By Pip McCrostie – Ernst & Young

Global M&A activity and volatility coexist

Our fifth Capital Confidence Barometer predicts a new paradigm: Corporate M&A activity and extreme market volatility coexisting. There is a surprisingly stable appetite to do deals over the next 12 months as top global corporates remain resilient to the market turbulence.

But why is that the case when we are in the midst of market upheaval and weakening global growth? Because this is not 2008 all over again. Leading corporates have spent three years focusing on reducing financial risk, operational fitness and learning to live with volatility:

• Balance sheets are stronger with less leverage.

• Companies have re-financed to improve their capital structures, reduced interest costs and extended maturities.

• Many companies can draw upon cash war chests.

• Earnings growth outlook is positive.

Consequently, the focus is now clearly on growth, with the fewest number of respondents since 2009 focusing on survival. We also see an increased consensus around asset values, resulting in a 30% rise in potential sellers coming to the table globally.

All of this is fostering a favorable environment for M&A — but some barriers do remain. Mounting regulatory pressures could potentially impede growth, and there is the fundamental question of the economy. While our respondents’ M&A attitudes are remarkably robust given the current environment, a slump into a double-dip global recession or another banking crisis would mean all bets are off.

However, for the time being, our respondents have learned how to manage in volatility: they have the capability — and ambition — to do strategic deals in the current climate.

About this survey

The Confidence Barometer is a regular survey of senior executives from large companies around the world conducted by the Economist Intelligence Unit (EIU).

Our panel, the “Ernst & Young 1,000” is comprised of selected Ernst & Young clients and contacts and regular EIU contributors.

This snapshot of our findings gauges corporate confidence in the economic outlook and identifies boardroom trends and practices in the way companies manage their capital agenda.

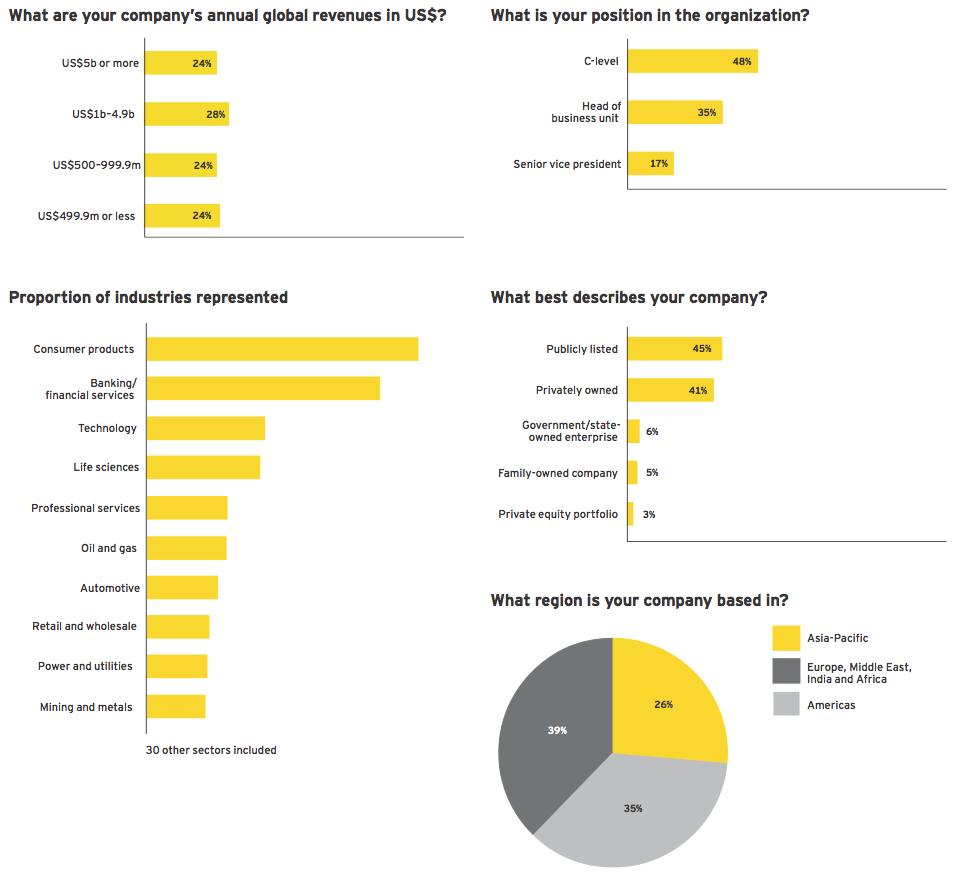

Profile of respondents

• Panel of over 1,000 executives surveyed in July and August 2011

• Companies from 51 countries

• Cross-section of respondents from more than 40 industry sectors

• 700 CEO, CFO and other C-level respondents

• 768 companies would qualify for the Fortune 500 based on revenues

The Capital Agenda

Based around four dimensions, it helps companies consider their issues and challenges, understand their options and make more informed capital decisions.

