By Stuart Robertson – KPMG

Fewer deals + more strategic projects = greater fulfilment

Introduction: The rising and pervasive influence of regulation

In the aftermath of the financial crisis, banks’ attention has shifted somewhat from growth to embrace a wider range of activities, from strategic planning to improved operational efficiency.This reflects a growing focus on improving margins, profitability and return on equity (ROE).

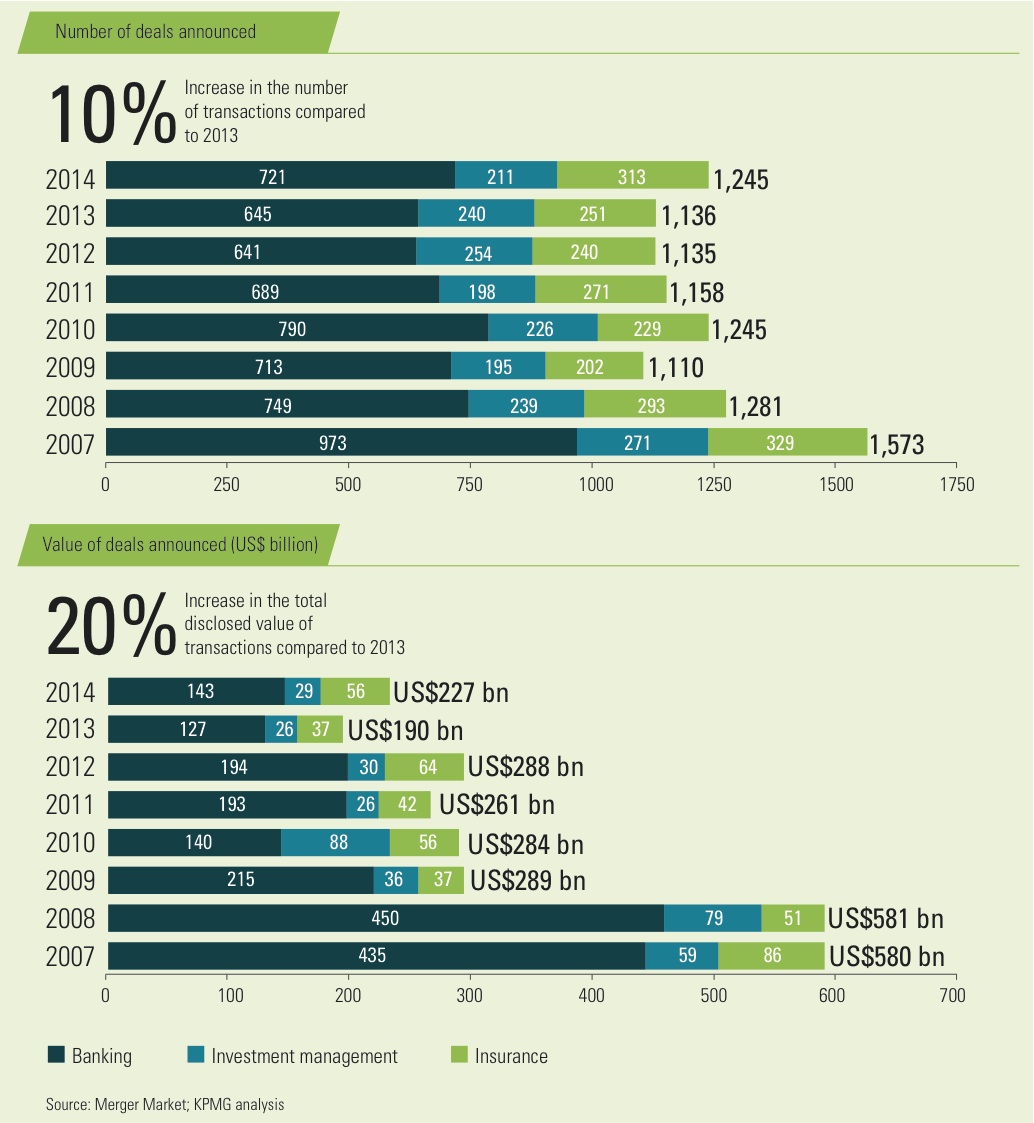

In a bid to reduce the chances of future shocks, regulators have introduced more onerous demands, with compliance, increasingly stringent capital requirements and risk assessment becoming a far greater influence over merger and acquisition (M&A) activity. Consequently, banking deal volumes have plummeted since the highs of 2008 and 2009, plateauing at a much lower level. Major acquisitions are likely to generate considerable skepticism from boards and attract regulatory review, which is a major concern, especially for larger, higher profile banks (global systemically important financial institutions, or G-SIFI). In deals involving institutions with multi-country entities, regulator intervention could delay deals for several months or even longer, possibly making the entire transaction prohibitively expensive.

Indeed, with the exception of Asia, plus a handful of strong banks in Europe and the Americas, low profitability and poor return on equity have pushed mergers & acquisitions (M&A) off the list of priorities.

Consequently, some banks are limiting, or even reducing, their global expansion plans, and are more likely to consider buying business units that they can bolt onto their existing operations, to improve the customer offerings. They are also divesting non-core functions, with regional banks eager to step in and buy these assets.This shift away from buy-side acquisitions can expose a lack of expertise on the sell-side (which tends to be a more complex, lengthy process) – something that banks may want to address.

