By Manuel Anibal Silva Portugal Vasconcelos Ferreira, Simone César da Silva Vicente, Felipe Mendes Borini, Martinho Isnard Ribeiro de Almeida

Abstract

This study analyzes how foreign multinational enterprises respond to uncertainty in their cross-border acquisitions in emerging economies and, specifically in Brazil, given the institutional differences that separate the home and host countries. We analyze how institutional distance impacts multinational enterprises strategy in taking a partial or full ownership stake in their Brazilian acquisitions. We propose that the equity stake is a strategic response to the uncertainty of operating in institutionally distant countries. In an study based on secondary data of 736 acquisitions between 2008 and 2012, we tested statistically the relation between nine dimensions of institutional distance and the equity stake acquired. Results show differentiated effects albeit with significant evidence that greater geographic distance lead multinational enterprises to take a partial equity stake, while financial and cultural distance leads to a full acquisition. This study has two contributions: reinforces the understanding of the institutional challenges of entering emerging economies, and puts forth how firms’ strategies may incorporate structural solutions that minimize risks and investments when facing institutional uncertainties.

Introduction

This paper analyzes the association between institutional distance among countries and the degree of equity ownership to reduce institutional uncertainty in the cross-border acquisitions by multinational corporations (MNCs) in an emerging economy. Specifically the strategic response researched is the degree of equity ownership based on the premise that an acquisition may involve either a partial or a full equity stake in the acquired firm (Hennart and Larimo, 1998 and Phene et al., 2012). This paper thus analyses the association between institutional distance and the strategy of undertaking a partial or full acquisition by foreign MNCs in an emerging economy, specifically Brazil.

Albeit MNCs hold firm-specific advantages (Rugman et al., 2011 and Verbeke and Brugman, 2009) that allows them to overcome the liabilities of foreignness (Meyer et al., 2011 and Zaheer, 1995), those advantages may have limited used when exposed to institutional environments that depart more substantially from the home country (Rugman et al., 2011), such as in emerging economies (Beule, Elia, & Piscitello, 2014). In these markets, MNCs are more susceptible to the disadvantages of foreignness (Zaheer, 1995). These are disadvantages related to a lack of knowledge on the “normal” ways of conducting business, lack of legitimacy, unfamiliarity with the normative, regulatory and cognitive aspects (Kostova, 1999). The disadvantages require that firms formulate a strategic response that promotes access to the host country’s specific advantages (Rugman and Verbeke, 2001 and Rugman et al., 2011) and, simultaneously, protects the MNC from the institutional insufficiencies of the host countries (Peng, Wang, & Jiang, 2008), in particular in the emerging economies. It is thus reasonable that the strategy for each acquisition will differ (Ferreira, 2007 and Phene et al., 2012), as it is reasonable to suggest that the degree of equity acquired in each acquisition – partial or full – needs to be adjusted not only to the strategic objectives but also to the external institutional uncertainties and risks.

Partial acquisitions have been treated in the literature as effective manners to avoid a loss of value post-acquisition (Dyer et al., 2004, Ferreira, 2007 and Vermeulen and Barkema, 2001), as means to absorb the target firm specific knowledge and learn in institutionally distant environments (Jakobsen and Meyer, 2008 and Phene et al., 2012). However, the literature is scarce in revealing how the structural form of the acquisition – in this study focusing only the degree of equity ownership – may be seen as a strategy to reduce institutional uncertainty. Thus, in this paper, we examine one specific aspect of a structural solution in the acquisition strategy. That is, how the institutional distance between countries impact the degree of ownership in cross-border acquisitions. We further propose that the nine dimensions of institutional distance described and measured by Berry, Guillen, and Zhou (2010) – cultural, economic, financial, political, administrative, demographic, knowledge, global connections and geographic – are positively related with undertaking a full cross-border acquisition in emerging economies, using the case of cross-border acquisitions in Brazil.

This study was based on secondary data collected from the SDC Platinum of acquisitions in Brazil between 2008 and 2012. The institutional dimensions considered followed the taxonomy of institutional distances of Berry et al. (2010). The sample comprised 736 acquisitions of Brazilian firms by foreign multinationals.

The results reveal that the impact of institutional distance is not uniform and it is necessary to understand the differential influences played by each institutional facet on firms’ strategies. In particular, the financial, cultural and geographic institutional dimensions emerged as determinants of the degree of equity ownership, influencing the likelihood that foreign MNCs will undertake a full acquisition of the Brazilian firms, over a partial equity stake. Hence, in conditions of high institutional uncertainty, the MNCs may prefer the internalization and control over the operations or share the responsibility with a partner, depending on the specific institutional dimension considered.