1. Preserving capital: reshaping the operational and capital base

2. Optimizing capital: driving cash and working capital and managing the portfolio of assets

3. Raising capital: assessing future capital requirements and assessing funding sources

4. Investing capital: strengthening investment appraisal and transaction execution

Economic outlook

Global economic outlook resilient despite volatility

July and August marked a return to intense volatility not seen since the early days of the economic crisis in 2008. The US credit rating downgrade, debt crisis in the Eurozone and weakening economic data from around the world sparked dramatic stock market activity and ultimately the global repricing of risk.

Nonetheless, two-thirds (63%) of the Ernst & Young 1,000 said that they felt the global economy was at least stable, if not modestly improving. Only 37% are pessimistic about global economic prospects.

63% of the Ernst & Young 1,000 surveyed said that they felt the global economy was either stable or improving.

80% of power and utilities and metals and mining sector respondents say the global economy is stable, modestly improving or strongly improving.

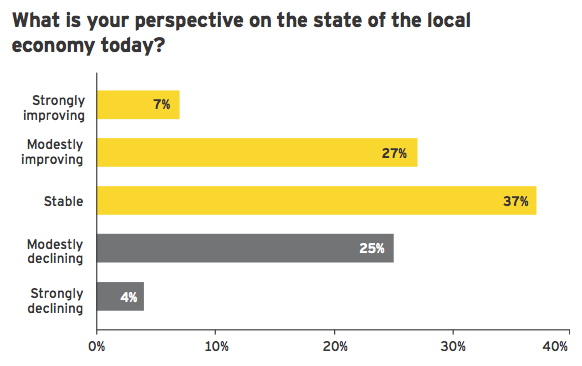

Confidence in local economies rising

When asked their perspective on the state of their local economies, 71% cited a stable or improving environment, compared with 66% in April 2011 and 64% in October 2010. Surprisingly, in the face of significant volatility beyond local borders, confidence is rising. This improvement is underpinned by expected corporate earnings growth, increased cash piles and reduced debt.

71% When asked their perspective on the state of their local economies 71% cited a stable or improving environment.

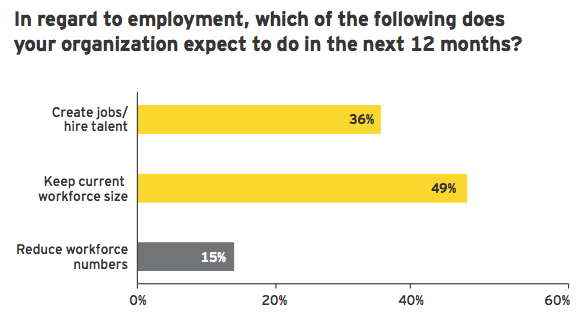

Employment outlook brightens

Despite some high-profile announced layoffs, 85% of the Ernst & Young 1,000 expect to maintain or increase their workforce over the next 12 months. While there are clearly some workforce reductions related to new and long-standing cost reduction programs, companies are starting to reinvest for growth.

90% of oil and gas and metals and mining sector respondents plan to create jobs or maintain their current workforce levels.

Access to capital

Confidence in credit availability improving

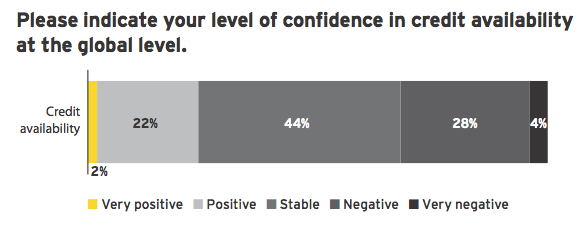

The Ernst & Young 1,000 believes credit markets are strong enough to support growth plans, with two-thirds (68%) of our mainly larger cap respondents saying credit availability is stable, positive or very positive.

