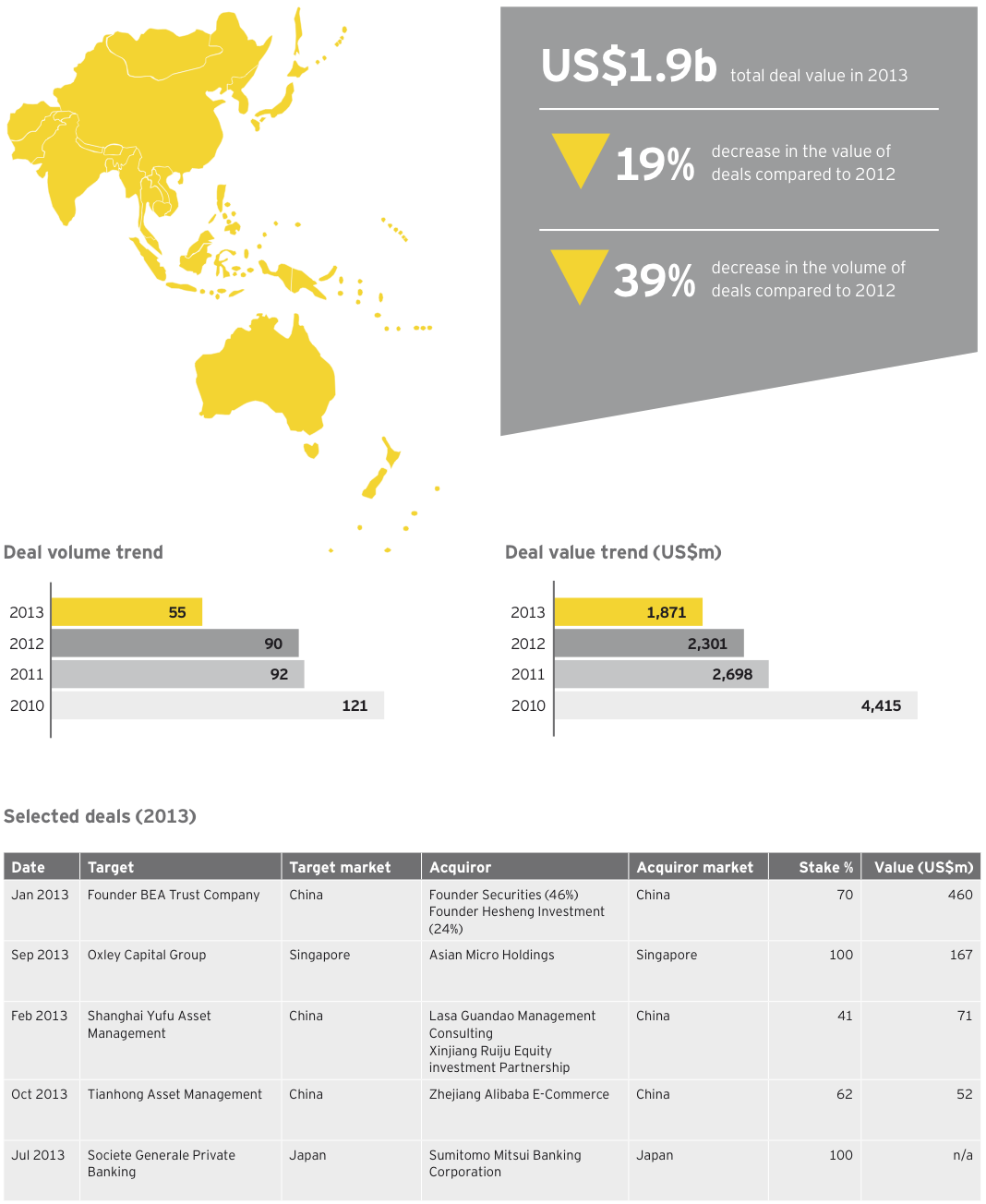

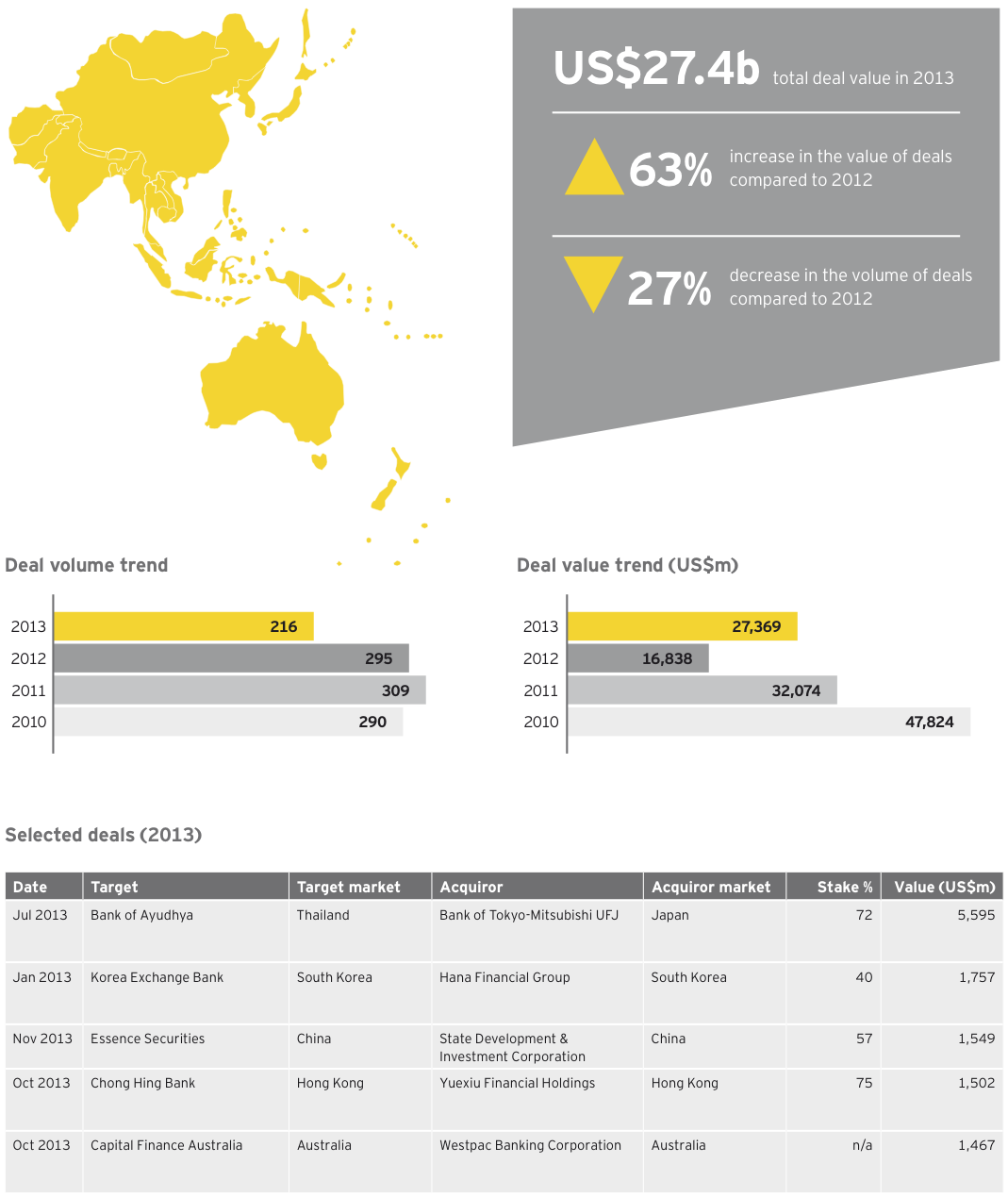

Asia-Pacific

Sizable banking and insurance acquisition opportunities may continue to attract strong interest in Southeast Asia: However, a lack of suitable acquisition targets could dampen the M&A activity level in the financial services sector.

Japanese institutions remain the most important group of buyers: The momentum of Japan’s inbound investments into Southeast Asia has shown no sign of abating and is expected to continue in 2014.

Spotlight on Myanmar: The micro-finance sector, in particular, presents new opportunities.

Middle East and Africa

Expect to see a jump in outbound activity: As the asset quality of Middle Eastern banks stabilizes and profitability improves, we expect more domestic banks to start exploring overseas markets for their expansion.