This study contributes to the analysis on the impact of institutional distances between countries in the strategic actions of firms. We follow the rationale that the institutional environment is not deterministic and that firms may act strategically (see Kostova, 1999, Oliver, 1991, Oliver, 1997 and Peng et al., 2008). It further contributes to integrate the literature on acquisitions with that on institutional distance, permitting to understand the structural solutions employed by the MNCs in entering emerging economies through acquisitions. We propose and test the degree of equity ownership as a structural response to institutional uncertainty in the host country. Thus, dialoguing with the literature on entry modes, the results of this paper contribute by going beyond the contrast among entry modes (Dikova & Witteloostuijn, 2007) and researching different degrees of ownership in acquisitions (Beule et al., 2014 and Chari and Chang, 2009). This study reveals that when the acquisitions involve firms in emerging economies, the structural solution to reduce uncertainty may be different from that portrayed in the literature. As to practitioner implications, this study shows that firms may react using the best structural solution to minimize institutional risks and uncertainties.

The paper has five sections. The first section comprises a brief literature review and conceptual development. The second section describes the method, including data and variables. The third presents the results and is followed by a broad discussion on the impact of institutional distance on cross-border acquisitions and on the equity ownership stake.

Literature review and conceptual development

Degree of equity ownership in acquisitions

Cross-border acquisitions are one of the primary forms firms use to access other firms’ resources and advantages (Anand and Kogut, 1997, Barkema and Vermeulen, 1998, Ferreira, 2007 and Vermeulen and Barkema, 2001) and location-specific advantages (Phene et al., 2012). An acquisition may involve different levels of property – may be a full acquisition of 100% of the target firm’s equity, or a partial acquisition that involves less than the totality of the target firm’s equity (Barkema and Vermeulen, 1998 and Chen and Hennart, 2004). The different forms of acquisitions – full or partial – are motivated by different exogenous factors (Chen, 2008), but they also entail different levels of risk (Chapman, 2003 and Chen and Hennart, 2004), transfer of resource to and from the acquired firm (Phene et al., 2012), and control over the foreign operations (Chen and Hennart, 2004 and Jakobsen and Meyer, 2008).

A partial acquisition may be preferred to access location-specific advantages that local firms absorbed. It may also be an intermediate step; that is, an initial investment that is followed by the full acquisition of the target firm (Hoffmann & Schaper-Rinkel, 2001). A partial acquisition possibly has the strategic objective of absorbing the resources and capabilities of the target firm, but in such manner as to prevent the loss of value post-acquisition (Dyer et al., 2004 and Ferreira, 2007). Hence, partial acquisitions seem to be better to prospect resources and capabilities not yet held (Phene et al., 2012), especially under conditions of uncertainty. For example, Chen and Hennart (2004) confirmed that the propensity of the Japanese firms to acquire less than the totality of the target firms in the USA was explained by a difficulty to assess the value of the acquisition.

In other turn, full acquisitions involve the intent of the investor to keep the total control of the target firm (Jakobsen & Meyer, 2008). The full ownership permits the total control of the operations but it is not as effective as a partial acquisition to access complementary resources by sharing investments and risks (Anderson and Gatignon, 1986 and Phene et al., 2012). The need for larger investments and greater exposure to the risks and liabilities of foreignness are some of the costs associated to full ownership (Anderson and Gatignon, 1986 and Slangen and Hennart, 2007). In addition to these disadvantages, there is the loss of value of the target’s assets post-acquisition (Dyer et al., 2004), due to a loss of human capital and knowledge. In this manner, full acquisitions seem to be the best strategic response to exploit abroad the portfolio of products, technologies and resources acquired (Phene et al., 2012).

Hence, the degree of equity ownership depends on the strategic objectives of the MNCs but these are not the only determinant. The conditions of institutional uncertainty are also important drivers of the choice for undertaking a full or partial acquisition.

Institutional environment in emerging economies

The institutions are crucial to sustain the functioning of markets and reduce transaction costs (North, 1990) and, as noted by Peng et al. (2008), decrease the risks and define the boundaries of what is taken as legitimate. The characteristics of the context in which firms operate, or “the rules of the game” (North, 1990) – the local institutional conditions (Peng et al., 2008) –, determine which strategies to deploy (Meyer and Peng, 2005 and Peng et al., 2009). Following the institutional theory, the MNCs need to gain legitimacy (Dacin, 1997) in the host markets to survive and prosper, adapting to the prevailing norms and systems of those markets (Dimaggio and Powell, 1983, Kostova, 1999, Meyer and Rowan, 1977 and North, 1990).

The institutional environment – that includes such facets as the legal system, regulatory, culture, protection of property rights, among others – if developed sustains a market economy (Meyer, Estrin, Bhaumik, & Peng, 2009). In contrast, institutional fragilities emerge, for instance, in the inability to provide effective and efficient regulatory mechanisms for the exchanges that end up generating uncertainty for the MNCs (Peng et al., 2009). For example, some countries may have legal restrictions to foreign investment constraining the full ownership of a local firm (Delios & Beamish, 1999), while in other countries it is the informal aspects such as a corruption permissive culture (Rodriguez, Uhlenbruck, & Eden, 2005) that ought to be taken into consideration in decision making. Regardless of the specific institutional dimension, institutional differences generate uncertainty and transaction costs that are barriers MNCs need to overcome. Hence, the quality of the institutional system influence the uncertainties, costs and risks of operations and thus determine the relative benefits of each foreign entry mode (Bevan et al., 2004 and Meyer, 2001).