Trend toward debt reduction continues

Strong corporate earnings and improved liquidity have enabled companies to reduce indebtedness levels. Balance sheet leverage has reduced slightly since April 2011 —

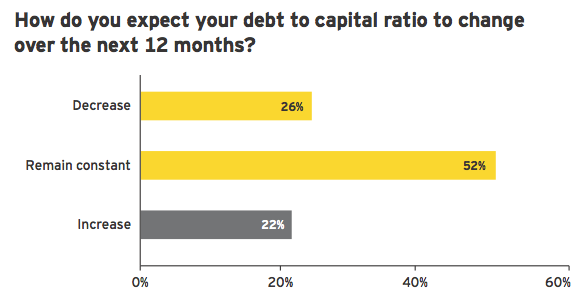

This debt reduction theme was first observed in November 2009, is expected to continue as 78% plan to maintain or reduce their debt to capital ratio in the next 12 months.

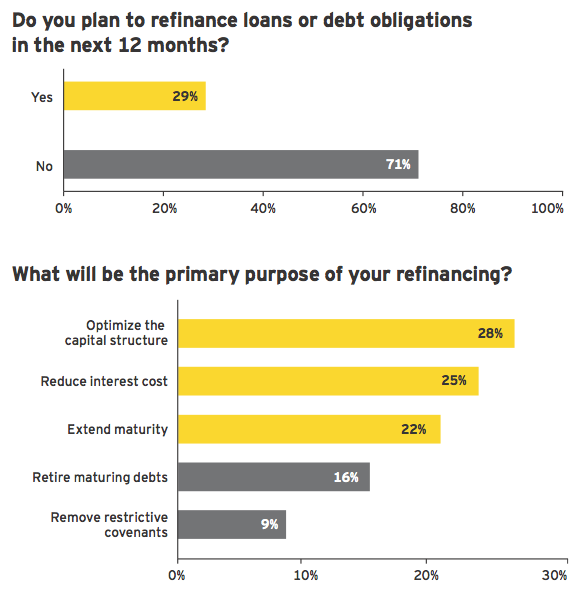

Refinancing to improve capital structure

Companies are focused on strengthening their balance sheets by refinancing. Twenty-nine percent plan to refinance loans or other debt obligations in October 2011 compared with 20% in April 2011. Better availability of lower-cost debt will enable them to improve their capital structures, reduce interest costs and extend maturities. Capital markets are particularly accommodating to larger cap, financially stable organizations, and the investment — grade corporate bond markets are rebounding.

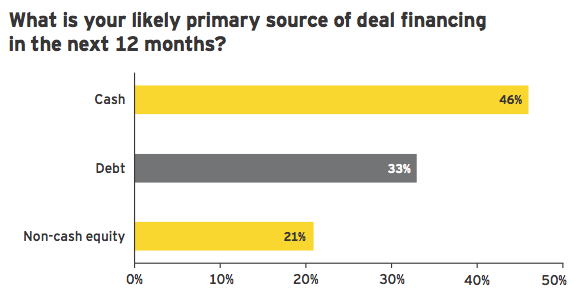

Cash remains the primary funding source for deals

With high cash balances and a growing aversion to leverage, 67% plan to use cash or non-cash equity as their primary funding source for deals, compared with 59% in April 2011. This trend further reinforces the debt reduction theme. Furthermore, those planning to use debt for acquisitions are more likely to use less than in previous years.

Growth

Shift from survival to growth continues

Despite market turbulence, this is not 2008. Companies have strengthened their balance sheets, cut costs and reduced overall financial risk. Our research builds a picture of corporate confidence amid market turmoil.

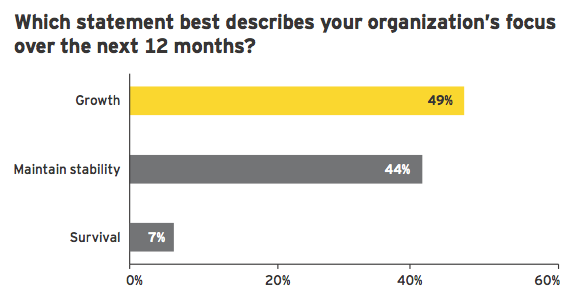

Growth tops the corporate agenda as half of the respondents are making it their top priority in the next 12 months. Only 7% cite survival as an imperative — the lowest level since the Barometer was first published in 2009.