Foreign banks exit the region: Foreign banks have been divesting their Middle East operations that do not fit their core market. As global players try to manage the strict capital requirements and look to optimize their portfolio, we expect more such exits in 2014.

Africa calling: We expect to see continuing inbound M&A activity as foreign investors look at countries such as Ghana is often seen as a foothold for an initial presence.

3. Insurance

Global deal activity in 2013

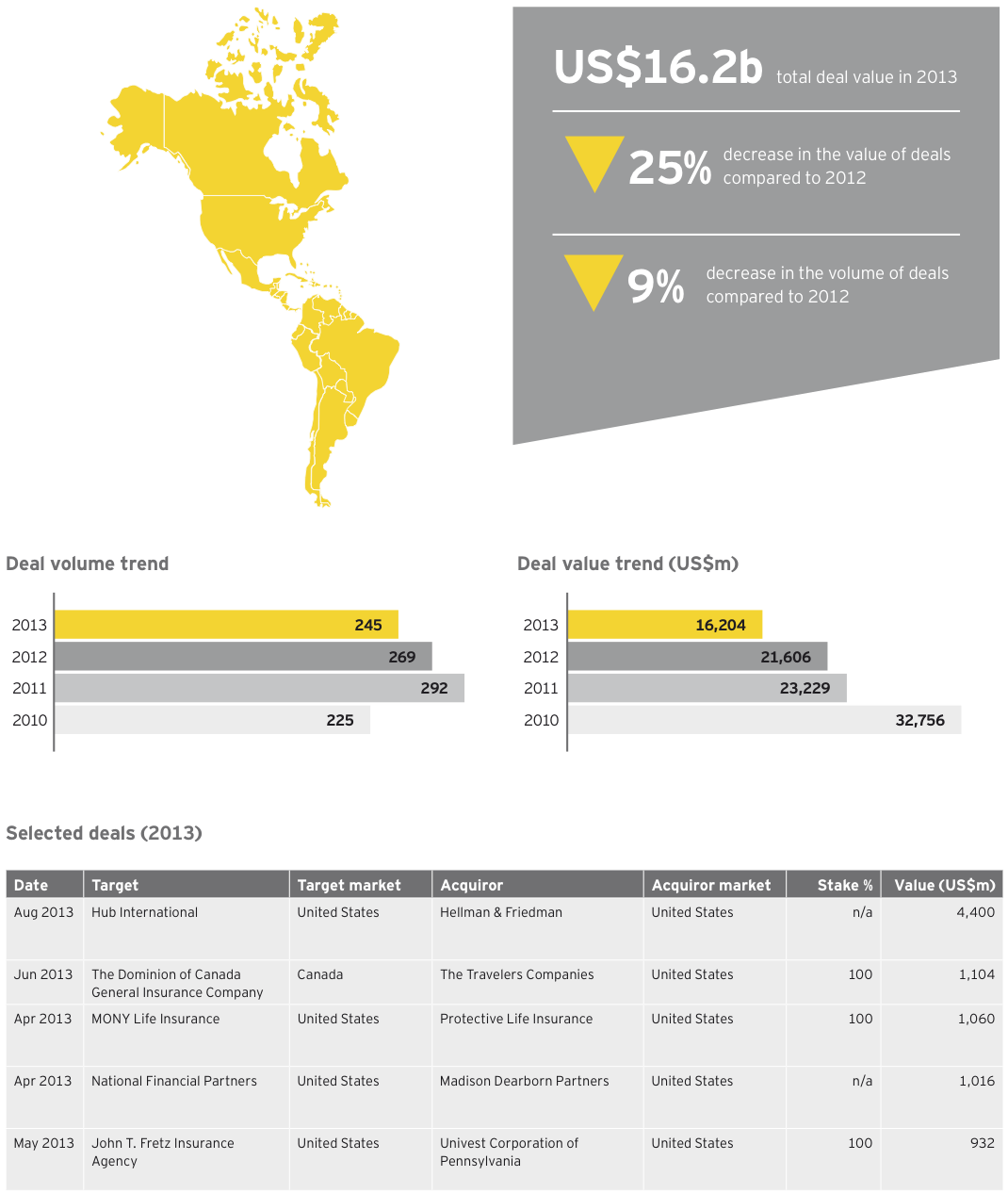

Americas

Growth in focus again: Growth has returned to the boardroom agenda. Given the challenges within the North American market, insurers will look further afield to propel top-line growth. Possible target markets could include Brazil, Colombia, Mexico and Turkey, as well as countries in the Far East.