Recent research has noted that in the emerging economies the institutional matters are especially relevant given the pronounced differences that distinguish these economies from their more developed counterparts (Gelbuda et al., 2008, Khanna et al., 2005, Meyer and Peng, 2005 and Wright et al., 2005). The institutional context of the emerging economies is marked by institutional debilities – already termed as institutional voids – that contrast with the degree of institutional sophistication of the more developed countries ( Khanna et al., 2005 and Meyer and Peng, 2005).

The institutions are not specific to countries (Berry et al., 2010 and Cuervo-Cazurra, 2016) and the institutional differences between countries augment the perceived risks and costs (Deng, 2009), due to a lack of knowledge on how the local institutions operate (Contractor, Lahiri, Elango, & Kundu, 2014). The more pronounced the differences, the greater will be the uncertainties concerning the local host market, partner’ resources, and learning potential (Contractor et al., 2014). The acquisitions in emerging economies are thus more complex for MNCs from developed countries due to: a less developed capital market, pool of labor less qualified, less sophisticated legal infrastructure, bureaucracy, inefficient enforcement of contracts, weak protection of property rights, corruption, etc. (Contractor et al., 2014 and Meyer et al., 2009). The cultural characteristics of the emerging economies are also distinct from the developed countries and manifest in such aspects as different attitudes, value systems and behaviors. Firms – suppliers, clients and competitors – in emerging economies tend to be (despite some cases of grand success such as JBS/Friboi, Embraer and Gerdau, all Brazilian firms) internationally little competitive (Khanna et al., 2005 and Meyer et al., 2009).

Give the institutional differences between countries, researchers have sought to understand the foreign entry strategies deployed by MNCs in the emerging economies (Meyer et al., 2009). Specifically, in this study we argue about the degree of equity ownership in cross-border acquisitions given a set of institutional distances, taking the specific case of Brazil as an emerging economy.

Institutional distance and the degree of ownership in acquisitions

Research in international business has evolved beyond descriptions of the countries’ institutional characteristics to seek to understand the many dimensions (Ghemawat, 2001, Guisinger, 2001, Kostova, 1996 and North, 1990) of institutional distance – or difference – between countries (Berry et al., 2010, Dikova et al., 2010, Kostova, 1996, Morosini et al., 1998 and Tihanyi et al., 2005). The differences between countries have been measured using the concept of institutional distance (Drogendijk & Martín, 2015), that may be defined as the degree of similarity or dissimilarity between the institutions of two countries. Some scholars have created taxonomies to characterize the institutional dimensions, such as the CAGE model by Ghemawat (2001), the six dimensions by Dow and Karunaratna (2006) or the nine dimensions by Berry et al. (2010). The importance of capturing the multidimensionality of the institutional environment has been highlighted by Berry et al. (2010, p. 1461) as: “defining and measuring cross-national distance along multiple dimensions is important, because different types of distance can affect firm, managerial or individual decisions in different ways, depending on the dimension of distance under examination”. In this vein, Berry et al. (2010) proposed a taxonomy of nine dimensions of institutional distance between countries: (1) economic, (2) financial, (3) political, (4) administrative, (5) cultural, (6) demographic, (7) knowledge, (8) global connections, and (9) geographic. This disaggregation of the construct of institutional distance presents a more complete classification that encapsulates other taxonomies (for instance, Ghemawat’s (2001) CAGE model) and thus permits a more detailed analysis of how the different facets of the institutional environment may influence MNCs’ strategies.

Albeit well established that MNCs use the foreign entry modes best suited to the conditions of the host markets to gain legitimacy (Meyer & Rowan, 1977) and be accepted (Dacin, 1997), the literature is not consensual on what is the best strategic response to the institutional differences, or distances, although Oliver, 1991 and Oliver, 1997 has suggested that MNCs are not prisoners of their immediate institutional milieu. For instance, it is not straightforward how cross-borer acquisitions must be conducted, even if they are a commonly deployed strategy for international growth (Hitt, Ireland, & Harrison, 2001). Albeit reasonable to suggest that a possible strategic action under conditions of uncertainty may drive the equity stake acquired in an acquisition, the extant theory is not consensual in pointing out what is the structural solution pertaining the degree of equity ownership in conditions of institutional uncertainty. Nonetheless, it seems reasonable to suggest that the institutional environment is likely to influence the level of control desired for a given foreign operation (Kostova, 1999).

When the home and host countries have similar institutional environments, the MNCs will be more familiar with the “rules of the game” (North, 1990). That is, the MNCs will suffer less uncertainty and may adopt foreign entry modes involving higher commitment of resources (Hennart and Larimo, 1998 and Kostova, 1999). However, when the institutional distance increases, the greater uncertainty increases the likelihood the MNCs seek for partnerships with local firms to overcome the inefficiencies derived from weak institutions. Moreover, weak institutions heighten the costs and risks of acquiring a local firm. Therefore, the structural solution of undertaking a partial acquisition – taking only partial ownership on the target firm – may function as a buffer to the institutional risks and uncertainties. A solution based on partial ownership would also be compatible with learning motivations and access to knowledge and specific assets of the target firm and host country (Barkema and Vermeulen, 1998, Ferreira, 2007 and Phene et al., 2012) while maintaining flexibility (Zhao, Luo, & Suh, 2004).