Two-thirds of the technology sector respondents are focusing on growth.

Corporate earnings outlook: stable to positive

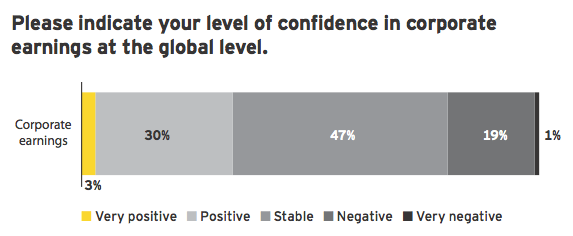

Continued focus on cost reduction and efficiency throughout the financial crisis has most corporates positioned for stable to growing earnings. Thirty-three percent feel positive or very positive about corporate earnings potential.

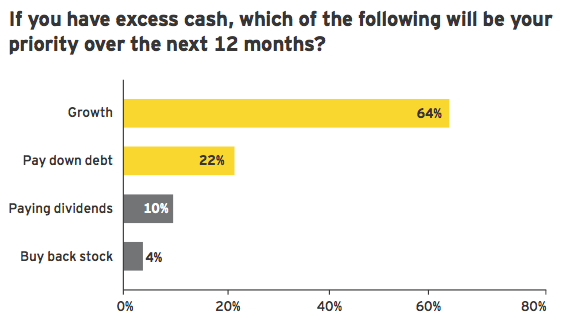

For those with excess cash flow in the next 12 months, nearly two-thirds of all companies (64%) prioritize investing in growth, followed by paying down debt.

Regulatory risk — a factor that could derail growth agendas

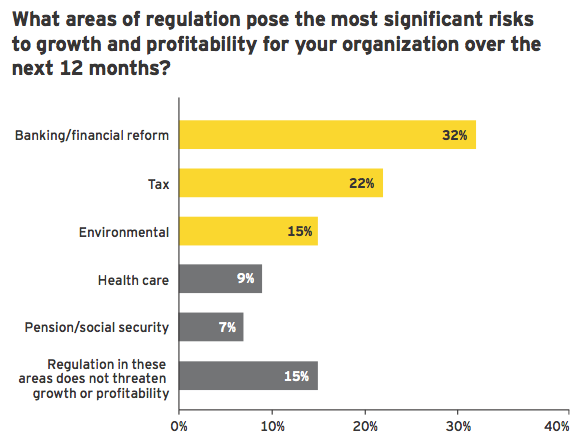

Eighty-five percent of respondents are concerned that mounting regulatory pressures across a number of areas could potentially impede growth. Banking and financial reform are viewed to have the broadest potential impact across all sectors. Tax and environmental regulatory frameworks are of next highest concern.

Mergers and acquisitions outlook

Deal activity and volatility now coexist: a new paradigm

In an unprecedented departure from the historical norm, the outlook for deal volumes is stable against a backdrop of significant short-term volatility.

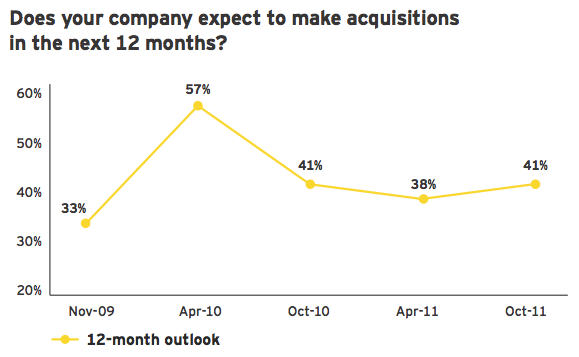

In fact, deal makers’ appetite to acquire has increased marginally, with 41% of respondents expecting to make acquisitions in the next 12 months compared with 38% in April 2011.

Many companies have learned to adapt and operate in a new and uncertain world. They are well-positioned to seize opportunities and plan to do so, as many have reduced their financial risk and have the ability to take on more business risk.