Challenging market environment: Valuations continue to be adversely affected by limited top-line growth and regulatory capital levels that exceed historical benchmarks. As a result, transactions must focus on generating synergies, regulatory and tax efficiency, and revised investment strategies to extract value.

Focus on operational efficiency: This could include non-performing or sub-scale businesses that are no longer considered strategic and therefore available for divestiture. Acquisitions could also be on the agenda. The emerging focus on big data will prompt insurers to actively pursue opportunities to acquire technologies.

Financial buyers active in market: Expect continued interest from financial buyers looking for opportunities to use their investment management expertise on long-dated liabilities and their long-standing interest in entities providing services to the industry.

Lloyd’s of London — an attractive market for investors: The potential of high returns, and the opportunity to write business across the world makes Lloyd’s of London an attractive market for US-based insurers.

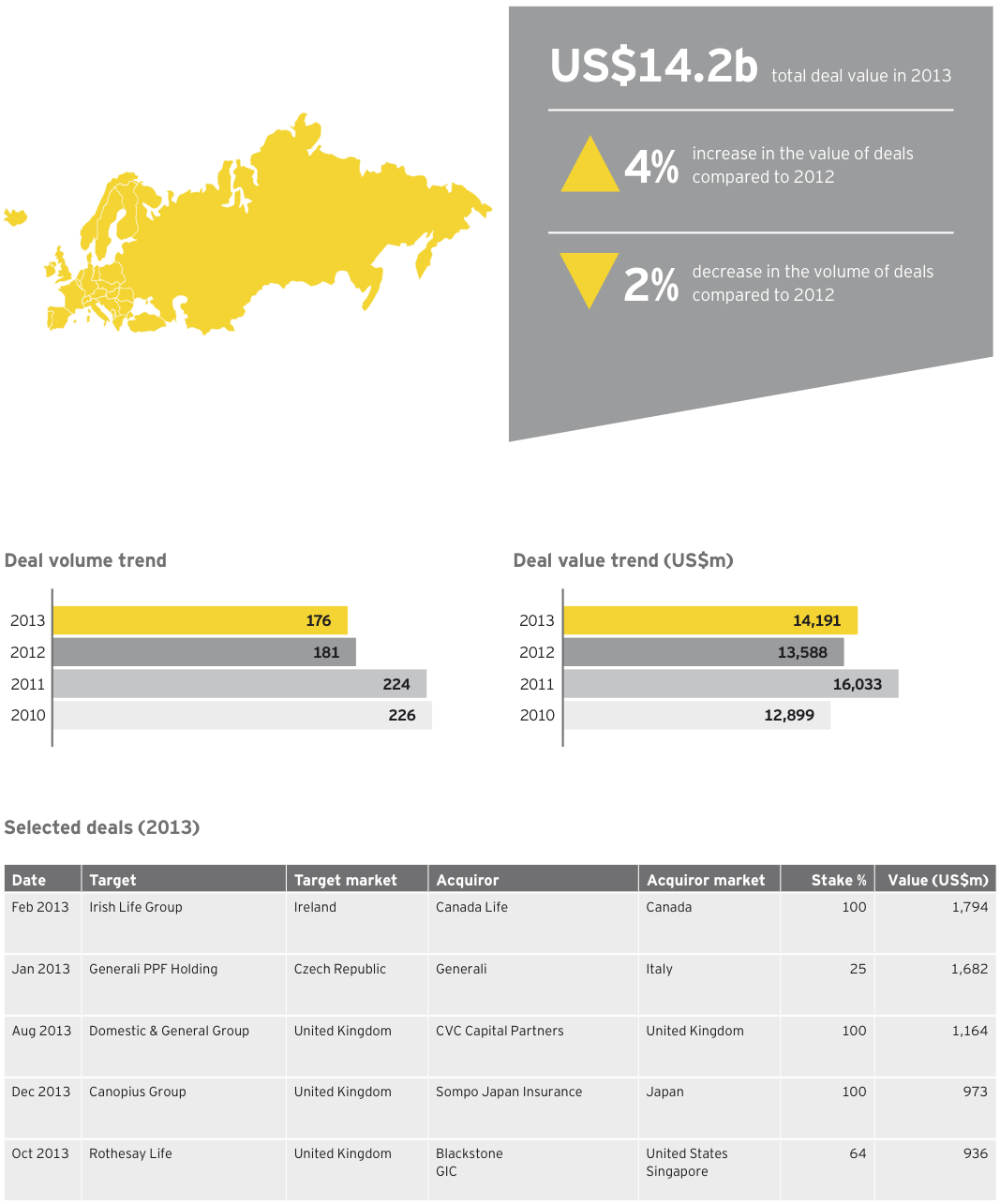

Europe

With capital positions improving, has the need for inorganic growth re-surfaced? With confidence returning and capital volatility reducing, insurers are again looking to improve margins and to focus on growth. Deals in the coming year will focus on operational efficiencies and synergies in addition to being based upon the attractiveness of the target market.

Rapid-growth markets attracting further waves of investments from global insurers:Insurers are looking at a range of rapid-growth markets (RGMs) to maximize returns and generate growth outside traditional developed markets.

Need for capital optimization driving insurers to sell non-core and legacy assets: This will present opportunities for consolidators in a number of markets. The very high level of capital supporting legacy portfolios across the insurance sectors is also coming under increasing focus.

UK insurance market remains of interest to inbound investors: The overall UK insurance market attracted interest from the US, Middle East, Japan and other European countries. This indicates that investors are seeing growth opportunities even in highly mature markets.