All these trends have an impact upon a bank’s corporate development team, which is likely to have to expand its range of responsibilities and develop new skills. To gain a better picture of the challenges facing the function, we spoke to senior executives from twenty-six corporate development teams from some of the world’s largest banking institutions.

The findings, augmented by expert comment from KPMG member firm practitioners, paint a vivid picture of a function in the midst of a major transition, shifting from pure deals to encompass wider strategic, operational and customer issues.

We spend about 20 percent of our time evaluating the deal based on strategy and growth potential, and about 80 percent of our time evaluating underlying business, compliance and regulatory risk. – Survey respondent

Key highlights

• Corporate development teams’ responsibilities have substantially increased and widened, with more involvement in strategy, asset disposal, business transformation, cost reduction and technology advancement.These factors have brought considerable variety and made the function an even more attractive place to work.

• Nevertheless, mergers and acquisitions (M&A) remains a strong focus, and time spent on deals appears to remain at previous levels. With an increased focus on value, these responses could reflect the fact that a similar amount of time is required for fewer transactions – not all of which close. It is not unusual for smaller deals to absorb more time and resources than longer ones. In addition, the regulatory impact on M&A is far greater, to the extent that it is influencing the types of acquisitions chosen. Most financial institutions are focusing more on ‘bolt-ons’ and ‘capital-weak’ targets, rather than complete new businesses.

• Banks from China and the Far East are more likely than their peers in Europe, the US and Australia to pursue growth.