The structural solution to reduce uncertainty may be different when the acquisitions involve firms in emerging economies, than when involving firms in developed countries. In many emerging economies, the information asymmetries in opaque markets make more difficult to obtain information on potential partners thus raising the risks of collaborating (Meyer, 2001). A weak institutional framework, volatile and arbitrary, makes impracticable collaborative entry modes given, for instance, the hazards in guaranteeing the enforcement of contracts (Meyer, 2001). The ability to regulate the partnership may also be especially hindered in void institutional environments. In conditions of high institutional uncertainty, maintaining a partnership (e.g., a partial acquisition) does not guarantee the ability to overcome regulatory inefficiencies, arbitrary norms and bureaucracy (Meyer, 2001; Peng, Wang & Jiang, 2008). Furthermore, the institutional differences will likely jeopardize the internal transfer of knowledge and best practices to other subsidiaries (Kostova, 1996, Kostova, 1999 and Kostova and Zaheer, 1999), discouraging MNCs from seeking partial acquisitions to absorb new knowledge in emerging economies. Hence, albeit acquiring a firm in an emerging economy exposes the MNC to great management challenges of the acquired firm (Capron, Mitchell, & Swaminathan, 2001); a partial acquisition also entails coordination challenges and difficulties in managing the partners’ objectives.

Delios and Beamish (1999), for example, have noted how the partial ownership (specifically, the joint ventures) were a means to access the resources of the local firms, including their networks that help in overcoming the voids of a weak institutional context. Notwithstanding, in high uncertainty conditions firms need to trust the ability to govern their partnerships and enforce contracts. Therefore the suggestion that the need for a local partner decreases with the strengthening of the institutional environment (Meyer, 2001) has another facet that is the own ability to regulate the relationship between partners, that is likely to be difficult in institutionally very weak environments.

Combining these arguments it seems reasonable to suggest that an high, and idiosyncratic, institutional uncertainty associate to entering emerging economies leads to maintain internalized the foreign operation resorting to a full acquisition. This proposition follows Transaction Costs Theory (Williamson, 1985) that under conditions of uncertainty the firms is likely to prefer maintaining internalized the operations. The institutional differences between investor and host emerging countries make integration, legitimacy and performance more difficult for MNCs (Kostova & Zaheer, 1999). We thus propose that firms will prefer foreign entry modes of greater commitment when the institutional differences are larger. That is, the preferred foreign entry mode may be based on fully controlling the subsidiary for greater institutional distances between the home and host countries. In other words, the larger the distance, the higher the propensity to conduct a full acquisition.

Method

To collect the data and pursue the research goal we follow a quantitative approach seeking to assess the ties between institutional distance and the degree of equity ownership acquired. We now describe the data collection procedures and sample, and detail de dependent, independent and control variables employed.

Data collection and sample

The data was collected from secondary sources. Data pertaining to the acquisitions of Brazilian firms by foreign MNCs was extracted from SDC Platinum (Securities Data Company Platinum) – mergers and acquisitions. This is a database with restricted access but widely used in prior studies (e.g., Capron and Guillén, 2009 and Capron and Shen, 2007). The database contains all acquisition deals with US firms as targets since 1979 and non US since 1985 until present. From SDC platinum, we collected data pertaining to the acquiring and acquired firms.

Data collection followed some procedures to select and delimit the sample. First, we only want deals in which the target firm is headquartered or located in Brazil and the acquiring firm is foreign. Second, we excluded all deals involving MNCs in offshores. Third, we excluded all deals in which the current status was unknown, rumors, intents and all sorts of ambiguous status. Fourth, we delimited the period to the acquisitions completed between 2008 and 2012. The period and the sample were selected intentionally to permit both a substantial sample for statistical tests and to construct an acquisition experience variable with the data from 1985 to 2007. It is worth noting that we had access to the data up to 2012 only. Fifth, we did not include deals involving an acquirer of the financial sector. Finally, we excluded the deals with insufficient data in the variables of interest. Albeit very used this dataset is also very incomplete and often does not reveal values of acquisitions, percentages acquired and so forth, and hence we have decided to dichotomize the dependent variable in full and partial acquisition.

With these procedures, we obtained a final sample of 736 acquisitions of Brazilian firms by foreign multinationals from 38 countries. The main investors were the USA, Canada, France and UK. 493 (or 67%) acquisitions involved undertaking a full equity stake and 243 (33%) were partial acquisitions.

The data pertaining to the institutional distances between the home countries of the MNCs and Brazil were collected from Berry et al. (2010) (Cross-national distance data).

Variables

The dependent variable is the degree of equity ownership acquired. An acquisition may involve any level of equity from 1 to 100% of the acquired firm but due to the dataset limitations, we only consider whether the acquisition involves part or the totality of the target. This simplification does not jeopardize the study since we do not propose associations that may be enriched scrutinizing the actual percentages of equity held. Data for equity acquired was collected from SDC Platinum and coded in a dichotomous variable such that 0 – partial acquisition and 1 – full acquisition. Partial acquisitions involve less than 100% of equity acquired.