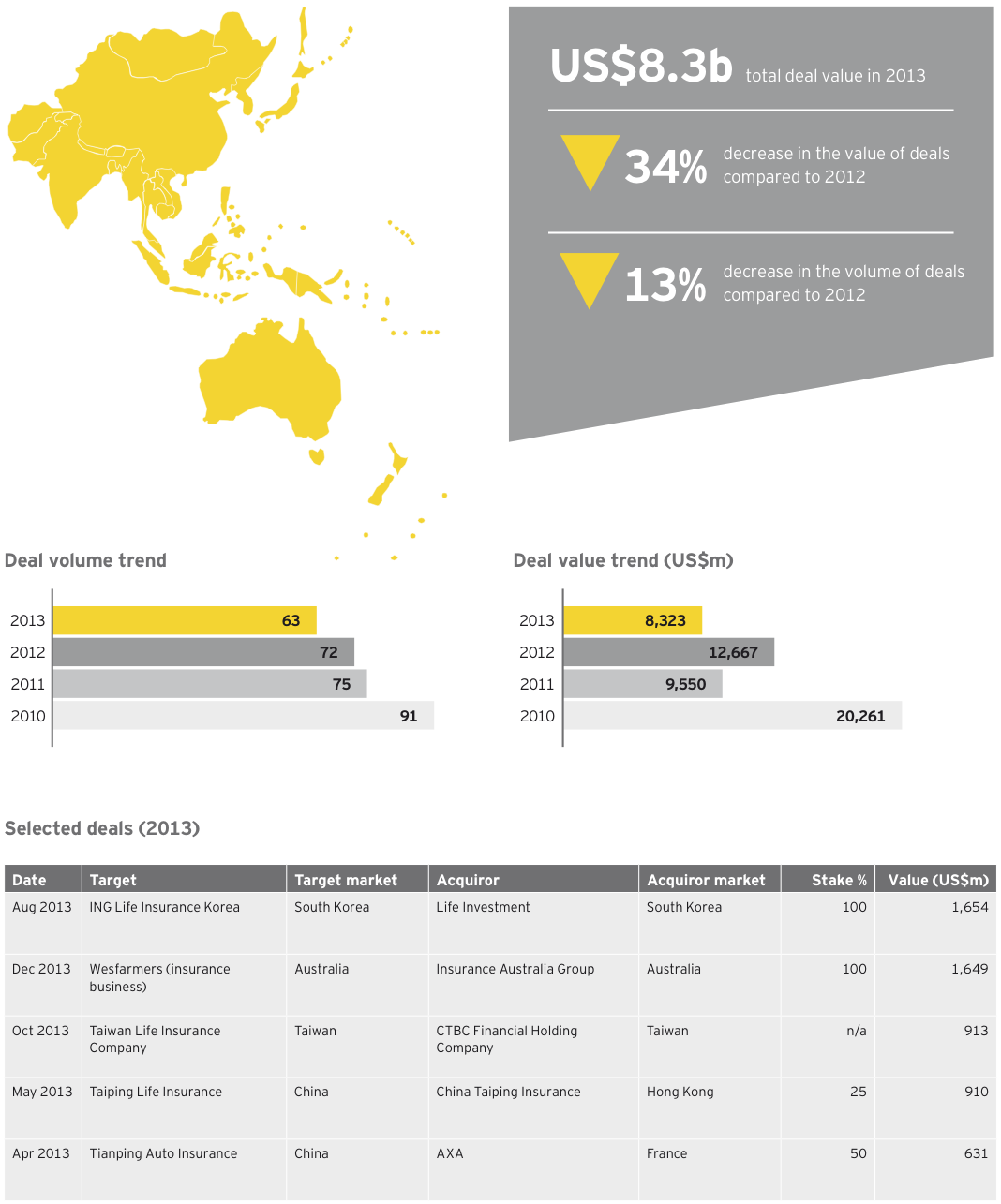

Asia-Pacific

The Southeast region continues to present growth opportunities: Southeast Asia countries are expected to see stronger overall GDP growth than mature Asia-Pacific economies in 2014, according to the Asian Development Bank.

Growing opportunity for takaful in Malaysia: Rising incomes and the increased adoption of sharia-compliant insurance products (takaful) are creating new opportunities in Malaysia. We are seeing high interest in M&A opportunities, organic growth and operational improvements in the market.

New pathway to the China market: The liberalization of trade barriers in China, as evidenced by the launch of the Shanghai Free-Trade Zone in H2 2013, is highly favorable for the growth of the insurance industry. Shanghai’s new financially oriented free trade zone may prove a major opportunity for the city to become the financial capital of East Asia.