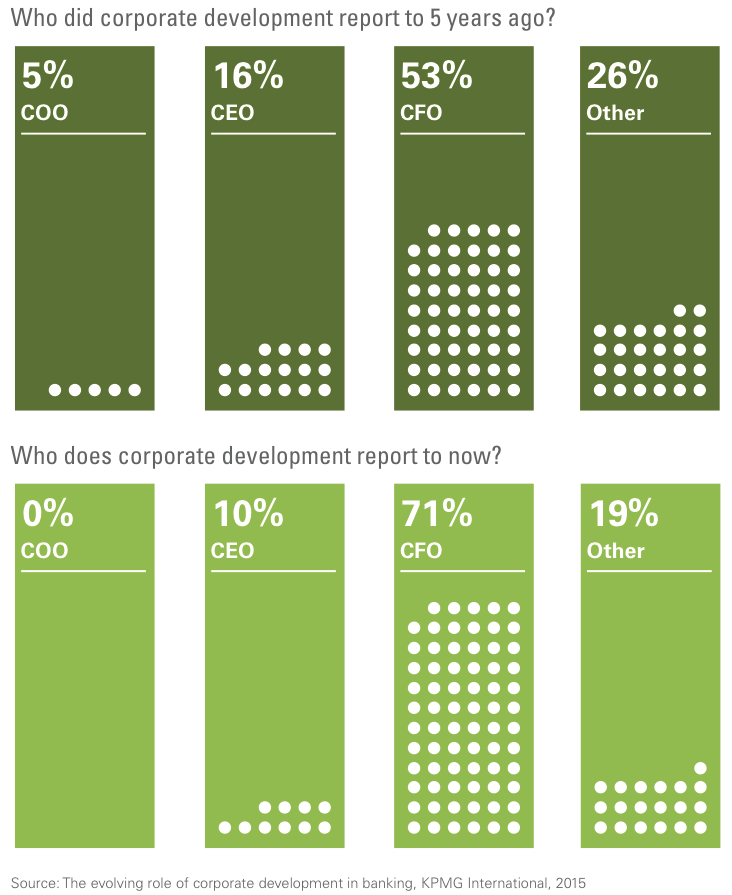

• The vast majority of corporate development teams now report to the Chief Financial Officer (CFO), which places them closer to the corporate center and brings more financial scrutiny over deals and other activities.

• Many teams were on a buying binge up until 2009 and consequently possess considerable buy-side skills, but are still lacking sell-side experience and capabilities

• Regulatory considerations have risen in importance, and now take precedence over, and permeate, other strategic areas. Forty-eight percent of respondents say they deal with regulators, marking a significant change in their roles.

• Some corporate development executives relish their broader roles, while others are concerned that the fun has gone from deal making.

• According to the responses, the function has no chance of being outsourced anytime soon.

The impact of the new banking environment on roles and responsibilities

• Widening focus and increased responsibility for corporate development teams

• Greater emphasis upon strategy and operational efficiency

• Fewer deals mean more strategic projects

With increasing demands from clients and regulators for transparency, banks’ corporate strategies are adjusting accordingly, with a greater emphasis upon regulatory strategy, highly rigorous transaction appraisal and rethinking organizational structure. One of the survey respondents notes that: “There is far more demand for support on corporate reorganization projects to simplify advisory (licensing), legal and regulatory setups, while we now have to elevate our level of M&A appraisal.”

