By Paul Bjacek – Accenture

Contributor: Kurt Eichhorn

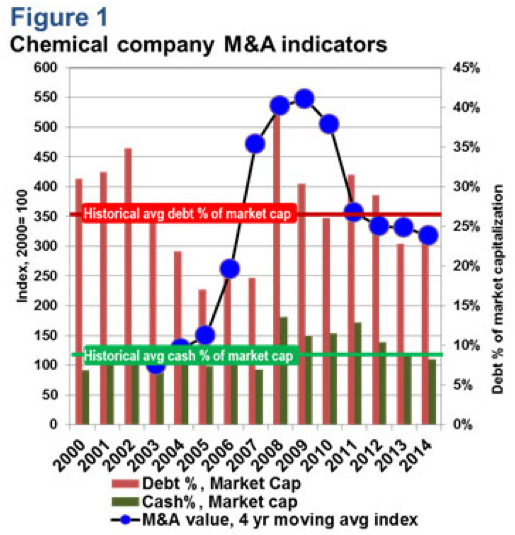

Mergers and acquisitions in the global chemicals industry have tumbled from their highs of the 2007-2009 period, jolted by the Great Recession and despite the steady, albeit gradual, recovery in chemicals markets since then, M&A has not returned to those past levels. The reasons for the M&A slowdown are likely due to the uncertainty of global economic health, greater diligence in managing financials (i.e. debt and cash), volatile exchange rates and prices and a digestion of the major acquisitions of the recent past (see the “boa constrictor swallowing an elephant” M&A pattern in Figure 1). A more noteworthy development is the changing of mix in M&A targets, with companies entering new, high growthenabling disciplines.

What can we expect M&A to be like in the near term?

M&A is difficult to predict and prognosticators continually misread the M&A outlook, primarily because M&A is a tool, rather than a market. That said; let’s first review some common M&A indicators.

M&A share of market capitalization is currently at about 1%, just above the 10 year historical average of 0.9% (based on figures from companies involved in M&A over the past 10 years), but if you exclude the boom years of 200608, the average is even lower, at 0.8%. So, there is not necessarily a thirst for M&A in that regard. Also, cash and short term investment levels (among a market basket of 88 chemical companies, globally) are not encouraging, with figures in 2014 just below the historic 10 year rate of 9% of market capitalization.

The biggest positive indicator is debt level, which as a share of market capitalization is currently around 25%, below the ten year average of 27%, a slight tailwind for the chemicals M&A environment.

An even better M&A indicator is chemical companies’ strategic intents. Chemical companies are increasingly adopting strategies to diversify and dive deeper into megatrend markets. Therefore, more strategic buying has been happening since around 2009 and is expected to increase going forward. These types of buys are also likely to be timed for the appropriate mix of financial variables, as in the case of consolidation plays or major business steps outs. As a matter of fact, the best M&A indicator should be a mix of business certainty and net company strategic intents – hard to measure!

Geographic mix: New players

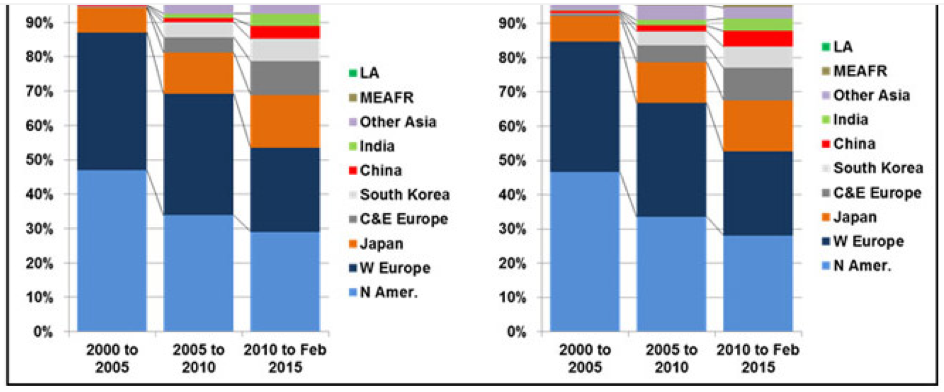

In 2000, North American and West European chemical companies dominated as buyers, primarily targeting those same regions. By the 2012 to 2014 period, M&A activity by chemical companies in Japan, South Korea and Central & East Europe had grown for both buyers and targets, correspondingly, as shown in Figure 2. Interestingly, crossborder M&A for the same mix of countries/regions has actually dropped from 7% of deal counts in the early 2000s to about a 4% average over the recent past few years. This is again likely related to a greater uncertainty of the future performance of markets around the world, as the European outlook is clouded by debt issues and emerging regions are not meeting growth expectations. North America dominated crossborder M&A, with 35% of the count over the past five years, taking over Western Europe’s lead from the previous five years. Western Europe and Japan are the next most active.

Figure 2

Targets: What’s hot and what’s not?

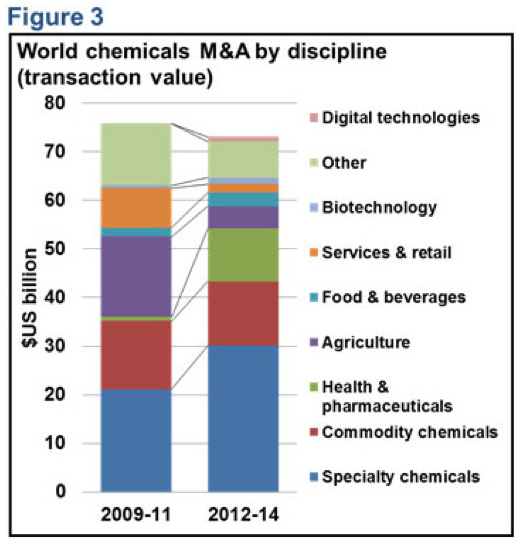

Clearly, the focus on megatrends is driving the change in the M&A target mix, as seen in Figure 3. Companies can invest in megatrends in big transformational steps, but a cautious, and perhaps more impactful, method is in incremental steps, investing in small to midsize companies or startups with new technologies that will enable them to provide their customers with new products, services and productivity solutions. Notable areas of acquisition are in specialty chemicals (oriented towards a broad variety of markets), health & pharmaceuticals and food & beverages.

Biotechnology is another megatrend area. The nature of biotechnology acquisition targets over the past few years overlap into various industries, related to improving chemical companies’ offerings in healthcare (such as diagnostic chemicals), bio fuels & materials, crop productivity and other segments.

There are some disciplines, still in M&A infancy, which we expect to grow significantly over the next few years, for example, digital technology.

Digital technologies offer new avenues to creating growth and value, such as the use of climate software to support the application of agricultural chemicals and software that helps manage commercial laundries for efficiency in the detergents business. Digital technologies have been acquired or added organically to enhance customer stickiness, that is, to add value to existing products and services by improving customer’s productivity.

The availability of industrial information (i.e., Big Data), bolstered by the greater use of wireless tracking (RFID, GPS, etc.), mobile equipment and visual and sensing devices is assisting in the development of new applications based on the convergence of information technology and industrial processes. Therefore, companies must actively strategize with this in mind. There can be significant potential to “change the rules of the game”, offering previously unthoughtof ways to help customers meet business challenges (E.g., as seen with the advent of precision farming in agriculture chemicals).

In summary, the financial indicators for M&A are mixed, but good strategy is always in season. Thinking broader, ahead of the competition, in terms of new technology solutions is the best way to bring value in an ever converging industrial age.