Independent variables

The independent variables include the institutional distance assessed using Berry et al.’s (2010) taxonomy of nine dimensions. The data used consisted in a distance for each institutional dimension between the home country of the acquirer MNC and Brazil. It is worth noting that the majority of the acquirers were from developed countries.

Economic distance reveals differences in the degree of economic development and stability. We have used the values in Berry et al. (2010) calculated with such items as Gross domestic product (GDP) per capita, inflation, exports and imports of the investor countries and Brazil. Financial distance assesses firms’ capacity to finance their operations in the target country, availability and efficiency of the financial sector. Data was collected from Berry et al. (2010) and include private credit (% of GDP), stock market capitalization (% of GDP) and number of firms listed per million inhabitants. Political distance reflects differences in the political system, stability and predictability of the public policies, norms and regulations. The data collected from Berry et al. (2010) use indicators as uncertainty of policymaking, number of institutional actors, veto power, extent of democracy, size of government, and so forth. Data for administrative distance collected from Berry et al. (2010) include aspects such as common language, religion, colonial ties and legal system. Kwok and Tadesse (2006) argued that a strong legal system reduces the uncertainties.

Cultural distance has been one of the variables more often used in international business research and noted as an effective measure of institutional differences among countries (Kogut & Singh, 1988). Since data for culture was not available for Brazil in Berry et al. we calculated cultural distance using Kogut and Singh’s (1988) Euclidean distance and Hofstede’s (1980) four primary cultural dimensions. Albeit Hofstede’s taxonomy was added of two dimensions, (Hofstede and Bond, 1988 and Hofstede et al., 2010) there is not data available for many countries in these two dimensions.

Demographic distance expresses differences in demographic aspects among countries such as income, age, gender, salaries, productivity, availability of labor (data from Berry et al., 2010). Knowledge distance refers to differences of technological sophistication and generation of innovations among countries (Anand & Kogut, 1997). Data used from Berry et al. (2010) that used indicators such as the number of patents and scientific papers published. Global connections distance, or connectivity between countries, shows differences in the level of integration in the global economy, easing operations and reducing some cost factors (e.g., communications, trade, international outsourcing), but is also an indicator of the quality of the infrastructure. Lastly, geographic distance that albeit not strictly related to institutional theory is a factor that is likely to reveal important differences between countries. Geographic distance between countries increase transportation costs and telecoms (Berry et al., 2010) and is an often-used proxy to highlight that countries differ. We used Berry et al. (2010) data.

Control variables

We have used a number of control variables capable of influencing the degree of equity ownership in acquisitions. We controlled for the size of the acquirer MNC because larger firms have more available resources for undertaking a full acquisition (Beule et al., 2014 and Kogut and Singh, 1988). Since the SDC platinum does not include data on size such as assets, number of workers or other conventional measure, we used the number of 4-digits SIC codes to proxy size (data from SDC Platinum). This proxy is reasonable since we may expect that the larger the number businesses the firms be involved in the larger they will be. This variable was measured counting the number of different SIC codes of each firm, and varies between 1 and 14.

We also controlled for industry because the specificities of each industry may interfere in the foreign investment strategies of MNCs. For instance, it is possible that technological and production aspects drive MNCs to protect, internalizing, their assets thus using full acquisitions to expand. The industries were coded as manufacturing, natural resources, services, trade and others. Data for industry was extracted from SDC Platinum. We further included a control for high technology to account for the knowledge intensity of both acquirer and acquired firms. The resource-Based view suggests that firms holding richer competences tend to prefer full control over the foreign operations, namely as a manner to prevent unintended diffusion of knowledge to competitors (Brouthers & Hennart, 2007). We coded in a dichotomous variable whether the firm is high technology (1) or not high technology (0) with data available in the SDC database that clearly specifies the firms high technology status.

We have also included a control for the degree of diversification. This denotes the relative proximity between the businesses of the acquirer and acquiring firms. If the acquisition involves greater diversification then a potential motive would be to access novel knowledge, which is better executed with partial acquisitions (Chari and Chang, 2009 and Ferreira, 2007). Using data from SDC Platinum, we included two measures of diversification. Diversification of the core primary business of the acquiring firm compares the main business of the acquirer to the main business of the acquired firms using the main 4-digits SIC (Standard Industrial Classification) of both firms. We have conducted robustness tests for 3-digits SIC codes with similar results. General diversification compared all businesses of each firm to assess the degree of diversification for the acquiring MNC when comparing the entire portfolio of businesses. The two variables were coded dichotomously in 1 – acquisition entails some diversification, and 0 – does not entail diversification.