4. Wealth and asset management

Global deal activity in 2013

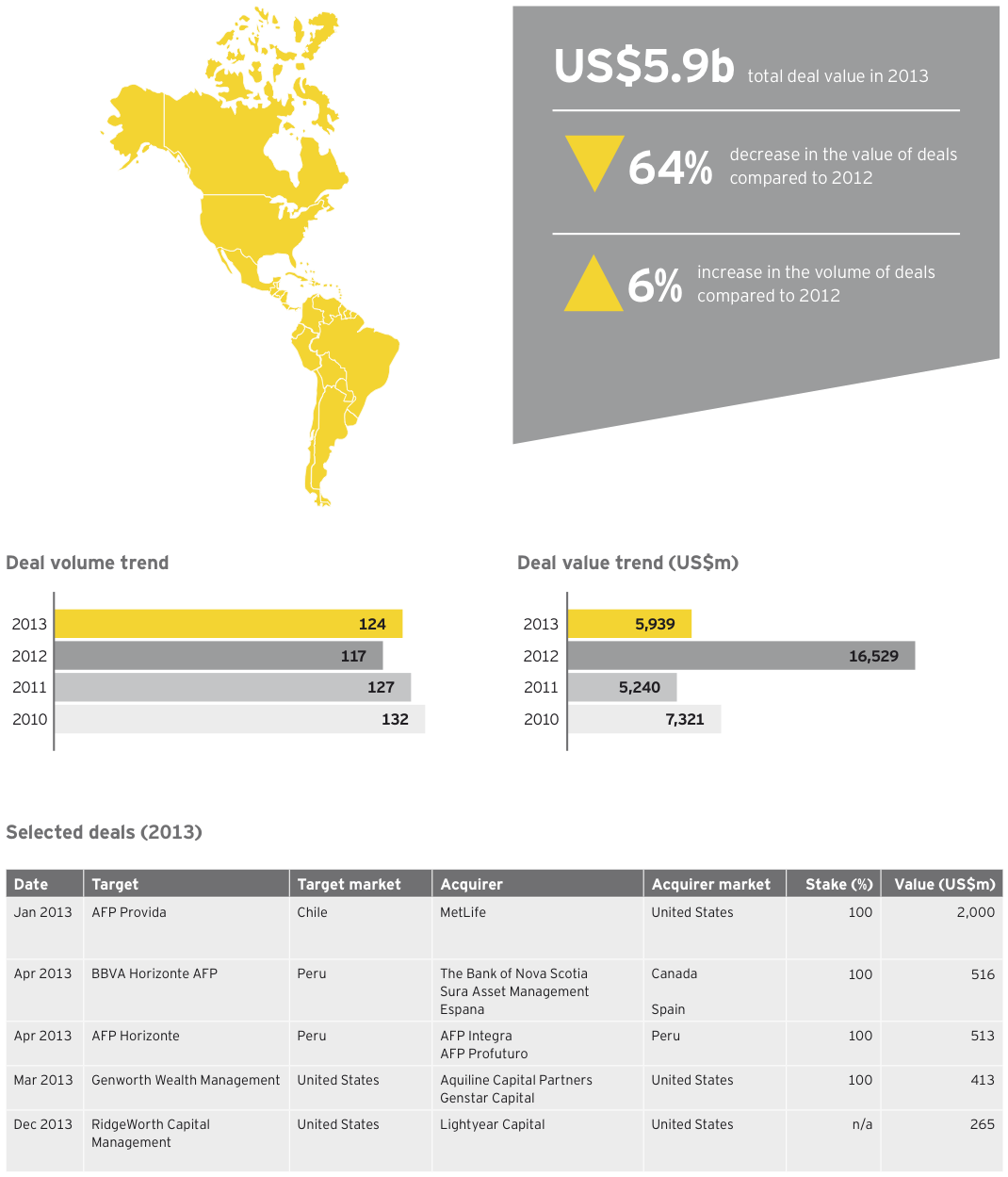

Americas

M&A activity increasing, with interest from a diverse set of buyers: Robust equity markets have helped boost the appetite for M&A on the part of buyers and sellers. M&A activity involving a strategic acquirer is still mostly used as a tactical tool to expand into new distribution channels or geographies, broaden product capabilities or a combination thereof.

Divestitures of subsidiaries driven by capital pressures coming to a close: Sale of asset managers out of distressed financial institutions are near their lowest levels since the start of the global financial crisis. We expect asset management M&A activity to return to being more strategic and middle market in nature (valuations <US$1b).

M&A activity centered around unique products, with particular focus around alternatives: Within the long-only product segment, acquirers are particularly interested in gaining access to global, non-US, infrastructure, real estate and other hard asset strategies.

Significant asset management M&A activity centered around the wealth management segment: Financial institutions, specifically banks, are placing greater emphasis on wealth management businesses due to “stickiness” of assets and fees.