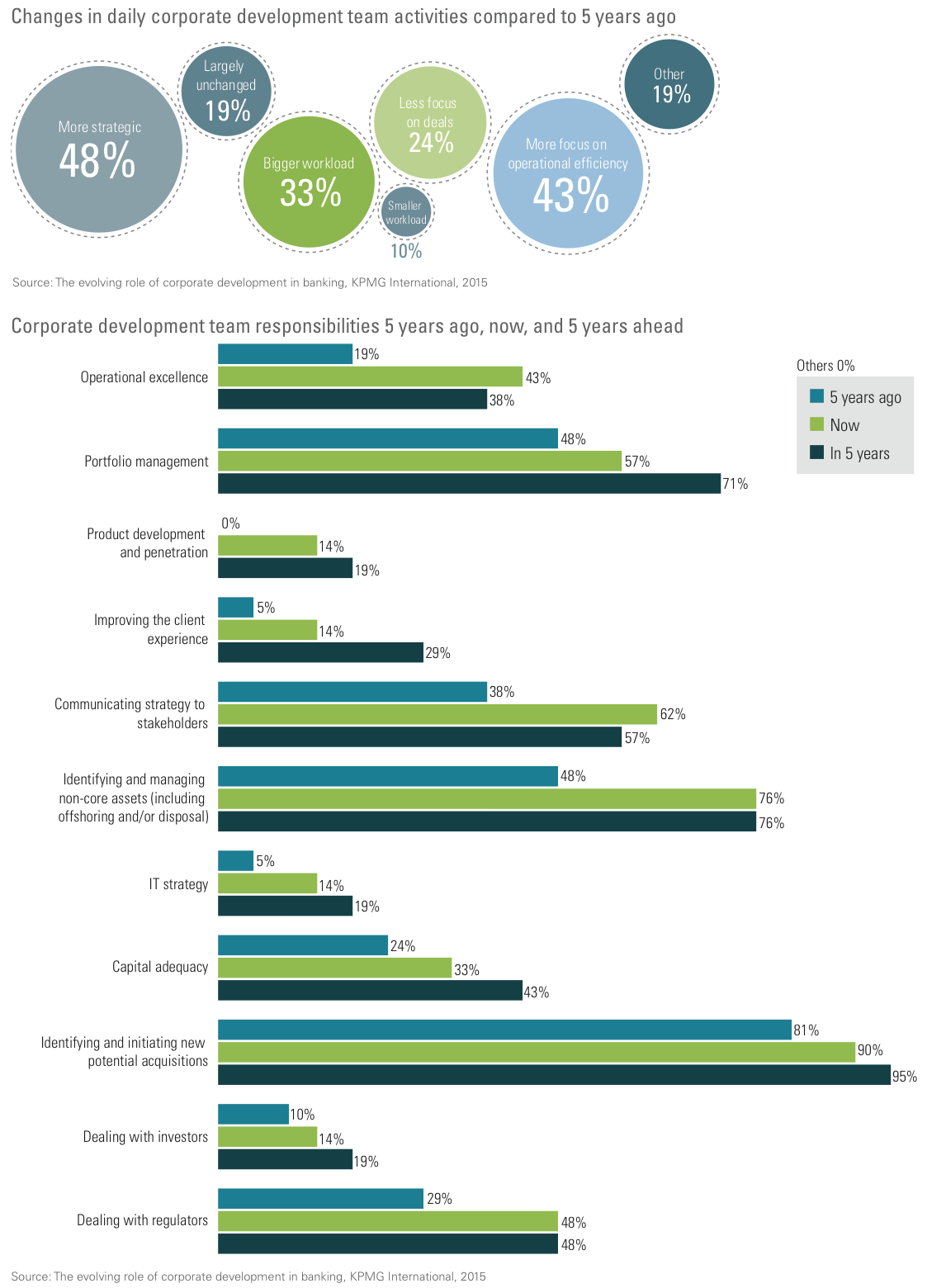

This change in focus is affecting the level of activity within corporate development and putting a strain on its resources. When asked how daily activities have changed over the past 5 years, the single biggest response is that they have become more strategic, with potential involvement in a wide range of activities, including operational efficiency, business transformation, cost reduction and technology advancements. Some are spending time on corporate restructuring, divestitures and winding down businesses, as well as continuing to look at new business opportunities, new products and new clients.

Having once been associated exclusively with growth, corporate development teams are now more likely to be involved in virtually any type of strategic initiative.

Seventy-six percent of respondents state that they are now involved in identification and management of non-core assets (in contrast to just 48 percent 5 years ago), which is a sign of banks’ desire to reassess their estates and portfolios and concentrate on core competencies. The heightened regulatory environment also explains why 48 percent say they now deal with regulators, against just 29 percent 5 years previously.

One respondent feels that the “dynamic development of the regulatory environment needs to be analyzed, to evaluate its future impact on proposed transactions,” while another sees the need to “build-up teams that focus exclusively on regulatory aspects and relationships with regulatory authorities.” A further respondent added: “We spend about 20 percent of our time evaluating the deal based on strategy and growth potential, and about 80 percent of our time evaluating business, compliance and regulatory risk.”