Acquisition experience was controlled for because the literature points that firms more experienced in conducting acquisitions may prefer to conduct full acquisitions (Beule et al., 2014, Kogut and Singh, 1988 and Meyer, 2001). Usually named as acquisition capability this variable captures the accumulated learning in conducting acquisitions, which predictably decreases the perceived risks in undertaking acquisitions. Acquisitions experience was measured summing the number of prior acquisitions each MNC had made in Brazil between 1985 (first year available in SDC Platinum) and the focal acquisition. Given that, we had only partial access to the database we could not calculate a broader acquisition capability that considered all acquisitions conducted by each MNC worldwide. Nonetheless, local experience is a more direct measure of relevant experience since prior acquisitions in Brazil should diminish the MNCs sensitivity to the local idiosyncrasies that are potential sources of uncertainties. Data were collected from SDC.

Lastly, we used the year the acquisition was announced as a control to account for potential economic cycles capable of influencing our model. We included four variables for years 2008, 2009, 2010 and 2011, using 2012 as the baseline.

Results

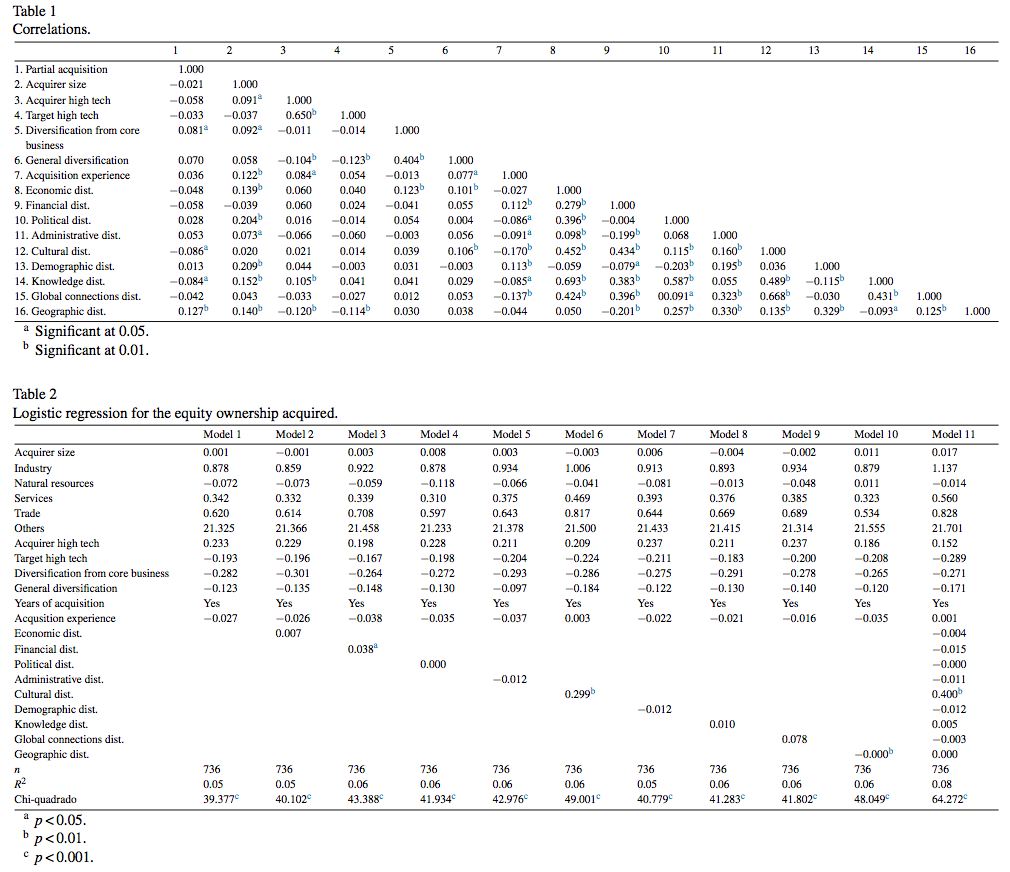

The statistical analysis involved multivariate techniques using a logistic regression. A logistic regression is appropriate to estimate the effects of a set of variables on a dichotomous dependent variable. The tests analyze how the foreign MNCs respond to institutional uncertainties in their acquisitions in Brazil selecting different degrees of equity ownership on the target: full or partial. Table 1 presents the correlations matrix. The correlations are not as high as to raise multicollinearity concerns and the collinearity diagnosis (specifically the Variance Inflation Factor – VIF) are lower than three. Thus, there is no evidence of multicollinearity in the data.

Table 2 includes the results of the logistic regression for the dependent variable: degree of equity acquired (full or partial). Model 1 includes only the control variables. Models 2–10 add each of the measures of institutional distance separately. Model 11 is the complete model and includes all independent variables.

We highlight that the control variables for high technology of the acquired and target firms are not significant which denotes that the relation sought after is not sensitive to the knowledge intensity involved in the deal. The variables on the diversification (or core business and general) are also not significant pointing that the relation is not related to entering into new businesses. Pertaining to the industry, in addition to not being significant, a complementary analysis we have conducted and not shown here shows that the majority of the acquisitions takes place inside the industry (using the 4-digits SIC codes) – that is, in the majority of the acquisitions the MNCs are not entering a novel business but rather extending on the business they already operate.