Favorable environment for deal making

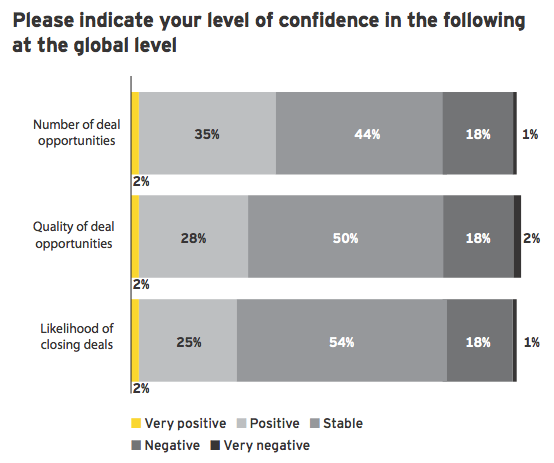

The Ernst & Young 1,000 are broadly comfortable with the deal environment in terms of quantity and quality of deals, as well as likelihood of closing deals.

Just as acquirers expect continued earnings growth, confidence in the earnings profile and quality of targets has risen. Deal makers also see improvement in the quality of assets coming to market.

Valuation levels could fuel activity

A further indicator of an encouraging deal market is the outlook for asset valuations. With 57% expecting asset prices to remain at current levels over the next 12 months, corporates may be inclined to deploy their cash reserves toward acquisitions.

Increasing appetite for divestments

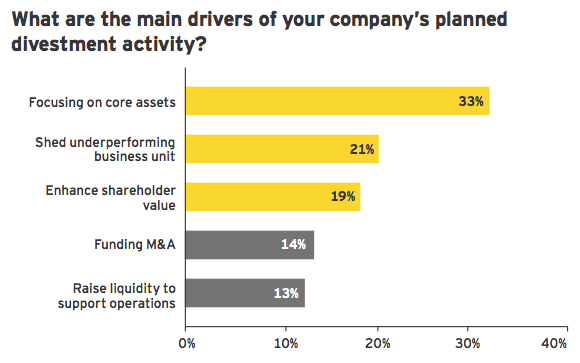

The willingness of companies to divest assets is an important element in the deal market. Twenty-six percent of respondents see divestments as likely or highly likely in their organization over the next 12 months, an increase of 30% since April 2011.

30% increase in appetite for divestments in the next 12 months.

The consumer products, oil and gas and technology sectors are the most likely to make acquisitions in the next 12 months.

The top three reasons for executing planned divestments are focusing on core assets, shedding underperforming business units and enhancing shareholder value.

37% of oil and gas and 33% of power and utilities companies are likely to make divestments in the next 12 months.

Emerging market opportunities fill deal pipelines

In an increasingly global economy, more than ever before, companies are pursuing emerging market investment opportunities. There is a desire to balance portfolios between emerging and developed markets to better position for growth and profitability.

The top three most attractive investment destinations are emerging markets — China, India and Brazil. The Asian emerging markets are among the most attractive due to their high growth potential, expanding domestic demand and resilience to current market volatility.

The US also remains attractive based on the size and diversity of its economy. Respondents anticipate inbound US activity will be driven by buyers from China, UK and Canada. Australia is ranked highly due to its inbound activity in the mining and metals sector.

What are the most likely countries where you will make outbound investments?

1. China

2. India

3. Brazil

4. US

5. Australia

The most popular emerging market destinations beyond the BRICs are:

1. Malaysia

2. Mexico

3. Colombia

4. Argentina

5. South Africa

Deals driven by quest for growth

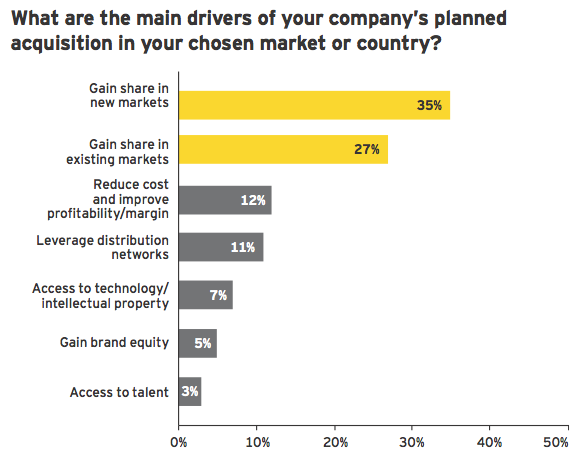

Sixty-two percent of respondents said the primary purpose for making acquisitions is to gain market share in new and existing markets (products or geography). Other drivers such as cost synergies, distribution network leverage and access to technology are less important factors.

Survey demographics