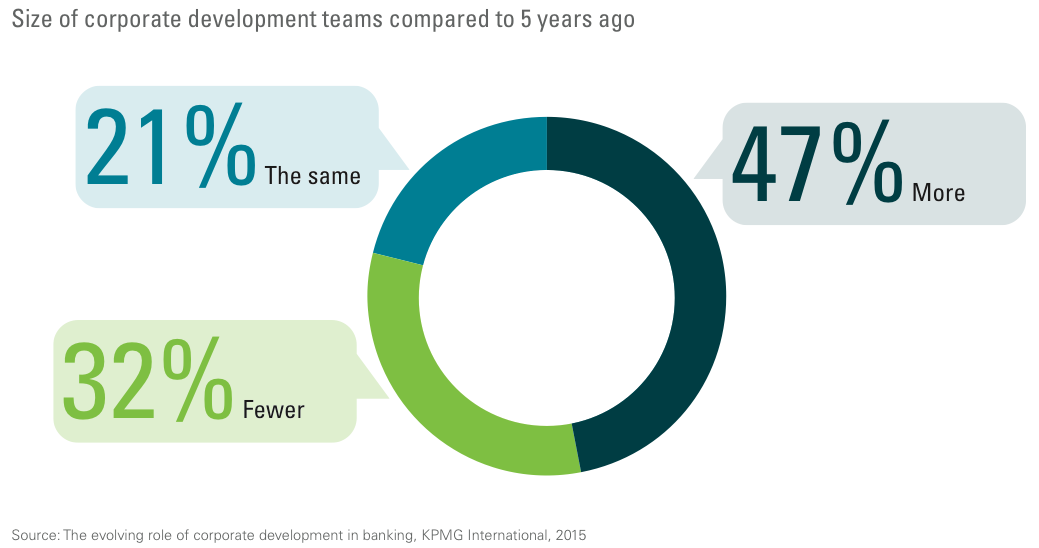

In response to the new, dynamic environment, teams are growing in size to ensure they can handle the impact of higher regulatory demands and take on wider responsibilities. Just under half of the respondents report that their team has become bigger in the past 5 years, but only one-fifth say it has shrunk. Sixty-two percent report that their area of focus has expanded, and 60 percent feel they have more responsibility, all of which is likely to raise the importance and the profile of the function.These factors, along with a roving brief for special projects, and a relative decline in bureaucratic line responsibilities, arguably make corporate development the most dynamic area of the entire bank. Although not specifically asked, the inference from this expansion of required skills is that there has been no corresponding diminished demand for traditional M&A skill sets.

Corporate development functions may now need additional people to carry out a similar number of (albeit smaller) deals, due to a greater regulatory workload per deal, and a higher deal-abort rate (a consequence of more rigorous due diligence), which add to the departmental workload. In a climate where investment banks are less likely to lend, smaller transactions often take much longer to close.

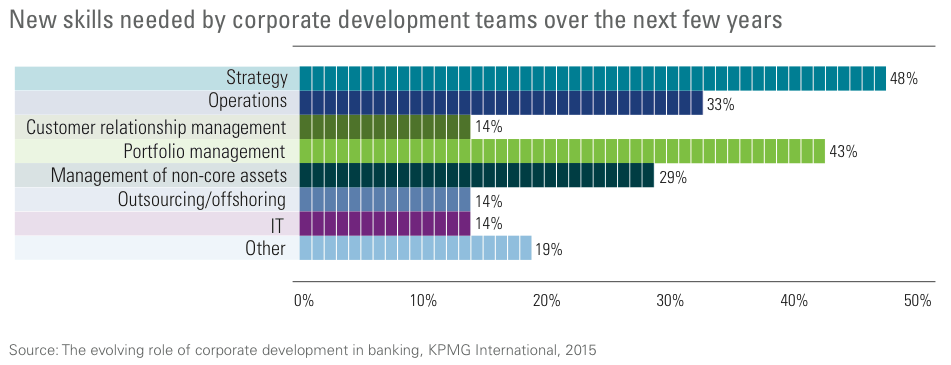

Looking ahead 5 years, the respondents expect portfolio management (evaluating banks’ portfolio of investments around the world, and considering acquisitions and suitable candidates for divestment) to be a bigger responsibility, along with capital adequacy. This calls for greater collaboration with in-house capital and treasury teams, and time will tell whether corporate development team members become over-engaged with such projects, diverting them from more innovative, strategic issues.

Outsourcing unlikely anytime soon

Regardless of the levels of work or any perceived skills gaps, outsourcing of M&A corporate development appears to be off the agenda. Ninety percent of respondents feel that outsourcing is either “quite” or “very” unlikely; reluctance that suggests a fear of losing control over the strategic agenda, plus a desire to maintain absolute confidentiality.

More than 60 percent of respondents say that, compared to 5 years ago, their area of focus has expanded and they have more responsibility.