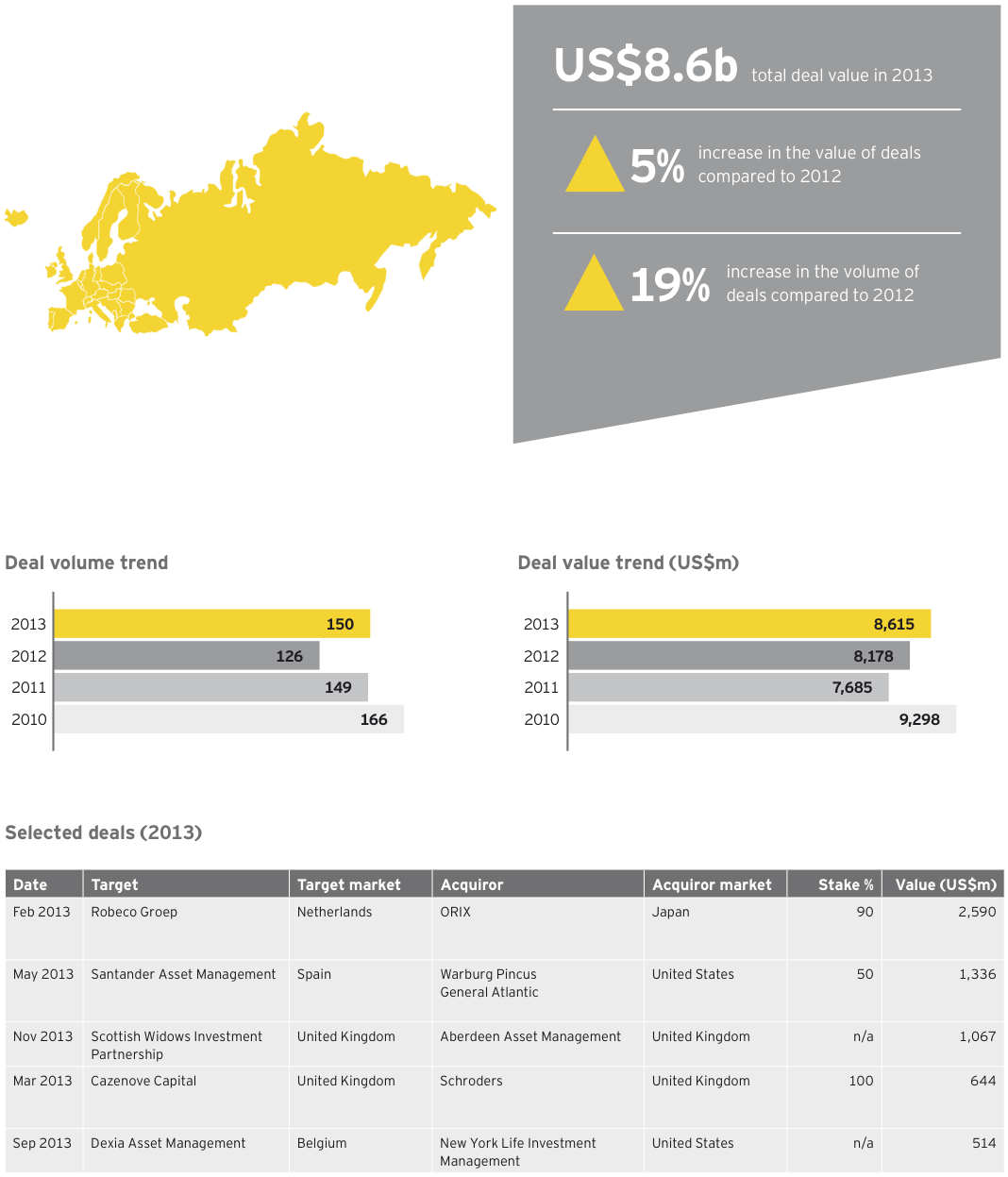

Europe

Overseas and private equity players are queuing to buy asset managers … Looking forward, global players are expected to continue to invest in the region as they look to expand beyond local markets, with notable interest from the US, Canada, Japan and China.

… but will banks continue to sell these assets? With the more obvious transactions largely complete, it is clear that the remaining banks increasingly regard their asset managers as core assets. With profitability of asset managers increasing and with some European economies showing signs of recovery, we would expect the pace of disposals by banks to decrease.

Deal pricing has increased: Sector valuations have been buoyed by robust capital markets, which in turn have led to increased assets under management (AUM) as well as greater investor appetite and stronger flows into higher margin equity and risk products.

Continued market consolidation in wealth management: An increase in regulatory and compliance costs and the need to upgrade risk management and IT systems are affecting margins of the wealth managers. This will open-up buying opportunities for larger players, which are scouting for talent and differentiated offerings.

Asia-Pacific

Strong appeal of the Asian asset management sector: Growing interest in long-term savings among the consumer class and demand for international exposure from institutional investors are driving growth at the industry level.

Creativity, flexibility key for asset managers aiming to expand in Asia-Pacific: Some key strategies for success include:

- Partnering with retail banks

- Partnering with insurers

- Partnering with a local asset manager

Cross-border transaction activity in both directions: The region is attracting a lot of foreign interest from mainly North American and European buyers. Also, several large asset managers from markets such as Australia, Japan and Korea are setting themselves targets for regional or global expansion.

Move toward investment solutions and fee-based relationships: Demand for asset management advisory services is expected to grow in Asia-Pacific, particularly from the high net worth (HNW) population. The growing HNW segment is also likely to drive the development of private banking distribution channels.