The results confirm that cultural and financial distance influence the likelihood of a full acquisition. That is, the grater these two distances, the more likely the MNCs will prefer to take full ownership of their acquisitions in Brazil. Hence, we found partial evidence for the impact of some institutional dimensions on the equity stake selected and specifically, that greater cultural distance (model 11) leads MNCs to acquire the totality of the Brazilian target firms. These results may seem unconventional given the possible expectation that under conditions of greater uncertainty the MNCs would prefer to share the risks with local partners – which would lead to partial acquisitions. However, the results are compatible with the arguments related to the transaction costs of operating in emerging economies and the better protection to the proprietary resources of the MNCs using models of full control of the operations in emerging economies.

Only the geographic distance is related to the likelihood that the acquisitions will entail a partial equity stake of the Brazilian subsidiary. Possibly geographic distance increases the difficulties in controlling and managing a more distant subsidiary, in addition to the costs that arise from distance and that the communication technologies cannot overcome. In these instances, a local partner may be a viable alternative.

We fail to confirm significant effects for the possible impact on the degree of equity ownership of economic, political, administrative, demographic, knowledge, and global connections distances. Notwithstanding, it is not surprising that these institutional dimensions reveal as less relevant in selecting the equity stake. At least in part, these institutional dimensions are more explicit and easier to observe and thus represent less uncertainty (see Rodriguez et al., 2005). In other words, the uncertainty and risk associated to these dimensions may be more easily identified, analyzed and incorporated in the very market selection decision. Therefore, the decision to enter Brazil by means of an acquisition predictably already considered these uncertainties.

Discussion

In this study, we examined the influence of institutional distance on the degree of equity ownership acquired in cross-border acquisitions. This study proposed that MNCs might react strategically to high levels of external institutional uncertainty using structural solutions. We have specifically proposed that the MNCs will acquire the totality of the target’s equity in conditions of high institutional uncertainty in emerging economies. This study, based on secondary data collected from SDC Platinum, analyzed and permitted to conclude that in conditions of institutional uncertainty – with distinct effects for the various institutional dimensions – the MNCs tend to acquire the full acquisition of the target Brazilian firms.

The results that sustain a positive effect of cultural and financial distance warrant additional considerations. First, they confirm that MNCs acquire greater equity ownership in the foreign subsidiaries when some institutional dimensions, specifically cultural and financial, differ more markedly from those of the home countries of the investor firms. The results contrast with the common argument that under conditions of higher risk the MNCs prefer to engage in operations committing less resources to assure lower risk and greater flexibility.

The distance in the financial environment seems to be relevant in the foreign MNCs choice to conduct a full acquisition. A plausible explanation is that the inefficiencies in the local financial market (Brazilian in this case) make it more difficult to obtain complete local financing for the operations. However, it is pertinent to consider other aspects of the financial environment such as the uncertainties emerging from such elements as the instability in the interest rates, exchange rates, monetary policies, and so forth that are hazardous for the operations (Capron & Guillén, 2009). Moreover, weak institutions do not guarantee the quality of the financial information about the target firms, potential intermediaries (Khanna et al., 2005 and Tong et al., 2008), nor about potential efficient incumbent local partners. In these instances of insecurity regarding the environment and partners in emerging countries, as Brazil, the foreign firms are likely to choose fully acquiring a target firm.

Cultural differences are broadly recognized as determinants of the foreign entry modes, noting that greater cultural differences tend to lead firms to prefer entry modes involving lower commitment of resources (Kogut and Singh, 1988 and Morosini et al., 1998). Nonetheless, much of the extant studies explore the possibility of learning when entering culturally distant countries (Barkema and Vermeulen, 1998, Ferreira, 2007 and Vermeulen and Barkema, 2001). In the emerging economies, possibly the learning sought is that related to the market and commercialization to a large albeit lower income population. Therefore, a solution of full property may signal that there is no emphasis on learning but rather on exploiting the resources and capabilities already held by the foreign MNC entering Brazil.

In what concerns the negative effect of geographic distance, it may not be a surprise that geographic institutional distance is related to a higher likelihood of a partial acquisition. It possibly reflects the difficulties of managing, controlling and coordinating subsidiaries that are geographically distant. In these instances a structural solution based on a partnership may be a rational choice especially when there is low potential of transferring knowledge to the partner. In the data used, the search for technological knowledge at the business level does not support this position. Given the tendency in the literature to observe the learning potential in acquisitions (Barkema and Vermeulen, 1998 and Vermeulen and Barkema, 2001), the data and analyzes showed that the acquisitions in Brazil have low business level learning potential. The evidence for this claim is in the low degree of business-level diversification between acquirer and target firms. The majority of the acquisitions took place between firms in the same business, thus characterizing these as horizontal acquisitions.

Hence, the learning potential is essentially restricted to learning about the market – for example, how to operate in the emerging economies, how to serve the lower income consumers – that at the business level. This analysis is relevant for future research insofar as it is important to understand what is the learning potential at the local level for further absorption and internal transfer to other subsidiaries geographically disperse.