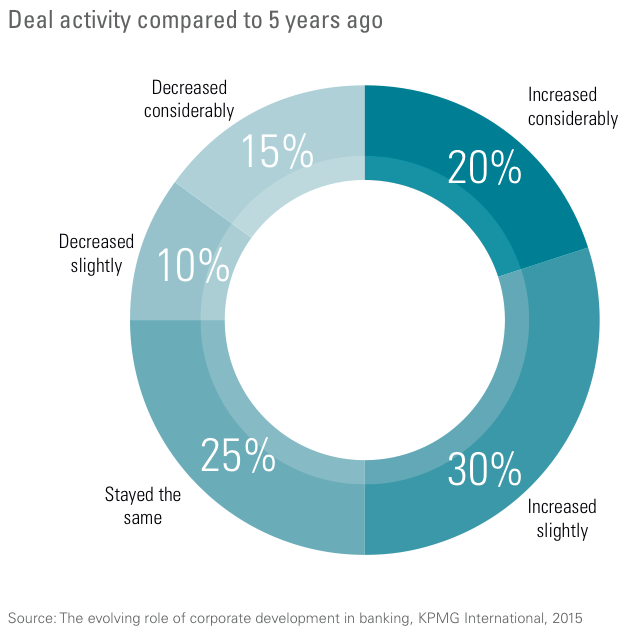

Half of the respondents report that deal activity in their company has increased; this may reflect the additional time spent on individual transactions, rising involvement in time-consuming smaller deals, and a greater focus on sales of non-core assets.

A new direction for transactions?

• Little evidence of a decline in the overall time spent on deal activity despite a reduction in deal volume

• Respondents suggest that focus has shifted to ‘bolt-ons’ rather than major acquisition of new banks

Despite concerns over tighter regulatory requirements, deal activity appears to remain strong, with half of respondents reporting that deal activity in their company has increased, and 20 percent saying it has increased “considerably.” Only 25 percent report a decline in deal activity. Given that the market has seen a substantial decline in actual completed transactions over the past 5-6 years, these findings could reflect the additional time required to complete a smaller number of deals – and the greater scrutiny applied by Boards – rather than a rising volume of deals. Some of the corporate development team’s time may also be devoted to sales of non-core assets, and smaller, buy-side deals, rather than traditional acquisitions.

Sell-side activity, along with more modest-sized transactions, typically absorbs more time and resources, which accelerates the pace and volume of work, rather than the deal volume.

Deals continue to occupy corporate development staff. Eighty percent of the executives taking part in the survey claim to spend more than half their time on transactions, and 40 percent state that deals take up more than three-quarters of their time.

According to some of the feedback from respondents, the focus of transactions may also be moving away from pure acquisitions. One senior executive speaks of “doing other kinds of deals,” while another explains that his organization is looking towards: “bolt-on acquisitions in established growth markets, entering new growth markets via partnership acquisitions and consolidation acquisitions in our established mature markets.” These views indicate a growing desire to avoid deals that absorb high levels of capital.

According to some of the feedback from respondents, the focus of transactions may also be moving away from pure acquisitions. One senior executive speaks of “doing other kinds of deals,” while another explains that his organization is looking towards: “bolt-on acquisitions in established growth markets, entering new growth markets via partnership acquisitions and consolidation acquisitions in our established mature markets.” These views indicate a growing desire to avoid deals that absorb high levels of capital.

Varying perspectives

Banks from China and the Far East are more likely than their peers in Europe, the US and Australia to pursue growth. According to a respondent: “We’re interested in scaling up in existing markets and business segments, as well as gaining access to new markets and capabilities.” This sentiment was echoed by a second survey participant, who feels that: “… the need to grow into new more attractive markets in North and South East Asia drives the way we look at potential acquisitions.”

The Chinese bank executives involved in the survey say their corporate development teams are concentrating on diversifying their businesses, in response to interest rate liberalization and tighter international capital regulation. One spoke of a focus on: “mergers, acquisitions and investments to diversify and globalize.”

Although all industries are becoming dependent upon technology, banking is particularly impacted. Corporate development teams are increasingly joining forces with IT teams, to make ‘build or buy’ decisions over required new technologies. Hence the response from one of the survey participants, who confirmed that his bank is looking for “…deals that help us digitize and, where it is preferable, to buy rather than build technology.” Another respondent stated the need to “…tap into new technology to bring forth the strategic capabilities of the bank.”