Conclusion

Research in international business and strategy has already established the importance of understanding the institutional environment and how the differences between the institutional environments impact the choices and strategies of the multinationals. To succeed in the foreign markets the MNCs need to have competitive advantages compared to the incumbent local firms. Foreign MNCs also need to be able to overcome institutional disadvantages. Albeit the current attractiveness of the emerging economies they still suffer from a number of fragilities and inefficiencies that may be especially hazardous to overcome by MNCs that are not familiar with the institutional facets of the emerging economies. In this study, we proposed that at least in some instances a manner to overcome institutional uncertainties might be in taking structural forms that permit greater adaptation or greater control over the operations. Acquiring a local firm the foreign MNC may access the intangible resources of the acquired firm as a manner to augment its local legitimacy. The potential costs of operating in less efficient and effective environments and the losses of flexibility may be inferior to the risks of undertaking partial acquisitions in emerging economies such as Brazil.

The degree of equity ownership acquired in cross-border acquisitions by the MNCs entails many strategic considerations (Chari & Chang, 2009). Strategic motivations supported in the technological upgrade or in knowledge are possibly implemented through full acquisitions, especially when it is necessary to control the assets of the target firm (Meyer et al., 2009). The total ownership avoids that MNCs incur in the coordination hazards when there is shared property (Chen, 2008), what may be especially relevant in institutional contexts where the legal system is not effective in preventing opportunistic behaviors (Williamson, 1985). Total ownership may also be preferred when the acquirer MNC seeks to transfer internally knowledge, resources and competences to the subsidiary (Ferreira, 2007), and this concern is higher for investments in less developed countries.

Partial acquisitions, in contrast, may be preferred to access complementary resources, and when the risk is high or the investments larger (Chari & Chang, 2009). The literature has pointed that partial acquisitions may promote learning with the local partners (Barkema & Vermeulen, 1998), wither learning about the business or about the market (Ferreira, 2007). Partial acquisitions are also easier to reverse, which may be important in environments that are more unstable. It is thus reasonable to seek to better understand how the strategies implemented through cross-border acquisitions vary according to the institutional conditions in the host countries.

This study contributes to the literature on the impact of the institutional environment in the internationalization of firms (Meyer et al., 2011) and in particular in the internationalization to less developed institutional environments found in the emerging economies (Khoury and Peng, 2011, Meyer et al., 2009 and Peng et al., 2008). Our results contrast, at least partially, with those found in the extant literature that emphasized preferably the more developed countries and show that in emerging economies the entries through full acquisition is the structural response preferred to reduce uncertainty. Hence, there is a contribution to the construction of an institutional perspective in strategy (Oliver, 1991, Oliver, 1997 and Peng et al., 2009) and a contribution to the literature on foreign entry modes by analyzing the degree of equity ownership (Jakobsen & Meyer, 2008) without resorting to the more usual studies contrasting among alternative entry modes, such as comparisons between acquisitions and greenfield investments or joint-ventures. Finally, this study makes a contribution to the research on emerging economies and, although the empirical context was limited to one host country, it raises new perspectives on the need to understand in detail the difficulties of operating in those countries. Our study shows that it is not sufficient to understand aggregate dimensions such as institutional distance, but rather that is necessary a deepening on the local specificities to capture how the institutional differences exist and their impact.

Limitations and future research avenues

This study has limitations. First, the limitations imposed by insufficiencies in the available data that impede additional analyses. For instance, it would be relevant to consider how the strategic motivations – market seeking, natural resource seeking, strategic asset seeking (Dunning, 1993) – impact the degree of equity ownership in acquisitions in context of institutional uncertainty. Other data potentially relevant include data on the economic performance and innovation since, on one side, the evidence on the impact of acquisitions on firms performance is not consensual (Chapman, 2003 and Capron and Shen, 2007) and, on other side, researchers have pointed to the potential that MNCs may reconfigure their portfolio of resources and competences using acquisitions (Barkema et al., 1996, Dyer et al., 2004, Ferreira, 2007 and Haspeslagh and Jemison, 1991). Future research will possibly require data collected through survey to assess the motivations and the benefits expected from the acquisitions.

Other limitation concerns the focus on acquisitions in a single country: Brazil. Future studies in other emerging economies, or with more than one host country, may provide a better understanding of how MNCs act when expanding into institutionally less developed countries. In a complementary vein, future studies may seek to comprehend the investments in south-south cross-border acquisitions, that is, acquisitions to and from emerging economies. Foreign investment still flows mainly from north to south, but there may be substantial differences in the strategic motivations of emerging MNCs.

Finally, using real options theory, in conditions of high uncertainty in the foreign markets it may be better for MNCs to commit less resources to maintain flexibility and permit a faster exit from the host country if the conditions become more adverse (Tong et al., 2008). Smaller investments may be terminated with lower costs if the host country conditions are worse than initially forecasted. However, in institutionally less developed countries there may be institutional barriers that hinder divestments (Peng et al., 2009) and make unviable adapting to changing environmental and business conditions. Thus, it is relevant to examine in future studies how MNCs may plan their strategies concerning the equity stakes of their investments to protect from a worsening of the host institutional conditions.