We have not done any deals that require Fed approval since the recession… Fed approval can drag the process on for months. – Survey respondent

One respondent says his organization is looking towards “bolt-on acquisitions in established growth markets, entering new growth markets via partnership acquisitions and consolidation acquisitions in our established mature markets.

Other sources show similar trends on deal activity

One respondent stated the need to ‘…tap into new technology to bring forth the strategic capabilities of the bank.’

Almost three-quarters of respondents say corporate development now reports to the CFO.

New demands bring new skills and reporting lines

• Greater involvement of the CFO brings more financial scrutiny over deals and other activities – and places corporate development teams center stage

• Corporate development teams need to build skills in risk, strategy and portfolio management – to more accurately assess the value of portfolios

The Chief Financial Officer (CFO) is a key figure influencing the activities of corporate development teams. In 2010, less than half of respondents say they reported to the CFO, whereas today that figure has leapt to almost three-quarters, although, interestingly, the proportion is expected to drop back to 48 percent in 5 years’ time. All the Chinese banks taking part in the survey say that their corporate development functions report to the Board, emphasizing the strategic nature of their work.

When it comes to comparisons with risk and regulatory operations, a majority – 70 percent – say the status of the corporate development team has risen in the past 5 years. Involvement in a wider range of strategic activities appears to have given the function far greater visibility.

If the corporate development function is to step up to its new status and fulfil its potential, it has to overcome a skills gap. Respondents feel that staff will need to build capabilities in strategy (almost half cite this as an imperative), regulatory, operations and portfolio management, as well as in managing non-core assets. Team members are also likely to acquire the kind of precision normally associated with private equity professionals, in order to assess whether portfolio components meet suitable, pre-set standards for profit, capital and return on equity.

According to one survey participant, the bank is seeking skills in “cross-selling, to gain a deeper client insight, allowing for more tailored services and products.” Another is looking for: “high-quality relationship managers that have compelling client-asset gathering ability in all locations, with a focus on our growth markets of Asia and Latin America.”

Building the strategic skill set could give the team a bigger role in strategic decision-making and engage with key stakeholders. Only one third of survey participants report that their function is currently responsible for overall strategy, and this figure could hopefully rise, once the members gain a stronger appreciation and competency. In the words of one respondent: “Strategy has become more important across the firm. All business lines consider strategy, which they did not do that much pre-crisis.”

Imagining a future corporate development team

The survey shows that most, if not all, corporate development professionals expect significant changes to their roles in the coming years. With a faster pace and broader, more strategic remit, the types of individuals being recruited may differ considerably from the past.

At the very least, there is likely to be a far greater emphasis upon strategic skills, enhanced with newly emerging knowledge in customer relationship management and outsourcing.These changes all point towards a more exciting and dynamic place at the heart of corporate strategy.

Transactions coming under the spotlight

The trend for CDOs to report to the CFO is a strong indication of the latter’s desire to gain greater oversight of and control over corporate financial matters – and also to make better use of the skills and experience of corporate development teams by involving them in a wider range of projects. CFOs are also seeking to maximize operational efficiencies; something that more and more corporate development teams are involved with. CDOs and their teams must therefore be aware of the CFO agenda and be prepared to up the level of transparency during the deal process and beyond, to ensure that financial goals are being tracked and achieved.

2020: a new era and a new corporate development function

• What would a Head of Corporate Development’s job profile look like in 2020?

As banks’ business models continue to evolve, the role of M&A and corporate development must adapt accordingly. Although deals remain a core part of the function’s mission, this is now just one of a widening range of tasks entrusted to teams.

In a highly competitive financial services marketplace, banks are also expecting corporate development teams to help identify new customer channels, enhance the client experience and improve internal efficiency – to name a few.

The senior executives taking part in our survey are aware of these challenges and threats, and, in addition to increasing the size of their teams and expanding their responsibilities, are seeking to add valuable new skills.

Casting our eyes to 2020, we envisioned the profile of a Head of Corporate Development through the eyes of an executive recruitment professional placing a job advertisement, and figured it could look something like this.